Market overview

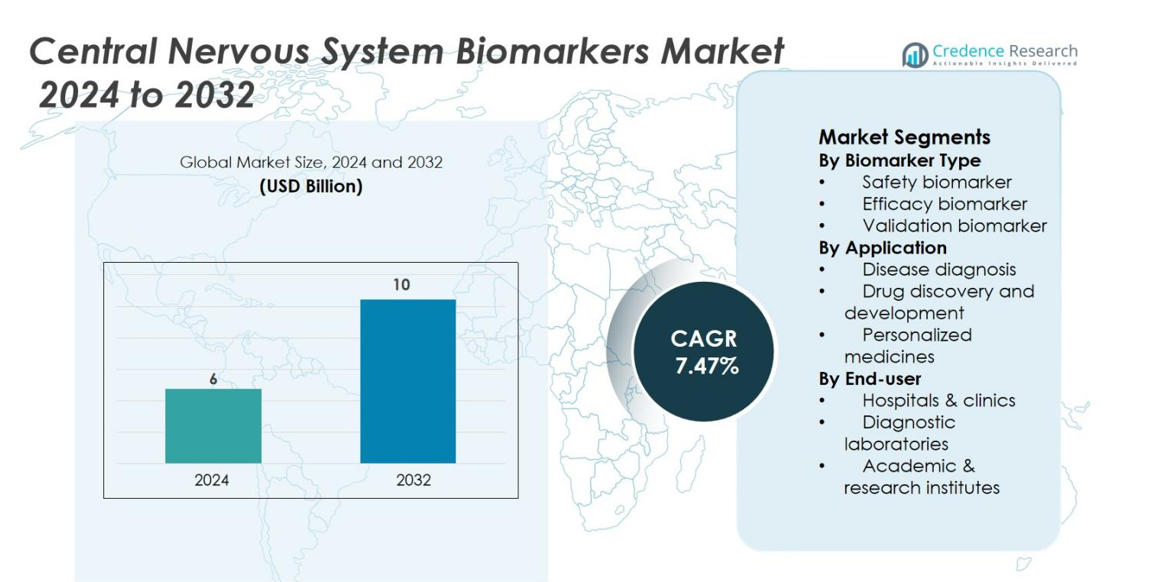

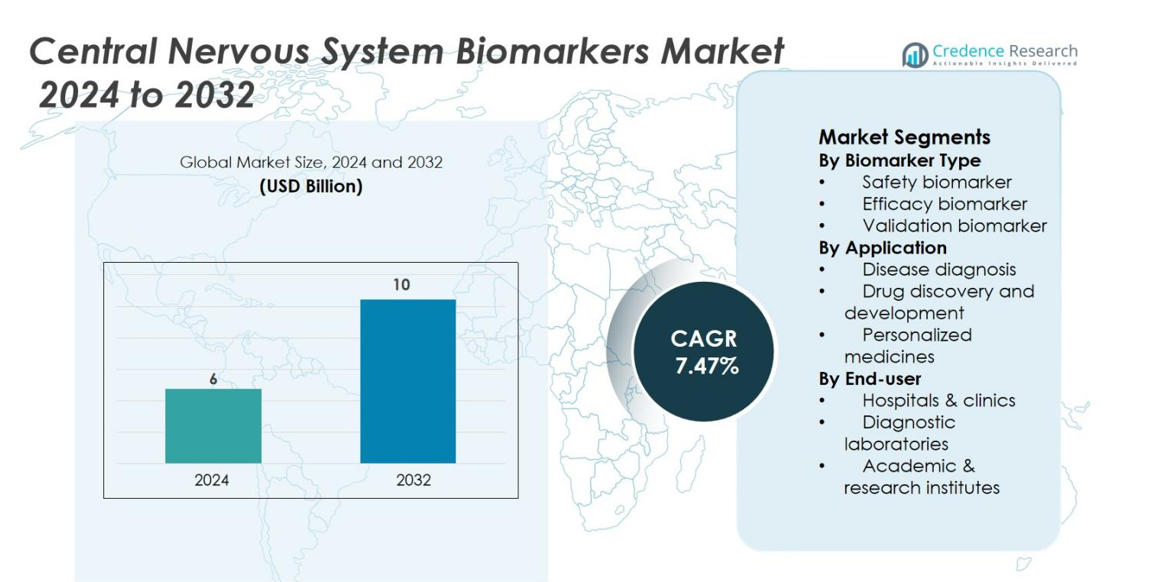

The Central Nervous System (CNS) biomarkers market was valued at USD 6 billion in 2024 and is expected to reach USD 10 billion by 2032, growing at a CAGR of 7.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Central Nervous System Biomarkers Market Size 2024 |

USD 6 billion |

| Central Nervous System Biomarkers Market, CAGR |

7.47% |

| Central Nervous System Biomarkers Market Size 2032 |

USD 10 billion |

The Central Nervous System Biomarkers market features prominent companies such as bioMérieux, Bio‑Rad Laboratories, Inc., F. Hoffmann‑La Roche Ltd, G‑Biosciences, Illumina, Inc., Merck KGaA, Myriad Genetics, Inc., Novartis AG, PerkinElmer Inc., and Siemens Healthineers AG, all actively enhancing their biomarker portfolios and global reach. The region leading this market is North America, commanding approximately 40% of the global share, thanks to its advanced healthcare infrastructure, strong neuro‑R&D investment, and high adoption of biomarker‑driven diagnostics and therapies

Market Insights

- The Central Nervous System (CNS) biomarkers market was valued at USD 6 billion in 2024 and is projected to reach around USD 10 billion by 2032, reflecting a compound annual growth rate (CAGR) of 7.47%.

- Growing prevalence of neurological disorders such as Alzheimer’s and Parkinson’s and the expanding demand for early diagnosis and monitoring are fuelling adoption of CNS biomarkers, pushing growth across segments.

- The assays/kit type segment leads with close to 44.8% share in 2024, and North America holds the largest regional share at about 43.1%, while Asia–Pacific is the fastest‑growing region.

- High costs associated with validation, regulatory hurdles, and reimbursement issues are limiting wider uptake in certain regions and end‑use segments.

- North America dominates the market – 43% share in 2024, Europe holds 22.8%, and Asia‑Pacific has 17.6% share but shows the highest growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Biomarker Type

The Central Nervous System (CNS) biomarkers market is segmented by biomarker type into safety biomarkers, efficacy biomarkers, and validation biomarkers. Among these, efficacy biomarkers dominate the market, holding the largest market share at 40%. This dominance is driven by the growing demand for accurate tools to assess the effectiveness of CNS-targeted therapies during clinical trials. Efficacy biomarkers play a crucial role in identifying and confirming therapeutic responses, particularly in neurodegenerative disorders such as Alzheimer’s disease, thereby fostering their widespread adoption in both research and clinical settings.

- For instance, Roche’s Elecsys® pTau 181 blood test obtained U.S. FDA clearance after a multicentre clinical study of 312 participants, where it achieved a 97.9 % negative predictive value for ruling out Alzheimer’s‑related amyloid pathology.

By Application

The application segment of the CNS biomarkers market includes disease diagnosis, drug discovery and development, and personalized medicines. Drug discovery and development leads this segment, accounting for 45% of the market share. This sub-segment is driven by the increasing need for early detection of neurological conditions and the ability to track disease progression in real time. Biomarkers are essential in the preclinical and clinical phases of drug development, facilitating the identification of potential candidates and enhancing the efficiency of bringing CNS drugs to market.

- For instance, biomarkers enable the early detection of neurological conditions and facilitate real-time tracking of disease progression, making drug development more efficient and cost-effective.

By End-User

The end-user segment comprises hospitals and clinics, diagnostic laboratories, and academic and research institutes. The hospitals and clinics sub-segment is the dominant player, with a market share of 50%. The increasing prevalence of CNS-related diseases, coupled with the growing need for precise diagnostic and therapeutic tools, drives the demand for biomarkers in healthcare settings. Hospitals and clinics play a critical role in the application of CNS biomarkers for routine diagnostics, disease monitoring, and personalized treatment plans, contributing significantly to the overall market growth.

Key Growth Drivers

Rising Prevalence of Neurological Disorders

The increasing prevalence of neurological disorders, such as Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis, is a significant driver for the growth of the Central Nervous System (CNS) biomarkers market. As the global aging population grows, the incidence of age-related neurological conditions is also on the rise, necessitating advanced diagnostic tools and treatments. CNS biomarkers play a crucial role in early diagnosis, disease monitoring, and therapeutic development, driving their demand in both clinical and research settings. Additionally, the need for personalized medicine in neurology, where biomarkers are used to tailor specific treatments, is further fueling the market growth.

- For instance, F. Hoffmann‑La Roche Ltd developed the Elecsys® Amyloid Plasma Panel which in a large‑scale study including 492 patients achieved a negative predictive value (NPV) of 96.2% for ruling out amyloid pathology in Alzheimer’s disease.

Advancements in Biomarker Discovery and Technology

Technological advancements in biomarker discovery and analytical techniques are propelling the growth of the CNS biomarkers market. Innovations such as high-throughput screening, next-generation sequencing, and advanced imaging technologies have significantly enhanced the ability to identify and validate novel biomarkers for CNS diseases. These advancements have not only improved the accuracy of diagnoses but have also accelerated drug development processes, reducing time and costs associated with clinical trials. Additionally, the integration of artificial intelligence and machine learning in biomarker discovery is enabling more precise identification of biomarkers related to complex neurological conditions.

- For instance, NeuraLight introduced AI-powered eye movement tracking as a progression biomarker for CNS disorders, using only a laptop and webcam to capture oculometric data, which has proven to be highly sensitive and scalable for multicenter trials.

Increasing Investment in Drug Development for CNS Diseases

The growing focus on drug discovery and development for neurological diseases is another major driver for the CNS biomarkers market. Pharmaceutical companies are increasingly investing in the development of targeted therapies and personalized medicines for CNS disorders, recognizing the significant unmet medical needs in this area. CNS biomarkers are crucial in the identification of suitable patient populations for clinical trials, monitoring disease progression, and assessing treatment efficacy. Furthermore, the regulatory approval of breakthrough therapies for CNS disorders is creating a favorable environment for the development and commercialization of new biomarkers.

Key Trends & Opportunities

Rise in Personalized Medicine for CNS Disorders

Personalized medicine is gaining traction in the treatment of CNS disorders, presenting a significant opportunity for the CNS biomarkers market. Personalized treatment strategies, which involve tailoring therapies based on an individual’s genetic, molecular, and clinical data, are increasingly being used to address the heterogeneity of neurological diseases. CNS biomarkers enable the identification of patients who are most likely to benefit from specific treatments, improving therapeutic outcomes. This shift toward personalized medicine is driving the demand for advanced biomarkers that can accurately predict patient response to therapies, identify disease subtypes, and monitor treatment efficacy.

- For instance, Siemens Healthineers AG achieved CE‑mark certification for its serum Neurofilament Light Chain (NfL) assay with a limit of quantitation of 3.0 pg/mL, enabling earlier detection of neuronal damage in multiple sclerosis.

Expansion of Liquid Biopsy Technologies

Liquid biopsy is emerging as a key trend in the CNS biomarkers market, offering a non-invasive alternative to traditional tissue biopsies. Liquid biopsies, which analyze biomarkers from blood, cerebrospinal fluid, or other bodily fluids, provide a less invasive and more accessible method for diagnosing and monitoring neurological diseases. This technology is particularly valuable in detecting early-stage diseases like Alzheimer’s and brain tumors, where early intervention can lead to better patient outcomes. As liquid biopsy technologies continue to improve in sensitivity and specificity, they are expected to become an integral part of CNS biomarker testing, opening up new opportunities for market growth in both diagnostic and therapeutic applications.

- For instance, Bio-Rad Laboratories developed the Droplet Digital PCR (ddPCR) technology, a highly sensitive method used to detect and quantify nucleic acid biomarkers, such as DNA and RNA.

Collaboration and Partnerships in CNS Biomarker Development

Another key opportunity for growth in the CNS biomarkers market is the increasing collaboration between pharmaceutical companies, academic institutions, and diagnostic firms. These partnerships are aimed at accelerating the discovery and validation of biomarkers for CNS diseases, with a focus on enhancing diagnostic accuracy and treatment efficacy. Collaborative efforts are also helping to bridge the gap between laboratory research and clinical applications, facilitating the rapid translation of biomarker discoveries into practical, commercially viable solutions. As partnerships continue to grow, particularly in the area of biomarker validation for clinical trials, the market for CNS biomarkers is expected to expand, benefiting from enhanced research capabilities and more efficient product development.

Key Challenges

Regulatory and Ethical Hurdles in Biomarker Validation

One of the major challenges facing the CNS biomarkers market is the stringent regulatory and ethical hurdles associated with biomarker validation. The process of validating biomarkers for clinical use is lengthy, complex, and costly, requiring robust clinical evidence to support their efficacy and safety. Regulatory bodies such as the FDA and EMA have rigorous approval processes for biomarkers used in diagnostics and drug development. This regulatory uncertainty can delay the adoption of new biomarkers in clinical practice and slow down their integration into drug development pipelines.

High Costs and Limited Accessibility

The high costs associated with developing and commercializing CNS biomarkers represent another significant challenge for the market. The complex technologies involved in biomarker discovery, such as advanced genomics and high-throughput screening, require significant investment in infrastructure and expertise. Additionally, the cost of biomarker testing can be prohibitively expensive, limiting its accessibility, particularly in low- and middle-income regions. This cost barrier can hinder the widespread adoption of CNS biomarkers in clinical practice, especially in settings with limited healthcare resources.

Regional Analysis

North America

North America accounts for 40% of the CNS biomarkers market, making it the most dominant region. This leadership stems from advanced healthcare infrastructure, high research & development investment, and a strong base of pharmaceutical and biotechnology firms leveraging biomarkers for diagnostics and drug development. The United States, in particular, offers a fertile environment for biomarker innovation and commercialisation owing to its significant clinical‑trial activity and regulatory support. As neurological disorders grow in prevalence and precision medicine becomes mainstream, North America is well positioned to sustain its market dominance.

Europe

Europe holds 30% of the global CNS biomarkers market. The region benefits from established healthcare systems, strong regulatory frameworks, and growing awareness of early‑stage diagnosis of CNS disorders. Public and private research initiatives in countries such as Germany, the UK and France are driving biomarker discovery and adoption. Cross‑border collaborations, reimbursement improvements and increasing use of biomarker‑guided therapies further bolster Europe’s position, though growth rates are somewhat lower than emerging markets due to market maturity.

Asia‑Pacific

Asia‑Pacific represents 20% of the CNS biomarkers market and is the fastest‑growing region. Rapid growth is spurred by rising prevalence of neurological diseases, expanding healthcare infrastructure, increased healthcare investment and improving access to advanced diagnostics in countries such as China and India. The region’s large patient population and increasing clinical trial activity present significant opportunities for biomarker providers. As local regulatory and reimbursement frameworks evolve, Asia‑Pacific is expected to gain further share in the global market.

Latin America

Latin America contributes 5% of the global CNS biomarkers market. The region’s growth is supported by modernization of diagnostic laboratories, increased pharmaceutical activity in CNS research, and growing awareness of neurological conditions. However, slower uptake of advanced biomarker technologies and constrained healthcare budgets limit faster expansion. As infrastructure and market adoption improve, Latin America offers a moderate growth path for biomarker vendors.

Middle East & Africa (MEA)

The Middle East & Africa region also holds 5% of the market. Growth is gradually increasing, driven by rising demand for advanced diagnostics, improving healthcare infrastructure and strategic initiatives in key countries. Nevertheless, the region faces challenges from uneven access to technology, regulatory fragmentation and budgetary constraints, which temper its rate of expansion relative to more developed regions.

Market Segmentations

By Biomarker Type

- Safety biomarker

- Efficacy biomarker

- Validation biomarker

By Application

- Disease diagnosis

- Drug discovery and development

- Personalized medicines

By End-user

- Hospitals & clinics

- Diagnostic laboratories

- Academic & research institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the central nervous system (CNS) biomarkers market is shaped by an array of global players, each leveraging robust R&D, strategic alliances, and diversified portfolios to maintain and grow their competitive edge. Leading companies such as F. Hoffmann‑La Roche Ltd, Bio‑Rad Laboratories, Inc., Merck KGaA, Siemens Healthineers AG, bioMérieux SA and Illumina, Inc. dominate the market with comprehensive biomarker assay platforms, advanced instrumentation and global footprints. These firms consistently invest in validating novel biomarkers for neurodegenerative disorders, forge partnerships with academic and biotech institutions, and pursue geographic expansion to capture growth in emerging markets. Smaller niche and regional players complement this ecosystem by focusing on specialised biomarker types, enabling differentiation through innovation and agility. The result is a moderately consolidated yet highly dynamic market, where technological differentiation and strategic collaborations are critical drivers of competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Illumina, Inc.

- Myriad Genetics, Inc.

- F. Hoffmann-La Roche Ltd

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Novartis AG

- Merck KGaA

- G-Biosciences

- PerkinElmer Inc.

- bioMérieux

Recent Developments

- In September 2025, Thermo Fisher Scientific Inc. launched its Gibco™ Efficient-Pro™ Medium (+) Insulin, a next-generation formulation created to enhance productivity and yields in insulin-dependent CHO cell lines.

- In September 2025, FUJIFILM Biosciences unveiled its “BalanCD HEK293 Perfusion A Medium,” a new medium optimized to support gene-therapy production workflows.

- In June 2025, FUJIFILM Corporation announced the rebranding of FUJIFILM Irvine Scientific to FUJIFILM Biosciences, consolidating its recombinant growth factors, proteins, and cell-culture media and supplements under a unified brand identity

Report Coverage

The research report offers an in-depth analysis based on Biomarker Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of biomarkers in early‑stage diagnosis will expand significantly as neurological disorders continue to rise globally.

- Integration of artificial intelligence and machine learning will accelerate biomarker discovery, interpretation and clinical deployment.

- Personalized medicine approaches will increasingly rely on CNS biomarkers to tailor therapeutic strategies and monitor patient response.

- Liquid biopsy and minimally invasive biomarker technologies will gain traction, improving patient experience and diagnostic throughput.

- Expansion of drug development in CNS therapies will drive demand for biomarkers that support efficacy, safety and validation across clinical trials.

- Collaborations between diagnostic, pharmaceutical and biotech companies will multiply, enabling faster translation of biomarkers into routine clinical use.

- Emerging markets in Asia‑Pacific, Latin America and MEA will contribute higher growth as healthcare infrastructure and diagnostic access improve.

- Regulatory frameworks will evolve to better support biomarker qualification, but companies will need to navigate changing standards and reimbursement landscapes.

- Standardisation and validation of biomarker assays will progress, enhancing reliability and facilitating wider adoption in clinics and research.

- Cost pressures and access disparities will continue to challenge market expansion, but technological advances and scale‑economies will help bring down per‑test costs over time.