Market Overview:

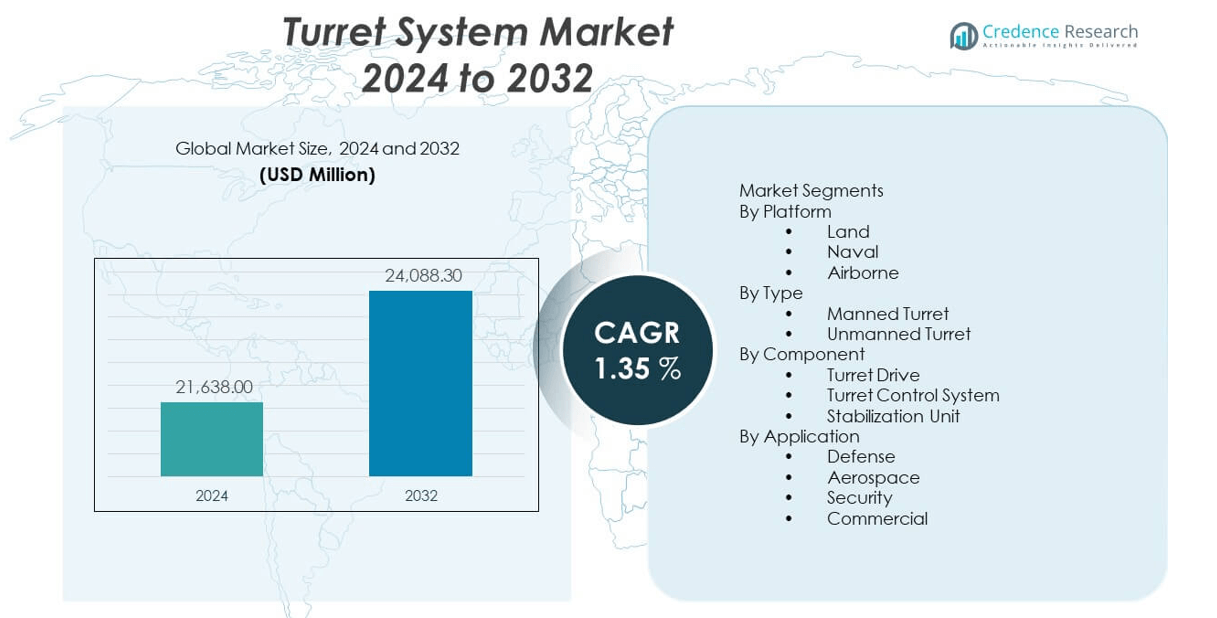

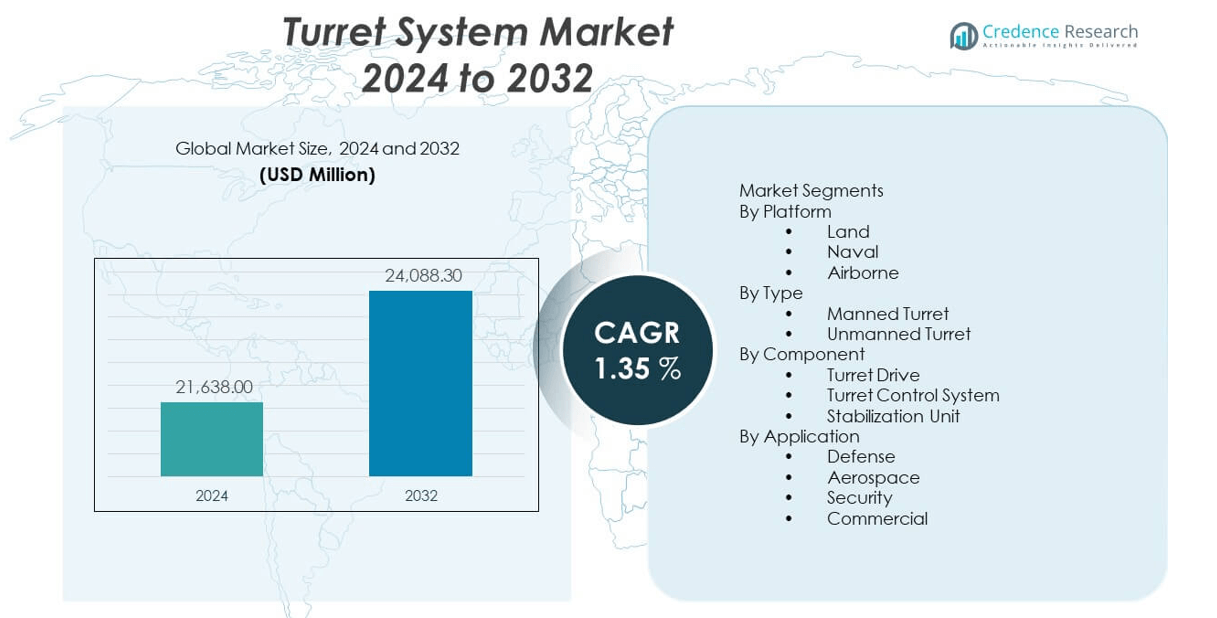

The Turret system market is projected to grow from USD 21,638 million in 2024 to an estimated USD 24,088.3 million by 2032, with a compound annual growth rate (CAGR) of 1.35% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Turret System Market Size 2024 |

USD 21,638 million |

| Turret System Market, CAGR |

1.35% |

| Turret System Market Size 2032 |

USD 24,088.3 million |

The turret system market is experiencing steady growth due to increasing defense modernization programs and rising demand for advanced weapon stations on armored vehicles and naval platforms. Nations continue to invest in automated, remote-controlled turrets to enhance precision targeting, situational awareness, and battlefield survivability. Technological upgrades such as AI-based fire control systems and lightweight materials support deployment across multiple vehicle classes. Procurement contracts and military alliances drive innovation and production, while modular turret designs improve flexibility and reduce lifecycle costs for military operators.

North America dominates the turret system market, led by high defense budgets, strong R&D capabilities, and active upgrade programs in the U.S. and Canada. Europe follows with major contributions from countries like France, Germany, and the UK, driven by NATO commitments and vehicle fleet modernization. Asia-Pacific is emerging rapidly due to growing geopolitical tensions and military expansion in China, India, and South Korea. The Middle East shows increasing activity through ongoing defense procurement initiatives.

Market Insights:

- The turret system market is projected to grow from USD 21,638 million in 2024 to USD 24,088.3 million by 2032, registering a CAGR of 1.35% during the forecast period.

- Rising demand for automated and remote-controlled turrets across land and naval platforms is a key driver, driven by military needs for precision targeting and crew safety.

- Defense modernization initiatives and vehicle fleet upgrades across NATO and allied nations are fueling steady procurement of modular turret systems.

- High integration costs, platform compatibility issues, and cybersecurity concerns related to digital fire control systems act as restraints on wider adoption.

- North America holds the largest market share, led by U.S. investments in next-gen armored vehicles and AI-enabled turret technologies.

- Europe shows sustained growth driven by NATO-aligned programs and strong participation from players in Germany, France, and the UK.

- Asia-Pacific is emerging as a key growth region due to expanding military capabilities and geopolitical tensions in China, India, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Escalating Global Defense Expenditure and Modernization Efforts Across Armed Forces:

Rising military budgets worldwide continue to drive the turret system market forward. Nations are investing in next-generation land, naval, and aerial platforms, each requiring advanced turret capabilities for precision and survivability. Armed forces are phasing out outdated systems and replacing them with modular, scalable turret technologies. Many procurement programs prioritize remote weapon stations, stabilizers, and sensor-integrated turrets to enhance battlefield performance. The growing focus on network-centric warfare pushes the demand for digitized turret systems. Defense ministries in regions such as North America, Europe, and Asia-Pacific actively fund R&D and acquisition programs. Strategic rivalries and border security threats create sustained demand for armored platforms equipped with modern turrets. The turret system market aligns with these trends by offering flexible integration across vehicle classes.

- For instance, Rheinmetall’s Skyranger 30 turret system, contracted by Austria in February 2024, integrates a 30mm automatic cannon capable of firing 1,200 rounds per minute and supporting dual Mistral missiles, providing mobile air defense across armored vehicle fleets and reflecting direct outcomes of defense modernization budgets.

Increasing Demand for Remote Weapon Stations to Enhance Operator Safety:

Remote-controlled turret systems are gaining prominence across defense forces due to their ability to operate weapons from protected positions. These systems allow operators to engage threats without direct exposure to hostile environments. Modern RWS platforms integrate electro-optics, fire control, and automated tracking systems. They are widely deployed on infantry fighting vehicles, armored personnel carriers, and unmanned ground vehicles. Demand has grown rapidly among NATO countries and other regions with high asymmetric threat levels. Compact and lightweight turret solutions have expanded adoption even in light utility vehicles. Integration ease with different calibers and payloads strengthens deployment flexibility. The turret system market supports this evolution with adaptable and interoperable remote configurations.

- For instance, Elbit Systems’ UT30 MK2 unmanned turret, awarded a roughly $100 million contract in May 2024, delivers fully remote operation with day/night sights, laser rangefinders, and stabilization on two axes, supporting 30mm cannons and anti-tank guided missiles, and has been fielded on over 500 vehicles across multiple NATO armies.

Proliferation of Unmanned and Autonomous Combat Systems Across Military Forces:

The integration of turrets into unmanned platforms creates a new growth frontier for the turret system market. Autonomous ground and aerial combat vehicles are increasingly equipped with lightweight, sensor-fused turrets for reconnaissance and engagement. Turret manufacturers are developing low-recoil, precision-guided solutions compatible with AI-based targeting systems. Several military programs focus on swarming drones and UGVs capable of coordinated, turret-based fire. These systems demand compact, energy-efficient turrets with high-speed actuation and stabilized sighting. Defense contractors collaborate with robotics firms to embed firepower into AI-enabled vehicles. The trend enhances lethality while minimizing troop deployment in high-risk zones. The market addresses these innovations with adaptable turret architectures for unmanned deployment.

Rising Cross-Domain Operational Requirements in Joint Warfare Environments:

Modern military operations often involve combined arms coordination across land, sea, and air domains. Turret systems must support multi-environment adaptability and integrate seamlessly with battlefield management systems. Interoperability with sensors, drones, and command centers enhances decision-making and situational awareness. Armed forces seek turret platforms with scalable firepower, real-time data connectivity, and cross-platform integration. Smart turrets now provide actionable analytics, reducing engagement time and improving accuracy. The need for standardized yet upgradeable systems supports modular turret configurations. The turret system market responds to these cross-domain needs by aligning with unified combat doctrines and digital command infrastructure.

Market Trends:

Integration of Artificial Intelligence and Advanced Targeting Algorithms in Turrets:

Artificial intelligence plays a growing role in automating turret functions and enhancing precision in high-threat scenarios. AI-powered targeting systems improve object recognition, threat prioritization, and fire control accuracy. Defense programs adopt neural networks to reduce operator workload and increase engagement efficiency. Smart turrets equipped with AI can autonomously track fast-moving targets across dynamic environments. AI also enables predictive maintenance and adaptive control, extending turret lifespan. These features prove valuable in reconnaissance missions and high-tempo battlefield operations. The turret system market incorporates AI modules across vehicle platforms, supporting autonomous decision cycles and faster reaction times.

- For instance, Leonardo’s LIONFISH naval turret, introduced in 2023, employs artificial intelligence to deliver real-time target classification and tracking, enabling engagement of threats moving at up to 80 knots, and provides sub-second automated aiming accuracy during adverse sea conditions.

Shift Toward Modular and Scalable Turret Architectures for Fleet Flexibility:

Military forces increasingly demand modular turret systems that support upgrades, retrofits, and mission-specific configurations. Modular turrets allow operators to switch between weapon types, sensors, and support systems without full replacement. This reduces lifecycle costs while improving battlefield adaptability. Turrets can now accommodate machine guns, autocannons, missiles, or non-lethal payloads depending on mission requirements. Scalability supports future-proofing in long-term procurement programs. Design frameworks emphasize plug-and-play integration with existing vehicle architecture. The turret system market advances this trend by engineering customizable platforms compatible with various payload and power specifications.

- For instance, Moog Inc.’s Reconfigurable Integrated-weapons Platform (RIwP) supports plug-and-play integration with over a dozen weapon types—including 7.62mm machine guns, 20-50mm autocannons, and anti-tank guided missiles—with tool-free swapping in under one hour, demonstrating a high level of scalability and mission-specific flexibility.

Advancements in Electro-Optical and Infrared Sighting Systems for All-Weather Operation:

Modern turrets feature high-resolution electro-optical and infrared systems for improved day/night targeting. These sensors provide greater engagement range and clearer situational awareness in low-visibility environments. Thermal imaging, laser rangefinding, and panoramic views support rapid threat detection and response. Advanced sighting systems operate effectively in diverse terrain and weather conditions, supporting both urban warfare and open battlefield engagements. Integration with digital battlefield networks enables real-time video feeds to command centers. The turret system market aligns with this demand by embedding high-grade optics and multi-sensor fusion in its platforms.

Adoption of Lightweight Composite Materials for Turret Weight Reduction:

Reducing turret weight while preserving structural integrity remains a critical design objective. Advanced composites, aluminum alloys, and lightweight ceramics help reduce vehicle load while maintaining protection and performance. Lighter turrets enhance vehicle mobility, fuel efficiency, and transportability across air or amphibious platforms. They also allow integration into lighter tactical vehicles without compromising firepower. This trend supports fast deployment and rapid maneuvering in expeditionary and special forces operations. The turret system market leverages material science innovation to produce durable, lightweight turrets with reduced recoil and improved balance.

Market Challenges Analysis:

Complex Integration and Interoperability Issues Across Diverse Platforms:

One of the main challenges in the turret system market lies in the complexity of integrating turrets with legacy and modernized vehicle fleets. Each platform may vary in weight tolerance, sensor compatibility, and communication protocols, complicating standardization. Retrofits on older vehicles often require structural modification or interface redesign, raising costs and timelines. Variability in defense procurement standards across countries further complicates interoperability. Manufacturers must provide scalable, adaptable solutions without compromising performance. Failure to meet diverse technical specifications can lead to contract delays or rejections. It becomes critical for suppliers to ensure open architecture and modular software frameworks. The turret system market contends with these challenges by investing in flexible integration engineering and cross-platform compatibility.

Rising Cybersecurity Threats to Digitized Turret Control and Surveillance Systems:

As turret systems evolve into network-connected, sensor-integrated platforms, they become more vulnerable to cyber threats. Adversaries could exploit communication links, targeting algorithms, or control interfaces to disrupt operations or hijack functionality. Military stakeholders demand robust cybersecurity protocols to safeguard mission-critical systems. Turret developers must implement encryption, firewalls, and intrusion detection in both hardware and software. Maintaining secure command-and-control becomes more complex with remote weapon stations and AI-driven systems. Regulatory compliance and cyber-hardening increase R&D and certification costs. The turret system market must address these vulnerabilities while balancing cost and performance efficiency.

Market Opportunities:

Growing Adoption of Turret Systems in Homeland Security and Border Surveillance Missions:

Beyond traditional military roles, turret systems are increasingly deployed in homeland defense, law enforcement, and border security. Agencies equip surveillance vehicles and coastal patrol vessels with stabilized turret platforms for round-the-clock threat monitoring. The ability to mount non-lethal payloads supports crowd control and checkpoint protection. The turret system market benefits from expanding defense budgets allocated to internal security operations, especially in regions with porous borders and active insurgencies.

Rising Demand for Export-Oriented Manufacturing from Emerging Defense Economies:

Countries such as India, South Korea, and Turkey invest in local turret production to reduce import dependence and boost defense exports. Their programs emphasize indigenous turret designs tailored to regional requirements. Export deals and joint ventures create new revenue streams for global and local turret suppliers. The turret system market finds new opportunities by forming partnerships with emerging economies and customizing platforms for export viability.

Market Segmentation Analysis:

By Platform

The land segment dominates the turret system market due to widespread use in main battle tanks, armored personnel carriers, and infantry fighting vehicles. It reflects continued investment in ground force modernization across major economies. The naval segment follows, with rising adoption of turret-mounted systems on warships for surface and aerial threat engagement. Airborne turrets are gaining relevance in rotary-wing platforms and UAVs, driven by ISR and light attack missions requiring stabilized weapon systems.

- For instance, BAE Systems’ Vantage automated turret system, live-fired in June 2025, integrates on both crewed and uncrewed ground vehicles, delivering a stabilized shot group at ranges up to 750 meters and enabling cross-platform deployment for Army and Marine platforms alike.

By Type

Manned turrets retain a significant share in legacy and front-line combat systems where direct control and situational awareness are prioritized. Armed forces continue to operate manned platforms across numerous mission profiles. Unmanned turrets are expanding rapidly, driven by demand for crew safety, weight reduction, and remote operation capabilities. They integrate seamlessly into next-generation armored vehicles and unmanned combat systems, supporting automation and digital battlefield frameworks.

- For instance, General Dynamics’ ARV-30 prototype, developed for the U.S. Marine Corps as of March 2024, utilizes a 30mm unmanned turret equipped with advanced fire control and under-armor reloading, achieving crew survivability enhancements and enabling operation in chemically contaminated or high-risk environments.

By Component

Turret drives provide precise mechanical actuation for aiming and tracking functions. Their performance directly impacts response time and firing accuracy. Turret control systems handle targeting, stabilization, and communication functions, serving as the operational brain of modern turrets. Stabilization units ensure consistent aim and fire precision across moving platforms, enhancing effectiveness under combat conditions and during high-speed maneuvers.

By Application

Defense is the primary application, accounting for most turret deployments across land, air, and sea platforms. Aerospace use is rising, especially in helicopters and UAVs that require lightweight, multi-axis turret systems. The security segment benefits from turret integration in patrol vehicles for urban, border, and riot control missions. Commercial applications remain limited but include specialized use in industrial inspection and infrastructure monitoring. The turret system market supports these segments with configurable, mission-ready solutions.

Segmentation:

By Platform

By Type

- Manned Turret

- Unmanned Turret

By Component

- Turret Drive

- Turret Control System

- Stabilization Unit

By Application

- Defense

- Aerospace

- Security

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Technological Superiority and Robust Defense Spending

North America holds the largest share in the turret system market at 32%, driven by advanced defense capabilities, large-scale modernization programs, and strong defense budgets. The United States leads regional demand through investments in next-generation armored vehicles, remote weapon stations, and turret-integrated ISR platforms. Key manufacturers such as Lockheed Martin, Northrop Grumman, and General Dynamics strengthen domestic production and innovation capacity. The U.S. Army’s strategic initiatives to upgrade its combat vehicle fleets with unmanned and AI-enabled turret systems support long-term procurement activity. Canada contributes with incremental demand for border security and military mobility solutions. The region maintains its position through early adoption of automation and digital integration within turret systems.

Europe Demonstrates Steady Demand Through NATO Initiatives and Joint Defense Programs

Europe accounts for 27% of the turret system market, supported by rising cross-border defense collaboration and NATO-driven armored modernization. Countries such as Germany, France, the United Kingdom, and Italy are upgrading main battle tanks, infantry vehicles, and naval platforms with advanced turret solutions. Rheinmetall, Leonardo, and Thales are key players in regional development, offering both manned and unmanned turret systems across land and naval platforms. The EU’s defense funding programs and collaborative vehicle initiatives improve market scale and standardization. Demand also rises from Eastern European nations enhancing deterrence capabilities. European procurement emphasizes modularity, interoperability, and cyber-secure turret control systems.

Asia-Pacific Emerges as the Fastest-Growing Region with Expanding Military Modernization

Asia-Pacific holds a 23% share and shows the fastest growth in the turret system market due to increasing defense budgets and geopolitical tensions. China, India, South Korea, and Australia lead regional procurement through large-scale indigenous vehicle production and border security upgrades. The region seeks cost-effective turret solutions with scalable integration for land and naval applications. Domestic firms and foreign partnerships drive local manufacturing growth. Countries emphasize the deployment of remote turrets for infantry support, coastal surveillance, and aerial engagement. The market benefits from regional diversification strategies and increasing demand for autonomous and semi-autonomous combat capabilities.

Other Regions (Middle East & Africa – 11%, Latin America – 7%)

The Middle East & Africa contribute 11%, supported by armored vehicle acquisitions and coastal security needs across Gulf states and North Africa. Latin America holds 7%, with limited but steady demand for border patrol and internal security platforms. Both regions show interest in turret upgrades and modular retrofit solutions aligned with national defense goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BAE Systems

- Lockheed Martin Corporation

- Rheinmetall AG

- Moog Inc.

- Elbit Systems Ltd.

- Leonardo S.p.A.

- Northrop Grumman Corporation

- General Dynamics Corporation

- Thales Group

- RAFAEL Advanced Defense Systems Ltd.

Competitive Analysis:

The turret system market features a competitive landscape dominated by established defense contractors and specialized turret system manufacturers. Companies such as BAE Systems, Lockheed Martin, Rheinmetall AG, and Elbit Systems lead the global market with extensive defense portfolios and strong R&D capabilities. These firms offer a wide range of manned and unmanned turret platforms integrated with advanced targeting, stabilization, and communication systems. Competition centers on modularity, automation, weight optimization, and integration with battlefield networks. Emerging players focus on local manufacturing, export potential, and cost-effective solutions. Strategic collaborations, defense contracts, and technology licensing agreements influence market positioning. The turret system market demands continuous innovation to meet evolving combat requirements and support platform versatility.

Recent Developments:

- In June 2025, BAE Systems Australia test-fired its latest Vantage automated turret system (ATS) integrated on the ATLAS Collaborative Combat Vehicle. This advanced turret, featuring a low-profile, wireless-controlled system with precision firing capabilities up to 750 meters, demonstrated its operational readiness during live-fire trials supported by the Slovenian Military. The demonstration showed the system’s compatibility with both crewed and uncrewed vehicles, marking a key milestone in BAE’s push for modular, platform-agnostic turret technology suited for evolving battlefield needs.

- In July 2025, Leonardo S.p.A. announced the acquisition of Iveco Defence for EUR 1.7 billion, consolidating its position among European land defense leaders. This move expands Leonardo’s portfolio in tracked and wheeled land systems, enhancing integration of next-generation turrets and electronics. The acquisition, set to close in early 2026 (subject to regulatory approval), will allow for joint commercial efforts and accelerated technological development—particularly in turret integration with advanced platforms and electronic suites.

- In May 2024, Elbit Systems Ltd. was awarded an approximately $100 million contract to supply its UT30 MK2 unmanned turret systems for General Dynamics European Land Systems’ ASCOD armored vehicles, destined for a NATO European customer. The UT30 MK2 offers a highly modular architecture, advanced gunner and commander sights, anti-tank guided missiles, and Level 4 protection with integrated electro-optic and countermeasure systems. The contract—significant for firepower and survivability—will be completed by late 2027 and strengthens Elbit’s European footprint.

- In July 2024, Rheinmetall AG and Leonardo S.p.A. signed a strategic partnership memorandum to form a 50:50 joint venture in Italy, aimed at developing state-of-the-art Main Battle Tanks and the new Lynx Armoured Infantry Combat System for the Italian Army’s modernization programs. The joint venture will serve as system integrator for these programs and leverage both companies’ technologies to lead in future European main ground combat systems efforts, further expanding the European industrial base and export potential of advanced turreted combat vehicles.

Market Concentration & Characteristics:

The turret system market exhibits moderate to high concentration, with top global players accounting for a significant share of total revenues. It is characterized by long development cycles, high entry barriers, and strict regulatory oversight due to defense contracting standards. The market prioritizes reliability, survivability, and customization for various platforms. It relies on sustained military budgets and long-term procurement programs. Competitive differentiation hinges on innovation, combat performance, and integration flexibility. Major players maintain close ties with defense ministries and often operate through government contracts and offset agreements.

Report Coverage:

The research report offers an in-depth analysis based on Platform, Type, Component, and Application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of unmanned turret systems across armored platforms

- Rising integration of AI and machine learning in turret targeting systems

- Expansion of indigenous manufacturing capabilities in Asia and the Middle East

- Growing demand for modular and scalable turret architectures

- Higher investment in turret-enabled autonomous combat vehicles

- Enhanced focus on cybersecurity for turret control and communication systems

- Wider use of lightweight composite materials for mobility optimization

- Increasing role of turrets in homeland security and border protection

- Development of multi-mission turrets with both lethal and non-lethal capabilities

- Greater collaboration between global OEMs and regional defense manufacturers