Market Overview:

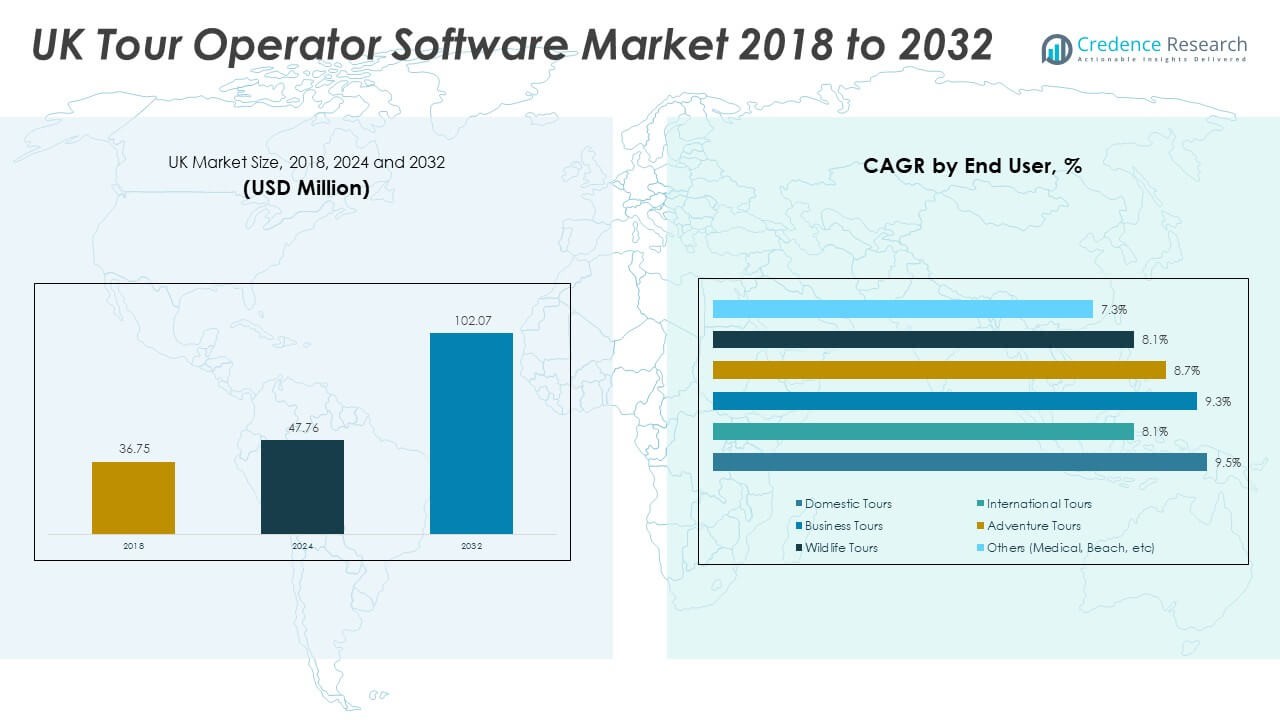

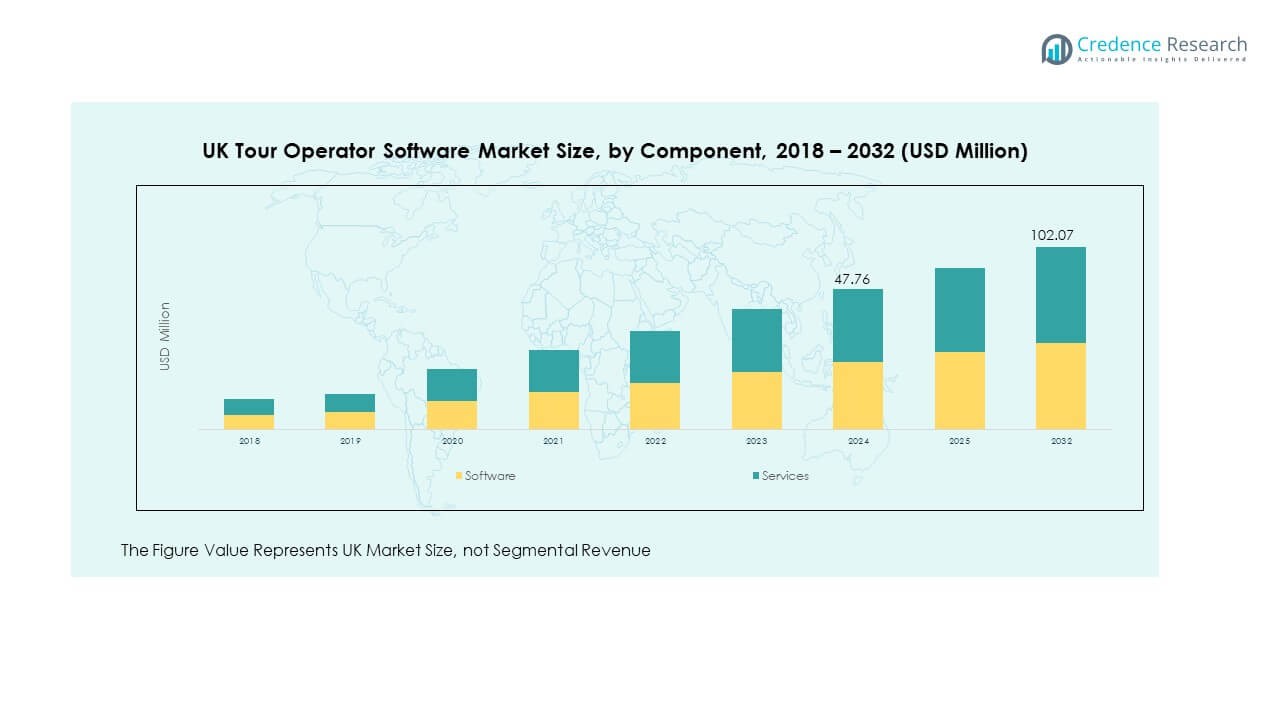

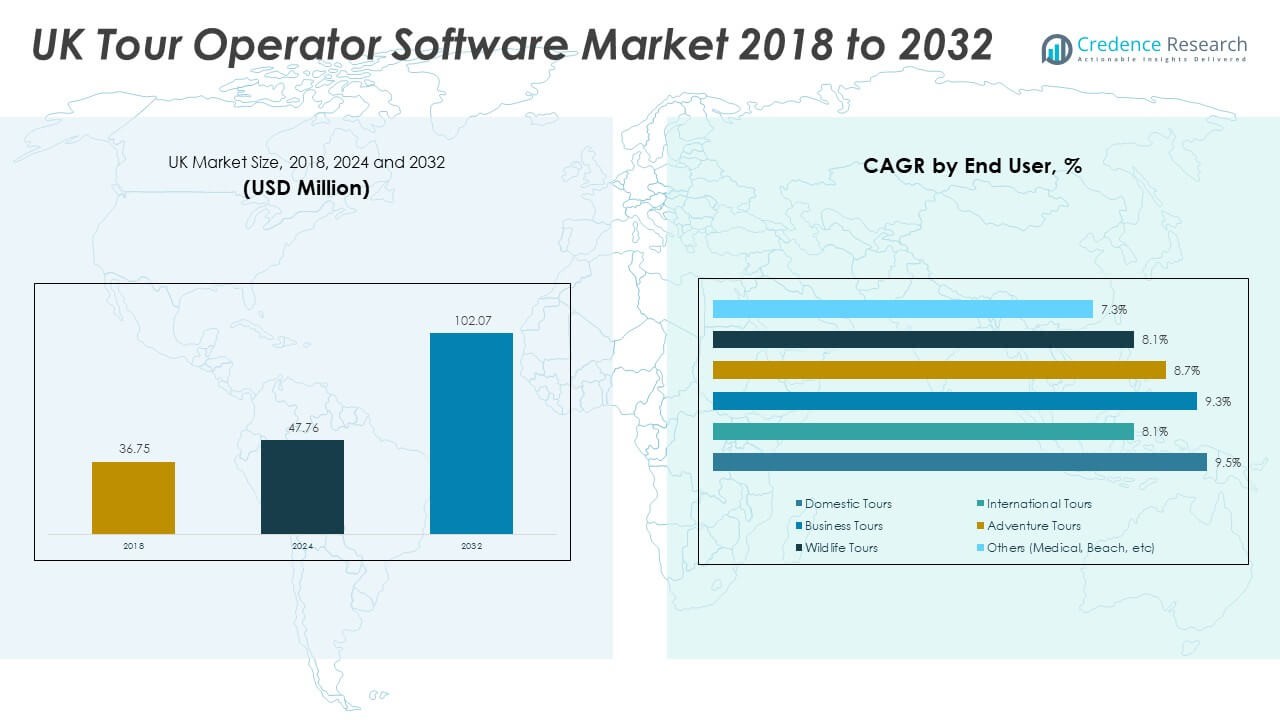

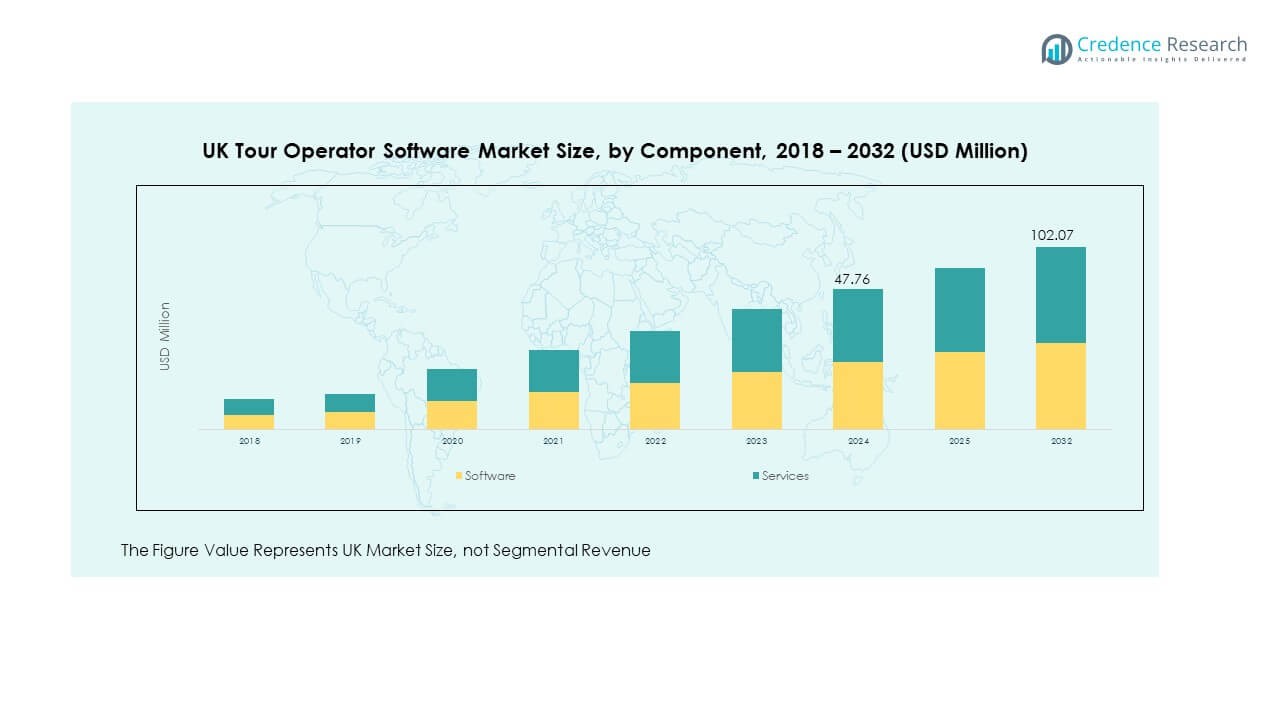

The UK Tour Operator Software Market size was valued at USD 36.75 million in 2018 to USD 47.76 million in 2024 and is anticipated to reach USD 102.07 million by 2032, at a CAGR of 9.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Tour Operator Software Market Size 2024 |

USD 47.76 Million |

| UK Tour Operator Software Market, CAGR |

9.96% |

| UK Tour Operator Software Market Size 2032 |

USD 102.07 Million |

The market is driven by the rising adoption of digital platforms that enhance travel planning and customer engagement. Tour operators in the UK are focusing on advanced booking systems, automation, and personalized services to improve efficiency and customer satisfaction. Growing demand for integrated solutions that combine payments, bookings, and CRM functions is boosting software adoption. The shift toward mobile-friendly platforms and cloud-based solutions also supports rapid growth, making the market more competitive and technology-driven.

Geographically, the UK leads this market due to its established tourism industry and advanced digital infrastructure. London and other major cities act as primary hubs for adoption, while emerging demand is also seen in smaller regions as local operators embrace digital tools. The market benefits from high internet penetration, strong inbound tourism, and government support for travel innovation. International players also consider the UK a testing ground for new solutions due to its mature ecosystem and customer-driven focus.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Tour Operator Software Market was valued at USD 36.75 million in 2018, reached USD 47.76 million in 2024, and is projected to attain USD 102.07 million by 2032, registering a CAGR of 9.96% during 2024–2032.

- England holds 45% share, driven by London’s position as a global tourism hub and strong adoption of digital solutions by leading operators.

- Scotland accounts for 28% share, supported by heritage tourism, government initiatives, and rapid digitalization of tour services.

- Wales contributes 15% share, benefiting from growth in adventure tourism and increasing investments in online booking platforms.

- Northern Ireland is the fastest-growing region with 12% share, driven by rising inbound tourism, improved connectivity, and adoption of software by local operators.

Market Drivers:

Rising Digital Transformation in Travel Services:

The UK Tour Operator Software Market is expanding due to the rapid digitalization of travel services. Operators are moving toward advanced booking systems that enhance automation, reduce errors, and improve efficiency. Travelers increasingly prefer digital platforms that allow seamless trip planning and payments. Cloud-based tools provide scalability and easy integration with third-party platforms, creating stronger adoption rates. Personalization features such as customer profiling and tailored itineraries strengthen customer satisfaction. The competitive landscape motivates companies to modernize legacy systems. It is supported by strong investment in digital infrastructure across the UK.

- For instance, Amadeus IT Group reported processing 471.2 million air bookings through its travel agency channel in 2024, representing approximately 1.3 million bookings per day globally. By leveraging API integrations, the company streamlines operations for tour operators, which helps reduce booking errors.

Growing Demand for Seamless Customer Experiences:

Customer-centric experiences drive higher adoption across the UK Tour Operator Software Market. Tourists expect simple interfaces, quick response times, and multi-channel booking options. Software providers now focus on combining CRM with reservation tools to streamline engagement. Enhanced analytics help operators predict customer behavior and create tailored offers. Social media integration supports marketing campaigns and real-time interaction. Payment gateways embedded within the software boost customer trust and improve security. It increases loyalty by creating convenience and transparency at every customer touchpoint.

- For instance, Sabre Corporation leverages advanced analytics and AI, like its Sabre Travel AI and SabreMosaic platforms, to create highly personalized offers for travelers and to improve operational efficiency. Through the use of data-driven strategies, the company aims to boost conversion rates and enhance the travel booking experience by tailoring services to individual customer needs.

Integration of AI and Automation Technologies:

Automation and artificial intelligence are accelerating growth in the UK Tour Operator Software Market. AI-driven chatbots assist customers with instant query resolution and round-the-clock support. Machine learning enables predictive insights on customer trends, enhancing decision-making. Robotic process automation reduces manual intervention, saving time and costs. Personalized recommendations powered by AI enrich the travel booking process. Automation also improves operational efficiency in handling large volumes of reservations. It creates new opportunities for cost-effective operations while delivering premium customer service. Companies that leverage automation gain significant competitive advantage.

Rising Popularity of Cloud-Based and Mobile Solutions:

The adoption of cloud and mobile platforms strengthens the UK Tour Operator Software Market. Operators benefit from subscription-based pricing models that lower upfront costs. Cloud solutions offer real-time updates, multi-user access, and data security. Mobile apps increase accessibility, especially for younger demographics who prefer on-the-go bookings. Software providers enhance mobile usability through intuitive designs and multi-language support. Mobile adoption also drives growth in rural areas with improved internet penetration. It provides flexibility to both operators and customers by enabling continuous access and faster response times. Demand for mobile-first solutions continues to rise steadily.

Market Trends:

Expansion of Omnichannel Booking and Distribution:

The UK Tour Operator Software Market experiences a trend toward omnichannel distribution. Customers seek consistent booking options across websites, apps, and offline touchpoints. Operators integrate software with global distribution systems to access wider networks. Partnerships with online travel agencies expand market visibility. Travel providers utilize white-label platforms for brand recognition and extended reach. Voice-assisted booking technology is also gaining attention for convenience. It ensures that travellers enjoy a unified experience regardless of the booking platform. Omnichannel adoption reshapes the competitive landscape.

- For instance, Booking Holdings has integrated AI-powered conversational AI tools, such as Priceline’s “Penny” for voice-assisted hotel reservations and Booking.com’s “AI Trip Planner” for generating itineraries, to enhance its omnichannel platform. The company reported a strong year in 2024 with significant growth in bookings and revenue.

Rise of Data-Driven Personalization and Analytics:

Personalization emerges as a leading trend in the UK Tour Operator Software Market. Operators use big data analytics to create customized itineraries and targeted campaigns. Predictive analysis identifies high-demand destinations and peak booking seasons. Real-time dashboards support informed decision-making and improve performance tracking. Loyalty programs are enhanced through customer data integration. Tailored promotional offers increase customer engagement and conversion rates. It drives stronger brand loyalty in a highly competitive market. Companies invest in analytics-driven innovation to gain market leadership.

- For instance, Expedia manages over 70 petabytes of traveller data and applies hundreds of billions of AI-driven predictions annually to create personalized recommendations. Its integration of generative AI since Q1 2023 via OpenAI’s ChatGPT in the Expedia app allows customers to receive tailored planning, increasing the company’s capacity to deliver data-driven travel experiences at scale.

Sustainability and Eco-Friendly Travel Innovations:

Growing sustainability concerns shape the UK Tour Operator Software Market. Operators integrate eco-friendly practices such as carbon footprint calculators into booking platforms. Travelers increasingly prioritize responsible tourism and environmentally conscious options. Software vendors support sustainable initiatives through green-certified partnerships. Virtual tours and digital documentation reduce reliance on paper-based processes. Integration with transport and accommodation providers helps track environmental impact. It aligns with consumer values and regulatory expectations. Sustainability becomes a defining factor influencing customer preferences.

Adoption of Blockchain for Secure and Transparent Transactions:

Blockchain technology creates transformative opportunities in the UK Tour Operator Software Market. Secure payment solutions based on distributed ledgers reduce fraud risks. Smart contracts automate agreements between operators and customers. Blockchain provides transparent supply chains for vendors and partners. Data privacy regulations gain compliance through decentralized platforms. Loyalty rewards systems also adopt blockchain for improved traceability. It enhances trust among stakeholders and strengthens security. Operators view blockchain as a tool to increase efficiency and transparency.

Market Challenges Analysis:

High Implementation Costs and Integration Complexities:

The UK Tour Operator Software Market faces challenges due to high implementation costs. Smaller operators hesitate to adopt modern systems because of budget limitations. Software integration with existing platforms often requires significant technical expertise. Transitioning from manual processes to digital systems involves training expenses and downtime. Scalability concerns emerge for operators dealing with unpredictable demand cycles. Compatibility issues with third-party applications create additional hurdles. It restricts widespread adoption, especially for independent or regional tour operators. Vendors must address these barriers with flexible solutions.

Data Privacy Concerns and Cybersecurity Risks:

Data security challenges also limit growth in the UK Tour Operator Software Market. Handling sensitive customer information exposes operators to cyber threats. Compliance with strict UK and EU data protection laws demands continuous updates. Software vulnerabilities create risks of data breaches and reputational damage. Customers expect robust security measures, including encryption and secure payment gateways. Rising cyberattacks across travel sectors increase concerns. It compels vendors to invest in advanced cybersecurity frameworks. Meeting evolving security standards remains critical for sustaining long-term adoption.

Market Opportunities:

Growth Potential Through Technological Innovation and AI Integration:

Significant opportunities exist for innovation in the UK Tour Operator Software Market. AI integration enhances personalization, predictive analytics, and customer engagement. Cloud-based subscription models open the market to smaller operators. Companies can introduce advanced mobile features for an expanding customer base. Virtual reality tours represent untapped potential for pre-trip engagement. It empowers operators to deliver unique, tech-driven travel experiences. Innovations strengthen competitiveness and capture evolving traveller expectations.

Expansion into Untapped Regional and International Segments:

Opportunities also lie in regional expansion within the UK Tour Operator Software Market. Smaller towns and rural areas with growing internet access are adopting digital platforms. International expansion allows UK-based vendors to extend services globally. Partnerships with airlines, hotels, and transport firms expand ecosystems. Multilingual support attracts foreign travelers seeking convenient booking systems. It positions operators to capture diverse demographics and tourism flows. Addressing underserved regions ensures long-term sustainability and growth potential.

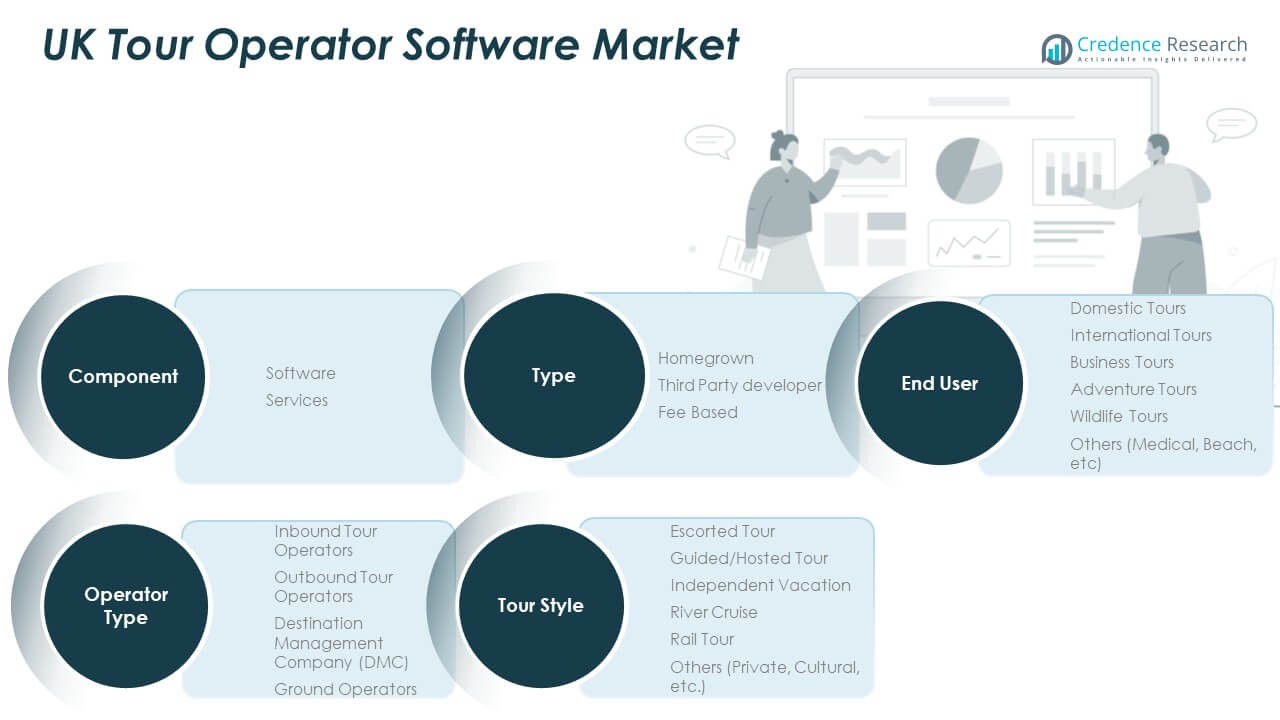

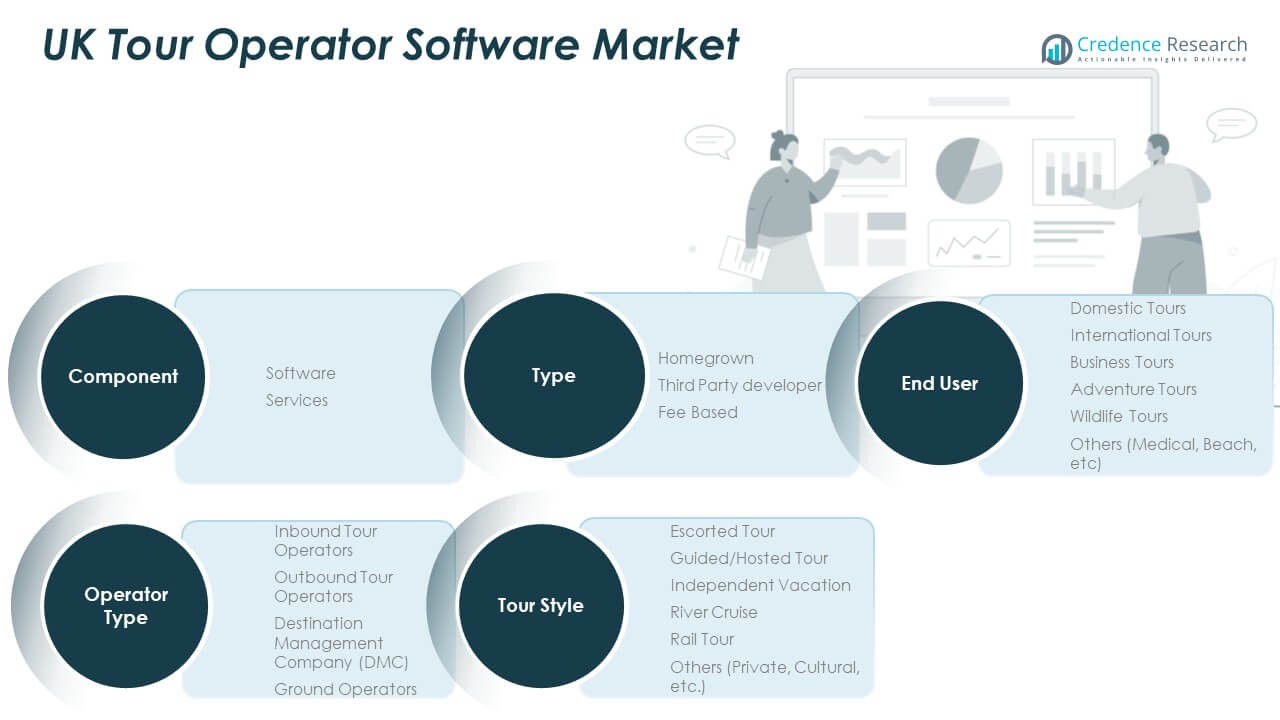

Market Segmentation Analysis:

By Type

The UK Tour Operator Software Market shows varied adoption across homegrown, third-party developer, and fee-based solutions. Homegrown platforms appeal to small and mid-sized operators prioritizing control and customization. Third-party developers lead the market with scalable systems, regular updates, and advanced features. Fee-based models attract businesses that value flexibility and predictable subscription costs. It highlights a balanced mix of tailored and standardized approaches.

- For instance, FareHarbor’s rollout of Tap to Pay on iPhone, in partnership with Stripe, led to a sustained 10% weekly increase in user adoption during the initial weeks after launch. A specific FareHarbor client, Island Life Bike Rentals, reported a substantial reduction in payment transaction times. By switching from manually typing in credit card data to using Tap to Pay, the company saw transaction times drop from 2–2.5 minutes to just 10–20 seconds.

By Component

Software holds a larger share as operators demand automation, CRM integration, and mobile functionality. It enables streamlined booking, analytics, and enhanced customer experiences. Services, including consulting, training, and ongoing support, continue to expand as operators need expert assistance for implementation. Together, software and services create a complementary ecosystem that sustains adoption and ensures efficiency.

- For instance, the Travelport Universal API supports multi-channel reservations and testing best practices, allowing developers to create end-to-end booking applications for air, hotel, and vehicle segments.

By Operator Type

Inbound tour operators remain central due to the UK’s strong inbound tourism base. Outbound operators expand rapidly as international travel demand rises. Destination Management Companies (DMCs) strengthen their role by offering localized expertise and tailored services. Ground operators maintain steady contributions in transportation and logistics, supporting the broader travel ecosystem. It demonstrates robust demand across specialized and mainstream operator categories.

By Tour Style and End User

Escorted and guided tours dominate due to preference for structured travel experiences. Independent vacations gain momentum among younger demographics seeking flexibility. Niche categories such as river cruises, rail tours, and cultural packages grow steadily. By end user, domestic tours retain prominence, while international tours expand with outbound growth. Business, adventure, and wildlife tours provide niche opportunities shaped by evolving traveler behavior.

Segmentation:

By Type

- Homegrown

- Third-Party Developer

- Fee-Based

By Component

By Operator Type

- Inbound Tour Operators

- Outbound Tour Operators

- Destination Management Company (DMC)

- Ground Operators

By Tour Style

- Escorted Tour

- Guided/Hosted Tour

- Independent Vacation

- River Cruise

- Rail Tour

- Others (Private, Cultural, etc.)

By End User

- Domestic Tours

- International Tours

- Business Tours

- Adventure Tours

- Wildlife Tours

- Others

Regional Analysis:

England

England leads the UK Tour Operator Software Market with a 45% share, supported by London’s global tourism hub status and widespread adoption of digital booking platforms. Strong internet penetration and advanced IT infrastructure provide a solid base for software innovation. Operators prioritize CRM integration, mobile-first solutions, and AI-driven personalization to improve customer engagement. The region’s diverse tourism offerings, including cultural and heritage sites, fuel continuous demand for advanced tools. It reflects a mature ecosystem where customer expectations drive rapid software adoption. Global vendors and domestic developers both target England as a key market for competitive expansion.

Scotland

Scotland accounts for a 28% share of the UK Tour Operator Software Market, driven by its strong inbound tourism and appeal as a cultural and natural destination. Operators focus on cloud-based solutions to streamline seasonal booking surges and improve operational efficiency. Government-backed initiatives encouraging tourism innovation further support technology adoption. Adventure and cultural tourism packages represent growing categories supported by tailored software applications. It shows how operators use technology to balance fluctuating demand and enhance visitor experiences. Scotland stands out as a dynamic regional hub with significant growth potential.

Wales and Northern Ireland

Wales contributes 15%, while Northern Ireland holds a 12% share of the UK Tour Operator Software Market. Wales benefits from its adventure tourism and eco-friendly travel appeal, pushing operators toward mobile platforms that attract younger and international travelers. Northern Ireland, though smaller, records the fastest growth, supported by rising inbound tourism, improved connectivity, and adoption of digital booking systems by local players. It highlights the growing importance of underserved regions in shaping overall market growth. Together, Wales and Northern Ireland underscore the value of regional diversification in building resilience and expanding digital reach within the UK market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The UK Tour Operator Software Market features a competitive landscape shaped by established vendors and emerging providers. Key players compete through innovative solutions, strong product portfolios, and customer-centric approaches. Companies emphasize automation, cloud integration, and mobile-first platforms to strengthen adoption among operators of varying sizes. It reflects a mix of homegrown developers offering tailored solutions and third-party vendors delivering scalable platforms. Strategic alliances, product launches, and investments in AI and analytics continue to reshape the market. The diversity of players fosters innovation, while customer expectations for seamless travel experiences push vendors to differentiate their offerings.

Recent Developments:

- In 2024, Open Destinations launched Travel Studio – Sunstone Release R2, a significant evolution of its booking and reservations platform specifically designed for multi-day tour operators. This release centralized multiple functions such as email communications, real-time enquiry tracking, and product reservation features into one platform to simplify workflows and improve efficiency for tour operators.

- In December 2023, CSI Media formed a global streaming and broadcasting partnership with M-1 Sports Media to expand the worldwide distribution of K-1 combat sports. This partnership will enable CSI SPORTS to deliver K-1 video content to combat sports fans worldwide, highlighting CSI’s strategic move into enhancing media content delivery.

- Distinctive Systems Ltd has continued to develop and upgrade its management software for coach, bus, and tour operators. In recent updates, the company revamped its Driver App with a modern interface and new features to work with both older and new backend systems to improve usability for drivers. Distinctive Systems also maintains operations for vehicle maintenance systems that comply with UK regulatory standards.

Report Coverage:

The research report offers an in-depth analysis based on type, component, operator type, tour style, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Cloud-based adoption will accelerate, driven by scalability and affordability.

- AI and predictive analytics will enhance personalization in travel services.

- Mobile-first platforms will dominate customer engagement strategies.

- Integration with CRM and payment systems will strengthen operator efficiency.

- Sustainability-focused software features will gain prominence.

- Niche segments such as cultural and wildlife tours will see rising demand.

- Partnerships between software providers and travel agencies will expand.

- Data security and compliance with regulations will remain critical priorities.

- Automation will reshape booking, reporting, and customer support processes.

- Competition will intensify, fostering innovation and price competitiveness.