Market Overview

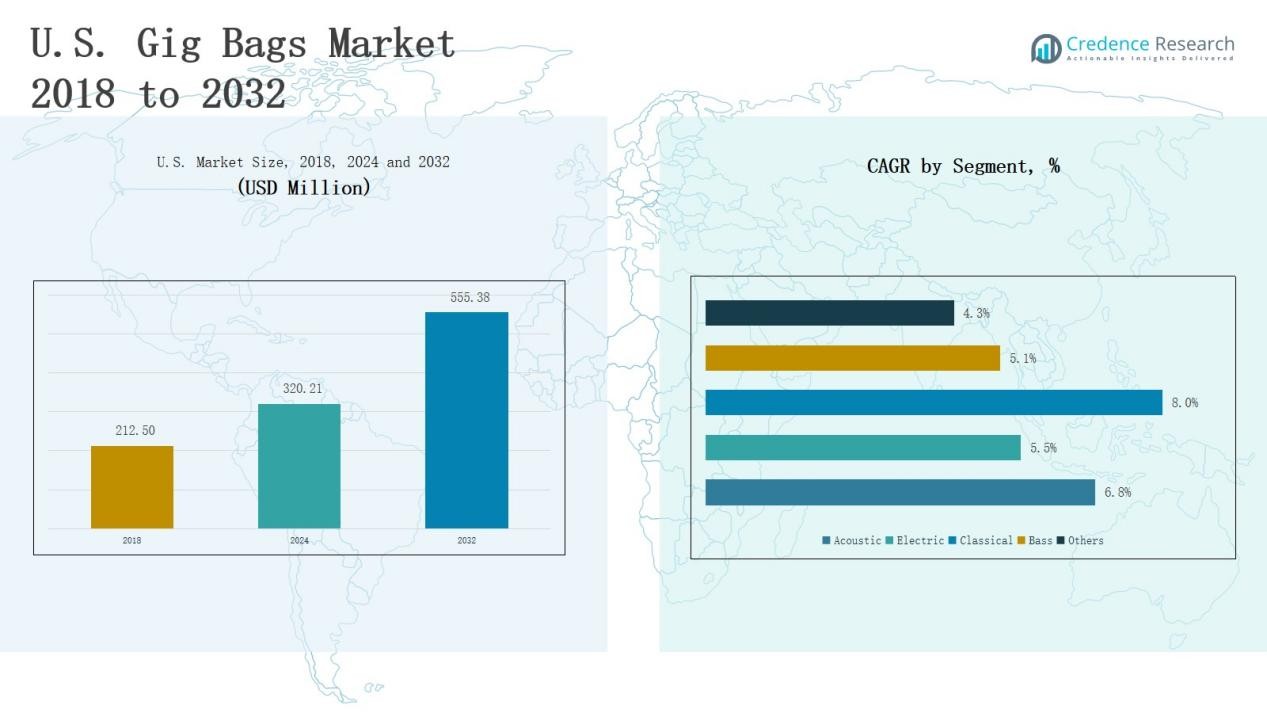

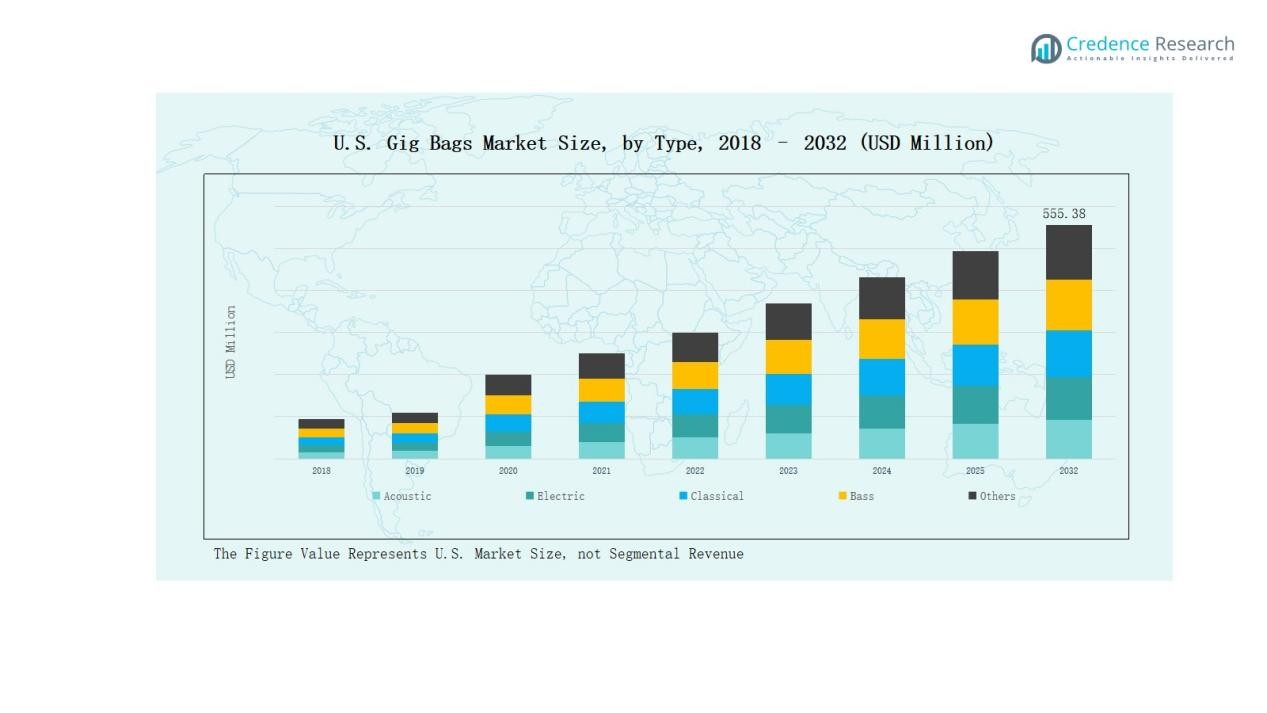

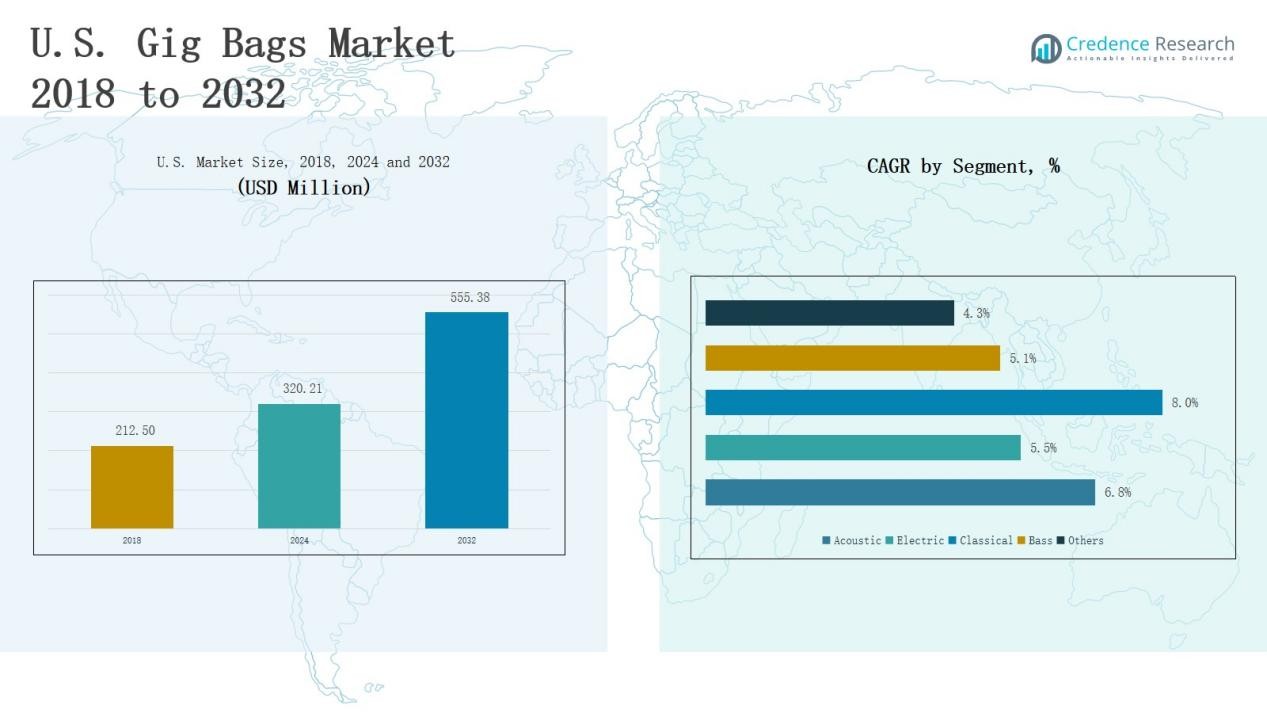

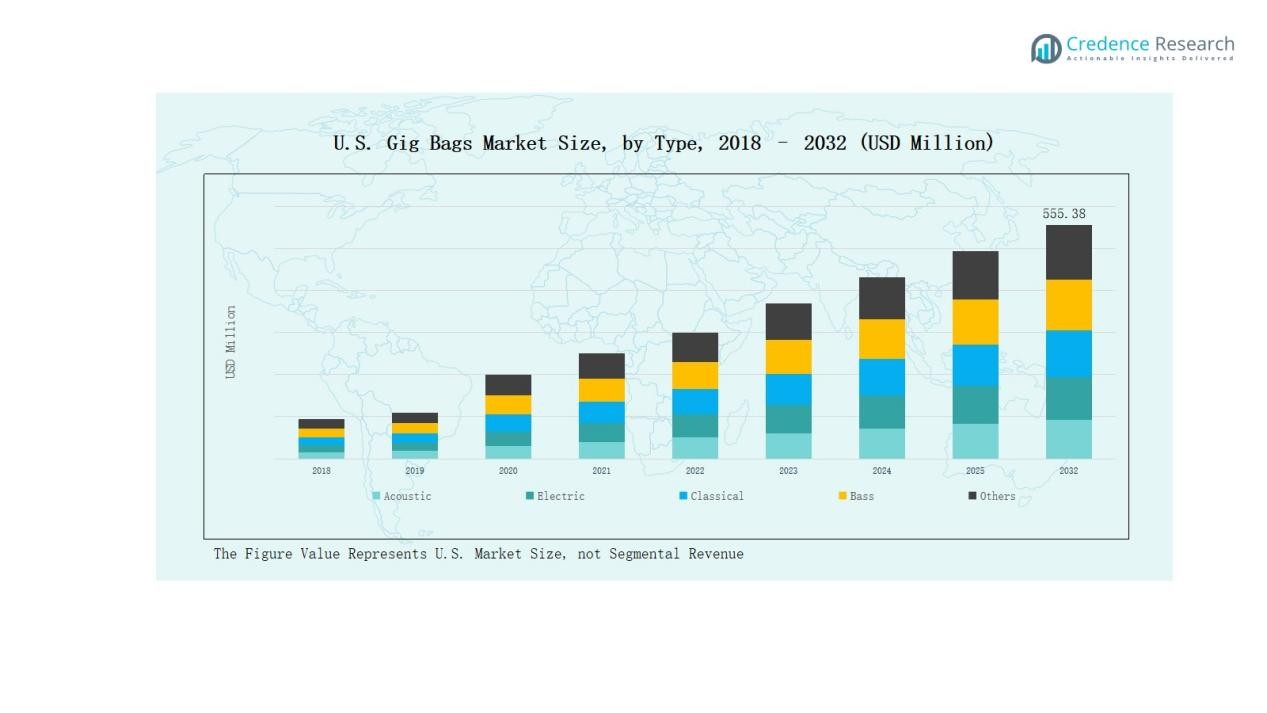

U.S. Gig Bags Market size was valued at USD 212.50 million in 2018 to USD 320.21 million in 2024 and is anticipated to reach USD 555.38 million by 2032, at a CAGR of 7.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Gig Bags Market Size 2024 |

USD 320.21 Million |

| U.S. Gig Bags Market , CAGR |

7.14% |

| U.S. Gig Bags Market Size 2032 |

USD 555.38 Million |

The U.S. Gig Bags Market is dominated by leading manufacturers such as Gator Cases, SKB Corporation, Levy’s Leathers, Reunion Blues, and MONO Creators, which maintain strong competitive positions through durable materials, innovative designs, and extensive distribution networks. These companies cater to a wide spectrum of musicians, offering gig bags for acoustic, electric, classical, and bass guitars, as well as other instruments. Within the U.S., the market is heavily concentrated in states with vibrant music industries and retail infrastructure, with the leading region accounting for approximately 68.4% of total market revenue in 2024, driven by high consumer demand, robust distribution channels, and an active professional and amateur musician base.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Gig Bags Market is projected to grow strongly, supported by established brands offering durable, innovative designs across acoustic, electric, classical, and bass guitar segments.

- Rising musical instrument ownership, influenced by music education programs and popular culture, continues to drive demand for protective and functional gig bags.

- Expanding e-commerce channels enhance accessibility, enabling competitive pricing, customization options, and broader market reach for both large and niche players.

- Product innovation and customization, including lightweight materials, weather resistance, and personalized designs, remain key differentiators attracting both professionals and casual users.

- Regional demand is led by the South, followed by the West, Northeast, and Midwest, each shaped by unique music cultures, distribution networks, and consumer preferences.

Market Segment Insights

By Type

In the U.S. Gig Bags Market, the electric gig bags segment emerges as the leading category, driven by the strong popularity of electric guitars among both professional and amateur musicians. Demand is supported by a vibrant live performance culture, active participation in music education programs, and the growing influence of contemporary music genres. Manufacturers enhance the appeal of this segment by offering lightweight, durable, and ergonomically designed products with features such as reinforced padding, weather resistance, and additional storage. Continuous innovation in design and materials further strengthens its position in the market.

- For instance, Fender offers electric gig bags featuring reinforced padding and weather-resistant materials that cater to touring professionals and students alike.

By Application

The personal application segment holds the dominant position in the U.S. Gig Bags Market, fueled by increasing individual ownership of musical instruments and the rising popularity of music as a leisure activity. Growth in this segment is supported by expanding online retail channels, which provide easy access to a wide range of styles, designs, and price points. Consumers in this category value portability, comfort, and visual appeal, prompting manufacturers to introduce customizable designs, diverse material options, and enhanced protective features.

- For instance, SKB Cases has developed rugged, weather-resistant designs catering to musicians who prioritize instrument safety during travel, reflecting the demand for versatile and protective options fueled by expanding online retail availability.

Key Growth Drivers

Rising Musical Instrument Ownership

The U.S. Gig Bags Market benefits from a steady increase in musical instrument ownership, particularly guitars, across diverse age groups. This growth is driven by expanding music education programs, the influence of popular music culture, and greater accessibility to instruments through retail and online platforms. As more consumers invest in instruments, the demand for protective and functional gig bags rises. Manufacturers respond by offering a wide range of designs, materials, and price points to cater to different customer segments, reinforcing steady market expansion.

- For instance, Fender reported that 16 million Americans picked up a guitar in the last two years, with 72% of new players aged between 13 to 34, many influenced by online content and social media platforms like TikTok.

Expansion of E-Commerce Channels

The rapid growth of e-commerce significantly boosts gig bag sales in the U.S., offering consumers convenient access to a wide product selection and competitive pricing. Online platforms provide detailed product descriptions, reviews, and customization options, enabling informed purchase decisions. For manufacturers and retailers, e-commerce opens opportunities to reach niche and geographically dispersed markets without heavy investment in physical stores. The ability to launch limited editions, bundle offers, and targeted marketing campaigns online further enhances sales potential, making digital retail a critical growth driver.

- For instance, brand-specific e-commerce platforms like Michael Kors and TUMI have experienced increased traffic and sales due to enhanced user-friendly features such as easy returns and multiple payment options.

Focus on Product Innovation and Customization

Innovation in gig bag design, materials, and features serves as a major growth catalyst for the U.S. market. Manufacturers integrate lightweight yet durable fabrics, improved padding, and weather-resistant coatings to enhance protection and portability. Customization options such as personalized embroidery, color choices, and modular compartments cater to consumer preferences for unique, functional products. These innovations appeal to both professional musicians seeking performance-ready solutions and casual users prioritizing style, helping brands strengthen customer loyalty and capture higher-value segments.

Key Trends & Opportunities

Sustainable and Eco-Friendly Materials

A growing emphasis on environmental responsibility is influencing gig bag production in the U.S. Manufacturers increasingly adopt recycled fabrics, biodegradable components, and low-impact manufacturing processes. Consumers, especially younger demographics, show strong preference for sustainable products without compromising durability or aesthetics. This trend creates opportunities for brands to differentiate themselves through eco-friendly offerings, supported by transparent supply chain practices and sustainability certifications, appealing to an environmentally conscious customer base.

- For instance, Sudarshan Addpack, a U.S. bulk bag manufacturer, uses recycled polypropylene that can be recycled again after use, significantly reducing waste and environmental impact.

Integration of Smart Features

The integration of technology into gig bags is emerging as an opportunity in the U.S. market. Features such as GPS tracking, built-in digital tuners, and charging ports are gaining attention among tech-savvy musicians. These smart additions enhance functionality, security, and convenience, particularly for touring artists and frequent travelers. As the adoption of connected devices grows, manufacturers that incorporate innovative, user-friendly technology can attract a premium audience and establish a strong competitive advantage.

- For instance, Samsara Luggage offers smart suitcases featuring real-time GPS tracking and built-in charging ports, helping musicians and travelers keep their gear secure and powered throughout their journeys.

Key Challenges

Intense Market Competition

The U.S. Gig Bags Market faces high competition from both established brands and low-cost imports, pressuring companies to differentiate through quality, design, and pricing strategies. The abundance of options can lead to price sensitivity among consumers, limiting premium segment growth. To remain competitive, brands must balance cost efficiency with innovation and maintain strong marketing efforts to sustain brand recognition in a crowded marketplace.

Fluctuating Raw Material Costs

Variations in the prices of fabrics, padding materials, and hardware components impact manufacturing costs and profit margins for gig bag producers. External factors such as supply chain disruptions, currency fluctuations, and changes in trade policies can exacerbate these challenges. Manufacturers often face the dilemma of absorbing cost increases or passing them on to consumers, risking reduced demand in price-sensitive segments.

Shifts in Consumer Preferences

Rapid changes in design trends, musical styles, and lifestyle needs present a challenge for gig bag manufacturers. Consumers increasingly seek multifunctional products that combine style with protection, forcing brands to frequently update their product lines. Failing to adapt quickly to evolving preferences can result in inventory obsolescence and loss of market share. Continuous market research and agile product development are essential to address these shifts effectively.

Regional Analysis

Northeast

The Northeast holds 22% of the U.S. Gig Bags Market, driven by professional musicians, music schools, and active performance venues in cities like New York and Boston. Demand centers on premium, durable designs suited for frequent travel and varied climates. Strong retail presence, music festivals, and educational programs sustain steady sales, making it a key region for established brands.

Midwest

The Midwest captures 19% of the U.S. Gig Bags Market, supported by school music programs, community bands, and regional touring artists. Consumers value affordable, durable gig bags for educational and personal use. Seasonal conditions increase demand for reinforced materials. Expanding online retail access strengthens distribution, creating opportunities for mid-range offerings targeting students, hobbyists, and emerging local performers.

South

The South leads with 34% of the U.S. Gig Bags Market, fueled by diverse music genres and hubs like Nashville and Austin. Demand spans electric and acoustic gig bags, with touring musicians favoring comfort and style. Strong retail networks and active live events drive sales. It remains a priority market for brands seeking high-volume and premium product growth.

West

The West holds 25% of the U.S. Gig Bags Market, led by California’s strong entertainment industry and consumer preference for innovative designs. Outdoor festivals and high mobility needs drive demand for weather-resistant, functional gig bags. E-commerce penetration and proximity to distribution hubs support growth. The region attracts brands blending durability, portability, and contemporary aesthetics for varied customer segments.

Market Segmentations:

By Type

- Acoustic

- Electric

- Classical

- Bass

- Others

By Application

- Personal

- Commercial

- Others

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The competitive landscape of the U.S. Gig Bags Market is defined by a mix of established brands and emerging players competing through product quality, innovation, and distribution reach. Leading companies such as Gator Cases, Levy’s Leathers, Mono Creators, SKB Cases, and Reunion Blues maintain strong market positions by offering a diverse range of gig bags tailored to electric, acoustic, classical, and bass guitars. These brands leverage durable materials, ergonomic designs, and advanced protective features to appeal to both professional and amateur musicians. Competition is further intensified by smaller manufacturers and low-cost imports that target price-sensitive segments. E-commerce platforms have expanded accessibility, enabling direct-to-consumer sales and greater brand visibility. Product differentiation, customization options, and brand reputation play critical roles in capturing market share. With the growing emphasis on style, portability, and functional enhancements, companies continue to invest in design upgrades and marketing strategies to strengthen their competitive advantage in the evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In 2025, Fender expanded its gig bag lineup for guitars and basses, enhancing portability and protection options across its current U.S. catalog.

- In April 2025, Quantum Industries announced the relaunch of its Hachiman Collection guitar bags, with production scheduled to resume in mid-April 2025.

- In January 2025, Gator Cases introduced the ICON Take Two Series gig bags, designed to carry two electric guitars or basses with enhanced padding, compact form, and travel-friendly features.

- In 2025, Michael Kelly Guitar Co. launched its custom electric bass guitar gig bag, a lightweight, padded design now available for pre-order in the U.S.

Market Concentration & Characteristics

The U.S. Gig Bags Market exhibits a moderately concentrated structure, with a few leading brands accounting for a significant share of total sales. It is characterized by strong brand loyalty, driven by consistent product quality, innovative designs, and effective distribution networks. Established players dominate the premium and mid-range segments, while smaller manufacturers and imports compete in price-sensitive categories. The market features a wide variety of products tailored to specific instruments and user needs, from professional touring gear to casual-use bags. Product differentiation through material quality, ergonomic features, and aesthetic appeal is a key competitive factor. E-commerce plays an essential role in expanding reach and enabling niche players to compete with established brands. It continues to evolve with increasing demand for customization, sustainable materials, and multifunctional designs, encouraging companies to adapt quickly to shifting consumer preferences while maintaining strong market positioning.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for gig bags will rise with growing musical instrument ownership across varied age groups.

- E-commerce expansion will strengthen direct-to-consumer sales and brand visibility.

- Product innovation will focus on lightweight, durable, and weather-resistant materials.

- Customization options will gain traction among style-conscious consumers.

- Sustainable materials will become a stronger selling point for eco-aware buyers.

- Smart features such as GPS tracking will attract tech-savvy musicians.

- Premium segments will expand with rising demand from touring professionals.

- Mid-range offerings will see growth through increased student and hobbyist purchases.

- Regional music hubs will continue to influence design and distribution strategies.

- Competition will intensify, pushing brands to differentiate through quality and design innovation.