Market Overview:

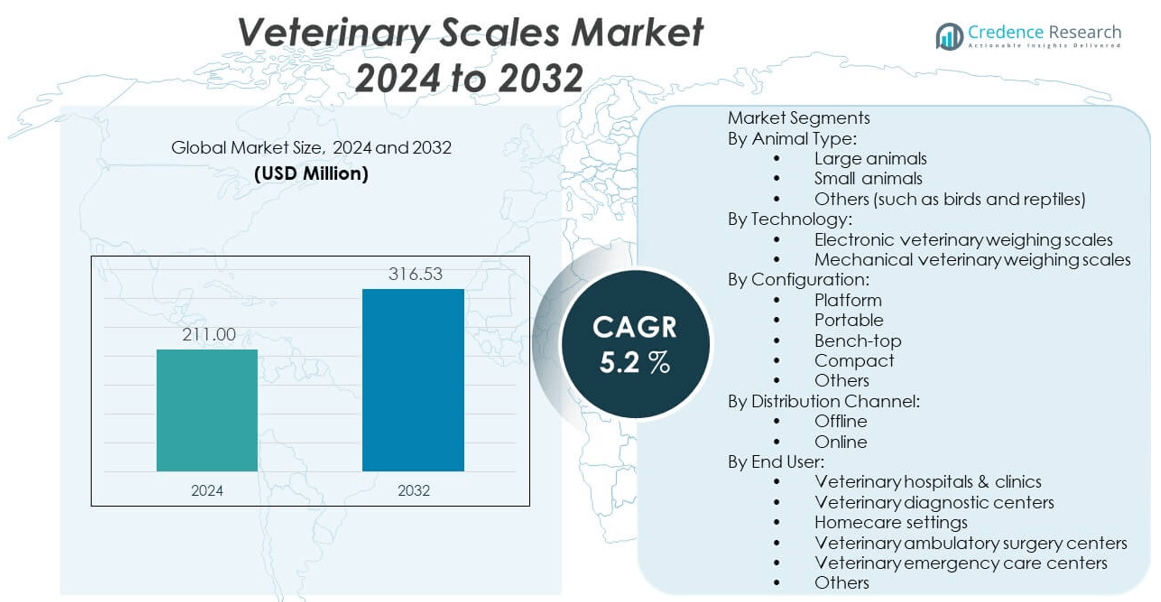

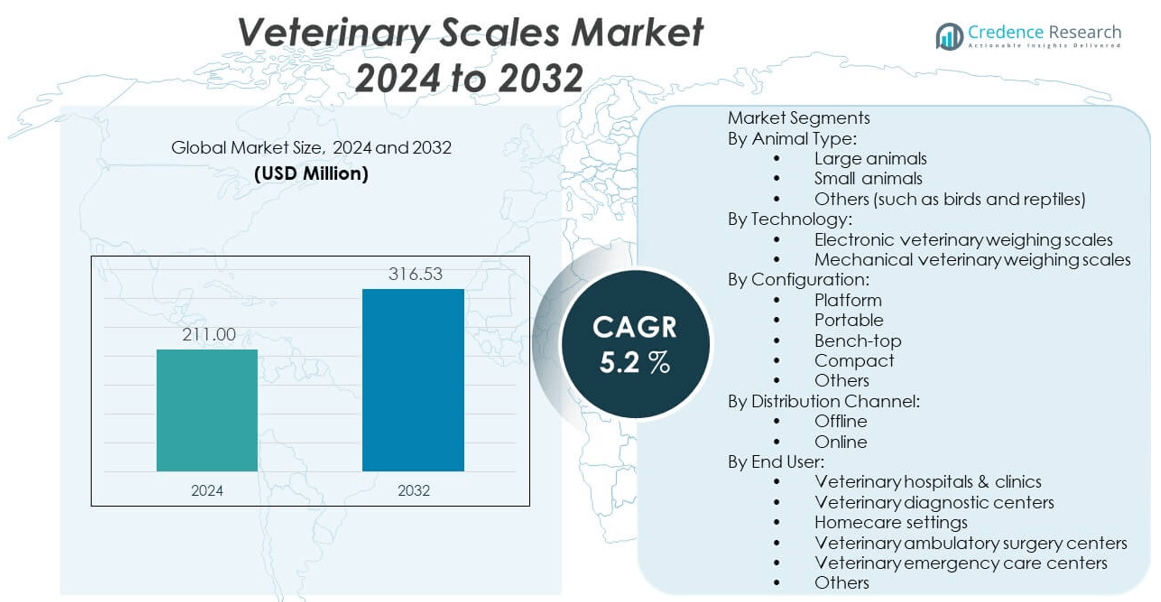

The veterinary scales market is projected to grow from USD 211 million in 2024 to an estimated USD 316.53 million by 2032, with a compound annual growth rate (CAGR) of 5.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veterinary Scales Market Size 2024 |

USD 211 million |

| Veterinary Scales Market, CAGR |

5.2% |

| Veterinary Scales Market Size 2032 |

USD 316.53 million |

Growth in the veterinary scales market is driven by the rising pet adoption rates, increasing livestock farming, and heightened focus on animal health monitoring. Advancements in digital weighing technology, such as precision sensors and portable designs, are improving accuracy and convenience. The growing demand from veterinary clinics, farms, and research institutions is further boosting market adoption, supported by expanding awareness of preventive animal healthcare.

Regionally, North America leads the veterinary scales market, supported by a well-established veterinary care infrastructure, high pet ownership, and strong livestock management practices. Europe follows, benefiting from stringent animal welfare regulations and growing investment in veterinary services. Asia-Pacific is emerging rapidly due to increasing livestock farming, expanding veterinary networks, and rising pet care awareness in countries such as China, India, and Australia.

Market Insights:

- The veterinary scales market was valued at USD 211 million in 2024 and is projected to reach USD 316.53 million by 2032, registering a CAGR of 5.2% during the forecast period.

- Growing pet ownership and heightened awareness of preventive animal healthcare are driving demand for accurate weight measurement solutions in clinics, farms, and homecare settings.

- Expansion of livestock farming and the need for precise dosing, feed management, and weight monitoring are boosting adoption across agricultural sectors.

- High initial investment costs, long replacement cycles, and the requirement for frequent calibration act as restraints for smaller veterinary facilities and cost-sensitive markets.

- North America leads the market, supported by strong veterinary infrastructure, insurance coverage, and advanced livestock management practices.

- Europe follows with demand driven by stringent animal welfare regulations, species-specific care needs, and sustainability preferences in equipment design.

- Asia-Pacific is expected to witness the fastest growth, fueled by increasing livestock populations, rising companion animal ownership, and the expansion of veterinary networks in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Pet Ownership and Increasing Demand for Animal Health Monitoring:

The veterinary scales market benefits strongly from the global rise in pet ownership, which has elevated spending on animal healthcare. It is increasingly important for pet owners to monitor weight accurately for preventive care, treatment plans, and nutrition management. Growing awareness of obesity-related health issues in pets has further increased the need for precise weighing solutions. Veterinary clinics and hospitals rely on advanced scales to track health progress effectively. Portable and easy-to-clean models have gained traction in urban veterinary facilities with space limitations. This trend is reinforced by the expansion of pet insurance, which encourages regular veterinary visits. Manufacturers are introducing ergonomic and user-friendly designs to meet clinical requirements. It is expected that this growth in pet healthcare awareness will remain a central driver for demand.

- For instance, the Redmon Precision Digital Pet Scale is widely used in veterinary clinics and homes to support accurate preventive care and medication dosing.

Expanding Livestock Industry and Farm Productivity Requirements:

The veterinary scales market is witnessing rising adoption in livestock farming due to the need for accurate weight measurement in productivity optimization and health management. Weighing livestock ensures correct dosing of medication and precise feed adjustments, which directly impact profitability. In regions with large-scale animal farming, such as North America and Asia-Pacific, farmers are integrating digital scales into automated farm management systems. This integration enables data tracking for herd health, growth rates, and breeding cycles. Portable and rugged outdoor scales are gaining demand in rural agricultural areas. The livestock industry’s focus on disease prevention and early detection further boosts scale adoption. Manufacturers are also developing weather-resistant and durable models for outdoor use. These factors position livestock farming as a major driver for market growth.

- For example, Livestock farms in North America and Asia-Pacific have integrated these scales into automated management systems, streamlining data collection on herd health and breeding cycles.

Technological Advancements in Digital and Smart Weighing Systems:

The veterinary scales market is evolving with the introduction of digital and smart weighing systems, offering improved precision and data integration. Clinics and farms now use Bluetooth and Wi-Fi-enabled scales to store and share data instantly with veterinary management software. Advanced load cell technology enhances accuracy, even with animal movement during weighing. Smart interfaces allow veterinary staff to track historical data for better diagnosis and treatment planning. The integration of scales into electronic medical records improves workflow efficiency. Some models include automatic animal recognition for faster processing. Manufacturers are investing in user-friendly digital displays and automated calibration features. This continuous innovation in scale technology drives adoption across both companion and production animal care.

Growing Emphasis on Regulatory Compliance and Quality Standards:

The veterinary scales market is increasingly influenced by regulatory standards related to animal welfare and product accuracy. Government bodies and industry associations mandate precise weighing for medication dosing, health monitoring, and trade purposes. This is particularly important in livestock markets where weight directly impacts pricing. Compliance with ISO and OIML standards ensures product reliability and boosts market credibility. Veterinary institutions prioritize certified scales to maintain operational integrity. Regular calibration and maintenance are also becoming standard requirements. The push for legal-for-trade certified models in livestock sales further encourages equipment upgrades. It is expected that adherence to quality and safety regulations will continue to drive replacement demand and new purchases.

Market Trends:

Integration of IoT and Cloud-Based Data Management in Weighing Systems:

The veterinary scales market is adopting IoT-enabled devices that transmit weight data directly to cloud-based platforms. This technology allows veterinarians and farmers to access real-time data from remote locations. Integration with herd management systems ensures comprehensive health monitoring. These platforms enable predictive analytics to detect early signs of illness. Cloud-based solutions also simplify regulatory reporting and compliance documentation. Mobile applications enhance usability by providing instant alerts and weight trend charts. Manufacturers are partnering with software developers to deliver complete digital solutions. This trend reflects a shift toward data-driven animal healthcare.

- For instance, Narrow Band IoT (NB-IoT) technology is now implemented for reliable long-range rural connection and efficient data transfer, sustaining large-scale herd management.

Rising Demand for Portable and Multi-Purpose Weighing Equipment:

There is growing interest in portable veterinary scales that can be used in field conditions and clinic environments. Farmers benefit from the ability to weigh animals in barns, pastures, or transport facilities. Foldable and lightweight models with battery operation cater to mobile veterinary services. Clinics prefer multi-purpose scales capable of accommodating both small and large animals. Space-saving designs are particularly popular in urban facilities. Manufacturers are introducing modular systems that allow quick size adjustments. This portability trend supports the flexibility needs of modern veterinary practices. It is expected to remain a competitive differentiator in product offerings.

- For example, Detecto’s VET-70 and VET-330WH veterinary scales are specifically designed for portability, weighing under 30lb for the compact model, and featuring built-in wheels for the 330lb-capacity model.

Increasing Customization for Species-Specific Weighing Requirements:

The veterinary scales market is seeing a rise in demand for species-specific designs. Clinics treating exotic pets require specialized platforms for birds, reptiles, and small mammals. Livestock farmers need high-capacity, durable platforms for cattle, pigs, and sheep. Precision requirements vary significantly between species, prompting manufacturers to develop targeted solutions. Customizable features include platform size, surface texture, and weight capacity. Anti-slip surfaces improve safety for nervous animals. Some models incorporate built-in restraining features for accurate readings. This customization trend reflects the diverse requirements of veterinary care and animal management.

Focus on Sustainability and Eco-Friendly Manufacturing Practices:

Sustainability has emerged as a key trend in the veterinary scales market, influencing product design and manufacturing. Companies are using recyclable materials and energy-efficient production processes. Long-lasting components reduce the need for frequent replacements, lowering environmental impact. Packaging is shifting toward biodegradable and minimal-use designs. Solar-powered weighing systems are being explored for rural and off-grid locations. This aligns with broader industry efforts toward sustainable agriculture and veterinary care. Clients increasingly consider environmental credentials when selecting equipment. Sustainable innovation is becoming a branding advantage for manufacturers.

Market Challenges Analysis:

High Accuracy Requirements, Motion Interference, and Calibration Rigor:

The Veterinary scales market faces strict accuracy expectations from clinics and farms. Animals move on platforms and cause fluctuating readings that strain load-cell design. It pushes manufacturers to add filters that sometimes slow response. Frequent calibration raises ownership cost and downtime. Field conditions introduce dust, moisture, and uneven floors that degrade precision. Hygienic cleaning protocols can damage sensors without careful sealing. Staff training gaps create misuse and misreads. It increases warranty claims and erodes trust.

Price Sensitivity, Fragmented Buying, and Lengthy Replacement Cycles:

The Veterinary scales market contends with tight capital budgets in small clinics and family farms. Buyers compare low-cost imports with premium brands and delay upgrades. Replacement cycles stretch because well-built platforms last years. Service networks remain uneven in rural regions and inflate total cost of ownership. Diverse species needs require multiple formats that complicate inventory. Regulatory certification adds compliance expense and paperwork. Integration with software remains inconsistent across brands. It slows scale-out decisions despite growing need.

Market Opportunities:

Connected Platforms, EMR Links, and Analytics-Ready Workflows:

The Veterinary scales market can unlock value through Bluetooth and Wi-Fi modules. Simple apps can push weight to EMRs and farm systems. Trend charts help detect illness earlier. Auto-ID pairs collars or EID tags with sessions. Battery packs support mobile calls. OTA updates keep firmware secure. Bundled warranties reduce risk. It converts a commodity into a data node.

Species-Specific Designs, Retrofit Kits, and Sustainability Upsell:

The Veterinary scales market can grow with bird, reptile, and small-mammal trays. Low-profile ramps help seniors and large breeds. Retrofit kits can digitize legacy platforms. Recycled materials improve bids. Solar options fit off-grid barns. Anti-slip, antimicrobial surfaces raise safety. Trade-in programs refresh fleets. It widens adoption across settings.

Market Segmentation Analysis:

By Animal Type

The veterinary scales market serves large animals, small animals, and others such as birds and reptiles. Large animal scales are designed with high-capacity platforms for livestock and equine practices, enabling accurate dosing and weight monitoring. Small animal models cater to dogs, cats, and other companion pets, often featuring ergonomic designs and easy-clean surfaces for clinical and home use. Scales for birds, reptiles, and exotic species include specialized trays and high-precision sensors for delicate weight readings, supporting both veterinary care and research needs.

- For instance, the Tree LVS 700 scale features a platform size of 20in x 38in and can accommodate animals up to 700lb, serving the needs of both equine and bovine practices. For small animals, Redmon’s Precision Digital Pet Scale provides ergonomic, easy-to-clean surfaces, essential for regular use with dogs, cats, and exotics. Scales for birds or reptiles employ high-precision sensors and specialized trays, enabling reliable readings for animals as light as 3.5oz.

By Technology

Electronic veterinary weighing scales dominate due to their accuracy, digital displays, and ability to integrate with veterinary management software. These models enable data tracking and seamless record-keeping. Mechanical veterinary weighing scales retain relevance in field applications and cost-sensitive markets, valued for durability, ease of use, and independence from power sources, making them ideal for remote livestock operations.

- For example, electronic veterinary scales such as those from Rice Lake and LW Measurements can natively integrate with veterinary management software, automating the data entry process for medical records. This digital connectivity streamlines record-keeping and compliance.

By Configuration

Platform scales are widely used in large and mixed-species facilities, offering stability and high weight capacity. Portable units support mobile veterinary services and farm visits, while bench-top models serve laboratories and small animal clinics. Compact designs address the needs of space-constrained practices, and other specialized configurations target niche procedures or species-specific requirements.

By Distribution Channel

Offline channels, including distributors, dealers, and direct suppliers, lead due to personalized service, installation, and after-sales support. Online sales are rapidly expanding, driven by e-commerce accessibility, broader product ranges, and competitive pricing options.

By End User

Veterinary hospitals and clinics form the largest segment, requiring versatile scales for varied patient types. Veterinary diagnostic centers depend on precision equipment for testing accuracy. Homecare settings adopt smaller, user-friendly models for ongoing monitoring. Ambulatory surgery centers and emergency care facilities demand reliable, quick-read systems, while other users, such as animal shelters and research institutions, contribute steadily to market adoption.

Segmentation:

By Animal Type:

- Large animals

- Small animals

- Others (such as birds and reptiles)

By Technology:

- Electronic veterinary weighing scales

- Mechanical veterinary weighing scales

By Configuration:

- Platform

- Portable

- Bench-top

- Compact

- Others

By Distribution Channel:

By End User:

- Veterinary hospitals & clinics

- Veterinary diagnostic centers

- Homecare settings

- Veterinary ambulatory surgery centers

- Veterinary emergency care centers

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Compliance-Led Demand and High Digital Adoption

North America leads the veterinary scales market, supported by dense clinic networks, pet insurance penetration, and livestock analytics programs. The region holds about 43% share, reflecting strong replacement cycles and premium feature adoption. Clinics favor EMR-linked indicators and legal-for-trade options in farm settings. Pet obesity programs and rehab centers sustain use beyond intake weighing. Distribution covers e-commerce, dealers, and OEM service networks. Public guidance on herd weighing reinforces compliance purchasing. It sustains steady upgrades.

Europe: Welfare Standards, Specialty Care, and Multi-Species Needs

Europe maintains the second-largest share, anchored by strict welfare rules and standardized dosing practices. Specialty hospitals and university clinics drive high-precision demand. Mixed species care boosts the need for configurable platforms and anti-slip surfaces. Auction regulations keep legal-for-trade interest strong. Sustainability preferences favor stainless, repairable, and recyclable builds. Dealer education programs improve correct use and calibration. It supports steady unit turnover across the bloc.

Asia-Pacific, Latin America, and Middle East & Africa: Herd Growth and Field-Ready Designs

Asia-Pacific expands quickly on the back of growing livestock herds, rising companion animal ownership, and new clinic chains. Buyers emphasize rugged, portable, and battery-backed units for field work. Latin America scales with beef and swine sectors and values crush-compatible load bars. Middle East & Africa adopt durable IP-rated platforms suited to dust and heat. Training and after-sales support remain key differentiators. National herd schemes that mandate weighing stimulate uptake. It builds momentum for connected kits.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Adam Equipment

- SR Instruments

- Rice Lake Weighing Systems

- Marsden Group (Marsden Weighing Machine Group Ltd)

- KERN & SOHN GmbH

- Avante Animal Health

- A&D Company, Limited

- Bosche GmbH & Co. KG

- Tanita

- Brecknell

- Arlyn Scales

- ADE GmbH & Co. KG

- Detecto

- Charder Electronic Co., Ltd.

- PARAGON MEDICAL SUPPLY, INC.

- OHAUS Corporation (Mettler-Toledo International Inc)

- Apexx Veterinary Equipment

Competitive Analysis:

The Veterinary scales market features mid-sized metrology leaders and livestock specialists competing on motion compensation, IP sealing, and indicator intelligence. Premium vendors differentiate with EMR connectors, analytics, and legal-for-trade approvals, while value brands press price and portability. Service coverage, calibration programs, and loaner pools influence procurement in clinics and farms. Livestock players win by bundling load bars, readers, and crush hardware. Digital add-ons and APIs raise switching costs and defend margins. M&A interest targets software tie-ins and regional distributors. Channel strength and training quality remain decisive in rural geographies. It keeps the field competitive yet concentrated around brands with metrology credibility.

Recent Developments:

- In March 2025, Adam Equipment launched its new BTT series touch-screen bench and floor scales, alongside the AE 505 touch-screen weighing indicator. This lineup delivers advanced touch-screen operation, user-customizable label printing, robust connectivity, and memory for tracking up to 1,006 samples. The AE 505’s durable housing and easy-to-clean stainless platform meet the needs of multiple sectors—including veterinary and animal care—by streamlining data capture and enhancing inventory control accuracy.

- In 2025, KERN & SOHN GmbH released its medical product catalogue, highlighting veterinary scales optimized for both stationary and mobile veterinary clinics. These models offer non-slip, low-profile, and easy-clean surfaces, a hold function for weighing moving animals, and dual (battery/mains) power options, with weighing capacities spanning from 6kg to 300kg. The scales are specifically engineered for clinics, breeders, and animal shelters requiring reliable and safe animal weighing solutions.

Market Concentration & Characteristics:

The Veterinary scales market shows moderate concentration with a core set of metrology brands and livestock specialists holding outsized share. It blends medical-grade clinic platforms with rugged farm systems across diverse species and capacities. Purchasing is fragmented among clinics, farms, universities, and public programs, which elevates the role of distributors and service partners. Product lifecycles are long, so vendors emphasize upgrades, connectivity kits, and calibration contracts. Regulations and legal-for-trade needs protect quality-focused suppliers. Integration with EMRs and herd platforms shifts competition toward software and data. It favors firms with accuracy pedigree, service reach, and digital roadmaps.

Report Coverage:

The research report offers an in-depth analysis based on animal type, technology, configuration, distribution channel, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Connected indicators will become default in mid-tier platforms.

- EMR and herd-software APIs will drive vendor lock-in.

- Battery and solar options will expand field deployments.

- Species-specific trays and ramps will grow premium niches.

- Legal-for-trade demand will rise in auction and farm commerce.

- Analytics on growth curves will aid early disease detection.

- Refurbish and trade-in programs will shorten replacement cycles.

- Sustainability features will influence procurement scoring.

- Distributor training will remain a key differentiator.

- Regional herd programs will catalyze bulk purchases.