| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Digital Oilfield Solutions Market Size 2024 |

USD 68.81 Million |

| UAE Digital Oilfield Solutions Market, CAGR |

4.80% |

| UAE Digital Oilfield Solutions Market Size 2032 |

USD 100.15 Million |

Market Overview

The UAE Digital Oilfield Solutions Market is projected to grow from USD 68.81 million in 2024 to an estimated USD 100.15 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.80% from 2025 to 2032. This growth is propelled by the increasing adoption of digital technologies in the oil and gas sector, aiming to enhance operational efficiency, reduce costs, and improve safety standards.

Key drivers of this market include the integration of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics. These innovations facilitate real-time monitoring, predictive maintenance, and data-driven decision-making, thereby optimizing production and reservoir management. Additionally, the global push towards sustainability and energy efficiency is prompting oil and gas companies to adopt digital solutions that minimize environmental impact and comply with stringent regulations.

Geographically, the UAE stands as a pivotal player in the Middle East’s digital oilfield landscape, accounting for a significant share of the regional market. Major companies such as the Abu Dhabi National Oil Company (ADNOC) are actively investing in digital transformation initiatives to bolster productivity and maintain their competitive edge. The market is also characterized by the presence of multinational corporations and specialized service providers offering critical solutions to optimize production efficiency, ensure safety, and minimize environmental impact.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UAE Digital Oilfield Solutions Market is expected to grow from USD 68.81 million in 2024 to USD 100.15 million by 2032, with a CAGR of 4.80% from 2025 to 2032.

- The Global Digital Oilfield Solutions Market is projected to grow from USD31,374.00 million in 2024 to USD 54,897.18 million by 2032, with a CAGR of 7.24% from 2025 to 2032.

- Increased adoption of IoT, AI, and big data analytics drives real-time monitoring, predictive maintenance, and data-driven decision-making in oilfield operations.

- The global push for sustainability is encouraging oil and gas companies to adopt digital technologies to minimize environmental impact and meet energy efficiency targets.

- Digital solutions help optimize production, enhance reservoir management, and improve cost-effectiveness while ensuring safety in oilfield operations.

- High initial investment costs for digital technologies and concerns over cybersecurity pose challenges to widespread adoption in the region.

- The UAE is a key player in the Middle East’s digital oilfield market, with major investments from companies like ADNOC and multinational corporations.

- Major companies in the UAE market include ADNOC, multinational corporations, and specialized service providers offering innovative solutions to optimize oilfield operations.

Market Drivers

Government Support and Investment in Digital Transformation

The UAE government’s strong commitment to advancing digital transformation in the oil and gas industry is a key driver of the digital oilfield solutions market. The country has recognized the importance of embracing new technologies to ensure the long-term sustainability of its oil and gas sector. To achieve this, the government has implemented a range of initiatives that encourage the adoption of digital oilfield solutions, such as investments in research and development, collaboration with international technology firms, and the establishment of a favorable regulatory environment for digital innovation. Additionally, the UAE’s National Innovation Strategy, which emphasizes the role of digital transformation in various sectors, including energy, has paved the way for increased government funding in the digital oilfield solutions sector. This strong focus on technological innovation has enabled the country’s oil and gas operators to deploy cutting-edge digital tools that improve efficiency, safety, and profitability. The government’s support, combined with the increasing integration of digital technologies, has positioned the UAE as a leader in the Middle East’s digital oilfield solutions market, creating new opportunities for both local and international players.

Focus on Sustainable and Environmentally Friendly Practices

Another crucial driver of the UAE Digital Oilfield Solutions Market is the growing focus on sustainability and environmental responsibility in oilfield operations. As the global energy landscape shifts towards cleaner energy and the UAE seeks to diversify its economy, there is an increasing emphasis on reducing the environmental impact of oil extraction and production activities. Digital oilfield solutions play a pivotal role in achieving sustainability goals by enabling companies to optimize resource usage, reduce energy consumption, and minimize waste. Technologies such as advanced sensors, data analytics, and AI-powered optimization tools enable more efficient use of energy and resources, reducing the carbon footprint of oilfield operations. These technologies allow for better monitoring of emissions, waste management, and energy consumption, ensuring that companies adhere to environmental regulations and sustainability standards. Furthermore, the ability to detect leaks, optimize energy use, and improve the efficiency of production processes through digital tools not only benefits the environment but also contributes to cost savings. The increasing demand for sustainable practices in the UAE’s oil and gas industry is, therefore, driving the adoption of digital oilfield solutions as a means to improve both operational efficiency and environmental performance.

Growing Demand for Operational Efficiency and Cost Optimization

One of the most significant drivers of the UAE Digital Oilfield Solutions Market is the increasing need for operational efficiency and cost optimization within the oil and gas sector. As the oil industry faces growing pressure to maximize production while reducing costs, companies are turning to digital oilfield solutions to enhance operational performance. These solutions leverage advanced technologies such as automation, real-time data analytics, and predictive maintenance to optimize various aspects of oilfield operations, including drilling, production, and maintenance. By using digital tools, operators can improve decision-making, increase production uptime, and reduce downtime due to equipment failures. Furthermore, these solutions allow for more efficient resource allocation and energy consumption, resulting in significant cost savings over the long term. For instance, in the UAE, companies like ADNOC have successfully implemented digital oilfield solutions, creating fully smart fields that operate remotely. This has led to significant improvements in operational efficiency, including reduced downtime and enhanced reservoir management accuracy. Such advancements highlight how digital oilfield technologies enable companies to navigate challenges like rising production costs and fluctuating oil prices. By adopting automation and machine learning technologies, UAE oil and gas companies can reduce human errors, improve equipment utilization, and maintain profitability while sustaining a competitive edge in the global market.

Technological Advancements in IoT, Big Data, and AI

The rapid advancement in key technologies such as the Internet of Things (IoT), big data analytics, and artificial intelligence (AI) is another significant factor propelling the UAE Digital Oilfield Solutions Market. These technologies enable the collection, storage, and analysis of vast amounts of data generated by oilfield operations in real time. IoT sensors deployed across oil rigs and pipelines provide continuous monitoring, allowing for more accurate tracking of equipment performance, environmental conditions, and resource use. This enables companies to detect potential issues before they lead to costly failures or production losses. For instance, predictive maintenance enabled by AI and machine learning has been instrumental in extending the lifespan of equipment and reducing downtime. By analyzing real-time data from IoT sensors across rigs and pipelines, companies can identify patterns and predict equipment failures with high accuracy. This ensures maintenance activities are scheduled only when necessary, preventing expensive repairs or unexpected interruptions in production. Additionally, major oil companies globally have demonstrated how integrating AI-driven algorithms with big data analytics enhances operational reliability while reducing costs. As these technologies continue to gain traction within UAE’s oilfields, their ability to boost efficiency and optimize resource utilization further drives demand for digital oilfield solutions in the region.

Market Trends

Emphasis on Remote Monitoring and Automation

The trend towards remote monitoring and automation in the UAE’s Digital Oilfield Solutions Market is another key development that is reshaping the landscape of oilfield operations. Oil companies in the UAE are increasingly leveraging digital technologies to remotely monitor oilfields, detect irregularities, and manage production activities without the need for a significant onsite workforce. This trend has been particularly important in the context of minimizing human intervention in hazardous environments, improving worker safety, and reducing operational costs. With the deployment of advanced sensors, IoT devices, and real-time data analytics, oil operators can remotely control equipment, monitor well performance, and adjust operational parameters from centralized control centers. Automation, which includes automated drilling, production control, and maintenance systems, further reduces the need for human input and enhances the precision and efficiency of oilfield operations. By automating repetitive tasks, companies in the UAE can focus their resources on more critical functions, leading to improved productivity and reduced risk of human error. Additionally, automation allows for the implementation of more sophisticated safety protocols and provides better control over environmental impact, aligning with the UAE’s sustainability goals. As remote monitoring and automation continue to evolve, they are expected to play an increasingly significant role in optimizing operations across the UAE’s oilfields.

Sustainability and Environmental Impact Mitigation

The growing emphasis on sustainability and environmental responsibility is another key trend influencing the UAE’s Digital Oilfield Solutions Market. As global pressures mount for the oil and gas sector to adopt more environmentally friendly practices, companies in the UAE are turning to digital solutions to mitigate their environmental impact. Technologies such as real-time monitoring, AI-driven optimization, and advanced analytics are helping operators reduce energy consumption, minimize emissions, and improve waste management practices. Digital oilfield solutions enable more efficient resource usage, allowing for better tracking of energy consumption and emissions across oilfield operations. Through the integration of IoT sensors and cloud-based platforms, companies can track environmental factors such as gas flaring, water usage, and CO2 emissions in real-time. This data-driven approach allows operators to adopt corrective measures more quickly, helping them stay in compliance with strict environmental regulations. Additionally, the UAE’s government has set ambitious sustainability goals as part of its vision to reduce the carbon footprint of the oil and gas industry, and digital oilfield technologies are instrumental in achieving these objectives. Moreover, there is a growing trend of integrating renewable energy sources, such as solar and wind power, into oilfield operations, supported by digital technologies that help manage energy production and consumption more effectively. This integration not only contributes to the UAE’s goal of reducing reliance on fossil fuels but also positions the country as a leader in sustainable energy practices within the oil and gas industry. As the market continues to evolve, sustainability will remain a core focus, driving the demand for digital oilfield solutions that support environmentally responsible operations.

Integration of Artificial Intelligence and Machine Learning

One of the most prominent trends in the UAE’s Digital Oilfield Solutions Market is the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) technologies to enhance the efficiency and effectiveness of oilfield operations. AI and ML are being integrated into various aspects of oil and gas exploration, drilling, production, and maintenance processes. These technologies enable predictive analytics, allowing companies to foresee potential equipment failures, production bottlenecks, or environmental hazards before they occur, thereby minimizing downtime and operational costs. For instance, the Abu Dhabi National Oil Company (ADNOC) has implemented a predictive maintenance project that utilizes AI and ML to monitor over 2,500 critical machines across its operations. This initiative has enabled ADNOC to predict equipment failures, reduce unplanned downtime, and enhance safety by leveraging real-time data analytics. The use of AI and ML has also transformed decision-making processes in the UAE’s oil and gas sector. By analyzing data collected through IoT sensors, AI-driven systems can identify patterns and make data-driven recommendations in real time. This not only optimizes operational performance but also improves safety by detecting anomalies that could lead to hazardous conditions. As a result, AI-powered predictive maintenance is helping UAE oil companies proactively address issues, reducing repair costs and enhancing operational efficiency.

Rise of Cloud-Based Platforms for Enhanced Collaboration and Data Sharing

Another major trend in the UAE Digital Oilfield Solutions Market is the increasing shift towards cloud-based platforms to support collaboration and data sharing among oilfield operators, service providers, and stakeholders. Cloud computing is revolutionizing how companies manage oilfield data by providing centralized platforms for real-time access to critical information from any location. This enables UAE oil companies to make more informed decisions, collaborate seamlessly with partners, and respond swiftly to operational challenges. For instance, IndianOil Adani Ventures Limited successfully transitioned to SAP S/4HANA Cloud, streamlining operations across 15 legal entities in just 155 days. This cloud-based platform allows for seamless data consolidation and real-time insights, facilitating efficient collaboration among stakeholders. Cloud-based platforms also offer scalable and cost-effective solutions compared to traditional on-premise infrastructure, which requires significant maintenance investments. The ability to store vast amounts of data in the cloud reduces hardware costs while ensuring all stakeholders have access to accurate, up-to-date information at any time. Moreover, integrating AI, big data, and IoT with cloud computing enables sophisticated analytics that further optimizes oilfield operations. As this trend gains traction among UAE oil and gas companies, it supports digital transformation initiatives while improving decision-making processes and operational performance across the sector.

Market Challenges

High Initial Investment and Infrastructure Costs

One of the major challenges facing the UAE’s digital oilfield solutions market is the high initial investment required to deploy advanced technologies such as AI, IoT, and cloud-based platforms. Implementing digital oilfield solutions necessitates substantial capital expenditure for infrastructure development, including the installation of sensors, data analytics systems, and network connectivity across oilfields. Moreover, upgrading existing infrastructure to accommodate these advanced technologies requires significant financial commitment, particularly in terms of training personnel, integrating new systems, and ensuring cybersecurity measures are in place. For instance, the high initial investment is evident in the need for substantial capital outlays on IoT sensors, data analytics systems, and network connectivity across oilfields. This challenge is further compounded by the necessity of training personnel and integrating new systems, which can be particularly burdensome for smaller operators with limited budgets. Additionally, the rapid pace of technological advancements means organizations must continuously invest in upgrades to remain competitive, creating a cycle of recurring expenses. For many oil and gas companies in the UAE, these high upfront costs act as a deterrent despite the long-term cost savings digital solutions can offer through optimized operations and reduced downtime. Overcoming this challenge requires strategic planning, partnerships, and government support to make digital oilfield solutions more accessible and cost-effective for a broader range of industry players.

Data Security and Privacy Concerns

As the adoption of digital oilfield solutions increases in the UAE, so does the volume of data being collected, stored, and transmitted across networks. This growing reliance on data analytics and cloud-based platforms brings with it significant concerns around data security and privacy. The risk of cyberattacks, data breaches, and unauthorized access to sensitive operational information is a major challenge that could undermine the effectiveness and trust in digital oilfield technologies. Oilfield operators in the UAE must invest heavily in robust cybersecurity measures to safeguard their digital infrastructure and prevent disruptions in operations. This includes implementing secure data encryption, advanced firewalls, and continuous monitoring to detect and address potential threats in real time. Additionally, compliance with international standards for data protection and privacy, as well as adhering to local regulations, is essential for ensuring that digital oilfield solutions remain secure and trustworthy. Addressing these concerns effectively is critical for the continued growth and acceptance of digital oilfield technologies in the UAE.

Market Opportunities

Expansion of Smart Oilfield Technologies

The UAE’s push for technological innovation in the oil and gas sector presents a significant market opportunity for the expansion of smart oilfield technologies. As companies seek to enhance operational efficiency, reduce costs, and improve safety, the demand for smart oilfield solutions that integrate advanced sensors, IoT devices, and AI-driven analytics continues to grow. These technologies enable real-time monitoring, predictive maintenance, and automation of drilling and production processes, leading to improved performance and reduced operational risks. Given the UAE’s commitment to maintaining its position as a leader in global oil production, there is considerable room for growth in the digital oilfield solutions market, particularly in the deployment of smart technologies across both onshore and offshore oilfields. The increasing focus on digital transformation in the country creates a favorable environment for innovation, making it an attractive market for solution providers to introduce new, cutting-edge products and services.

Government Initiatives Supporting Digitalization

The UAE government’s emphasis on digital transformation within the energy sector is another key market opportunity. Through initiatives such as the UAE Vision 2021 and the National Innovation Strategy, the government is actively promoting the adoption of digital technologies to improve the efficiency, sustainability, and safety of the oil and gas industry. This creates significant opportunities for digital oilfield solutions providers to partner with government-backed projects, take advantage of financial incentives, and align with the country’s long-term strategic objectives. Additionally, the government’s investment in digital infrastructure and support for research and development in energy technologies further bolsters the potential for market growth. The ongoing focus on diversification and sustainable energy within the UAE’s oil sector enhances the demand for digital solutions that can support these goals.

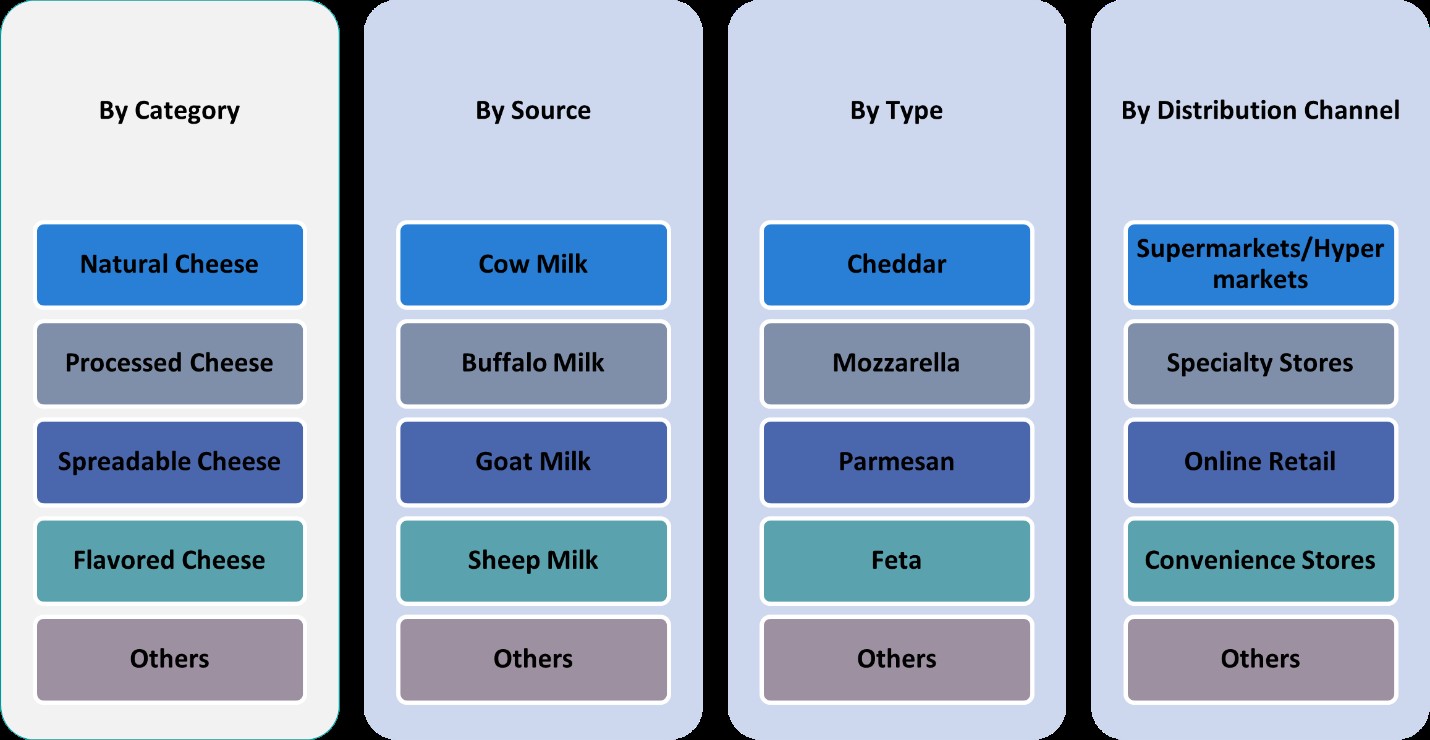

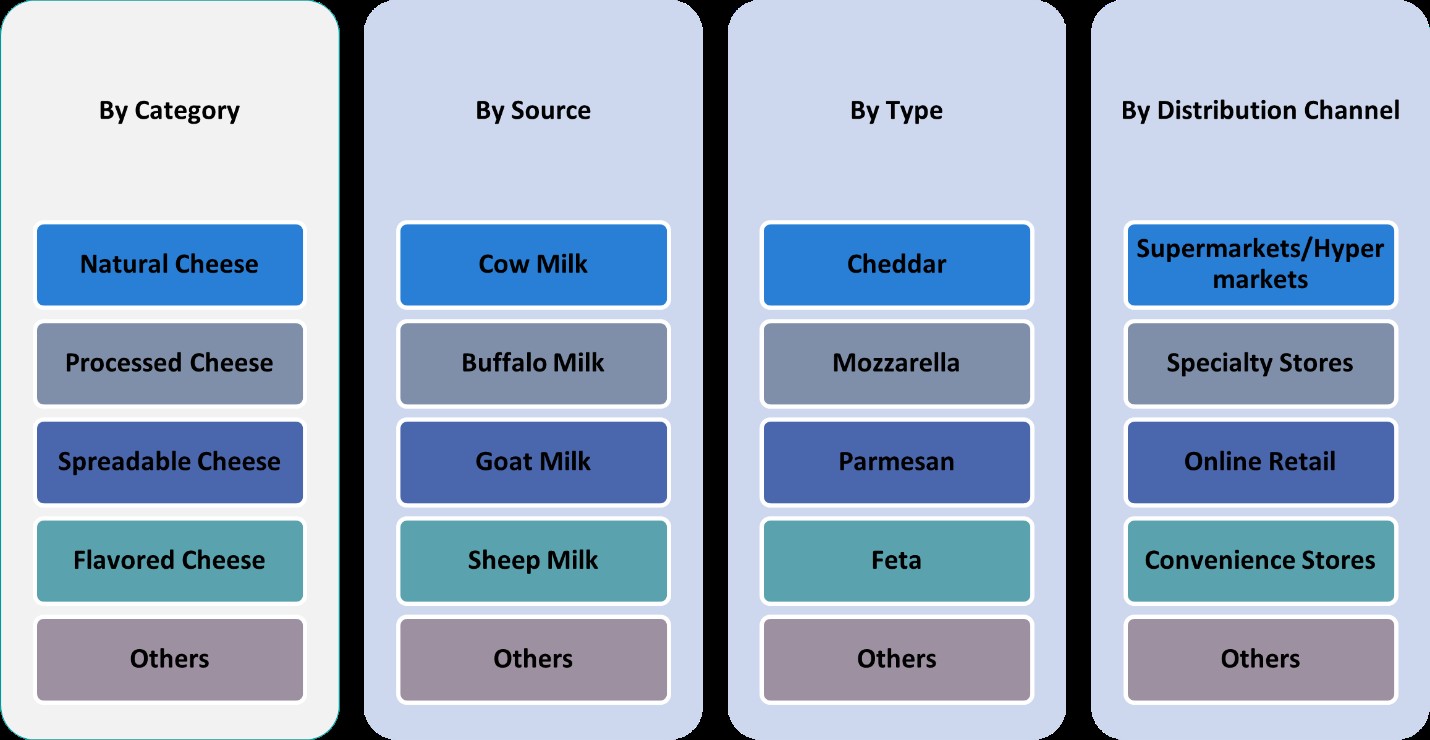

Market Segmentation Analysis

By Solution

The digital oilfield solutions market in the UAE can be divided into hardware, software, and services. Hardware is integral to the foundation of digital oilfield systems, including sensors, IoT devices, and other physical infrastructure that enables real-time data collection. Software solutions comprise data analytics, AI algorithms, and cloud platforms that process and analyze the vast amounts of data collected by hardware. The demand for software solutions is expected to grow as more oilfields in the UAE adopt AI and machine learning technologies to optimize operations. Additionally, the services segment, which includes consulting, integration, and maintenance, is also crucial for ensuring the successful deployment and operation of digital oilfield solutions. The services sector is particularly poised for growth due to the increasing complexity of digital solutions and the need for skilled expertise in implementation and maintenance.

By Application

The application of digital oilfield solutions in the UAE is segmented into onshore and offshore operations. Onshore oilfields, which are more accessible and easier to manage, are increasingly adopting digital solutions to enhance operational efficiency, reduce downtime, and improve reservoir management. Offshore oilfields, however, present a unique set of challenges due to their remote nature and harsh environmental conditions. As such, digital oilfield solutions for offshore operations focus heavily on remote monitoring, predictive maintenance, and real-time performance optimization. The demand for digital solutions in offshore applications is expected to rise as the UAE continues to develop its offshore oil and gas resources.

Segments

Based on Solution

- Hardware

- Software

- Services

Based on Application

Based on Process

- Reservoir Optimization

- Production Optimization

- Drilling Optimization

Based on Deployment

Based on Region

Regional Analysis

Abu Dhabi (55%)

Abu Dhabi is the primary hub for oil production in the UAE, accounting for the largest share of the country’s oil reserves. As a result, the demand for digital oilfield solutions in this region is the highest, with a market share of approximately 55%. The focus in Abu Dhabi is primarily on offshore oilfields, where significant technological advancements are required to enhance efficiency, optimize production, and ensure safety. The region has already witnessed substantial investments in digital solutions to address the complexities of offshore exploration, drilling, and production. Moreover, the UAE government’s commitment to sustainability and digital transformation through initiatives like the UAE Vision 2021 has further accelerated the adoption of digital oilfield technologies in Abu Dhabi. Abu Dhabi’s strong emphasis on innovation and infrastructure development continues to drive market growth. Companies operating in this region are increasingly adopting smart technologies such as IoT, AI, and big data analytics to optimize drilling operations, manage reservoirs, and predict equipment failures. With offshore and onshore oilfield optimization at the forefront, Abu Dhabi is expected to maintain its position as the leader in digital oilfield solutions in the UAE.

Dubai (30%)

Dubai, known for its technological advancements and business-friendly environment, holds a market share of approximately 30% in the UAE Digital Oilfield Solutions Market. While Dubai is not as heavily involved in oil extraction as Abu Dhabi, the region’s strength lies in providing digital infrastructure, cloud computing services, and technological innovations that support the broader UAE oil and gas industry. The increasing shift towards cloud-based platforms for oilfield data management and real-time monitoring has driven significant growth in the demand for digital oilfield solutions in Dubai. Additionally, Dubai is positioning itself as a leader in innovation, attracting international technology firms to collaborate with UAE oil companies to develop cutting-edge digital solutions. As the region enhances its digital infrastructure, including the expansion of IoT networks and data analytics capabilities, the role of Dubai in the digital oilfield solutions market is expected to grow rapidly.

Key players

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- Siemens AG

- Honeywell International Inc.

- Yokogawa Electric Corporation

- ABB Ltd.

- Emerson Electric Co.

- IBM Corporation

Competitive Analysis

The UAE Digital Oilfield Solutions Market is highly competitive, with major international players leveraging their advanced technologies and global expertise. Schlumberger Limited, Halliburton, and Baker Hughes dominate the market with their comprehensive portfolios of digital solutions, including IoT devices, AI-driven analytics, and real-time monitoring systems for both onshore and offshore operations. These companies continue to innovate, investing in R&D to improve operational efficiency and reduce costs. Weatherford International and Siemens AG also play significant roles, offering advanced automation and production optimization solutions. Honeywell, ABB, and Emerson Electric focus on enhancing system integration and safety measures, aligning their offerings with the UAE’s growing emphasis on sustainability. Additionally, Yokogawa Electric Corporation and IBM Corporation provide robust cloud-based solutions, data analytics, and artificial intelligence to support real-time decision-making and predictive maintenance in digital oilfields. Overall, the competition revolves around technological innovation, operational efficiency, and adaptability to the evolving market demands.

Recent Developments

- In March 2025, Schneider Electric unveiled the One Digital Grid Platform, an AI-powered platform designed to enhance grid resiliency and efficiency. This platform is set to be available later in 2025. The company announced a $700 million investment plan in the U.S. to enhance energy infrastructure and AI capabilities.

- In April 2025, ABB India delivered integrated automation and digital solutions for IndianOil’s cross-country pipeline network, enhancing efficiency and safety through real-time monitoring and robust cybersecurity.

- In March 2025, Kongsberg Digital participated in the IPTC 2025, focusing on digital transformation in the oil and gas sector.

- In January 2025, SAP S/4HANA Cloud was highlighted as a key enabler for a smarter, more efficient energy ecosystem in the oil and gas industry.

- In April 2025, Schlumberger (SLB) announced a partnership with Shell to deploy Petrel™ subsurface software across Shell’s global assets. This collaboration aims to enhance digital capabilities and operational efficiencies through advanced AI-driven seismic interpretation workflows. This development underscores SLB’s ongoing commitment to advancing subsurface digital technology and fostering strategic partnerships in the energy sector.

Market Concentration and Characteristics

The UAE Digital Oilfield Solutions Market is moderately concentrated, with a few dominant global players, such as Schlumberger, Halliburton, and Baker Hughes, commanding a significant market share. These companies have established strong market presence due to their extensive portfolios of advanced technologies, including IoT, AI, and cloud-based platforms. However, the market also features a growing number of regional and smaller players offering specialized solutions tailored to the specific needs of UAE oilfields, such as remote monitoring and predictive maintenance. The market characteristics reflect a trend towards technological innovation, with increasing demand for real-time data analytics, automation, and efficiency improvements. Furthermore, there is a strong emphasis on sustainability, with digital solutions being integral to reducing energy consumption, emissions, and enhancing operational safety. As the UAE continues to diversify its oilfield operations, the market will likely see further fragmentation and increased competition among both global and local players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Solution, Application, Process, Deployment and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UAE’s focus on expanding offshore oil production will drive further adoption of digital solutions for remote monitoring, predictive maintenance, and real-time optimization. This trend is expected to increase significantly in the coming years.

- AI and automation technologies will play a crucial role in optimizing drilling, production, and reservoir management processes, reducing operational costs and improving efficiency across the oil and gas sector.

- As digital infrastructure evolves, more companies in the UAE will adopt cloud-based platforms for seamless data sharing, scalability, and enhanced collaboration, improving operational flexibility and decision-making.

- The UAE’s commitment to sustainability will encourage the adoption of digital oilfield solutions that focus on energy efficiency, reducing emissions, and supporting the transition to a low-carbon future in oil and gas operations.

- With the increasing amount of data generated from IoT sensors and digital systems, there will be greater demand for advanced data analytics to gain actionable insights, improve decision-making, and enhance operational efficiency.

- Major oilfield solution providers will continue to invest in research and development to introduce innovative technologies, ensuring that they stay competitive in the rapidly evolving digital oilfield market.

- The UAE government’s strategic initiatives, such as the UAE Vision 2021, will continue to encourage digital transformation in the oil and gas sector, driving the market’s expansion through public-private partnerships.

- As digital oilfield solutions expand, there will be a heightened focus on cybersecurity to protect critical infrastructure, prevent cyber threats, and safeguard sensitive operational data from breaches.

- The ongoing trend toward remote operations, driven by digital solutions, will continue to reduce the need for onsite personnel, enhancing safety and enabling oilfield operators to manage operations from centralized locations.

- With growing digital adoption, local UAE companies are expected to increasingly compete with global players, offering specialized, cost-effective solutions tailored to the region’s specific needs and challenges.