Market Overview

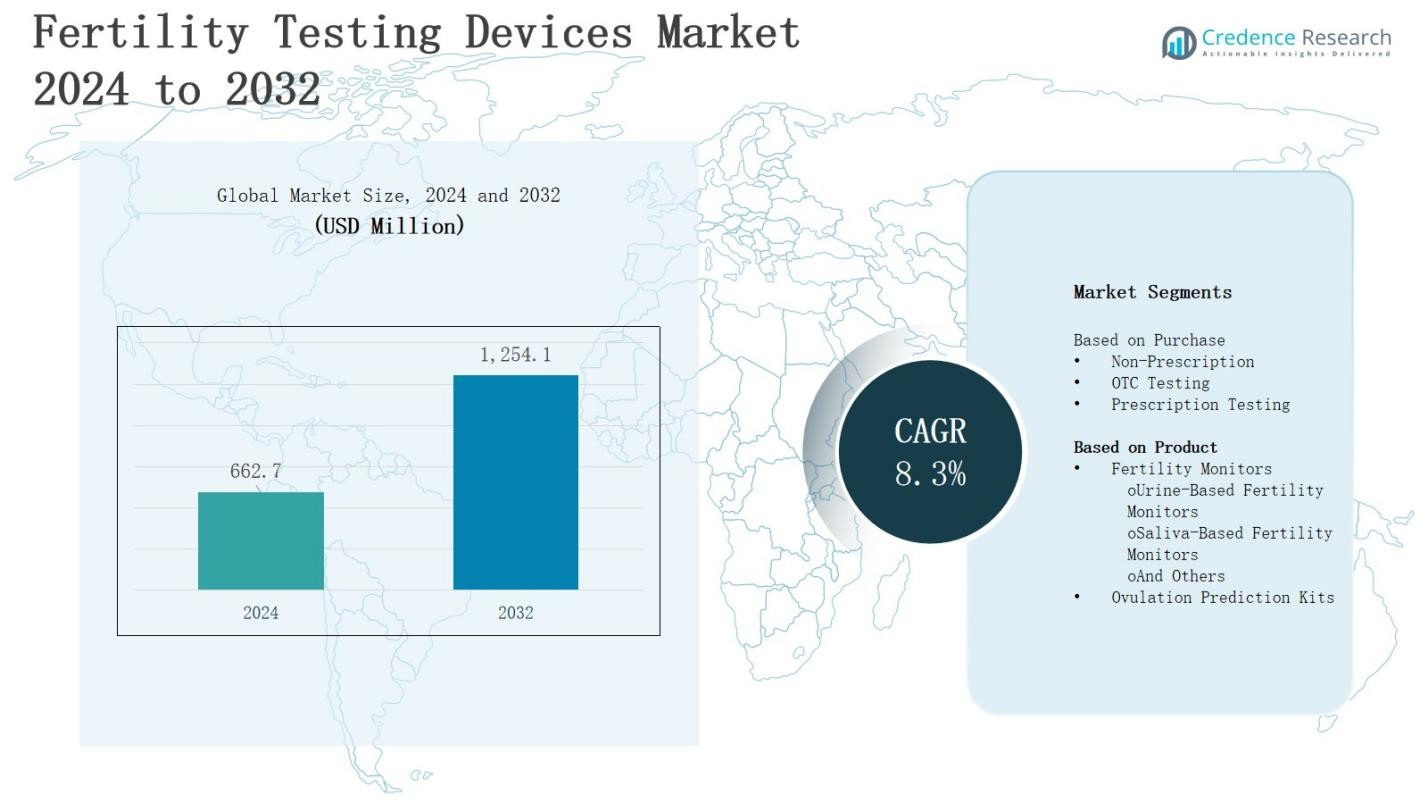

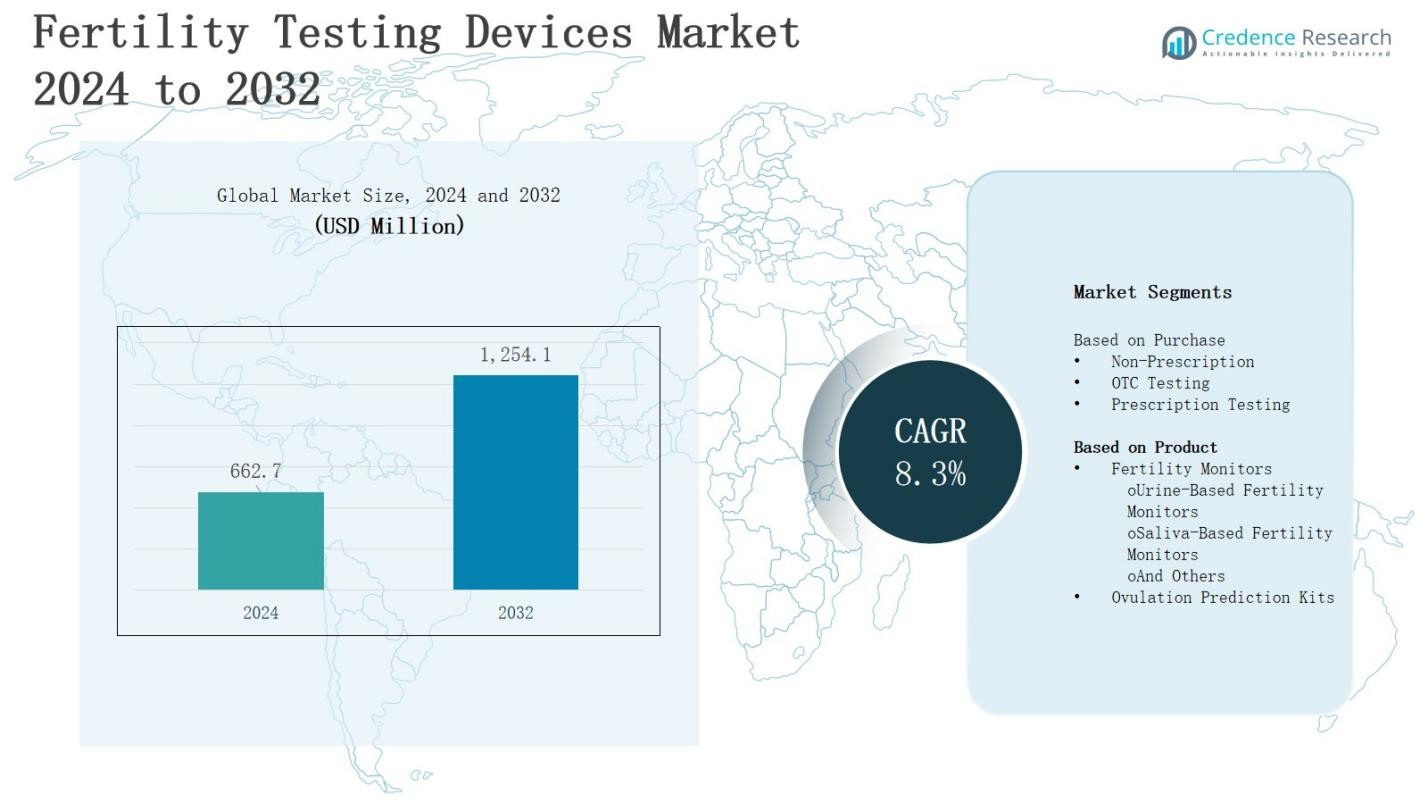

The global fertility testing market is projected to grow from USD 662.7 million in 2024 to USD 1,254.1 million by 2032, registering a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fertility Testing Market Size 2024 |

USD 662.7 Million |

| Fertility Testing Market, CAGR |

8.3% |

| Fertility Testing Market Size 2032 |

USD 1,254.1 Million |

The fertility testing devices market is driven by rising infertility rates, increasing awareness of reproductive health, and the growing adoption of advanced home-based testing solutions. Expanding access to assisted reproductive technologies and the shift toward proactive family planning support market growth. Technological advancements, such as smartphone-connected ovulation monitors and AI-driven fertility tracking, enhance accuracy and user convenience. Trends include the integration of digital health platforms, demand for non-invasive and hormone-based testing, and the expansion of personalized fertility solutions. Increasing healthcare expenditure and supportive government initiatives further strengthen the market’s growth prospects across developed and emerging regions.

The fertility testing devices market spans North America, Europe, Asia-Pacific, and the Rest of the World, each contributing distinct growth drivers. North America leads with advanced healthcare infrastructure and high awareness, while Europe benefits from supportive policies and rising infertility rates. Asia-Pacific shows rapid growth driven by urbanization and increasing healthcare access. The Rest of the World sees demand from improving infrastructure and affordable OTC kits. Key players include Church & Dwight Co. Inc., SPD Swiss Precision Diagnostics GmbH, Quidel Corporation, and Fertility Focus Limited.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global fertility testing market is projected to grow from USD 662.7 million in 2024 to USD 1,254.1 million by 2032, registering a CAGR of 8.3% during the forecast period.

- Rising infertility rates, delayed parenthood, and lifestyle-related health issues are driving demand for accurate fertility assessment tools.

- Technological advancements, including smartphone-connected monitors and AI-powered fertility tracking, enhance accuracy, ease of use, and adoption rates.

- Expanding awareness campaigns, healthcare integration, and government programs are improving access to fertility education and testing solutions.

- High costs, limited accessibility in low-income regions, and accuracy concerns remain significant challenges to market growth.

- North America leads with 34% share, followed by Europe at 28%, Asia-Pacific at 25%, and Rest of the World at 13%, each with unique growth drivers.

- Key players include Church & Dwight Co. Inc., SPD Swiss Precision Diagnostics GmbH, Quidel Corporation, and Fertility Focus Limited.

Market Drivers

Rising Prevalence of Infertility and Delayed Parenthood

The fertility testing devices market benefits from the growing prevalence of infertility caused by lifestyle changes, stress, obesity, and underlying medical conditions. Couples are increasingly delaying parenthood due to career priorities and economic considerations, raising the demand for reliable fertility assessment tools. It addresses the need for accurate ovulation prediction and reproductive health monitoring. Rising global infertility rates continue to push healthcare providers and consumers toward early detection and intervention strategies.

- For instance, Ava Women developed wearable fertility trackers that continuously monitor reproductive health, supporting the trend of delayed pregnancies by providing digital, real-time fertility insights.

Technological Advancements in Fertility Testing Solutions

The fertility testing devices market gains momentum from rapid advancements in diagnostic technologies, including digital ovulation monitors, smartphone-integrated testing kits, and AI-powered fertility tracking. These innovations improve accuracy, ease of use, and accessibility, appealing to tech-savvy consumers seeking convenience. It offers non-invasive and hormone-based testing that enables real-time insights into reproductive health. Continuous product innovation enhances adoption rates, making fertility testing more efficient and user-friendly for both clinical and home-based applications.

Increasing Awareness and Access to Reproductive Health Services

The fertility testing devices market experiences growth due to rising awareness campaigns promoting reproductive health and family planning. Government programs, NGOs, and private healthcare providers are improving access to fertility education and affordable testing solutions. It benefits from the integration of these devices into primary healthcare systems, expanding reach in urban and rural areas. Growing social acceptance and open discussions on fertility challenges encourage more individuals to seek early diagnosis and monitoring.

- For instance, Clearblue launched a Bluetooth-enabled pregnancy test that connects to a smartphone app, enhancing user engagement and guidance during testing.

Expansion of Assisted Reproductive Technologies (ART) and Medical Support

The fertility testing devices market strengthens through the parallel growth of assisted reproductive technologies such as IVF and IUI. Accurate fertility testing is critical for optimizing treatment success rates in these procedures. It supports personalized treatment plans by identifying ovulation patterns and hormonal fluctuations. The collaboration between fertility clinics and device manufacturers improves patient outcomes. Expanding insurance coverage and financing options further encourage adoption among couples seeking medical intervention for conception.

Market Trends

Integration of Digital Health and Mobile Applications

The fertility testing devices market is witnessing a strong shift toward digital health integration, with mobile apps and cloud-based platforms enhancing data tracking and interpretation. Consumers increasingly prefer connected devices that sync with smartphones for real-time fertility insights and predictive analytics. It allows users to store, share, and analyze reproductive health data with healthcare professionals. This integration improves accuracy, user engagement, and personalization, creating a seamless link between home-based testing and clinical decision-making.

- For instance, Femometer offers a smart ring that collects and analyzes fertility-related data while syncing with mobile apps, enabling users to share reproductive health information with healthcare professionals for personalized care.

Growing Demand for Non-Invasive and Hormone-Based Testing Methods

The fertility testing devices market benefits from rising consumer preference for non-invasive testing solutions that offer comfort and reliability. Hormone-based urine tests, saliva-based monitors, and wearable sensors are gaining popularity for their convenience and accuracy. It reduces the need for complex laboratory procedures while delivering actionable insights. Manufacturers are investing in research to refine biomarker detection, improve sensitivity, and shorten result times, aligning with the growing demand for user-friendly diagnostic tools.

- For instance, saliva testing labs like ZRT Laboratory utilize non-invasive saliva collection to measure hormones like cortisol, estrogens, progesterone, and androgens. Their advanced liquid chromatography/tandem mass spectrometry (LC-MS/MS) techniques provide precise hormone level readings outside of clinical settings.

Expansion of Home-Based Fertility Monitoring Solutions

The fertility testing devices market is experiencing rapid growth in the home-use segment, driven by consumer interest in privacy, convenience, and cost-effectiveness. Portable and discreet devices allow users to monitor ovulation and hormonal changes without frequent clinical visits. It enables individuals to make informed reproductive decisions on their own terms. Companies are developing compact, AI-enhanced kits that provide lab-quality accuracy, catering to the needs of tech-savvy, health-conscious consumers seeking greater autonomy.

Adoption of AI and Predictive Analytics in Fertility Tracking

The fertility testing devices market is embracing AI-powered algorithms to analyze cycle patterns, hormonal fluctuations, and lifestyle factors for enhanced fertility prediction. Predictive analytics improves conception planning by identifying optimal fertile windows with high precision. It supports healthcare providers in offering tailored treatment recommendations. This trend is driving partnerships between medtech firms and AI developers, fostering the creation of advanced platforms that combine hardware, software, and data science for superior reproductive health management.

Market Challenges Analysis

High Cost and Limited Accessibility in Emerging Markets

The fertility testing devices market faces growth constraints due to high product costs and limited accessibility in low-income and rural regions. Advanced digital monitors and AI-enabled solutions often remain unaffordable for a significant portion of the population. It restricts adoption despite rising awareness of reproductive health. Infrastructural gaps, low healthcare penetration, and lack of insurance coverage further hinder market expansion. Manufacturers must address affordability through localized production, tiered pricing strategies, and distribution partnerships to tap underserved markets.

Accuracy Concerns and Lack of Standardization

The fertility testing devices market encounters challenges related to accuracy, reliability, and standardization of testing outcomes. Variability in hormonal cycles, user errors, and differences in device calibration can lead to inconsistent results, impacting consumer trust. It demands rigorous clinical validation and compliance with international quality standards. Limited regulatory oversight in certain markets increases the risk of substandard products. Addressing these issues through robust R&D, improved product design, and stronger regulatory frameworks is essential for sustained market credibility and growth.

Market Opportunities

Rising Demand for Personalized and Preventive Reproductive Health Solutions

The fertility testing devices market holds significant potential through the growing demand for personalized and preventive reproductive health solutions. Consumers are increasingly seeking tailored fertility insights that align with individual health profiles and lifestyle factors. It enables early detection of potential issues, allowing timely medical intervention and improved conception planning. Integration of wearable devices, AI-driven analytics, and home-based kits supports customization. Expanding interest in holistic wellness and family planning creates opportunities for innovative, user-centric product development.

Untapped Growth Potential in Emerging Economies

The fertility testing devices market can expand substantially in emerging economies with large, underserved populations and rising healthcare awareness. Increasing urbanization, higher disposable incomes, and improved digital connectivity are creating favorable conditions for market entry. It benefits from growing e-commerce penetration, enabling broader distribution of home-based testing kits. Strategic partnerships with local healthcare providers and distributors can strengthen market reach. Government initiatives promoting reproductive health and family planning further enhance adoption prospects in these high-growth regions.

Market Segmentation Analysis:

By Purchase

The fertility testing devices market is segmented by purchase into non-prescription, OTC testing, and prescription testing. Non-prescription and OTC testing products dominate due to their convenience, affordability, and wide availability through pharmacies, retail stores, and e-commerce channels. It caters to consumers seeking privacy and quick results without clinical visits. Prescription testing holds a smaller share but is critical for medically supervised fertility assessments, particularly in complex cases requiring professional interpretation and integration with assisted reproductive treatments.

- For instance, devices like the Mira Starter Kit offer at-home hormone tracking paired with an app to aid in fertility monitoring.

By Product

The fertility testing devices market is categorized by product into fertility monitors and ovulation prediction kits. Fertility monitors, including urine-based, saliva-based, and other types, are gaining traction for their accuracy, digital connectivity, and ability to track multiple cycle parameters. It appeals to tech-savvy users seeking advanced insights into reproductive health. Ovulation prediction kits remain widely adopted for their simplicity and affordability, making them a preferred choice for first-time users and consumers seeking quick, reliable ovulation detection.

- For instance, Clearblue, a brand by SPD Swiss Precision Diagnostics, introduced a Bluetooth-enabled pregnancy test that connects to a smartphone app to guide users through testing and interpreting results, exemplifying the integration of digital technology in fertility monitoring.

Segments:

Based on Purchase

- Non-Prescription

- OTC Testing

- Prescription Testing

Based on Product

- Fertility Monitors

- Urine-Based Fertility Monitors

- Saliva-Based Fertility Monitors

- And Others

- Ovulation Prediction Kits

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 34% share of the fertility testing devices market, driven by high awareness of reproductive health, advanced healthcare infrastructure, and strong adoption of digital fertility solutions. It benefits from the presence of leading manufacturers and continuous product innovations, including AI-powered monitors and smartphone-enabled testing kits. Insurance coverage for certain fertility-related services also supports growth. The region shows strong demand for home-based, non-prescription fertility tests due to convenience and privacy. Expanding e-commerce distribution further enhances product accessibility and consumer engagement.

Europe

Europe accounts for 28% share of the fertility testing devices market, supported by growing infertility rates, lifestyle shifts, and government initiatives promoting reproductive health awareness. It experiences steady adoption of both OTC and prescription-based fertility tests, driven by robust healthcare systems and favorable reimbursement policies in select countries. The market benefits from technological advancements and collaborations between healthcare providers and device manufacturers. Urban populations exhibit higher demand for connected, data-driven fertility monitoring solutions.

Asia-Pacific

Asia-Pacific captures 25% share of the fertility testing devices market, propelled by a large population base, rising healthcare expenditure, and increasing awareness of fertility management. It gains momentum from rapid urbanization, higher disposable incomes, and expanding access to modern healthcare facilities. Digital adoption is accelerating, with mobile health apps integrating fertility tracking features. Manufacturers target this region with affordable, portable testing solutions to address growing demand in both urban and semi-urban areas.

Rest of the World

The Rest of the World represents 13% share of the fertility testing devices market, with demand emerging in Latin America, the Middle East, and Africa. It is driven by gradual improvements in healthcare infrastructure, growing awareness of reproductive health, and rising penetration of affordable OTC fertility tests. Limited access to advanced diagnostic facilities in certain areas sustains demand for home-based testing kits. Partnerships with local distributors and healthcare providers support market expansion in these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Quidel Corporation

- Fertility Focus Limited

- Biozhena Corporation

- SPD Swiss Precision Diagnostics GmbH

- Prestige Brands Holdings Inc.

- Geratherm Medical AG

- UEBE Medical GmbH

- HiLin Life Products Inc.

- Babystart Ltd

- AccuQuik

- Church & Dwight Co. Inc.

- Alere Inc.

Competitive Analysis

The fertility testing devices market is characterized by strong competition among established brands and emerging innovators, each focusing on product accuracy, digital integration, and user convenience. It includes major players such as Church & Dwight Co. Inc., SPD Swiss Precision Diagnostics GmbH, Quidel Corporation, Prestige Brands Holdings Inc., HiLin Life Products Inc., Fertility Focus Limited, Geratherm Medical AG, Babystart Ltd, UEBE Medical GmbH, Biozhena Corporation, AccuQuik, and Alere Inc. Companies compete through technological advancements, AI-driven analytics, and smartphone compatibility to enhance user engagement. Strategic partnerships with healthcare providers, e-commerce platforms, and retail chains strengthen distribution networks. Continuous investment in research supports the development of non-invasive, hormone-based, and home-use solutions that meet growing consumer demand. Competitive pricing, targeted marketing campaigns, and global expansion strategies are critical for gaining market share in both developed and emerging economies.

Recent Developments

- In August 2025, Maven Clinic launched its “Cycle Tracker” and male fertility tools, offering personalized predictions, at-home semen tests, and specialist support.

- In April 2024, Clearblue—a flagship brand of SPD Swiss Precision Diagnostics GmbH—rolled out an upgraded version of its Connected Ovulation Test System. The new model features enhanced Bluetooth connectivity and AI-driven cycle prediction, offering users more personalized fertility insights and tighter integration with mobile apps.

- In August 2025, Health-E Commerce announced a collaboration with Fertility Cloud to expand access to at-home fertility testing services through integrated telehealth solutions.

Market Concentration & Characteristics

The fertility testing devices market exhibits moderate concentration, with a mix of global leaders and niche players competing through innovation, brand presence, and distribution reach. It is characterized by steady technological advancements, particularly in AI-powered fertility monitors, smartphone integration, and non-invasive testing methods. Competition focuses on accuracy, user convenience, and affordability to capture both developed and emerging markets. Key companies leverage partnerships with healthcare providers, retail chains, and e-commerce platforms to strengthen market penetration. Regulatory compliance and product standardization play a critical role in maintaining credibility and consumer trust. Demand is fueled by rising infertility rates, growing reproductive health awareness, and expanding home-use adoption. The market structure allows room for new entrants offering specialized or cost-effective solutions while established brands maintain dominance through continuous R&D investment and product diversification.

Report Coverage

The research report offers an in-depth analysis based on Purchase, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising global infertility rates will continue to drive demand for advanced fertility testing solutions.

- Technological integration with AI and mobile health apps will enhance accuracy and user experience.

- Home-based fertility monitoring will gain greater adoption due to convenience and privacy preferences.

- Affordable and portable testing kits will see higher demand in emerging economies.

- Expansion of assisted reproductive technologies will increase the need for precise fertility assessment tools.

- Partnerships between device manufacturers and healthcare providers will strengthen product accessibility.

- Non-invasive and hormone-based testing methods will dominate consumer preference.

- Digital health platforms will support personalized fertility tracking and treatment recommendations.

- E-commerce and online distribution will expand market reach globally.

- Regulatory focus on product quality and standardization will shape competitive dynamics.