Market Overview:

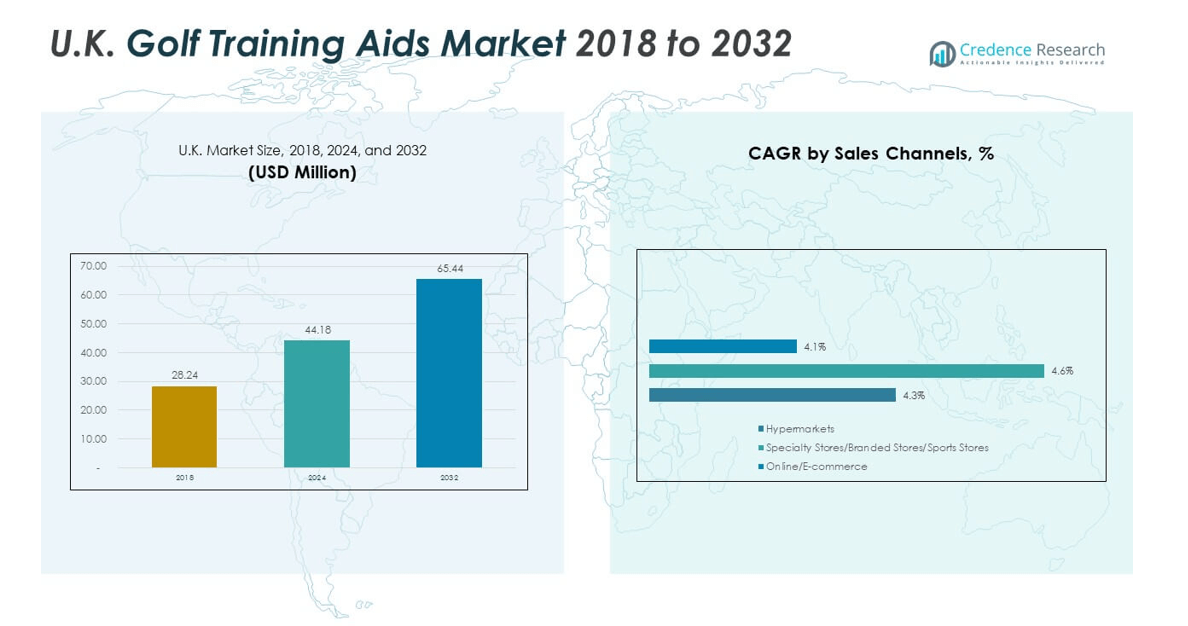

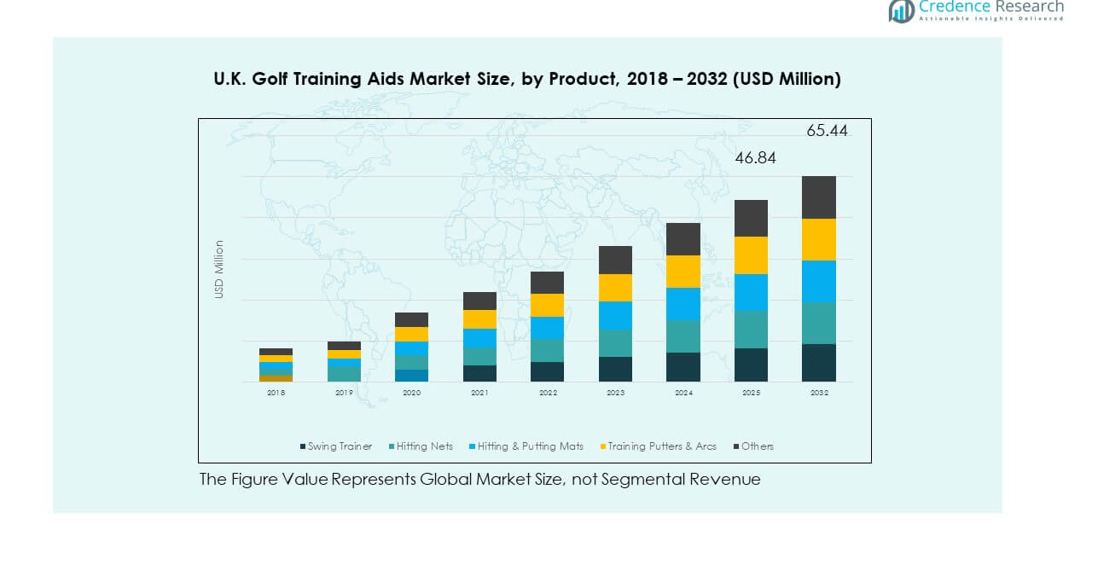

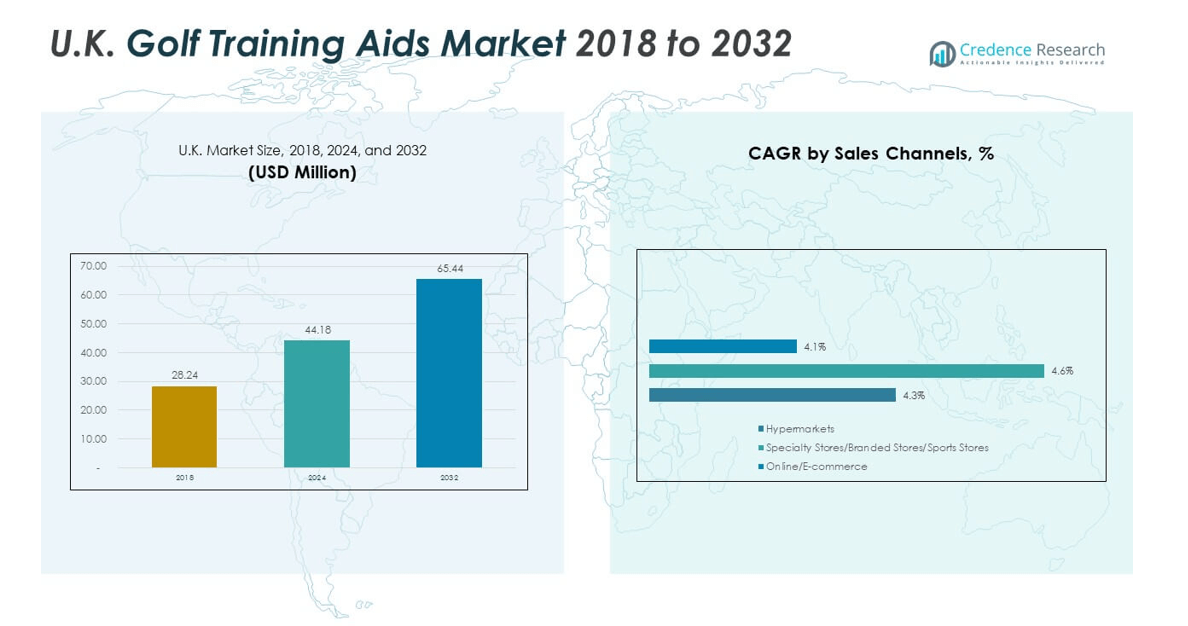

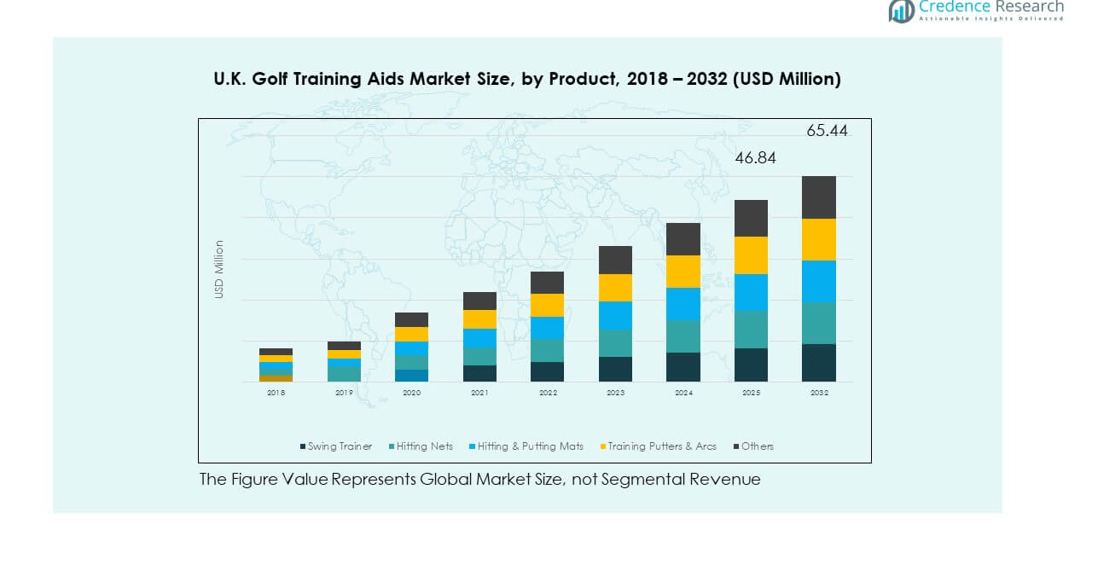

The U.K. Golf Training Aids Market size was valued at USD 28.24 million in 2018 to USD 44.18 million in 2024 and is anticipated to reach USD 65.44 million by 2032, at a CAGR of 5.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Golf Training Aids Market Size 2024 |

USD 44.18 million |

| U.K. Golf Training Aids Market, CAGR |

5.06% |

| U.K. Golf Training Aids Market Size 2032 |

USD 65.44 million |

The growth of the U.K. Golf Training Aids Market is driven by the increasing participation in golf across all age groups, fueled by rising interest in leisure sports and fitness-oriented recreational activities. Advancements in training technologies, such as AI-enabled swing analyzers and portable simulators, are enhancing the appeal of practice equipment. Additionally, the popularity of golf tourism and growing adoption of indoor golf facilities are creating more opportunities for both amateur and professional players to invest in specialized training aids, thereby supporting steady market expansion.

Regionally, the market is witnessing strong demand in areas with well-established golf infrastructures, particularly England and Scotland, where the sport has deep cultural roots. These regions lead in terms of both player base and facility availability, driving significant adoption of training aids. Wales and Northern Ireland are emerging markets, benefiting from government initiatives and tourism-based golf promotions. The urbanization of golf through indoor simulators in metropolitan areas is also broadening accessibility, attracting younger demographics, and stimulating market growth beyond traditional golf hubs.

Market Insights:

- The U.K. Golf Training Aids Market was valued at USD 44.18 million in 2024 and is anticipated to reach USD 65.44 million by 2032, growing at a CAGR of 5.06%.

- Rising participation in golf across diverse age groups is boosting demand for advanced and portable training aids.

- Technological innovations, including AI-enabled swing analyzers and simulator-compatible devices, are enhancing practice efficiency.

- High price sensitivity among amateur golfers is limiting adoption of premium products.

- Seasonal dependency and weather constraints continue to challenge consistent outdoor equipment sales.

- England leads the market with 58% share, driven by established golf infrastructure and high player engagement.

- Scotland holds 25% share, leveraging its strong golfing heritage and global tourism appeal.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Participation and Expanding Consumer Base in Golf Practice Equipment

The U.K. Golf Training Aids Market benefits from a steady increase in golf participation among diverse age groups, supported by the sport’s growing reputation as a lifestyle and wellness activity. It is witnessing demand from both amateur enthusiasts and professional players seeking performance enhancement. Indoor golfing facilities and simulator-based practice centers are helping attract urban audiences who lack easy access to courses. The rising popularity of golf tourism in regions such as Scotland is boosting awareness of training aids. E-commerce platforms are expanding accessibility to advanced products beyond traditional sports stores. Marketing campaigns from golf brands and associations are promoting structured training, encouraging higher spending on aids. The inclusion of golf in televised sports coverage has raised public interest, driving equipment adoption. Technological upgrades in devices like swing analyzers and putting trainers are enhancing value propositions.

Technological Advancements Enhancing Player Performance and Engagement

Innovations in golf training devices are transforming the practice experience for U.K. players. It is benefiting from AI-driven swing analyzers, launch monitors, and mobile app integrations that provide instant feedback. Real-time performance analytics enable players to adjust techniques more efficiently, fostering continuous improvement. Brands are offering portable and compact devices, allowing practice in varied environments, including homes and indoor spaces. Partnerships between technology firms and sports equipment manufacturers are delivering products with higher accuracy and durability. The integration of augmented reality features is adding interactive elements to training, making it more engaging for younger audiences. Product designs now emphasize user-friendly interfaces, appealing to golfers with varying skill levels. The market is seeing consistent investment in R&D, aiming to replicate professional training experiences for a broader consumer segment.

- For instance, companies like HackMotion introduced wrist sensor devices that provide immediate, accurate swing feedback utilizing advanced motion sensor technology, capturing precise wrist angles and clubface control metrics for each swing.

Growing Influence of Golf Tourism and Competitive Events

Golf tourism is a significant contributor to the adoption of training aids in the U.K. It draws players from domestic and international markets, creating a consistent demand for high-quality practice equipment. Prestigious tournaments such as The Open Championship inspire amateurs to improve their skills, leading to higher sales of training tools. Golf academies and resorts are incorporating advanced aids into their facilities to attract clientele. The growth of regional and local tournaments encourages continuous practice, which supports year-round equipment demand. Retail outlets in tourist-heavy golf regions are expanding product ranges to cater to seasonal spikes in visitors. Collaborations between golf resorts and equipment brands are further promoting premium training products. The increased visibility of golf-related content on social media is amplifying interest in skill improvement.

- For example, Full Swing Golf simulators, trusted by top professionals including Tiger Woods, are officially licensed by the PGA TOUR and used in both commercial and residential settings. The company’s portable launch monitor, the Full Swing KIT, delivers 16 points of club and ball data, including metrics such as carry distance, spin rate, and ball speed, supporting performance improvement for golfers at various skill levels.

Expansion of Indoor Golf Facilities and Simulator-Based Practice Centers

The rise of indoor golfing facilities across urban centers is strengthening the U.K. Golf Training Aids Market. It is enabling players to practice regardless of weather, ensuring year-round demand for equipment. Advanced simulators are offering immersive experiences that replicate professional course conditions. Facility operators are investing in premium training devices to differentiate their offerings from competitors. Membership-based indoor clubs are promoting continuous use of training aids as part of coaching packages. Product manufacturers are aligning designs with the needs of indoor play, including compact, lightweight, and easily storable equipment. This indoor shift is widening access to new demographics, especially in metropolitan areas. It supports steady revenue streams for suppliers while encouraging experimentation with innovative product features.

Market Trends:

Increasing Adoption of Data-Driven Golf Practice Solutions

The U.K. Golf Training Aids Market is evolving with the integration of data analytics into practice routines. It is using motion sensors, launch monitors, and smart mats to record detailed performance metrics. Golfers are embracing these insights to make precise adjustments, replacing guesswork with evidence-based improvement. Mobile apps linked to devices allow remote coaching, expanding training accessibility. The demand for subscription-based digital coaching platforms is rising, blending equipment sales with long-term service engagement. Consumers value products that can track progress over time, influencing repeat purchases. Integration with cloud-based storage is making performance history easily accessible. This trend aligns with a wider shift toward technology-enhanced sports performance.

- For example, TrackMan’s ball flight analysis system captures approximately 27 distinct data points related to the golf swing and ball trajectory, offering highly detailed feedback. It serves more than 1,000 professional golfers globally and stands as one of the most widely adopted systems among data-driven golf training tools.

Growing Appeal of Portable and Multi-Functional Training Devices

Consumers are favoring compact training aids that can be used in various environments without requiring extensive setup. It is driving manufacturers to design multi-functional products that address multiple aspects of the game, from swing mechanics to putting accuracy. Foldable practice nets, adjustable swing trainers, and travel-friendly putting mats are gaining popularity. Urban golfers, constrained by space, are a primary audience for these innovations. The convenience of storage and transport is influencing purchasing decisions. Marketing emphasizes versatility and adaptability, making such products suitable for both indoor and outdoor use. Product designs increasingly cater to multi-skill practice in a single unit. This trend is fostering growth among first-time buyers seeking value in flexible training solutions.

Sustainability and Eco-Friendly Materials in Golf Training Equipment

Sustainability is becoming a defining feature in purchasing decisions across the U.K. Golf Training Aids Market. It is encouraging brands to adopt eco-friendly materials and manufacturing processes. Biodegradable tees, recycled plastic mats, and low-impact packaging are entering mainstream product ranges. Companies are promoting environmental responsibility as part of their branding strategies. Golfers are showing preference for products that balance performance with environmental considerations. Supply chains are adapting to source sustainable raw materials without compromising durability. Certifications and eco-labels are becoming marketing tools, adding value for environmentally conscious buyers. This shift reflects a broader cultural emphasis on sustainability in sports.

Integration of Gamification to Enhance User Engagement

Gamification is emerging as a key feature in golf training aid development. It is adding competitive and entertainment elements to practice sessions, encouraging longer and more frequent use. Features such as scoring challenges, skill progression tracking, and virtual tournaments are integrated into devices and apps. Gamified training appeals to younger audiences and casual golfers, broadening the consumer base. Indoor facilities are leveraging this trend to differentiate themselves from traditional driving ranges. Product developers are aligning gamification features with performance improvement goals, ensuring they retain practical value. The trend is also fostering community-based engagement through online leaderboards and shared challenges.

- For example, the Sportsbox AI mobile app enables golfers to capture swings using a smartphone and generate 3D biomechanical measurements from a single video. It tracks over 30 key body points, allows swing visualization from multiple angles, and offers side-by-side comparisons to help golfers and coaches monitor progress and refine technique.

Market Challenges Analysis:

High Price Sensitivity and Limited Awareness Among Amateur Golfers

The U.K. Golf Training Aids Market faces a challenge in appealing to price-sensitive consumers, especially amateur golfers with limited budgets. It often struggles to justify the cost of advanced training devices to casual players who may not view them as essential. Awareness about the long-term benefits of structured training remains low outside dedicated golfing circles. Retailers must invest in demonstrations and education to address this gap. E-commerce platforms face high return rates when product expectations are unclear. Competition from low-cost imports puts pressure on premium brands. Smaller local manufacturers may lack resources to engage in sustained marketing, limiting their reach. Consumer hesitation delays adoption despite technological advancements. The lack of targeted financing or installment options for premium devices further hinders adoption among budget-conscious buyers. Overcoming this challenge will require a combination of price innovation, targeted promotions, and education-focused marketing.

Seasonal Dependency and Weather-Related Limitations

Seasonal fluctuations affect market performance, as outdoor golfing activity in the U.K. slows during colder months. It creates periods of reduced sales, especially for products designed exclusively for outdoor use. Indoor facilities partly offset this challenge but remain concentrated in urban areas. Rural players may have limited access to alternative practice venues. Weather unpredictability also disrupts planned golf-related events, reducing exposure for training aids. Manufacturers with narrow seasonal product lines face greater volatility in revenue streams. Balancing production to match seasonal cycles remains a persistent challenge. Without year-round demand, suppliers may struggle to scale operations efficiently. Introducing multi-season, adaptable products could help stabilize sales throughout the year. Expanding indoor golfing infrastructure into underserved regions may also mitigate weather-related impacts.

Market Opportunities:

Expansion into Emerging Demographics and Non-Traditional Golf Audiences

The U.K. Golf Training Aids Market can grow by targeting younger demographics and casual sports participants. It can position training aids as recreational tools rather than niche sports equipment. Social media and influencer marketing can highlight the fun and skill-building aspects of these products. Collaborations with schools and community sports programs can create early exposure. The rise of indoor gaming and simulator golf can bridge the gap between virtual and real-world play. Designing products with broader appeal can open access to new consumer segments. These efforts can build long-term brand loyalty and repeat purchases. Offering affordable entry-level products could help capture first-time buyers. Partnerships with lifestyle brands may also extend reach to audiences outside traditional golf circles.

Leveraging E-Commerce and Direct-to-Consumer Sales Models

E-commerce provides a scalable channel for reaching both domestic and international buyers. It allows brands to showcase full product ranges without retail space limitations. Direct-to-consumer sales models give manufacturers better control over pricing, promotions, and customer engagement. Bundling training aids with online coaching subscriptions can enhance perceived value. Strategic partnerships with sports marketplaces can expand visibility. Offering customization options through online platforms can increase consumer interest. Leveraging data from online sales can inform targeted marketing campaigns. Incorporating virtual product demos and augmented reality previews could further improve online conversion rates. Streamlined logistics and faster delivery services can strengthen brand competitiveness in the digital space.

Market Segmentation Analysis:

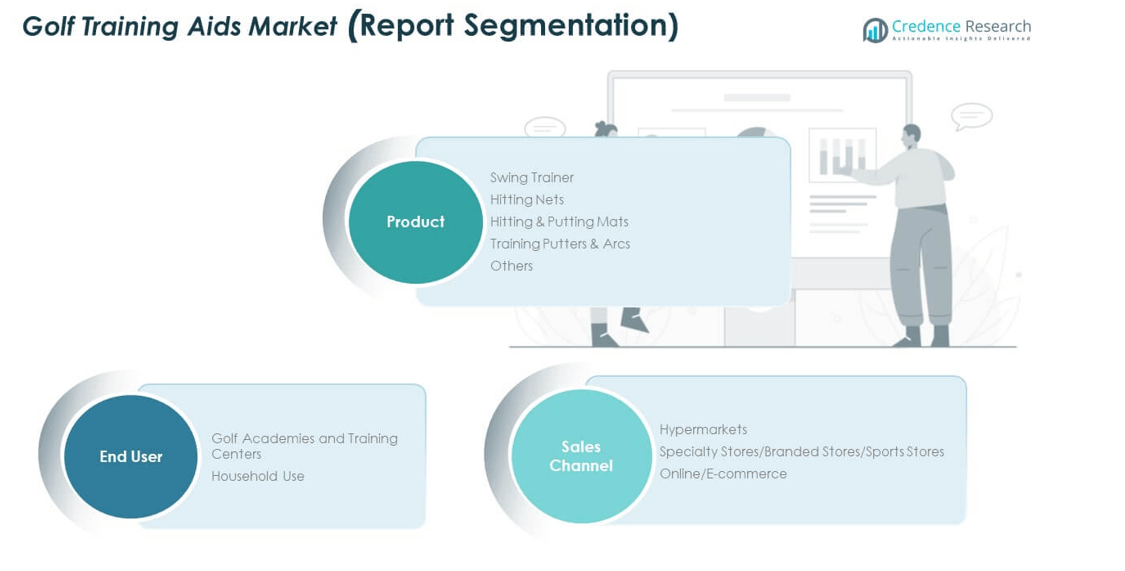

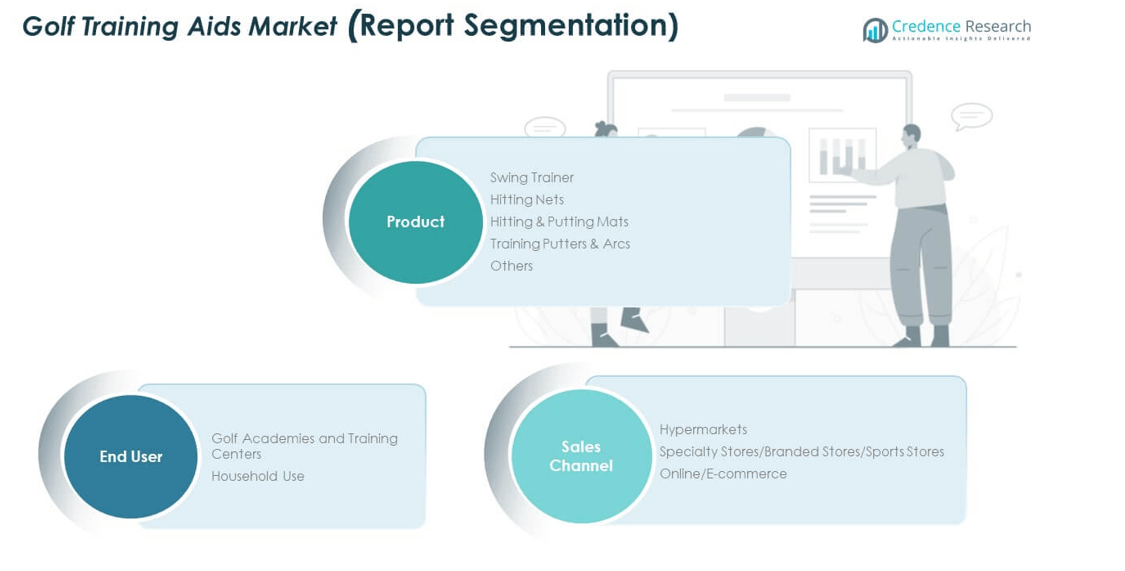

The U.K. Golf Training Aids Market is segmented

By product into swing trainers, hitting nets, hitting & putting mats, training putters & arcs, and others. Swing trainers hold a strong position due to their role in improving swing mechanics for players of all levels. Hitting nets and hitting & putting mats are gaining popularity for their convenience in indoor and outdoor practice. Training putters & arcs cater to players seeking to refine precision and putting alignment. The “others” category includes niche aids such as grip trainers and alignment sticks, which appeal to specialized training needs.

- For example, the Club Champ Golf Practice Net features a large practice area of approximately 9 ft wide by 7 ft tall and is constructed with weather-resistant nylon and fiberglass-reinforced poles. It effectively absorbs powerful shots and offers quick setup, making it a durable and popular choice for both home and academy use.

By end user, the market serves golf academies and training centers, as well as household users. Golf academies and training centers drive steady demand, integrating advanced aids into structured coaching programs. Household use is expanding rapidly, supported by the growth of home practice setups and compact equipment designed for small spaces. It is helping broaden adoption among amateur players and casual golf enthusiasts.

- For example, Sunningdale Heath and Stoke Park golf academies use advanced swing analysis tools such as TrackMan and biomechanics systems to deliver precise, data-driven coaching. Their facilities feature technologies like radar capture, video analysis, and 3D force plates to enhance player performance.

By sales channel, the market is divided into hypermarkets, specialty stores/branded stores/sports stores, and online/e-commerce platforms. Specialty and branded stores maintain strong relevance by offering expert guidance and in-person demonstrations. Hypermarkets provide accessible purchasing points for mainstream buyers. Online and e-commerce channels are witnessing the fastest growth, driven by the convenience of home delivery, wider product selection, and competitive pricing strategies. The segment structure reflects a balanced demand pattern across professional and recreational golfers, supported by multiple purchasing avenues.

Segmentation:

By Product Segment

- Swing Trainer

- Hitting Nets

- Hitting & Putting Mats

- Training Putters & Arcs

- Others

By End User Segment

- Golf Academies and Training Centers

- Household Use

By Sales Channel Segment

- Hypermarkets

- Specialty Stores / Branded Stores / Sports Stores

- Online / E-commerce

Regional Analysis:

England dominates the U.K. Golf Training Aids Market with a market share of 58%, supported by a large concentration of golf courses, training facilities, and active player communities. It benefits from a well-established golfing culture, with regions such as Surrey, Kent, and Yorkshire hosting numerous academies and competitive events. The presence of premium golf resorts and professional tournaments fuels continuous investment in advanced training equipment. Retail networks are extensive, offering both physical and online purchasing options. Urban centers drive significant demand for indoor practice solutions due to space constraints. The combination of high player participation rates and strong infrastructure sustains England’s leadership in the market.

Scotland holds 25% of the market share, leveraging its heritage as the birthplace of golf to attract domestic and international players. It is home to world-renowned courses like St Andrews and Gleneagles, which attract tourism and support demand for high-quality training aids. Golf tourism contributes significantly to equipment sales, with resorts and pro shops offering premium practice tools. Local golf academies integrate advanced devices into coaching programs, strengthening adoption. The cultural significance of golf in Scotland ensures consistent year-round demand despite seasonal weather challenges. Regional manufacturers and distributors benefit from a loyal customer base that values quality and tradition.

Wales and Northern Ireland collectively account for 17% of the market share, showing steady growth through expanding golf participation and infrastructure development. It is seeing increased investment in golf tourism, with coastal courses and championship events drawing attention to the regions. Local governments and sports associations are promoting grassroots golf programs, encouraging equipment uptake among younger demographics. Urban centers such as Cardiff and Belfast are adopting indoor golfing facilities to counter weather-related limitations. Specialty sports stores and online platforms are extending product availability across rural and semi-urban areas. These regions are emerging as promising markets with potential for higher growth in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BEC Group

- Acushnet Holdings Corp.

- WhyGolf

- PlaneSWING UK

- Pro-Fit Net Installations Ltd

- EyeLine Golf

- Optishot Golf

- Skytrak

- FinalPutt

- Strand Sports, Inc

- Other Key Players

Competitive Analysis:

The U.K. Golf Training Aids Market features a competitive landscape dominated by established brands and specialized equipment manufacturers. Key players include BEC Group, Acushnet Holdings Corp., WhyGolf, PlaneSWING UK, Pro-Fit Net Installations Ltd, EyeLine Golf, Optishot Golf, Skytrak, FinalPutt, and Strand Sports, Inc. It is characterized by continuous product innovation, with companies introducing advanced swing trainers, putting systems, and simulator-compatible aids. Strategic developments such as new product launches, collaborations with golf academies, and expansion into online retail channels are common. Premium brands focus on high-performance, technology-integrated solutions, while emerging players target affordability and niche training needs. Competition is intensified by global brands expanding into the U.K. through partnerships and distribution networks.

Recent Developments:

- In April 2025, GolfNow onboarded over 320 new golf properties across North America including traditional golf courses and off-course fitting, training, and entertainment venues and integrated its technology and services into their daily operations. It reflects growing demand for golf training facilities and underscores how the North America Golf Training Aids Market connects with expanding infrastructure

- In May 2025, EyeLine Golf launched the Speed Trap 2.0, a new and highly versatile training aid designed to improve swing path and ball striking in golfers of all skill levels. This innovative product quickly became popular in North America for delivering immediate feedback, helping users correct slices and hooks while enhancing overall swing trajectory.

- In April 2024, OptiShot Golf announced the launch of its Nova simulator, manufactured entirely in America. Nova sets a new standard for golf simulation with a single high-speed camera, infrared sensors, and integration with the company’s Orion Live simulator software, offering 20+ digital courses and robust online play features

Market Concentration & Characteristics:

The U.K. Golf Training Aids Market demonstrates moderate concentration, with a mix of global brands and regional manufacturers competing for market share. It benefits from strong brand loyalty among professional and committed amateur golfers, while new entrants leverage affordability to capture casual users. Innovation cycles are short, driven by advancements in digital training technologies and materials. Distribution spans specialty sports stores, hypermarkets, and rapidly growing e-commerce platforms. The market is price-sensitive but responds positively to high-quality, durable products that deliver measurable performance improvements.

Report Coverage:

The research report offers an in-depth analysis based on Product, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Technological advancements in AI-enabled swing analyzers and simulator-compatible devices will drive innovation in training aids.

- Expansion of indoor golfing facilities will create year-round demand and attract urban consumers with limited access to courses.

- Integration of gamification features into training equipment will enhance user engagement and appeal to younger audiences.

- Growth in golf tourism will increase the adoption of premium training aids in resorts, academies, and retail outlets.

- Sustainability initiatives will encourage the use of eco-friendly materials in product manufacturing and packaging.

- Partnerships between training aid manufacturers and golf academies will strengthen brand visibility and market reach.

- Online sales channels will expand further, supported by advanced digital marketing and targeted e-commerce strategies.

- Customization options for training equipment will appeal to both professional players and recreational users seeking personalized solutions.

- Grassroots programs and school-based golf initiatives will boost participation and drive entry-level equipment demand.

- Global brands entering the market through strategic collaborations will intensify competition and raise product standards.