Market Overview:

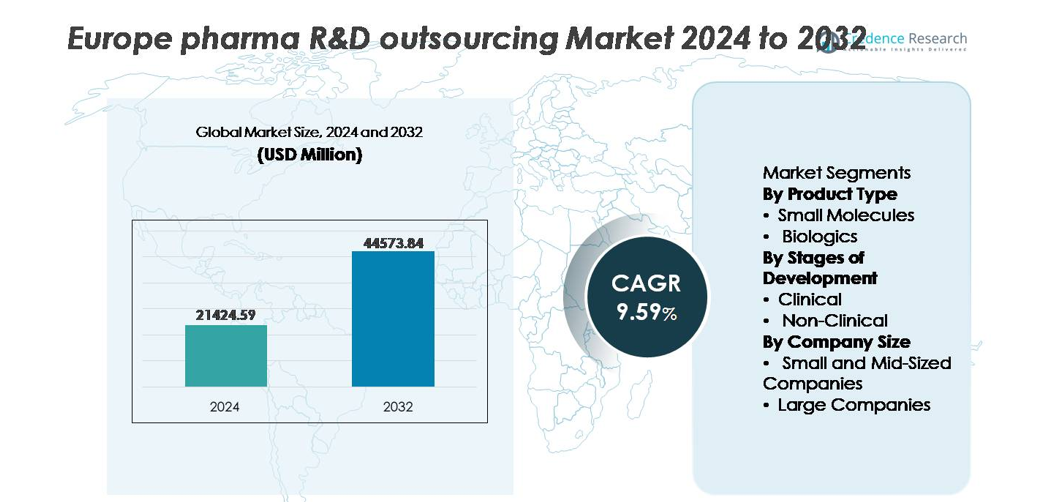

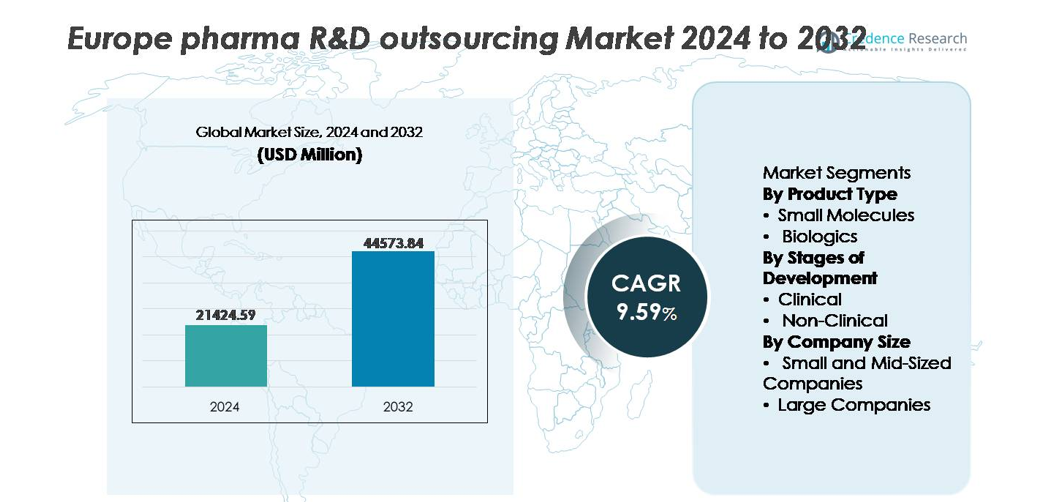

The Europe pharma R&D outsourcing market was valued at USD 21,424.59 million in 2024 and is projected to reach USD 44,573.84 million by 2032, registering a CAGR of 9.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Pharma R&D Outsourcing Market Size 2024 |

USD 21,424.59 million |

| Europe Pharma R&D Outsourcing Market, CAGR |

9.59% |

| Europe Pharma R&D Outsourcing Market Size 2032 |

USD 44,573.84 million |

The Europe pharma R&D outsourcing market is shaped by globally recognized research and development partners, including Thermo Fisher Scientific, Syneos Health, ICON, IQVIA, WuXi AppTec, Labcorp Drug Development, and Charles River Laboratories, each leveraging specialized competencies in clinical execution, biologics development, and AI-enabled data analytics. These companies continue to strengthen full-service outsourcing models through integrated clinical operations, regulatory support, and advanced laboratory capabilities. Western Europe remains the leading regional contributor, accounting for approximately 45–48% of total market share, driven by strong pharma headquarters presence, mature biotechnology clusters, and government-supported research infrastructure that fosters long-term outsourcing partnerships.

Market Insights

- The Europe pharma R&D outsourcing market was valued at USD 21,424.59 million in 2024 and is projected to reach USD 44,573.84 million by 2032, progressing at a CAGR of 9.59% during the forecast period.

- Growing complexity in drug discovery, increasing biologics and personalized therapy pipelines, and the cost advantages of external R&D partnerships are accelerating outsourcing demand across clinical and non-clinical functions.

- Trends such as AI-enabled trial design, decentralized patient monitoring, and end-to-end outsourcing models are transforming the operational framework and reducing development cycle timelines.

- The competitive landscape includes global CROs and CDMOs like Thermo Fisher Scientific, ICON, IQVIA, WuXi AppTec, Syneos Health, Labcorp Drug Development, and Charles River Laboratories, competing through specialization and strategic consolidation.

- Western Europe leads the market with 48% share, followed by Northern Europe (20%) and Southern Europe (17%), while small molecules hold the dominant product-type segment share, driven by established regulatory pathways and lifecycle management strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Small molecules represent the dominant segment in Europe’s pharma R&D outsourcing market, holding the largest share due to their established regulatory pathways, lower development costs, and extensive application across chronic therapies. Outsourcing small-molecule development supports patent cliff strategies and lifecycle management, driving partnerships for medicinal chemistry, lead optimization, and bioanalytical services. However, biologics are expanding rapidly, fueled by growth in biosimilars, cell and gene therapies, and demand for specialized protein characterization, which encourages outsourcing to CROs and CDMOs equipped with biologics-specific infrastructure and regulatory expertise.

- For instance, Charles River Laboratories delivered more than 42,000 reports and supported approximately 1,500 Investigational New Drug (IND) programs in the last 12 months, many of which involved small-molecule research across discovery and safety assessment, supporting global clients in advancing candidate selection.”

By Stages of Development

Clinical services account for the majority of outsourced spending, driven by the increasing number of complex trials, decentralized trial models, and multi-country regulatory submissions across Europe. CROs with scalability in Phase II–III trials and digital patient engagement tools secure more partnerships as sponsors seek to reduce time-to-market and improve trial success rates. Non-clinical outsourcing continues to grow steadily, accelerated by predictive toxicology, in-vitro analytics, and advanced preclinical modeling, but clinical outsourcing remains the dominant segment due to higher cost intensity and longer timelines associated with human trials.

- For instance, ICON has managed more than 1,500 Phase II–III clinical studies globally, supporting advanced therapeutic programs in oncology, CNS, and rare diseases through its integrated trial management platforms.

By Company Size

Small and mid-sized companies dominate outsourcing demand, representing the largest share as they rely extensively on external R&D capacity to access drug discovery platforms, regulatory expertise, and clinical infrastructure without expanding internal fixed costs. Outsourcing provides faster entry into competitive therapy areas and supports capital-efficient development cycles. Large pharmaceutical companies also engage deeply in strategic outsourcing but typically for specialized functional services and geographic expansion. The dominant role of small and mid-sized innovators is strengthened by emergence of biotech clusters across Germany, the U.K., France, and the Nordics, fueling continuous pipeline development through partnerships.

Key Growth Drivers:

Growing Complexity of Drug Development and Specialized Therapeutics

Europe’s shift toward precision medicine, biologics, rare disease therapies, and advanced cell and gene therapeutics is intensifying demand for specialized contract research and development support. Complex molecular platforms, multi-biomarker trial endpoints, and advanced pharmacokinetic modeling require capabilities not typically available in traditional in-house settings. Outsourcing provides access to AI-enabled target validation, high-containment biologics laboratories, and GMP-certified commercialization pathways without requiring capital-heavy infrastructure. Regulatory requirements for safety, traceability, and companion diagnostics further increase the need for integrated outsourcing partnerships to accelerate submissions and improve approval rates. As sponsors prioritize reducing late-stage failure risk, outsourcing of toxicology studies, genomic profiling, and translational research becomes a core strategic lever, driving the market’s expansion.

- For instance, Thermo Fisher Scientific operates more than 55 GMP facilities and supports over 140 gene therapy development programs, enabling advanced analytical, viral vector, and cell-processing capabilities.

Cost Optimization and Reduction of Fixed R&D Overheads

Escalating R&D expenditures, increasing clinical trial durations, and stringent compliance frameworks compel pharmaceutical companies in Europe to adopt outsourced R&D models as a core cost-containment strategy. CROs and CDMOs enable flexible resource allocation, eliminating high internal staffing costs, real estate, and continuous investment in laboratory upgrades. Outsourcing also supports parallel development capabilities—reducing time-to-market and improving pipeline productivity across multiple therapy portfolios. Favorable government incentives for collaborative innovation in the U.K., Germany, and Western Europe further enhance cross-border research networks. The ability to convert fixed infrastructure into variable operational spending allows firms to reinvest savings into late-stage assets, portfolio diversification, and commercialization pathways.

- For instance, Syneos Health manages a network of 50,000 clinicians within its Deployment Solutions, which includes clinical nurse educators, medical science liaisons, and medical directors, allowing sponsors to scale development and commercial operations without expanding permanent headcount. (The company’s total employee count is approximately 26,000 to 29,000).

Expansion of Biotech Startups and Venture-Backed Innovators

The surge in biotech formations and university spinouts across Europe drives strong demand for outsourced discovery, preclinical development, and early-stage clinical research. These companies often operate asset-light models, relying almost entirely on external partners to progress molecules toward proof of concept and licensing milestones. Access to specialized CROs offers scientific expertise, regulatory navigation, and capital-efficient infrastructure without shareholders absorbing large upfront R&D expenditure. Growing venture capital deployment, government-backed biotech incubators, and cross-border commercialization initiatives expand the regional innovation pipeline. Outsourcing serves as the backbone that enables small and mid-sized innovators to compete globally, improving drug development throughput across emerging therapy domains.

Key Trends and Opportunities:

Digital Clinical Trials, Real-World Evidence, and AI-Enabled Research Models

Europe’s R&D outsourcing landscape is undergoing a digital transformation as CROs adopt AI-driven trial design, predictive analytics, decentralized clinical trial platforms, and remote patient monitoring technologies. Integration of real-world evidence supports post-market surveillance, label expansions, and payer negotiations by demonstrating real-time therapeutic value. Digital tools reduce site burden, accelerate recruitment, and improve patient retention across multi-country trials. As chronic disease prevalence and aging populations increase, demand rises for long-term, data-driven outcomes validation. AI-enabled pharmacovigilance and automated document management enhance regulatory compliance and reduce cycle times, creating strong opportunities for tech-enabled CRO platforms.

- For instance, IQVIA’s Connected Intelligence platform processes more than 100 million longitudinal patient records sourced from over 30 countries, enabling predictive recruitment and protocol optimization for complex clinical studies.

Strategic Partnerships, M&A Consolidation, and End-to-End Service Models

Pharmaceutical companies increasingly seek end-to-end outsourcing frameworks that cover discovery, IND filing, formulation, manufacturing scale-up, and post-approval studies. This trend reinforces consolidation in Europe’s CRO and CDMO ecosystem, forming larger entities capable of offering integrated, cross-functional R&D solutions. Strategic alliances reduce vendor complexity, improve data continuity, and streamline regulatory submissions across the EMA landscape. Collaborative innovation hubs linking universities, biotechnology startups, and CDMOs accelerate technology transfer and commercial readiness. The ability to offer modular, scalable outsourcing packages positions full-service partners strongly in competitive bidding cycles.

- For instance, Thermo Fisher Scientific manages more than 30 global development and manufacturing sites within its pharma services network, supporting drug programs from preclinical development through commercial supply.

Key Challenges:

Regulatory Variability and Multi-Country Approval Complexity

The fragmented regulatory environment across European markets creates significant operational complexity for sponsors and outsourcing partners. Variations in ethics approval timelines, data governance requirements, pricing regulations, and pharmacovigilance standards extend clinical development timelines and increase risk exposure. Harmonization efforts under the EU Clinical Trial Regulation have reduced some administrative burden; however, country-specific enforcement, language requirements, and digital data compliance remain ongoing challenges. Non-EU collaborations add another layer of procedural checkpoints related to material transfer, data exchange, and GMP comparability. This regulatory complexity demands strong compliance infrastructure and increases partner selection scrutiny.

Capacity Constraints, Talent Shortage, and Competitive Pressure

Rapid growth in biologics, advanced therapeutics, and digital clinical operations has intensified demand for highly skilled scientific and regulatory talent across Europe. Limited availability of biostatisticians, toxicologists, GMP biologics specialists, and decentralized trial coordinators challenges outsourcing throughput and delivery schedules. Capacity constraints in specialized testing, high-containment facilities, and sterile manufacturing create bottlenecks that affect both timelines and costs. As demand outpaces supply, competition for expertise increases outsourcing prices and elongates contract lead times. This challenge compels CROs to invest in workforce development, automation, and expansion strategies to meet evolving sponsor expectations.

Regional Analysis:

Western Europe

Western Europe holds the largest share of the Europe pharma R&D outsourcing market, accounting for approximately 48% of total spending, driven by mature pharmaceutical hubs in Germany, France, Switzerland, and the United Kingdom. The region benefits from strong innovation ecosystems, well-established CRO and CDMO networks, and the highest concentration of biotech investment initiatives. Favorable regulatory harmonization, university–industry collaboration, and government-backed research funding strengthen outsourced clinical trial operations and translational sciences. Western Europe’s dominance is reinforced by large pharmaceutical headquarters and advanced biologics production capabilities, supporting continuous demand for end-to-end outsourcing models.

Northern Europe

Northern Europe represents around 20% of the regional market share, supported by a rapidly expanding biotech cluster across Sweden, Denmark, Finland, and Norway. Strong presence in personalized medicine, digital therapeutics development, and clinical data management positions Northern Europe as a high-value outsourcing destination. Denmark’s leadership in diabetes and metabolic research, Sweden’s AI-driven drug discovery infrastructure, and growing gene therapy pipelines drive cross-border outsourcing agreements. Although smaller in scale, the region offers a highly specialized environment for early-stage innovation and niche clinical trial capabilities, supported by streamlined regulatory engagement and high patient enrollment compliance.

Southern Europe

Southern Europe accounts for approximately 17% of the market, driven by increasing cost-competitive clinical research operations in Spain, Italy, and Portugal. The region has emerged as a preferred location for Phase II–III trials due to faster enrollment timelines, diverse patient demographics, and expanding hospital-based trial sites. Growing EU-supported life sciences infrastructure and foreign investment incentives encourage outsourcing adoption among regional pharmaceutical manufacturers. While historically focused on generics and traditional formulations, Southern Europe is gradually increasing biologics-centered outsourcing partnerships, supported by academic collaborations and mid-size biotech expansions targeting oncology, infectious diseases, and immunotherapies.

Eastern Europe

Eastern Europe holds roughly 14% of market share, supported by competitive labor costs, accelerated regulatory timelines, and large patient recruitment pools, especially in Poland, Hungary, and the Czech Republic. The region is recognized for operational efficiency in multicenter clinical trials, particularly in oncology, rare diseases, and cardiovascular research. Outsourcing demand is fueled by affordability advantages and strong government initiatives aimed at life sciences investment. However, limitations in advanced biologics infrastructure, high-containment laboratory capacity, and CDMO scale-up capabilities restrict the segment’s expansion. Eastern Europe remains an attractive hub for cost-driven clinical outsourcing while gradually advancing upstream R&D capabilities.

Market Segmentations:

By Product Type

- Small Molecules

- Biologics

By Stages of Development

By Company Size

- Small and Mid-Sized Companies

- Large Companies

By Geography

- Western Europe

- Northern Europe

- Southern Europe

- Eastern Europe

Competitive Landscape

The Europe pharma R&D outsourcing market features a highly competitive and evolving landscape, shaped by a mix of global CROs, specialized CDMOs, regional biotech service providers, and integrated end-to-end research partners. Large multinational firms hold a competitive advantage through scale, digital trial capabilities, biologics expertise, and multinational regulatory support, enabling them to secure long-term strategic collaborations. Mid-sized and niche service providers compete on specialization in early discovery, advanced analytics, and therapeutic expertise in oncology, neurology, and rare diseases. Consolidation through mergers and acquisitions is reshaping the market as companies build broader service portfolios, expand geographic presence, and integrate AI-driven platforms for predictive modeling and decentralized trial management. Strategic partnerships with biotech startups, university research centers, and public–private innovation ecosystems further strengthen competitive positioning, creating differentiated value through speed, cost efficiency, and scientific depth.Top of FormBottom of Form

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, WuXi AppTec received the 2025 Global Company of the Year Award from Frost & Sullivan, marking its ninth consecutive win a recognition that underscores WuXi’s operational excellence across its CRDMO (contract research, development & manufacturing) services.

- In October 2025, Thermo Fisher Scientific announced its agreement to acquire Clario Holdings, a major endpoint data-management and digital-health firm. This move strengthens Thermo Fisher’s digital trial and data-management capabilities, positioning it for expanded involvement in decentralized and hybrid trials.

- In June 2025, IQVIA rolled out a new suite of custom-built AI agents aimed at enhancing trial feasibility, patient recruitment, and monitoring underscoring its commitment to integrating advanced analytics in clinical trial outsourcing.

Report Coverage:

The research report offers an in-depth analysis based on Product type, Stages of development, Company size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Outsourcing models will expand as pharma companies prioritize flexible, cost-efficient R&D structures.

- AI-driven discovery and predictive analytics will accelerate molecule selection and reduce development risks.

- Demand for specialized biologics and cell and gene therapy outsourcing will increase substantially.

- Decentralized and hybrid clinical trial models will become standard practice across Europe.

- Strategic partnerships between CROs, CDMOs, and biotech startups will intensify innovation pipelines.

- Digital data platforms will enhance real-world evidence collection and regulatory submissions.

- More CDMOs will invest in high-containment and sterile biologics manufacturing capacity.

- Regulatory harmonization will improve trial activation timelines and cross-border collaboration.

- Talent development and automation will address workforce shortages in specialized research.

- Sustainability-linked R&D practices and green laboratory operations will influence outsourcing decisions.