Market Overview:

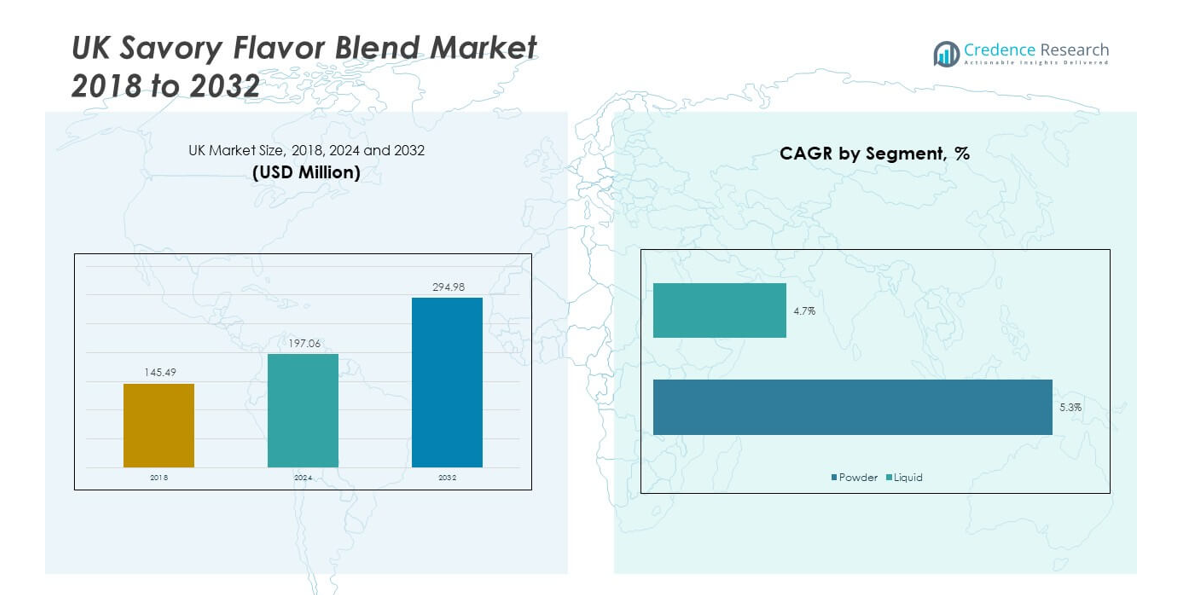

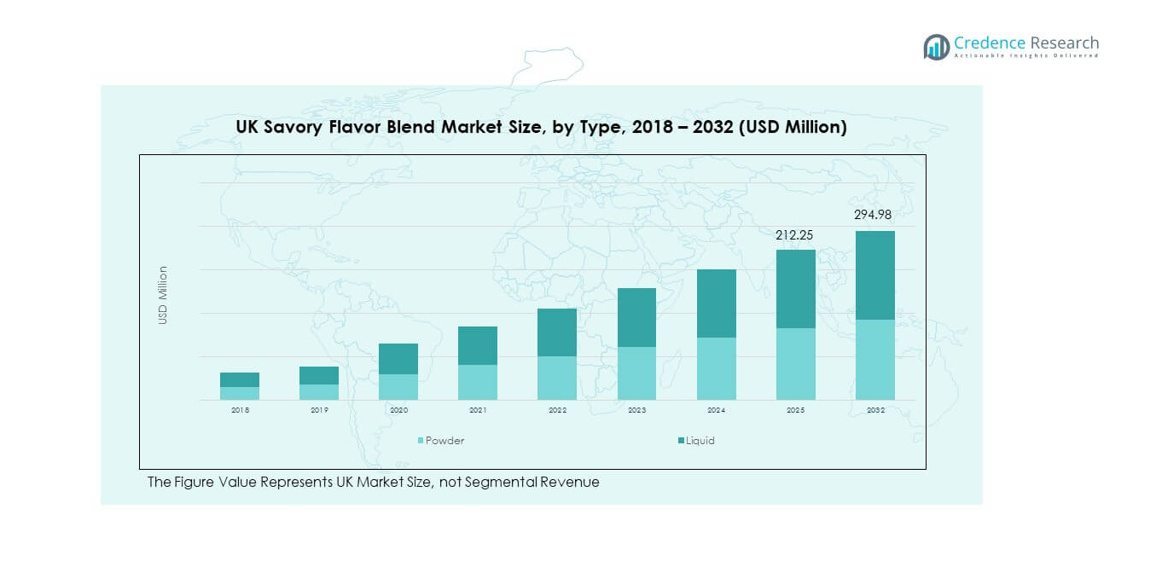

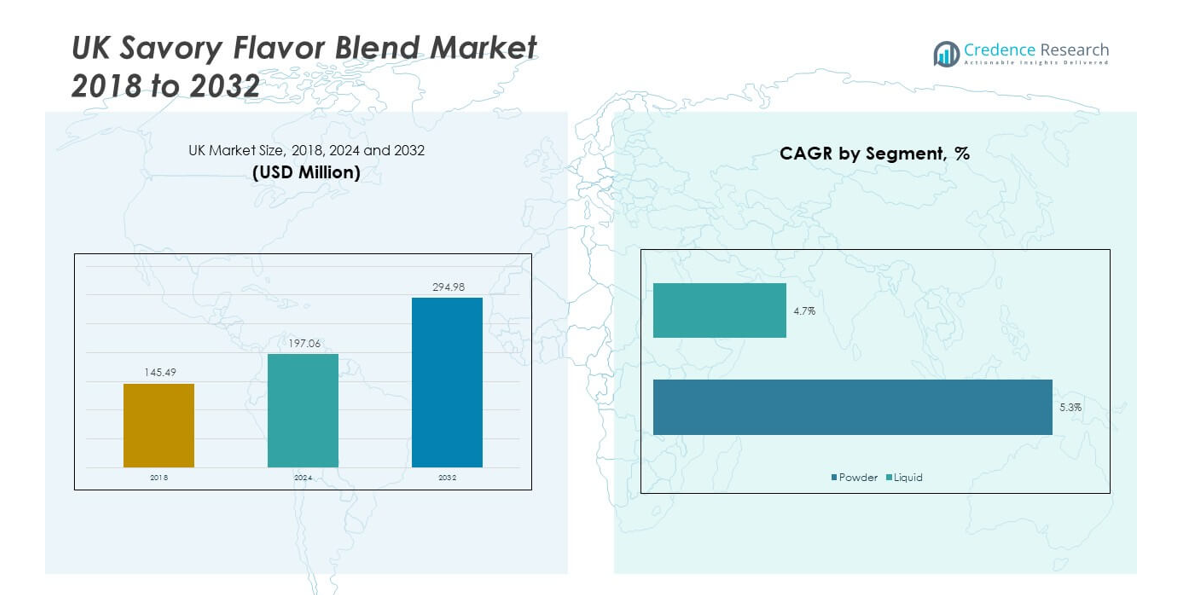

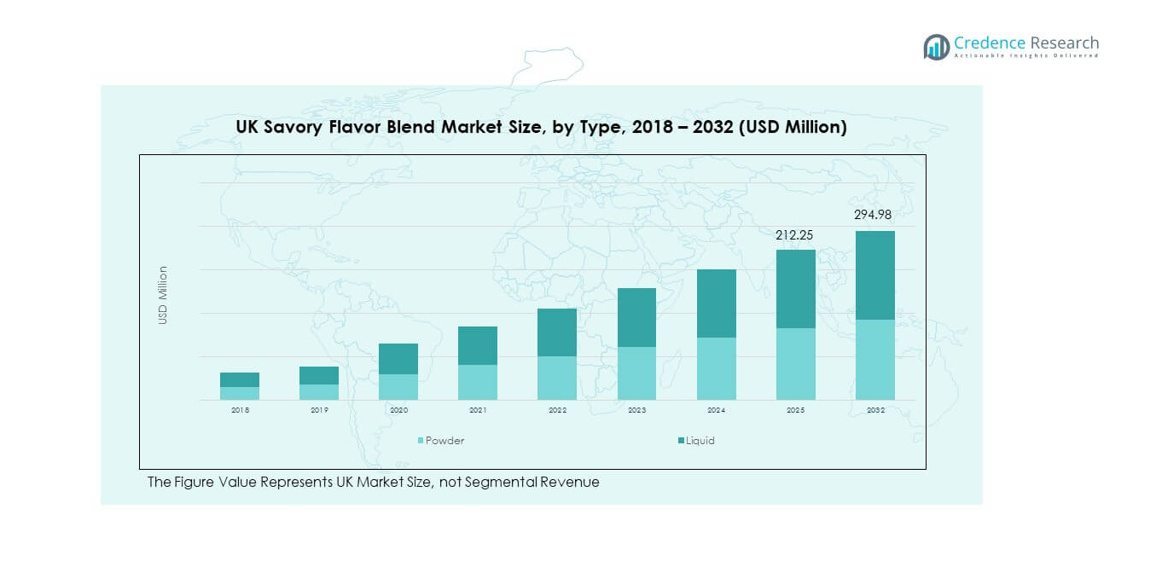

The UK Savory Flavor Blend Market size was valued at USD 145.49 million in 2018 to USD 197.06 million in 2024 and is anticipated to reach USD 294.98 million by 2032, at a CAGR of 4.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Savory Flavor Blend Market Size 2024 |

USD 197.06 million |

| UK Savory Flavor Blend Market, CAGR |

4.81% |

| UK Savory Flavor Blend Market Size 2032 |

USD 294.98 million |

Growth in the UK savory flavor blend market is driven by changing dietary preferences, increasing demand for convenient meal solutions, and rising interest in ethnic and fusion cuisines. Manufacturers are introducing innovative blends with natural ingredients and reduced sodium to align with health-conscious consumer trends. The surge in plant-based and clean-label products also boosts adoption across retail and foodservice sectors. Expanding applications in ready-to-eat meals, sauces, snacks, and meat substitutes further strengthen demand, positioning the market for steady expansion.

Regionally, the UK market benefits from a robust food and beverage industry and strong consumer awareness of flavor innovation. London and other metropolitan areas lead due to diverse consumer bases and higher acceptance of global cuisines. Emerging growth is observed in semi-urban regions, where convenience foods and packaged meals are gaining popularity. The market also sees rising opportunities from export demand, supported by the UK’s reputation for premium and specialty food products.

Market Insights:

- The UK Savory Flavor Blend Market was valued at USD 145.49 million in 2018, reached USD 197.06 million in 2024, and is projected to reach USD 294.98 million by 2032, at a CAGR of 4.81%.

- England leads with 46% share, supported by high consumer demand, strong retail penetration, and diverse culinary preferences.

- Scotland holds 28%, driven by expanding foodservice adoption and rising interest in global cuisines, while Wales accounts for 17% due to packaged food growth.

- Northern Ireland, with a 9% share, is the fastest-growing region, fueled by increasing demand for convenience meals and rising export opportunities.

- By type, Powder blends captured 62% of the market in 2024, while Liquid blends held 38%, reflecting stronger adoption of powdered formats in packaged and ready-to-eat foods.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Shift Toward Health-Oriented and Natural Ingredients:

Health-conscious consumers in the UK are demanding products that prioritize natural and clean-label ingredients. The rising awareness of sodium reduction, artificial additive avoidance, and the importance of wholesome eating influences product choices. Food manufacturers are responding with blends that integrate herbs, spices, and plant-based alternatives, aligning with consumer health goals. This shift strengthens the UK Savory Flavor Blend Market, creating new product opportunities in both retail and foodservice. It encourages suppliers to innovate formulations while ensuring compliance with nutritional standards. The expansion of wellness-focused product categories supports consistent demand for healthier flavor blends. Consumer education campaigns also reinforce this movement, driving sales further. It positions the market for sustained relevance within the evolving dietary landscape.

- For instance, Dalziel Ingredients Ltd has leveraged plant-based technology to develop umami-rich seasoning blends using Sichuan peppercorns, which contributes to increased product variation adapted to health-conscious consumers.

Expanding Growth of Ready-to-Eat and Convenience Food Segments:

The fast-paced urban lifestyle in the UK has intensified the need for convenient food options. Ready-to-eat meals, frozen foods, and instant meal kits integrate savory flavor blends to deliver taste without preparation effort. Consumers value time efficiency, making convenience foods a growing driver of demand. The UK Savory Flavor Blend Market leverages this trend by supplying tailored solutions for diverse food applications. It supports food producers with flavor innovations that enhance the appeal of processed meals. Growing adoption of work-from-home models sustains this need, as families balance work and dining efficiency. The increased role of e-commerce also supports wider access to convenient meals enhanced with blends. The evolving consumer pattern ensures steady market demand.

- For instance, Kalsec enhanced its hop-based flavor solutions with KalHops technology in 2025, resulting in a faster flavor integration time for ready-to-eat applications, improving product launch speed in convenience foods.

Strong Consumer Preference for Diverse Global and Ethnic Flavors:

Cultural diversity in the UK has shaped a broader appetite for ethnic cuisines and international food profiles. Consumers actively explore Indian, Middle Eastern, Asian, and Latin flavors, driving innovation across the flavor blend segment. Restaurants and foodservice operators are integrating unique spice combinations to cater to these preferences. The UK Savory Flavor Blend Market benefits from this cultural openness, ensuring steady interest in bold and authentic flavors. It enables suppliers to experiment with regional specialties and global-inspired mixes. Millennials and Gen Z consumers, with higher exposure to international travel and social media, amplify demand for variety. Retail brands expand portfolios with internationally inspired flavor ranges to capture attention. This expanding curiosity sustains consistent growth momentum.

Increasing Demand From Plant-Based and Alternative Protein Products:

The rise of plant-based diets has reshaped consumer expectations around taste and quality. Savory flavor blends are integral to improving the appeal of meat substitutes and vegan meals. The UK Savory Flavor Blend Market thrives on this trend by offering specialized blends that enhance natural textures. It supports plant-based producers by ensuring that products replicate traditional taste experiences. Consumers value indulgence even in healthier choices, making flavorful blends critical in adoption. Partnerships between plant-based food companies and flavor suppliers further accelerate innovation. Expanding supermarket offerings of vegan and flexitarian options increase demand. The convergence of health, sustainability, and taste reinforces this market driver.

Market Trends:

Growing Integration of Digital Technology in Product Development and Consumer Engagement:

Technology is transforming the way flavor blends are developed and marketed in the UK. Artificial intelligence tools are now used for analyzing consumer preferences and predicting flavor success. This enhances innovation efficiency and reduces time to market for new blends. The UK Savory Flavor Blend Market is adapting to digital transformation, offering advanced consumer engagement through personalized recommendations. It helps producers capture evolving taste trends faster while reducing product failure risk. Online platforms also provide space for direct interaction with customers, offering insights into demand. Digital analytics shape flavor campaigns, ensuring relevance to targeted demographics. The trend strengthens competitive advantage by aligning innovation with data-backed strategies.

- For instance, Lionel Hitchen introduced its FutureFlavours concept using AI-driven flavor trend analysis to shorten R&D cycles by enabling faster response to emerging consumer preferences in 2024.

Rising Adoption of Premiumization and Gourmet Blends Across Retail and Foodservice:

Consumers in the UK are increasingly seeking premium dining experiences, even in everyday meals. Gourmet-inspired blends that highlight exotic herbs, truffle, or smoked flavors are gaining attention. The UK Savory Flavor Blend Market reflects this trend with expanded high-end product ranges. It creates value differentiation by elevating basic meals into indulgent culinary experiences. Retail shelves showcase premium packaging and storytelling that enhances perception. Foodservice establishments also incorporate gourmet blends to attract discerning customers. Social media exposure to luxury dining further boosts consumer awareness of premium blends. This trend elevates market competition, encouraging suppliers to continuously refine offerings.

- For instance, Social media exposure to luxury dining further boosts consumer awareness of premium blends, where influencer campaigns have delivered engagement rates higher than standard food content. This trend elevates market competition, encouraging suppliers to continuously refine offerings and invest in innovative formulation techniques.

Increasing Popularity of Limited-Edition and Seasonal Flavor Variations:

Seasonal product launches are becoming a major trend, catering to festive and cultural demand shifts. The UK Savory Flavor Blend Market captures attention with limited-edition blends during holidays and events. It creates consumer excitement through exclusivity and novelty. Retailers often use these blends to boost seasonal sales, enhancing market turnover. Food producers align launches with Christmas, Easter, and summer events to strengthen engagement. Consumers embrace these variations as part of celebratory traditions, driving repeat purchases. Limited runs also allow producers to experiment with unique flavor combinations. The cyclical trend ensures a dynamic market flow across the year.

Strengthening Focus on Sustainability and Ethical Ingredient Sourcing:

Sustainability is becoming central to consumer decisions in the UK flavor industry. The UK Savory Flavor Blend Market embraces ethically sourced herbs, spices, and raw materials to gain trust. It reflects consumer demand for transparency in sourcing and fair-trade practices. Brands highlight sustainability credentials on packaging, influencing purchasing behavior. Ethical sourcing strategies also align with corporate social responsibility goals. Foodservice operators and retailers promote sustainable brands, boosting adoption further. Consumer loyalty strengthens toward companies demonstrating visible environmental commitment. This trend drives continuous transformation of supply chains to meet future sustainability expectations.

Market Challenges Analysis:

Managing Cost Volatility of Raw Materials and Supply Chain Pressures:

One of the key challenges lies in fluctuating prices of raw materials, including herbs, spices, and flavor bases. The UK Savory Flavor Blend Market is vulnerable to global supply chain disruptions, currency fluctuations, and rising logistics costs. It faces pressure from geopolitical uncertainties and climate-driven agricultural risks. These factors increase operational costs for producers, challenging profit margins. Companies often struggle to balance affordability with premium quality positioning. It requires strong risk management and long-term supplier contracts to stabilize supply chains. Import dependency creates added vulnerabilities to global price variations. This structural challenge persists as a recurring barrier for sustained growth.

Addressing Shifts in Regulatory Compliance and Consumer Transparency Demands:

The flavor industry in the UK is also challenged by evolving regulatory standards and labeling requirements. The UK Savory Flavor Blend Market must comply with strict health, safety, and disclosure norms. It often demands reformulation to meet changing sodium, allergen, or additive guidelines. Transparency expectations from consumers further complicate this challenge, pushing companies to disclose sourcing and processing details. Brands failing to meet these demands risk reputational damage and loss of consumer trust. Compliance processes require higher investment in R&D and documentation. Smaller firms often struggle with the costs of adapting quickly. The challenge highlights the constant tension between compliance and operational efficiency.

Market Opportunities:

Expansion Into Functional Blends That Support Health and Wellness Goals:

Functional foods are rising in importance, creating opportunities for innovation in flavor blends. The UK Savory Flavor Blend Market can expand into products enriched with probiotics, vitamins, or immunity-boosting herbs. It aligns with consumer interest in foods that offer both taste and health benefits. Producers introducing such blends gain competitive advantage across wellness-driven segments. Retailers can position these products as premium offerings with added value. The growing consumer preference for holistic health sustains demand. Collaborations with nutritionists and wellness brands strengthen the opportunity further. It ensures long-term integration of flavor innovation with wellness trends.

Leveraging Growth in Export Potential and International Market Penetration:

The UK’s reputation for quality and innovation in food products creates export opportunities. The UK Savory Flavor Blend Market is well-positioned to expand its global footprint through strategic distribution. It can target emerging regions with rising interest in authentic and premium flavor blends. Producers can leverage government trade initiatives and partnerships to reach wider audiences. Export potential is supported by growing interest in UK culinary traditions abroad. Brands can differentiate through premium packaging and storytelling to appeal to global consumers. International expansion helps mitigate domestic market saturation risks. This opportunity strengthens long-term resilience and revenue diversification.

Market Segmentation Analysis:

By Type

The UK Savory Flavor Blend Market is segmented into powder and liquid formats. Powder blends lead the segment, favored for their long shelf life, easy handling, and wide use in packaged foods. It holds strong demand across meat, bakery, and snack applications. Liquid blends occupy a smaller share but are vital in soups, sauces, and ready-to-cook meals, where consistency and quick integration are priorities. Both formats remain essential, with powder expected to sustain dominance.

- For instance, Powder blends lead the segment, favored for their long shelf life (up to 18 months), easy handling, and wide use in packaged foods. They hold strong demand across meat, bakery, and snack applications, accounting for total savory blend usage by volume.

By Application

Meat is the largest application segment, supported by the UK’s strong consumption of processed and flavored meats. It ensures consistent growth through marinades, spice coatings, and seasoning mixes. Bakery follows as a high-potential area, reflecting rising demand for flavored breads, savory pastries, and snacks. Seasonings and soups continue steady expansion, driven by convenience preferences and home cooking. Other applications, including plant-based alternatives, are gaining importance, supported by flexitarian diets and innovation in meat substitutes.

- For instance, Bakery follows as a high-potential area, reflecting rising demand for flavored breads, savory pastries, and snacks, where flavor blend incorporation has grown by 15% over two years. Seasonings and soups continue steady expansion, driven by convenience preferences and home cooking, with innovations improving flavor retention by up to 30% in shelf-stable product.

By Sales Channel

Distribution channels dominate the market, driven by established relationships with supermarkets, large food processors, and foodservice operators. It ensures wide availability and stable product flow across the UK. Direct channels, while smaller, play a key role in catering to niche manufacturers and specialty products, providing customized solutions. The growing shift toward efficient distribution underlines the importance of networks for scale and reach.

Segmentation:

By Type

By Application

- Meat

- Bakery

- Seasonings

- Soups

- Others

By Sales Channel

- Direct Channel

- Distribution Channel

By Country

- England

- Scotland

- Wales

- Northern Ireland

Regional Analysis:

England – Leading Market with Strong Consumer Base

England dominates the UK Savory Flavor Blend Market, accounting for 46% share in 2024. The region benefits from a diverse consumer base with strong demand for ethnic cuisines and convenience foods. Large urban centers, including London, drive innovation and adoption of premium and international flavor blends. It enjoys robust retail penetration, with supermarkets and foodservice operators leading product distribution. The region also benefits from high exposure to global food trends, fueling experimentation with new blends. Strong purchasing power further supports growth, making England the core market driver.

Scotland – Expanding Role in Foodservice and Packaged Foods

Scotland holds 28% share in 2024, making it the second-largest regional contributor. The region shows strong demand from the foodservice industry, which increasingly relies on savory flavor blends to enhance restaurant and catering menus. It benefits from rising adoption of convenience foods and packaged meals, where blends ensure consistent taste and quality. The growing interest in global cuisines has also encouraged suppliers to introduce diverse flavor formats. It continues to attract investments from manufacturers seeking to tap into regional demand. Scotland’s market position is strengthened by consumer openness to new flavors and evolving eating habits.

Wales and Northern Ireland – Emerging Growth Hubs

Wales represents 17% share in 2024, supported by steady growth in packaged food and bakery applications. It benefits from increasing interest in ready-to-eat and flavored snack categories. Northern Ireland accounts for 9% share in 2024, but it stands out as the fastest-growing region. The region’s growth is fueled by rising demand for convenience meals, expanding exports, and increasing acceptance of innovative blends. It leverages its smaller but rapidly evolving food landscape to attract new product launches. Together, Wales and Northern Ireland highlight emerging opportunities, complementing the dominance of England and Scotland in shaping the overall market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The UK Savory Flavor Blend Market is moderately competitive, with both multinational players and regional specialists operating actively. McCormick & Company, MANE UK, and Kalsec maintain strong presence with wide portfolios and advanced flavor technologies. Local firms such as Dalziel Ingredients Ltd, Lionel Hitchen, and UK Blending Solutions strengthen competition through tailored blends and closer customer relationships. It shows balanced competition, where innovation, supply chain efficiency, and product differentiation are key strategies. Companies invest in healthier formulations, plant-based flavors, and clean-label blends to align with consumer demand. Expansion into export markets also supports competitiveness, enhancing resilience against domestic saturation.

Recent Developments:

- In July 2025, Kalsec rebranded its hops division as KalHops, reinforcing its commitment to innovation in hop solutions for both alcoholic and non-alcoholic beverages. This rebrand empowers brewers with enhanced product offerings and technical expertise to innovate efficiently under supply chain pressures. Additionally, in December 2024, Kalsec expanded its partnership with Connell Caldic as an exclusive distribution partner for China, aiming to broaden its savory category presence in the Asia-Pacific market.

- In May 2025, Dalziel Ingredients Ltd announced the launch of their brand new website designed with a customer-centric approach, showcasing their bespoke seasoning blends and functional blends for various food sectors. They have also highlighted their use of Sichuan peppercorns to create adventurous umami-rich flavors in 2025, catering to current consumer trends.

- Kanegrade, celebrating 45 years in 2025, launched a new flavor brand called Excite Flavours, returning to their roots by creating authentic food flavor solutions with a focus on natural colors and powders. This reflects their dedication to quality and innovation in natural ingredients.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for natural and clean-label blends will grow steadily.

- Expansion in plant-based and vegan food applications will accelerate.

- Export opportunities will strengthen through premium positioning.

- Technology-driven flavor innovations will influence product launches.

- Retail and foodservice partnerships will expand market penetration.

- Sustainability and ethical sourcing will gain higher importance.

- Health-focused blends with reduced sodium will attract consumer attention.

- Digital tools will support personalized flavor innovation.

- Seasonal and limited-edition blends will drive consumer excitement.

- Strong distribution networks will remain central to market leadership.