Market Overview

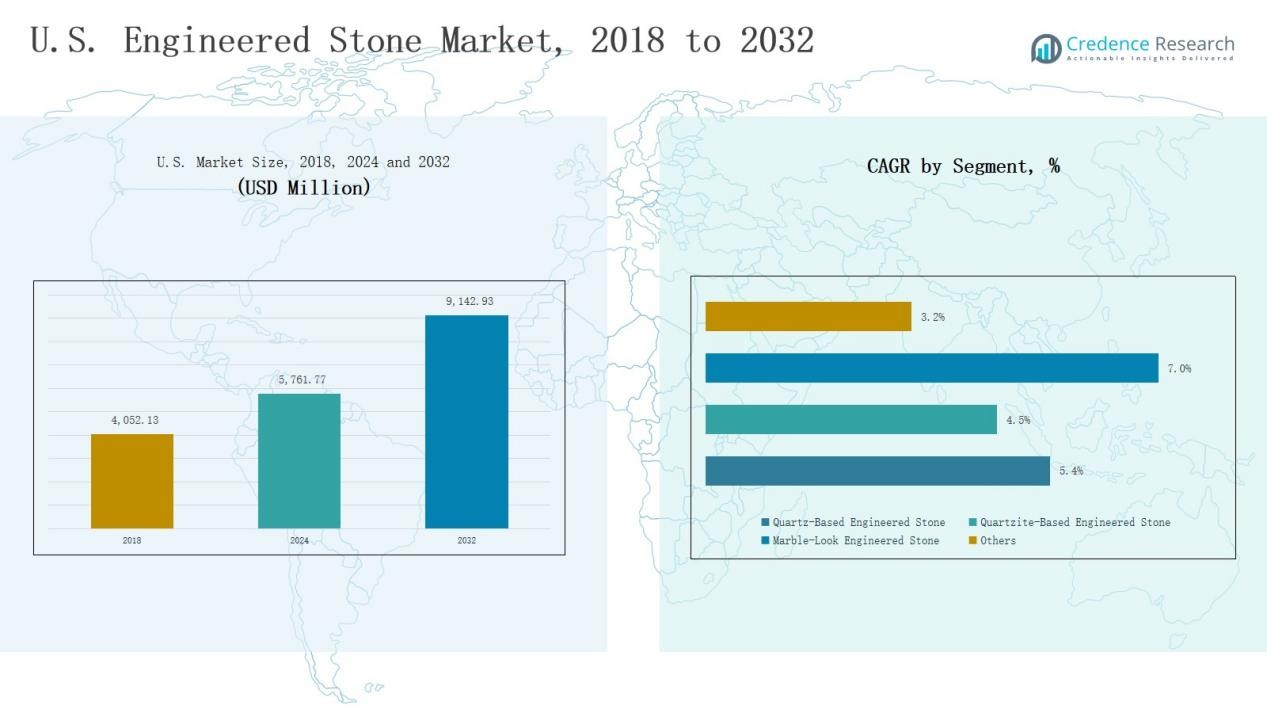

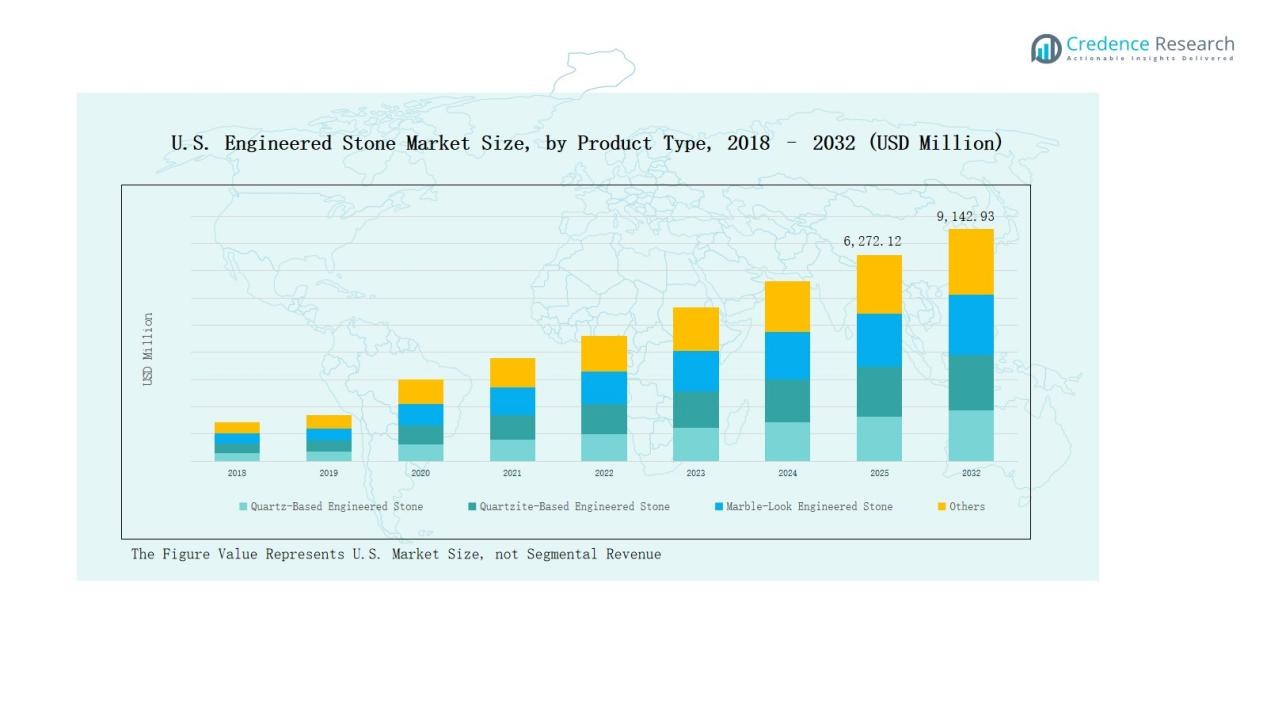

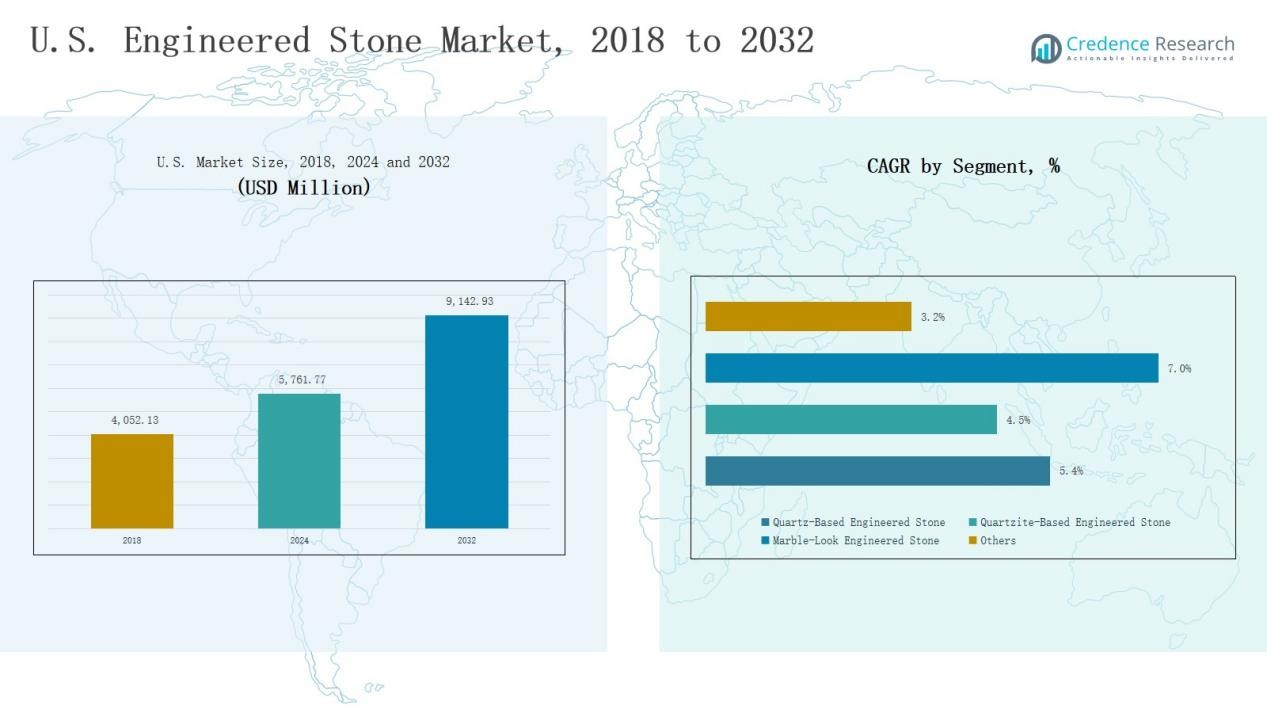

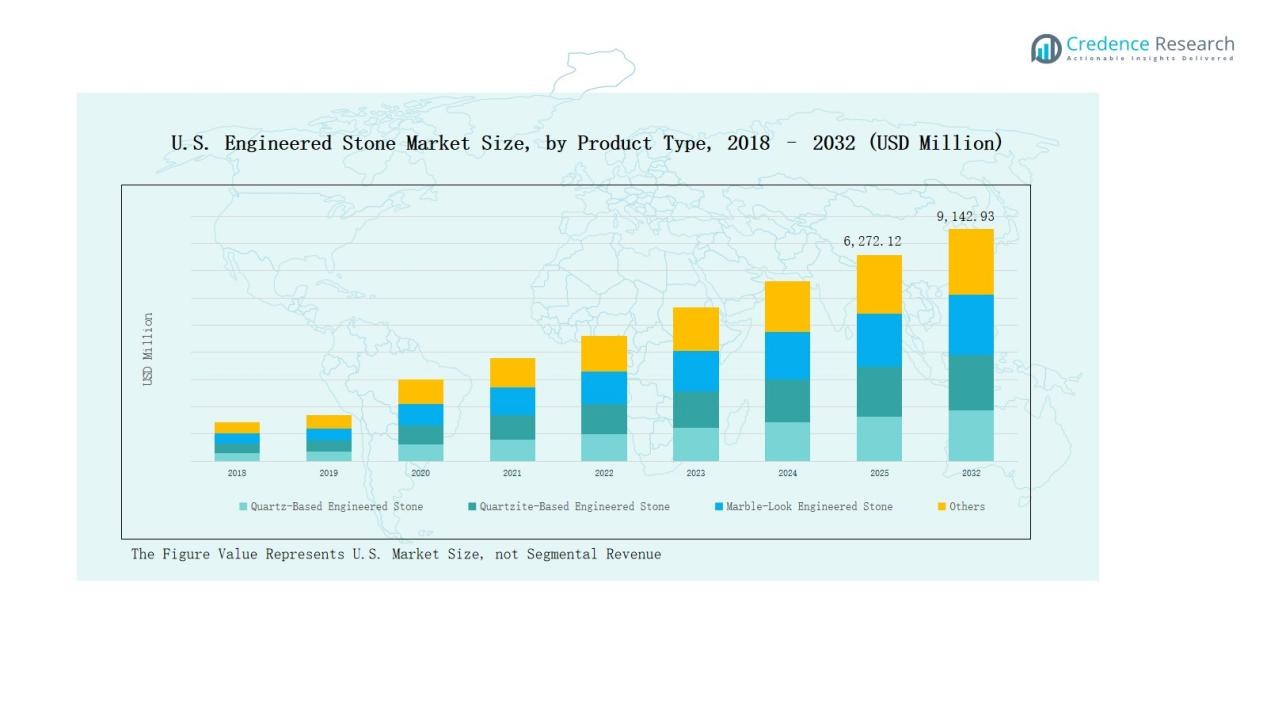

U.S. Engineered Stone Market size was valued at USD 4,052.13 million in 2018, reached USD 5,761.77 million in 2024, and is anticipated to reach USD 9,142.93 million by 2032, growing at a CAGR of 5.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Engineered Stone Market Size 2024 |

USD 5,761.77 Million |

| U.S. Engineered Stone Market, CAGR |

5.53% |

| U.S. Engineered Stone Market Size 2032 |

USD 9,142.93 Million |

The U.S. Engineered Stone Market is shaped by established players including Cambria Company LLC, MSI Surfaces, Hanstone Quartz, Vadara Quartz, Daltile, Silestone (Cosentino), Absolute Marble & Granite, AMG Stone Inc., and Stone Panels International LLC. These companies compete through strong product portfolios, sustainable innovations, and strategic partnerships with architects, contractors, and distributors. They emphasize eco-friendly materials, premium finishes, and broad distribution networks to strengthen market penetration across residential and commercial projects. Regionally, the South led the market with 37% share in 2024, driven by rapid urbanization, luxury housing projects, and expanding commercial construction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Engineered Stone Market grew from USD 4,052.13 million in 2018 to USD 5,761.77 million in 2024 and is expected to reach USD 9,142.93 million by 2032.

- Quartz-based engineered stone held 62% share in 2024, driven by durability, affordability, and rising demand in kitchen and bathroom renovations across residential projects.

- The residential segment led with 68% share in 2024, supported by housing renovations, luxury projects, and growing consumer preference for modern, durable, and low-maintenance interior solutions.

- Construction and infrastructure accounted for 54% share in 2024, fueled by urban development, large-scale housing, and demand for sustainable materials meeting green building standards.

- Regionally, the South dominated with 37% share in 2024, supported by urban growth, luxury housing expansion, and large commercial construction projects in Texas, Florida, and Georgia.

Market Segment Insights

By Product Type

Quartz-based engineered stone dominated the U.S. market in 2024, holding nearly 62% share. Its widespread adoption is driven by superior durability, design flexibility, and affordability compared to natural stone. Strong demand for quartz kitchen countertops and bathroom surfaces in residential remodeling projects supports growth. Increased consumer preference for low-maintenance and stain-resistant surfaces further strengthens the position of quartz-based products, while marble-look engineered stone continues to gain traction in luxury residential and commercial applications.

- For instance, G Hausys expanded its U.S. plant capacity to over 1.05 million m² annually to meet growing demand.

By Application

The residential segment led the U.S. engineered stone market in 2024 with around 68% share. Rising housing renovations, urban luxury projects, and consumer demand for modern kitchen and bathroom solutions drive this dominance. Homeowners prioritize engineered stone for its durability, wide design variety, and resistance to stains and scratches. Expanding residential construction, coupled with premium interior preferences in metropolitan areas, further boosts growth. Commercial adoption is also increasing, supported by retail outlets, hotels, and office developments emphasizing aesthetics and functionality.

- For instance, Caesarstone introduced its Pebbles Collection in the U.S., offering nature-inspired quartz surfaces tailored for modern kitchens.

By End-Use Industry

The construction and infrastructure segment accounted for the largest share, nearly 54% in 2024. Demand is fueled by large-scale housing developments, urban infrastructure upgrades, and commercial real estate expansion. Builders and contractors increasingly favor engineered stone for its strength, design appeal, and cost efficiency. Growing green building certifications also encourage use of engineered stone as a sustainable alternative to natural materials. Interior design and decoration applications remain vital, supported by rising consumer interest in aesthetic finishes and premium interiors.

- For instance, Cosentino introduced its Silestone Sunlit Days collection, created with HybriQ+ technology to reduce silica content and align with sustainable building practices.

Key Growth Drivers

Rising Demand for Residential Renovations

Residential remodeling and kitchen upgrades remain the strongest growth driver for the U.S. engineered stone market. Homeowners prefer engineered stone for its durability, scratch resistance, and design versatility compared to natural stone. Increasing investments in premium kitchen countertops and bathroom vanities, especially in metropolitan housing markets, sustain high demand. Government-backed housing development projects and rising disposable income levels also fuel renovation activities. Together, these factors make residential renovations a consistent driver for market expansion across the country.

- For instance, Cambria expanded its product line with the Inverness Quartz series, designed to meet modern remodeling trends with distinctive vein patterns and enhanced durability for bathrooms and kitchens.

Expanding Commercial Real Estate Projects

The growth of commercial construction, including hotels, offices, and retail outlets, drives strong adoption of engineered stone in the U.S. market. Developers and architects prioritize engineered stone for its modern aesthetic, durability, and compliance with building standards. High demand for sustainable materials in green-certified buildings also strengthens adoption. Commercial interiors increasingly use engineered stone for flooring, wall panels, and reception areas, positioning it as a preferred material. The surge in corporate investments in premium office spaces further amplifies this growth.

Advancements in Product Innovation

Product innovation has become a major growth catalyst in the engineered stone industry. Manufacturers are introducing new marble-look finishes, silica-free surfaces, and eco-friendly quartz alternatives to meet rising consumer and regulatory expectations. Integration of recycled materials enhances sustainability, aligning with U.S. green building standards. Innovation in designs and finishes broadens application scope in both residential and commercial projects. By combining aesthetics, durability, and environmental compliance, these innovations attract architects, contractors, and end consumers, ensuring sustained growth momentum across key market segments.

- For instance, Cosentino introduced its Dekton Onirika collection featuring carbon-neutral surfaces and high scratch resistance, appealing to sustainable luxury design requirements.

Key Trends & Opportunities

Sustainability and Green Building Initiatives

Sustainability is shaping the U.S. engineered stone market as developers and consumers shift toward eco-friendly materials. Demand for silica-free, recycled-content, and low-carbon production processes is accelerating. Certifications such as LEED and WELL encourage builders to integrate engineered stone that meets environmental standards. This trend creates opportunities for manufacturers offering green portfolios. Companies that adapt quickly to these requirements strengthen brand positioning and expand market share. Growing awareness among eco-conscious consumers further cements sustainability as both a trend and opportunity.

- For instance, Cosentino launched its HybriQ+ technology for Silestone, which incorporates 99% recycled water and 100% renewable electric energy in production, reducing the material’s carbon footprint.

Rising Preference for Luxury Interiors

The U.S. market is witnessing a strong preference for premium, luxury interior designs, creating significant opportunities for engineered stone. Marble-look and customized finishes are increasingly favored in luxury housing, high-end retail outlets, and hospitality spaces. The ability of engineered stone to combine elegance with long-term durability positions it as a preferred material in luxury projects. Expanding demand for upscale residential developments and renovation of premium hotels provides opportunities for manufacturers to capture higher-value contracts through innovative product offerings.

- For instance, Cambria introduced its Clairidge Matte and Hailey Quartz designs, offering premium finishes that resonate with upscale residential and hospitality projects

Key Challenges

High Silica Exposure and Regulatory Scrutiny

Worker safety concerns related to crystalline silica exposure pose a critical challenge for the U.S. engineered stone market. Regulatory bodies such as OSHA are tightening standards, pushing manufacturers toward costly compliance measures. Growing awareness of health risks has prompted lawsuits and potential bans on traditional engineered stone in some regions. Manufacturers face pressure to develop silica-free alternatives to remain competitive. Addressing this challenge requires significant investments in product reformulation, safety equipment, and worker protection, raising overall production costs.

Competition from Natural and Alternative Materials

The U.S. engineered stone market faces strong competition from natural stone, porcelain slabs, and emerging sustainable materials. Granite, marble, and porcelain are often preferred in luxury segments due to established consumer trust and brand recognition. Alternative materials offering lower costs or unique finishes also pressure market share. To maintain competitiveness, engineered stone producers must highlight superior durability, consistency, and design flexibility. Failure to differentiate clearly risks losing customers to these competing materials across both residential and commercial projects.

Fluctuating Raw Material and Production Costs

Volatility in raw material prices, coupled with rising energy and logistics costs, challenges profitability in the engineered stone industry. Quartz, resins, and pigments are subject to global supply chain disruptions, affecting pricing stability. U.S. manufacturers face higher operational costs due to labor expenses and compliance with safety standards. Import reliance for certain inputs adds further risk during geopolitical or trade disruptions. Managing cost efficiency while maintaining product quality remains a key challenge for producers striving to protect market margins.

Regional Analysis

Northeast

The Northeast held 24% share of the U.S. Engineered Stone Market in 2024. Strong demand for premium residential interiors across metropolitan hubs such as New York and Boston drives growth. Renovation activity in older housing stock further supports adoption of quartz-based surfaces. Commercial spaces, including offices and retail outlets, integrate engineered stone for aesthetics and durability. Architects and contractors favor marble-look finishes for luxury projects. It benefits from high consumer spending power and ongoing investment in high-rise residential developments.

Midwest

The Midwest accounted for 19% share in 2024. Demand is fueled by construction of suburban homes and infrastructure upgrades in states like Illinois and Ohio. Homeowners prioritize cost-effective yet durable materials, making quartz-based engineered stone the preferred choice. Growth in retail and healthcare construction also supports commercial adoption. The region benefits from lower housing costs, which boost renovation activity. It shows rising interest in eco-friendly engineered stone, aligning with growing sustainability initiatives in local construction markets.

South

The South led with a dominant 37% share of the U.S. Engineered Stone Market in 2024. Rapid population growth and urban expansion in states such as Texas, Florida, and Georgia drive strong residential demand. Rising luxury housing projects and large-scale commercial construction further support adoption. Developers favor engineered stone for its durability and wide range of finishes. Infrastructure spending enhances opportunities across both residential and commercial applications. It continues to serve as the largest growth hub, supported by favorable demographics and rising disposable income.

West

The West region held 20% share in 2024. High-end residential projects in California and luxury commercial spaces in cities like Los Angeles and San Francisco drive demand. Strong renovation activity in older housing markets boosts adoption of quartz-based and marble-look products. Growing emphasis on sustainable construction increases demand for eco-friendly engineered stone. Hospitality and retail developments also contribute to regional growth. It benefits from strong design preferences and higher consumer willingness to invest in premium interior finishes.

Market Segmentations:

By Product Type

- Quartz-Based Engineered Stone

- Quartzite-Based Engineered Stone

- Marble-Look Engineered Stone

- Others

By Application

By End-Use Industry

- Construction and Infrastructure

- Interior Design and Decoration

- Others

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. Engineered Stone Market is highly competitive, driven by a mix of global leaders and domestic specialists. Key players such as Cambria Company LLC, MSI Surfaces, Hanstone Quartz, Vadara Quartz, Daltile, and Silestone (Cosentino) dominate the landscape with strong product portfolios, extensive distribution networks, and premium brand positioning. These companies focus on innovation, introducing silica-free and recycled-content surfaces to align with rising sustainability demands and regulatory compliance. Domestic firms including Absolute Marble & Granite, AMG Stone Inc., and Stone Panels International LLC strengthen competition by catering to regional demand with cost-effective solutions. Players compete on design variety, durability, and pricing while targeting both residential and commercial applications. Strategic partnerships with contractors, architects, and retailers enhance market penetration. Recent developments emphasize eco-friendly materials and luxury finishes, positioning leading brands to capture expanding demand in housing renovations, commercial interiors, and sustainable construction projects across the country.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- MSI Surfaces

- Meta Surfaces

- Vadara Quartz

- Hanstone Quartz

- Daltile

- Absolute Marble & Granite

- Stone Panels International LLC

- AMG Stone Inc.

- Silestone (Cosentino)

Recent Developments

- In May 2025, LOTTE Chemical partnered with EKO Stone to distribute its Radianz Quartz across the U.S. Midwest.

- In February 2025, LX Hausys introduced new VIATERA quartz colors and technologies, expanding its U.S. product portfolio.

- In August 2024, Vadara Quartz Surfaces announced four new distributor partnerships on the U.S. East Coast.

- In July 2024, UMI Stone became the exclusive East Coast supplier of Vicostone engineered quartz (South Carolina to Maine).

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz-based engineered stone will remain dominant due to durability and versatility.

- Marble-look engineered stone will gain traction in luxury housing and commercial interiors.

- Residential renovations will continue driving adoption across kitchens and bathrooms.

- Commercial projects, including offices, hotels, and retail outlets, will expand usage.

- Eco-friendly and silica-free engineered stone will attract higher acceptance from regulators and consumers.

- Regional growth will concentrate in the South, supported by rapid urbanization and housing projects.

- Sustainability certifications will boost demand for recycled and low-carbon engineered stone products.

- Competition from porcelain slabs and natural stone will push companies to innovate in designs.

- Partnerships with architects, contractors, and distributors will strengthen market presence nationwide.

- Consumer preference for premium interiors will shape future product development and design offerings.