Market Overview:

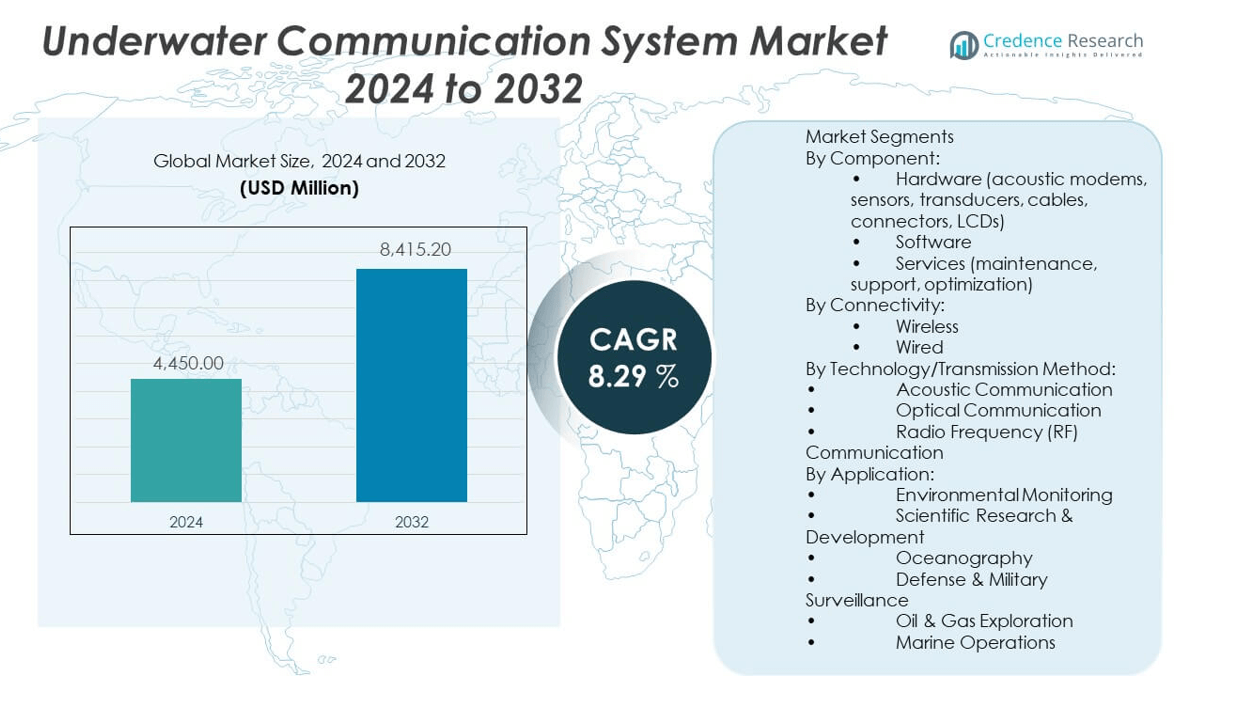

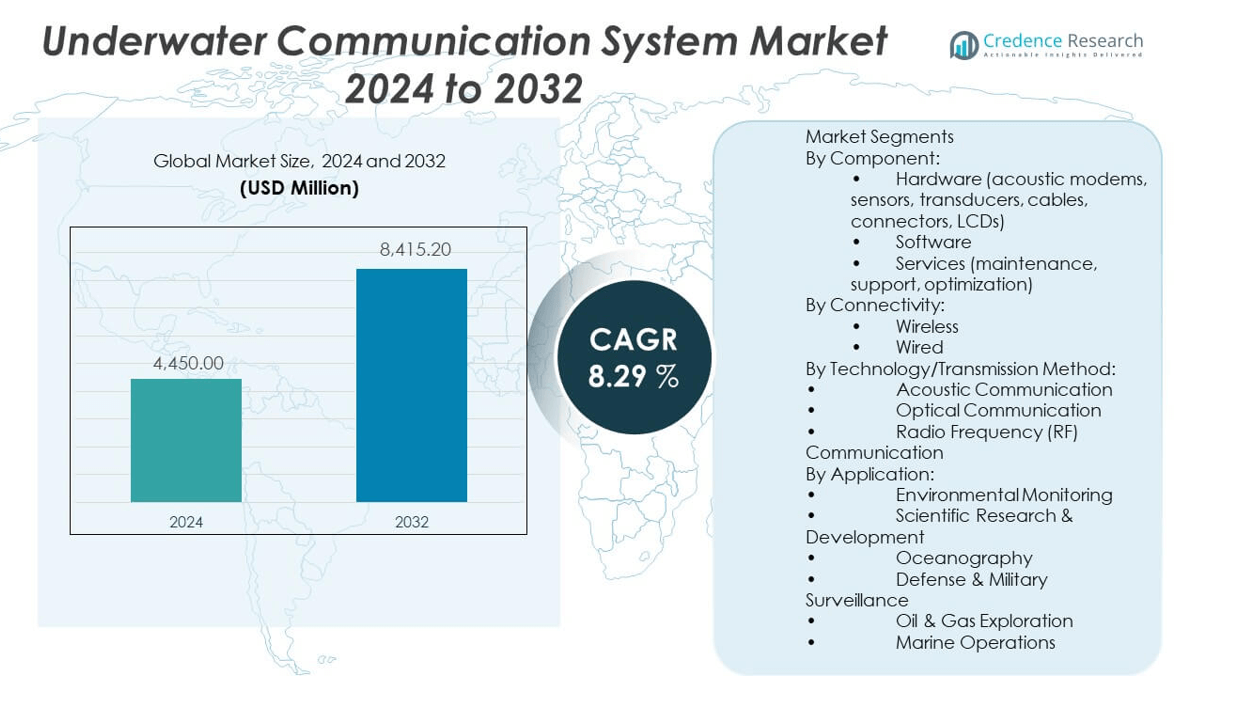

The Underwater Communication System market is projected to grow from USD 4,450 million in 2024 to an estimated USD 8,415.2 million by 2032, with a compound annual growth rate (CAGR) of 8.29% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Underwater Communication System market Size 2024 |

USD 4,450 million |

| Underwater Communication System market, CAGR |

8.29% |

| Underwater Communication System market Size 2032 |

USD 8,415.2 million |

This market is expanding due to increasing demand for secure and efficient underwater data exchange across naval defense, offshore oil and gas, and marine research sectors. Operators require reliable communication for remotely operated vehicles (ROVs), autonomous underwater vehicles (AUVs), and diver-based operations. Advances in acoustic, optical, and electromagnetic technologies have improved transmission speed, range, and clarity, making these systems more robust for deep-sea applications. Investments in ocean surveillance and subsea infrastructure further stimulate market growth.

North America leads the underwater communication system market, driven by strong naval capabilities, extensive offshore energy projects, and technological leadership. Europe maintains substantial demand supported by maritime security programs and commercial underwater activities. Asia-Pacific is rapidly emerging, with countries like China, Japan, and South Korea investing heavily in subsea surveillance, deep-sea exploration, and oceanographic research. The region’s growing focus on underwater security and digital transformation of marine operations supports continued adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Underwater Communication System market is projected to grow from USD 4,450 million in 2024 to USD 8,415.2 million by 2032, registering a CAGR of 8.29% during the forecast period.

- Growing demand for real-time underwater data exchange in naval defense, oil and gas exploration, and marine science continues to drive market expansion.

- Dependence on ROVs, AUVs, and diver communication systems fuels the need for robust, long-range subsea communication networks.

- Advanced acoustic, optical, and electromagnetic technologies improve transmission quality, enabling operations in deeper and more complex underwater environments.

- High initial investment costs and technical complexity related to signal degradation and environmental interference restrain market penetration, especially for smaller operators.

- North America dominates the global market with 35.6% share due to extensive naval fleets and offshore infrastructure, followed by Europe at 28.4%, driven by collaborative maritime research and regional security initiatives.

- Asia-Pacific, holding 24.1% market share, is the fastest-growing region, led by strategic investments from China, Japan, and South Korea in subsea surveillance, digital marine ecosystems, and research capabilities.

Market Drivers:

Rising Demand for Secure Naval and Defense Communication Across Subsea Domains:

The underwater communication system market is witnessing strong growth due to increasing investments in naval defense modernization. Military forces are deploying advanced underwater communication systems to support secure, uninterrupted communication between submarines, unmanned underwater vehicles (UUVs), and surface ships. Governments are prioritizing robust undersea networks for surveillance and intelligence gathering. It is becoming critical for naval operations to maintain data exchange in contested maritime zones. Demand for real-time sonar and acoustic communication tools is growing across strategic defense corridors. Defense budgets across the U.S., China, India, and NATO member countries support procurement of acoustic modems and long-range wireless systems. This creates a continuous requirement for interoperable, low-latency communication. The underwater communication system market benefits from the sustained focus on enhancing submarine warfare capabilities.

- For instance, the U.S. Navy, in collaboration with MIT Lincoln Laboratory, has implemented advanced MIMO (Multiple Input Multiple Output) acoustic communication systems for its fleets. These systems enable simultaneous multi-channel data exchange between AUVs and manned submarines, enhancing mission reliability. Performance metrics show MIMO acoustic networks can increase data density by up to 50% and improve error rates by 30% compared to single-antenna systems—enabling submarine operations to sustain reliable communication over several kilometers, even in environments with substantial interference

Expansion of Offshore Oil and Gas Activities Demands Reliable Undersea Communication:

The global expansion of offshore exploration and production has created a significant push for robust underwater communication infrastructure. Drilling platforms and subsea systems rely on real-time monitoring and coordination tools, making acoustic and optical communication essential. Deep-sea operators need effective communication with remote-operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) to manage complex operations. It is essential to maintain efficient data transmission between submerged assets and surface facilities. The underwater communication system market supports vital functions such as structural inspections, pressure sensing, and leak detection. Offshore fields in Brazil, the North Sea, and the Gulf of Mexico are key adopters of these technologies. Oil and gas firms are integrating wireless acoustic networks to enhance safety and operational efficiency. This segment remains a primary driver of underwater communication technology adoption.

- For example, Petrobras, operating in Brazil’s pre-salt offshore fields, deploys ROVs and AUVs equipped with ultra-low power acoustic and electromagnetic modems capable of real-time data transmission over distances up to 2km, maintaining communication link reliability above 98% even at depths exceeding 2,000m

Rapid Technological Advancement in Oceanographic and Marine Research Applications:

The underwater communication system market gains significant traction from marine research and oceanographic exploration. Research organizations and universities deploy UUVs and sensor arrays to collect and transmit marine data. Oceanographic studies demand uninterrupted signal transmission from deep-sea sensors to surface receivers. It enables data collection for seabed mapping, climate studies, and ecological monitoring. Scientists increasingly use underwater communication to gather biodiversity and temperature readings from remote locations. Integration with satellite links and remote processing units enhances the functionality of marine observation systems. High-frequency acoustic and optical modems are enabling extended deployment durations. The use of AI and data analytics in ocean science further boosts demand for real-time subsea data communication. The market supports long-term observation projects across international marine corridors.

Increasing Adoption of Underwater Drones and Autonomous Vehicles Across Industries:

The rise of AUVs and underwater drones is expanding the scope of the underwater communication system market. These vehicles require reliable, secure, and energy-efficient communication systems to operate effectively. Industries such as offshore energy, environmental monitoring, and underwater inspection depend on real-time vehicle communication. It is crucial for mission coordination, obstacle avoidance, and system diagnostics. Acoustic and hybrid communication technologies help transmit control signals and sensor data. AUVs are being deployed for pipeline inspection, cable maintenance, and marine surveying. Companies are integrating advanced telemetry and wireless communication tools to extend vehicle range and mission precision. The demand for seamless underwater-to-surface data relay continues to grow. This driver reinforces the critical role of underwater communication in autonomous maritime operations.

Market Trends:

Increasing Research Focus on Bio-Inspired and Biomimetic Communication Models in Subsea Systems:

The underwater communication system market is witnessing a growing research focus on bio-inspired communication methods modeled after marine life. Scientists and engineers are developing systems that mimic the sound production and detection abilities of marine mammals like dolphins and whales. These biological models offer low-power, adaptive solutions capable of functioning in challenging ocean conditions. Research institutions are designing communication protocols that simulate animal echolocation for enhanced range and clarity. Bioacoustics is emerging as a viable alternative to traditional modems, especially in environmentally sensitive areas. These models aim to reduce acoustic pollution and promote coexistence with marine ecosystems. It enables researchers to explore energy-efficient, stealth-compatible communication designs. This trend reflects the sector’s alignment with ecological awareness and sustainable marine operations.

- For instance, recent work applying the Tunicate Swarm Algorithm (TSA) for autonomous surveillance has demonstrated an increase in network lifespan for underwater sensor deployments by more than 40%, compared to conventional clustering protocols. In practical simulations involving 100–800 sensor nodes over a 1,000m × 1,000m area, these systems achieved optimized energy balance, extended operational duration, and consistent single-hop data transfer—addressing energy consumption and network stability under dynamic oceanic conditions

Use of Blockchain and Distributed Ledger Technologies in Subsea Data Security:

Stakeholders are exploring the use of blockchain and distributed ledger technologies to enhance security in underwater data communication. These systems offer immutable data verification and decentralized control over sensitive transmissions. The underwater communication system market benefits from the integration of such frameworks to protect defense, energy, and research data. Underwater nodes and smart devices can authenticate messages without relying on surface verification. This allows real-time, secure transactions between autonomous vehicles and fixed subsea assets. Blockchain enhances data integrity and provides audit trails for subsea operations. Researchers are implementing lightweight cryptographic protocols suitable for bandwidth-constrained underwater channels. This trend strengthens the market’s role in supporting digital trust within ocean-based systems.

- For example, a recent deployment of a blockchain-secured acoustic communication network for marine disaster management involved node registration and digital signatures, resulting in zero unauthorized data access during extended test operations. Empirical results show that integrating blockchain-based cryptographic protocols reduces the risk of data tampering to less than 0.5% and provides a complete audit trail for every data packet exchanged, even under high-interference scenarios

Emergence of Smart Buoy Networks for Real-Time Environmental and Navigational Data:

Smart buoy networks are becoming a prominent trend in ocean monitoring and navigation. These buoys integrate sensors, satellite uplinks, and underwater communication modules to gather and relay data. The underwater communication system market supports these platforms by enabling efficient subsea-to-surface data transmission. Smart buoys track wave patterns, current flows, and marine traffic with high precision. Maritime authorities and environmental agencies deploy them to monitor ecosystems and improve safety. The buoys also assist in early detection of oil spills and storm surges. Integration with underwater modems allows them to receive real-time input from seabed sensors. This trend reflects a move toward decentralized, automated marine surveillance.

Development of Temporary and Disposable Communication Nodes for Short-Term Missions:

Temporary and disposable underwater communication devices are gaining popularity in applications where long-term deployment is unnecessary or impractical. Researchers and commercial operators use them during short-duration missions such as underwater archeology, salvage operations, or military exercises. These lightweight, low-cost nodes are designed to function effectively for limited periods before degradation or retrieval. The underwater communication system market benefits from this trend by expanding its product range to serve tactical and project-based operations. Manufacturers are experimenting with biodegradable casings and low-impact materials to reduce environmental footprint. Such devices offer flexibility without the need for maintenance or recovery. This trend promotes agile deployment and lowers barriers for entry-level users in academia and exploration.

Market Challenges Analysis:

Environmental and Technical Constraints Impact Signal Strength and Range:

The underwater communication system market faces persistent challenges from harsh underwater conditions. Acoustic signals often degrade due to temperature gradients, salinity variations, and seabed topography. High noise levels from marine traffic and natural sources reduce signal clarity and reliability. Optical and radio frequency systems suffer from limited range due to water absorption and turbidity. It restricts their application to short-range or clear-water scenarios. Maintaining signal quality over long distances remains a technical hurdle for real-time data transmission. Latency issues hinder responsiveness, especially in dynamic applications like underwater drones. Complex algorithms are required to manage signal interference, increasing system complexity. These environmental constraints limit the performance of even the most advanced communication technologies.

High Cost of Deployment and Maintenance Restricts Adoption Across Smaller Operators:

The cost of developing, installing, and maintaining underwater communication systems remains high. It includes expenses related to pressure-proof enclosures, signal testing, and integration with existing subsea infrastructure. Smaller marine research institutes, independent oil operators, and regional defense forces often face budget limitations. It reduces their ability to adopt state-of-the-art systems. High maintenance requirements due to corrosion, biofouling, and mechanical wear increase lifecycle costs. It makes long-term deployment economically challenging without strong return on investment. Training personnel to operate and troubleshoot these systems adds to operational costs. The underwater communication system market must address affordability to broaden its user base. Without scalable pricing models, adoption may remain concentrated among large organizations.

Market Opportunities:

Expansion of Smart Maritime Infrastructure and Digital Ocean Initiatives:

Smart ports, intelligent buoys, and digital twin ocean projects are creating demand for high-bandwidth, real-time underwater communication. Governments and ocean technology firms are collaborating to build connected ecosystems for maritime monitoring. The underwater communication system market can supply core communication links for these initiatives. It supports integration of underwater sensors, AI systems, and data analytics platforms. Demand will increase for scalable, interoperable communication solutions that connect seabed to surface.

Growth Potential in Aquaculture, Environmental Monitoring, and Renewable Energy Sectors:

Underwater communication is gaining traction in aquaculture farms for real-time monitoring of fish health and water quality. It enables automated feeding and environmental control. In offshore wind and tidal energy projects, underwater systems help inspect turbine foundations and manage cables. The underwater communication system market has untapped potential in these non-traditional sectors. It aligns with sustainability objectives and supports regulatory compliance through accurate, continuous data transmission.

Market Segmentation Analysis:

By Component

The hardware segment dominates the underwater communication system market due to widespread use of acoustic modems, transducers, connectors, and sensors across critical applications. These components enable the physical transmission of data in underwater environments. Software plays a key role in signal interpretation, system configuration, and data visualization. Services such as maintenance and optimization are vital for ensuring long-term operational efficiency, especially in remote or deep-sea deployments.

- For example, achieves reliable communication at depths up to 6,000m, covering distances exceeding 10km with packet delivery rates above 95% in field operations. Their acoustic triggers allow seamless device integration, addressing the demands for real-time telemetry and remote actuation in defense and energy applications

By Connectivity

Wireless communication holds the leading position in this segment, supporting mobile operations like autonomous underwater vehicles (AUVs), divers, and temporary installations. It offers flexibility and rapid deployment in dynamic underwater environments. Wired communication, while less prevalent, remains critical for fixed systems and applications demanding stable, high-integrity data transmission.

- For instance, supports multi-node communication in dynamic environments, maintaining robust two-way links with moving AUVs and ROVs at ranges up to 1,000m, and data transfer rates of several kilobits per second in noisy, turbid waters

By Technology/Transmission Method

Acoustic communication is the most widely used transmission method, valued for its effectiveness over long distances and compatibility with deep-sea conditions. Optical communication offers high-speed data transfer but is limited to short-range, clear-water environments. Radio Frequency (RF) communication is suitable only in shallow waters or specific hybrid use cases due to high signal attenuation in saline water.

By Application

Defense and military surveillance generate significant demand for secure and long-range underwater communication. Oil and gas exploration also heavily relies on these systems for asset inspection and safety. Environmental monitoring, oceanography, and scientific R&D utilize communication systems for real-time data collection and analysis. Marine operations benefit from improved coordination and operational control.

By End-User

Military and defense lead in terms of market share, backed by consistent investment in naval modernization. The oil and gas industry follows, while research institutions and commercial marine sectors continue to adopt underwater communication for exploration, monitoring, and industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Component:

- Hardware (acoustic modems, sensors, transducers, cables, connectors, LCDs)

- Software

- Services (maintenance, support, optimization)

By Connectivity:

By Technology/Transmission Method:

- Acoustic Communication

- Optical Communication

- Radio Frequency (RF) Communication

By Application:

- Environmental Monitoring

- Scientific Research & Development

- Oceanography

- Defense & Military Surveillance

- Oil & Gas Exploration

- Marine Operations

By End-User:

- Military & Defense

- Oil & Gas Industry

- Scientific Research Organizations

- Commercial & Marine Industries

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads the Market with Strong Defense and Offshore Investments

North America holds the largest share in the underwater communication system market, accounting for 35.6% of the global revenue. The United States drives this leadership through consistent naval modernization, heavy defense spending, and advanced subsea infrastructure. The region benefits from strong presence of key players developing acoustic modems, sonobuoys, and wireless sensor networks. Offshore oil fields in the Gulf of Mexico also require advanced underwater communication for inspection and production activities. Canada supports the market through Arctic marine monitoring and defense projects in its northern territories. Investment in underwater drones and integrated ocean observatories continues to support market dominance. The region maintains a high rate of innovation and early technology adoption.

Europe Maintains a Competitive Edge through Collaborative Marine Research

Europe ranks second in the underwater communication system market, holding a market share of 28.4%. Countries including the United Kingdom, Germany, Norway, and France support the market through marine robotics, subsea research programs, and renewable energy initiatives. The North Sea and Baltic Sea operations generate demand for underwater monitoring and data communication. Institutions across Europe collaborate on projects such as undersea cable surveillance and smart ocean infrastructure. The EU’s investments in marine biodiversity and sustainable ocean development further drive adoption of subsea communication systems. Europe fosters strong cross-industry partnerships, enabling innovation in hybrid and AI-driven systems. It remains an important contributor to the global underwater communication ecosystem.

Asia-Pacific Emerges as a Fast-Growing Market Driven by Maritime Expansion

Asia-Pacific accounts for 24.1% of the underwater communication system market, supported by rapid growth in maritime defense, aquaculture, and offshore energy. China, Japan, South Korea, and India are increasing investments in naval fleets, undersea surveillance, and underwater drones. The South China Sea and Indian Ocean activities create sustained demand for subsea communication technologies. Regional governments and research institutions are expanding oceanographic research, requiring real-time underwater data transfer. Companies in the region are also developing cost-effective modems and AUV-compatible systems to meet domestic needs. It shows strong growth potential and is expected to increase its global share through localized production and government support.

Rest of the World Supports Niche Demand and Regional Projects

The Rest of the World, including Latin America, the Middle East, and Africa, contributes 11.9% to the underwater communication system market. Brazil’s offshore oil industry, South Africa’s marine biodiversity research, and the UAE’s investment in maritime security create opportunities. These regions often adopt modular, rugged systems suited for specific underwater tasks. Cross-border marine initiatives and defense upgrades are expanding the addressable market in these areas. Limited infrastructure and budget constraints impact the adoption pace. However, international collaboration and donor-backed research programs are helping bridge capability gaps. It continues to support regional demand and niche applications in underexplored waters.

Key Player Analysis:

- Kongsberg Maritime

- Teledyne Technologies / Teledyne Marine

- L3Harris Technologies

- Thales Group

- Saab AB

- Ultra-Electronics Holdings (Ultra)

- Sonardyne International

- EvoLogics GmbH

- HYDROMEA

- Subnero

- Undersea Systems International, Inc.

- Sea and Land Technologies

- Benthowave Instrument Inc.

- Nortek

- DSPComm

- Fugro

- WSense

- Alcatel Submarine Networks (ASN)

Competitive Analysis:

The underwater communication system market is highly competitive, with leading players such as Kongsberg Maritime, Teledyne Marine, L3Harris Technologies, and Thales Group driving innovation and global deployment. These companies focus on advanced acoustic, optical, and hybrid technologies to meet evolving operational demands across military, oil & gas, and research sectors. Firms like EvoLogics GmbH and Sonardyne specialize in niche, high-performance systems used in deep-sea missions and autonomous platforms. Competitive advantage is often driven by product reliability, system range, signal clarity, and seamless integration with AUVs and ROVs. Companies increasingly invest in R&D, strategic partnerships, and regional expansion to strengthen their market positions. It remains technology-intensive and favors firms with strong engineering capabilities and global service networks.

Recent Developments:

- In May 2025, Kongsberg Maritime announced the launch of a new electric towing winch designed for the harbor tug market. This innovative winch utilizes a frequency converter-driven electric motor, delivering up to 35 tons of pulling force with multiple drum configurations, and emphasizing operational efficiency and reduced environmental impact. The system also features rapid quick-release compliance with IACS standards, supporting enhanced safety and integration with Kongsberg’s connectivity ecosystem.

- In February 2025, Teledyne Technologies completed its $710 million acquisition of select aerospace and defense electronics businesses from Excelitas Technologies, including the optical systems business Qioptiq and the U.S. advanced electronic systems division. The acquired units now operate under Teledyne Qioptiq, expanding Teledyne’s portfolio with advanced optical, night vision, and frequency standard solutions for defense and subsea platforms.

- In August 2025, L3Harris Technologies formed a partnership with Joby Aviation to co-develop a new gas turbine hybrid vertical take-off and landing (VTOL) aircraft for defense. Announced on August 1, 2025, this collaboration leverages L3Harris’ missionization expertise (including sensors and communication systems) and Joby’s hybrid aircraft platform, aiming for flight tests in fall 2025 and government demonstrations in 2026.

- In March 2025, Thales Group was selected to provide the full sonar and acoustic suite for the Royal Netherlands Navy’s new Orka-class submarines. This contract marks a pivotal move outside Thales’ core markets. The advanced sensor suite includes bow, flank, and mine avoidance sonars, and features an R&D partnership with Optical11 for next-generation fiber optic towed linear antennas, with ongoing feasibility studies through 2025.

Market Concentration & Characteristics:

The underwater communication system market is moderately concentrated, with a mix of multinational corporations and specialized regional players. It features high technological entry barriers and capital intensity, favoring companies with strong R&D capabilities and established maritime expertise. Most players offer vertically integrated solutions, including hardware, software, and services. Innovation cycles are steady, with consistent advancements in signal clarity, transmission range, and energy efficiency. It serves both defense and commercial sectors, with applications ranging from tactical naval operations to oceanographic research and offshore asset management.

Report Coverage:

The research report offers an in-depth analysis based on by component, connectivity, technology, application, end-user, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise for secure, low-latency communication in naval and underwater defense systems

- Adoption of AI-driven signal processing will enhance adaptive communication performance

- Integration with autonomous underwater vehicles will expand operational deployment

- Coastal nations will invest in subsea surveillance and environmental monitoring networks

- Hybrid communication systems will gain popularity for their flexibility across use cases

- Optical modems will improve in range and stability for short-distance high-data tasks

- Energy-efficient and compact systems will support long-duration and mobile applications

- Oceanographic institutions will increase use of sensor-based real-time communication

- Market entry will remain limited to firms with advanced acoustic and marine expertise

- Government-backed innovation programs will continue to shape regional market dynamics