Market Overview:

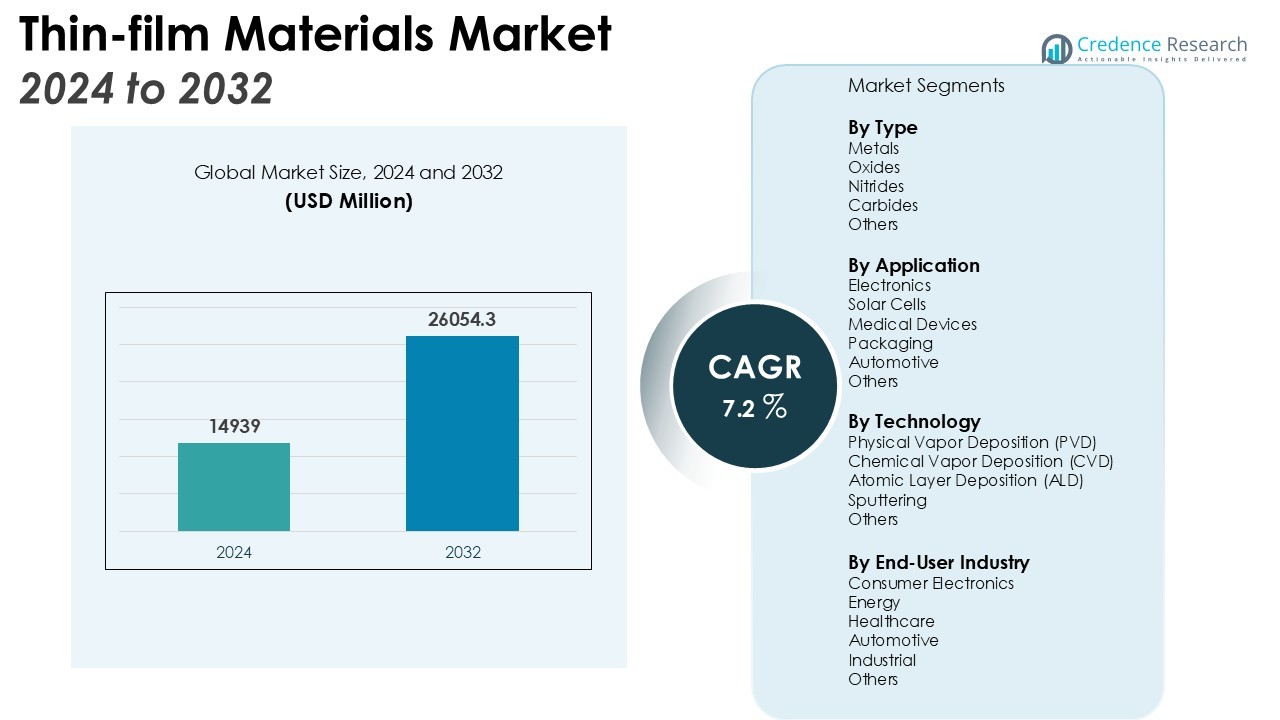

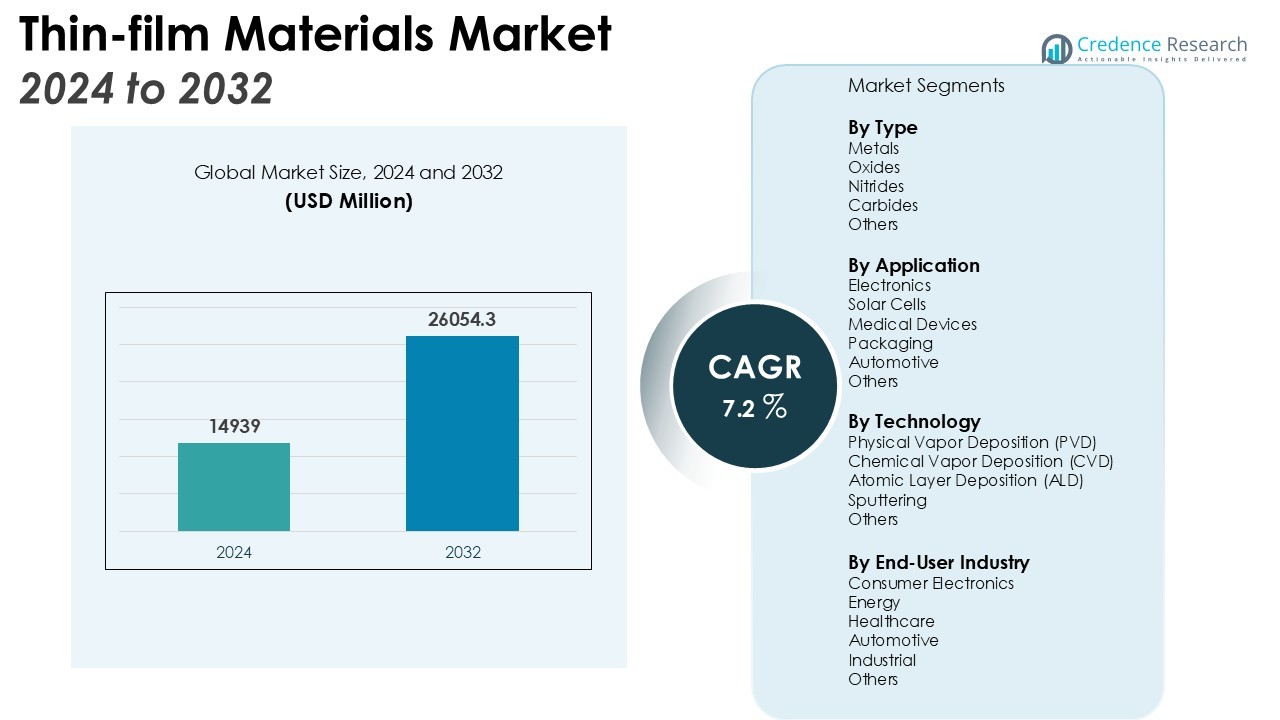

The Thin-film Materials Market size was valued at USD 14939 million in 2024 and is anticipated to reach USD 26054.3 million by 2032, at a CAGR of 7.2 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thin-film Materials Market Size 2024 |

USD 14939 Million |

| Thin-film Materials Market, CAGR |

7.2 % |

| Thin-film Materials Market Size 2032 |

USD 26054.3 Million |

Key drivers propelling the Thin-film Materials Market include the shift toward miniaturized and energy-efficient electronic devices, the surge in solar energy installations, and technological advancements in material science. The rising penetration of thin-film semiconductors in smartphones, wearables, and medical devices continues to fuel demand. In addition, ongoing innovations in deposition techniques and cost-effective production processes have enhanced the commercial viability of thin-film materials. The growing emphasis on sustainable materials and environmentally friendly manufacturing practices is also shaping market evolution.

Regionally, Asia Pacific dominates the Thin-film Materials Market, accounting for the largest revenue share, attributed to the presence of leading electronics manufacturers in China, Japan, and South Korea. North America and Europe also represent significant markets, underpinned by strong investments in renewable energy projects and semiconductor manufacturing. Emerging economies in Latin America and the Middle East present new growth avenues as technology adoption accelerates. The increasing establishment of local manufacturing facilities in developing regions is expected to strengthen market presence and foster competitive dynamics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Thin-film Materials Market reached USD 14,939 million in 2024 and is forecast to attain USD 26,054 million by 2032, registering a CAGR of 7.2% during the forecast period.

- Miniaturization and energy efficiency trends in consumer electronics, along with the rapid adoption of thin-film semiconductors in smartphones and wearables, continue to drive robust market growth.

- Increasing investments in solar energy projects and the shift to thin-film photovoltaic cells are expanding the application landscape, supporting market expansion across the energy sector.

- Advancements in deposition technologies, such as atomic layer deposition and chemical vapor deposition, are improving material quality, scalability, and yield, fueling broader adoption.

- Market participants face challenges from the high complexity and initial costs of manufacturing, along with the need for skilled personnel and defect-free production for optimal performance.

- Asia Pacific holds 53% of global market revenue, benefiting from a strong manufacturing base in China, Japan, South Korea, and Taiwan, while North America and Europe contribute 23% and 17%, respectively.

- Latin America and the Middle East, with a combined 6% market share, are poised for growth due to rising investments in urbanization, renewable energy, and technology transfer initiatives.

Market Drivers:

Rising Demand for Miniaturized and Energy-Efficient Electronics Fuels Growth

The Thin-film Materials Market benefits significantly from the increasing preference for compact and energy-efficient electronic devices. Manufacturers in the consumer electronics sector actively seek thin-film materials to enhance device functionality while reducing size and power consumption. The adoption of thin-film semiconductors in smartphones, tablets, and wearables supports this trend, meeting consumer demand for sleek and high-performing products. It is clear that the pursuit of advanced electronics will continue to generate new opportunities for thin-film material suppliers.

- For instance, researchers at MIT have successfully developed ultralight fabric solar cells capable of generating 730 watts of power per kilogram when freestanding, a key advancement for integrating power sources directly into wearables and portable devices.

Expansion of Renewable Energy Installations Drives Market Expansion

The global shift toward renewable energy, especially solar power, drives demand for high-performance thin-film materials. Thin-film photovoltaic cells are gaining traction due to their flexibility, lightweight construction, and lower material costs compared to conventional silicon-based panels. Governments and private investors are increasing their focus on large-scale solar projects, which in turn boosts the Thin-film Materials Market. It stands to benefit further from continuous advancements in solar cell efficiency and deployment.

Technological Advancements in Deposition Techniques Enhance Market Viability

Progress in deposition technologies, such as atomic layer deposition and chemical vapor deposition, has improved thin-film material performance and scalability. These innovations enable manufacturers to achieve greater precision, uniformity, and yield in large-scale production. It has enabled the development of high-quality thin-film coatings for diverse applications, including displays and medical devices. This ongoing evolution of manufacturing processes remains a cornerstone of market growth.

- For instance, using plasma-enhanced chemical vapor deposition, researchers at the National Institute for Laser, Plasma and Radiation Physics have fabricated carbon nanowall structures with edges measuring less than 10 nm.

Growing Emphasis on Sustainability and Cost-Effectiveness Accelerates Adoption

The increasing prioritization of sustainable manufacturing and resource-efficient processes has accelerated thin-film material adoption. Industries aim to minimize waste and lower energy consumption throughout the production cycle, making thin-film solutions a strategic choice. It is becoming essential for companies to address both performance and environmental impact when selecting materials. The Thin-film Materials Market is poised to benefit as regulatory frameworks and consumer preferences continue to favor sustainable innovations.

Market Trends:

Integration of Thin-Film Materials in Next-Generation Flexible Electronics and Displays

The Thin-film Materials Market is experiencing strong momentum with the integration of thin-film materials into next-generation flexible electronics and advanced displays. The proliferation of foldable smartphones, wearable devices, and rollable OLED screens has driven manufacturers to invest in thin-film technologies that enable lightweight, durable, and bendable components. It has led to increased research and partnerships focused on improving material performance, transparency, and resilience. Companies are prioritizing thin-film innovations to deliver enhanced user experiences and unique product designs. With consumer electronics brands emphasizing device flexibility and advanced functionality, thin-film materials are becoming central to product differentiation strategies. These trends are accelerating the adoption of advanced materials across major electronics segments.

- For instance, Samsung’s application of advanced thin-film materials is showcased in its Galaxy Z Fold7, which achieves a remarkable thinness of just 8.9 millimeters when folded.

Adoption of High-Performance Thin-Film Materials in Renewable Energy and Smart Coatings

The Thin-film Materials Market is witnessing growing demand for high-performance materials in renewable energy, especially within the solar and energy storage sectors. Manufacturers are leveraging thin-film coatings to improve photovoltaic cell efficiency and durability while addressing industry requirements for lighter and more versatile panels. It is also seeing expanded application in smart coatings, which enhance energy conservation, provide anti-reflective or self-cleaning surfaces, and offer improved protection for underlying substrates. The trend toward energy-efficient buildings and sustainable infrastructure is driving investment in thin-film coatings for architectural glass and construction materials. With the global focus on energy efficiency and sustainability, thin-film materials are set to play a pivotal role in supporting long-term industry transformation.

- For instance, demonstrating remarkable durability, First Solar’s thin-film photovoltaic technology completed 25 years of continuous outdoor performance testing at the National Renewable Energy Laboratory.

Market Challenges Analysis:

Complexity of Manufacturing Processes and High Initial Costs Limit Widespread Adoption

The Thin-film Materials Market faces significant challenges due to the complexity and cost-intensive nature of its manufacturing processes. Advanced deposition methods, such as atomic layer deposition and chemical vapor deposition, demand specialized equipment and skilled personnel, leading to high capital expenditure for new entrants. These requirements can slow down the pace of production scale-up and make it difficult for smaller companies to compete. It is further complicated by the need to maintain uniformity and defect-free surfaces, which is essential for the high performance required in electronics and solar cells. Market participants often experience tight margins as a result of these operational challenges. This dynamic can hinder broader adoption and limit the expansion of the Thin-film Materials Market in price-sensitive sectors.

Material Performance Limitations and Supply Chain Vulnerabilities Pose Risks

The Thin-film Materials Market must also address persistent issues related to material performance and supply chain stability. Some thin-film materials may not achieve the same level of durability, electrical conductivity, or efficiency as traditional bulk materials, constraining their use in certain applications. Supply chain disruptions for critical raw materials, such as indium or gallium, introduce volatility in pricing and availability. It is necessary for manufacturers to secure reliable sources and invest in alternative materials to mitigate these risks. These limitations underscore the importance of continued innovation in material science. Industry players must balance technical requirements with cost-efficiency to sustain market competitiveness.

Market Opportunities:

Expansion into Emerging Applications in Medical Devices and Wearable Technology

The Thin-film Materials Market presents strong opportunities through its expanding role in medical devices and wearable technology. Growing demand for minimally invasive medical equipment and compact biosensors increases the need for flexible, biocompatible thin-film solutions. Manufacturers are actively developing advanced coatings and films that improve device functionality, patient comfort, and reliability. It is well positioned to capitalize on the healthcare sector’s emphasis on innovation and precision. The integration of thin-film technology into next-generation diagnostics and smart healthcare wearables will open new revenue streams for industry players. This momentum supports continued collaboration between material suppliers and device manufacturers to accelerate the commercialization of novel products.

Growth Potential in Renewable Energy and Sustainable Building Solutions

The Thin-film Materials Market stands to benefit from the global push toward renewable energy adoption and sustainable construction practices. Rapid investments in thin-film photovoltaic modules and energy-efficient coatings for buildings reflect a clear shift toward environmental responsibility. It is seeing heightened interest from both public and private sectors that aim to reduce carbon footprints and enhance energy savings. Thin-film materials offer advantages in cost, design flexibility, and application versatility, making them ideal for integration into solar panels, architectural glass, and insulation systems. The continued evolution of regulatory frameworks supporting green technologies is expected to further drive market demand. Industry participants have a unique opportunity to align product development with sustainability trends and capture market share in eco-conscious segments.

Market Segmentation Analysis:

By Type

The Thin-film Materials Market covers metals, oxides, nitrides, and carbides. Metals and oxides secure the largest share, driven by their integral roles in semiconductor devices and solar modules. Nitrides and carbides are increasingly used in advanced electronics, displays, and high-performance industrial applications. It experiences rising demand for specialty thin-film materials tailored to specific end-use requirements. The market’s diverse material base supports innovation in product functionality and durability.

- For instance, the C3M0065090J silicon carbide (SiC) MOSFET from Wolfspeed is engineered to handle a high blocking voltage of 900V, making it suitable for demanding applications like electric vehicle battery chargers and high-voltage DC/DC converters.

By Application

The Thin-film Materials Market serves electronics, solar cells, medical devices, packaging, and automotive industries. Electronics represent the dominant application, propelled by the proliferation of smartphones, displays, and integrated circuits. Solar cells are a key growth area as the shift toward renewable energy accelerates adoption of thin-film photovoltaic materials. Medical devices and packaging segments also exhibit rapid growth, with manufacturers leveraging thin-film coatings for improved product protection and efficiency.

- For instance, Vishay’s Thin Film FC series of high-frequency radio frequency resistors are designed to function within a maximum frequency range of 40 gigahertz.

By Technology

Key technologies in the Thin-film Materials Market include physical vapor deposition (PVD), chemical vapor deposition (CVD), atomic layer deposition (ALD), and sputtering. PVD and CVD hold strong market positions due to their efficiency in producing high-quality films at scale. ALD is favored for applications requiring precise layer thickness and uniformity, particularly in semiconductor fabrication. Sputtering remains vital for uniform thin-film deposition in electronics and optics, advancing the market’s technical capabilities.

Segmentations:

By Type

- Metals

- Oxides

- Nitrides

- Carbides

- Others

By Application

- Electronics

- Solar Cells

- Medical Devices

- Packaging

- Automotive

- Others

By Technology

- Physical Vapor Deposition (PVD)

- Chemical Vapor Deposition (CVD)

- Atomic Layer Deposition (ALD)

- Sputtering

- Others

By End-User Industry

- Consumer Electronics

- Energy

- Healthcare

- Automotive

- Industrial

- Others

By Region

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

Regional Analysis:

Asia Pacific Commands the Largest Share Due to Robust Electronics and Solar Manufacturing Base

Asia Pacific holds 53% of the global Thin-film Materials Market revenue, maintaining its leadership through dominant manufacturing in China, Japan, South Korea, and Taiwan. The region’s established supply chains, skilled labor, and sustained investments in research and development continue to drive market expansion. Leading multinational corporations and domestic manufacturers advance thin-film technologies to serve both domestic and international demand. It stands out as a primary market for thin-film semiconductors, display panels, and solar modules, leveraging its significant scale and innovation capacity. Governments across the region actively support industry growth with favorable policies and robust funding for renewable energy projects.

North America and Europe Gain Momentum Through Technological Innovation and Clean Energy Focus

North America accounts for 23% of the global Thin-film Materials Market revenue, while Europe captures 17%, supported by their focus on technological advancement and clean energy. The United States and Germany nurture innovation ecosystems that prioritize the development and commercialization of thin-film materials for electronics, energy, and healthcare sectors. It benefits from active collaborations between universities, research institutes, and industry players, accelerating progress in deposition methods and material performance. Both regions report increased adoption of thin-film coatings in architectural glass, medical devices, and flexible electronics. Investments in sustainable infrastructure and advanced semiconductor manufacturing strengthen their competitive position.

Emerging Markets in Latin America and the Middle East Offer Untapped Potential

Latin America and the Middle East collectively contribute 6% to the global Thin-film Materials Market revenue, reflecting expanding opportunities in urbanization and renewable energy projects. Rapid urban development and increased consumer electronics usage stimulate demand for advanced thin-film materials across both regions. It is gaining traction among regional manufacturers aiming to improve competitiveness through technological upgrades and energy-efficient solutions. Collaborations with international technology providers and targeted knowledge transfer initiatives support market development. Government incentives and new production facilities are expected to accelerate thin-film material adoption across key industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3M Company

- Applied Materials Inc.

- Corning Incorporated

- Hitachi Chemical Co., Ltd.

- Sigma-Aldrich Corporation (Merck Group)

- Asahi Glass Co. Ltd. (AGC)

- DuPont de Nemours, Inc.

- ULVAC, Inc.

- Mitsubishi Materials Corporation

- Materion Corporation

- Samsung SDI Co., Ltd.

- Kaneka Corporation

Competitive Analysis:

The Thin-film Materials Market features a dynamic and highly competitive landscape, characterized by the presence of major multinational corporations and specialized regional players. Companies such as 3M Company, Applied Materials Inc., Corning Incorporated, and DuPont de Nemours, Inc. invest heavily in research and development to strengthen their product portfolios and maintain technological leadership. It witnesses ongoing strategic collaborations, mergers, and acquisitions that help companies expand their market reach and accelerate innovation. Firms differentiate themselves through advancements in deposition technologies, material performance, and cost-effective manufacturing processes. The market also rewards suppliers who can provide tailored solutions for emerging applications in electronics, renewable energy, and healthcare. Intense competition fosters rapid adoption of new technologies and continuous improvement in quality standards. The Thin-film Materials Market expects further intensification of competition as new entrants target high-growth segments and established players invest in capacity expansions.

Recent Developments:

- In November 2023, 3M announced that the planned independent health care company to be created from its spin-off would be named Solventum.

- In March 2025, Corning Incorporated launched GlassWorks AI™ Solutions, a portfolio of customized data center products and services which includes the new Contour™ Flow Cable.

- In May 2024, Hitachi High-Tech Corporation announced an extension of its long-standing partnership with Roche, committing to at least ten more years of collaboration in diagnostics innovation.

Market Concentration & Characteristics:

The Thin-film Materials Market exhibits a moderate to high level of market concentration, with a few global leaders commanding significant market shares alongside numerous specialized regional firms. It is characterized by rapid technological advancements, a strong emphasis on innovation, and substantial investments in research and development. Companies prioritize the development of advanced deposition techniques and cost-effective materials to address evolving customer needs in electronics, solar energy, and medical devices. High entry barriers, driven by the need for sophisticated manufacturing infrastructure and skilled expertise, help established players maintain their competitive advantage. The market demonstrates steady growth, robust demand for quality, and an increasing focus on sustainability throughout the value chain.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Technology, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Thin-film Materials Market expects continued expansion, driven by innovation in electronics, photovoltaics, and flexible displays.

- Companies will prioritize R&D investments to advance deposition techniques and material performance.

- The adoption of thin-film materials in medical devices and wearable technology will gain momentum, opening new growth avenues.

- Demand for sustainable and eco-friendly thin-film solutions will shape product development strategies.

- Manufacturers will focus on enhancing supply chain resilience to address potential raw material shortages and global disruptions.

- The shift toward electric vehicles and advanced automotive electronics will accelerate thin-film adoption in the automotive sector.

- Asia Pacific will maintain its dominant position, while emerging markets in Latin America and the Middle East will register faster adoption rates.

- Collaboration between industry players, research institutes, and universities will drive next-generation material innovation.

- Increased integration of thin-film coatings in construction and architectural glass applications will support market diversification.

- Regulatory frameworks and green energy policies will stimulate long-term investments, reinforcing the market’s growth trajectory.