Market Overview

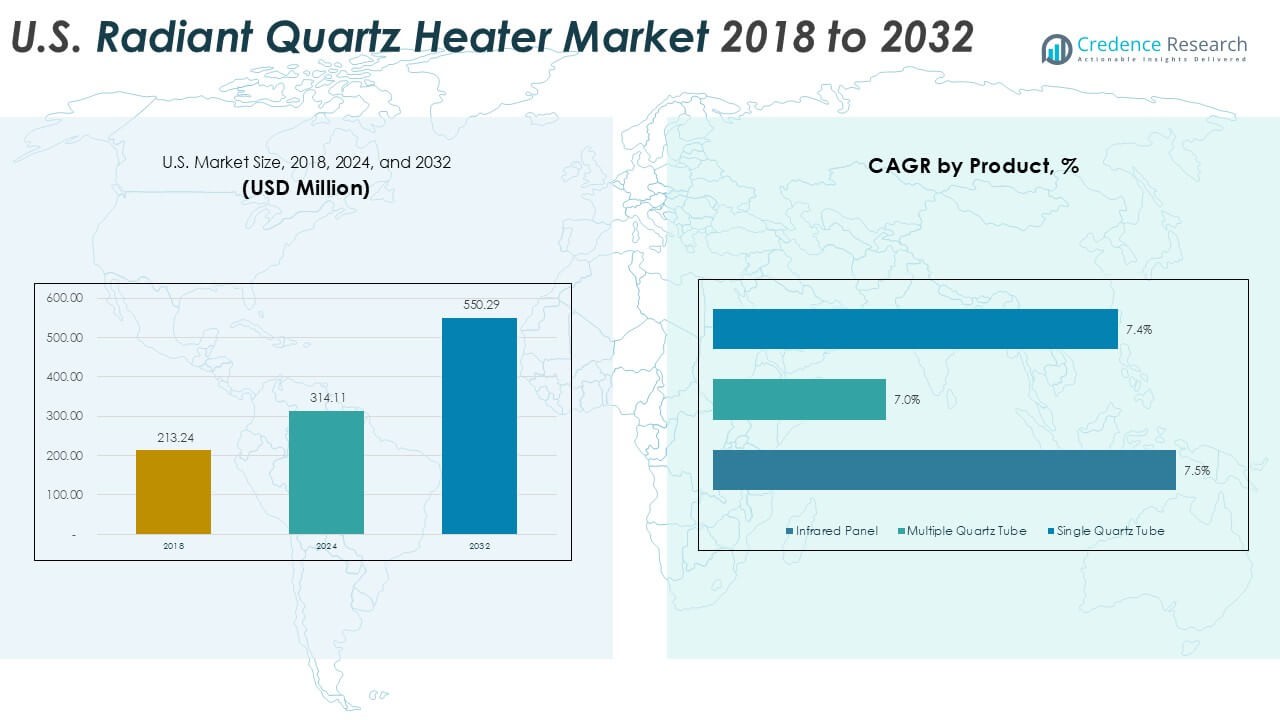

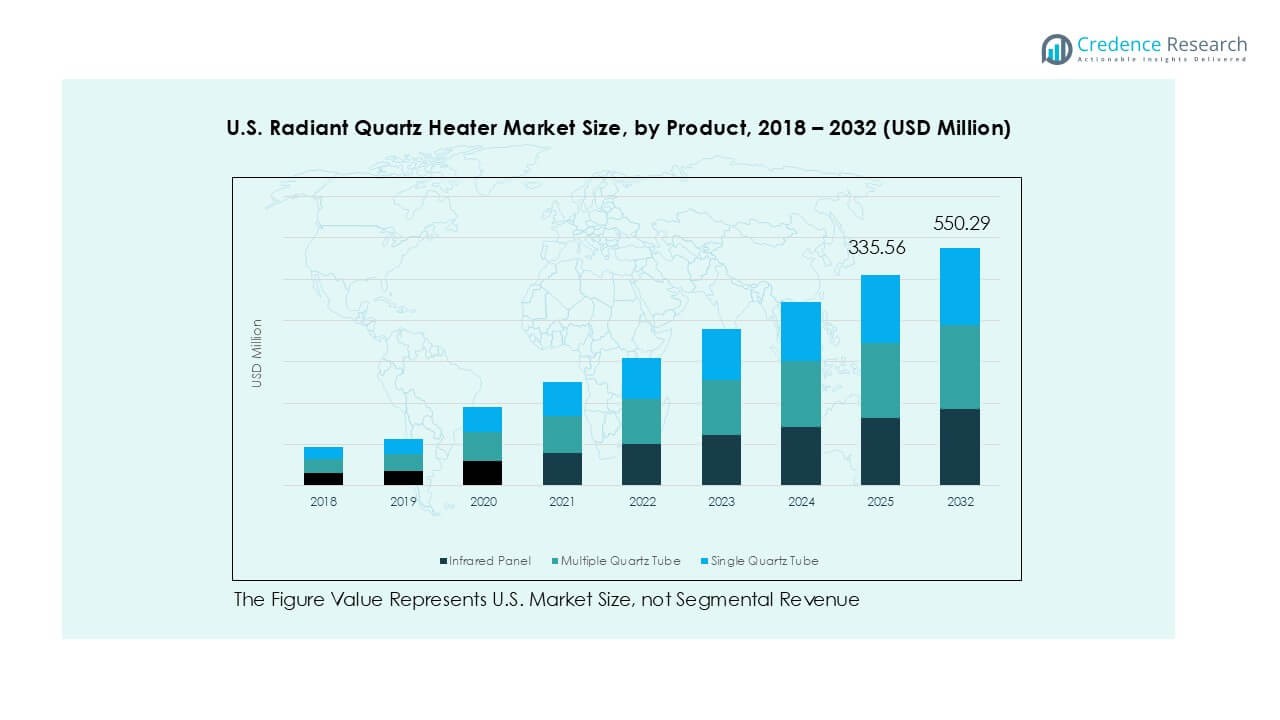

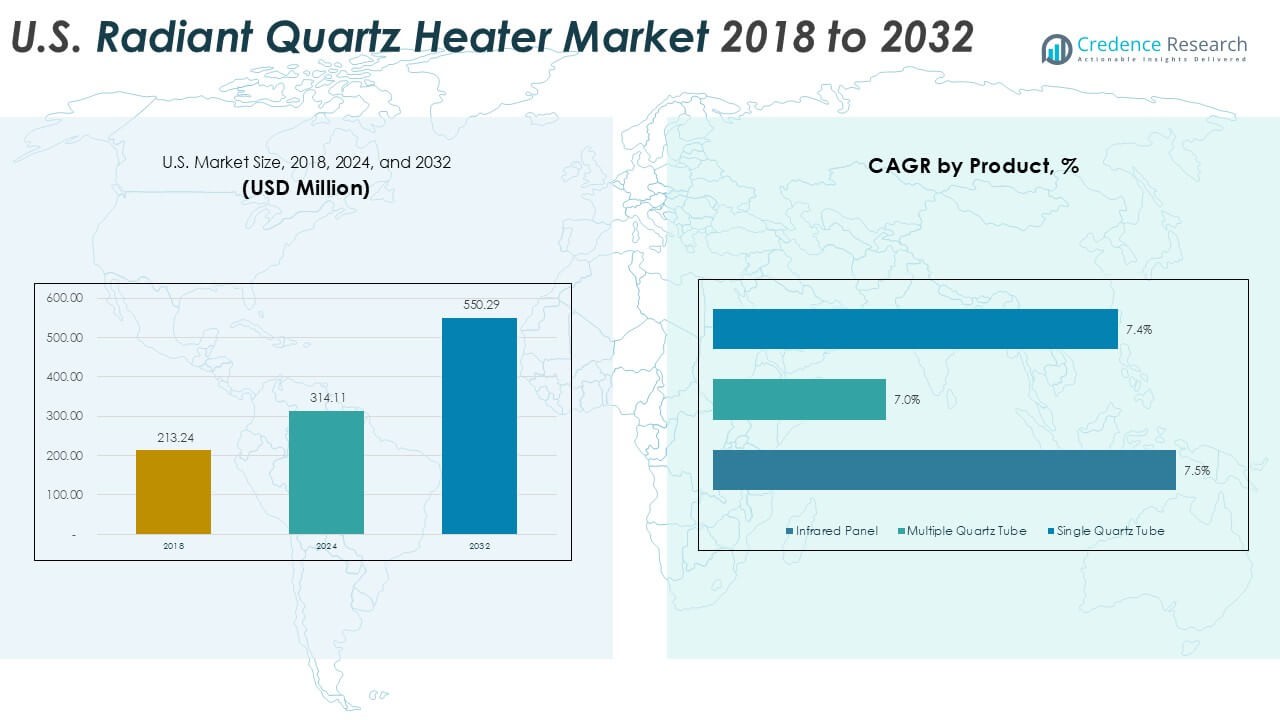

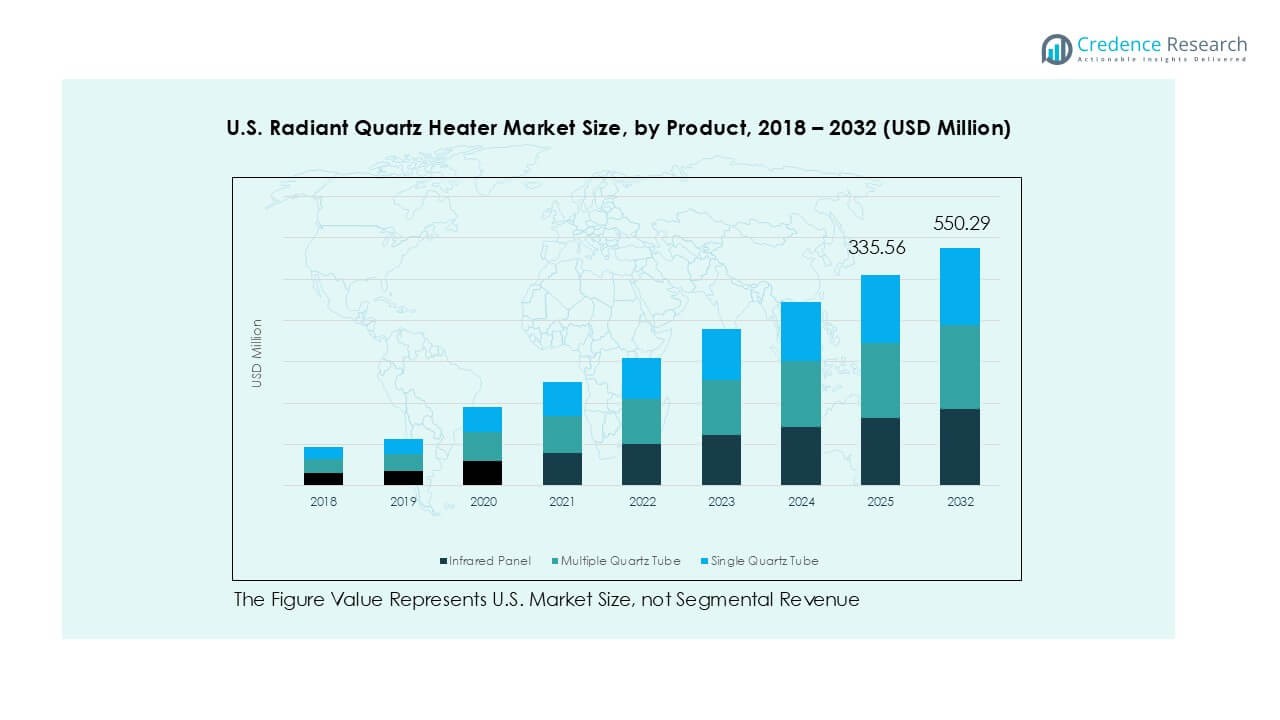

U.S. Radiant Quartz Heater market size was valued at USD 213.24 million in 2018 to USD 314.11 million in 2024 and is anticipated to reach USD 550.29 million by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Radiant Quartz Heater Market Size 2024 |

USD 314.11 Million |

| U.S. Radiant Quartz Heater Market, CAGR |

7.3% |

| U.S. Radiant Quartz Heater Market Size 2032 |

USD 550.29 Million |

The U.S. radiant quartz heater market features strong competition among established consumer appliance brands. Honeywell International, Lasko Products, Vornado Air, and Duraflame lead the market through broad product portfolios and nationwide retail presence. Pelonis Technologies, TPI Corporation, and Sunpentown International strengthen competition in value and mid-range segments. These players compete on safety certifications, energy efficiency, and brand trust. The Midwestern United States leads the market with a 28% share, driven by long winters and high reliance on supplemental heating. The Western region follows with 26%, supported by urban housing and energy efficiency demand. Strong regional coverage and seasonal promotions help top players maintain volume leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. radiant quartz heater market grew from USD 213.24 million in 2018 to USD 314.11 million in 2024 and is projected to reach USD 550.29 million by 2032, registering a CAGR of 7.3% during the forecast period.

- Rising demand for energy-efficient and cost-effective supplemental heating drives market growth, as consumers seek instant heat, lower upfront costs, and room-specific heating to manage electricity expenses during winter seasons.

- Key trends include growing adoption of multiple quartz tube heaters holding about 45% segment share, increasing preference for 1000–1500 watt models with nearly 48% share, and gradual integration of digital controls and safety-enhanced features.

- The competitive landscape includes established brands such as Honeywell, Lasko, Vornado, and Duraflame, competing on safety, efficiency, design, and retail reach, with pricing pressure remaining strong in entry-level segments.

- Regionally, the Midwestern United States leads with 28% market share, followed by the West at 26%, the Northeast at 24%, and the South at 22%, reflecting climate severity, housing patterns, and seasonal heating demand.

Market Segmentation Analysis:

By Product

The U.S. radiant quartz heater market shows strong differentiation by product type. Multiple quartz tube heaters dominate this segment, holding nearly 45% market share. Demand remains high due to faster heat output, wider heat dispersion, and better room coverage. These models suit living rooms, garages, and commercial spaces. Infrared panel heaters follow, driven by slim design and wall-mount use in modern homes. Single quartz tube heaters capture a smaller share, mainly for personal heating. Energy efficiency, durability, and higher heating intensity continue to drive multiple quartz tube adoption.

- For instance, Duraflame’s 3D Infrared Quartz Heater operates at 1,500 watts and is rated to heat areas up to 1,000 square feet, supporting living rooms and garages.

By Wattage Segment:

By wattage, the 1000–1500-watt segment leads the U.S. market with about 48% share. Consumers prefer this range for balanced heating performance and controlled power consumption. These heaters suit bedrooms and medium-sized spaces without overloading circuits. Below 1000-watt units serve niche demand for spot heating and portable use. Above 1500-watt models see growth in garages and workshops. Rising electricity costs and safety concerns support demand for mid-range wattage heaters offering effective warmth with manageable operating expenses.

- For instance, Vornado’s VH200 quartz-enhanced space heater operates at 1,500 watts, includes three heat settings, and is designed for rooms up to 300 square feet, aligning with residential safety limits.

By Distribution Channel:

Offline channels dominate the U.S. radiant quartz heater market, accounting for nearly 62% of total sales. Home improvement stores, appliance retailers, and specialty heating shops drive this share through in-person demonstrations and immediate availability. Consumers value physical inspection, safety guidance, and brand trust. Online channels grow steadily due to price comparison, seasonal promotions, and home delivery convenience. E-commerce adoption increases among younger buyers. However, bulky product size and preference for in-store evaluation keep offline retail as the leading distribution channel.

Key Growth Drivers

Rising Demand for Energy-Efficient and Cost-Effective Heating

Energy efficiency remains a primary growth driver in the U.S. radiant quartz heater market. Rising electricity prices push households to seek heaters that convert power directly into usable heat. Radiant quartz heaters deliver instant warmth without long preheating cycles. This feature reduces overall energy waste compared to convection systems. Consumers also favor localized heating for occupied spaces rather than whole-home systems. Quartz heaters support this behavior well. Compact designs and lower upfront costs further strengthen adoption. Apartments, rental homes, and seasonal residences drive steady demand. Energy-conscious consumers view radiant heaters as practical alternatives during peak winter months. Manufacturers emphasize efficiency ratings and safety features to reinforce value. These factors collectively sustain strong replacement and first-time purchase demand.

- For instance, Dr. Infrared Heater’s DR-968 portable space heater operates at 1,500 watts, includes a dual heating system combining one infrared quartz tube with a PTC element, and maintains room temperature using a built-in electronic thermostat adjustable from 50°F to 85°F, supporting supplemental zone heating.

Growth in Urban Housing and Rental Accommodation

Urban population growth strongly supports radiant quartz heater demand across the U.S. Smaller living spaces require compact and portable heating solutions. Quartz heaters fit well in apartments, studios, and rental units. Landlords often prefer plug-and-play heating devices with minimal installation needs. Tenants value mobility and ease of storage. Radiant quartz heaters meet both requirements effectively. The rental housing segment also drives seasonal purchasing patterns. Many tenants avoid permanent heating upgrades. Instead, they rely on supplemental heaters during colder months. Increasing urbanization across Sun Belt and Midwest cities expands this user base. Product affordability further attracts young professionals and students. This housing trend ensures consistent volume growth across entry and mid-priced heater categories.

- For instance, Lasko’s 6101 quartz console heater operates at 1,500 watts, stands approximately 16.75 inches tall, and includes two heat settings (high and low) with tip-over protection and a cool-touch exterior, making it suitable for rental and studio spaces.

Increased Adoption in Commercial and Semi-Outdoor Applications

Commercial usage acts as another major growth driver for radiant quartz heaters. Restaurants, cafés, and retail stores increasingly use these heaters for spot heating. Semi-outdoor spaces like patios and workshops benefit from directional heat output. Quartz heaters perform well in draft-prone environments where convective heating fails. Businesses value fast heat delivery and reduced operating costs. Warehouses and garages also adopt high-wattage quartz models. These applications demand durable and high-intensity heating solutions. Growing outdoor dining culture supports steady commercial demand. Safety certifications and rugged designs further encourage adoption. As businesses seek flexible heating without major infrastructure changes, radiant quartz heaters gain wider acceptance across non-residential settings.

Key Trends & Opportunities

Shift Toward Smart and Feature-Enhanced Quartz Heaters

Smart functionality represents a key trend and opportunity in the U.S. market. Consumers increasingly expect heaters with timers, remote controls, and app connectivity. Smart thermostats improve energy control and safety. Integration with home automation systems adds convenience. Premium quartz heaters now offer digital displays and programmable settings. These features appeal to tech-savvy households. Smart upgrades also justify higher price points. Manufacturers leverage this trend to improve margins. Retailers highlight smart features during winter promotions. Growing awareness of energy monitoring strengthens this opportunity. As smart home adoption rises, feature-rich quartz heaters gain competitive advantage in urban and suburban markets.

- For instance, Heat Storm’s HS-1500-PHX WiFi quartz infrared heater operates at 1,500 watts, supports smartphone control via 2.4 GHz Wi-Fi, and allows temperature settings from 50°F to 99°F through a mobile app.

Expansion of Online Retail and Direct-to-Consumer Sales

E-commerce growth creates strong opportunities for radiant quartz heater brands. Online platforms enable price comparison and easy access to product reviews. Seasonal discounts drive high digital sales volumes. Direct-to-consumer channels improve brand visibility and margins. Improved logistics now support delivery of bulky appliances. Younger buyers prefer online purchasing for convenience. Manufacturers invest in digital marketing and content-rich product listings. Online channels also support regional demand spikes during cold spells. Subscription-based replacement parts and accessories add value. This shift accelerates market penetration beyond traditional retail networks. Digital expansion remains a long-term growth opportunity.

- For instance, Amazon-listed Duraflame infrared quartz heaters typically feature dual heat settings at around 1,000 watts and 1,500 watts, are equipped with a power cord of approximately 6 feet in length, and vary in weight depending on the specific model.

Key Challenges

Safety Concerns and Regulatory Compliance Pressure

Safety remains a key challenge for the U.S. radiant quartz heater market. Improper use increases fire and burns risks. Regulatory bodies enforce strict safety standards and certifications. Compliance increases manufacturing costs. Product recalls can damage brand reputation. Consumers remain cautious due to past safety incidents. Manufacturers must invest heavily in testing and design improvements. Overheat protection and tip-over switches are now mandatory features. Educating consumers on safe usage also requires effort. Smaller brands struggle to meet compliance costs. These factors limit new market entrants and slow innovation cycles. Safety concerns continue to shape product development strategies.

Sensitivity to Electricity Costs and Seasonal Demand

Electricity price volatility presents another major challenge. Rising utility bills discourage prolonged heater usage. Consumers may limit operating hours during peak pricing periods. Demand remains highly seasonal, concentrated in winter months. This pattern affects inventory planning and revenue stability. Warm winters reduce sales volumes significantly. Manufacturers face forecasting difficulties. Retailers manage high off-season inventory risks. Alternative heating technologies also compete for consumer spending. To offset this challenge, brands focus on efficiency messaging. However, cost sensitivity remains a persistent barrier to consistent year-round demand growth.

Regional Analysis

Western United States:

The Western United States accounts for about 26% of the U.S. radiant quartz heater market. Demand centers on states such as California, Washington, and Colorado. Mild winters and strict energy regulations shape buying behavior. Consumers prefer energy-efficient and portable heating for apartments and secondary heating needs. Wildfire-related power awareness also drives interest in low-consumption heaters. Urban density supports compact and wall-mounted models. Online sales perform well due to strong e-commerce penetration. Commercial use in garages and workshops adds demand. Overall, efficiency, design, and regulatory compliance drive steady regional adoption.

Midwestern United States:

The Midwest represents nearly 28% of total market share, making it the largest regional contributor. Harsh winters and long heating seasons strongly support heater demand. States such as Illinois, Ohio, and Michigan drive volume sales. Households use radiant quartz heaters as supplemental heating to reduce central heating costs. High adoption appears in basements, garages, and workshops. Consumers favor mid- to high-wattage models for stronger heat output. Offline retail dominates due to reliance on local appliance stores. Cold weather reliability and affordability remain the primary regional demand drivers.

Southern United States:

The Southern United States holds approximately 22% market share. Heating demand remains seasonal and intermittent across states such as Texas, Florida, and Georgia. Consumers rely on radiant quartz heaters during short cold spells. Portability and quick heat delivery attract buyers. Lower wattage and compact units dominate sales. Rental housing and mobile homes increase adoption. Online channels grow faster than offline due to price sensitivity and convenience. Commercial use remains limited but rising in workshops and semi-outdoor spaces. Affordability and ease of use remain the key drivers across southern markets.

Northeastern United States:

The Northeastern United States accounts for around 24% of the market. States such as New York, Pennsylvania, and Massachusetts drive strong demand. Cold winters and high electricity costs influence buying decisions. Consumers use radiant quartz heaters for room-level heating to manage energy expenses. Apartment living supports compact and wall-mounted models. Safety-certified products gain strong preference. Offline sales remain important due to trust in established retailers. Commercial demand rises in retail and hospitality spaces. Overall, climate severity and cost control strongly shape regional market growth.

Market Segmentations:

By Product

- Infrared Panel

- Multiple Quartz Tube

- Single Quartz Tube

By Wattage Segment

- Below 1000 Watt

- 1000–1500 Watt

- Above 1500 Watt

By Distribution Channel

By Geography

- Western United States

- Midwestern United States

- Southern United States

- Northeastern United States

Competitive Landscape

The U.S. radiant quartz heater market shows moderate fragmentation with a mix of global brands and specialized heating manufacturers. Companies such as Honeywell, Lasko, Vornado, and Duraflame leverage strong brand recognition and wide retail reach. These players compete on energy efficiency, safety features, and product reliability. Mid-sized manufacturers focus on niche applications, including commercial and industrial heating. Product differentiation centers on wattage range, heat coverage, and safety certifications. Innovation remains incremental, with emphasis on digital controls and improved durability. Pricing competition stays intense in entry segments, while premium models rely on design and smart features. Strategic partnerships with retailers and seasonal promotions play a key role in market positioning and volume growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Backer Hotwatt, Inc.

- Convectronics

- Tempco Electric Heater Corporation

- Honeywell International Inc.

- Lasko Products, LLC

- TPI Corporation

- Pelonis Technologies, Inc.

- Duraflame, Inc.

- Vornado Air, LLC

- Sunpentown International, Inc.

Recent Developments

- In June 2023, The European Union revised its overarching Energy Efficiency Directive, and new, stricter Ecodesign standards for local space heaters, including radiant heaters, were adopted in April 2024 and will apply from July 1, 2025.

- In January 2023, Honeywell announced a new line of smart radiant quartz heaters with integrated Wi-Fi capabilities.

Report Coverage

The research report offers an in-depth analysis based on Product, Wattage Segment, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue growing due to steady demand for supplemental indoor heating.

- Energy efficiency will remain a primary purchase criterion for consumers.

- Smart controls and enhanced safety features will gain wider adoption.

- Multiple quartz tube heaters will maintain leadership across residential applications.

- Mid-range wattage models will dominate due to balanced performance and power use.

- Online sales channels will expand faster than traditional retail formats.

- Urban apartments and rental housing will drive portable heater demand.

- Commercial use in workshops and semi-outdoor spaces will increase gradually.

- Regulatory standards will push manufacturers toward safer and more durable designs.

- Competitive pricing and product differentiation will shape long-term market dynamics.