Market Overview

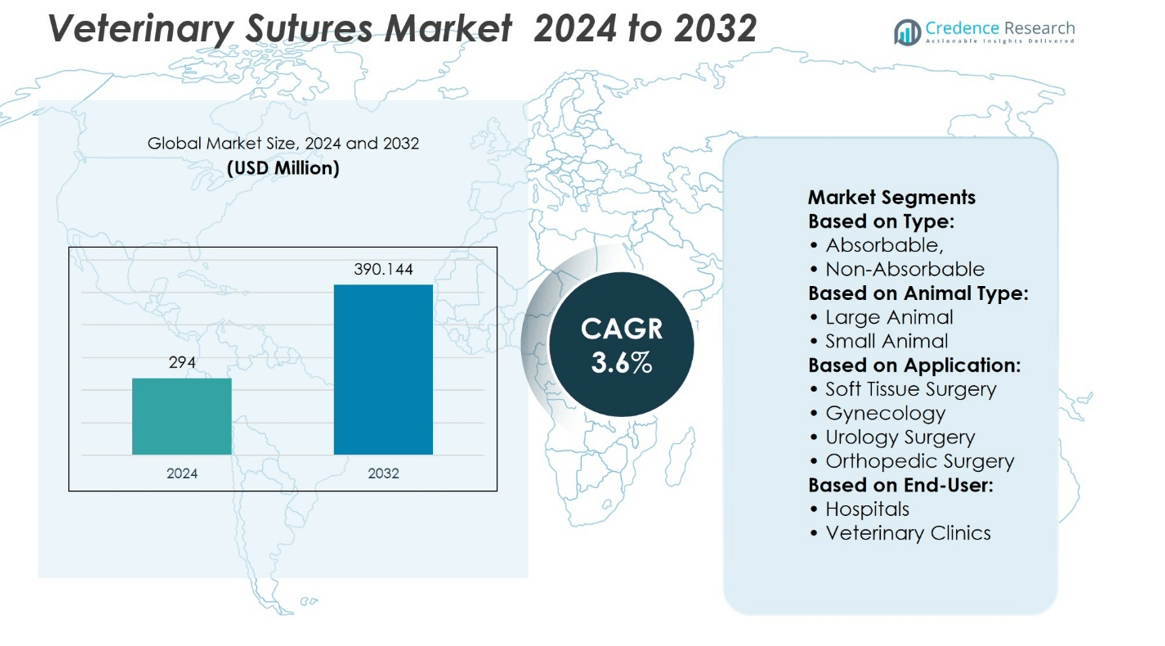

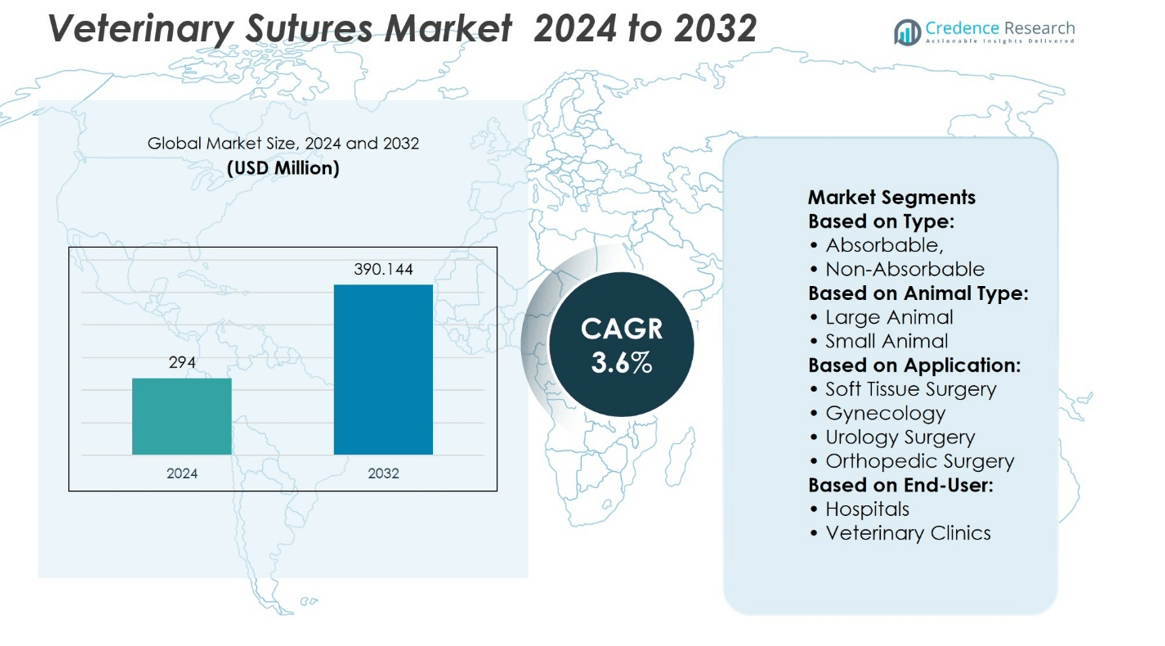

The Global Veterinary Sutures Market size was valued at USD 294 million in 2024 and is anticipated to reach USD 390.144 million by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veterinary Sutures Market Size 2024 |

USD 294 million |

| Veterinary Sutures Market, CAGR |

3.6% |

| Veterinary Sutures Market Size 2032 |

USD 390.144 million |

The Veterinary Sutures Market is driven by the rising number of surgical procedures in companion animals and livestock, fueled by increased pet ownership and advancements in veterinary care. Growing awareness of animal health, expanding veterinary infrastructure, and demand for minimally invasive surgeries further support market growth. Additionally, the development of absorbable and antimicrobial sutures enhances surgical outcomes and reduces complications. Market trends include a shift toward biodegradable and synthetic suture materials, along with technological innovations that improve suture strength and handling. Manufacturers are also focusing on customizable suture solutions tailored to different animal types and surgical needs.

North America dominates the Veterinary Sutures Market due to advanced veterinary infrastructure, high pet ownership, and increased spending on animal healthcare. Europe follows closely, driven by stringent animal welfare regulations and growing demand for surgical interventions. The Asia-Pacific region is witnessing rapid growth owing to rising awareness and expanding veterinary services. Key players in the market include Medtronic PLC, DemeTech, Teleflex Inc., UNIFY Sutures, Vitrex Surgical, and AmerisourceBergen Corporation, all focusing on innovation and strategic collaborations to strengthen market presence.

Market Insights

- The Veterinary Sutures Market was valued at USD 294 million in 2024 and is expected to reach USD 390.144 million by 2032, growing at a CAGR of 3.6% during the forecast period.

- Rising pet adoption and increasing surgical interventions in animals are significantly boosting market demand.

- There is a growing trend toward using absorbable, antimicrobial, and biodegradable sutures for better post-operative outcomes.

- Leading players like Medtronic PLC, Teleflex Inc., and DemeTech are investing in advanced product lines and global distribution strategies.

- High costs associated with veterinary surgeries and lack of skilled professionals in emerging markets may limit growth.

- North America holds the largest market share due to robust veterinary infrastructure, while Asia-Pacific shows the fastest growth.

- Market players are focusing on developing customizable suture materials tailored to specific animal types and surgical procedures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increased Companion Animal Surgeries Drive Demand for Advanced Suture Materials

The growing volume of surgical procedures in pets is a key driver of the Veterinary Sutures Market. Rising pet ownership and improved access to veterinary care have led to a higher number of orthopedic, soft tissue, and spay-neuter surgeries. Clinics increasingly seek sutures that support faster healing and lower infection risks. Absorbable and antimicrobial sutures are gaining preference in clinical settings. Manufacturers are focusing on providing sterile, biocompatible materials tailored for different animal sizes and tissue types. It encourages product innovation that aligns with diverse surgical requirements.

- For instance, Ethicon (a Johnson & Johnson company) manufactures VICRYL RAPIDE™ sutures, which retain approximately 50% of their tensile strength at 5 days and are fully absorbed by hydrolysis within 42 days. In 2022, Ethicon’s animal health division supported over 2.7 million veterinary surgical procedures worldwide, with its suture products accounting for nearly 38 million linear meters sold globally.

Livestock Health Programs and Regulatory Support Promote Suture Usage

Government-funded livestock healthcare initiatives support the adoption of high-quality sutures across rural and commercial veterinary practices. Disease management and surgical interventions under national animal health programs boost demand for reliable wound closure products. The Veterinary Sutures Market benefits from these efforts by expanding its reach in developing regions. Regulatory bodies promote the use of approved suture materials to maintain animal safety during surgeries. Standardized protocols require durable and non-reactive sutures to reduce post-operative complications. It ensures consistent procurement across public and private veterinary facilities.

- For instance, under India’s National Animal Disease Control Programme (NADCP), more than 19,200,000 livestock were treated surgically between 2021 and 2023 across state-run veterinary hospitals.

Veterinary Practice Modernization and Hospital Infrastructure Expansion Accelerate Product Uptake

The modernization of veterinary hospitals and clinics creates a structured demand for surgical consumables, including sutures. New facilities integrate advanced surgical units requiring precision wound closure materials. The Veterinary Sutures Market gains traction as hospitals adopt minimally invasive and laparoscopic techniques. These methods require specialized sutures compatible with sensitive procedures. Clinics prioritize products that reduce operation time and improve wound management efficiency. It strengthens partnerships between suture manufacturers and veterinary networks

Rising Demand for Specialty Animal Care Encourages Use of Tailored Sutures

Specialty practices in oncology, cardiology, and neurology demand suture products that support delicate tissue handling and secure closure. The rise in elective procedures in pets and exotic animals expands the need for custom suture solutions. It drives manufacturers to design materials with controlled absorption rates and tensile strength. The Veterinary Sutures Market adapts to species-specific needs, including cats, dogs, horses, and small mammals. Clinics select sutures that match anatomical and procedural requirements. Surgeons rely on high-performance materials that minimize tissue trauma.

Market Trends

Shift Toward Absorbable and Antimicrobial Sutures Enhances Post-Surgical Outcomes

Veterinarians increasingly prefer absorbable sutures due to their ability to degrade naturally without the need for removal. These sutures reduce stress on animals and minimize follow-up visits, especially in rural or large-animal settings. Antimicrobial coatings are also gaining attention for their role in lowering infection risks during recovery. The Veterinary Sutures Market sees innovation in this area, with products tailored for improved wound healing and reduced inflammatory response. It reflects a broader industry push for safer, more efficient surgical materials. Clinics are adopting these solutions to streamline patient care and support faster healing.

- For instance, Ethicon’s VICRYL RAPIDE™ (polyglactin 910) sutures retain approximately half of initial tensile strength at five days post‑implantation and are fully absorbed by the body within 42 days, as validated in subcutaneous implantation studies on rats.

Product Customization Aligns with Species-Specific Surgical Needs

Manufacturers are developing suture products designed for specific animal categories, including small pets, large livestock, and exotic species. Differences in tissue strength, anatomy, and movement patterns require tailored solutions. The Veterinary Sutures Market incorporates materials with variable tensile strength, needle types, and absorption profiles to match procedure types. It encourages surgeons to adopt sutures that reduce risk of breakage or irritation. Clinics prefer options that align with the anatomical demands of each case. Demand is rising for kits and bundled products that simplify surgical preparation.

- For instance, Ethicon offers VICRYL RAPIDE™ (polyglactin 910) in multiple USP sizes—from USP 8/0 up to USP 0—with needle‑thread configurations optimized for smaller species such as rabbits and felines; one version.

Surge in Minimally Invasive and Laparoscopic Procedures Influences Material Choices

Modern veterinary practices are integrating minimally invasive techniques, driving the need for compatible suture products. These procedures often require finer sutures that allow precise closure in restricted spaces. The Veterinary Sutures Market responds with micro-gauge and monofilament materials designed for reduced tissue drag. It supports enhanced visibility and control during procedures. Manufacturers focus on providing sterile, preloaded needle options for quick application. This trend aligns with growing expectations for low-complication recovery.

Veterinary Education and Skill Development Shape Product Adoption Patterns

Training programs and continuing education initiatives are increasing awareness of advanced suturing techniques. Surgeons are learning to differentiate materials based on factors like knot security, tissue reaction, and handling ease. The Veterinary Sutures Market benefits from this trend by aligning product features with practitioner preferences. It allows for broader uptake across both entry-level and specialist facilities. Clinical workshops promote the use of innovative materials in real-world scenarios. This shift drives knowledge-based procurement across hospitals and independent practices.

Market Challenges Analysis

Limited Standardization and Regulatory Variations Restrict Product Consistency

Variations in veterinary regulations across regions create inconsistencies in product approval and usage standards. Many countries lack unified guidelines for veterinary surgical materials, which affects the adoption of advanced suture technologies. Clinics in rural or under-resourced areas often rely on general surgical sutures rather than those developed specifically for animals. This inconsistency limits the overall effectiveness of surgical outcomes and increases the risk of complications. The Veterinary Sutures Market must navigate fragmented regulatory environments and address the gap in clinical training on proper suture selection. It creates challenges for manufacturers trying to offer globally accepted, compliant products. Delays in approval processes and variations in quality control also hinder product availability in emerging markets.

Cost Sensitivity and Low Awareness Impact Advanced Product Adoption

High-quality veterinary sutures with specialized coatings or absorption properties often carry premium pricing, which limits access in price-sensitive markets. Many veterinary practices, especially smaller clinics, continue to prioritize cost over performance. It creates a barrier to the widespread adoption of innovative sutures that could improve clinical outcomes. Awareness about the long-term benefits of using species-specific and procedure-specific sutures remains low in several regions. The Veterinary Sutures Market must invest in practitioner education and demonstrate measurable clinical benefits to encourage adoption. Limited budgets, especially in livestock care, further restrict demand for advanced materials. It makes balancing affordability and performance a continuing challenge for both manufacturers and end-users.

Market Opportunities

Expansion of Companion Animal Care and Elective Surgeries Creates New Product Demand

The growing focus on pet wellness and preventive healthcare opens significant opportunities for advanced suture products. Rising demand for elective procedures such as sterilization, dental surgeries, and tumor removals increases the need for reliable wound closure materials. Clinics seek sutures that improve healing and reduce the risk of post-operative infections. The Veterinary Sutures Market stands to benefit from this shift by offering products tailored for various surgical specialties. It creates room for innovation in absorbable, antimicrobial, and bio-compatible materials. Increased willingness among pet owners to invest in high-quality veterinary care supports wider adoption of premium sutures in urban and semi-urban areas.

Growth in Veterinary Infrastructure and Training Supports Product Diversification

Veterinary hospitals and clinics continue to expand their surgical capabilities through infrastructure upgrades and advanced procedure offerings. Institutions are investing in specialized units and staff training, which creates an opportunity for product differentiation. The Veterinary Sutures Market can introduce procedure-specific kits and materials aligned with updated clinical protocols. It encourages suppliers to collaborate with teaching hospitals and training centers to build long-term user familiarity. Opportunities exist to supply targeted solutions for niche areas like exotic animal care or laparoscopic surgery. The increasing number of veterinary graduates also strengthens the market’s foundation for knowledge-driven product selection.

Market Segmentation Analysis:

By Type:

The veterinary sutures market is segmented into absorbable and non-absorbable sutures. Absorbable sutures hold a significant share due to their ability to naturally dissolve within the animal’s body, reducing the need for follow-up visits. These are preferred in internal surgeries where suture removal is not feasible. Non-absorbable sutures remain essential for external wound closures and orthopedic procedures that demand extended support. Product selection depends on the healing time required and surgical site accessibility. Both types continue to see innovation in materials and coatings to enhance performance and reduce infection risks.

- For instance, Ethicon’s VICRYL™ (polyglactin 910) braided sutures demonstrate a tensile strength of approximately 195 N at time zero, declining to about 157 N by day 14 and as low as 14 N by day 42 under standardized incubation studies, with full absorption occurring between day 56 and day 70.

By Animal Type:

The market is divided into large and small animals. Small animals, including cats and dogs, dominate the segment owing to the rising trend of pet ownership and frequent surgical interventions in veterinary clinics. It supports strong demand for both absorbable and non-absorbable sutures tailored to various species and sizes. Large animals, such as horses and cattle, contribute steadily to the market, primarily through soft tissue and orthopedic procedures. Growth in equine sports medicine and livestock care strengthens product uptake. The Veterinary Sutures Market benefits from increasing awareness around professional post-operative care in both segments.

- For instance, Medtronic partnered with over 900 rural veterinary clinics across India in 2024, supplying specialized absorbable sutures designed for post-operative recovery in both small pet surgeries and large animal interventions.

By Application Type:

Soft tissue surgery accounts for a major share due to its prevalence in both routine and emergency care. It includes procedures involving organs, skin, and subcutaneous tissues where suture choice directly influences recovery outcomes. Gynecology and urology surgeries demand precision sutures that minimize tissue reaction and support rapid healing. Orthopedic surgeries use stronger sutures that ensure long-term stability. The others category includes dental, ophthalmic, and oncological procedures where specific suture features are critical to success.

By End-User:

Hospitals lead due to access to advanced surgical infrastructure and trained professionals. Veterinary clinics follow closely, driven by rising caseloads and convenience for pet owners. Clinics often stock a wide range of suture types to cater to different animal breeds and medical needs. This diversity in demand across end-users promotes continuous product development and customization by manufacturers.

Segments:

Based on Type:

- Absorbable,

- Non-Absorbable

Based on Animal Type:

- Large Animal

- Small Animal

Based on Application:

- Soft Tissue Surgery

- Gynecology

- Urology Surgery

- Orthopedic Surgery

Based on End-User:

- Hospitals

- Veterinary Clinics

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America dominates the veterinary sutures market with a market share of approximately 37.2% in 2024. The region’s leadership is supported by the presence of well-established veterinary healthcare infrastructure and high animal healthcare expenditure. The United States, in particular, exhibits strong demand due to the high adoption rate of companion animals and increasing surgical interventions in veterinary practices. Rising pet insurance coverage, growth in equine and livestock populations, and awareness of animal health have elevated the need for specialized suturing solutions. Key players operating in this region also invest heavily in R&D to develop advanced suture materials. Demand for absorbable sutures is increasing due to better post-operative outcomes and fewer follow-ups. The region continues to witness strong growth driven by robust veterinary service networks and stringent regulations emphasizing animal care quality.

Europe

Europe holds the second-largest share of the veterinary sutures market, accounting for around 26.8% in 2024. Countries such as Germany, France, and the UK lead in veterinary surgical procedures and investments in animal healthcare technologies. The rise in livestock monitoring programs and efforts toward animal disease control by EU regulatory bodies push the demand for effective surgical solutions. The growing trend of pet humanization in Western Europe contributes to the demand for soft tissue and orthopedic surgeries, which in turn fuels suture consumption. Veterinarians in this region increasingly prefer biodegradable sutures that reduce the need for re-visits. Local and regional manufacturers support the supply chain with cost-effective and high-quality suture materials. Europe’s market reflects maturity, yet continues to expand with improvements in companion animal healthcare.

Asia Pacific

The Asia Pacific region accounts for a market share of 19.5% in 2024, and it is expected to grow at a strong pace over the forecast period. The increasing livestock population and pet adoption rates in countries like China, India, and Japan drive demand for surgical products. Government initiatives to control zoonotic diseases and improve veterinary service access also support market expansion. The region experiences a rising need for affordable and effective suturing solutions to support growing animal surgeries in both rural and urban setups. Domestic players play a critical role in supplying low-cost sutures to meet the large-scale veterinary needs. Urbanization and rising disposable incomes contribute to pet care spending and support higher surgical intervention rates. Demand for non-absorbable sutures remains steady, particularly for large animals in agricultural settings.

Latin America

Latin America represents a smaller yet emerging share of the veterinary sutures market with a market share of 9.1% in 2024. Brazil and Argentina are major contributors due to their large livestock industries and growing companion animal care services. The market is largely driven by agricultural veterinary needs, including soft tissue and orthopedic procedures in large animals. Improvements in veterinary education and awareness are promoting better surgical practices. Import reliance remains high, although local manufacturing is gradually expanding to meet regional demand. The market shows steady development with growing investments in animal welfare programs and public-private partnerships aimed at rural veterinary outreach.

Middle East and Africa Remain

The Middle East and Africa (MEA) account for 7.4% of the global market in 2024, indicating the lowest market share but with considerable potential. The region’s growth is influenced by increasing focus on livestock health in Gulf countries and growing pet adoption in urban centers of South Africa. Access to advanced veterinary services is limited in rural areas, yet improving infrastructure supports market entry. The demand is primarily focused on cost-effective suture materials for large animals, especially in agricultural economies. International aid and veterinary programs also support basic surgical interventions in underdeveloped regions. MEA is projected to grow steadily as government and NGO efforts strengthen veterinary service coverage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- UNIFY sutures

- Teleflex Inc.

- DemeTech

- Medtronic PLC

- Vitrex Surgical

- AmerisourceBergen Corporation

- KRUUSE UK Ltd.

- B.Braun

- Q-Close

- Ethicon U.S.

Competitive Analysis

The Veterinary Sutures Market such as Medtronic PLC, DemeTech, B.Braun, Ethicon U.S., Q-Close, KRUUSE UK Ltd., Teleflex Inc., AmerisourceBergen Corporation, UNIFY Sutures, and Vitrex Surgical dominate the market by offering a comprehensive range of suture solutions designed for various veterinary procedures. Market leaders emphasize innovation in both absorbable and non-absorbable sutures, targeting a wide range of applications from routine wound closures to complex surgical interventions. These firms invest heavily in research and development to introduce materials that reduce tissue reaction and improve handling properties for veterinary professionals. Strategic collaborations, regional expansions, and tailored product offerings further strengthen their market positions. Additionally, companies leverage extensive distribution networks and provide educational support to veterinarians to boost product adoption and brand loyalty. Their ability to address the distinct needs of small animals, livestock, and equine practices demonstrates a commitment to comprehensive care. The competitive landscape remains dynamic, driven by ongoing innovation, regulatory compliance, and a growing emphasis on animal welfare.

Recent Developments

- In 2025, AmerisourceBergen expanded its distribution partnerships, increasing accessibility of advanced veterinary sutures in North America, helping meet the rising demand for veterinary surgical care

- In January 2025, Medtronic launched new absorbable monofilament sutures, advancing veterinary surgical options with improved biocompatibility and ease of use, reflecting a significant milestone in enhancing surgical outcomes for pets.

- In April 2023, Corza Medical finalized a deal to acquire Takeda Pharmaceuticals’ TachoSil manufacturing operations in Linz, Austria.

Market Concentration & Characteristics

The Veterinary Sutures Market Market displays a moderately concentrated structure with a mix of global and regional players competing across various product categories. Large multinational companies dominate the upper tier through strong brand portfolios, extensive distribution networks, and ongoing investments in product innovation. These players maintain high entry barriers through regulatory approvals, proprietary materials, and established relationships with veterinary professionals. At the same time, regional manufacturers contribute to market diversity by offering cost-effective alternatives tailored to local clinical needs. It features a wide range of absorbable and non-absorbable sutures designed for small animal, livestock, and equine procedures, reflecting growing demand for precision in wound management. Product differentiation relies heavily on factors such as suture strength, biocompatibility, and ease of handling. Technological advancements, such as antibacterial coatings and synthetic materials, further define competition. Pricing remains competitive, particularly in emerging markets, where affordability drives procurement decisions. Companies leverage training initiatives and clinical support to build trust among veterinary practitioners and expand their user base. Despite the presence of several active participants, a few key firms continue to command significant market share by consistently meeting evolving clinical standards and aligning products with veterinary best practices.

Report Coverage

The research report offers an in-depth analysis based on Type, Animal Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily due to increased pet ownership and spending on companion animal healthcare.

- Demand for advanced suture materials will grow as surgical precision and recovery outcomes become more critical.

- Manufacturers will focus on biodegradable and antimicrobial sutures to reduce post-operative complications.

- Veterinary hospitals and clinics will continue to drive procurement through bulk purchases and long-term contracts.

- Emerging markets will offer new growth opportunities due to expanding veterinary infrastructure and animal welfare initiatives.

- Innovation in synthetic suture technology will improve handling, tensile strength, and tissue compatibility.

- Online distribution channels will gain traction, supporting broader access to surgical supplies in remote regions.

- Rising awareness of livestock health and veterinary surgical procedures will support consistent demand across rural areas.

- Regulatory compliance will remain essential, prompting companies to invest in certifications and quality control.

- Key players will strengthen their positions through acquisitions, product portfolio expansion, and veterinarian education programs.