| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Book Paper Market Size 2024 |

USD 105.97 Million |

| UAE Book Paper Market, CAGR |

3.02% |

| UAE Book Paper Market Size 2032 |

USD 134.44 Million |

Market Overview:

The UAE Book Paper Market is projected to grow from USD 105.97 million in 2024 to an estimated USD 134.44 million by 2032, with a compound annual growth rate (CAGR) of 3.02% from 2024 to 2032.

Several factors are propelling the growth of the book paper market in the UAE. The government’s substantial investments in the education sector, under initiatives like the “UAE Vision 2030” and “Education 2020 Strategy,” have led to an increased demand for educational materials, including textbooks and other printed resources. Additionally, the UAE’s focus on promoting literacy and reading culture, exemplified by events such as the Sharjah International Book Fair, has stimulated the consumption of printed books. The rise of self-publishing and the growth of independent authors in the region have also contributed to the demand for high-quality book paper. Furthermore, the preference for environmentally friendly and sustainable paper products is influencing publishers and consumers to opt for eco-friendly book paper options.

Within the UAE, certain emirates are emerging as key hubs for the book paper market. Dubai, with its status as a commercial and educational center, holds a significant share of the market, accounting for approximately 38% of the overall revenue in the writing instruments sector. The presence of numerous schools, universities, and corporate offices in Dubai drives the demand for a wide range of paper products, including book paper. Abu Dhabi follows, contributing around 26% to the market, supported by steady economic development and investments in education and infrastructure. Sharjah, known for its cultural and academic emphasis, accounts for nearly 14% of the market, with a strong focus on education and literacy programs. These regional dynamics indicate a robust and growing demand for book paper across the UAE, with each emirate contributing uniquely to the market’s expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UAE Book Paper Market is set to grow from USD 105.97 million in 2024 to USD 134.44 million by 2032, registering a CAGR of 3.02% during the forecast period.

- The Global Book Paper Market is projected to grow from USD 10,203.76 million in 2024 to USD 14,364.15 million by 2032, with a CAGR of 4.37%, driven by increasing demand for printed educational materials and books worldwide.

- Government-led educational initiatives, including Vision 2030 and Education 2020 Strategy, are significantly boosting demand for book paper across academic institutions.

- Literacy promotion campaigns and events like the Sharjah International Book Fair are strengthening public interest in printed books, supporting steady market expansion.

- The rise of self-publishing and independent authorship is increasing the need for short-run, high-quality book paper tailored to niche genres and personal publishing.

- Eco-conscious trends are driving demand for recyclable, sustainably sourced paper, influencing procurement strategies among publishers and printers.

- Despite digital transformation posing a challenge, the physical book market remains resilient in segments such as early education, academic publishing, and premium formats.

- Regionally, Dubai leads the market with a 38% share, followed by Abu Dhabi at 26% and Sharjah at 14%, reflecting varying levels of educational and cultural investment across emirates.

Market Drivers:

Educational Sector Expansion

The UAE’s strategic investments in education under initiatives like Vision 2031 and the Education 2020 Strategy have significantly stimulated the demand for book paper. The government’s push toward enhancing literacy and access to quality education has resulted in a steady increase in the number of schools, universities, and educational institutions across the country. For instance, in the UAE, the Abu Dhabi Arabic Language Centre launched a AED700,000 fund in 2022 to support local publishers by purchasing 10,927 books from 50 publishing houses for distribution to institutions and government entities, with a focus on educational and children’s content. As curricula expand and the emphasis on printed learning materials remains strong, especially in early education and secondary schools, the need for book-grade paper continues to grow. Private institutions also contribute to this trend, sourcing substantial quantities of high-quality paper for textbooks, workbooks, and supplementary academic publications.

Cultural Emphasis on Literacy and Reading

The UAE has consistently demonstrated its commitment to fostering a culture of reading and literacy. For instance, National initiatives such as the “Year of Reading” and high-profile literary events like the Sharjah International Book Fair and the Emirates Airline Festival of Literature have created a conducive environment for book publishing and consumption. These events not only promote the sale and distribution of printed books but also encourage the production of diverse genres that rely heavily on premium book paper. This cultural drive enhances public engagement with physical books, sustaining demand across various demographic groups including students, professionals, and general readers.

Growing Self-Publishing and Independent Authors Movement

The emergence of self-publishing platforms and the increasing presence of independent authors in the UAE have contributed to a broader base of demand for book paper. As more writers bypass traditional publishing channels to produce and distribute their work independently, the demand for short-run, high-quality printing services has risen. These services often use specialized book paper to cater to niche literary segments such as poetry, regional fiction, and academic research. Moreover, local printing houses are increasingly offering customized printing solutions, further fueling the market’s growth and diversification.

Sustainability Trends and Eco-Friendly Paper Demand

Environmental awareness is becoming a key consideration in the UAE’s paper consumption landscape. Both consumers and publishers are showing a growing preference for sustainably sourced and recyclable paper materials. As a result, there is increasing demand for book paper that is certified by environmental organizations or manufactured using eco-conscious processes. The alignment with global sustainability goals and the UAE’s national agenda on green growth is encouraging suppliers and publishers to adopt paper solutions that are both efficient and environmentally responsible. This trend not only shapes procurement practices but also adds long-term value and credibility to brands that prioritize sustainable publishing.

Market Trends:

Digital Printing Integration

The UAE’s book paper market is increasingly shaped by the adoption of digital printing technologies. Publishers are turning to digital presses for their ability to handle short-run, high-quality print jobs with greater speed and flexibility. This trend supports the growing demand for customized and on-demand books, particularly in the educational and self-publishing sectors. Digital printing reduces the need for large inventories and minimizes waste, making it a cost-effective solution for both large-scale publishers and small independent authors. The ability to produce smaller quantities while maintaining quality standards is helping publishers better align with changing consumer preferences and market demands.

Sustainable and Eco-Friendly Practices

There is a growing emphasis on environmental responsibility across the UAE’s publishing ecosystem. The demand for book paper produced using sustainable methods is increasing, as publishers respond to the shift in consumer behavior towards eco-conscious choices. Both governmental policies and public awareness campaigns are reinforcing the need for recyclable, biodegradable, and responsibly sourced materials. Publishers are now prioritizing partnerships with suppliers that offer environmentally certified paper, leading to more books being produced with reduced environmental impact. For instance, Ittihad Paper Mill (IPM), based in Abu Dhabi, has prioritized sustainability by producing paper using one of the lowest amounts of water and energy in the industry. This trend is also encouraging innovation in paper production, with manufacturers exploring alternatives like bamboo paper or chlorine-free bleaching processes.

Luxury Finishes and Premium Quality

An emerging preference for premium-quality books is influencing paper selection and production in the UAE. Readers and gift buyers are increasingly drawn to books that feature elegant aesthetics and durable finishes. As a result, publishers are investing in high-grade book paper that can support enhanced printing techniques such as embossing, foil stamping, and matte or gloss lamination. For instance, the adoption of digital presses such as the Canon imagePRESS C850 has enabled publishers to offer books with luxury finishes, including embossing, foil stamping, and matte or gloss lamination, without compromising on turnaround time or print quality. These features not only elevate the visual appeal of books but also improve their perceived value in retail and gifting contexts. This shift toward high-end presentation is especially notable in coffee-table books, limited editions, and children’s literature, where physical design plays a key role in consumer purchasing decisions.

Interactive and Augmented Reality (AR) Integration

The integration of digital technology with traditional print is a growing trend in the UAE’s book paper market. Publishers are experimenting with interactive formats, including books embedded with QR codes, AR content, and mobile-friendly experiences that bring printed content to life. These hybrid formats enhance reader engagement and are particularly popular among younger audiences and educational publishers. To support this trend, the book paper used must offer consistency in print clarity and compatibility with scanning technologies. This evolving intersection of print and digital is reshaping book design and driving demand for specialized paper products capable of delivering a seamless interactive experience.

Market Challenges Analysis:

Digital Shift and Decline in Print Readership

One of the most prominent challenges facing the UAE book paper market is the increasing consumer shift toward digital media. E-books, audiobooks, and online learning platforms are becoming more prevalent, especially among younger demographics who prefer the convenience of mobile and tablet-based reading. Educational institutions are gradually adopting digital classrooms and interactive e-learning solutions, reducing their reliance on printed textbooks. This digital transformation is impacting the demand for traditional book paper, forcing publishers and suppliers to reassess their print volumes and market strategies.

Volatility in Raw Material Supply

The book paper market in the UAE is also affected by global fluctuations in raw material availability and cost. The country relies heavily on imported pulp and paper products, making it vulnerable to international supply chain disruptions, shipping delays, and price volatility. Factors such as geopolitical tensions, currency fluctuations, and environmental regulations in exporting countries can drive up the cost of raw materials, impacting profit margins for local publishers and printers. These uncertainties create operational challenges and hinder long-term planning for stakeholders in the market.

Environmental Regulations and Sustainability Pressures

Although there is a growing demand for eco-friendly paper, meeting sustainability requirements poses operational and financial challenges. Importers and manufacturers must comply with stringent environmental regulations and certification standards, which can increase production and sourcing costs. Smaller printing businesses and publishers often struggle to meet these requirements due to limited resources, making it difficult for them to compete with larger, environmentally certified entities. Balancing economic viability with sustainability goals remains a critical restraint for market participants.

High Production and Printing Costs

Local printing and publishing operations in the UAE face high costs related to labor, energy, and advanced printing technologies. For example, starting a printing services business in Dubai Mainland requires an initial investment ranging from 120,405 AED to 470,905 AED, including license fees, office rent, equipment, and staffing. These expenses, combined with import tariffs on raw materials, contribute to elevated production costs. As a result, some publishers opt for overseas printing, which affects domestic paper demand and undermines local industry growth.

Market Opportunities:

The UAE book paper market presents promising growth opportunities driven by the country’s commitment to fostering a knowledge-based economy and enhancing educational infrastructure. Ongoing investments in schools, universities, and academic publishing—under national initiatives such as Vision 2031—are creating sustained demand for printed educational content. Despite the rise of digital learning platforms, printed books remain a preferred medium for early education, exam preparation, and academic instruction, particularly in bilingual and Arabic-language curriculums. This creates an ongoing need for high-quality, durable book paper that meets diverse academic standards and printing requirements.

Furthermore, the UAE’s vibrant literary culture and emphasis on promoting reading offer substantial potential for market expansion. Events such as the Sharjah International Book Fair and Abu Dhabi International Book Fair draw significant domestic and international participation, boosting demand for locally printed books across various genres. In parallel, the growth of self-publishing and independent authorship provides a new customer base for short-run, customized printing that relies on flexible paper supply. Additionally, the rising popularity of eco-conscious and premium paper products opens doors for suppliers specializing in sustainable and luxury-grade materials. With the right strategic focus on innovation, sustainability, and localized production, stakeholders in the UAE book paper market can capitalize on both traditional publishing demand and evolving consumer preferences.

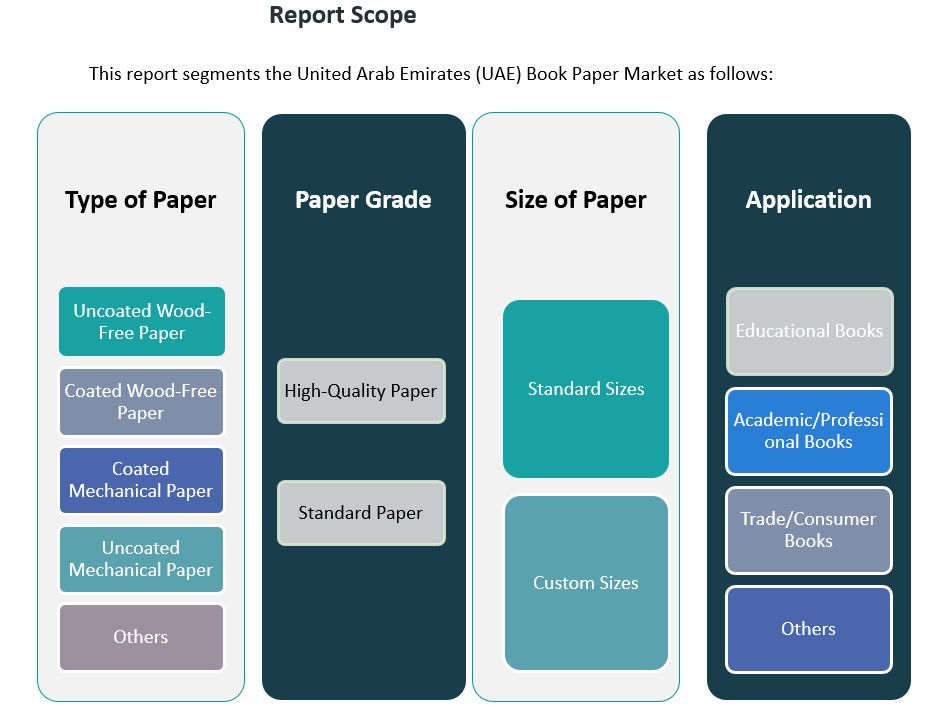

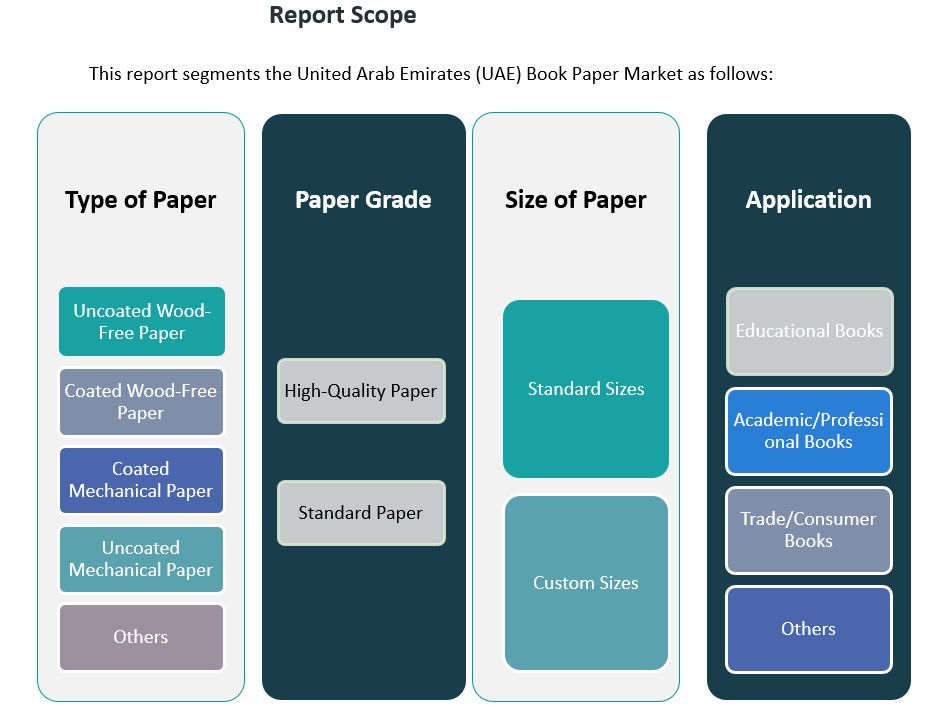

Market Segmentation Analysis:

The UAE book paper market is segmented by type, grade, size, and application, each contributing uniquely to overall market dynamics.

By paper types, uncoated wood-free paper holds a significant share due to its wide usage in educational and academic publications, offering excellent readability and print quality. Coated wood-free paper is preferred for consumer and trade books requiring vibrant imagery and smooth finishes. Coated and uncoated mechanical papers, while more cost-effective, are typically used for mass-market books and short-life publications. The “others” category includes specialty papers that cater to niche applications such as limited-edition prints and artistic publications.

By paper grade, standard paper remains the most widely used segment, driven by demand in educational institutions and general publishing. However, the high-quality paper segment is gaining traction, especially for premium and luxury book formats that require superior aesthetics and durability.

By size, standard paper sizes dominate the market due to their compatibility with printing equipment and binding processes. Meanwhile, custom sizes are increasingly adopted for specialized publications and self-publishing formats, offering differentiation and design flexibility.

By Application-wise, educational books represent the largest segment, supported by government initiatives to enhance school and university infrastructure. Academic and professional books follow closely, driven by continuous growth in tertiary education and vocational training. Trade and consumer books form a growing niche, benefiting from strong cultural interest and national campaigns promoting reading. Other applications, including religious texts and art books, also contribute to market diversity, expanding opportunities across printing and publishing sectors.

Segmentation:

By Type of Paper:

- Uncoated Wood-Free Paper

- Coated Wood-Free Paper

- Coated Mechanical Paper

- Uncoated Mechanical Paper

- Others

By Paper Grade:

- High-Quality Paper

- Standard Paper

By Size of Paper:

- Standard Sizes

- Custom Sizes

By Application:

- Educational Books.

- Academic/Professional Books

- Trade/Consumer Books

- Others

Regional Analysis:

The UAE book paper market exhibits distinct regional dynamics, with key emirates contributing variably based on their economic activities, educational infrastructure, and cultural initiatives.

Dubai: Commercial and Educational Hub

Dubai stands as a central player in the UAE’s book paper market, driven by its robust commercial sector and expansive educational institutions. The emirate’s emphasis on becoming a knowledge-based economy has led to increased investments in educational infrastructure, thereby boosting the demand for book paper. Moreover, Dubai’s hosting of international book fairs and literary events further stimulates the market by attracting publishers and readers alike.

Abu Dhabi: Cultural and Academic Center

Abu Dhabi contributes significantly to the book paper market, leveraging its status as the nation’s capital and a cultural epicenter. The presence of numerous universities and research institutions necessitates a steady supply of academic books, thereby influencing the demand for high-quality book paper. Additionally, government-backed initiatives to promote reading and literacy have a positive impact on the market dynamics in the region.

Sharjah: Literary and Publishing Stronghold

Sharjah has carved a niche in the book paper market through its strong focus on literature and publishing. The emirate’s dedication to cultural development is evident in its support for libraries, publishing houses, and literary festivals. These efforts not only enhance the local demand for book paper but also position Sharjah as a significant contributor to the UAE’s overall market.

Northern Emirates: Emerging Markets

The Northern Emirates, including Ajman, Fujairah, Ras Al Khaimah, and Umm Al Quwain, are gradually emerging in the book paper market. While currently contributing a smaller share, ongoing developments in educational sectors and infrastructural improvements are expected to elevate their roles in the near future. These regions present opportunities for market expansion, particularly as investments in education and literacy programs continue to grow.

Key Player Analysis:

- Kalimat Group

- Al Hudhud Publishing

- Tashkeel

- Al Saqi Books

- Al Qasimi Publishing House

Competitive Analysis:

The UAE book paper market features a moderately competitive landscape, shaped by both domestic suppliers and international paper manufacturers. Key players in the market include Asia Pulp & Paper, Mondi Group, International Paper, and UPM-Kymmene, all of whom supply high-grade paper products to the UAE through regional distributors and partnerships. Local printing firms and publishers also maintain strategic alliances with regional suppliers to meet specific print and customization needs. Competition is increasingly influenced by sustainability practices, paper quality, and cost-efficiency, prompting suppliers to offer eco-friendly and premium-grade options. The rise of digital printing and self-publishing trends is creating additional demand for agile suppliers capable of handling short-run orders. As educational and literary demand continues to grow across emirates, companies that prioritize reliability, adaptability, and environmentally conscious production are likely to maintain a competitive edge in the evolving UAE book paper market.

Recent Developments:

- In April 2025, Kalimat Group announced a series of major developments during the Sharjah Children’s Reading Festival. The company celebrated its latest book, The House of Wisdom by Sheikha Bodour bint Sultan Al Qasimi, which won the prestigious Sharjah Children’s Book Award and the BolognaRagazzi Award 2025. Alongside this, Kalimat Group launched new children’s titles such as Did You Know? by Sheikha Meera Al Qasimi and Fasten Your Seatbelt by Noura Alkhoori, the latter in collaboration with Sharjah Airport.

- In April 2025, the UAE witnessed a significant development in its book and paper market with the participation of the UAE Media Council at the 34th Abu Dhabi International Book Fair, held at the Abu Dhabi National Exhibition Centre from April 26 to May 5, 2025. The Council’s involvement aimed to foster cooperation with both local and international publishers, attract global publishing houses, and introduce stakeholders to the latest updates in media legislation and publishing industry procedures. This initiative is part of the Council’s broader strategy to establish the UAE as a regional hub for the publishing industry and to support new models for digital publishing and content distribution.

Market Concentration & Characteristics:

The UAE book paper market displays moderate market concentration, with a mix of global suppliers and regional distributors servicing the country’s growing demand for print materials. International players such as UPM-Kymmene, Mondi Group, and Asia Pulp & Paper dominate the supply chain by providing high-quality paper products through well-established distribution networks. However, the market also includes a diverse range of local printers and publishers who source paper based on print volume, quality requirements, and sustainability preferences. The market is characterized by its increasing orientation toward customization, sustainability, and digital adaptability. While educational and academic publishing drive bulk demand, the rise of self-publishing and short-run printing has introduced a need for flexible, responsive supply. Environmental concerns are also influencing purchasing behavior, pushing suppliers toward offering recyclable and certified paper. Overall, the UAE book paper market maintains a balance between quality, efficiency, and environmental responsibility, reflecting the evolving preferences of consumers and institutions alike.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type of paper, paper grade, size of paper, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for book paper in the UAE will remain stable due to sustained investments in educational infrastructure.

- Increasing literacy initiatives and reading campaigns will support continued consumption of printed books.

- The self-publishing sector is expected to grow, boosting short-run printing and specialty paper usage.

- Eco-conscious preferences will drive the adoption of recyclable and FSC-certified book paper.

- Digital printing advancements will enhance customization, reducing waste and improving efficiency.

- High-quality paper segments will see increased demand in premium and gift-oriented publishing.

- Local production capacity may expand to reduce reliance on imported paper and improve supply stability.

- Government-led cultural events and book fairs will continue to stimulate domestic publishing.

- Rising raw material costs and supply chain disruptions may challenge pricing strategies.

- Integration of augmented reality and interactive features will create new design requirements for book paper.