Market Overview:

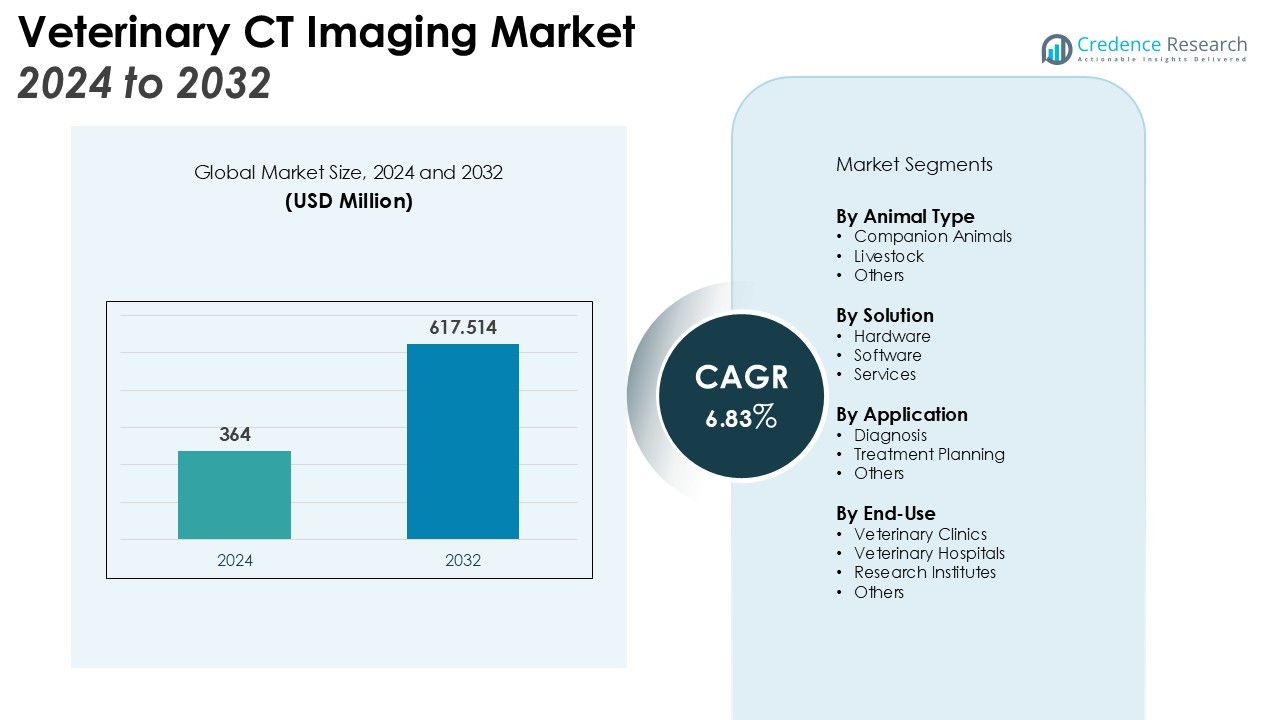

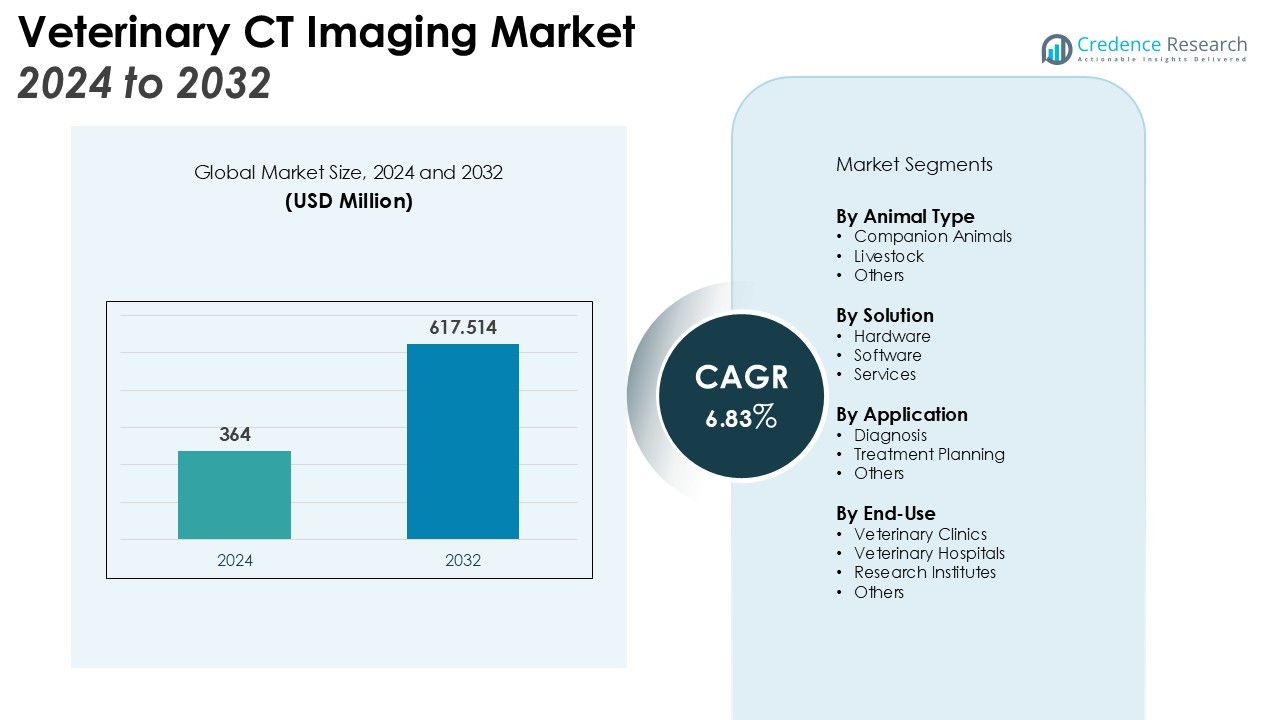

The Veterinary CT Imaging Market size was valued at USD 364 million in 2024 and is anticipated to reach USD 617.514 million by 2032, at a CAGR of 6.83% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veterinary CT Imaging Market Size 2024 |

USD 364 Million |

| Veterinary CT Imaging Market, CAGR |

6.83% |

| Veterinary CT Imaging Market Size 2032 |

USD 617.514 Million |

Key market drivers include the rising prevalence of chronic diseases and injuries in animals, which necessitate accurate diagnostic imaging. The increasing focus on pet healthcare, coupled with advancements in veterinary imaging technologies, such as high-resolution CT scanners, has enhanced the ability to detect and monitor a wide range of conditions in companion and livestock animals. Moreover, the growing number of veterinary clinics and hospitals investing in state-of-the-art imaging equipment is contributing significantly to the market expansion. The adoption of telemedicine in veterinary practices also plays a pivotal role in accelerating the demand for advanced imaging solutions.

Regionally, North America dominates the Veterinary CT Imaging Market, owing to the well-established veterinary healthcare infrastructure and high pet adoption rates. Europe follows closely, driven by advancements in diagnostic technologies and rising awareness of animal health. The Asia-Pacific region is anticipated to witness the highest growth, fueled by improving veterinary care, increasing pet ownership, and expanding healthcare facilities in emerging economies like China and India. Additionally, the region’s growing awareness of veterinary diagnostics is fostering the demand for innovative imaging technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Veterinary CT Imaging Market is valued at USD 364 million in 2024 and is projected to reach USD 617.514 million by 2032, growing at a CAGR of 6.83%.

- Rising prevalence of chronic diseases and injuries in animals is driving the demand for advanced imaging solutions such as high-resolution CT scanners.

- Technological advancements in CT imaging, including high-resolution scanners, are enhancing diagnostic capabilities and enabling accurate monitoring of animal health.

- The increasing focus on pet healthcare is contributing to the market’s growth as veterinary clinics invest in advanced diagnostic tools like CT imaging.

- North America holds 40% of the market share due to its well-established veterinary healthcare infrastructure and high pet adoption rates.

- Europe represents 30% of the market, driven by rising awareness of animal health and demand for advanced diagnostic services in veterinary practices.

- The Asia-Pacific region accounts for 20% of the market and is expected to grow rapidly, fueled by increasing pet ownership and improving veterinary care in emerging economies.

Market Drivers:

Rising Prevalence of Chronic Diseases and Injuries in Animals

The increasing occurrence of chronic diseases and injuries in animals is a major driver for the growth of the Veterinary CT Imaging Market. Conditions such as cancers, neurological disorders, and musculoskeletal injuries require precise diagnostic tools for effective treatment. With advanced imaging techniques, veterinary professionals can diagnose and monitor these diseases with greater accuracy, improving the overall outcomes of treatments and interventions. This growing demand for accurate and reliable diagnostic imaging directly fuels the market’s expansion.

- For instance, Antech Diagnostics’ AI-powered AIS RapidRead technology, which was trained on an extensive library of companion animal images, reviewed more than 5,000 cases during its 2023 pilot program to help with early detection and diagnosis.

Advancements in Veterinary Imaging Technologies

Advancements in veterinary CT imaging technologies, particularly the development of high-resolution CT scanners, have significantly enhanced the diagnostic capabilities available for veterinary practices. These improvements allow for clearer and more detailed images, enabling veterinarians to diagnose complex conditions in both companion and livestock animals. The rise in technologically advanced equipment, along with continuous innovations, is driving the demand for more sophisticated imaging solutions, further expanding the Veterinary CT Imaging Market.

- For instance, the technologically advanced Siemens SOMATOM Force CT scanner can complete a scan of the entire chest region in just 0.6 seconds.

Increasing Focus on Pet Healthcare

The rising focus on pet healthcare plays a crucial role in driving the Veterinary CT Imaging Market. As more pet owners prioritize the health and well-being of their animals, the demand for advanced diagnostic tools, including CT imaging, continues to rise. Veterinary clinics and hospitals are increasingly investing in state-of-the-art imaging equipment to provide better care for pets, further contributing to the market’s growth. This shift towards enhanced healthcare for pets supports the adoption of advanced imaging technologies across veterinary practices.

Expanding Veterinary Healthcare Infrastructure

The expansion of veterinary healthcare infrastructure globally, especially in emerging markets, significantly drives the Veterinary CT Imaging Market. New veterinary clinics and hospitals are being established in regions with growing pet ownership, demanding more advanced diagnostic equipment. As healthcare facilities expand, there is an increasing need for cutting-edge diagnostic tools such as CT imaging to cater to the diverse needs of both companion and farm animals.

Market Trends:

Increasing Adoption of Advanced Imaging Technologies in Veterinary Practices

The increasing adoption of advanced imaging technologies is a significant trend in the Veterinary CT Imaging Market. High-resolution CT scanners are becoming more common in veterinary practices, providing clearer, more detailed images that enhance diagnostic capabilities. These advancements allow veterinarians to accurately assess complex conditions in animals, such as cancer, neurological disorders, and trauma-related injuries. The growing need for non-invasive diagnostic solutions is also driving the shift towards CT imaging, as it enables quicker diagnosis and more effective treatment planning. As the technology continues to evolve, veterinary clinics and hospitals are investing in state-of-the-art imaging systems to improve patient outcomes, increasing the demand for advanced CT scanners.

- For instance, the Vimago™ imaging platform from Epica Animal Health, which utilizes High-Definition Volumetric Imaging (HDVI), can achieve a resolution as small as 0.09 mm, approximately the thickness of a human hair.

Integration of Telemedicine and Remote Diagnostics

Another notable trend in the Veterinary CT Imaging Market is the integration of telemedicine and remote diagnostics. With the rise of telehealth in the veterinary sector, more practices are utilizing CT imaging to remotely diagnose and consult with specialists. This trend enhances the accessibility of advanced imaging for rural and underserved areas, expanding the reach of high-quality veterinary care. It also allows for faster consultation and treatment planning, improving overall efficiency in veterinary practices. The growing trend of remote diagnostics and telemedicine is driving the demand for CT imaging systems that can be easily integrated with cloud-based platforms for remote image sharing and consultation. This trend not only supports the growth of the Veterinary CT Imaging Market but also promotes more collaborative and accessible veterinary care.

- For instance, a veterinary hospital that integrated a Vet Cloud Picture Archiving and Communication System (PACS) successfully reduced its average diagnostic report turnaround time from 48 hours to under 12 hours.

Market Challenges Analysis:

High Cost of Veterinary CT Imaging Equipment

One of the primary challenges facing the Veterinary CT Imaging Market is the high cost of equipment. The advanced technology used in veterinary CT scanners, including high-resolution imaging capabilities, comes with a significant financial investment. This makes it difficult for smaller veterinary practices and clinics, particularly in emerging markets, to afford and maintain such equipment. The upfront and operational costs associated with CT scanners can be a barrier for many veterinary healthcare providers, limiting the widespread adoption of this advanced diagnostic tool.

Limited Awareness and Training Among Veterinary Professionals

Another challenge hindering the growth of the Veterinary CT Imaging Market is the limited awareness and training among veterinary professionals. Many veterinarians are not fully equipped to operate or interpret CT imaging results effectively, especially in smaller or rural veterinary practices. The lack of specialized training in using advanced imaging technology can delay diagnosis and treatment, affecting the overall efficiency of veterinary practices. Addressing this issue requires ongoing education and training initiatives to ensure that veterinary professionals are proficient in utilizing CT imaging systems for accurate diagnostics and patient care.

Market Opportunities:

Expansion of Veterinary Healthcare in Emerging Markets

The expansion of veterinary healthcare in emerging markets presents a significant opportunity for the Veterinary CT Imaging Market. With the growing pet population and increasing disposable income in regions such as Asia-Pacific, there is a rising demand for advanced diagnostic tools. As veterinary practices expand and modernize, there is an opportunity for CT imaging solutions to become more widely adopted in these regions. Increased awareness of the importance of diagnostic imaging in animal healthcare further supports market growth, creating opportunities for manufacturers to introduce cost-effective, high-quality CT imaging systems tailored to the needs of emerging markets.

Integration with Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into veterinary CT imaging systems offers substantial growth potential for the market. AI-powered solutions can improve diagnostic accuracy by providing automated image analysis, reducing human error, and assisting veterinary professionals in making faster, more accurate decisions. The use of AI and ML algorithms to analyze CT scans could revolutionize the way veterinary professionals diagnose and treat animals, further boosting the adoption of these technologies. This technological advancement presents a major opportunity for companies to develop innovative CT imaging systems with AI capabilities, driving future growth in the market.

Market Segmentation Analysis:

By Animal Type

The Veterinary CT Imaging Market is segmented into companion animals, livestock, and others. Companion animals hold the largest market share due to the rising pet population and increasing emphasis on pet healthcare. Livestock also represents a significant portion of the market, driven by the need for accurate diagnostics to monitor diseases and injuries in farm animals. Other segments include wildlife and exotic animals, although they contribute less to the market compared to companion animals and livestock.

- For instance, Canon Medical’s Aquilion Lightning CT system features imaging elements as fine as 0.5mm, delivering high-resolution isotropic images suitable for detailed examination of small animals.

By Solution

The market is divided into hardware, software, and services. Hardware holds the dominant share due to the high demand for advanced CT imaging systems. Software, which includes imaging analysis tools and processing software, plays an essential role in supporting these systems. Services, such as installation, maintenance, and training, are critical to ensuring optimal performance and continued usage of CT imaging equipment in veterinary practices.

- For instance, the IDEXX ImageVue DR50 system is a hardware solution that utilizes a detector with a pixel size of 150 micrometers, enabling the capture of sharp, high-resolution diagnostic images.

By Application

The market is categorized into diagnosis, treatment planning, and others. Diagnosis is the leading application, as CT imaging is crucial for identifying a range of conditions, including cancers, neurological disorders, and musculoskeletal injuries. Treatment planning follows closely, as accurate imaging assists veterinarians in determining the most effective treatment options for animals. Other applications include monitoring the progress of treatment and post-operative care, although they contribute less to the overall market.

Segmentations:

By Animal Type

- Companion Animals

- Livestock

- Others

By Solution

- Hardware

- Software

- Services

By Application

- Diagnosis

- Treatment Planning

- Others

By End-Use

- Veterinary Clinics

- Veterinary Hospitals

- Research Institutes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America

North America holds 40% of the Veterinary CT Imaging Market, making it the largest regional market. This dominance is attributed to its well-established veterinary healthcare infrastructure and a high rate of pet ownership. The region’s strong demand for advanced diagnostic tools in veterinary practices, particularly in the U.S. and Canada, supports the widespread adoption of CT imaging technology. The growing focus on pet healthcare, along with the increasing prevalence of chronic diseases in animals, further fuels market growth. North America’s high standard of veterinary care and advanced imaging solutions create a favorable environment for the continued expansion of CT imaging technology in the region.

Europe

Europe represents 30% of the Veterinary CT Imaging Market, driven by key contributors such as the U.K., Germany, and France. The region’s rising awareness of animal health and the increasing demand for advanced diagnostic services in veterinary practices play a pivotal role in the market’s expansion. Veterinary clinics and hospitals in Europe are investing in state-of-the-art imaging equipment to improve diagnostic capabilities and treatment outcomes for both companion animals and livestock. The growing adoption of CT imaging, coupled with favorable regulations and veterinary standards, ensures the steady growth of the market across Europe.

Asia-Pacific

The Asia-Pacific region accounts for 20% of the Veterinary CT Imaging Market, with the highest expected growth rate during the forecast period. This growth is fueled by increasing pet ownership, rising disposable incomes, and improvements in veterinary healthcare infrastructure, especially in countries like China, India, and Japan. The expanding demand for advanced diagnostic tools, such as CT scanners, is becoming a priority as the region’s veterinary market continues to evolve. As veterinary practices modernize and expand in these emerging markets, the adoption of advanced imaging technologies, including CT imaging, is set to increase, creating significant opportunities for growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Shenzhen Anke High-Tech Co. Ltd

- Xoran Technologies, LLC.

- GE Healthcare

- Siemens Healthcare Limited

- PLANMED OY

- Canon Medical Systems Corporation

- Sound

- Hallmarq Veterinary Imaging

- Epica International (Epica Animal Health)

- Neurologica corporation

Competitive Analysis:

The Veterinary CT Imaging Market is competitive, with leading players such as Siemens Healthineers, Philips Healthcare, and Canon Medical Systems focusing on technological advancements to maintain their market position. These companies offer high-resolution CT scanners and software solutions to improve diagnostic accuracy in veterinary practices. Additionally, they are integrating AI and machine learning to enhance image analysis and interpretation. Smaller players target niche markets by offering portable, cost-effective CT scanners suited for smaller clinics. Strategic collaborations with veterinary clinics, hospitals, and research institutions help expand market presence. Companies are also heavily investing in R&D to innovate and improve existing technologies to meet the rising demand for advanced veterinary imaging solutions.

Recent Developments:

- In July 2025, GE HealthCare launched its new advanced digital X-ray system, the Definium Pace Select ET, to provide affordable and high-quality medical imaging.

- In March 2025, Canon Medical announced that major AI enhancements, including the PIQE 1024 matrix and SilverBeam, received clearance for its Aquilion ONE / INSIGHT Edition CT system.

- In December 2024, Canon Medical launched its AI-powered Automation Platform, a zero-click solution designed to streamline clinical workflows for stroke and chest pain assessment.

Market Concentration & Characteristics:

The Veterinary CT Imaging Market is moderately concentrated, with a few key players holding a significant market share. Leading companies such as Siemens Healthineers, Philips Healthcare, and Canon Medical Systems dominate the market by offering advanced CT imaging systems with high-resolution capabilities and integrated software solutions. These players are actively innovating, focusing on developing AI-driven imaging technologies and expanding product portfolios. The market also features smaller players who focus on specialized products, such as portable and cost-effective CT scanners, to cater to veterinary clinics with limited resources. The presence of both established and emerging players creates a competitive environment where technological innovation and strategic partnerships are critical for success. The market’s characteristics include a high level of investment in research and development, aiming to meet the growing demand for advanced imaging solutions in veterinary care.

Report Coverage:

The research report offers an in-depth analysis based on Animal Type, Solution, Application, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Veterinary CT Imaging Market is expected to witness continued growth, driven by technological advancements and increased adoption of advanced imaging solutions in veterinary care.

- Demand for high-resolution CT scanners will remain strong, with a focus on improving diagnostic accuracy for complex conditions in both companion animals and livestock.

- The integration of AI and machine learning technologies will revolutionize image analysis, enhancing diagnostic capabilities and reducing human error.

- The growing focus on pet healthcare will fuel the demand for advanced veterinary imaging technologies, as pet owners increasingly prioritize the well-being of their animals.

- Smaller veterinary practices will benefit from the availability of portable and cost-effective CT scanners, allowing for greater accessibility to advanced imaging solutions.

- Telemedicine adoption in veterinary care will drive the need for remote diagnostics, further expanding the role of CT imaging in telehealth services.

- The Asia-Pacific region will experience significant growth, driven by improving veterinary infrastructure and increasing pet ownership in emerging economies like China and India.

- Ongoing research and development will lead to the introduction of more compact and affordable CT imaging systems, making the technology accessible to a wider range of veterinary clinics.

- Veterinary clinics and hospitals will continue to invest in state-of-the-art imaging equipment to improve treatment outcomes and enhance their service offerings.

- Competitive pressures will encourage both established and emerging companies to innovate, ensuring that the market remains dynamic and responsive to evolving veterinary needs.