Market Overview

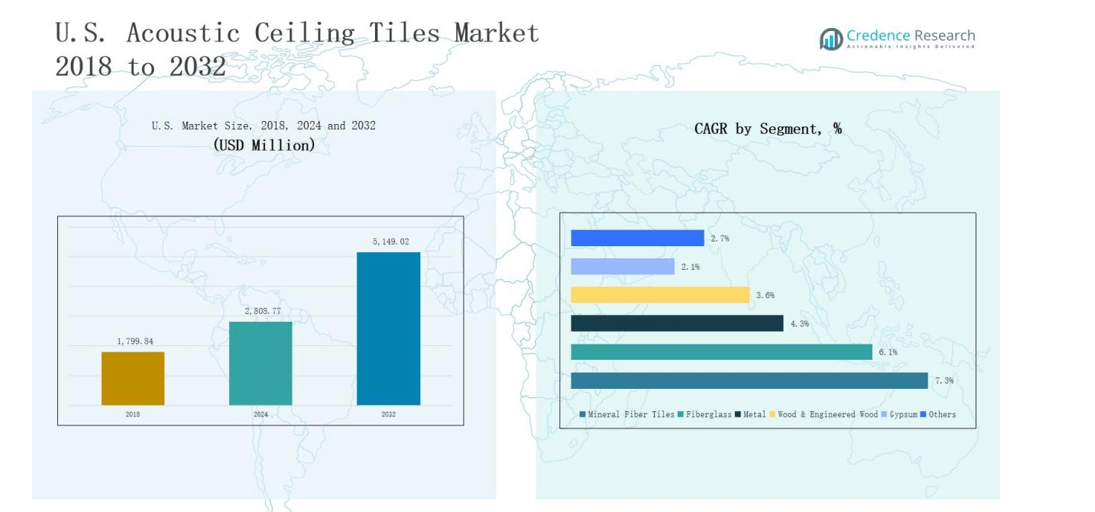

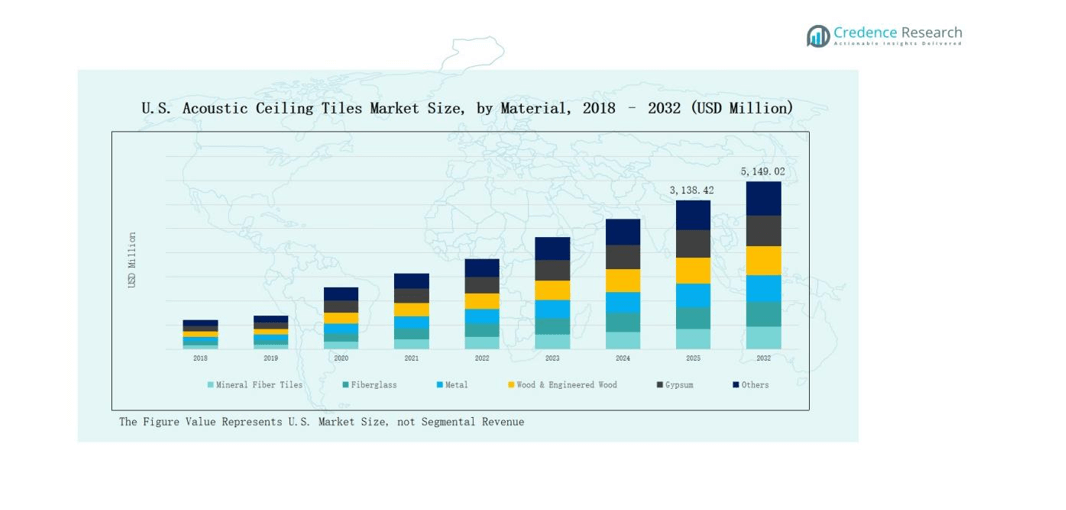

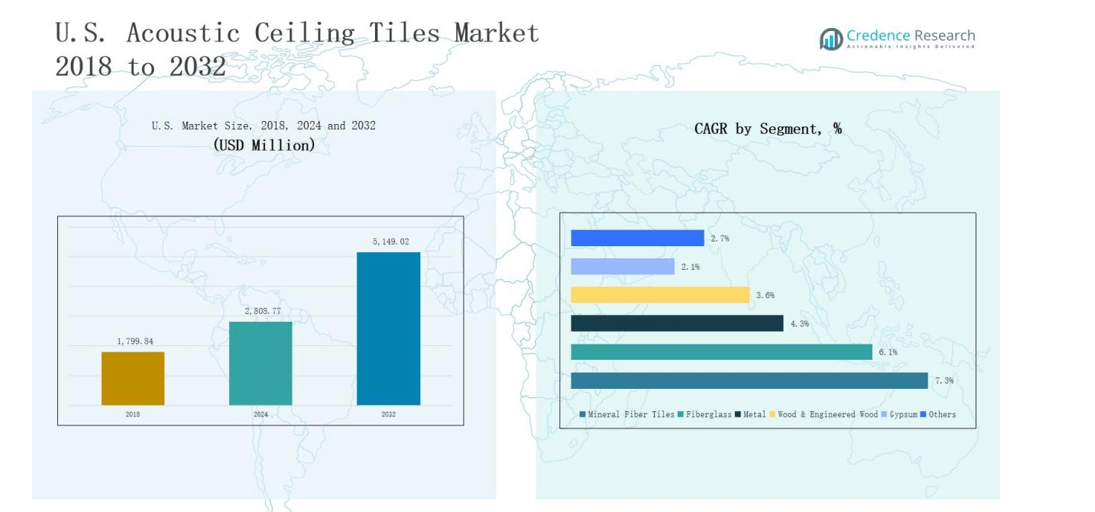

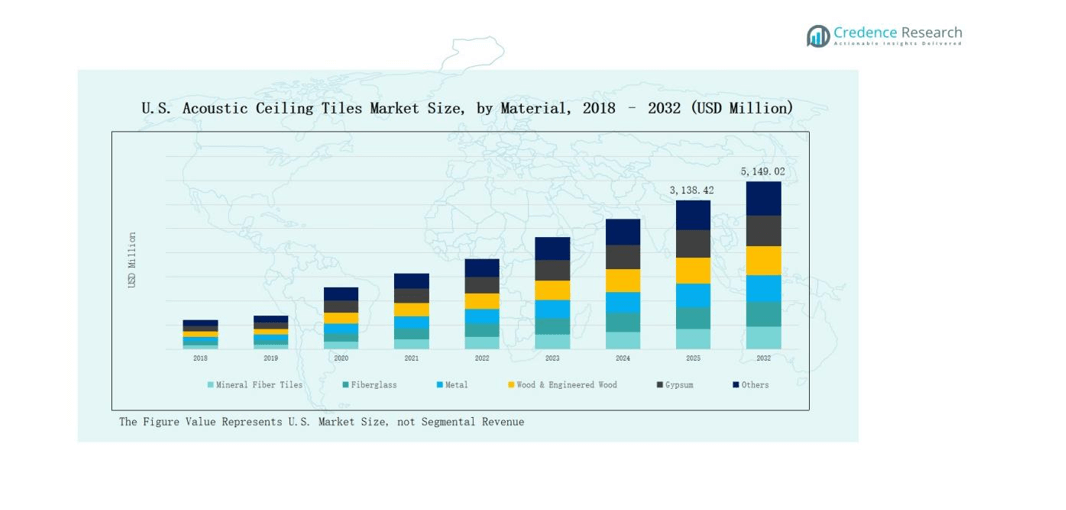

U.S. Acoustic Ceiling Tiles Market size was valued at USD 1,799.84 million in 2018, reached USD 2,808.77 million in 2024, and is anticipated to reach USD 5,149.02 million by 2032, growing at a CAGR of 7.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Acoustic Ceiling Tiles Market Size 2024 |

USD 2,808.77 million |

| U.S. Acoustic Ceiling Tiles Market, CAGR |

7.33% |

| U.S. Acoustic Ceiling Tiles Market Size 2032 |

USD 5,149.02 million |

The U.S. Acoustic Ceiling Tiles Market is shaped by leading companies such as Armstrong World Industries, USG Corporation, CertainTeed (Saint-Gobain), Rockfon, Hunter Douglas, SAS International, Ceilume, OWA Ceiling Systems Inc., Acoustical Surfaces, and Autex Acoustics. These players compete through product innovation, sustainable material development, and strategic partnerships with architects and contractors to strengthen their market presence. Armstrong World Industries and USG Corporation hold strong positions with extensive mineral fiber and fiberglass portfolios, while Rockfon and CertainTeed focus on premium solutions. The South region emerged as the leading market in 2024, commanding 31% share, driven by rapid urbanization, large-scale commercial projects, and expanding institutional infrastructure.

Market Insights

- The U.S. Acoustic Ceiling Tiles Market grew from USD 1,799.84 million in 2018 to USD 2,808.77 million in 2024 and is expected to reach USD 5,149.02 million by 2032.

- Mineral fiber tiles led with 41.2% share in 2024, supported by strong acoustic insulation, fire resistance, and cost efficiency, making them the preferred choice in institutional and commercial buildings.

- Suspended ceiling tiles dominated with 63.5% share in 2024, driven by flexibility, easy maintenance, and widespread use across offices, schools, and healthcare facilities nationwide.

- Building contractors accounted for 46.7% share in 2024, reflecting their pivotal role in material selection for new construction and renovation activities across commercial and residential sectors.

- The South region led with 31% share in 2024, supported by urbanization, large-scale projects in Texas and Florida, and growing adoption of premium designs in retail and hospitality.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

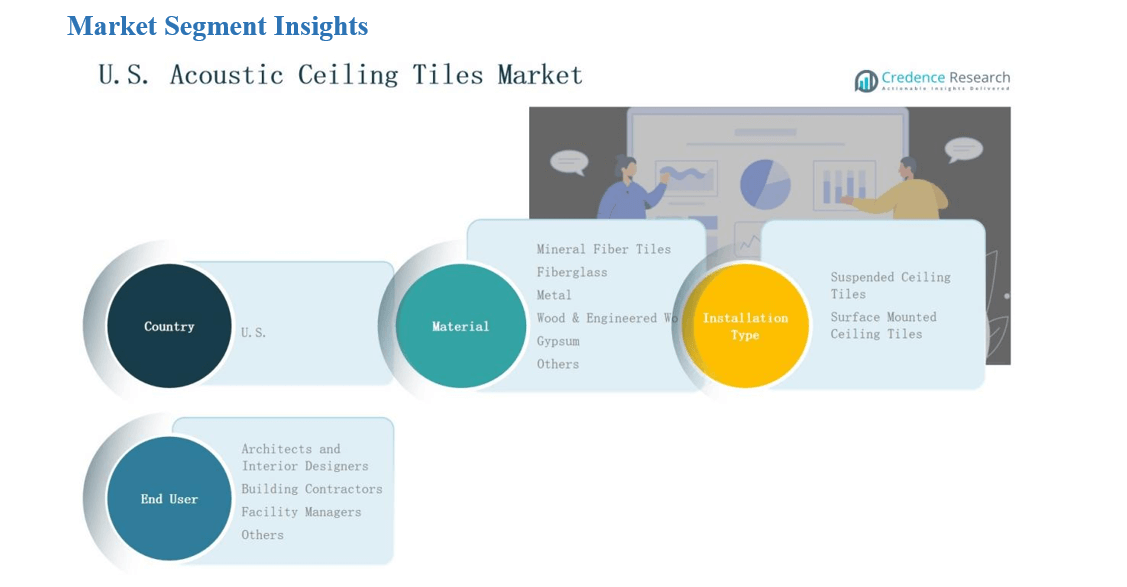

Market Segment Insights

By Material

Mineral fiber tiles held the dominant share of 41.2% in the U.S. acoustic ceiling tiles market in 2024. Their strong acoustic insulation, cost-effectiveness, and fire-resistant properties drive adoption in commercial and institutional projects. Fiberglass follows due to lightweight construction and design flexibility, while metal and wood variants cater to premium aesthetics. Gypsum tiles gain traction in residential applications for durability. The “others” category includes composites addressing niche needs, but mineral fiber tiles remain the primary choice across diverse construction projects.

- For instance, Armstrong World Industries expanded its mineral fiber ceiling tile line with enhanced acoustical control solutions targeted at healthcare and education facilities.

By Installation Type

Suspended ceiling tiles accounted for 63.5% share in 2024, making them the leading installation type in the U.S. market. Their easy maintenance, flexibility for electrical and HVAC integration, and widespread use in offices, schools, and healthcare facilities drive this dominance. Surface-mounted ceiling tiles, though less common, gain use in small-scale renovations where suspended frameworks are not feasible. Demand for suspended designs continues to grow with large-scale commercial developments and retrofitting projects across urban regions.

- For instance, Armstrong World Industries introduced its Sustain portfolio of ceiling panels designed for schools and offices, emphasizing sustainable materials and integration with modern HVAC systems.

By End User

Building contractors dominated the market with a 46.7% share in 2024, reflecting their strong role in selecting cost-efficient and performance-driven materials for projects. Architects and interior designers follow closely, driving demand for premium finishes and sustainable materials in high-end commercial and residential projects. Facility managers represent a steady segment focused on replacement and maintenance. The “others” category includes DIY users and small-scale builders. Building contractors’ purchasing influence secures their leading position across new construction and renovation activities.

Market Overview

Rising Commercial Construction Projects

The U.S. market benefits from sustained demand in commercial construction, including office spaces, healthcare facilities, and educational institutions. Acoustic ceiling tiles are essential for sound absorption, compliance with building codes, and improved occupant comfort. Government infrastructure initiatives and private real estate investments reinforce this growth. The preference for efficient designs that balance aesthetics with functionality keeps mineral fiber and fiberglass tiles in high demand, cementing their role as the standard choice across high-volume commercial developments.

- For instance, USG’s Soft Fiber ceiling tiles provide NRC values close to 1.0 along with high ceiling attenuation, widely used in healthcare and educational buildings for privacy and noise reduction.

Focus on Energy Efficiency and Sustainability

Increasing focus on green building certifications such as LEED and WELL is boosting adoption of eco-friendly ceiling solutions. Acoustic ceiling tiles made from recycled content, low-emission materials, and sustainable composites meet regulatory standards while enhancing market appeal. Rising corporate sustainability targets and consumer awareness also drive demand for such products. Manufacturers respond with advanced offerings that combine acoustic performance with environmental responsibility, aligning with the U.S. construction industry’s shift toward sustainable and energy-efficient designs.

- For instance, Gyproc by Saint-Gobain provides gypsum boards and ceiling tiles certified under Green-Pro standards that align with corporate sustainability targets and regulatory requirements.

Urban Renovation and Retrofit Demand

Urbanization and the aging building stock across major U.S. cities create strong demand for renovation projects. Retrofitting ceilings with acoustic tiles provides cost-effective noise reduction and aesthetic improvements without extensive structural changes. Schools, offices, and healthcare facilities lead this trend, focusing on modernizing interiors while maintaining budgets. Facility managers and contractors favor suspended ceiling systems due to their adaptability and quick installation. This retrofit momentum drives steady growth, particularly in dense urban regions undergoing commercial and institutional upgrades.

Key Trends & Opportunities

Integration of Smart and Modular Designs

The U.S. market is witnessing rising demand for modular acoustic ceiling tiles that integrate lighting, sensors, and air filtration systems. These multifunctional ceilings address energy efficiency, aesthetics, and workplace wellness simultaneously. Manufacturers see opportunity in offering customizable designs that support flexible office layouts and smart building technologies. Modular innovations also appeal to facility managers seeking scalable solutions for renovations. This trend positions ceiling systems as integral to broader smart infrastructure development.

- For instance, Vibe by Vision offers smart acoustic ceiling tiles embedded with sensors that detect temperature and humidity, enabling building management systems to optimize acoustics and air quality automatically.

Premiumization and Aesthetic Appeal

An increasing opportunity lies in premium tiles offering superior aesthetics alongside acoustic performance. Metal and wood-based ceiling tiles are gaining traction in luxury offices, hospitality, and retail spaces where design is as critical as functionality. Architects and interior designers drive this demand by specifying high-end finishes to meet client expectations. The combination of durability, customization, and modern aesthetics provides manufacturers with lucrative opportunities to target niche but profitable market segments within the U.S. construction industry.

- For instance, CertainTeed expanded its Ecophon® Focus™ range, offering customizable premium ceiling tiles designed for both acoustics and visual appeal in high-end hospitality projects.

Key Challenges

High Installation and Maintenance Costs

The adoption of acoustic ceiling tiles in the U.S. faces restraint from high installation and ongoing maintenance costs. While suspended ceilings dominate due to their utility, they require significant labor and material investments. Small-scale projects and budget-sensitive institutions often hesitate to adopt premium ceiling solutions. Regular cleaning and replacement needs also increase lifecycle expenses. This cost barrier reduces adoption in low-budget renovations and residential projects, limiting market penetration beyond core commercial applications.

Competition from Alternative Solutions

Alternative soundproofing and interior design options, such as acoustic wall panels, spray-applied insulation, and drywall systems, challenge the growth of ceiling tiles. These substitutes often offer similar acoustic benefits at lower costs or with easier installation. Architects and contractors sometimes prefer these solutions in projects with limited ceiling height or structural constraints. As alternative materials evolve with better performance, the competitive pressure on acoustic ceiling tiles intensifies, requiring manufacturers to differentiate through innovation and value-added features.

Volatility in Raw Material Prices

Price fluctuations in raw materials, particularly mineral fiber, metal, and gypsum, create challenges for manufacturers in the U.S. acoustic ceiling tiles market. Supply chain disruptions, rising energy costs, and global trade uncertainties add to pricing volatility. Frequent adjustments in procurement and production costs affect profit margins, forcing companies to increase product prices. This volatility makes it difficult for contractors and distributors to plan budgets effectively, potentially slowing down adoption in cost-sensitive market segments.

Regional Analysis

Northeast

The Northeast accounted for 28% share of the U.S. Acoustic Ceiling Tiles Market in 2024. Strong demand arises from commercial real estate development in New York, Boston, and Philadelphia. Renovation of aging institutional buildings supports steady adoption of mineral fiber and fiberglass tiles. Architects emphasize sustainability standards, which drive demand for eco-friendly ceiling materials. The presence of large educational and healthcare institutions ensures long-term growth. It remains a leading market due to a balance of new construction and retrofit projects.

Midwest

The Midwest held 22% share of the market in 2024, supported by industrial hubs and expanding office spaces. Cities such as Chicago and Detroit record strong demand for suspended ceiling tiles. Facility managers in manufacturing-heavy states focus on cost-efficient acoustic solutions to enhance work environments. The regional construction sector emphasizes durable products, creating opportunities for gypsum and metal-based tiles. It continues to attract investments in commercial infrastructure. The market reflects a strong balance between affordability and performance.

South

The South led with 31% share of the U.S. Acoustic Ceiling Tiles Market in 2024. Rapid urbanization, population growth, and large-scale commercial projects in Texas, Florida, and Georgia fuel demand. Architects and contractors adopt premium wood and metal ceiling tiles in luxury retail and hospitality spaces. High demand in educational institutions further expands the use of mineral fiber tiles. The region also benefits from favorable construction activity driven by corporate relocations. It remains the fastest-growing contributor with both urban and suburban projects.

West

The West captured 19% share of the market in 2024, supported by California’s strong real estate and technology sectors. Demand for acoustic ceiling tiles is driven by modern office spaces, healthcare expansions, and sustainability mandates. Architects in the region prefer advanced fiberglass and modular tile systems to align with smart building practices. Premium designs hold traction in retail and entertainment projects. It benefits from eco-conscious construction trends and strict energy codes. The region continues to show growth through innovation-led adoption.

Market Segmentations:

By Material

- Mineral Fiber Tiles

- Fiberglass

- Metal

- Wood & Engineered Wood

- Gypsum

- Others

By Installation Type

- Suspended Ceiling Tiles

- Surface Mounted Ceiling Tiles

By End User

- Architects and Interior Designers

- Building Contractors

- Facility Managers

- Others

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. Acoustic Ceiling Tiles Market is highly competitive, characterized by the presence of global leaders and regional specialists. Key players such as Armstrong World Industries, USG Corporation, CertainTeed (Saint-Gobain), and Rockfon dominate with strong distribution networks, advanced product portfolios, and established relationships with architects and contractors. Their focus on mineral fiber and fiberglass tiles secures broad adoption in commercial and institutional projects. Companies like Hunter Douglas, SAS International, Ceilume, OWA Ceiling Systems Inc., and Autex Acoustics strengthen competition by offering premium wood, metal, and modular solutions targeting niche segments. The landscape reflects intense emphasis on innovation, with firms introducing sustainable, lightweight, and energy-efficient ceiling systems that align with evolving green building standards. Strategic mergers, partnerships, and product diversification remain central to market positioning. It continues to attract new entrants in design-driven and eco-friendly categories, further intensifying competition and shaping long-term growth opportunities across U.S. construction sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In September 2025, Armstrong World Industries acquired Geometrik, a maker of wood acoustical ceiling and wall systems.

- In August 2024, WAVE, the joint venture of Armstrong and Worthington, acquired the assets of Data Center Resources to expand modular aisle containment and ceiling solutions.

- In November 2023, Swedish brand BAUX introduced its Acoustic Pulp Bio Colour panels to the U.S. market.

Report Coverage

The research report offers an in-depth analysis based on Material, Installation Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for mineral fiber tiles will continue leading due to cost efficiency and acoustic strength.

- Fiberglass tiles will gain traction with rising preference for lightweight and flexible ceiling solutions.

- Premium wood and metal tiles will expand in luxury offices, retail, and hospitality projects.

- Renovation and retrofit projects in schools and hospitals will drive consistent replacement demand.

- Green building standards will push manufacturers to introduce eco-friendly and recyclable tile options.

- Smart modular ceiling systems integrating lighting and sensors will see wider adoption.

- Building contractors will remain the largest end-user group influencing material choice.

- Architects and designers will shape premium segment growth with emphasis on aesthetics.

- Facility managers will sustain steady demand through maintenance and upgrade cycles.

- Regional growth will remain strongest in the South, driven by large-scale commercial construction.