Market Overview

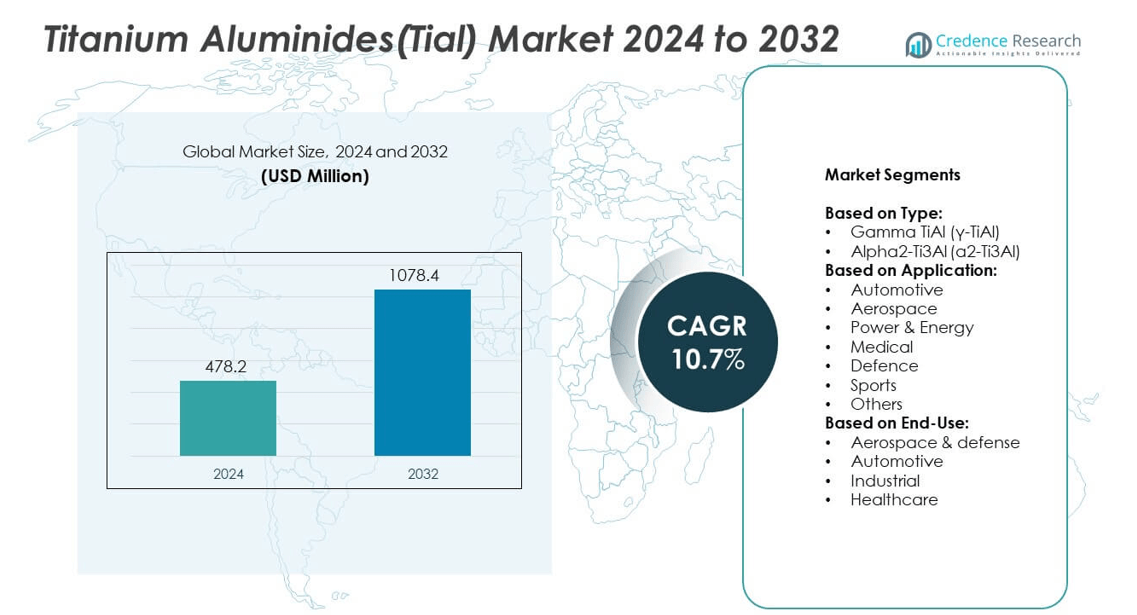

Titanium Aluminides (TiAl) market size was valued at USD 478.2 million in 2024 and is anticipated to reach USD 1078.4 million by 2032, at a CAGR of 10.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Titanium Aluminides (TiAl) Market Size 2024 |

USD 478.2 million |

| Titanium Aluminides (TiAl) Market CAGR |

10.7% |

| Titanium Aluminides (TiAl) Market Size 2032 |

USD 1078.4 million |

The Titanium Aluminides (TiAl) market grows through rising demand for lightweight, high-strength materials in aerospace and automotive industries. It benefits from TiAl’s ability to withstand extreme temperatures, reduce fuel consumption, and improve efficiency in jet engines and turbochargers. Power generation and defense sectors also adopt TiAl for turbines and propulsion systems requiring durability. Advances in additive manufacturing and alloy development further enhance adoption. These drivers, combined with sustainability targets and emission regulations, strengthen the market’s long-term growth outlook.

North America leads the Titanium Aluminides (TiAl) market due to strong aerospace and defense manufacturing, followed by Europe with advanced material research and power applications. Asia-Pacific shows rapid growth driven by expanding aviation and automotive sectors across China, Japan, and South Korea. Latin America and the Middle East & Africa show emerging demand in industrial and energy sectors. Key players operating across these regions include ATI, VSMPO-AVISMA Corporation, Howmet Aerospace, and Alcoa Corporation, each contributing to innovation and regional supply chain development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Titanium Aluminides (TiAl) market was valued at USD 478.2 million in 2024 and is projected to reach USD 1078.4 million by 2032, growing at a CAGR of 10.7%.

- Demand for lightweight, heat-resistant materials in aerospace, automotive, and power sectors fuels market expansion.

- Increased use of TiAl in jet engines, turbochargers, and turbines reflects a shift toward fuel efficiency and emission control.

- Leading companies focus on advanced alloy development, additive manufacturing, and strategic collaborations with OEMs.

- High production costs, limited ductility, and complex machining processes restrict large-scale TiAl adoption in mass markets.

- North America leads market growth due to strong aerospace production, followed by Europe and rapidly expanding Asia-Pacific.

- Investments in R&D, government-backed aerospace programs, and energy-efficient manufacturing support long-term market growth.

Market Drivers

Rising Demand for Lightweight Materials in Aerospace and Automotive Applications

The Titanium Aluminides (TiAl) market is gaining momentum through increased use in aerospace and automotive sectors. Aircraft engines, turbochargers, and structural parts benefit from TiAl’s high strength-to-weight ratio. It helps reduce fuel consumption and emissions in commercial and military aircraft. Automakers use TiAl components in engine parts to meet emission norms and efficiency standards. Its superior thermal stability also enables performance in extreme heat environments. These properties drive material substitution in weight-critical applications. The Titanium Aluminides (TiAl) market benefits from these sustainability and performance goals.

- For instance, CFM International (a joint venture of GE Aerospace and Safran Aircraft Engines) uses titanium aluminide (TiAl) for some low-pressure turbine blades in its LEAP engines. The TiAl blades weigh approximately 50% less than traditional nickel-based alloy blades.

Improved Performance in High-Temperature and Corrosive Environments

TiAl alloys demonstrate excellent oxidation resistance and high-temperature mechanical properties. It performs reliably in temperatures exceeding 750°C, making it ideal for turbine blades and exhaust systems. Power generation and oil & gas industries prefer TiAl for durability in harsh conditions. TiAl’s lower density compared to nickel-based alloys reduces overall system weight. This performance profile meets growing efficiency and safety expectations across multiple sectors. Its ability to retain strength and resist scaling enhances operational stability. The Titanium Aluminides (TiAl) market sees increased traction from these end-user requirements.

- For instance, MTU Aero Engines deployed advanced γ-titanium aluminide (γ-TiAl) low-pressure turbine (LPT) blades, based on the TNM alloy, for the third stage of the high-speed LPT in the Pratt & Whitney PW1500G geared turbofan program. These blades achieved a weight reduction of approximately 50% compared to traditional nickel-based alloy components. The TiAl blades operate in a high-temperature environment, and the TNM alloy is suitable for temperatures up to around 850°C, though the specific operating temperature range of the PW1500G’s LPT may vary within this range depending on flight conditions.

Ongoing Technological Advancements in Processing and Fabrication

Advances in powder metallurgy, 3D printing, and vacuum arc remelting improve TiAl production capabilities. Manufacturers now achieve better uniformity, reduced defects, and cost-efficiency. These methods make TiAl alloys more accessible for commercial-scale applications. Investment in R&D continues across Europe, Japan, and the U.S. to refine compositions and processing routes. This supports expanded applications beyond aerospace into industrial tools and sports equipment. The Titanium Aluminides (TiAl) market leverages these innovations to expand across sectors.

Favorable Policy Push for Sustainable and Efficient Materials

Government regulations promote the adoption of low-emission and fuel-efficient technologies. TiAl supports these policies by enabling lighter engines and reduced greenhouse gas emissions. Defense and space agencies prioritize high-performance lightweight metals for strategic projects. EU REACH regulations and U.S. EPA standards encourage advanced material use in transport and energy. TiAl aligns well with industry decarbonization goals. Incentives and funding for material research strengthen the Titanium Aluminides (TiAl) market outlook. It helps meet strict environmental and energy-efficiency criteria globally.

Market Trends

Increased Use of Titanium Aluminides in Next-Generation Jet Engines

Aerospace OEMs are shifting toward titanium aluminides in next-gen jet engines. TiAl alloys replace nickel-based superalloys in low-pressure turbine blades to reduce engine weight. This shift helps increase fuel efficiency and extend engine life. Major engine programs such as GE’s LEAP and Rolls-Royce’s UltraFan integrate TiAl parts. The trend supports growing demand for fuel-efficient, lightweight propulsion systems. OEMs collaborate with material suppliers to optimize alloy grades and design integration. The Titanium Aluminides (TiAl) market benefits from these aerospace modernization initiatives.

- For instance, Osaka Titanium Technologies has developed titanium powders, including Ti-6Al-4V (TILOP64) and pure Ti (TILOP-45), for additive manufacturing (AM).

Adoption of Additive Manufacturing to Enhance Component Customization

Additive manufacturing is gaining adoption for producing complex TiAl parts. Aerospace and automotive industries use 3D printing to reduce material waste and lead time. This method enables fine control over part geometry and performance. It allows manufacturers to produce prototypes and small-batch components cost-effectively. Titanium aluminides respond well to powder-based additive techniques like electron beam melting. Companies invest in scalable production platforms to expand adoption. The Titanium Aluminides (TiAl) market is evolving alongside this shift in fabrication methods.

- For instance, Airbus’s A320neo aircraft, when powered by CFM International’s LEAP engines, uses titanium aluminide (TiAl) in its low-pressure turbine blades, contributing to an overall 15-20% reduction in fuel burn and CO₂ emissions per seat compared to previous generation aircraft

Integration of TiAl Alloys in Power Generation and Turbomachinery

Power generation turbines now include titanium aluminide blades to reduce rotor weight. Lighter rotating components increase mechanical efficiency and reduce maintenance needs. TiAl’s ability to withstand thermal stress and corrosion suits combined cycle and aero-derivative turbines. Energy providers prefer TiAl-based parts for long operating life and stable performance. Research continues into alloy tuning for longer service intervals and higher stress endurance. The Titanium Aluminides (TiAl) market aligns with demand for advanced materials in efficient energy systems.

Increased Focus on Alloy Development for Enhanced Ductility and Machinability

New grades of TiAl offer better ductility and improved machinability for industrial applications. Alloy developers focus on balancing strength, toughness, and ease of processing. Integration with aluminum and niobium elements improves mechanical properties. This makes TiAl viable for automotive turbocharger rotors and industrial blades. Research institutions and material suppliers form partnerships to accelerate testing and certification. The Titanium Aluminides (TiAl) market reflects this trend toward alloy diversification for broader industrial use.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes Limit Broader Adoption

Titanium aluminides require precise manufacturing techniques and advanced equipment to ensure material stability. Processing methods such as vacuum arc melting and powder metallurgy involve high capital and operational costs. These expenses raise the final price of TiAl components, limiting their use to premium applications. Complex machining, low ductility, and brittleness in certain grades pose additional challenges during forming and shaping. It restricts flexibility in mass production for automotive or general industrial sectors. The Titanium Aluminides (TiAl) market faces barriers in scaling due to these cost and manufacturing limitations.

Limited Material Availability and Design Standards Slow Commercial Expansion

Global supply of high-quality TiAl alloy feedstock remains limited, with few producers serving niche demand. Lack of established supply chains and dependence on specialized alloys affect lead times and pricing stability. Standardization in TiAl-based component design is still under development across many end-user industries. Certification requirements in aerospace and energy sectors further extend the adoption cycle. It creates entry barriers for new players and slows design approval processes. The Titanium Aluminides (TiAl) market must overcome these limitations to reach wider commercial maturity.

Market Opportunities

Rising Investments in Aerospace Modernization and Lightweight Turbomachinery Programs

Aerospace manufacturers are increasing investments in fuel-efficient engines and lightweight airframes. Titanium aluminides enable engine weight reduction while maintaining high strength and thermal resistance. Commercial aircraft programs demand advanced materials that support strict emission norms and performance benchmarks. Defense applications also seek weight savings in jet propulsion and space systems. TiAl fits these needs by offering high temperature capability and reduced component mass. Governments and private entities fund research to expand its aerospace footprint. The Titanium Aluminides (TiAl) market has strong potential to grow within these evolving aviation platforms.

Expansion into Emerging Applications Across Industrial and Energy Sectors

Power generation, automotive turbochargers, and industrial gas turbines present untapped application potential. Manufacturers seek materials that extend component life under thermal fatigue and corrosive environments. Titanium aluminides meet these criteria while offering reduced maintenance cycles and energy consumption. New alloy compositions improve machinability, allowing broader usage beyond aerospace. OEMs in Asia-Pacific and Europe explore TiAl for clean energy systems and lightweight industrial tools. The Titanium Aluminides (TiAl) market stands to benefit from this diversification into high-performance industrial applications.

Market Segmentation Analysis:

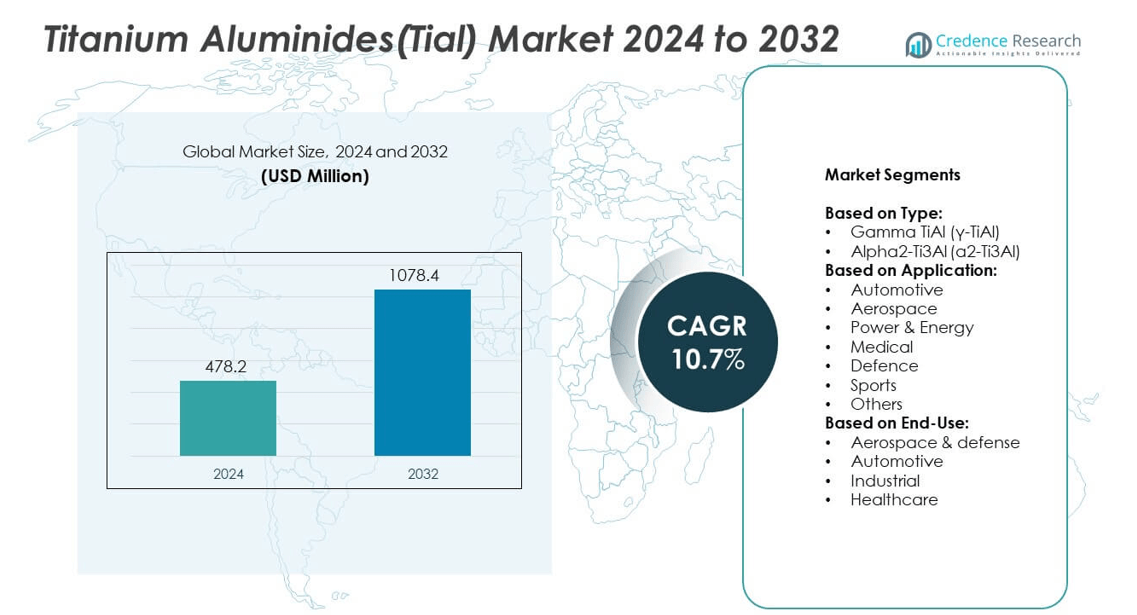

By Type:

Gamma TiAl (γ-TiAl) dominates the Titanium Aluminides (TiAl) market due to its superior strength-to-weight ratio and high oxidation resistance. It is widely used in jet engine components, turbocharger wheels, and turbine blades. Its performance in high-temperature environments makes it ideal for aerospace and automotive sectors. Alpha2-Ti3Al (α2-Ti3Al) holds a smaller share but sees use in structural components requiring creep resistance and moderate ductility. Research continues into blending γ-TiAl and α2-Ti3Al phases to enhance material balance. Both types serve critical functions, but γ-TiAl leads in commercial scale applications. The Titanium Aluminides (TiAl) market relies heavily on gamma phase alloys for advanced design integration.

- For instance, Rolls-Royce’s UltraFan demonstrator uses composite fan blades with a titanium leading edge and a composite casing. These advanced materials contribute to a significant weight reduction, and the demonstrator features a 140-inch fan diameter.

By Application:

The aerospace segment leads in TiAl adoption due to increasing demand for lightweight, high-temperature materials in engines and exhaust systems. Automotive follows with growing use in turbochargers and exhaust valves to reduce engine weight and improve fuel efficiency. Power and energy sectors apply TiAl in turbines to increase thermal efficiency and lower maintenance costs. The medical field shows emerging interest in TiAl for implants and instruments due to its biocompatibility. Defense applications benefit from TiAl’s performance in extreme heat and stress environments. Sports equipment manufacturers explore TiAl for high-performance gear, but usage remains niche. Other industrial sectors evaluate TiAl for its corrosion resistance and mechanical stability.

- For instance, Siemens Energy’s SGT-5-8000H gas turbine demonstrated a combined-cycle efficiency of around 61.5% during its initial operation at the Lausward power plant in Düsseldorf, Germany

By End-Use:

Aerospace and defense account for the largest share of end-use due to continued investments in jet propulsion and structural optimization. Automotive end-use grows steadily with the push toward emission control and engine light-weighting. Industrial applications include gas turbines, compressors, and high-speed rotating machinery, where thermal and structural integrity are critical. Healthcare represents a small but growing segment where TiAl offers durability and compatibility for specialized devices. It remains under development for broader biomedical adoption. The Titanium Aluminides (TiAl) market expands through varied end-user demand for high-performance materials that balance weight, strength, and heat resistance.

Segments:

Based on Type:

- Gamma TiAl (γ-TiAl)

- Alpha2-Ti3Al (α2-Ti3Al)

Based on Application:

- Automotive

- Aerospace

- Power & Energy

- Medical

- Defence

- Sports

- Others

Based on End-Use:

- Aerospace & defense

- Automotive

- Industrial

- Healthcare

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the 32.4% share of the Titanium Aluminides (TiAl) market, leading global adoption due to its advanced aerospace and defense manufacturing ecosystem. The United States drives most of the regional demand through companies like GE Aviation, Boeing, and Pratt & Whitney, which integrate TiAl alloys into jet engines and propulsion systems. Federal support for lightweight materials in military aircraft and space programs sustains research partnerships with universities and material firms. Automotive suppliers in the region adopt TiAl for turbochargers and emission control parts to meet regulatory standards. Research institutions such as NASA and the Department of Energy also invest in high-temperature materials, expanding use cases in power generation and turbine technologies. North America continues to dominate high-value applications, supported by a robust supply chain and early commercialization of additive manufacturing processes.

Europe

Europe captures 27.6% of the Titanium Aluminides (TiAl) market, with strong demand from the aerospace, automotive, and energy sectors. Countries like Germany, France, and the UK host key aircraft engine OEMs, including Rolls-Royce and Safran, which actively incorporate TiAl into turbine blades and exhaust systems. The European Union supports low-carbon transportation through strict CO₂ emission regulations, prompting automotive OEMs to adopt lightweight engine components. Power generation firms deploy TiAl-based blades in stationary turbines to enhance efficiency and reduce emissions. Research initiatives funded by Horizon Europe and national programs accelerate alloy development and pilot-scale production. With a strong focus on decarbonization and sustainable manufacturing, Europe drives innovation in TiAl processing and expands industrial use across sectors.

Asia-Pacific

Asia-Pacific accounts for 22.1% of the Titanium Aluminides (TiAl) market, led by growing industrialization and large-scale manufacturing across China, Japan, South Korea, and India. Aerospace investment in the region continues to rise, with China’s COMAC and Japan’s IHI Corporation developing indigenous aircraft platforms. Automotive companies like Toyota, Hyundai, and Tata Motors show interest in TiAl components for weight reduction and performance gains. China and South Korea expand R&D capabilities for additive manufacturing and alloy development. Turbine blade suppliers in the region explore TiAl for next-generation power plants and high-efficiency industrial machinery. The region’s growing demand aligns with energy-efficiency targets and rising adoption of advanced engineering materials, positioning Asia-Pacific as a strong growth frontier for TiAl.

Latin America

Latin America represents 9.3% of the Titanium Aluminides (TiAl) market, driven by growing demand in industrial equipment and energy generation. Brazil and Mexico serve as the leading countries where TiAl finds niche applications in gas turbines, automotive manufacturing, and small-scale aerospace projects. Regional OEMs explore the material for boosting thermal performance and reducing operational weight in high-stress applications. Investment in additive manufacturing hubs and partnerships with North American suppliers help build local capacity. Though limited by cost sensitivity and lower industrial penetration, TiAl usage grows gradually as governments prioritize energy transition and efficient industrial technologies.

Middle East & Africa

Middle East & Africa hold 8.6% of the Titanium Aluminides (TiAl) market, supported by growing power generation demand and emerging aerospace interest. Countries such as the UAE and Saudi Arabia explore advanced materials for gas turbines used in energy diversification strategies. Defense modernization and investment in civil aviation in the Gulf region create early opportunities for TiAl integration in propulsion systems. South Africa shows potential in industrial applications through its mining and processing expertise. However, the market remains underdeveloped due to limited production infrastructure and high costs. Future growth depends on international partnerships, R&D investments, and regional manufacturing capabilities for high-performance alloys.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GfE Metalle und Materialien

- Alcoa Corporation

- Toho Titanium

- Stanford Advanced Materials

- Carpenter Technology Corporation

- Daido Steel

- Western Superconducting Technologies

- Aerospace Alloys

- VSMPO-AVISMA Corporation

- KBM Affilips

- Titanium Metals Corporation

- AMG Advanced Metallurgical Group

- 6K

- Kobe Steel

- ATI

- Arconic Corporation

- Howmet Aerospace

- American Elements

- Precision Castparts

Competitive Analysis

The Titanium Aluminides (TiAl) market features strong competition among key players such as ATI, VSMPO-AVISMA Corporation, Howmet Aerospace, Precision Castparts, Alcoa Corporation, Carpenter Technology Corporation, and KBM Affilips. These companies focus on advanced alloy development, strategic partnerships, and high-precision manufacturing techniques to serve aerospace, automotive, and energy industries. Leading firms invest in R&D to enhance TiAl properties such as ductility, fatigue strength, and oxidation resistance. They also expand additive manufacturing capabilities to support customized production and reduce lead times. Suppliers target aerospace OEMs through long-term contracts, ensuring consistent demand for turbine blades and engine components. Companies leverage vertically integrated supply chains and proprietary processes to gain cost and quality advantages. Smaller players compete through niche applications, quick delivery, and specialized material offerings. Global expansion, regional production hubs, and collaboration with research institutes further enhance competitive positioning. The focus remains on scaling production while maintaining alloy purity and performance standards. Market players differentiate by improving machinability, increasing yield rates, and complying with aerospace-grade certifications. Competitive intensity is high, driven by increasing demand from defense, energy, and mobility sectors worldwide.

Recent Developments

- In 2025, KBM Affilips continued its ongoing development and production of master alloys for various high-performance applications, including those serving the aerospace and automotive industries.

- In June 2025, AMG continued supplying titanium aluminides for CFM International LEAP engines, maintaining mass production for low-pressure turbine blades in single-aisle aircraft.

- In April 2023, IperionX (industry collaborator) completed a life cycle evaluation for fully recyclable, low-carbon titanium metal powder at their Virginia facility, impacting sustainable titanium production for the North American market

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Titanium aluminides will see growing use in next-generation jet engines to improve fuel efficiency.

- The market will benefit from rising demand for lightweight, high-performance materials in defense systems.

- Automotive OEMs will adopt more TiAl components to meet emission norms and engine downsizing trends.

- Additive manufacturing will expand TiAl adoption by reducing waste and enabling complex part production.

- Power generation sectors will use TiAl for turbine blades to increase thermal efficiency and service life.

- Research into alloying and coating technologies will improve TiAl ductility and corrosion resistance.

- Asia-Pacific will emerge as a high-growth region due to expanding aerospace and industrial capabilities.

- Medical and industrial applications will grow as biocompatibility and high-temperature stability gain attention.

- Strategic partnerships between OEMs and alloy producers will accelerate large-scale TiAl integration.

- Supply chain advancements and cost reduction efforts will broaden TiAl usage across mid-volume sectors.