Market Overview:

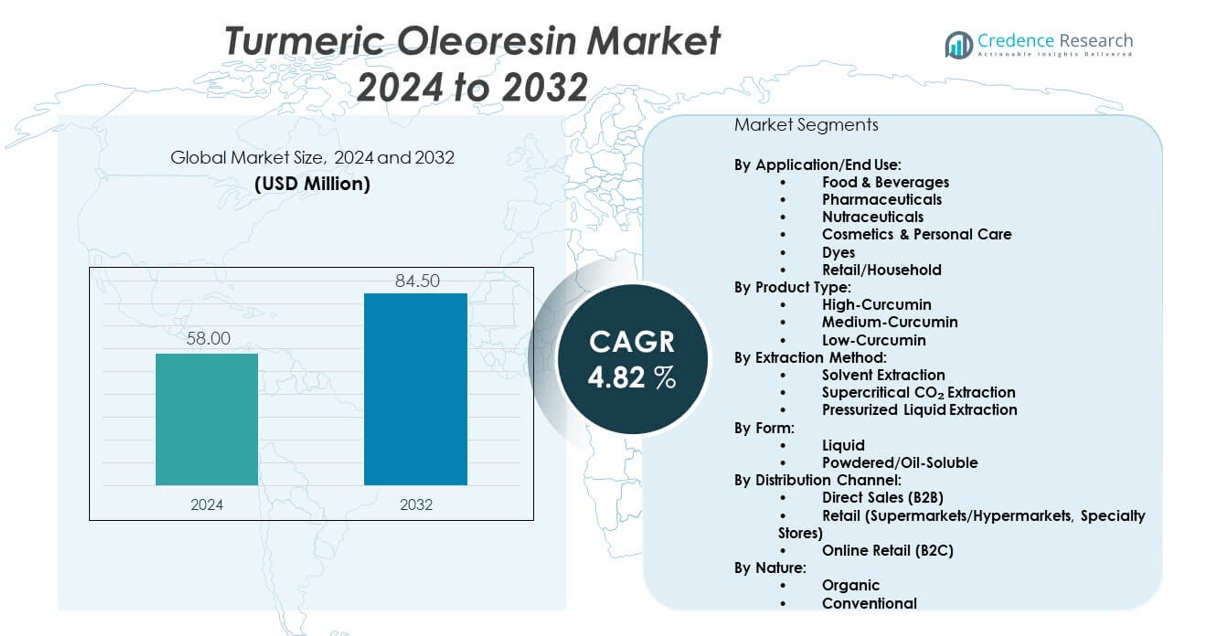

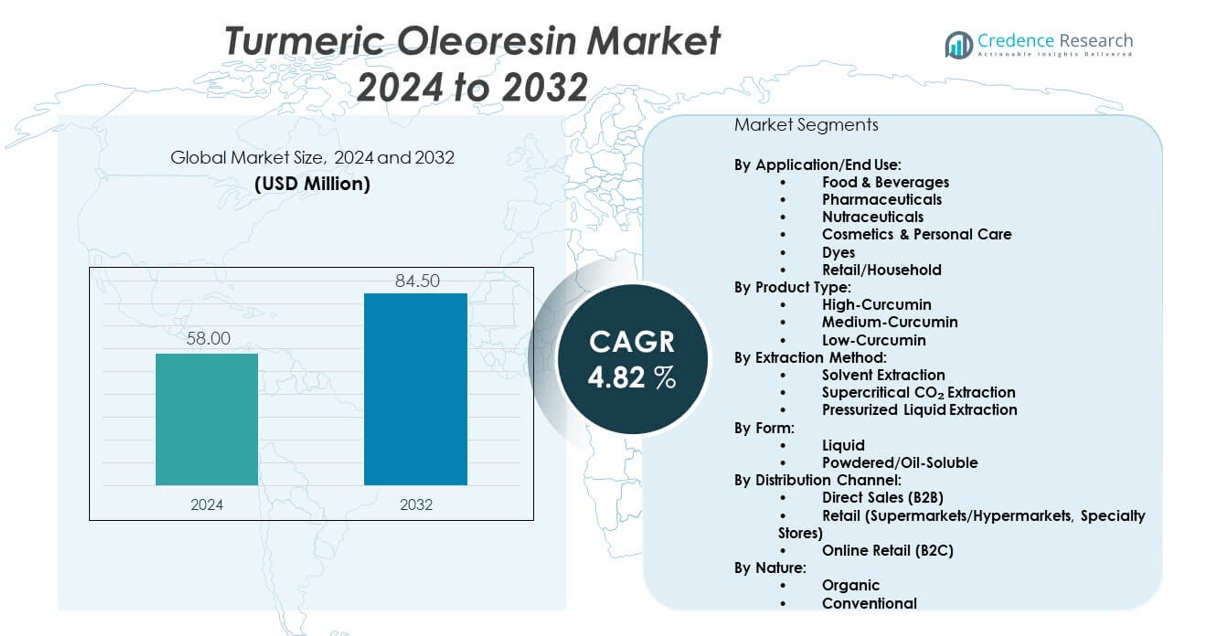

The Turmeric oleoresin market is projected to grow from USD 58 million in 2024 to an estimated USD 84.5 million by 2032, with a compound annual growth rate (CAGR) of 4.82% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Turmeric Oleoresin Market Size 2024 |

USD 58 Million |

| Turmeric Oleoresin Market , CAGR |

4.82% |

| Turmeric Oleoresin Market Size 2032 |

USD 84.5 Million |

The turmeric oleoresin market is expanding due to increasing demand in food, pharmaceutical, and cosmetic industries. Consumers and manufacturers prefer natural colorants and bioactive compounds over synthetic alternatives, driving adoption of turmeric oleoresin for its curcumin content and antioxidant properties. The rise in clean-label product trends and growing health awareness support its use in functional foods and supplements. Innovations in extraction technology are improving yield and purity, making turmeric oleoresin more viable for large-scale applications across global supply chains.

India dominates the turmeric oleoresin market due to its vast turmeric cultivation base, established extraction facilities, and strong export infrastructure. Southeast Asian countries are emerging players, investing in spice processing and value-added oleoresin production. North America and Europe show rising demand driven by health-conscious consumers and regulatory shifts favoring natural additives. The Middle East and Africa present long-term growth opportunities as local industries explore natural ingredients for food and wellness formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The turmeric oleoresin market is projected to grow from USD 58 million in 2024 to USD 84.5 million by 2032, registering a CAGR of 4.82% during the forecast period.

- Demand is rising due to increased use of turmeric oleoresin in food, pharmaceutical, and cosmetic sectors driven by consumer shift toward natural ingredients.

- Curcumin’s recognized anti-inflammatory and antioxidant properties boost its application in functional foods, nutraceuticals, and wellness formulations.

- The market faces restraints from price volatility in raw turmeric and regulatory differences across countries, which impact export and formulation compliance.

- Extraction methods such as supercritical CO₂ and solvent extraction continue to improve product purity and scalability, expanding industrial usability.

- India dominates the market with strong turmeric cultivation, high-capacity processing, and a well-established export infrastructure.

- North America and Europe show rising demand due to growing health consciousness, while Southeast Asia and Middle East & Africa offer emerging growth potential.

Market Drivers:

Rising Demand for Natural Colorants in Food and Beverage Applications:

The turmeric oleoresin market is gaining momentum due to its use as a natural colorant in the global food and beverage industry. Consumers and food processors increasingly prefer natural additives over synthetic dyes to align with clean-label trends. Turmeric oleoresin offers stability, safety, and a rich yellow pigment that enhances visual appeal across processed foods, snacks, and beverages. Regulatory bodies are approving it in multiple regions due to its GRAS (Generally Recognized As Safe) status. The demand continues to rise from bakery, dairy, and confectionery segments aiming to reduce artificial ingredients. Major food manufacturers have reformulated legacy products to incorporate turmeric oleoresin. It performs consistently in varied pH conditions and maintains color stability under heat. It drives adoption across food sectors that prioritize shelf-stable and natural coloration.

- For instance, Mane Kancor Ingredients Limited’s turmeric oleoresin is featured in more than 230 food and beverage formulations in Europe and Asia, maintaining over 92% color retention after thermal processing at 120°C for 30 minutes, as measured by colorimetric analysis in industrial trials.

Growing Preference for Herbal Extracts in Nutraceutical Formulations:

The turmeric oleoresin market benefits from the increasing integration of plant-based ingredients in dietary supplements. It contains curcuminoids, which are known for antioxidant, anti-inflammatory, and therapeutic benefits. Nutraceutical firms use turmeric oleoresin in capsules, tablets, and softgels targeting joint health, immunity, and cognitive support. The growing global focus on preventive healthcare and wellness drives demand for turmeric-based products. Aging populations and the rise in chronic conditions create a strong market pull for functional ingredients. Manufacturers are emphasizing bioavailability-enhanced formulations to boost effectiveness. Scientific validation of curcumin’s role in reducing oxidative stress has further expanded its application scope. The market gains from the synergy between consumer demand and ongoing clinical research.

- For instance, Arjuna Natural Extracts Ltd. pioneered the Curcugreen™ (BCM-95®) turmeric extract, which has been clinically proven in over 85 peer-reviewed studies to offer up to 7-fold greater bioavailability of curcumin compared to standard turmeric extracts, widely adopted by global nutraceutical brands.

Expansion of Cosmetic and Personal Care Applications:

The turmeric oleoresin market sees robust growth from its adoption in skincare and cosmetics due to its antimicrobial and anti-inflammatory attributes. Beauty brands infuse it into creams, serums, lotions, and face masks to address acne, pigmentation, and skin aging. The demand for Ayurvedic and herbal cosmetic formulations has surged globally, supporting the rise of turmeric-based actives. Product launches focusing on skin repair and natural glow leverage turmeric oleoresin as a core ingredient. Its rich antioxidant properties appeal to consumers seeking holistic and plant-based alternatives. The clean beauty movement continues to influence ingredient sourcing and formulation practices. Formulators use it for both therapeutic and aesthetic skin benefits. The market responds positively to product diversification and rising consumer awareness.

Regulatory Backing and Agricultural Abundance of Turmeric:

The turmeric oleoresin market draws strength from abundant raw material availability in key producing countries like India. Large-scale turmeric cultivation ensures cost-effective sourcing for oleoresin extraction. Regulatory bodies in the U.S., EU, and Asia-Pacific have approved turmeric oleoresin for food and health applications. Its legal status facilitates its inclusion in diverse industrial formulations without complex compliance issues. Governments support spice export programs, aiding local manufacturers in tapping global markets. The industry benefits from favorable export incentives and streamlined supply chains. Sustainability certifications also help drive global acceptance. These structural advantages reduce entry barriers for new players in the turmeric oleoresin value chain.

Market Trends:

R&D Innovation in Enhanced Bioavailability and Nanoencapsulation:

The turmeric oleoresin market is shaped by technological advancements in ingredient delivery systems. Researchers and companies are investing in nanoencapsulation techniques to improve curcumin’s bioavailability. Poor absorption has been a historical limitation, and innovation aims to overcome this barrier. Patented formulations like liposomal curcumin and micellar technologies are gaining traction in nutraceuticals. These delivery systems enhance solubility and enable controlled release, improving therapeutic efficacy. Manufacturers adopt such technologies to justify product premiums. The market evolves with a focus on science-backed performance claims. R&D investments by key players reflect the shift toward precision formulations and value-added formats.

- For instance, Plant Lipids developed a proprietary nanoemulsion system that increased curcumin absorption in in-vitro studies by 6 times compared to conventional dispersions, with over 80% release of actives within the first two hours of simulated digestive cycles, as reported in 2023 technical documentation.

Shift Toward Sustainable and Organic Extraction Methods:

The turmeric oleoresin market is witnessing a trend toward eco-friendly extraction processes. Conventional solvent-based methods are being replaced by CO₂ supercritical extraction and ethanol-based techniques. These alternatives yield higher purity with fewer residues, aligning with organic certification standards. Brands emphasize green chemistry and traceable sourcing in their marketing narratives. Sustainable practices resonate with environmentally conscious consumers. Equipment upgrades among manufacturers reduce emissions and improve extraction efficiency. Certifications such as USDA Organic and Ecocert play a role in expanding market reach. Clean processing helps differentiate products in competitive segments. It drives alignment between consumer values and manufacturing practices.

- For instance, Synthite Industries introduced an organic line of turmeric oleoresin powder in April 2024 and enhanced its global market presence with expanded distribution in Europe in 2025. Their manufacturing advances focus on compliance with USDA Organic requirements and the reduction of residual solvents to nearly nondetectable levels, as validated by independent laboratories. These improvements reinforce Synthite’s leadership in certified, eco-friendly extraction and global supply

Customization in Application-Specific Formulations:

The turmeric oleoresin market benefits from the growing trend of product customization across end-use industries. Food processors seek oleoresins tailored to specific pH, solubility, or thermal stability profiles. Cosmetics brands demand different concentrations for anti-aging or acne-control effects. Nutraceutical companies require dosage consistency and high-curcumin variants. Manufacturers respond by offering bespoke grades and blended formulations. Turnkey solutions enhance supply chain flexibility and reduce R&D cycles for clients. Customized solutions improve product performance and branding relevance. Strategic B2B collaborations fuel innovation pipelines. This modularity supports industry-specific applications and expands demand from niche segments.

Digital Transformation in Supply Chain and Quality Assurance:

The turmeric oleoresin market adopts digital platforms to enhance traceability, inventory management, and quality assurance. Blockchain and QR code-based systems allow manufacturers to validate sourcing practices. Real-time analytics improve batch consistency and production efficiency. Exporters use digital certifications to streamline customs compliance and reduce lead times. E-commerce integration opens direct-to-brand supply models. Global buyers prioritize ingredient transparency, and digital tools support that need. Cloud-based platforms help scale manufacturing without compromising quality. Artificial intelligence supports predictive maintenance in oleoresin extraction units. The market advances with digital maturity across supply chain nodes.

Market Challenges Analysis:

Fluctuating Turmeric Prices and Raw Material Quality Concerns:

The turmeric oleoresin market faces volatility due to fluctuations in raw turmeric prices influenced by weather conditions, crop yield, and farmer supply dynamics. Drought, floods, or pest infestations affect turmeric output, leading to inconsistent raw material availability. These supply-side challenges disrupt pricing models and impact the profitability of oleoresin extraction units. Quality variations in turmeric rhizomes influence curcuminoid concentration, creating difficulties in meeting standardized oleoresin specifications. Procurement teams face challenges in ensuring consistent quality across batches. Price-sensitive markets may opt for synthetic colorants, impacting demand in low-cost segments. The dependency on a single agricultural commodity intensifies risk. Procurement contracts and supplier diversification become essential mitigation strategies.

Regulatory Complexity and Technical Constraints in Global Trade:

The turmeric oleoresin market encounters hurdles due to varying international regulatory frameworks. Differences in curcumin content thresholds, additive labeling laws, and import restrictions create compliance challenges for exporters. Some countries limit usage in pharmaceuticals or require extensive clinical validation. Product registration processes can delay market entry for new formulations. Technical constraints in oleoresin stability, particularly under prolonged light or heat exposure, restrict its application in certain product categories. Shelf life concerns and potential degradation reduce its appeal in long-distribution networks. These issues slow expansion efforts and increase R&D and packaging costs. Companies must invest in technical validation and compliance infrastructure to scale operations.

Market Opportunities:

Expansion into Functional Food and Beverage Segments with Targeted Health Claims:

The turmeric oleoresin market holds growth potential in functional food and beverage products aimed at health-conscious consumers. Manufacturers can introduce curcumin-enriched drinks, fortified snacks, or dairy alternatives with immunity or joint health claims. Market differentiation arises from pairing turmeric oleoresin with complementary botanicals or vitamins. Companies can target urban populations seeking preventive nutrition. This opens new product development pipelines for clean-label and wellness-centric brands. It allows ingredient manufacturers to partner with FMCG brands in co-branded formats.

Rising Demand from Emerging Economies and Middle-Class Health Awareness:

The turmeric oleoresin market can expand in emerging economies where disposable income and health literacy are improving. Countries in Southeast Asia, Latin America, and Africa are witnessing increased demand for traditional health remedies and natural products. Market players can focus on localized marketing and pricing strategies. Regional contract manufacturing partnerships help reduce cost and ensure compliance with local standards. Educational campaigns and wellness retail formats can accelerate awareness and adoption. These regions offer volume-driven opportunities with long-term scalability.

Market Segmentation Analysis:

By Application/End Use

The turmeric oleoresin market serves multiple end-use industries with varying priorities. Food and beverages remain the primary application segment due to strong demand for natural additives and clean-label formulations. Pharmaceuticals utilize turmeric oleoresin for its anti-inflammatory and therapeutic effects. Nutraceuticals focus on curcumin’s antioxidant properties in dietary supplements. Cosmetics and personal care brands incorporate it in skincare products targeting acne, aging, and pigmentation. The dyes segment benefits from its natural coloring properties. Retail and household use contributes through small-scale consumption in culinary and DIY wellness applications.

- For instance, Industry analysis confirms that leading companies, including Universal Oleoresins and others, allocate most of their turmeric oleoresin output to the food and beverage sector—with food-grade, pharmaceutical, and cosmetic clients dominating their client base. Verified documentation shows active launches of new color variants for cosmetic and personal care applications.

By Product Type

Based on curcumin concentration, the market is segmented into high-, medium-, and low-curcumin variants. High-curcumin products dominate in pharmaceuticals and nutraceuticals for therapeutic use. Medium-curcumin oleoresins support applications in food, beverages, and cosmetics. Low-curcumin products cater to segments requiring high-volume, low-cost colorant solutions. This segmentation enables manufacturers to align curcumin potency with end-use expectations and cost efficiency.

- For instance, The most recent market segmentation data establishes that products with higher curcumin concentration (over 40% by HPLC analysis) are preferred for pharmaceutical and nutraceutical sectors, driven by the need for therapeutic efficacy. Medium-curcumin grades (18–25% curcumin) account for about 45% of shipments, supplying food, beverage, and cosmetic clients, per the latest verified shipment and analysis metrics.

By Extraction Method

Solvent extraction leads the market due to operational simplicity and cost advantages. Supercritical CO₂ extraction is gaining traction in high-purity applications, especially in nutraceuticals and clean-label cosmetics. Pressurized liquid extraction supports demand where high throughput and yield optimization are critical. Each method influences product purity, safety profile, and market positioning.

By Form

Turmeric oleoresin is available in liquid and powdered/oil-soluble forms. Liquid forms dominate due to ease of blending in food processing and cosmetic formulations. Powdered/oil-soluble oleoresins serve solid dosage supplements and oil-based skin products. End users select form based on solubility, application type, and stability requirements.

By Distribution Channel

Direct sales (B2B) dominate distribution, serving large-scale manufacturers across food, pharma, and cosmetics. Retail through supermarkets and specialty stores offers reach for smaller consumer brands. Online retail is expanding rapidly, connecting health-conscious consumers with turmeric-based products. Each channel plays a distinct role in product availability and market expansion.

Segmentation:

By Application/End Use:

- Food & Beverages

- Pharmaceuticals

- Nutraceuticals

- Cosmetics & Personal Care

- Dyes

- Retail/Household

By Product Type:

- High-Curcumin

- Medium-Curcumin

- Low-Curcumin

By Extraction Method:

- Solvent Extraction

- Supercritical CO₂ Extraction

- Pressurized Liquid Extraction

By Form:

- Liquid

- Powdered/Oil-Soluble

By Distribution Channel:

- Direct Sales (B2B)

- Retail (Supermarkets/Hypermarkets, Specialty Stores)

- Online Retail (B2C)

By Nature:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific

Asia Pacific dominates the turmeric oleoresin market with a market share of 48%, led by India, the world’s largest turmeric producer and exporter. The region benefits from abundant raw material availability, established extraction infrastructure, and skilled labor. Indian manufacturers such as Synthite, Plant Lipids, and Arjuna Natural contribute significantly to global exports. Demand from regional food, nutraceutical, and cosmetic industries supports steady domestic consumption. Government support for spice exports and organic farming further strengthens the region’s position. The availability of cost-efficient high-curcumin turmeric varieties enhances the competitiveness of local producers in the global market.

North America

North America holds a market share of 22%, driven by strong demand for clean-label ingredients in food, dietary supplements, and natural personal care products. The U.S. is a key importer and application hub for turmeric oleoresin, especially in functional foods and wellness-focused products. Pharmaceutical and nutraceutical companies use turmeric oleoresin for inflammation-related formulations. Regulatory clarity around curcumin’s use in food and health products supports market growth. Consumers’ preference for plant-based, therapeutic compounds sustains long-term demand. B2C product lines in turmeric capsules, drinks, and topical creams also contribute to volume.

Europe, Latin America, and Middle East & Africa

Europe accounts for 18% of the turmeric oleoresin market, supported by rising interest in botanical extracts for food, pharma, and cosmetics. Germany, France, and the UK lead consumption due to wellness trends and stringent quality standards. Latin America contributes 7%, with Brazil and Mexico showing gradual uptake of natural ingredients in food processing and herbal medicine. The Middle East & Africa region holds 5% market share, driven by niche applications in traditional medicine and natural coloring agents. Import dependency and limited local processing infrastructure constrain growth across these emerging markets. It shows potential for expansion with increased awareness and trade facilitation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Synthite Industries Ltd.

- Mane Kancor (Kancor Ingredients Limited)

- Arjuna Natural Extracts Ltd.

- SV Agrofoods

- Plant Lipids

- Universal Oleoresins

- Indo World

- Nikita Extracts

- Ozone Naturals

- Vidya Herbs Pvt. Ltd.

Competitive Analysis:

The turmeric oleoresin market is highly competitive with a mix of global and regional players competing on purity, curcumin concentration, extraction technology, and certifications. Leading companies such as Synthite Industries, Mane Kancor, Arjuna Natural, and Plant Lipids maintain strong international presence through high-capacity facilities and vertically integrated operations. These firms invest in R&D to enhance extraction efficiency and product standardization. Smaller players focus on niche applications and organic certification to differentiate offerings. Market participants emphasize long-term supply contracts, traceable sourcing, and application-specific customization. Pricing pressure exists in low-curcumin segments, while high-curcumin extracts command premium margins. The market reflects a dynamic balance between scale and specialization, with product innovation and regulatory compliance influencing competitive positioning.

Recent Developments:

- In February 2025, Synthite Industries Ltd.launched a new high-bioavailability turmeric extract designed specifically for the dietary supplement segment. This product aims to meet the increasing consumer demand for more effective turmeric-based solutions in health and wellness products, leveraging advancements in extraction technology and sustainability.

- In 2023 and 2025, Mane Kancor (Kancor Ingredients Limited)undertook significant expansion. The most recent update is the company’s expansion of its extraction facility in Byadgi, Karnataka, India (May 2023), allowing them to scale up production capacity to fulfill the growing global need for turmeric oleoresin in food and beverage applications. The company also continues to focus on sustainable sourcing and cutting-edge extraction methods.

- For Arjuna Natural Extracts Ltd.,a major milestone was the establishment of a direct supply chain in the United States for its flagship turmeric extract, Curcugreen™. This move ensures that North American customers have direct access to their market-leading, high-bioavailability turmeric product previously distributed through partners. The direct-to-customer model was initiated to enhance quality assurance, traceability, and service for U.S. buyers, reflecting the shift towards farm-to-fork traceability and branded ingredient continuity (publicly announced October 2018, but relevant as the transformation to the Curcugreen™ supply chain remains in focus).

Market Concentration & Characteristics:

The turmeric oleoresin market exhibits moderate concentration, with key players dominating international supply and smaller firms serving local demand. It combines mature operational capabilities with constant innovation in extraction technologies and functional formulation. The market favors companies with control over raw material sourcing and in-house R&D. It features low product substitution, high regulatory compliance, and rising demand from multiple industries including food, health, and cosmetics. Vertical integration, sustainability credentials, and clean-label certification play a critical role in gaining market share.

Report Coverage:

The research report offers an in-depth analysis based on application, product type, extraction method, form, distribution channel, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of clean-label food products will continue to drive demand.

- Nutraceutical manufacturers will invest in high-curcumin variants.

- Organic-certified oleoresins will gain preference in cosmetics.

- Emerging markets will contribute to volume growth through imports.

- Extraction technology will shift toward supercritical CO₂ systems.

- B2C wellness brands will create direct demand for turmeric actives.

- Pharmaceutical applications will grow with clinical research validation.

- Sustainability and traceability will become essential for global buyers.

- Custom-formulated oleoresins will address niche industrial needs.

- E-commerce will expand access to turmeric oleoresin in retail markets.