Market Overview

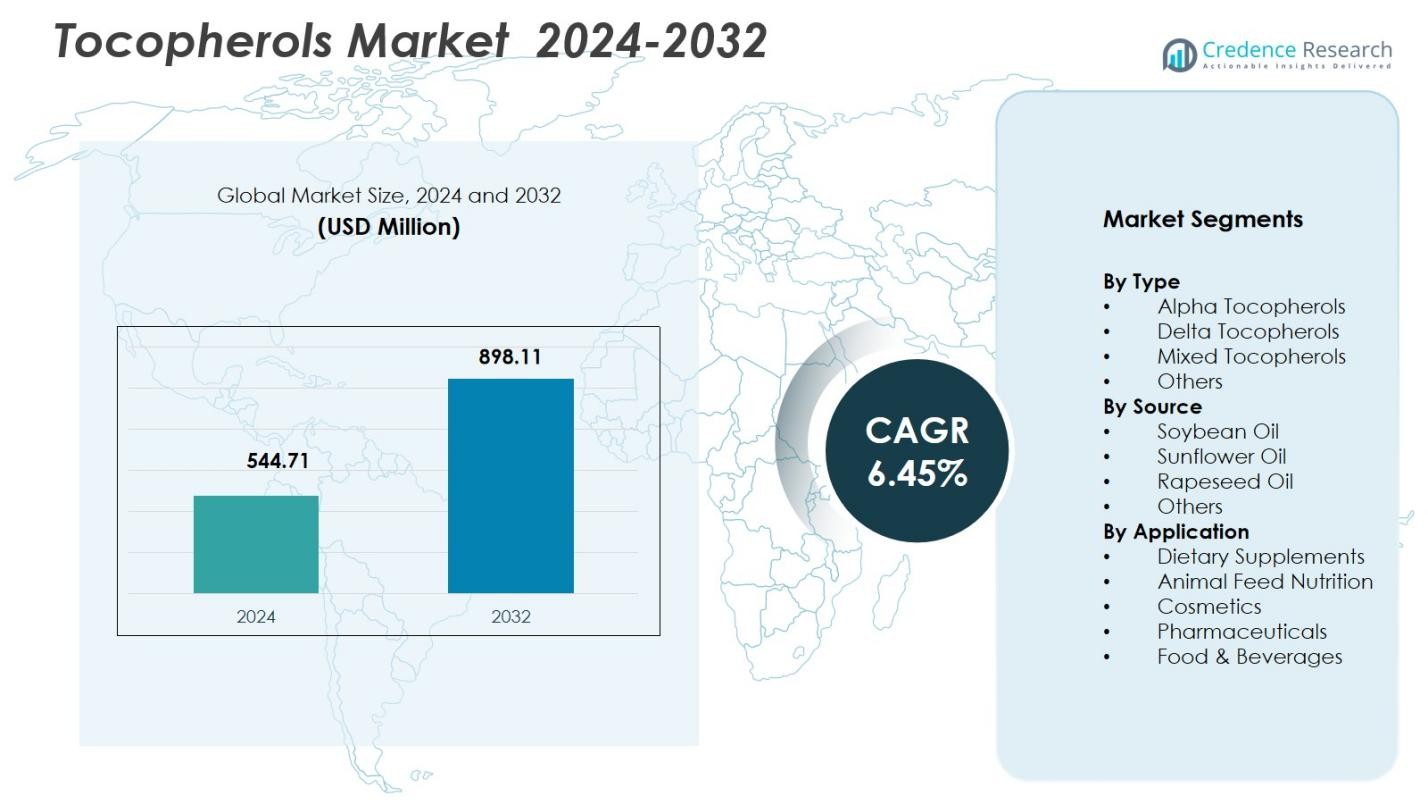

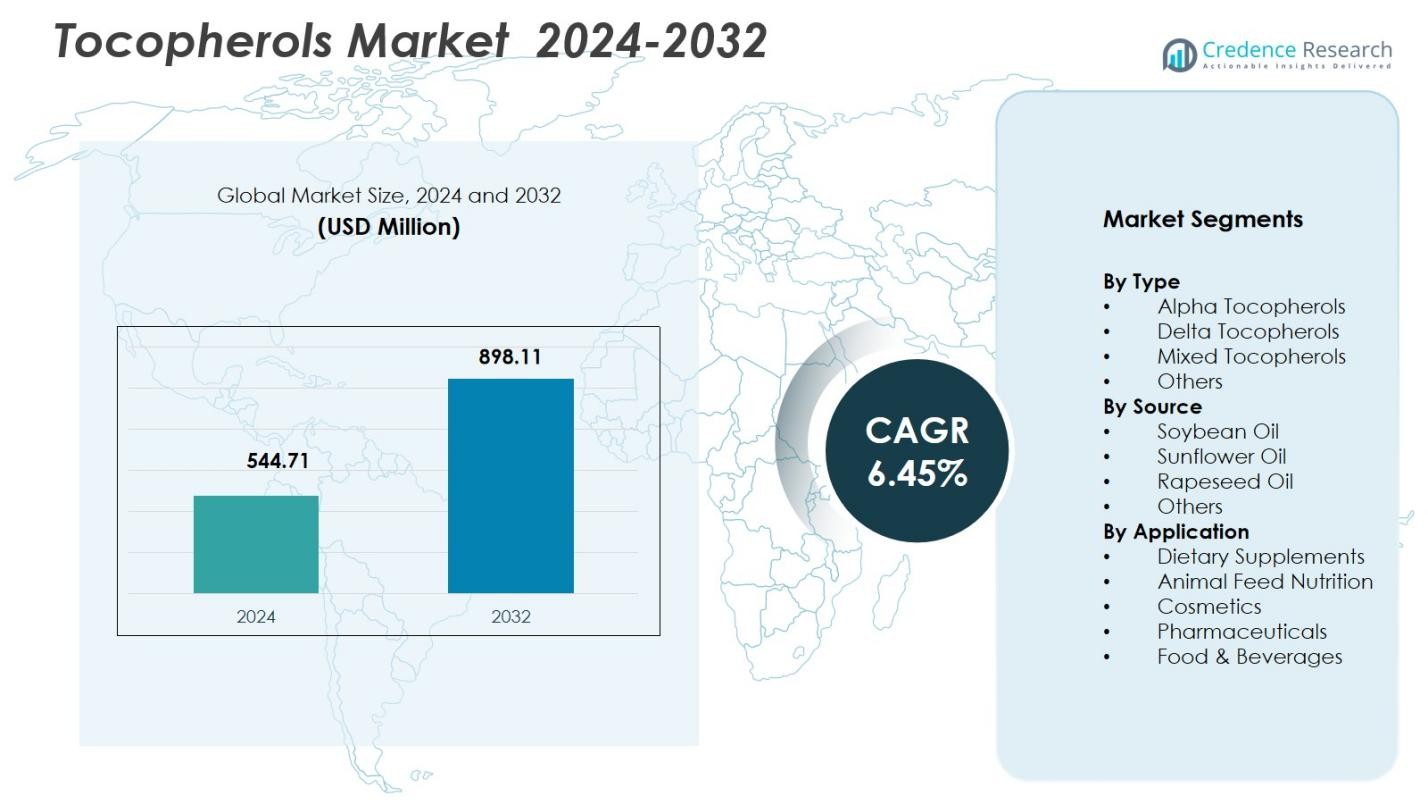

Tocopherols Market size was valued at USD 544.71 million in 2024 and is anticipated to reach USD 898.11 million by 2032, at a CAGR of 6.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tocopherols Market Size 2024 |

USD 544.71 Million |

| Tocopherols Market, CAGR |

6.45% |

| Tocopherols Market Size 2032 |

USD 898.11 Million |

Tocopherols Market is characterized by the strong presence of BASF SE, DSM-Firmenich, Archer Daniels Midland Company, Cargill, Incorporated, Evonik Industries AG, BTSA Biotecnologías Aplicadas S.L., Wilmar International Limited, Zhejiang Worldbestve Biotechnology Co., Ltd., and COFCO Tech Bioengineering (Tianjin) Co., Ltd., which focus on integrated sourcing, advanced extraction technologies, and application-specific tocopherol formulations. These companies strengthen their positions through capacity expansion, consistent quality delivery, and alignment with clean-label and natural antioxidant demand across food, feed, nutraceutical, and cosmetic applications. Regionally, North America leads the Tocopherols Market with a 34.6% share, supported by strong dietary supplement consumption and established oilseed processing infrastructure, followed by Europe with 28.1% share, driven by stringent food safety regulations and high adoption of natural additives across multiple end-use industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Tocopherols Market was valued at USD 544.71 million in 2024 and is projected to grow at a CAGR of 6.45% through 2032, driven by rising adoption across food, nutraceutical, feed, and cosmetic applications supported by clean-label and natural ingredient preferences.

- Demand growth is fueled by increasing replacement of synthetic antioxidants with natural tocopherols, with mixed tocopherols holding a dominant 46.8% segment share due to broad-spectrum antioxidant performance and cost efficiency in food preservation and dietary supplements.

- Market trends highlight strong momentum in clean-label foods, functional nutrition, and premium personal care products, while major manufacturers focus on integrated oilseed sourcing, application-specific formulations, and capacity optimization to strengthen positioning.

- Market expansion faces restraints from volatility in vegetable oil raw material pricing and complex extraction processes, which increase production costs and create entry barriers, particularly for small and mid-scale producers.

- Regionally, North America leads with a 34.6% share, followed by Europe at 28.1% and Asia Pacific at 24.3%, while soybean oil dominates sourcing with a 52.4% share and dietary supplements remain the largest application at 38.9%.

Market Segmentation Analysis:

By Type:

By type, Mixed Tocopherols dominate the Tocopherols Market, accounting for 46.8% market share in 2024. This dominance is driven by their broad-spectrum antioxidant composition, combining alpha, beta, gamma, and delta tocopherols, which enhances oxidative stability across food, feed, and nutraceutical applications. Mixed tocopherols are widely preferred for food preservation and dietary supplements due to superior efficacy and cost efficiency compared to single-isomer products. Alpha tocopherols hold a strong position in pharmaceutical and supplement formulations, while delta tocopherols are increasingly adopted in food applications for extended shelf-life performance.

- For instance, Kemin’s FORTIUM MT mixed tocopherols serve as a heat-stable, plant-derived antioxidant blended into snack foods like potato chips and extruded snacks, protecting against color and flavor degradation without sensory impact.

By Source:

By source, Soybean Oil leads the market with a 52.4% share, supported by its abundant global availability, cost-effectiveness, and high tocopherol yield during oil refining. The dominance of soybean oil is reinforced by large-scale oilseed processing infrastructure, particularly in North America and South America. Sunflower oil follows, driven by demand for non-GMO and allergen-free sourcing, while rapeseed oil maintains steady adoption in Europe. Manufacturers favor soybean-derived tocopherols due to reliable supply chains, scalable extraction processes, and consistent quality for food, feed, and supplement applications.

- For instance, ADM’s Spiritwood, North Dakota soy crush-and-refining complex was announced with capacity to process 150,000 bushels/day illustrating how North American infrastructure supports dependable soybean-oil streams for downstream ingredients.

By Application:

By application, Dietary Supplements represent the largest segment with a 38.9% market share, driven by rising consumer focus on immune health, cardiovascular wellness, and antioxidant intake. Tocopherols are extensively incorporated into vitamin E supplements due to proven bioavailability and regulatory acceptance. Food & beverages follow closely, supported by clean-label preservation needs, while animal feed nutrition benefits from tocopherols’ role in improving livestock health and feed stability. Cosmetics and pharmaceuticals maintain stable demand, leveraging tocopherols for skin protection, oxidative stress reduction, and formulation stability across premium product lines.

Key Growth Drivers

Rising Demand for Natural Antioxidants

The Tocopherols Market is strongly driven by increasing demand for natural antioxidants across food, nutraceutical, and cosmetic applications. Manufacturers are steadily replacing synthetic antioxidants with naturally derived tocopherols to comply with clean-label requirements and evolving consumer preferences. Tocopherols offer proven efficacy in preventing lipid oxidation, extending shelf life, and maintaining nutritional value. Regulatory approvals supporting natural vitamin E use in food and supplements further reinforce adoption. This shift is particularly pronounced in packaged foods and dietary supplements, where ingredient transparency and safety credentials directly influence purchasing decisions.

- For instance, BASF provides DL-alpha-tocopheryl acetate as a vitamin E source for dietary supplements and fortified foods. It functions as an antioxidant to maintain product stability in supplements targeting nutritional support.

Expanding Dietary Supplement Consumption

Growth in dietary supplement consumption significantly accelerates demand for tocopherols as an essential source of vitamin E. Rising awareness of immune health, cardiovascular wellness, and age-related nutrition has increased vitamin E supplementation globally. Tocopherols are preferred due to their high bioavailability and established clinical relevance. Aging populations and lifestyle-related health concerns further strengthen supplement uptake. In addition, preventive healthcare trends and expanding e-commerce channels have improved accessibility, enabling manufacturers to launch fortified products that integrate tocopherols as core functional ingredients.

- For instance, Nordic Naturals Vitamin E Complex provides a blend of six forms of vitamin E, including alpha-tocopherol and tocotrienols from annatto, to support a healthy immune response by neutralizing free radicals.

Increased Use in Animal Feed Nutrition

The expanding livestock and aquaculture sectors drive tocopherol consumption in animal feed nutrition. Tocopherols improve feed stability, enhance immune response, and support growth performance in poultry, swine, and ruminants. Their role in preventing oxidative degradation of fats in feed formulations has become increasingly important as feed compositions grow more complex. Regulatory support for natural feed additives further boosts adoption. Rising global meat and dairy demand encourages producers to invest in high-quality nutritional inputs, reinforcing tocopherols’ strategic importance in feed formulations.

Key Trends & Opportunities

Growth of Clean-Label and Functional Foods

Clean-label and functional food development presents significant opportunities for the tocopherols market. Food manufacturers increasingly prioritize natural preservation solutions that align with health-conscious consumer expectations. Tocopherols enable extended shelf life without compromising label simplicity, making them attractive for premium and organic product lines. Functional foods fortified with vitamin E also gain traction due to their added health benefits. This trend encourages innovation in formulation technologies and drives collaboration between ingredient suppliers and food producers seeking differentiation through nutritional value.

- For instance, ADM’s Novatol vegetable oil-sourced vitamin E serves as a natural alpha-tocopherol fortifier in foods and supplements, helping manufacturers meet FDA labeling rules for vitamin E while enhancing nutritional value.

Rising Demand in Cosmetic and Personal Care Products

The cosmetic and personal care industry offers expanding opportunities for tocopherols due to their antioxidant and skin-protective properties. Tocopherols are widely incorporated into anti-aging, sun-care, and moisturizing formulations to combat oxidative stress and improve product stability. Growing consumer preference for natural and plant-derived cosmetic ingredients supports this trend. Premium skincare brands increasingly position tocopherols as active ingredients, enhancing product value and brand credibility while driving consistent demand from high-margin personal care applications.

- For instance, Cetaphil uses tocopherol, the active form of vitamin E, in its Intensive Moisturizing Cream to retain skin moisture and support the barrier after regular use over 2-4 weeks.

Key Challenges

Volatility in Raw Material Supply and Pricing

Raw material supply volatility poses a key challenge for the tocopherols market. Tocopherols are primarily extracted from vegetable oils, making production sensitive to fluctuations in oilseed availability, agricultural yields, and commodity prices. Climate variability, geopolitical disruptions, and changing trade policies directly impact sourcing stability. These factors increase production costs and pricing uncertainty for manufacturers. Maintaining consistent quality while managing cost pressures remains challenging, particularly for suppliers serving price-sensitive food and feed applications.

Complex Extraction and Processing Requirements

The extraction and purification of tocopherols involve complex processing technologies that require high capital investment and technical expertise. Maintaining product purity and stability while meeting regulatory standards adds operational complexity. Smaller manufacturers often face barriers in scaling production due to equipment costs and process efficiency constraints. Additionally, variations in tocopherol concentration across different oil sources demand precise processing control. These challenges can limit market entry, slow capacity expansion, and affect profitability across the value chain.

Regional Analysis

North America

North America accounted for 34.6% market share in the Tocopherols Market in 2024, supported by strong demand from dietary supplements, functional foods, and animal nutrition sectors. High consumer awareness of vitamin E benefits and widespread adoption of clean-label food formulations drive sustained usage. The region benefits from advanced oilseed processing infrastructure and consistent availability of soybean-based tocopherols. Robust regulatory frameworks supporting natural antioxidants further strengthen market penetration. Additionally, strong presence of nutraceutical manufacturers and rising preventive healthcare spending continue to reinforce North America’s leadership position in global tocopherol consumption.

Europe

Europe held a 28.1% market share, driven by stringent food safety regulations and a strong preference for natural additives across food, cosmetics, and pharmaceuticals. The region shows high adoption of sunflower- and rapeseed-derived tocopherols due to regulatory support for non-GMO and allergen-conscious sourcing. Growing demand for natural preservatives in bakery, dairy, and processed food products supports market stability. Europe’s well-established cosmetics industry also contributes significantly, using tocopherols for antioxidant and skin-protection properties. Sustainability-focused sourcing and clean-label compliance remain key structural drivers across the region.

Asia Pacific

Asia Pacific captured 24.3% market share, reflecting rapid growth in dietary supplements, fortified foods, and animal feed applications. Expanding middle-class populations and increasing health awareness drive higher vitamin E consumption in countries such as China, India, and Japan. The region benefits from rising food processing capacity and growing demand for shelf-life extension in packaged foods. Strong expansion in livestock production further accelerates tocopherol use in feed formulations. Increasing investments in nutraceutical manufacturing and improving regulatory alignment with global standards continue to support long-term market expansion across Asia Pacific.

Latin America

Latin America represented 8.1% market share, supported by abundant availability of soybean oil as a key raw material for tocopherol extraction. Brazil and Argentina play central roles due to strong oilseed production and expanding food and feed industries. Demand is driven by growing use of natural antioxidants in edible oils, animal nutrition, and processed foods. Rising export-oriented food production encourages manufacturers to adopt tocopherols for quality preservation. Improving awareness of nutritional supplementation and gradual expansion of local nutraceutical manufacturing further strengthen regional market development.

Middle East & Africa

The Middle East & Africa accounted for 4.9% market share, driven by increasing adoption of fortified foods and dietary supplements. Growing urbanization and rising disposable incomes support demand for functional nutrition products enriched with vitamin E. The region also shows steady growth in animal feed consumption, particularly in poultry and dairy sectors. Dependence on imported tocopherols remains high, but improving food processing capabilities support gradual market penetration. Expanding healthcare awareness and regulatory initiatives promoting food fortification contribute to consistent, though comparatively moderate, market growth across the region.

Market Segmentations:

By Type

- Alpha Tocopherols

- Delta Tocopherols

- Mixed Tocopherols

- Others

By Source

- Soybean Oil

- Sunflower Oil

- Rapeseed Oil

- Others

By Application

- Dietary Supplements

- Animal Feed Nutrition

- Cosmetics

- Pharmaceuticals

- Food & Beverages

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Tocopherols Market is shaped by the strong presence of BASF SE, DSM-Firmenich, Archer Daniels Midland Company, Cargill, Incorporated, Evonik Industries AG, BTSA Biotecnologías Aplicadas S.L., Wilmar International Limited, Zhejiang Worldbestve Biotechnology Co., Ltd., and COFCO Tech Bioengineering (Tianjin) Co., Ltd. These players focus on integrated sourcing from vegetable oils, advanced extraction technologies, and consistent product quality to strengthen market positioning. Strategic emphasis remains on expanding production capacity, improving purification efficiency, and developing application-specific tocopherol blends for food, feed, nutraceutical, and cosmetic uses. Companies increasingly invest in clean-label, non-GMO, and natural antioxidant portfolios to align with regulatory and consumer expectations. Geographic expansion across Asia Pacific and Latin America remains a key growth strategy, supported by partnerships with regional distributors and food processors. Continuous product innovation, supply chain optimization, and sustainability-aligned sourcing practices collectively define the competitive dynamics of the global tocopherols market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- DSM-Firmenich

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Evonik Industries AG

- Koninklijke DSM N.V.

- BTSA Biotecnologías Aplicadas S.L.

- Wilmar International Limited

- Zhejiang Worldbestve Biotechnology Co., Ltd.

- COFCO Tech Bioengineering (Tianjin) Co., Ltd.

Recent Developments

- In April 2025, Kensing LLC launched Sun E®, a sustainable, non-GMO sunflower-derived tocopherol ingredient to expand its natural vitamin E product portfolio and meet clean-label demand.

- In December 2024, A.C. Grace Company’s UNIQUE E® Mixed Tocopherols was reaffirmed as ConsumerLab.com’s Top Pick for natural vitamin E supplements, highlighting product quality and purity.

- In November 2023, Kensing Solutions LLC acquired Advanced Organic Materials S.A., enhancing its production of natural tocopherols and phytosterols.

- In February 2023, DSM Personal Care introduced Retinol CB 50, incorporating natural mixed tocopherols as antioxidants.

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The tocopherols market will benefit from sustained demand for natural antioxidants across food, feed, nutraceutical, and cosmetic applications.

- Clean-label reformulation initiatives will continue to accelerate the replacement of synthetic antioxidants with naturally sourced tocopherols.

- Dietary supplement consumption will expand further, driven by preventive healthcare trends and rising awareness of vitamin E benefits.

- Food manufacturers will increasingly use tocopherols to enhance shelf life while maintaining ingredient transparency.

- Growth in livestock and aquaculture production will strengthen demand for tocopherols in animal feed nutrition.

- Cosmetic and personal care brands will expand tocopherol usage in anti-aging and skin-protection formulations.

- Advances in extraction and purification technologies will improve yield efficiency and product consistency.

- Sustainable sourcing and traceable supply chains will become critical selection criteria for buyers.

- Asia Pacific and Latin America will emerge as key growth regions due to expanding food processing and nutraceutical industries.

- Strategic partnerships and capacity expansions will shape long-term competition and market consolidation.