| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Book Paper Market Size 2024 |

USD 2,907.07 Million |

| U.S. Book Paper Market, CAGR |

4.47% |

| U.S. Book Paper Market Size 2032 |

USD 4,123.77 Million |

Market Overview:

The U.S. Book Paper Market is projected to grow from USD 2,907.07 million in 2024 to an estimated USD 4,123.77 million by 2032, with a compound annual growth rate (CAGR) of 4.47% from 2024 to 2032.

The U.S. book paper market is driven by several key factors, with the primary driver being the robust demand from the education sector. The reliance on printed textbooks and academic materials in schools, colleges, and universities ensures a continuous need for book paper. Additionally, the publishing industry plays a significant role, with major U.S.-based publishers like Penguin Random House and HarperCollins contributing to the market demand. Despite the rise of digital content, a large consumer base still prefers printed books, especially for educational materials, fiction, and other literary works. This ongoing preference for physical books, coupled with the growing trend for sustainable paper products, is further propelling the market. Publishers are increasingly adopting eco-friendly materials such as recycled and sustainably sourced papers in response to both consumer demand and environmental regulations.

Regionally, the U.S. holds a dominant position in the global book paper market, contributing significantly to the North American region’s market share. North America is expected to maintain its leadership, accounting for a substantial portion of the global book paper demand, primarily driven by the high number of publishing houses and educational institutions in the U.S. However, the market is not without its challenges. Recent trade policies and tariffs, particularly those affecting imports of raw materials and printing services from international markets, have introduced some cost uncertainties for publishers. Moreover, stringent environmental regulations in the U.S. are pushing the book paper industry towards more sustainable practices, influencing both production and consumption patterns. These factors, along with the growing push for sustainability, will shape the future trajectory of the market in the U.S.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Book Paper Market is projected to grow from USD 2,907.07 million in 2024 to USD 4,123.77 million by 2032, driven by steady demand from educational institutions.

- The Global Book Paper Market is projected to grow from USD 10,203.76 million in 2024 to USD 14,364.15 million by 2032, with a CAGR of 4.37%, driven by increasing demand for printed educational materials and books worldwide.

- The education sector is the primary driver, as schools, colleges, and universities rely on printed textbooks and academic materials, fueling continuous demand for book paper.

- Despite the rise of digital content, consumer preference for printed books remains strong, especially in educational, literary, and fiction genres, supporting ongoing demand for high-quality paper.

- Sustainability trends are driving growth in eco-friendly and recycled paper products, as both consumers and publishers focus on reducing the environmental impact of paper production.

- Technological advancements in paper production, such as improvements in manufacturing processes and coating techniques, have made book paper more durable and cost-efficient.

- The increasing popularity of e-books, audiobooks, and digital formats poses a challenge to the book paper market, as more consumers opt for digital reading options.

- Rising raw material costs, particularly for wood pulp, are affecting production costs, placing financial pressure on publishers and potentially leading to higher book prices for consumers.

Market Drivers:

Demand from the Education Sector

The U.S. education sector remains one of the primary drivers of the book paper market. With a large number of educational institutions, including primary schools, colleges, and universities, there is an ongoing need for printed textbooks, academic journals, and other educational materials. For instance, according to the National Center for Education Statistics (NCES), in 2022, approximately 49.6 million students were enrolled in public elementary and secondary schools across the United States. These materials, which often require specialized paper grades for durability and quality, fuel demand for book paper. Additionally, the growing focus on educational accessibility and literacy across the country sustains this demand. As educational content continues to be essential, particularly for students who rely on physical textbooks, the U.S. book paper market remains robust and is expected to maintain steady growth due to the educational sector’s substantial paper consumption.

Consumer Preference for Printed Books

Despite the increasing adoption of digital media, there remains a strong preference for physical books among U.S. consumers. Many readers, particularly those in literary and educational markets, still prefer the tactile experience of printed books, which are often perceived as more personal and collectible. This preference extends to various genres, including fiction, non-fiction, and textbooks, where readers continue to favor printed versions over digital formats. As a result, the demand for high-quality book paper persists, driving the market forward. This continued consumer demand for printed materials ensures that publishers continue to require substantial quantities of paper to meet production needs.

Sustainability and Environmental Considerations

Sustainability has become a key focus for both consumers and companies in the U.S. book paper market. The increasing consumer demand for eco-friendly products has led to the adoption of recycled and sustainably sourced paper in the production of books. Publishers and manufacturers are aligning with environmental standards to reduce the ecological impact of paper production. This trend is further supported by regulatory pressures that promote the use of recycled content and environmentally friendly production methods. As sustainability becomes a core value for businesses and consumers alike, the demand for eco-conscious book paper is expected to increase, influencing market dynamics.

Technological Advancements and Innovations in Paper Production

Advancements in paper production technologies have also contributed to the growth of the U.S. book paper market. Improvements in paper manufacturing processes, such as the development of more durable and cost-efficient paper, have made it easier and more affordable to produce high-quality book paper. Innovations in paper coating techniques, for example, have enhanced the printability and longevity of books, particularly in the educational and publishing sectors. These technological advancements not only improve the quality of book paper but also increase production efficiency, allowing publishers to meet growing demand at competitive prices. The ongoing development of new paper products will continue to drive market growth by offering enhanced options to meet evolving consumer preferences.

Market Trends:

Shift Towards Digitalization and E-books

One of the prominent trends shaping the U.S. book paper market is the increasing shift towards digitalization and e-books. As more readers opt for digital formats, the demand for physical books, including paperbacks and hardcover editions, has been tempered. E-books and audiobooks have gained significant traction, especially among younger demographics, due to their convenience and ease of access. This trend has led publishers to reevaluate their print runs and adopt hybrid models that include both digital and printed versions of books. While the printed book industry still holds a considerable market share, the growing acceptance of digital formats is gradually reshaping consumer preferences, affecting the demand for book paper.

Growth in Independent and Self-Publishing

The rise of independent and self-publishing is another significant trend influencing the U.S. book paper market. With the increasing availability of online platforms such as Amazon’s Kindle Direct Publishing, many authors are opting to self-publish their work instead of going through traditional publishers. This trend has led to a surge in the number of printed books being produced by smaller, independent publishers, driving demand for book paper. Self-published authors typically rely on print-on-demand services, which reduces waste and enhances production efficiency. The growing number of self-published books, especially in niche genres, is expected to continue fueling demand for book paper in the coming years.

Preference for Eco-friendly and Sustainable Paper

As sustainability becomes an increasingly important consumer and corporate value, the U.S. book paper market is witnessing a significant trend toward eco-friendly and sustainable materials. Consumers are more aware of the environmental impacts of paper production, pushing for books to be made from recycled or sustainably sourced paper. Publishers are responding to this demand by opting for paper that adheres to environmental standards, such as certifications from the Forest Stewardship Council (FSC). For instance, Macmillan USA reports that 80% of its directly sourced paper for trade books comes from sawmill residuals and is certified by FSC, SFI, or PEFC standards. Additionally, innovations in biodegradable and eco-friendly coatings have allowed the production of high-quality paper with a reduced environmental footprint. This growing emphasis on sustainability is reshaping the production processes within the book paper industry.

Technological Advancements in Printing Techniques

Technological advancements in printing and paper manufacturing are playing a critical role in the U.S. book paper market. Innovations such as digital printing technologies, which offer shorter print runs and faster turnaround times, are transforming how books are produced. For instance, according to Printing Impressions, digital inkjet technology supports on-demand printing, reducing inventory and waste, and is particularly beneficial for niche titles and self-published works. These advancements allow publishers to print books on demand, reducing excess inventory and minimizing waste. Additionally, improvements in paper quality, including advancements in paper coatings and weight, have enhanced the printing process, resulting in higher-quality finished products. The integration of automation and smart technologies in paper production is also helping manufacturers increase operational efficiency and reduce costs, which is benefiting the overall book paper industry.

Market Challenges Analysis:

Impact of Digital Substitution

One of the key restraints facing the U.S. book paper market is the increasing substitution of printed books with digital formats. As e-books, audiobooks, and online publications continue to grow in popularity, particularly among tech-savvy and younger generations, the demand for physical books has experienced a decline. While printed books are still in demand, the growing preference for digital content presents a significant challenge for the book paper industry. This trend is likely to continue as more consumers embrace the convenience, cost-effectiveness, and portability of digital reading options.

Rising Paper Costs

The U.S. book paper market is also challenged by rising raw material costs. Fluctuations in the price of wood pulp, a primary component of book paper, directly impact production costs for publishers and paper manufacturers. Furthermore, import tariffs have exacerbated these cost challenges. For instance, US imports a significant amount of paper, with Canada being a major supplier. Additionally, environmental regulations and sustainability practices are driving up the cost of producing eco-friendly and recycled paper, which has become increasingly important to consumers and businesses. These rising costs create financial pressures within the book publishing industry, particularly for smaller publishers and independent authors, who may struggle with higher production expenses. As a result, increased paper costs may ultimately lead to higher prices for consumers, reducing the demand for printed books.

Environmental Regulations and Compliance

While sustainability has become a driving force for the industry, it also presents a challenge for paper manufacturers in the U.S. Stringent environmental regulations, such as emissions controls and recycling mandates, increase production costs and complicate manufacturing processes. Compliance with these regulations requires investments in eco-friendly technologies, waste management systems, and sustainable sourcing practices. Although these regulations are essential for long-term environmental protection, they represent a financial and operational burden for companies that must adapt to these evolving standards. This added complexity can hinder the growth of the book paper market, particularly for smaller players who may lack the resources to comply.

Market Opportunities:

The U.S. book paper market presents significant opportunities in the growing demand for sustainable and eco-friendly paper products. As environmental consciousness increases among consumers, publishers are under pressure to adopt more sustainable practices in their production processes. This includes the use of recycled paper, sustainably sourced raw materials, and biodegradable coatings. Paper manufacturers that invest in green technologies and certifications such as FSC (Forest Stewardship Council) can differentiate themselves in a competitive market. By catering to this increasing demand for sustainability, companies can tap into a growing niche of environmentally conscious consumers and publishers, positioning themselves as leaders in the eco-friendly paper segment.

Another key opportunity for the U.S. book paper market lies in the rise of self-publishing and print-on-demand services. The ease of publishing through digital platforms has led to a surge in independent authors and smaller publishing houses, all of whom require printed materials. Print-on-demand technology, which allows books to be printed in smaller quantities as needed, helps reduce waste and inventory costs while providing flexibility for authors and publishers. This trend is expected to continue, with self-publishing becoming more mainstream. As a result, the demand for book paper from these smaller, independent publishers will increase, providing a steady revenue stream for paper manufacturers that can meet the specific needs of this growing market segment.

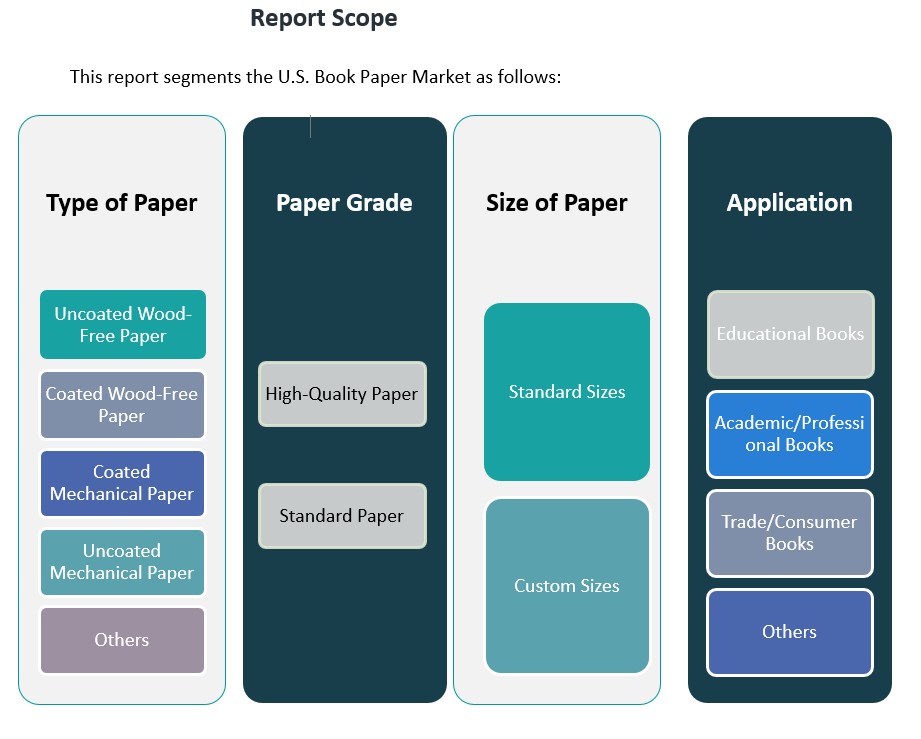

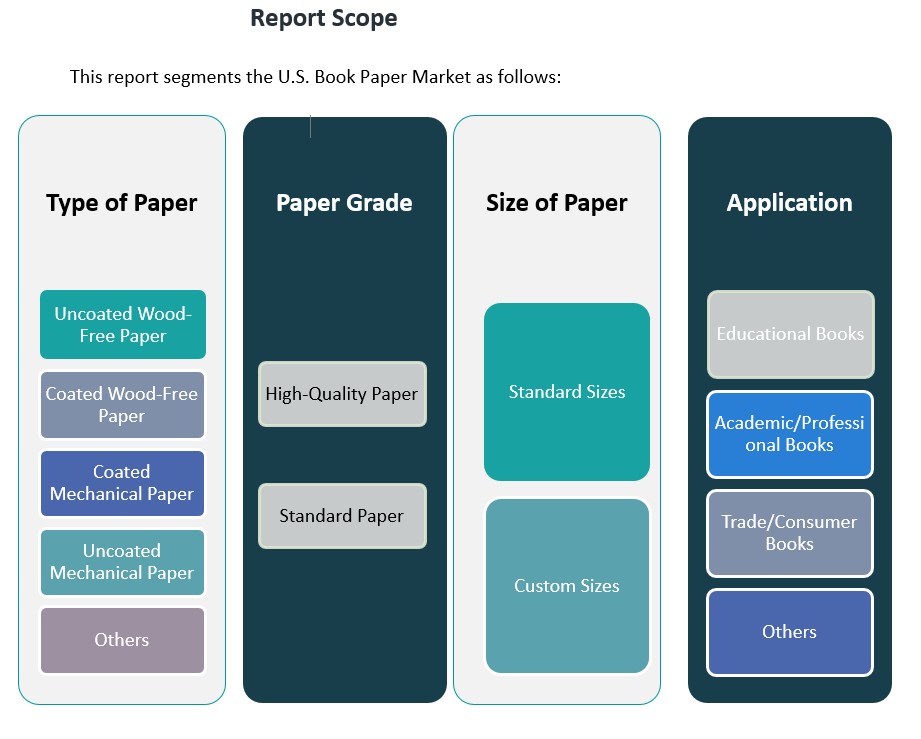

Market Segmentation Analysis:

The U.S. book paper market is divided into several key segments based on paper type, grade, size, and application.

By Type of Paper

The market is dominated by Uncoated Wood-Free Paper, which is widely used for high-quality printed books, particularly in the educational and professional sectors. Coated Wood-Free Paper is also significant, offering a glossy finish suitable for premium trade books. Coated Mechanical Paper is commonly used for books with less emphasis on print quality, often in high-volume consumer publications. Uncoated Mechanical Paper is utilized in mass-market printing, offering a more cost-effective alternative. The Others category includes specialty papers used for specific printing needs, such as textured or eco-friendly papers.

By Paper Grade

The U.S. book paper market can also be segmented by High-Quality Paper and Standard Paper. High-quality paper, typically used for premium books, offers better durability, print clarity, and a superior feel. In contrast, standard paper is more economical and is used in mass production of trade and academic books.

By Size of Paper

The market includes Standard Sizes, such as A4 and letter sizes, widely used in educational and trade books. Custom Sizes cater to niche markets, offering flexibility for specialty publishers or specific product designs.

By Application

The primary applications include Educational Books, which account for a significant portion of demand, particularly in the K-12 and higher education sectors. Academic/Professional Books also contribute to market growth, while Trade/Consumer Books remain a vital segment. The Others category includes specialized books such as art books and graphic novels.

Segmentation:

By Type of Paper:

- Uncoated Wood-Free Paper

- Coated Wood-Free Paper

- Coated Mechanical Paper

- Uncoated Mechanical Paper

- Others

By Paper Grade:

- High-Quality Paper

- Standard Paper

By Size of Paper:

- Standard Sizes

- Custom Sizes

By Application:

- Educational Books.

- Academic/Professional Books

- Trade/Consumer Books

- Others

Regional Analysis:

The U.S. book paper market exhibits significant regional variation, influenced by factors such as population density, educational infrastructure, and publishing activity. While specific market share percentages by region are not readily available, a general overview can be provided based on industry trends and data.

Northeast Region

The Northeast, encompassing states like New York, New Jersey, and Pennsylvania, is a major hub for the U.S. book paper market. New York City, in particular, serves as a publishing epicenter, housing numerous publishing houses and literary agencies. The region’s dense population and high literacy rates contribute to a substantial demand for both educational and trade books, driving the need for various types of book paper.

Midwest Region

The Midwest, including states such as Illinois, Ohio, and Michigan, plays a pivotal role in the book paper market due to its strong manufacturing base and central location. Cities like Chicago are home to major printing and publishing companies, facilitating efficient distribution across the country. The region’s educational institutions further bolster the demand for academic and professional books, influencing the consumption of book paper.

South Region

The South, covering states like Texas, Florida, and Georgia, has a growing influence on the book paper market. The region’s expanding population and educational initiatives increase the demand for educational materials. Additionally, the rise of self-publishing and digital platforms has led to a surge in print-on-demand services, affecting paper consumption patterns.

West Region

The West, including California, Washington, and Oregon, is characterized by a diverse publishing landscape. California, with cities like Los Angeles and San Francisco, is home to a wide array of publishers, from large corporations to independent presses. The region’s tech-savvy population and emphasis on sustainability drive the demand for eco-friendly and innovative paper products.

Key Player Analysis:

- International Paper

- Georgia-Pacific

- WestRock

- Domtar

- Verso Corporation

Competitive Analysis:

The U.S. book paper market is highly competitive, with key players including major paper manufacturers, publishers, and paper converters. Leading companies such as International Paper, Georgia-Pacific, and WestRock dominate the production of paper products, offering a wide range of book papers for educational, academic, and trade publishing. These players benefit from economies of scale, extensive distribution networks, and a strong presence in both traditional and eco-friendly paper segments. Smaller, specialized players also contribute to the market, focusing on niche applications such as high-quality, recycled, and sustainably sourced papers. Innovations in paper production, such as advancements in digital printing and sustainable paper solutions, further intensify competition. Publishers and printers are increasingly seeking partnerships with manufacturers that offer flexible, cost-efficient, and environmentally responsible paper products to meet the growing consumer demand for sustainable publishing practices. As sustainability and digitalization continue to reshape the market, competition will focus on innovation and adaptability.

Recent Developments:

- In January 2025, International Paper completed the acquisition of DS Smith, creating a global leader in sustainable packaging with a strong focus on the North American and European markets. This acquisition is expected to generate at least $514 million in synergies and is immediately accretive to earnings per share. The integration of DS Smith enhances International Paper’s product offerings, innovation, and geographic reach, positioning the company for accelerated growth and improved profitability. The new shares of International Paper began trading on February 4, 2025, on both the New York and London Stock Exchanges.

- In November 2024, Domtar acquired Iconex Paper, the world’s leading low-cost provider of paper receipt solutions, from Atlas Holdings. This acquisition strengthens Domtar’s position in the North American point-of-sale paper business, integrating Iconex’s five North American locations and enhancing operational and supply chain excellence for receipt paper products.

- in April 2025, Domtar extended its long-term strategic distribution agreement with Pacific Woodtech Corporation (PWT). Under this partnership, Domtar will manufacture I-joists at its engineered wood facilities, which PWT will distribute under its brand, expanding both companies’ market presence and product portfolios.

Market Concentration & Characteristics:

The U.S. book paper market exhibits moderate concentration, with a few large players dominating the production of paper products. Major companies such as International Paper, Georgia-Pacific, and WestRock account for a significant portion of market share, benefiting from economies of scale, extensive supply chains, and established customer bases. These industry giants control much of the manufacturing capacity for both coated and uncoated book paper, offering a variety of grades to meet diverse publishing needs. Despite this concentration, the market also features smaller, specialized producers who focus on niche segments such as recycled paper, eco-friendly options, and high-quality materials for premium books. The market is characterized by ongoing innovation, particularly in sustainable practices, with manufacturers increasingly adopting environmentally friendly production processes. As demand for eco-conscious products grows, competition is likely to intensify, requiring even the largest players to adapt to changing consumer preferences and technological advancements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type of paper, paper grade, size of paper, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. book paper market is expected to experience moderate growth driven by consistent demand from educational and publishing sectors.

- Increased adoption of sustainable paper products will shape the future, as consumers and publishers prioritize eco-friendly materials.

- Digital printing technologies and print-on-demand services will lead to more efficient production methods, reducing waste and cost.

- Rising demand for high-quality book paper in educational and academic publications will support the market’s expansion.

- Self-publishing trends will continue to grow, increasing the need for book paper from independent authors and smaller publishers.

- The shift towards e-books may moderate growth, but printed books will remain popular in key genres such as fiction and education.

- The market will see increased competition as smaller, specialized manufacturers focus on niche paper products and sustainability.

- Environmental regulations will drive manufacturers to innovate, balancing production efficiency with eco-conscious practices.

- The Midwest and Northeast regions will continue to lead in market activity due to their strong publishing infrastructure.

- The U.S. market will see a growing focus on custom-sized book paper, catering to diverse publishing requirements.