Market Overview:

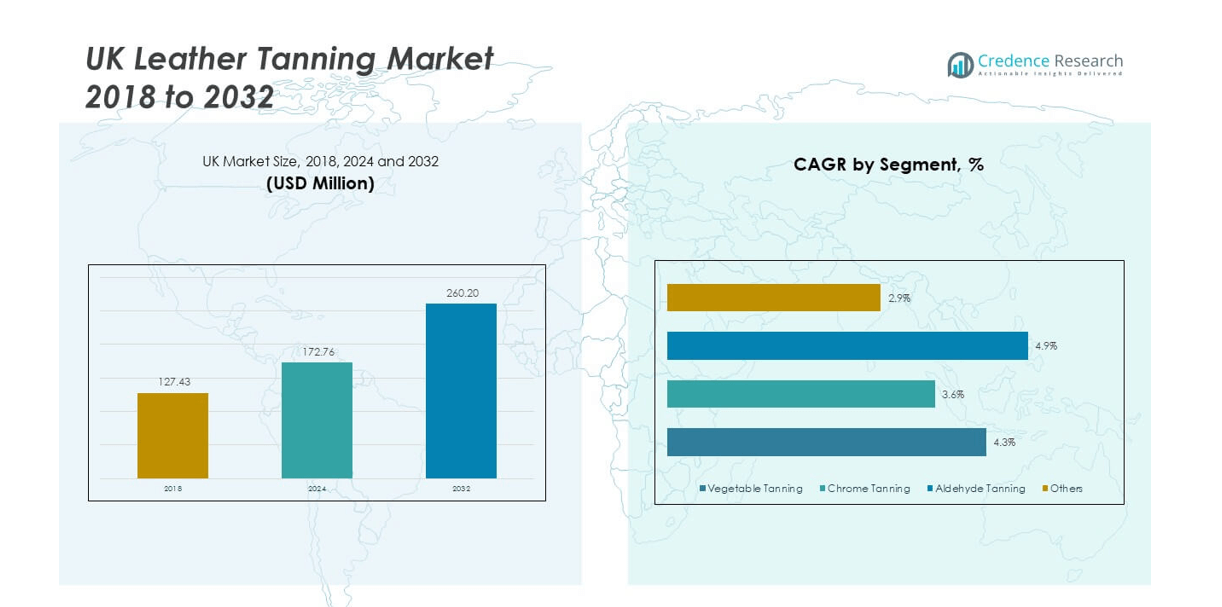

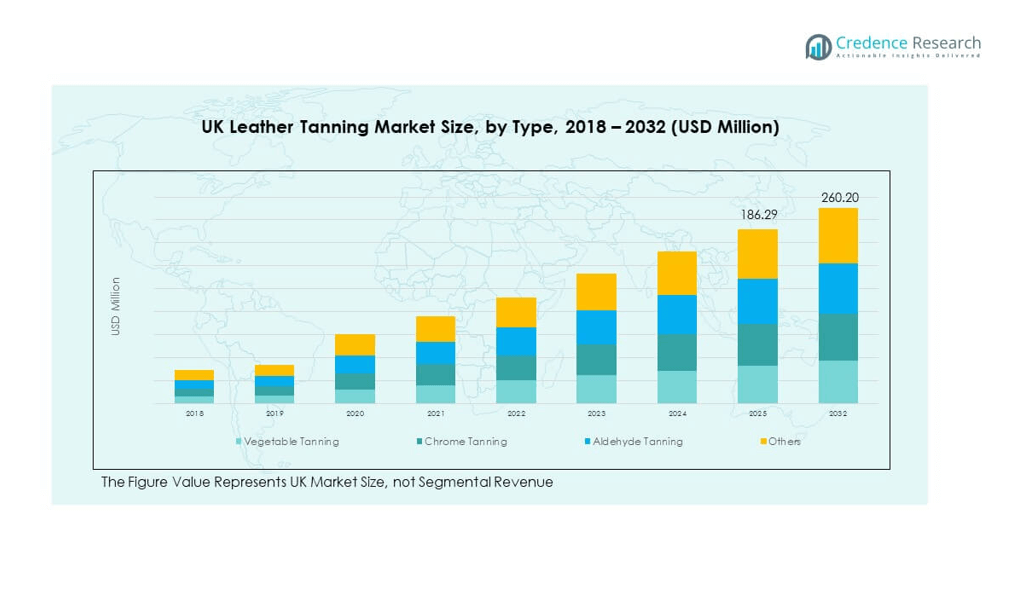

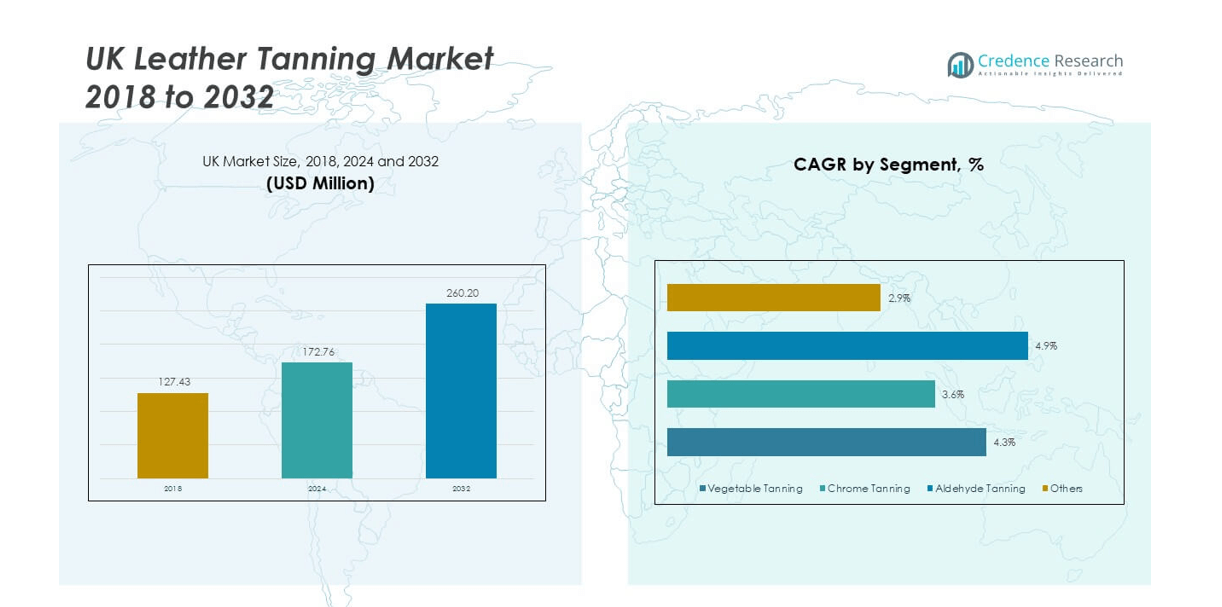

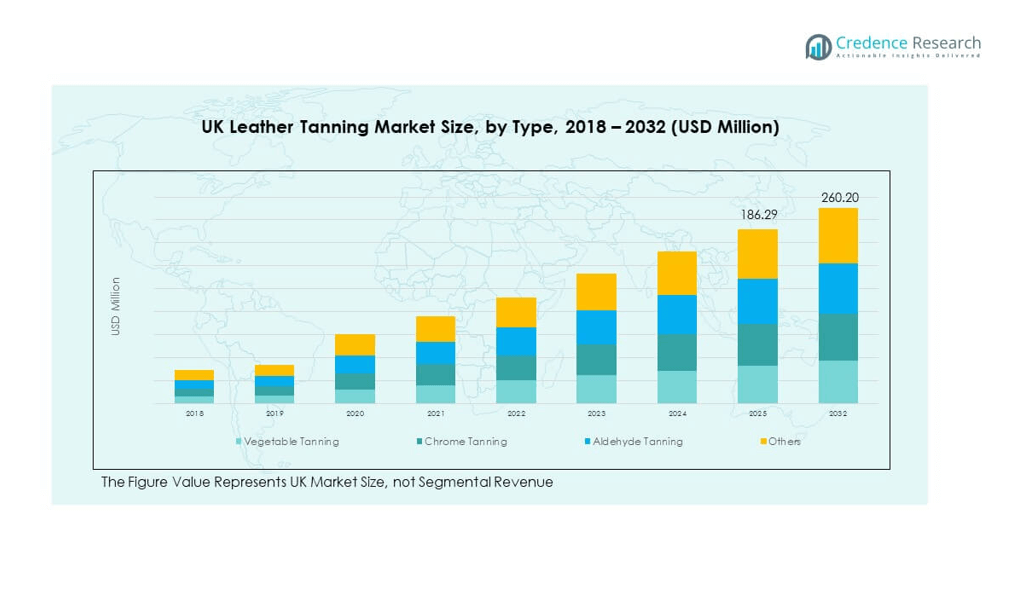

The UK Leather Tanning Market size was valued at USD 127.43 million in 2018 to USD 172.76 million in 2024 and is anticipated to reach USD 260.20 million by 2032, at a CAGR of 4.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Leather Tanning Market Size 2024 |

USD 172.76 million |

| UK Leather Tanning Market, CAGR |

4.89% |

| UK Leather Tanning Market Size 2032 |

USD 260.20 million |

Growth in the UK leather tanning industry is driven by increasing demand from luxury fashion, automotive interiors, and footwear. Rising consumer preference for premium and sustainable leather products is encouraging manufacturers to adopt eco-friendly tanning processes. Strict environmental regulations are pushing companies to invest in advanced technologies, reducing harmful emissions and improving efficiency. The market also benefits from exports to Europe and Asia, supported by growing applications in luxury accessories and furniture.

Regionally, the UK dominates the leather tanning sector in Europe due to its strong fashion industry, advanced manufacturing practices, and global trade networks. Demand is particularly strong in urban centers, where premium and eco-conscious products are in high demand. Emerging players from Asia are entering the market, supported by cost advantages and rising global trade flows. However, the UK retains a competitive edge through innovation, sustainability initiatives, and close links with luxury brands worldwide.

Market Insights:

- The UK Leather Tanning Market was valued at USD 127.43 million in 2018, expected to reach USD 172.76 million in 2024, and projected at USD 260.20 million by 2032, growing at a CAGR of 4.89%.

- Europe holds the largest share at 38%, driven by luxury fashion demand and strong automotive applications. North America follows with 27%, supported by high consumer spending and premium product demand, while Asia-Pacific stands at 22%, boosted by manufacturing capacity and expanding middle-class consumers.

- Asia-Pacific is the fastest-growing region with rising demand for sustainable leather and strong exports, supported by urbanization and expanding fashion industries.

- Chrome tanning dominates with 42% share, due to its efficiency and wide use in footwear and automotive applications.

- Vegetable tanning accounts for 28%, supported by sustainability initiatives and consumer preference for eco-friendly products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Luxury Fashion and Automotive Industries Fueling Growth in the Market:

The UK Leather Tanning Market is witnessing growth due to expanding demand from luxury fashion houses and premium automotive brands. Luxury leather goods, including handbags, footwear, and accessories, are driving consistent demand for high-quality tanned leather. In the automotive sector, leather is widely used in vehicle interiors, where comfort and premium aesthetics remain priorities. Leading manufacturers are securing long-term contracts with luxury carmakers, ensuring stable demand. It is also benefiting from increased exports of leather products to Europe and Asia. Consumers seeking durable and elegant products prefer natural leather over substitutes. Fashion cycles and design trends continue to enhance usage in new collections. Sustainability-focused brands are aligning with eco-friendly tanning to capture a wider customer base.

- For instance, Billy Tannery has pioneered the UK’s first leather microtannery specializing in goat leather, implementing environmentally conscious tanning approaches that support collaborations with luxury brands demanding highly sustainable, artisanal leather products.

Regulatory Push Toward Eco-Friendly and Sustainable Tanning Practices Supporting Expansion:

Strict environmental regulations in the UK have accelerated investments in sustainable tanning practices. Companies are adopting vegetable tanning and chrome-free processes to reduce chemical pollution. It is benefiting from technological upgrades such as advanced effluent treatment systems and water recycling facilities. These improvements reduce ecological impact while enhancing brand reputation. Consumer awareness around eco-friendly leather is rising, influencing purchasing choices. Sustainable practices are helping brands attract environmentally conscious buyers in both domestic and export markets. Industry players integrating circular economy models are improving efficiency and resource use. Long-term adoption of green processes ensures regulatory compliance and competitive advantage.

- For instance, Charles F Stead & Co Ltd has achieved Leather Working Group certification through technological upgrades including automated dyehouses and effluent treatment systems, enabling compliance with strict environmental norms while reducing water usage significantly.

Growing Export Opportunities Enhancing Market Expansion Across International Markets:

The UK leather tanning industry benefits from strong export networks across Europe, Asia, and North America. Demand for premium leather in fashion capitals such as Milan, Paris, and New York supports steady growth. It is expanding its global reach through trade partnerships and participation in international exhibitions. Export-oriented companies are leveraging digital platforms to showcase eco-certified leather products. Rising demand from Asian markets, particularly China and Japan, further strengthens opportunities. Global luxury brands sourcing sustainable leather from the UK ensure consistent export revenues. Premium quality and craftsmanship differentiate UK tanned leather in the international marketplace. Exports also help balance domestic demand fluctuations and drive foreign revenue inflows.

Rising Consumer Preference for Premium and Durable Leather Products Sustaining Market Demand:

Changing consumer lifestyles are shaping demand for premium and long-lasting leather goods. Shoppers prefer tanned leather for its durability, comfort, and elegant appearance. It continues to remain the preferred choice in furniture, accessories, and specialty goods. Younger buyers are aligning with brands offering traceable and responsibly sourced leather. High disposable incomes in urban regions are supporting purchases of luxury products. Durable leather ensures better life cycles, reducing replacement needs compared to synthetic substitutes. Consumer preference for authentic and natural textures creates consistent demand. This trend is helping the market retain a strong position across multiple application industries.

Market Trends:

Adoption of Digital Tools and AI in Leather Production Transforming the Industry Landscape:

The UK Leather Tanning Market is embracing digital technologies and automation to streamline production. AI-driven tools are being used to optimize tanning cycles and reduce energy consumption. It is also leveraging data analytics to monitor quality and maintain consistency in output. Digital design platforms enable customization and quicker response to market trends. Virtual showrooms and digital catalogs are expanding reach for leather exporters. The integration of automation is reducing manual labor dependency in processing. Companies adopting these technologies are gaining efficiency advantages. This transformation ensures faster delivery times and sustainable growth in a competitive market.

- For instance, a leading pharmaceutical company employs AI algorithms to optimize tanning batch processing, enhancing operational efficiency which has resulted in a measurable decrease in energy consumption and improved medication quality consistency.

Emergence of Traceability Systems Strengthening Trust in Leather Supply Chains:

Brands in the UK are increasingly adopting traceability solutions to verify leather origins. It ensures compliance with animal welfare and environmental standards. Blockchain systems are being integrated to track the leather journey from raw hides to finished goods. Transparent supply chains are building consumer confidence in premium products. Digital tags and certification platforms are enhancing brand credibility worldwide. Buyers in luxury markets now prefer fully traceable leather, making it a standard expectation. Adoption of traceability is also helping UK firms access high-end international buyers. Such transparency trends are reshaping global buyer-supplier relationships.

- For instance, Alice V Robinson, a co-founder of British Pasture Leather, has established full lifecycle transparency for leather sourced from regenerative farms, enhancing its appeal among environmentally conscious luxury clientele. While the company has developed a traceable supply chain, publicly available information does not confirm the use of blockchain technology for this purpose.

Rising Popularity of Customization and Bespoke Leather Solutions in Luxury Sectors:

Customization is becoming a significant trend in luxury leather goods, influencing tanning demand. The UK Leather Tanning Market is responding to this trend by producing specialized leathers for bespoke applications. Fashion houses and automotive brands increasingly request unique finishes, textures, and colors. It drives higher value contracts for tanning firms capable of meeting such specifications. Bespoke solutions enhance exclusivity, appealing to premium buyers worldwide. This trend is particularly strong in accessories, footwear, and automotive interiors. Leather tanning companies offering flexible, small-batch production are attracting high-value customers. Tailored leather is now seen as a marker of prestige and authenticity.

Integration of Sustainable and Plant-Based Chemicals Driving New Technological Directions:

The market is witnessing growing adoption of plant-based tanning agents and bio-based chemicals. It helps reduce dependency on hazardous materials while improving environmental outcomes. Researchers in the UK are developing advanced bio-tanning solutions to minimize water use. Chemical manufacturers are collaborating with tanners to bring eco-certified alternatives into large-scale use. Brands highlighting bio-based processes are gaining traction among environmentally focused consumers. Shifting to plant-derived chemicals supports long-term alignment with global sustainability goals. This shift is encouraging innovation and collaboration across the leather value chain. The trend is positioning UK producers as leaders in eco-conscious leather.

Market Challenges Analysis:

Stringent Environmental Regulations and Compliance Costs Impacting Industry Profit Margins:

The UK Leather Tanning Market faces rising challenges from strict environmental regulations. Companies must comply with limits on chemical discharges, water usage, and emissions. It has forced manufacturers to invest heavily in advanced treatment systems and waste management. High compliance costs impact profit margins, particularly for small-scale players. Strict rules have also led to plant closures, reducing overall production capacity. Adopting eco-friendly solutions requires significant upfront capital, limiting new entrants. The challenge intensifies when balancing operational efficiency with sustainability targets. Global competition from regions with looser regulations adds further strain on UK producers.

Supply Chain Disruptions and Raw Material Volatility Restraining Market Stability:

The market is also impacted by volatile raw material prices and supply chain disruptions. Availability of high-quality hides is inconsistent due to fluctuating livestock numbers. It creates unpredictability in production planning and inventory management. Global shipping delays and trade restrictions increase costs and extend lead times. Small and mid-sized firms are most vulnerable to these fluctuations. Dependence on imports for certain chemicals raises exposure to currency variations. Competition from synthetic substitutes also challenges long-term demand growth. These issues collectively pressure profitability and disrupt smooth market expansion.

Market Opportunities:

Expanding Role of Eco-Friendly Leather in Luxury and Mainstream Segments Creating Growth Scope:

The UK Leather Tanning Market has strong opportunities in sustainable leather categories. Eco-certified leather is gaining preference among global fashion and automotive leaders. It is expected to unlock new opportunities in mainstream product categories as well. Collaborations with luxury brands strengthen the reputation of UK tanners in global markets. Increasing consumer awareness of sustainability offers firms long-term growth opportunities. The market can benefit by positioning eco-leather as both premium and practical. This strategy aligns with global goals while enhancing brand credibility. Expanding exports of sustainable leather creates lasting competitive advantages.

Rising Opportunities from Innovation in Bio-Based Chemicals and Advanced Leather Applications:

Advances in bio-tanning chemicals are opening new opportunities for UK producers. It helps meet rising demand from eco-conscious industries while reducing compliance risks. New research collaborations between universities and industry players encourage innovation. Potential applications include furniture, electronics, and luxury packaging. Adopting smart tanning technologies ensures faster production and lower costs. Firms embracing digital integration can access broader international markets. These innovations create differentiation in a competitive global environment. The opportunity to lead in sustainable leather innovation strengthens the long-term outlook.

Market Segmentation Analysis:

By Type

The UK Leather Tanning Market demonstrates diverse growth across type segments, reflecting evolving consumer and industrial needs. Vegetable tanning is gaining traction with rising demand for eco-friendly and durable leather, especially in luxury goods and accessories. Chrome tanning dominates the market due to its efficiency, cost-effectiveness, and suitability for mass production, particularly in footwear and automotive interiors. Aldehyde tanning finds niche applications in products requiring softness and flexibility, such as garments and upholstery. Other tanning methods, including synthetic and hybrid approaches, continue to grow as companies explore innovative, sustainable alternatives.

- For instance, Abbey England offers a variety of leathers, including traditional vegetable-tanned and specialized chrome-tanned options, to provide clients with different properties, softness, and durability, thereby meeting a range of market demands.

By Application

By application, the UK Leather Tanning Market shows strong penetration in footwear, which remains the largest segment supported by consistent consumer demand and fashion trends. Garments represent a growing share with premium leather apparel gaining popularity among younger demographics. Furniture and upholstery applications are expanding due to rising demand for luxury interiors in both residential and automotive sectors. Leather accessories, including handbags, belts, and wallets, maintain steady growth, driven by the appeal of durable and stylish products. Other applications such as automotive interiors and specialty goods contribute further to market diversification, supported by technological improvements in tanning processes.

- For instance, Aston Martin Lagonda Ltd integrates advanced leather tanning technologies that enhance leather softness and durability in automotive interiors, supporting their premium vehicle design and elevating comfort standards.

Segmentation:

By Type

- Vegetable Tanning

- Chrome Tanning

- Aldehyde Tanning

- Others

By Application

- Footwear

- Garment

- Furniture & Upholstery

- Leather Accessories

- Others (Automotive, etc.)

By Country

- Country-wise Revenue Share

- By Type

- By Application

Regional Analysis:

England – Core Hub for Leather Tanning and Luxury Manufacturing

England dominates the UK Leather Tanning Market with the largest share, supported by established industrial clusters in Northamptonshire and surrounding regions. The area is historically recognized for footwear and leather craftsmanship, supplying both domestic and global luxury brands. London also contributes strongly, as high-end fashion houses and designer labels demand premium, eco-certified leather. It benefits from strong export activity and advanced infrastructure for processing. Companies in England continue to invest in sustainable technologies to align with regulatory and consumer expectations. The region’s dominance is reinforced by its integration with global trade networks and reputation for premium quality.

Scotland – Growing Contributor with Heritage and Niche Specialization

Scotland holds a significant share of the UK Leather Tanning Market, supported by its heritage in leather production and specialized offerings. Traditional tanning practices remain strong, catering to premium accessories and high-value upholstery. It benefits from rising exports of Scottish-branded leather products, which carry strong international appeal. The region is also investing in environmentally friendly tanning methods to strengthen sustainability credentials. Niche demand from luxury furniture and accessories boosts growth opportunities. Strong heritage branding and authenticity provide Scottish producers with a competitive advantage in global markets.

Wales and Northern Ireland – Emerging Regions with Expanding Role

Wales and Northern Ireland together account for a smaller but growing share of the UK Leather Tanning Market. Wales is gradually building presence through niche producers focusing on sustainable and artisanal leather goods. Northern Ireland contributes with exports of processed leather, leveraging access to both UK and EU markets. It benefits from small-scale but highly specialized tanneries catering to luxury and industrial applications. Both regions are attracting attention through innovation and partnerships with fashion designers. Their growth is supported by rising consumer preference for traceable, eco-friendly, and regionally branded products. These regions are expected to strengthen their share as demand for diversified sourcing expands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- A & A Crack & Sons

- Abbey England

- Alice V Robinson

- Aston Martin Lagonda Ltd

- Authenticae

- Avery Leather Consulting

- Billy Tannery

- Charles F Stead & Co Ltd

- Charles Laurie London

- Clyde Leather

- Crawford Hide Ltd

- DD Practical Leathercraft

Competitive Analysis:

The UK Leather Tanning Market is defined by a mix of established players, niche producers, and luxury-focused brands. Leading companies compete by emphasizing sustainable tanning practices, product quality, and heritage craftsmanship. Chrome tanning remains dominant, but vegetable tanning is gaining traction due to rising demand for eco-friendly products. It is characterized by strong domestic clusters in England and Scotland, supported by export-oriented firms targeting fashion, automotive, and upholstery markets. Competition is influenced by regulatory compliance, innovation in bio-based tanning, and traceability solutions. Established players leverage their heritage and global connections, while smaller tanneries focus on customization and artisanal production. Strategic collaborations with luxury brands enhance visibility, ensuring the market sustains both tradition and innovation.

Recent Developments:

- In August 2025, Charles F. Stead & Co Ltd renewed its collaboration with PUMA to launch the “PUMA Suede” premium collection featuring English suede leather. The release includes elegant colorways like “Honey Butter,” “Persian Blue,” and “Orange Glo,” and it began rolling out from September 1, 2025.

- In April 2025, Charles F. Stead & Co Ltd partnered with PUMA on an earlier launch of the PUMA Suede collection, offering six color variants such as Black, Natural, Baby Blue, Royal Blue, Pink, and Caramel. The collection debuted on April 25, 2025.

- In 2025, Abbey England unveiled a new range of patent leather colors with glossy finishes. The announcement labeled it a “NEW PRODUCT ALERT” and emphasized the launch of patent leather in fresh, high-gloss tones.

Report Coverage:

The research report offers an in-depth analysis based on type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK Leather Tanning Market will continue to evolve with stronger emphasis on eco-friendly tanning.

- Chrome tanning will remain dominant, though vegetable tanning will expand due to sustainability drivers.

- Demand from luxury fashion, automotive interiors, and footwear will fuel long-term growth.

- England will sustain its leadership position supported by heritage clusters and global exports.

- Scotland will strengthen its share with niche offerings and heritage branding in premium leather goods.

- Wales and Northern Ireland will expand gradually with artisanal and specialized tanning operations.

- Technological adoption in bio-based chemicals and digital traceability will reshape the industry landscape.

- Export opportunities to Europe, North America, and Asia-Pacific will remain strong for premium products.

- Rising collaborations with fashion and automotive brands will enhance growth prospects for domestic producers.

- The market will balance tradition with innovation, ensuring sustainable growth in competitive environments.