Market Overview:

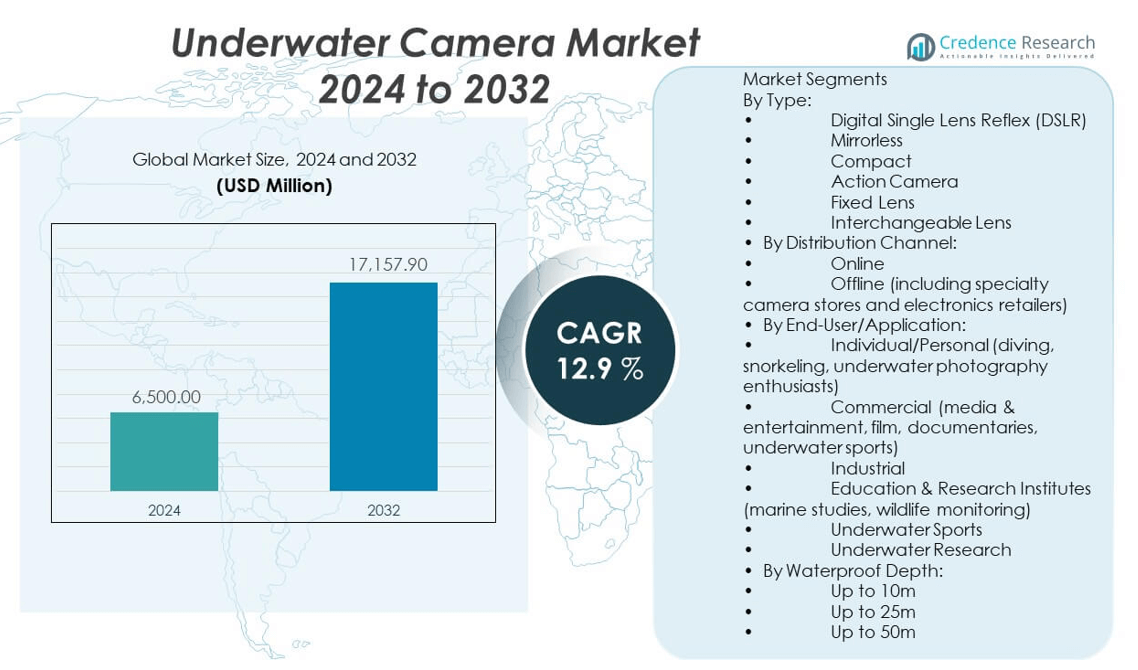

The Underwater Camera market is projected to grow from USD 6,500 million in 2024 to an estimated USD 17,157.9 million by 2032, with a compound annual growth rate (CAGR) of 12.9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Underwater Camera market Size 2024 |

USD 6,500 million |

| Underwater Camera market, CAGR |

12.9% |

| Underwater Camera market Size 2032 |

USD 17,157.9 million |

This market is expanding due to the rising popularity of adventure tourism, recreational diving, and marine photography. Consumers are seeking durable, high-resolution cameras capable of capturing underwater imagery for social media, documentaries, and professional projects. Technological advancements such as 4K recording, AI-enabled stabilization, and improved depth resistance are enhancing product appeal. The growing use of underwater cameras in marine research, underwater inspections, and security operations also contributes to broader commercial demand.

North America leads the underwater camera market due to high consumer spending, widespread participation in water sports, and strong presence of leading camera manufacturers. Europe follows closely, supported by tourism in coastal regions and demand from professional photographers and research institutions. Asia-Pacific is emerging rapidly, driven by increasing underwater activities in destinations such as Indonesia, the Maldives, and Thailand. Expanding e-commerce platforms and growing interest in vlogging and underwater content creation further stimulate demand across emerging markets

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The underwater camera market is projected to grow from USD 6,500 million in 2024 to USD 17,157.9 million by 2032, registering a strong CAGR of 9% during the forecast period.

- Rising interest in adventure tourism, snorkeling, scuba diving, and marine photography is driving demand for high-quality underwater imaging devices.

- Consumers increasingly prefer cameras with 4K video, AI-enabled stabilization, and superior depth resistance, boosting product innovation and adoption.

- The market benefits from growing applications in marine biology, underwater inspections, environmental monitoring, and security operations.

- High product costs and limited depth capabilities in entry-level models restrict adoption in budget-sensitive markets.

- North America holds the largest market share, driven by high consumer spending and a strong base of water sports enthusiasts and major camera brands.

- Asia-Pacific is emerging as a high-growth region, supported by expanding tourism in Indonesia, Thailand, and the Maldives, and increasing interest in vlogging and online content creation.

Market Drivers:

Growing Demand for Marine Exploration and Recreational Diving Fuels Equipment Sales:

The underwater camera market is experiencing substantial growth due to rising interest in marine exploration and recreational diving. Tourists and hobbyists seek high-quality underwater imaging tools to document diving experiences. Marine biologists, ecologists, and researchers increasingly rely on underwater cameras for habitat studies, fish population assessments, and coral reef monitoring. The demand for compact and durable imaging equipment is intensifying among ocean-based tour operators and dive centers. It supports the growing emphasis on marine conservation and underwater biodiversity documentation. Enhanced accessibility to exotic marine destinations also increases consumer engagement in underwater photography. The rising popularity of diving certifications has expanded the customer base for underwater imaging gear. This trend drives consistent sales of waterproof and deep-sea compatible camera systems, strengthening the underwater camera market.

- For instance, SeaLife pioneered the world’s first fully sealed digital underwater camera, the Micro 3.0, which features a 16-megapixel Sony sensor, 4K 30fps video, and is waterproof up to 200ft (60m)

Technological Advancements in Imaging and Durability Drive Product Adoption:

Innovation in underwater camera technology is transforming user expectations across professional and consumer segments. The integration of 4K/8K resolution, AI-enabled image stabilization, and wide dynamic range enhances photo and video quality under low light or deep-sea conditions. Manufacturers incorporate advanced sensors, waterproof casings, and extended battery life to support prolonged submersion. High-performance features, such as Wi-Fi connectivity and real-time image transfer, improve usability for content creators. Lightweight designs with rugged construction attract adventure enthusiasts and vloggers. The underwater camera market is benefiting from the convergence of digital photography and extreme sports. Product reliability in corrosive saltwater environments builds consumer confidence and supports repeat purchases. These developments contribute to faster adoption across travel, research, and entertainment sectors.

- For example, Sony’s ZV-E1 camera incorporates an advanced AI autofocus processor and dynamic active steadyshot stabilization, allowing 4K video capture at up to 120fps and providing up to 15 stops of dynamic range, critical for low-light and deep-sea shooting

Increasing Integration with Smartphones and Wearable Devices Expands Accessibility:

The expanding compatibility of underwater camera systems with smartphones and wearable tech increases their appeal among general consumers. Wireless pairing allows users to control, view, and share underwater images directly from mobile devices. Many entry-level products now feature app-based navigation and auto-adjustment settings, making them easier to operate for beginners. It supports a more intuitive user experience, even for those unfamiliar with underwater photography. Wearable mounts and lightweight action cam designs drive consumer interest across snorkeling, kayaking, and surfing activities. The integration of GPS and motion sensors further enhances the utility of these devices for sports tracking and geo-tagging images. This accessibility widens market reach beyond professionals to casual users. It helps establish underwater cameras as part of mainstream adventure gear.

Expanding Applications Across Industrial and Security Sectors Accelerate Market Penetration:

Underwater cameras are increasingly deployed in industrial and commercial sectors for inspection, maintenance, and monitoring purposes. Oil and gas companies use underwater imaging for pipeline inspections and subsea infrastructure analysis. Ports, dams, and water treatment plants also employ these tools for structural integrity assessments. The underwater camera market benefits from growing demand in marine surveillance, search-and-rescue missions, and coastal security operations. These applications require rugged systems with night vision and high-pressure resistance. It expands product utility beyond consumer photography. Government contracts and commercial tenders create sustained demand for specialized underwater imaging tools. This cross-sector adoption reinforces the role of underwater cameras in critical infrastructure and security workflows.

Market Trends:

Rise of Social Media Influencers Driving Demand for High-Quality Underwater Content

Content creators and travel influencers are shaping new trends in the underwater camera market through visually striking marine imagery. Platforms like Instagram, YouTube, and TikTok encourage production of immersive underwater content. Influencers invest in professional-grade gear to capture vivid scenes of marine life and underwater landscapes. The rise of experiential travel and eco-tourism adds momentum to this trend. It pushes manufacturers to enhance aesthetics and performance features in consumer-grade models. Consumers emulate influencer styles and seek similar equipment for personal adventures. This user-generated content cycle continuously expands brand exposure and product visibility. The market evolves in response to changing social content standards, encouraging innovation in image clarity and user-friendly features.

- For instance, GoPro’s Hero cameras—widely adopted by influencers—offer features like 27-megapixel RAW photos, vertical video support, and up to 120fps at 4K, enabling users to generate slow-motion, cinematic content for platforms like Instagram and YouTube

Development of Compact, Modular, and Customizable Camera Systems Gains Traction:

Consumers increasingly prefer modular underwater camera systems that allow flexibility in lens, lighting, and housing configurations. Interchangeable parts make devices adaptable for varying depths, lighting conditions, and recording durations. Compact systems appeal to travelers seeking space-efficient gear. Manufacturers are launching customizable setups that align with specific diving levels, sport’s needs, and technical applications. It enables broader personalization in underwater photography workflows. The trend supports hybrid use across land and water environments, improving product utility. Advanced modular systems are gaining popularity among tech-savvy enthusiasts and professionals. These developments cater to niche usage preferences and contribute to broader market differentiation.

- For instance, SeaLife’s Flex-Connect system allows users to quickly attach or detach trays, arms, and accessory lights, optimizing gear for various diving conditions

Adoption of AI and Computational Imaging Enhances Underwater Photography Performance:

Artificial intelligence and computational imaging are reshaping the way underwater cameras process visuals. AI assists in real-time color correction, low-light enhancement, and object recognition under water. These technologies enable clearer imaging in murky or deep environments where traditional optics fall short. Advanced algorithms adjust brightness and contrast based on ambient light variations. It allows even non-experts to produce high-quality photos. Face and motion detection features streamline focus on marine life or moving subjects. The underwater camera market is shifting toward smarter devices that automate editing and enhance image output. These AI-driven features reduce the need for manual post-processing and increase convenience for users.

Growth in Eco-Conscious Design and Use of Sustainable Materials Shapes Product Innovation:

Manufacturers are responding to rising environmental awareness by developing underwater cameras using eco-friendly materials and sustainable packaging. Designs now incorporate biodegradable components, recycled plastics, and energy-efficient circuits. Companies position their products as environmentally responsible alternatives. It aligns with the values of conservation-driven consumers and marine researchers. Packaging reduction and carbon-neutral logistics contribute to brand appeal among sustainability-conscious buyers. The underwater camera market is seeing a shift in messaging and product presentation driven by global environmental priorities. These trends influence purchasing decisions, particularly in premium and niche market segments focused on marine preservation.

Market Challenges Analysis:

High Cost of Advanced Equipment Limits Mass Adoption Among Price-Sensitive Consumers:

Despite growing interest in underwater photography, cost remains a critical barrier to mass adoption of high-performance underwater cameras. Professional-grade devices often require specialized waterproof housings, external lighting, and stabilization gear, increasing total ownership costs. Budget-conscious users may opt for basic models that lack durability and advanced functionality. This segmentation limits revenue potential in emerging markets where disposable income remains constrained. The underwater camera market faces difficulty in balancing affordability with quality, especially in price-competitive regions. Manufacturers struggle to offer cutting-edge features without inflating product pricing. High maintenance costs and risk of equipment loss under water further deter new users from upgrading.

Limited Depth Capacity and Performance Degradation in Extreme Conditions Constrain Usability:

Underwater cameras face performance constraints related to depth pressure, visibility, and salinity exposure. Devices designed for recreational diving often fail in deep-sea environments, restricting their industrial or research applications. Lens fogging, corrosion, and battery failure reduce operational life in harsh aquatic conditions. Image clarity suffers due to particulate matter, inadequate lighting, or turbulent currents. These technical limitations require frequent product upgrades and repairs, disrupting continuity for professional users. The underwater camera market must overcome these physical and environmental barriers to support diverse user needs. Reliability issues under high-pressure or long-duration conditions hinder expansion into critical commercial sectors.

Market Opportunities:

Rising Interest in Marine Conservation and Educational Use Cases Creates New Customer Segments:

Institutions and NGOs are investing in underwater camera systems for documenting biodiversity and promoting marine conservation. Educational programs in schools and universities increasingly include underwater video modules to raise awareness about ocean ecosystems. It helps expand the underwater camera market by driving non-commercial, purpose-driven demand. Camera use in documentaries and public outreach campaigns also boosts visibility across new audience segments. Manufacturers can collaborate with conservation agencies to deliver customized solutions aligned with environmental initiatives.

Emerging Markets and Tourism-Driven Economies Offer Untapped Growth Potential:

Coastal economies in Southeast Asia, South America, and Africa present untapped growth opportunities for underwater camera adoption. Tourism development in these regions attracts divers and content creators who require compact and affordable imaging tools. It creates market potential for entry-level models and rental-based business models. Government efforts to promote marine heritage tourism also support demand for underwater cameras in guided experiences. Local vendors and tour operators increasingly stock underwater gear to serve growing tourist inflows.

Market Segmentation Analysis:

By Type

The underwater camera market includes a range of camera types that meet various technical and user-specific needs. DSLR and mirrorless cameras lead in professional usage due to superior image quality and interchangeable lenses. Compact cameras cater to casual users seeking simplicity and portability. Action cameras hold strong appeal for adventure seekers and sports enthusiasts with their rugged design and mounting options. Fixed lens models offer point-and-shoot functionality, while interchangeable lens systems attract advanced users requiring flexibility in underwater environments.

- For instance, the Canon EOS R5 Mark II, a professional DSLR, captures 45MP stills at 30fps

By Distribution Channel

Online distribution channels have gained traction due to competitive pricing, wide product availability, and consumer convenience. E-commerce platforms allow users to compare features and access niche brands. Offline channels, including specialty camera stores and electronics retailers, continue to serve users seeking personalized guidance and hands-on experience before purchase. These stores play a key role in promoting high-end and professional-grade underwater cameras.

- For instance, Offline stores like specialty camera shops facilitate hands-on demos and personalized advice, crucial for products like SeaLife cameras that rely on ergonomic operation and accessory compatibility for performance under water

By End-User/Application

Recreational users, including snorkelers and divers, drive demand for entry-level and mid-range models. The commercial segment—comprising filmmakers, sports broadcasters, and media companies—prioritizes performance, durability, and high-resolution output. Industrial applications focus on inspection and surveillance functions in underwater infrastructure. Education and research institutes use underwater cameras for marine biology, wildlife observation, and training. Specialized uses in underwater sports and scientific exploration also influence product development.

By Waterproof Depth

Cameras rated up to 10 meters cater to general recreational use. Models rated up to 25 meters serve advanced divers and content creators. High-performance cameras rated up to 50 meters target professional divers, industrial inspectors, and researchers. Waterproof depth ratings directly influence user confidence and application scope, making it a crucial consideration in purchasing decisions. The underwater camera market adapts its offerings to suit different depth-specific performance needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Type:

- Digital Single Lens Reflex (DSLR)

- Mirrorless

- Compact

- Action Camera

- Fixed Lens

- Interchangeable Lens

By Distribution Channel:

- Online

- Offline (including specialty camera stores and electronics retailers)

By End-User/Application:

- Individual/Personal (diving, snorkeling, underwater photography enthusiasts)

- Commercial (media & entertainment, film, documentaries, underwater sports)

- Industrial

- Education & Research Institutes (marine studies, wildlife monitoring)

- Underwater Sports

- Underwater Research

By Waterproof Depth:

- Up to 10m

- Up to 25m

- Up to 50m

By Geography/Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads the Market with Strong Consumer Base and Innovation Ecosystem

North America holds the largest share in the underwater camera market at 34.2%, driven by widespread consumer adoption and strong presence of premium camera brands. The region benefits from high disposable income, adventure tourism culture, and extensive coastline activity, including diving, surfing, and marine research. The U.S. and Canada support early adoption of advanced imaging technologies, with demand reinforced by influencers and travel bloggers. Technological innovations from key companies headquartered in the region strengthen its competitive edge. Applications in marine biology, underwater filmmaking, and coastal surveillance also contribute to sustained demand. It continues to lead in terms of product development and consumer spending on high-end underwater imaging systems.

Europe Maintains Strong Market Position Backed by Dive Tourism and Environmental Research

Europe accounts for 27.5% of the underwater camera market, with key contributions from Germany, the UK, France, and Italy. High tourism activity in Mediterranean coastal regions supports camera sales through professional dive centers and retail outlets. European consumers prioritize sustainability and quality, influencing manufacturers to offer eco-conscious camera solutions. Government-funded marine conservation initiatives and academic research programs further fuel equipment procurement. It benefits from both consumer and institutional demand, with strong aftermarket services and product support. The market in Europe maintains steady growth through innovation and strong consumer-brand loyalty.

Asia Pacific Emerges as a High-Growth Region Driven by Tourism and Affordability Trends

The Asia Pacific region holds 23.6% of the underwater camera market and is witnessing rapid growth driven by expanding middle-class income and marine tourism in countries like Thailand, Indonesia, and Australia. Local and international tourists are driving sales of compact and entry-level underwater cameras for snorkeling and scuba diving. The presence of electronics manufacturing hubs in China, Japan, and South Korea enhances availability of cost-effective models. It benefits from favorable climatic conditions, year-round tourism, and rising awareness about marine ecosystems. Consumer preference for affordable and mobile-friendly devices contributes to market penetration. Latin America and the Middle East & Africa collectively represent the remaining 14.7%, showing moderate growth supported by infrastructure development and eco-tourism expansion.

Key Player Analysis:

- Canon Inc.

- Sony Corporation

- Nikon Corporation

- Panasonic Corporation

- GoPro Inc.

- Fujifilm Holdings Corporation

- Ricoh Company Ltd.

- OM Digital Solutions Corporation

- Olympus Corporation

- Garmin Ltd.

- SZ DJI Technology Co., Ltd.

- SeaLife Cameras

- Shenzhen Zhiyong Industrial Co. Ltd.

Competitive Analysis:

The underwater camera market features intense competition among global electronics and imaging brands. Canon, Sony, Nikon, and Panasonic lead in high-performance imaging, leveraging strong R&D and established distribution networks. GoPro dominates the action camera segment with its rugged, compact models and wide accessory ecosystem. Fujifilm and Olympus focus on mid-range and compact waterproof solutions, while DJI integrates drone and imaging technology. SeaLife Cameras and niche brands target professional diving and marine research markets with specialized equipment. Product innovation, waterproof depth, image quality, and durability remain key differentiators. It continues to see strategic positioning through feature enhancements, pricing strategies, and influencer-led marketing to capture both recreational and professional segments.

Recent Developments:

- In March 2025, Canon Inc. announced the release of the PowerShot V1, a compact camera designed for creators and vloggers. It features a newly designed ultra-wide-angle zoom lens (17–52mm for movies), a 1.4-type sensor with approximately 22.3 megapixels, and Dual Pixel CMOS AF II for improved autofocus and subject detection. This launch expands Canon’s EOS/PowerShot V Series and reflects their focus on versatility and high-quality output for on-the-go shooting.

- In December 2024, Sony Corporation entered an official global partnership with World Aquatics, supporting all aquatic world competitions through 2028. As part of this collaboration, Sony’s Alpha mirrorless cameras and G Master lenses will be used by official event photographers and videographers, highlighting the reliability and technical performance of Sony’s cutting-edge cameras in challenging aquatic environments.

- In September 2024, Panasonic Corporation unveiled two new 4K multi-purpose cameras—the AW-UB50 and AW-UB10. These cameras, available from early 2025, utilize LUMIX digital interchangeable lens technology and offer full-frame (UB50) and Micro Four Thirds (UB10) sensors. Designed for robust video workflows, they are suitable for production houses and education, and are being adapted into underwater housings for marine research, sports, and pool environments

Market Concentration & Characteristics:

The underwater camera market is moderately concentrated, with a few multinational corporations accounting for the majority of global sales. It is characterized by continuous innovation, high brand loyalty, and increasing adoption across consumer and commercial sectors. Product differentiation centers on imaging performance, waterproof depth, connectivity, and ease of use. The market sees a mix of premium and affordable options catering to diverse user bases, including professionals, hobbyists, and industrial clients. It remains driven by seasonal demand trends, travel patterns, and rapid shifts in imaging technology.

Report Coverage:

The research report offers an in-depth analysis based on By type, distribution channel, end-user/application and waterproof depth. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Consumer interest in marine adventures will support steady product demand

- Advancements in sensor and lens technology will improve underwater clarity

- Growth in underwater tourism will expand rental and retail channels

- AI-powered image processing will reduce manual editing requirements

- Increased use in marine research will drive demand for specialized gear

- Smartphone-compatible housings will attract recreational users

- Eco-friendly designs will gain preference in conservation-focused markets

- Influencer marketing will shape product visibility and brand appeal

- Asia Pacific will emerge as a strong demand hub due to tourism growth

- Manufacturers will prioritize compact, modular product development