Market Overview:

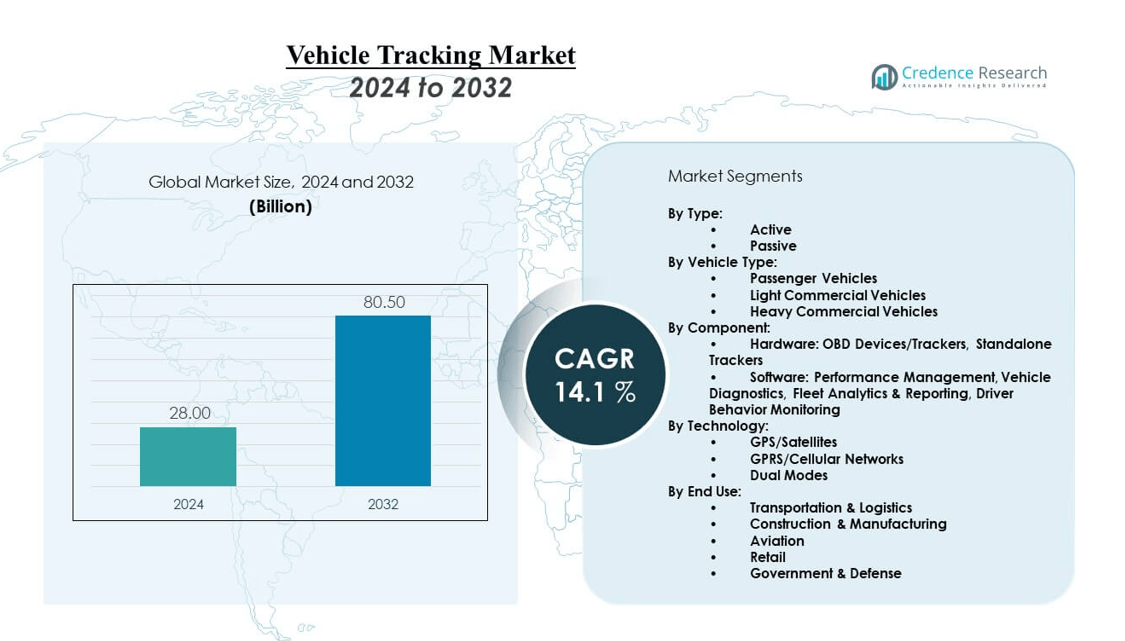

The vehicle tracking market is projected to grow from USD 28 billion in 2024 to an estimated USD 80.5 billion by 2032, with a compound annual growth rate (CAGR) of 14.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vehicle Tracking Market Size 2024 |

USD 28 billion |

| Vehicle Tracking Market, CAGR |

14.1% |

| Vehicle Tracking Market Size 2032 |

USD 80.5 billion |

The market expands rapidly as rising demand for fleet management, safety, and regulatory compliance fuels adoption across logistics, transportation, and automotive sectors. Companies leverage vehicle tracking solutions to improve operational efficiency, reduce fuel costs, and enhance real-time monitoring. Growing integration of IoT, telematics, and AI-based analytics strengthens predictive maintenance and route optimization, while rising concerns about theft prevention and driver behavior monitoring accelerate widespread deployment. Governments also promote adoption through mandates for vehicle safety, emissions reduction, and road infrastructure management.

Regionally, North America leads the vehicle tracking market due to strong adoption of telematics, advanced automotive infrastructure, and strict regulatory frameworks. Europe follows with emphasis on sustainability, safety, and smart mobility initiatives. The Asia Pacific region is emerging as a high-growth market, driven by rapid urbanization, expanding e-commerce logistics, and rising vehicle ownership in countries like China and India. Latin America and the Middle East & Africa are also adopting vehicle tracking solutions at a steady pace, supported by growing fleet operations, infrastructure modernization, and efforts to improve road safety./

Market Insights:

- The vehicle tracking market is projected to grow from USD 28 billion in 2024 to USD 80.5 billion by 2032, registering a CAGR of 14.1% during the forecast period.

- Rising demand for fleet management, operational efficiency, and real-time monitoring drives strong adoption across logistics, transportation, and automotive industries.

- Increasing integration of IoT, AI, and telematics enhances predictive maintenance, route optimization, and driver performance tracking.

- High implementation costs, complex system integration, and data privacy concerns act as restraints, particularly for small and medium enterprises.

- North America leads due to advanced automotive infrastructure, telematics adoption, and stringent regulatory frameworks.

- Europe shows strong growth supported by sustainability policies, smart mobility initiatives, and transport compliance requirements.

- Asia Pacific emerges as the fastest-growing region, driven by rapid urbanization, rising e-commerce logistics, and expanding vehicle ownership in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Fleet Management Solutions to Improve Efficiency:

The vehicle tracking market grows strongly as fleet operators seek tools to optimize operations and lower costs. Companies rely on advanced tracking systems to monitor routes, reduce idle time, and ensure timely deliveries. Demand rises with the expansion of e-commerce and last-mile delivery services, which depend on real-time visibility. Organizations integrate vehicle tracking into logistics systems to manage large fleets more effectively. Government regulations promoting road safety and emission reduction strengthen the case for adoption. Businesses recognize the competitive advantage of reducing fuel expenses and downtime through efficient fleet utilization. It addresses driver accountability by tracking performance metrics and compliance with safety standards. The demand for integrated fleet solutions continues to expand across diverse sectors.

Increasing Role of IoT and Telematics in Connected Mobility:

The vehicle tracking market benefits from the growing integration of IoT and telematics technologies. Connected devices transmit real-time data that improves predictive maintenance and enables efficient decision-making. IoT platforms link vehicles to centralized systems, allowing fleet managers to monitor location, engine health, and driving behavior. Artificial intelligence and machine learning enhance insights, turning raw data into actionable outcomes. Telecom advancements such as 5G accelerate adoption by ensuring low-latency data transfer. Telematics systems also support route optimization and enhance customer satisfaction in logistics services. Demand rises from businesses that aim to strengthen transparency and accountability. It creates a foundation for smarter mobility solutions across industries.

- For instance, Geotab’s telematics platform processed real-time data from over 2 million connected vehicles globally in 2024, enabling predictive diagnostics that decreased vehicle breakdowns by 18% in large fleet operations.

Heightened Concerns About Security and Vehicle Theft Prevention:

The vehicle tracking market expands as end users prioritize safety and asset protection. Rising cases of vehicle theft drive adoption of advanced GPS-enabled tracking systems. Insurance providers encourage installation of such solutions by offering premium discounts to policyholders. Tracking systems provide real-time alerts and geofencing features that help reduce unauthorized use. Governments in several countries mandate tracking devices in commercial and public transport vehicles. Enterprises utilize tracking to prevent cargo theft and monitor valuable assets during transit. Consumers adopt personal tracking devices for private vehicles to improve security and peace of mind. It strengthens trust among fleet operators and customers through improved protection measures.

- Governments in India, for example, mandate GPS tracking in all commercial vehicles exceeding 3.5 tons, impacting more than 5 million trucks nationwide.

Government Regulations and Infrastructure Development Initiatives:

The vehicle tracking market receives strong impetus from government policies aimed at road safety and smart mobility. Authorities in many regions require installation of tracking devices in commercial fleets, school buses, and emergency vehicles. Regulations promoting emission control and compliance with transport laws further encourage adoption. Public transportation systems integrate tracking solutions to enhance passenger safety and improve scheduling accuracy. Infrastructure modernization programs, including smart highways and connected cities, rely on robust tracking networks. Policymakers push adoption as part of broader digital transformation in the transport sector. Mandatory compliance drives consistent growth, especially in developing economies. It aligns private investments with national priorities in safety and sustainability.

Market Trends:

Integration of Artificial Intelligence for Predictive Insights:

The vehicle tracking market advances with the integration of artificial intelligence and predictive analytics. AI enhances decision-making by processing large volumes of telematics data into real-time insights. Predictive capabilities enable maintenance scheduling, reducing downtime and improving fleet availability. Machine learning algorithms improve route planning by analyzing historical and current traffic patterns. Businesses gain operational efficiency by forecasting fuel consumption and optimizing vehicle loads. The integration of AI-driven dashboards strengthens fleet visibility across industries. It supports better risk management by identifying unsafe driving practices early. AI adoption continues to reshape competitive differentiation in tracking solutions.

- For instance, Trimble’s AI-powered fleet management system helped a U.S.-based transportation company reduce unscheduled maintenance events by 30% within 12 months, maintaining a fleet uptime increase of 7,500 hours.

Expansion of Cloud-Based and SaaS-Based Tracking Platforms:

The vehicle tracking market shifts toward cloud and SaaS models as businesses prefer scalable and cost-efficient solutions. Cloud platforms allow centralized access to vehicle data from multiple locations, enhancing flexibility. Software-as-a-Service offerings reduce upfront costs and provide subscription-based models for small and medium enterprises. Cloud solutions enable rapid deployment and seamless updates without heavy infrastructure investments. Integration with other enterprise applications such as ERP and CRM improves operational alignment. Remote accessibility ensures managers can monitor fleets from any device. It drives adoption among logistics, retail, and passenger transport businesses. The move toward SaaS models creates recurring revenue streams for solution providers.

- For instance, Geotab releases quarterly software updates automatically to its network exceeding 2 million connected vehicles. Integration with ERP and CRM systems improves operational workflows for companies such as Ryder, which manages over 200,000 vehicles with integrated telematics.

Integration of Vehicle Tracking With Smart Mobility Ecosystems:

The vehicle tracking market evolves with its role in supporting smart cities and connected ecosystems. Municipalities use tracking for public transport scheduling, congestion management, and emergency response. Smart mobility programs integrate tracking with EV charging infrastructure and shared mobility platforms. Real-time data enables authorities to plan infrastructure improvements effectively. Tracking supports multimodal transportation by linking buses, rail, and taxis under unified systems. The convergence with mobility-as-a-service platforms enhances user experience through integrated journey planning. It aligns with government initiatives to reduce emissions and improve urban mobility. Integration with broader ecosystems increases adoption beyond traditional logistics.

Adoption of Video Telematics and Advanced Safety Features:

The vehicle tracking market sees growing integration of video telematics and driver-assistance technologies. Cameras combined with GPS systems provide comprehensive visibility into driver behavior and incidents. Video data supports accident reconstruction, liability management, and insurance claims. Advanced driver-assistance features such as lane monitoring and collision alerts integrate with tracking systems. Fleet operators value video insights to improve training and accountability. Combining telematics with vision-based systems reduces risk and enhances compliance with safety laws. Adoption grows in sectors like logistics, public transportation, and hazardous goods movement. It elevates tracking systems from simple monitoring to holistic safety solutions.

Market Challenges:

High Implementation Costs and Integration Complexities:

The vehicle tracking market faces challenges due to the significant costs of installation and system integration. Small and medium enterprises often hesitate to adopt due to upfront expenses for hardware, software, and connectivity. Integrating tracking solutions with existing enterprise platforms can be complex and resource-intensive. Organizations struggle with interoperability issues when using multiple vendors or legacy systems. Training staff and maintaining systems require additional investment, raising total ownership costs. High initial barriers slow adoption rates in cost-sensitive regions. Companies with limited budgets delay investments despite clear long-term benefits. It creates a gap between technological advancements and mass adoption.

Concerns About Data Security, Privacy, and Regulatory Compliance:

The vehicle tracking market also contends with concerns about data security and privacy. Continuous data transmission exposes systems to risks of hacking and unauthorized access. Breaches can compromise sensitive information such as location, route history, and driver behavior. Companies must comply with strict data protection regulations in regions like Europe and North America. Legal frameworks add complexity to deployment, especially for multinational operations. Customers worry about misuse of personal and vehicle data, slowing adoption in consumer markets. Strong encryption, secure servers, and compliance certifications are essential to address risks. It requires solution providers to balance innovation with robust security measures.

Market Opportunities:

Rising Adoption in Emerging Economies With Expanding Logistics Networks:

The vehicle tracking market presents opportunities in developing regions where logistics demand grows rapidly. Expanding e-commerce, industrialization, and urbanization drive the need for advanced tracking solutions. Businesses in countries such as India, Brazil, and Indonesia adopt systems to enhance delivery efficiency. Rising vehicle ownership increases demand for personal security and theft prevention solutions. Governments in emerging markets invest in smart transport infrastructure that supports adoption. Enterprises benefit from scalable solutions that meet both commercial and consumer needs. It provides vendors with strong growth prospects by addressing underserved markets. The opportunity aligns with global expansion strategies of technology providers.

Growing Integration With Electric Vehicles and Green Mobility Programs:

The vehicle tracking market finds opportunities in supporting electric vehicles and sustainability initiatives. Tracking solutions integrate with EV fleets to monitor charging, optimize routes, and reduce energy costs. Governments promote green mobility programs that require real-time monitoring systems. Businesses adopt eco-friendly fleets to meet sustainability targets and leverage tracking for compliance. The demand for carbon footprint reduction strengthens integration of telematics with renewable energy ecosystems. Tracking also supports shared and autonomous mobility platforms aligned with sustainability goals. It creates a new layer of demand beyond traditional fleet management applications. Vendors gain competitive advantage by aligning with global sustainability agendas.

Market Segmentation Analysis:

By Type

The vehicle tracking market is divided into active and passive systems. Active tracking dominates due to its ability to deliver real-time data that enhances visibility and operational control. Enterprises favor active systems for monitoring large fleets and ensuring compliance with safety and service standards. Passive systems continue to serve smaller businesses and individual users where cost is a critical factor. They provide historical trip data and basic tracking functionality without requiring constant connectivity.

- For instance, Vodafone Automotive supplies passive tracking devices annually, targeted at individual users and small fleets.

By Vehicle Type

Passenger vehicles represent a strong share due to growing demand for personal security and insurance-driven adoption. Light commercial vehicles play a critical role in last-mile delivery and urban logistics where efficiency and real-time updates are vital. Heavy commercial vehicles hold significant demand in freight and industrial transport, where compliance and long-distance monitoring are essential. Each segment contributes uniquely to the expansion of the market across consumer and enterprise applications.

- For instance, Heavy commercial vehicle fleets depend on compliance and long-distance tracking; for example, Scania has integrated telematics across 75,000 trucks to optimize freight operations and regulatory adherence.

By Component

Hardware such as OBD devices and standalone trackers provides the core infrastructure for deployment. Software is becoming the key differentiator as enterprises increasingly rely on advanced platforms for performance management, vehicle diagnostics, fleet analytics, and driver behavior monitoring. It supports predictive insights that reduce costs, extend vehicle life, and improve operational efficiency.

By Technology and End Use

GPS and satellite-based systems dominate for their accuracy, while GPRS and cellular networks remain cost-effective for urban and regional use. Dual-mode solutions gain adoption where reliability and redundancy are necessary. Transportation and logistics lead end-use demand, followed by construction and manufacturing. Aviation, retail, and government and defense adopt tracking solutions for security, efficiency, and regulatory compliance, making them important growth drivers in specialized segments.

Segmentation:

By Type:

By Vehicle Type:

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Component:

- Hardware: OBD Devices/Trackers, Standalone Trackers

- Software: Performance Management, Vehicle Diagnostics, Fleet Analytics & Reporting, Driver Behavior Monitoring

By Technology:

- GPS/Satellites

- GPRS/Cellular Networks

- Dual Modes

By End Use:

- Transportation & Logistics

- Construction & Manufacturing

- Aviation

- Retail

- Government & Defense

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America leads the vehicle tracking market with a share of around 34%, supported by high adoption of telematics, strong regulatory frameworks, and advanced automotive infrastructure. The region benefits from stringent government mandates on fleet safety, emission control, and electronic logging devices, which drive consistent demand. Logistics companies in the United States and Canada invest heavily in real-time tracking to improve operational efficiency and customer service. Integration of AI and IoT technologies enhances fleet visibility and predictive analytics. The presence of leading solution providers such as Verizon Connect, Geotab, and Trimble strengthens market maturity. It continues to grow with expanding e-commerce and increasing investments in connected mobility solutions.

Europe

Europe holds approximately 27% share of the vehicle tracking market, driven by sustainability initiatives, smart mobility projects, and strict compliance requirements. Countries such as Germany, the United Kingdom, and France focus on fleet optimization to reduce carbon emissions and improve road safety. European Union policies on intelligent transport systems create a favorable environment for adoption. Enterprises adopt advanced tracking solutions to manage cross-border logistics and enhance supply chain visibility. Demand rises in sectors such as construction, retail distribution, and public transportation. It gains further momentum with investments in electric vehicle fleets and integration of tracking with green mobility platforms.

Asia Pacific

Asia Pacific accounts for about 25% of the vehicle tracking market and represents the fastest-growing region. Rapid urbanization, rising e-commerce, and expanding logistics networks in China and India drive adoption. Governments mandate tracking systems in commercial vehicles and public transportation to improve safety and compliance. The growing vehicle fleet across emerging economies creates strong demand for hardware and software solutions. Domestic and international vendors expand aggressively to capture untapped opportunities in fleet management and consumer security. It strengthens its position as a high-growth market with investments in smart cities and advanced transport infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Verizon Connect

- Geotab Inc.

- Cartrack

- TomTom International B.V.

- CalAmp

- Teltonika

- Orbcomm Inc.

- Xirgo Technologies, LLC

- Laipac Technology Inc.

- Trackimo Inc.

- Continental AG

- Robert Bosch GmbH

- Inseego Corp.

- Spireon Inc.

- AT&T Inc.

- Trimble Inc.

- Samsara

- Sierra Wireless Inc.

- Concox Wireless Solution Co., Ltd.

- ATrack Technology Inc.

- Meitrack Group

- Fleet Complete

- Teletrac Navman

- GPS Insight

- Fleetmatics

Competitive Analysis:

The vehicle tracking market is highly competitive with global and regional players offering a mix of hardware and software solutions. Leading companies such as Verizon Connect, Geotab, TomTom, CalAmp, and Continental AG strengthen their positions through technological innovation, acquisitions, and strategic partnerships. New entrants emphasize affordable and customizable solutions to capture small and medium enterprises, while established firms invest in AI-driven analytics and cloud-based platforms to enhance value. It remains innovation-driven, where product differentiation and service reliability shape customer preference and long-term contracts secure market dominance.

Recent Developments:

- In 2025, Verizon Connect launched new advanced technology solutions to enhance fleet safety, driver performance, and operational efficiency. These innovations underscore Verizon’s commitment to optimizing fleet management with cutting-edge tools designed for modern operational needs.

- In August 2025, Geotab announced a partnership with Mercedes-Benz USA, integrating Mercedes-Benz connectivity services with Geotab’s fleet management platform. This initiative provides a seamless telematics solution that unifies vehicle data from electric and internal combustion vehicles, enhancing fleet visibility and management efficiency.

- Cartrack was introduced in July 2025 as part of the Mercedes-Benz partner solutions network, enabling integration of real-time vehicle data into Cartrack’s fleet management platform without retrofit devices, improving workflow digitalization and operational efficiency.

- CalAmp entered financial restructuring in 2024 to reduce debt and go private, aiming to invest more in innovation and customer support despite ongoing business operations.

Market Concentration & Characteristics:

The vehicle tracking market is moderately concentrated, with top players accounting for a significant share through strong technological capabilities and global reach. It is characterized by high competition in hardware devices but increasing consolidation in software and analytics solutions. Strategic alliances and OEM collaborations drive growth, while smaller vendors compete by offering cost-effective and niche applications.

Report Coverage:

The research report offers an in-depth analysis based on Type, Vehicle Type, Component, Technology, End Use, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing integration of AI and predictive analytics will enhance operational efficiency.

- Adoption of dual-mode GPS and cellular systems will strengthen reliability.

- Cloud-based SaaS platforms will gain traction among SMEs.

- Electric and green mobility programs will accelerate adoption of tracking solutions.

- Video telematics will evolve as a key differentiator in safety monitoring.

- Government mandates for commercial fleets will drive compliance-based adoption.

- Smart city projects will integrate tracking with intelligent transport systems.

- Cross-border logistics growth will fuel demand for advanced tracking features.

- Cybersecurity and data protection will remain a strategic focus for vendors.

- Emerging markets in Asia Pacific and Latin America will deliver the fastest expansion.