| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Digital Oilfield Solutions Market Size 2024 |

USD 9,156.79 Million |

| U.S. Digital Oilfield Solutions Market, CAGR |

7.35% |

| U.S. Digital Oilfield Solutions Market Size 2032 |

USD 16,145.31 Million |

Market Overview

The U.S. Digital Oilfield Solutions Market is projected to grow from USD 9,156.79 million in 2024 to an estimated USD 16,145.31 million by 2032, with a compound annual growth rate (CAGR) of 7.35% from 2025 to 2032. This growth reflects the increasing adoption of advanced technologies aimed at enhancing operational efficiency and productivity within the oil and gas sector.

Key drivers fueling this expansion include the industry’s need to optimize production from mature oilfields and the integration of technologies such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics. These innovations facilitate real-time monitoring and decision-making, leading to improved asset performance and safety. Additionally, the shift toward cloud-based solutions offers scalability and flexibility, further propelling market growth.

Geographically, North America, particularly the United States, holds a significant share of the digital oilfield market, driven by technological advancements and substantial onshore and offshore oilfield operations. Prominent industry players contributing to this market include Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, and Siemens Energy AG. These companies are at the forefront of providing innovative solutions that enhance oilfield operations and efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Digital Oilfield Solutions Market is expected to grow from USD 9,156.79 million in 2024 to USD 16,145.31 million by 2032, with a CAGR of 7.35% from 2025 to 2032.

- The Global Digital Oilfield Solutions Market is projected to grow from USD31,374.00 million in 2024 to USD 54,897.18 million by 2032, with a CAGR of 7.24% from 2025 to 2032.

- Increasing adoption of advanced technologies such as AI, IoT, and big data analytics is enhancing operational efficiency and productivity within the oil and gas sector.

- The growing need for optimizing production from mature oilfields and reducing operational costs is propelling the market demand for digital solutions.

- High initial investment and implementation costs for integrating digital technologies can hinder adoption, particularly for smaller oil operators.

- Data security and privacy concerns around the use of cloud-based platforms and real-time data collection pose challenges to market growth.

- North America, especially the U.S., holds the largest share due to significant oilfield operations, both onshore and offshore, and advanced technological adoption.

- The Southern and Western U.S. regions are key contributors to market growth, driven by large-scale oilfield operations and increasing automation in production processes.

Market Drivers

Increase in Demand for Enhanced Oil Recovery (EOR)

As oil reserves become increasingly harder to extract, the industry is turning to enhanced oil recovery (EOR) techniques to maximize production from mature fields. Digital oilfield solutions play a crucial role in improving the efficiency of EOR methods, such as water flooding, gas injection, and thermal recovery. Real-time data collection and analysis, facilitated by digital oilfield technologies, enable operators to better monitor reservoir conditions and adjust their techniques to optimize oil extraction. Advanced sensor technologies and cloud-based solutions provide detailed insights into the reservoir’s behavior and performance, allowing companies to make informed decisions on injection strategies, fluid dynamics, and reservoir management. This increased focus on EOR methods to extract more oil from existing reserves is driving demand for digital oilfield solutions, positioning these technologies as essential to long-term field productivity.

Regulatory Compliance and Sustainability Pressures

Regulatory bodies in the U.S. have implemented stricter environmental regulations and safety standards to mitigate the environmental impact of oil and gas operations. These regulations require oil companies to adopt more efficient and environmentally friendly practices. Digital oilfield solutions are crucial in helping companies comply with these regulations by enabling real-time monitoring of emissions, water usage, and energy consumption. Technologies such as IoT sensors, AI, and cloud-based platforms allow operators to track and report on various environmental parameters with higher accuracy, ensuring compliance with federal and state regulations. Additionally, digital oilfield solutions facilitate a more sustainable approach to oil and gas operations. By optimizing energy use, reducing waste, and minimizing emissions, companies can not only comply with regulations but also improve their overall environmental footprint. This shift towards more sustainable operations is a critical factor driving the growth of the digital oilfield solutions market in the U.S.

Technological Advancements in Digital Oilfield Solutions

The continuous evolution of technology is one of the primary drivers for the growth of the U.S. digital oilfield solutions market. Innovations such as the Internet of Things (IoT), big data analytics, artificial intelligence (AI), and machine learning (ML) are rapidly transforming the oil and gas industry. These technologies enable real-time monitoring, data analytics, and predictive maintenance, which optimize decision-making processes and operational efficiency. With the ability to collect and analyze vast amounts of data from various sensors deployed in the field, oil operators can gain insights into well performance, predict potential failures, and optimize resource utilization. For instance, companies like Aramco have deployed over 40,000 sensors in its Khurais oil field to leverage Big Data analytics and AI. This integration has helped optimize fuel gas consumption and improve maintenance efficiency, resulting in faster troubleshooting and increased production levels. Similarly, ExxonMobil employs AI-driven algorithms to simulate reservoir behavior, enabling better extraction strategies while minimizing risks. The integration of AI-driven predictive maintenance further enhances asset life cycles and reduces downtime. As these technologies become more widespread across the industry, they are expected to boost demand for digital oilfield solutions, making them indispensable for modern oilfield operations.

Improvement in Operational Efficiency and Cost Reduction

In an increasingly competitive and price-sensitive environment, the oil and gas industry faces immense pressure to reduce operational costs while maintaining or increasing production levels. Digital oilfield solutions, such as advanced data analytics, automation technologies, and optimization platforms, offer tangible ways for companies to meet these demands. Automation technologies like robotic process automation (RPA) and automated drilling systems reduce human intervention in hazardous environments, minimizing operational risks while ensuring high safety standards. Predictive analytics enables operators to forecast potential issues before they occur, leading to less downtime and more efficient maintenance schedules. For instance, Royal Dutch Shell utilizes AI for predictive maintenance to significantly reduce downtime and lower maintenance expenses. Additionally, Shell’s use of automation has streamlined supply chain operations and optimized energy consumption across its facilities. These advancements illustrate how digital solutions help companies achieve operational improvements while driving down costs. By reducing risks, improving safety standards, and enhancing energy efficiency, digital oilfield technologies provide a compelling incentive for adoption across the industry. As a result, these solutions are fueling market growth by enabling oil and gas companies to operate more efficiently in an increasingly competitive landscape.

Market Trends

Rise of Remote Monitoring and Automation Technologies

Another significant trend reshaping the U.S. digital oilfield solutions market is the increasing use of remote monitoring and automation technologies. Remote monitoring systems, powered by IoT devices and real-time data analytics, allow operators to track the performance of oilfield equipment and operations without being physically present on-site. This trend is particularly relevant in the context of deepwater and offshore operations, where personnel safety is a concern and operational costs can be high. Remote monitoring helps detect issues such as equipment malfunctions, leaks, or safety risks, enabling operators to take immediate corrective actions without the need for on-site intervention. Furthermore, automation technologies, including automated drilling systems, robotic process automation (RPA), and autonomous vehicles, are improving operational efficiency while reducing human intervention. Automation plays a crucial role in reducing errors, increasing precision, and enhancing overall productivity. The growth of remote monitoring and automation aligns with the industry’s increasing emphasis on safety, cost reduction, and operational efficiency, all of which contribute to the growing adoption of digital oilfield solutions in the U.S.

Emphasis on Sustainability and Environmental Impact Reduction

Sustainability and environmental concerns are becoming key drivers of innovation in the U.S. digital oilfield solutions market. With mounting pressure from regulatory bodies, stakeholders, and the public, oil and gas companies are increasingly focused on reducing their environmental impact. Digital oilfield solutions are crucial in helping companies meet these sustainability goals by providing real-time monitoring of emissions, water consumption, and energy usage. For instance, sensors and AI-based analytics allow operators to track and manage methane emissions, reducing the environmental footprint of oilfield operations. Additionally, digital solutions can optimize energy consumption in various processes, leading to greater energy efficiency and a reduction in greenhouse gas emissions. This trend is being driven by both regulatory requirements and the increasing need for oil companies to demonstrate their commitment to corporate social responsibility (CSR). Moreover, digital solutions facilitate better waste management by optimizing the disposal and recycling of fluids and other by-products from drilling operations. As the U.S. oil and gas sector continues to face pressure for cleaner, more sustainable practices, the trend toward incorporating sustainability into digital oilfield solutions is expected to grow, influencing future market developments.

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

One of the most prominent trends in the U.S. digital oilfield solutions market is the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies. These advancements enable oilfield operators to shift from reactive to proactive management of their operations. AI and ML applications are used for predictive maintenance, anomaly detection, and performance optimization. By analyzing large datasets generated by IoT sensors, AI algorithms can detect patterns that humans may miss and predict potential failures or inefficiencies in the system. For instance, companies like ExxonMobil are using AI to simulate reservoir behavior, maximizing extraction efficiency and recovery rates. AI-driven predictive maintenance also enhances safety by identifying potential hazards early, allowing for proactive measures to prevent accidents. Additionally, Chevron uses machine learning to process seismic data with high accuracy, improving subsurface imaging and oil reserve identification. AI-powered tools can predict equipment malfunctions before they occur, allowing for preemptive repairs that prevent costly downtime. Machine learning algorithms also help optimize drilling operations by continuously learning from historical data and adjusting operations to maximize efficiency. This trend is expected to accelerate as oil companies seek ways to improve operational efficiency and reduce costs by leveraging the power of AI and ML technologies.

Increased Adoption of Cloud-based Solutions

Cloud technology has become a key enabler for digital oilfield solutions, and its adoption is growing rapidly within the U.S. oil and gas industry. Cloud-based platforms offer the scalability and flexibility needed for the extensive data storage and real-time analysis required in digital oilfield operations. By moving away from on-premise solutions to cloud infrastructure, oilfield operators benefit from reduced operational costs, improved accessibility to data, and enhanced collaboration across teams. These platforms facilitate the collection, storage, and processing of vast amounts of real-time data generated by sensors deployed in the field. For example, Aramco has deployed advanced digital solutions at its Khurais oil field, utilizing over 40,000 sensors to monitor more than 500 oil wells. This setup relies on cloud computing for managing and analyzing vast amounts of data, enabling real-time monitoring and predictive maintenance. Cloud solutions also allow operators to access advanced analytics tools, such as predictive models and optimization algorithms, from anywhere, improving decision-making processes. Moreover, cloud-based technologies enhance collaboration across departments by enabling seamless data sharing among stakeholders. As the industry continues to prioritize remote work and real-time decision-making, the trend toward cloud adoption is expected to grow even further, driving efficiency in the digital oilfield solutions market.

Market Challenges

High Initial Investment and Implementation Costs

One of the significant challenges faced by the U.S. digital oilfield solutions market is the high initial investment and implementation costs associated with deploying advanced technologies. While digital solutions promise long-term operational efficiency and cost reduction, the upfront capital required for integrating Internet of Things (IoT) devices, cloud infrastructure, artificial intelligence (AI), and machine learning (ML) algorithms can be prohibitively expensive. Many oil and gas companies, especially smaller operators, may face difficulties in securing the necessary funding for such technology investments. For instance, the integration of IoT devices, cloud infrastructure, AI, and ML algorithms often involves substantial upfront investments. This includes deploying wireless communication systems and sensors in remote fields, where installation complexities further add to the expense. Additionally, specialized expertise and workforce training are required to manage these advanced systems effectively, increasing overall costs. The financial burden is compounded by ongoing maintenance and security measures necessary to ensure operational reliability. The complexity of installing and maintaining these systems often delays adoption, particularly for companies operating under tight budget constraints due to fluctuating oil prices and economic uncertainty. As a result, despite the potential for long-term gains, the high initial costs remain a significant barrier to widespread adoption of digital oilfield technologies in the U.S. market.

Data Security and Privacy Concerns

The increasing reliance on digital technologies and real-time data collection in the oil and gas industry raises significant concerns about data security and privacy. Oilfield operations generate vast amounts of data from sensors, monitoring systems, and AI-driven platforms, much of which is sensitive and proprietary. As digital solutions become more integrated into the daily operations of oilfields, the risk of cyberattacks, data breaches, and unauthorized access to critical information also increases. Ensuring the security of this data is a complex and ongoing challenge for oil and gas companies, as cyber threats become more sophisticated and widespread. Moreover, the integration of cloud platforms, while offering scalability and accessibility, can expose organizations to additional risks if adequate cybersecurity measures are not in place. As regulatory frameworks surrounding data security and privacy continue to evolve, oilfield operators must prioritize robust cybersecurity strategies to protect valuable operational data and comply with industry regulations. The growing importance of data security remains a key challenge to the growth and adoption of digital oilfield solutions in the U.S. market.

Market Opportunities

Expansion of Enhanced Oil Recovery (EOR) Techniques

The increasing focus on maximizing production from mature oilfields presents a significant market opportunity for digital oilfield solutions in the U.S. Enhanced Oil Recovery (EOR) methods, such as gas injection and water flooding, are crucial in extending the life of aging oilfields. Digital oilfield solutions, including real-time monitoring, advanced data analytics, and AI-driven optimization algorithms, play an essential role in improving the efficiency of EOR techniques. By providing operators with detailed insights into reservoir conditions, digital technologies allow for more precise and effective EOR interventions, helping to optimize injection strategies, fluid dynamics, and overall reservoir management. As the need to maximize output from existing reserves intensifies, the demand for digital solutions to enhance EOR processes is expected to grow, offering substantial opportunities for market players.

Growth in Adoption of Automation and Remote Monitoring Technologies

The trend toward automation and remote monitoring technologies in the U.S. oil and gas industry presents a significant opportunity for the digital oilfield solutions market. With the ongoing demand for operational efficiency, cost reduction, and safety, oilfield operators are increasingly adopting automated systems and remote monitoring solutions to optimize field operations. Automation technologies, such as autonomous drilling systems and robotic process automation (RPA), reduce human intervention, improving safety and productivity while minimizing errors. Remote monitoring, enabled by IoT and cloud-based solutions, allows operators to track real-time performance and detect issues remotely, ensuring proactive decision-making. As these technologies continue to evolve, they offer substantial growth potential for digital oilfield solutions providers, positioning them to capitalize on the industry’s increasing focus on automation and operational efficiency.

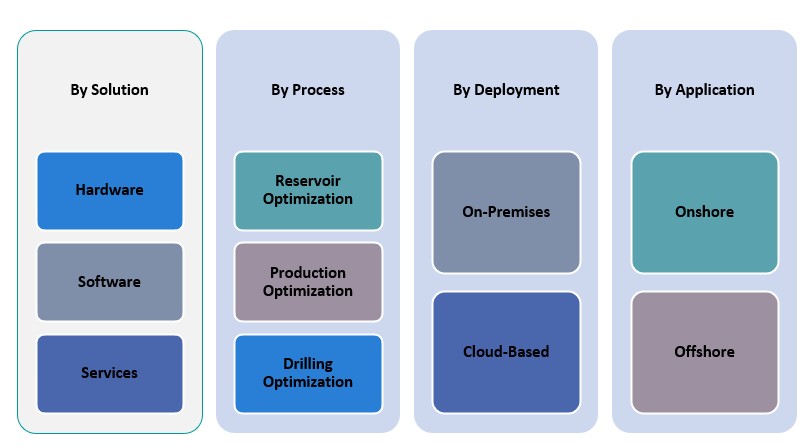

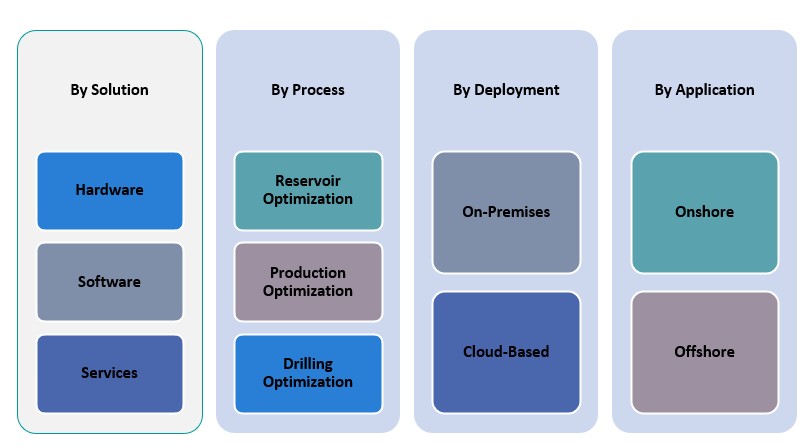

Market Segmentation Analysis

By Solution

The U.S. digital oilfield solutions market is divided into three primary solution categories: hardware, software, and services. Hardware accounts for a significant portion of the market, with essential components such as sensors, communication devices, and controllers being key to digital oilfield operations. These hardware solutions enable real-time monitoring, data collection, and automation. Software solutions, which include data analytics platforms, predictive maintenance software, and optimization tools, are experiencing rapid growth as companies seek to leverage big data for enhanced decision-making and operational efficiency. Services, including consulting, system integration, and maintenance, also form a substantial part of the market, providing ongoing support to ensure the smooth operation and integration of digital solutions across oilfield operations.

By Application

The market is further divided into onshore and offshore applications. Onshore oilfields represent a large share of the market, driven by the need for enhanced operational efficiency and cost reduction in land-based operations. Offshore applications, however, are expected to experience robust growth due to the complexity and high cost associated with offshore oil extraction. Digital solutions in offshore environments help optimize production, enhance safety, and reduce environmental risks, making them increasingly essential for operators in this challenging space.

Segments

Based on Solution

- Hardware

- Software

- Services

Based on Application

Based on Process

- Reservoir Optimization

- Production Optimization

- Drilling Optimization

Based on Deployment

Based on Region

- North region

- South region

- East region

- West region

Regional Analysis

Southern U.S. (35%)

The Southern U.S. region holds the largest share of the digital oilfield solutions market, accounting for approximately 35% of the total market. This region includes some of the largest onshore and offshore oil reserves, such as in Texas and the Gulf of Mexico. The Southern U.S. is a key hub for both conventional and unconventional oil extraction, which heavily drives demand for digital oilfield solutions like reservoir optimization, production monitoring, and automation technologies. The presence of large oil companies and the strategic importance of the Gulf Coast for offshore drilling further contribute to this region’s dominant position in the market.

Western U.S. (30%)

The Western U.S. follows closely with a market share of 30%, driven primarily by extensive oil reserves in states like California, Colorado, and North Dakota. The region is known for its mix of onshore shale oil production and offshore activities, which require advanced monitoring systems and digital optimization tools to enhance operational efficiency. The increasing adoption of automation and cloud-based solutions in the Western U.S. has played a significant role in bolstering market growth. Furthermore, this region’s oilfields are often located in challenging environments, making digital oilfield technologies crucial for reducing operational risks and improving safety.

Key players

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- Emerson Electric Co.

- Honeywell International Inc.

- Rockwell Automation, Inc.

- ABB Ltd.

- IBM Corporation

- GE Digital

Competitive Analysis

The U.S. digital oilfield solutions market is highly competitive, with major players such as Schlumberger, Halliburton, and Baker Hughes leading the charge. These companies provide a range of advanced technologies and services, including AI-driven analytics, automation systems, and IoT solutions. Schlumberger and Halliburton dominate with their extensive product portfolios and global reach, continually innovating through research and development. Meanwhile, newer entrants like Rockwell Automation and IBM Corporation focus on software solutions and industrial automation, driving digital transformation in oilfields. ABB and Honeywell offer specialized technologies that enhance operational efficiency, while GE Digital integrates industrial IoT for real-time data processing. As oil and gas operators increasingly embrace digitalization, these key players are leveraging their technological expertise to secure a competitive edge, positioning themselves as critical players in optimizing oilfield operations, improving production efficiency, and reducing costs in the ever-evolving energy sector.

Recent Developments

- In March 2025, Schneider Electric unveiled the One Digital Grid Platform, an AI-powered platform designed to enhance grid resiliency and efficiency. This platform is set to be available later in 2025. The company announced a $700 million investment plan in the U.S. to enhance energy infrastructure and AI capabilities.

- In April 2025, ABB India delivered integrated automation and digital solutions for IndianOil’s cross-country pipeline network, enhancing efficiency and safety through real-time monitoring and robust cybersecurity.

- In March 2025, Kongsberg Digital participated in the IPTC 2025, focusing on digital transformation in the oil and gas sector.

- In January 2025, SAP S/4HANA Cloud was highlighted as a key enabler for a smarter, more efficient energy ecosystem in the oil and gas industry.

- In April 2025, Schlumberger (SLB) announced a partnership with Shell to deploy Petrel™ subsurface software across Shell’s global assets. This collaboration aims to enhance digital capabilities and operational efficiencies through advanced AI-driven seismic interpretation workflows. This development underscores SLB’s ongoing commitment to advancing subsurface digital technology and fostering strategic partnerships in the energy sector.

Market Concentration and Characteristics

The U.S. Digital Oilfield Solutions Market exhibits a moderate to high level of market concentration, with several key players dominating the landscape, including Schlumberger, Halliburton, Baker Hughes, and Weatherford International. These industry leaders hold a substantial market share due to their extensive technological portfolios, strong global presence, and ongoing investment in research and development. However, the market also features a growing number of smaller players and technology providers, particularly those focusing on niche areas such as software solutions, automation, and cloud computing. The market is characterized by rapid technological advancements, with continuous innovations in AI, IoT, and data analytics driving competition. Moreover, there is an increasing emphasis on strategic partnerships, mergers, and acquisitions, as established players seek to enhance their capabilities and expand their service offerings. This dynamic market structure reflects the increasing demand for digital solutions that optimize oilfield operations, improve efficiency, and ensure regulatory compliance in a cost-sensitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Solution, Application, Process, Deployment and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- As oilfield operators seek greater efficiency, AI and automation technologies are expected to see broader implementation, enhancing predictive maintenance and drilling optimization.

- Cloud technology will continue to dominate, providing scalable, flexible, and cost-effective solutions for data storage, real-time analytics, and remote monitoring of oilfield operations.

- Remote monitoring will become integral to operations, allowing real-time performance tracking, problem detection, and quick corrective actions, especially in offshore and hazardous environments.

- The use of big data analytics will expand, enabling better decision-making through real-time data processing, leading to optimized production and resource management.

- Digital solutions will play a critical role in enhancing EOR techniques, helping operators maximize extraction from aging oilfields with advanced monitoring and optimization tools.

- The market will see increased demand for digital oilfield solutions that ensure regulatory compliance and improve environmental sustainability by minimizing emissions and optimizing energy consumption.

- As digital solutions proliferate, oil and gas companies will invest more in robust cybersecurity to protect sensitive operational data and prevent potential cyberattacks.

- Hybrid deployment models that combine on-premises and cloud-based solutions will become more common, offering a balance between security and flexibility in data management.

- The development of more advanced IoT devices and sensors will enable continuous, real-time monitoring of oilfields, improving operational insights and driving further automation in the sector.

- Market consolidation will accelerate as larger players acquire smaller firms or form strategic alliances, expanding their capabilities and gaining access to innovative technologies.