Market Overview:

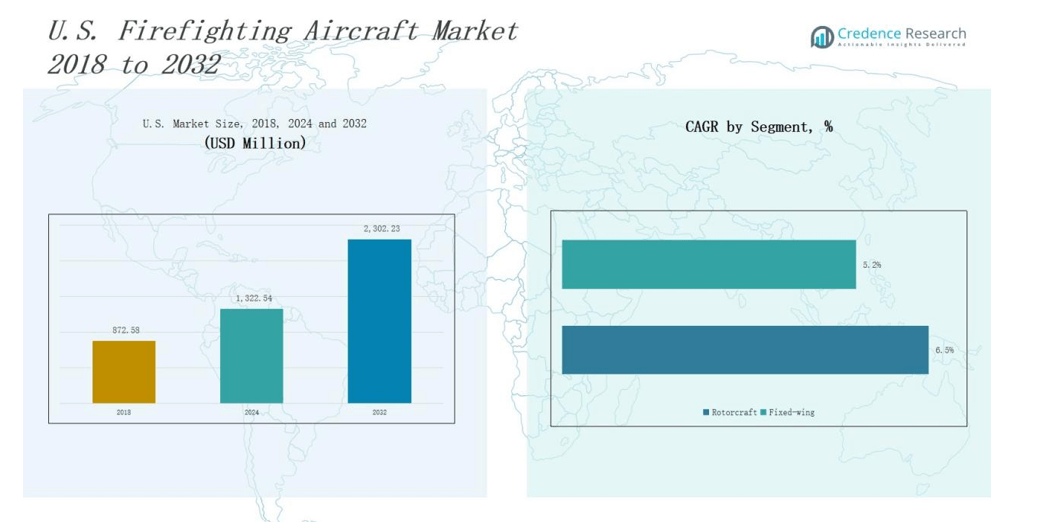

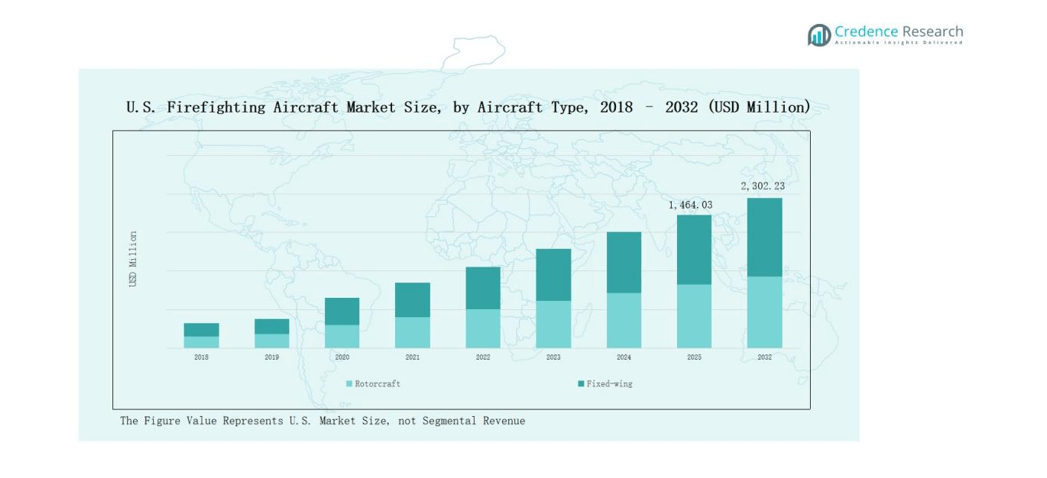

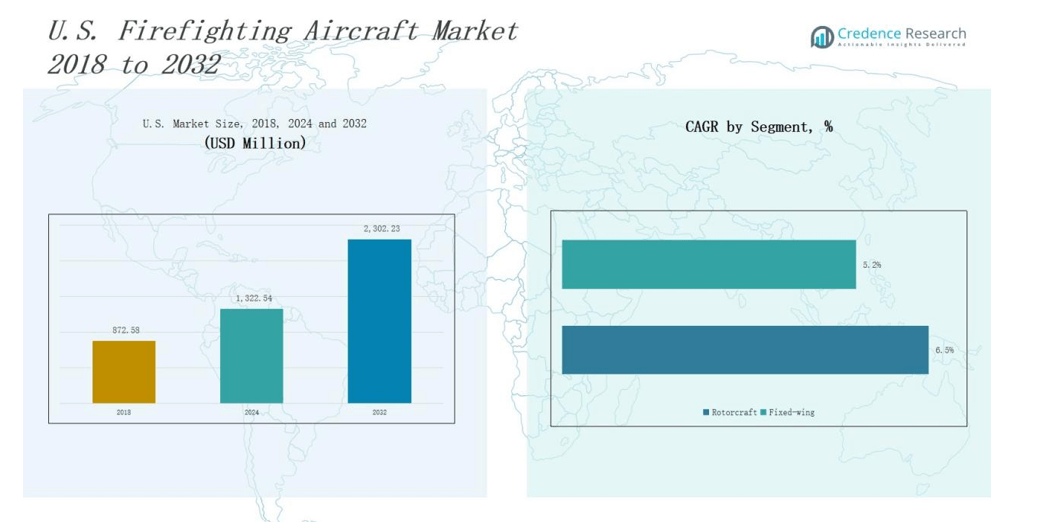

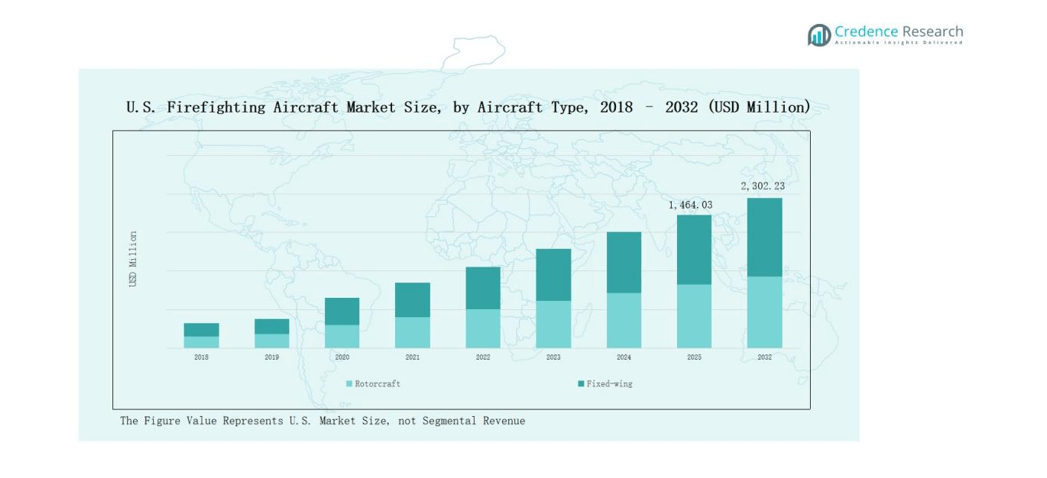

U.S. Firefighting Aircraft Market size was valued at USD 872.58 million in 2018 to USD 1,322.54 million in 2024 and is anticipated to reach USD 2,302.23 million by 2032, at a CAGR of 6.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Firefighting Aircraft Market Size 2024 |

USD 1,322.54 million |

| U.S. Firefighting Aircraft Market, CAGR |

6.68% |

| U.S. Firefighting Aircraft Market Size 2032 |

USD 2,302.23 million |

The U.S. Firefighting Aircraft Market is shaped by leading players such as Lockheed Martin Corporation, Boeing Commercial Airplanes, Erickson Incorporated, Coulson Aviation, Air Tractor Inc., Kaman Corporation, Neptune Aviation Services Inc., and Marsh Aviation Company. These companies strengthen their positions through fleet modernization, aircraft conversions, and long-term government contracts. Lockheed Martin and Boeing dominate with advanced platforms and technological upgrades, while Coulson Aviation and Erickson focus on specialized aerial firefighting services. Air Tractor Inc. plays a crucial role in supplying purpose-built aircraft for tactical operations. Among regions, the West leads with 48% market share in 2024, driven by frequent and severe wildfires across California, Oregon, and Washington, which demand high-capacity fixed-wing aircraft and rapid-response rotorcraft to ensure large-scale suppression capabilities.

Market Insights

- The U.S. Firefighting Aircraft Market grew from USD 872.58 million in 2018 to USD 1,322.54 million in 2024 and will reach USD 2,302.23 million by 2032.

- Fixed-wing aircraft dominate with 68% share in 2024, driven by higher payload capacity and long-range efficiency, while rotorcraft hold 32% for tactical precision roles.

- Heavy aircraft above 30,000 Kg command 61% share, supported by large airtankers like the DC-10, whereas below 30,000 Kg accounts for 39% in tactical missions.

- By range, the 1,000–3,000 km segment leads with 54% share, while less than 1,000 km holds 28% and more than 3,000 km captures 18% share in 2024.

- Regionally, the West leads with 48% share, followed by the South at 23%, Midwest at 16%, and Northeast at 13%, reflecting wildfire frequency and state-level investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Aircraft Type

In the U.S. firefighting aircraft market, fixed-wing aircraft account for nearly 68% of revenue share in 2024, making them the dominant sub-segment. Their higher payload capacity, extended operational range, and efficiency in covering vast wildfire-prone areas such as California and Oregon drive their adoption. Rotorcraft, holding about 32% share, remain critical for precision water drops in rugged terrains and urban-wildland interfaces. Federal and state investments in modernization programs continue to strengthen the use of fixed-wing aircraft in large-scale operations.

- For instance, Coulson Aviation’s modified Boeing 737 FIRELINER has been actively deployed in Australia since 2018, with capacity to carry nearly 4,000 gallons of retardant while also transporting up to 72 crew members.

By Maximum Take-off Weight

Aircraft above 30,000 Kg command nearly 61% share of the U.S. firefighting aircraft market in 2024, supported by strong reliance on heavy airtankers like the DC-10 and converted military cargo planes. These aircraft deliver high water or retardant volumes in fewer sorties, enhancing operational efficiency during severe wildfire outbreaks. Meanwhile, the below 30,000 Kg segment, with 39% share, is preferred for tactical missions in remote or mountainous areas. The continued increase in mega-fires across western states sustains demand for heavy-class aircraft.

- For instance, The DC-10 Air Tanker, operated by 10 Tanker Air Carrier, can drop up to 9,400 gallons of fire retardant in a single pass, significantly aiding wildfire containment.

By Range

In terms of range, the 1,000 to 3,000 km segment dominates with nearly 54% of revenue share in 2024, balancing fuel efficiency and mission readiness for both regional and interstate deployments. Aircraft in this category can operate effectively across multiple wildfire zones without frequent refueling. The less than 1,000 km segment holds about 28% share, valued for localized, rapid-response missions, especially with helicopters. The more than 3,000 km category accounts for 18% share, primarily serving cross-country redeployments and international support missions.

Market Overview

Rising Wildfire Incidence and Severity

The increasing frequency and intensity of wildfires across the western United States remain the strongest driver for firefighting aircraft demand. States like California, Oregon, and Arizona face prolonged fire seasons due to climate change and rising temperatures. This has pushed federal and state agencies to invest in expanding aerial firefighting fleets. The growing scale of wildfires requires advanced aircraft capable of sustained operations, ensuring continuous demand for fixed-wing tankers and rotorcraft. Rising wildfire management budgets further strengthen market expansion.

- For instance, in December 2023, legislation signed by President Biden officially transferred ownership of seven former U.S. Coast Guard C-130H aircraft to the state of California. These planes then underwent extensive refurbishment by Cal Fire to be converted into large airtankers, a project that began much earlier.

Government Modernization Programs and Contracts

Government-led fleet modernization programs significantly accelerate market growth in the U.S. Agencies such as the U.S. Forest Service and CAL FIRE invest heavily in upgrading legacy aircraft with advanced avionics, efficient engines, and larger payload capacities. Long-term contracts for private operators also provide stability for companies like Coulson Aviation and Erickson. Modernization not only extends aircraft service life but also enhances efficiency, safety, and rapid response capabilities. These initiatives ensure a steady pipeline of procurement and leasing opportunities.

- For instance, the U.S. Forest Service awarded a contract to Coulson Aviation in 2023 for its C-130H Hercules air tanker, which carries up to 4,000 gallons of retardant for wildfire suppression.

Technological Advancements in Aircraft Design

Ongoing innovations in aircraft design, materials, and fire suppression systems drive adoption. Advanced tank systems with higher water or retardant carrying capacity reduce turnaround times and improve operational coverage. Integration of satellite-based tracking, AI-driven fire mapping, and next-generation avionics further boosts efficiency. Hybrid and sustainable propulsion systems are emerging as development priorities, aligning with government sustainability goals. These advancements collectively position the U.S. market to achieve higher effectiveness in combating large-scale wildfire outbreaks.

Key Trends & Opportunities

Expansion of Public-Private Partnerships

Public-private collaboration continues to expand as government agencies seek flexible and scalable firefighting capacity. Leasing agreements and outsourcing contracts with private operators reduce upfront procurement costs and increase fleet readiness. This trend provides opportunities for companies to secure long-term revenue streams while supporting national wildfire management programs. Strengthening partnerships also encourage innovation, as private firms introduce modern aircraft conversions and purpose-built tankers to meet government performance standards.

- For instance, for the 2025 fire season, Conair is delivering two Dash 8-400MRE and two Dash 8-400ATs to Saskatchewan, having previously supplied Dash 8-400ATs to other government entities, including Australia, British Columbia, and Alaska.

Shift Toward Sustainable Aerial Operations

Environmental regulations and climate-focused policies are pushing adoption of sustainable firefighting aircraft technologies. Opportunities arise in developing hybrid-electric propulsion systems, biofuel-compatible engines, and lightweight composite structures. Operators and manufacturers investing in green technologies stand to gain competitive advantage in future contracts. The shift also aligns with broader U.S. commitments to carbon reduction, positioning eco-friendly aerial firefighting solutions as a long-term opportunity within the market.

- For instance, the U.S. Navy successfully flew its Northrop Grumman MQ-8B Fire Scout UAV on a blend of conventional JP-5 aviation fuel and plant-based camelina. This test flight demonstrated a 75% reduction in carbon dioxide output compared to conventional fuel and is part of a larger Navy initiative toward clean energy.

Key Challenges

High Procurement and Operational Costs

The market faces challenges due to the high costs associated with acquiring, maintaining, and operating firefighting aircraft. Large tankers and specialized rotorcraft require substantial investment, making fleet expansion financially demanding for both government and private operators. Maintenance, fuel, and pilot training expenses further add to the cost burden, restricting wider adoption among smaller agencies.

Aging Fleet and Replacement Gaps

A significant portion of the current U.S. firefighting aircraft fleet consists of converted military and commercial aircraft. Many are nearing the end of their operational lifespan, creating urgent replacement needs. However, limited availability of new purpose-built aircraft and long delivery timelines hinder smooth fleet transition. This aging fleet raises concerns over reliability, safety, and response effectiveness during peak fire seasons.

Operational Limitations in Extreme Conditions

Firefighting aircraft face operational challenges in extreme weather and terrain conditions. High winds, poor visibility, and rugged topography restrict aircraft deployment in critical scenarios, reducing their effectiveness. Additionally, limited access to refueling and maintenance infrastructure in remote areas delays mission continuity. These operational barriers highlight the need for ongoing advancements in aircraft resilience and tactical planning to ensure reliable performance during severe wildfire incidents.

Regional Analysis

West

The West holds the largest share of the U.S. Firefighting Aircraft Market at 48% in 2024. The region faces the highest wildfire frequency due to dry climates and dense forests across states like California, Oregon, and Washington. It benefits from substantial federal and state investments in aerial firefighting fleets to protect urban-wildland interfaces. Fixed-wing aircraft dominate operations, supported by large water and retardant capacities that suit vast fire zones. Helicopters remain critical for mountainous terrain and rapid deployment. The region’s growing wildfire severity ensures continuous reliance on aircraft-based suppression capabilities.

South

The South accounts for 23% share of the U.S. market in 2024, driven by seasonal wildfire activity across Texas, Arizona, and New Mexico. It depends on both rotorcraft and fixed-wing assets, balancing tactical missions with large-scale containment. Expansion of state-level firefighting programs has increased demand for modernized fleets with improved payload and endurance. Aircraft capable of extended missions across arid and desert landscapes play a vital role. The presence of wide rural areas and critical infrastructure increases the region’s reliance on effective aerial suppression. Market growth remains steady with ongoing state and federal collaboration.

Midwest

The Midwest represents 16% share of the market in 2024, supported by moderate wildfire risks across forested and agricultural zones. It relies more on helicopters and small fixed-wing aircraft to manage regional fire activity. While wildfire incidents occur less frequently than in the West and South, states like Minnesota and Michigan require aerial response during peak summer seasons. Government preparedness programs strengthen demand for flexible aircraft fleets. The region prioritizes cost-effective solutions, often leasing equipment during peak seasons. It continues to serve as a stable but secondary contributor to market revenues.

Northeast

The Northeast holds 13% share of the market in 2024, reflecting its lower wildfire frequency compared to other regions. Fire risks are concentrated in states like Maine and New Jersey, where forest density and seasonal dryness elevate threats. The region primarily uses helicopters for rapid containment in confined or urban-adjacent fire zones. Limited demand for heavy airtankers results in a smaller share of total market revenue. Federal support programs and resource sharing agreements enhance readiness in peak fire months. It remains the smallest regional market but plays a strategic role in national fire management efforts.

Market Segmentations:

By Aircraft Type

By Maximum Take-off Weight

- Below 30,000 Kg

- Above 30,000 Kg

By Range

- Less than 1,000 km

- 1,000 to 3,000 km

- More than 3,000 km

By Region

- West

- South

- MidWest

- Northeast

Competitive Landscape

The U.S. Firefighting Aircraft Market is highly competitive, with a mix of aerospace giants, specialized operators, and private service providers shaping industry dynamics. Leading companies such as Lockheed Martin, Boeing Commercial Airplanes, and Erickson Incorporated dominate through strong product portfolios and long-term contracts with federal and state agencies. Coulson Aviation, Air Tractor Inc., and Neptune Aviation Services play pivotal roles by offering purpose-built and converted aircraft tailored for aerial firefighting missions. Competition focuses on payload capacity, operational efficiency, and fleet modernization initiatives, while private operators expand leasing and service agreements to meet government demand. Partnerships and fleet conversions remain key strategies, as aging aircraft fleets are replaced with advanced platforms. Innovation in avionics, retardant systems, and sustainable propulsion is also intensifying competition, with firms positioning to capture future contracts linked to wildfire management programs. The market reflects consolidation and steady investments, ensuring resilience against rising wildfire threats.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In April 2025, Coulson Aviation USA acquired four C‑130H Hercules aircraft from the New Zealand Defence Force. The company plans to convert these into high-capacity airtankers equipped with the proprietary RADS‑XXL tank system.

- On March 25, 2025, Bridger Aerospace entered into a Memorandum of Understanding with Positive Aviation. Bridger secured exclusive North American launch hub rights for the FF72 water‑scooping aircraft, with the option to purchase ten units and the option for ten more.

- In July 2025, aviation tech leader Skyryse partnered with CAL FIRE to introduce its SkyOS system into future firefighting aircraft. SkyOS adds automation, fly‑by‑wire control, and optionally‑piloted capability to reduce pilot workload and improve safety.

- On June 26, 2025, Airbus completed a successful test campaign of its A400M equipped with a firefighting kit, demonstrating precise retardant distribution using cup-grid drop tests during late April.

Report Coverage

The research report offers an in-depth analysis based on Aircraft Type, Maximum Take-Off Weight, Range and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fixed-wing aircraft will continue rising due to large-scale wildfire outbreaks.

- Rotorcraft will remain vital for rapid response in mountainous and urban-adjacent areas.

- Government fleet modernization programs will drive adoption of advanced firefighting aircraft.

- Private operators will expand leasing services through long-term contracts with state agencies.

- Sustainable propulsion technologies will gain traction in response to environmental regulations.

- Integration of AI and satellite-based tracking will improve aerial firefighting efficiency.

- Heavy airtankers will dominate deployments for high-volume water and retardant delivery.

- Public-private partnerships will increase to ensure adequate national firefighting capacity.

- Regional investment will intensify in western states facing the highest wildfire risks.

- Aircraft conversions from military and commercial fleets will remain a cost-effective strategy.