Market Overview

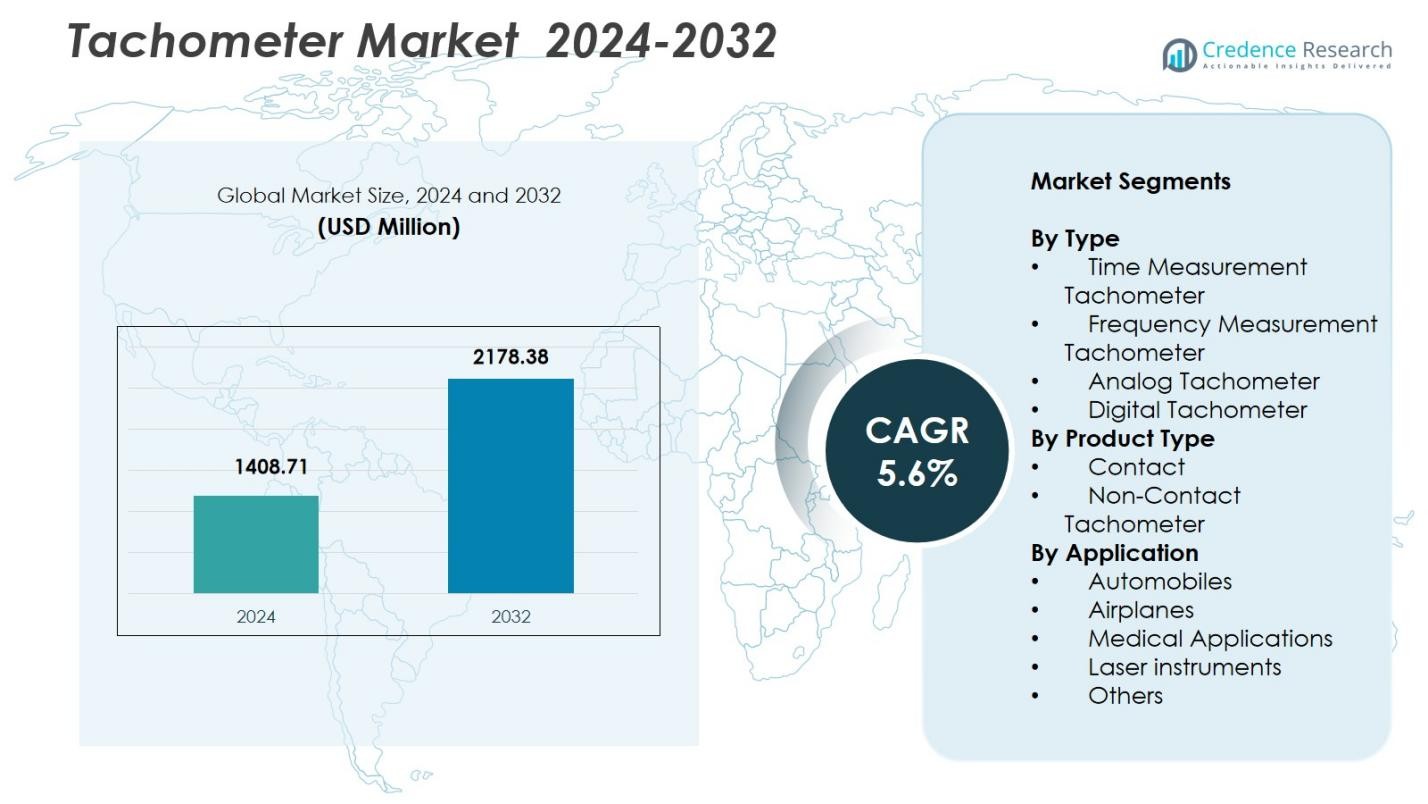

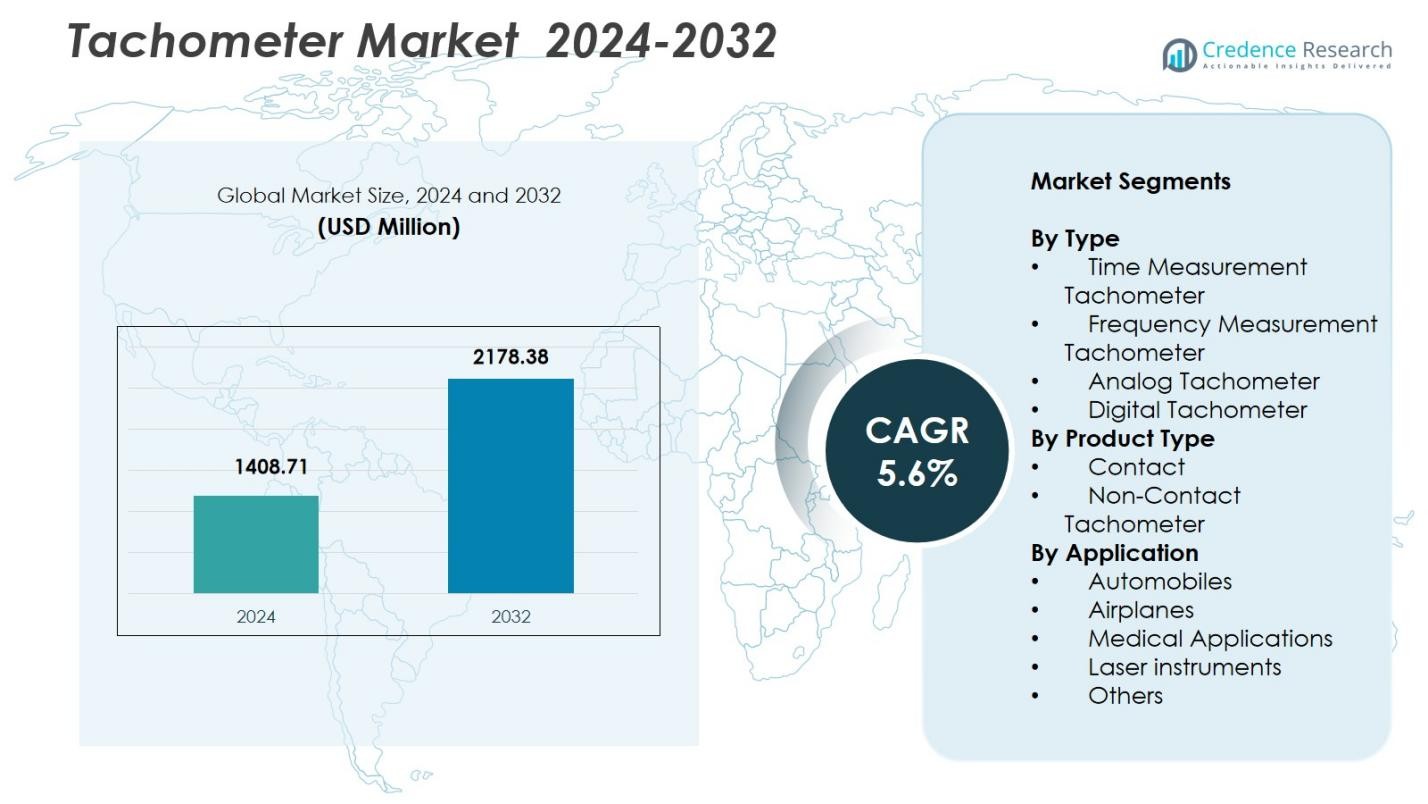

Tachometer Market size was valued at USD 1408.71 Million in 2024 and is anticipated to reach USD 2178.38 Million by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tachometer Market Size 2024 |

USD 1408.71 Million |

| Tachometer Market, CAGR |

5.6% |

| Tachometer Market Size 2032 |

USD 2178.38 Million |

Tachometer Market is driven by major players such as ABB Ltd., AMETEK Inc., Siemens AG, Honeywell International Inc., Robert Bosch GmbH, Danaher Corporation, Emerson Electric Co., Yokogawa Electric Corporation, Extech Instruments, and Fluke Corporation, all of whom focus on advancing digital, laser-based, and non-contact tachometer technologies. These companies strengthen market presence through innovation, product diversification, and integration of smart monitoring capabilities. Regionally, North America led the Tachometer Market with a 31.4% share in 2024, supported by strong automotive, aerospace, and industrial automation adoption. Europe and Asia-Pacific followed closely, reflecting robust manufacturing activity and rising investments in high-precision instrumentation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Tachometer Market size reached USD 1408.71 Million in 2024 and will expand at a CAGR of 5.6% through 2032.

- Market growth is driven by rising adoption of digital tachometers, which held a 41.6% share in 2024, supported by strong demand from automotive, aerospace, and industrial automation sectors.

- Key trends include accelerated transition toward non-contact tachometers, which led the market with a 57.3% share, and increasing integration of IoT-enabled monitoring and predictive maintenance solutions.

- Leading players such as ABB, AMETEK, Siemens, Honeywell, Bosch, Emerson, and Fluke strengthen their positions through product innovation, expanded portfolios, and technology upgrades.

- Regional demand is led by North America with a 31.4% share, followed by Europe at 28.7% and Asia-Pacific at 30.6%, reflecting strong manufacturing activity and investments in high-precision instrumentation across global markets.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

The Digital Tachometer segment dominated the Tachometer Market in 2024 with a 41.6% share, driven by its high accuracy, rapid response time, and ability to integrate with data-logging and industrial automation systems. Industries increasingly prefer digital variants due to their compatibility with predictive maintenance tools and user-friendly interfaces. The growing shift toward Industry 4.0 accelerates demand for digital tachometers across manufacturing, automotive testing, and process control environments. Time Measurement and Frequency Measurement Tachometers continue to gain traction, but their adoption remains secondary as end users prioritize advanced digital measurement capabilities.

- For instance, Nidec-SHIMPO’s DT-2100 model provides data-logging with continuous, single-unit, or statistics modes, alongside USB output for PC integration, enabling real-time monitoring of RPM up to 99,999 in non-contact mode at distances to 13 feet.

By Product Type

The Non-Contact Tachometer segment led the market in 2024 with a 57.3% share, supported by its superior safety, ease of use, and ability to measure rotational speed without physically interacting with the moving part. This segment benefits from rising automation in manufacturing, expanding usage in hazardous or high-speed environments, and increasing adoption in quality inspection processes. Non-contact devices offer reduced wear, minimal operational risk, and higher measurement precision, making them the preferred choice across automotive testing, aerospace systems, and industrial machinery diagnostics.

- For instance, AI-Tek Instruments’ Tachpak series tachometers provide non-contact speed monitoring for aerospace applications, using configurable microprocessor-based inputs from magnetic or optical sensors to ensure reliable operation in critical rotating components like turbines.

By Application

The Automobiles segment held the largest share of 38.4% in the Tachometer Market in 2024, propelled by rising vehicle production, stringent safety norms, and the growing integration of tachometers in performance testing, engine diagnostics, and speed monitoring systems. As automotive OEMs emphasize advanced monitoring tools to enhance engine efficiency and compliance with emission standards, demand for high-precision tachometers continues to expand. Applications in airplanes, medical devices, and laser instruments also grow steadily, but they collectively remain smaller compared to the dominant role of automotive applications in global revenue contribution.

Key Growth Drivers

Rising Demand from Automotive and Aerospace Industries

Tachometer Market growth is strongly driven by expanding applications across automotive and aerospace sectors, where precise rotational speed monitoring is essential for performance optimization, safety compliance, and engine diagnostics. Automakers increasingly integrate advanced tachometers into testing benches, electric vehicle platforms, and real-time monitoring systems to ensure operational efficiency and regulatory adherence. Similarly, aerospace manufacturers rely on high-accuracy tachometers for turbine inspections, vibration analysis, and rotor performance assessment. The rising production of vehicles and aircraft globally continues to strengthen demand for both digital and non-contact tachometer technologies.

- For instance, Ono Sokki developed the CT-6710 digital engine tachometer, which measures revolution speeds of gasoline, diesel engines, and motors in electric vehicles or hybrid electric vehicles.

Adoption of Industry 4.0 and Smart Manufacturing

The market benefits significantly from the rapid adoption of Industry 4.0, which encourages the use of intelligent monitoring tools to improve operational efficiency. Tachometers integrated with IoT sensors, cloud dashboards, and predictive maintenance software support data-driven decision-making in industrial environments. Manufacturers prefer digital tachometers capable of remote monitoring, automated calibration, and real-time analytics to reduce downtime and enhance process optimization. Increasing investments in smart factories and the global shift toward automated production lines continue to propel the deployment of advanced tachometer solutions.

- For instance, ONO SOKKI’s TM-4000 series Digital Tachometer provides a wide input frequency range of 0.05 Hz to 100 kHz with three contact outputs for alarm control and evaluation every 1 ms.

Increased Usage in Medical Technology and Precision Instruments

Growing demand for tachometers in medical devices and precision instruments acts as a key accelerator for market expansion. Medical applications such as centrifuges, cardiovascular pumps, and dental equipment require highly accurate rotational speed measurement to maintain performance reliability. Tachometers also support quality assurance in laboratory tools and surgical devices. The rising adoption of miniaturized tachometer sensors in portable medical instruments, combined with stricter performance standards in healthcare equipment manufacturing, continues to drive steady demand for high-precision tachometer technologies.

Key Trends & Opportunities

Shift Toward Non-Contact and Laser-Based Tachometers

A major trend shaping the Tachometer Market is the increasing preference for non-contact and laser-based tachometers, which provide enhanced measurement accuracy, operator safety, and greater versatility. These devices are gaining traction due to their ability to measure high-speed rotating components without requiring physical contact, making them ideal for hazardous, high-temperature, or vibration-intensive environments. Ongoing innovations in laser optics and sensor miniaturization present significant opportunities for expanding adoption across automotive diagnostics, aerospace component testing, and advanced manufacturing applications.

- For instance, the PLT200 from Monarch Instrument also measures fan speeds for ventilation monitoring and cutting speeds in machining, leveraging its ergonomic design for safe line-of-sight viewing in vibration-heavy applications.

Integration of Digital Tachometers with IoT and Predictive Maintenance

Digital tachometers integrated with IoT platforms are emerging as a major opportunity, enabling continuous monitoring, remote data access, and real-time alerts for machinery performance. Industries adopting predictive maintenance strategies increasingly rely on smart tachometers to detect anomalies early and reduce unplanned downtime. Cloud-enabled dashboards, Bluetooth connectivity, and automated data logging enhance operational visibility for maintenance teams. As manufacturing processes shift toward connected and intelligent systems, companies offering software-integrated tachometer solutions are well-positioned to capture growing demand.

- For instance, Extech Instruments’ RPM250W laser tachometer features Bluetooth connectivity, allowing maintenance professionals to view data remotely on mobile devices, set alarms, and export logs in CSV format for analysis.

Key Challenges

High Cost of Advanced Tachometer Technologies

The Tachometer Market faces challenges associated with the high cost of advanced digital, laser-based, and IoT-enabled tachometers, limiting their adoption among small and medium-sized enterprises. These devices require sophisticated optics, sensors, and electronic components, increasing production expenses and end-user pricing. Industries with tight capital budgets may continue to prefer traditional analog or contact-based devices despite their limitations. The cost barrier affects market penetration in developing regions, where investment capability remains comparatively lower, slowing the widespread adoption of innovative tachometer technologies.

Calibration Issues and Sensitivity to Operating Conditions

Frequent calibration requirements and sensitivity to temperature variations, vibrations, and electromagnetic interference present operational challenges for tachometer users. Inaccurate readings caused by environmental conditions can impact critical applications such as aerospace testing, automotive performance analysis, and medical device operation. Non-contact tachometers may also struggle with reflective surface inconsistencies or alignment issues, affecting measurement reliability. These technical limitations necessitate continuous maintenance and skilled handling, increasing operational complexity and restricting adoption in industries lacking technical expertise.

Regional Analysis

North America

North America held a 31.4% share of the Tachometer Market in 2024, driven by strong automotive manufacturing activity, advanced aerospace operations, and widespread adoption of smart industrial monitoring systems. The U.S. leads regional demand due to high investments in precision testing equipment and rapid integration of digital and non-contact tachometers across manufacturing facilities. The region’s emphasis on predictive maintenance and Industry 4.0 technologies further accelerates adoption. Expanding medical device production and research laboratories also contribute to sustained market growth, positioning North America as a key adopter of high-performance tachometer solutions.

Europe

Europe accounted for a 28.7% share of the Tachometer Market in 2024, supported by its well-established automotive sector, strong aerospace engineering capabilities, and stringent regulatory standards for equipment accuracy. Countries such as Germany, France, and the U.K. lead adoption due to their advanced manufacturing ecosystems and high demand for digital diagnostic instruments. Investments in industrial automation and machinery upgrades continue to drive tachometer deployment, particularly in precision engineering and aerospace component testing. The region’s growing adoption of laser-based and non-contact tachometers strengthens Europe’s position as a significant innovation hub.

Asia–Pacific

Asia-Pacific dominated emerging demand with a 30.6% share of the Tachometer Market in 2024, driven by rapid industrialization, large-scale automotive production, and the expansion of aerospace and electronics manufacturing. China, Japan, India, and South Korea are key contributors, benefiting from rising investments in automation and quality assurance systems. The region’s focus on high-speed machinery, EV manufacturing, and medical equipment production supports strong uptake of digital and non-contact tachometers. Growing government initiatives to strengthen industrial productivity and manufacturing competitiveness further enhance Asia-Pacific’s long-term market growth trajectory.

Latin America

Latin America captured a 5.4% share of the Tachometer Market in 2024, with demand primarily driven by the automotive and industrial sectors in Brazil, Mexico, and Argentina. Increasing modernization of manufacturing facilities and rising adoption of precision diagnostic tools are key drivers across the region. As industries invest in predictive maintenance and equipment performance monitoring, the use of digital tachometers continues to expand. Although the region faces economic fluctuations and limited high-tech integration, gradual industrial upgrades and expanding aerospace maintenance operations create steady growth opportunities.

Middle East & Africa

The Middle East & Africa region held a 3.9% share of the Tachometer Market in 2024, supported by growing industrial development, expanding automotive servicing networks, and rising investments in aviation maintenance. GCC countries contribute significantly due to their focus on modernizing industrial operations and improving equipment reliability. The region’s increasing adoption of non-contact tachometers in oil & gas machinery monitoring further strengthens demand. Although technological penetration remains lower than in other regions, ongoing infrastructure development and diversification initiatives continue to encourage gradual adoption of advanced tachometer solutions.

Market Segmentations:

By Type

- Time Measurement Tachometer

- Frequency Measurement Tachometer

- Analog Tachometer

- Digital Tachometer

By Product Type

- Contact

- Non-Contact Tachometer

By Application

- Automobiles

- Airplanes

- Medical Applications

- Laser instruments

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Tachometer Market is shaped by major players such as ABB Ltd., AMETEK Inc., Siemens AG, Honeywell International Inc., Robert Bosch GmbH, Danaher Corporation, Emerson Electric Co., Yokogawa Electric Corporation, Extech Instruments, and Fluke Corporation. These companies strengthen their market positions through continuous innovation, product range expansion, and advancements in digital, laser-based, and non-contact tachometer technologies. Leading manufacturers focus heavily on integrating IoT connectivity, enhanced measurement accuracy, and predictive monitoring capabilities into their devices to address rising industrial automation demands. Strategic initiatives such as mergers, acquisitions, and regional expansion support global footprint enhancement, while partnerships with automotive, aerospace, and manufacturing industries drive long-term growth. Companies also invest in R&D to develop compact, high-precision sensors and user-friendly digital interfaces. As demand increases across industrial, automotive, and medical applications, key players compete by offering diversified product portfolios, robust distribution networks, and value-added software-enabled monitoring solutions.

Key Player Analysis

- Yokogawa Electric Corporation (Japan)

- Fluke Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Emerson Electric Co. (U.S.)

- Extech Instruments (U.S.)

- Siemens AG (Germany)

- Danaher Corporation (U.S.)

- AMETEK, Inc. (U.S.)

- ABB Ltd. (Switzerland)

Recent Developments

- In July 2025, Intelligent Bio Solutions Inc. (INBS) announced new positive data from ultra-micro sweat testing to strengthen its FDA 510(k) submission for the Intelligent Fingerprinting Drug Screening System.

- In September 2025, IQ Biozoom’s founder received recognition as Startup of the Year 2025 and inclusion in “Top 15 Most Influential Women in Medicine 2025,” highlighting ongoing momentum in saliva glucose innovations.

Report Coverage

The research report offers an in-depth analysis based on Type, Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Future Outlook

- The Tachometer Market will experience steady growth driven by rising automation and the increasing need for precision monitoring across industries.

- Adoption of digital and non-contact tachometers will accelerate as industries prioritize accuracy, safety, and ease of use.

- Integration of tachometers with IoT platforms and predictive maintenance systems will become a standard requirement in modern manufacturing.

- Automotive and aerospace sectors will continue to generate strong demand due to expanding diagnostic, testing, and performance monitoring applications.

- Advancements in laser-based measurement technologies will create new opportunities for high-speed and high-precision applications.

- Miniaturized tachometer sensors will witness increased adoption in medical devices and compact industrial tools.

- Software-enabled data analytics and automated calibration features will enhance operational efficiency for end users.

- Emerging economies will contribute significantly to market expansion due to industrial modernization initiatives.

- Sustainability considerations will drive development of energy-efficient and long-life tachometer components.

- Competition among major players will intensify as companies invest in innovation, connectivity features, and global distribution expansion.

Market Segmentation Analysis:

Market Segmentation Analysis: