Market Overview

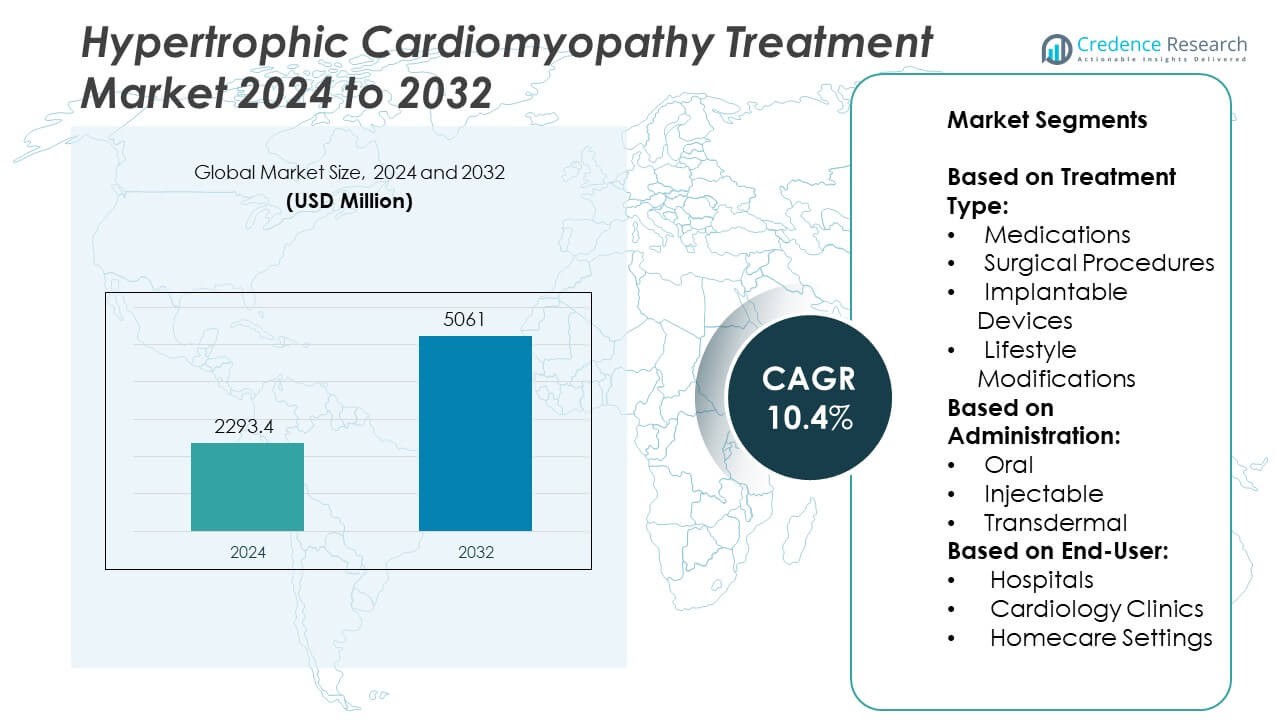

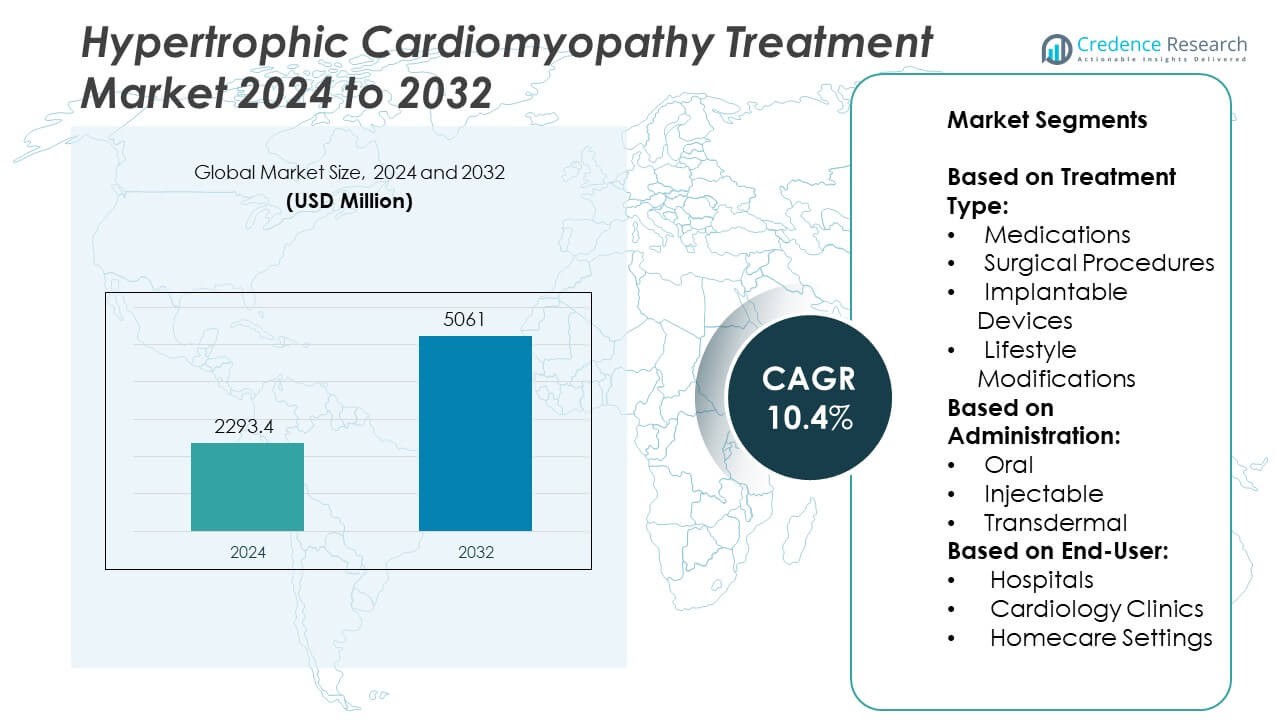

Hypertrophic Cardiomyopathy Treatment Market size was valued at USD 2293.4 million in 2024 and is anticipated to reach USD 5061 million by 2032, at a CAGR of 10.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hypertrophic Cardiomyopathy Treatment Market Size 2024 |

USD 2293.4 Million |

| Hypertrophic Cardiomyopathy Treatment Market, CAGR |

10.4% |

| Hypertrophic Cardiomyopathy Treatment Market Size 2032 |

USD 5061 Million |

The Hypertrophic Cardiomyopathy Treatment market advances through rising global prevalence of inherited cardiac disorders, improved access to diagnostic technologies, and growing awareness of sudden cardiac death risks. It gains momentum from the adoption of precision medicine, expansion of genetic screening, and increasing use of myosin inhibitors for targeted therapy. Healthcare providers integrate artificial intelligence into imaging and diagnostics to enhance accuracy and early detection.

The Hypertrophic Cardiomyopathy Treatment market demonstrates strong growth across North America, Europe, and Asia-Pacific, driven by advanced healthcare infrastructure, rising awareness, and expanding access to specialty cardiac care. North America leads due to early adoption of genetic screening and novel therapeutics, while Europe benefits from standardized clinical guidelines and research funding. Asia-Pacific shows high potential with improving diagnostic capabilities and increasing healthcare investment. Key players shaping the market include Bristol Myers Squibb, which offers mavacamten through Myokardia, along with Novartis, Pfizer, and Takeda Pharmaceuticals, all investing in targeted therapies and expanding their cardiovascular treatment portfolios.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hypertrophic Cardiomyopathy Treatment market was valued at USD 2293.4 million in 2024 and is projected to reach USD 5061 million by 2032, growing at a CAGR of 10.4% during the forecast period.

- Increasing prevalence of inherited cardiovascular disorders and heightened awareness of sudden cardiac death risks are driving demand for early diagnosis and effective treatment.

- The market is witnessing a shift toward precision medicine, supported by genetic testing, AI-enabled imaging, and the adoption of myosin inhibitors that directly target disease mechanisms.

- Pharmaceutical companies such as Bristol Myers Squibb, Novartis, Pfizer, and Takeda Pharmaceuticals actively invest in R&D pipelines, strategic acquisitions, and regulatory approvals to strengthen their market positions.

- High treatment costs, limited access to advanced care in developing regions, and underdiagnosis due to symptom overlap with other cardiac conditions continue to restrain market expansion.

- North America leads the market due to strong healthcare infrastructure, rapid adoption of innovative therapies, and favorable reimbursement systems; Europe follows with robust clinical protocols and increasing use of ICDs, while Asia-Pacific shows rising potential through healthcare investments and growing diagnostic capabilities.

- The market continues to evolve through digital health integration, expansion of family screening programs, and increasing focus on non-invasive procedures and personalized therapeutic model.

Market Drivers

Rising Global Prevalence of Cardiovascular Disorders Drives Clinical Demand

The Hypertrophic Cardiomyopathy Treatment market benefits from the increasing burden of cardiovascular diseases worldwide. Sedentary lifestyles, poor dietary habits, and genetic predisposition contribute to the rise in hypertrophic cardiomyopathy (HCM) cases. It creates an urgent need for early diagnosis and effective long-term care solutions. Healthcare systems are prioritizing cardiovascular risk mitigation, prompting greater investment in advanced therapeutic protocols. Patients seek targeted treatment to manage symptoms and prevent complications like sudden cardiac death. Governments and healthcare agencies recognize this trend and support awareness campaigns to improve detection rates. The market continues to expand in response to growing public health attention to cardiac disorders.

- For instance, Pfizer supported the “Get Ahead of Heart Failure” initiative with the American Heart Association, reaching over 20,000 clinicians with updated cardiomyopathy treatment guidelines by mid-2024.

Technological Advancements in Diagnostics and Targeted Therapeutics Expand Accessibility

Innovation in cardiac imaging and molecular diagnostics enhances the accuracy of hypertrophic cardiomyopathy diagnosis. The market benefits from progress in echocardiography, cardiac MRI, and genetic testing, enabling personalized treatment strategies. It allows clinicians to differentiate HCM from similar cardiomyopathies and apply specific interventions. Pharmaceutical companies develop new therapies, including allosteric myosin inhibitors and beta-blockers with improved tolerability. These advancements improve patient adherence and reduce hospitalizations. Research initiatives in precision cardiology accelerate drug development pipelines. The Hypertrophic Cardiomyopathy Treatment market grows as technology improves patient outcomes and broadens access to tailored care.

- For instance, Bristol Myers Squibb’s Camzyos (mavacamten), approved in April 2022, achieved 60% improvement in peak VO2 in Phase III EXPLORER-HCM trials, confirming its efficacy in obstructive HCM.

Supportive Regulatory Pathways and Orphan Drug Incentives Encourage Product Development

The regulatory landscape supports innovation in rare cardiac conditions through fast-track approvals and orphan drug designations. It reduces time-to-market for novel therapies and incentivizes investment in specialized treatments. Governments offer financial benefits and market exclusivity to encourage development of HCM-targeted drugs. These incentives attract both established and emerging pharmaceutical firms. Regulators prioritize therapies addressing unmet clinical needs, ensuring rapid evaluation of promising compounds. The Hypertrophic Cardiomyopathy Treatment market gains momentum through this supportive ecosystem that fosters accelerated product availability.

Growing Healthcare Infrastructure and Insurance Coverage Promote Market Penetration

Expanding hospital infrastructure and improved healthcare accessibility support treatment delivery in emerging and developed regions. It enables timely diagnosis and chronic care management, especially in urban centers with cardiac specialty units. Insurance reforms and broader reimbursement policies improve affordability of high-cost therapies. Patients gain access to advanced drugs and implantable devices through public and private funding mechanisms. Telemedicine and remote monitoring tools complement treatment plans, reducing the burden on healthcare facilities. The Hypertrophic Cardiomyopathy Treatment market expands as systemic improvements facilitate better care delivery.

Market Trends

Expansion of Precision Medicine and Genotype-Driven Treatment Approaches

The Hypertrophic Cardiomyopathy Treatment market is shifting toward personalized medicine through integration of genetic insights. Advancements in genomic sequencing enable clinicians to identify HCM-causing mutations and tailor therapy accordingly. It supports risk stratification and guides treatment plans, especially in familial cases. Providers are increasingly incorporating genotype data into drug selection and monitoring strategies. Precision cardiology tools offer improved disease management for both obstructive and non-obstructive HCM forms. Pharmaceutical firms are leveraging this trend by developing mutation-specific drug candidates. The market reflects the growing emphasis on individualized therapeutic outcomes.

- For instance, Johnson & Johnson MedTech completed the acquisition of V-Wave , enhancing its cardiovascular portfolio by integrating minimally invasive heart failure monitoring systems used in over 400 hospitals globally.

Increasing Adoption of Myosin Inhibitors in Place of Conventional Therapy

Novel drug classes such as myosin inhibitors are gaining traction due to their ability to address disease mechanisms directly. The market sees a shift from symptom control using beta-blockers and calcium channel blockers to disease-modifying therapy. It results in improved cardiac function and symptom relief in patients with obstructive HCM. Clinical trials continue to validate safety and efficacy profiles of these agents. Providers favor such alternatives that minimize need for invasive procedures. Adoption rates rise as guidelines integrate these therapies into treatment algorithms. The Hypertrophic Cardiomyopathy Treatment market evolves in response to this pharmacological advancement.

- For instance, Bristol Myers Squibb’s mavacamten demonstrated a 36-meter increase in 6-minute walk distance and ≥1 NYHA class improvement in 80 out of 123 patients in the Phase III EXPLORER-HCM trial, leading to FDA approval in April 2022 for obstructive hypertrophic cardiomyopathy.

Integration of Artificial Intelligence and Imaging Analytics in Diagnostic Protocols

Cardiologists increasingly use AI-based tools to enhance diagnostic accuracy in HCM evaluations. It supports early identification of subtle structural abnormalities and automates measurement parameters. Integration with cardiac MRI and echocardiography platforms improves workflow efficiency and consistency in interpretation. AI enables scalable screening models, particularly in high-risk populations. Hospitals invest in machine learning solutions to reduce diagnostic variability. The Hypertrophic Cardiomyopathy Treatment market incorporates digital tools to support clinical decision-making and patient stratification.

Growing Focus on Minimally Invasive Septal Reduction and Device-Based Therapies

Clinicians show growing preference for septal reduction techniques that offer fewer complications and quicker recovery times. The market responds to demand for less invasive alternatives to surgical myectomy. It includes alcohol septal ablation and emerging catheter-based approaches supported by real-time imaging. Implantable cardioverter defibrillators (ICDs) and pacing devices are also gaining acceptance in high-risk patients. These innovations offer long-term rhythm management and sudden cardiac death prevention. The Hypertrophic Cardiomyopathy Treatment market aligns with patient demand for advanced procedural safety and reduced downtime.

Market Challenges Analysis

High Cost of Therapy and Limited Accessibility Impede Widespread Adoption

The Hypertrophic Cardiomyopathy Treatment market faces barriers due to the high cost of advanced therapeutics and procedures. Many patients, particularly in low- and middle-income regions, struggle to access myosin inhibitors, ICDs, or advanced imaging services. It creates disparity in treatment outcomes and delays diagnosis in resource-constrained settings. Insurance coverage remains inconsistent across geographies, limiting affordability of long-term care. Specialized treatments often require cardiac centers equipped with expert personnel and infrastructure. This concentration restricts market reach and reduces the scalability of high-cost interventions. The need for cost-effective alternatives remains unmet for a significant patient segment.

Diagnostic Complexity and Low Awareness Undermine Timely Intervention

Hypertrophic cardiomyopathy often presents with non-specific symptoms, leading to misdiagnosis or delayed detection. The market faces challenges from inconsistent clinical awareness among general practitioners and primary care providers. It reduces opportunities for early intervention and increases the risk of disease progression. Variability in diagnostic criteria and lack of access to genetic testing complicate accurate classification. Many regions lack structured screening programs, especially for asymptomatic familial cases. Patients often undergo unnecessary procedures before receiving appropriate care. The Hypertrophic Cardiomyopathy Treatment market must address educational and diagnostic gaps to improve outcomes.

Market Opportunities

Expansion of Genetic Testing and Family Screening Creates New Commercial Avenues

The Hypertrophic Cardiomyopathy Treatment market holds growth potential through integration of genetic screening into clinical workflows. Family-based testing enables early identification of at-risk individuals, expanding the pool of treatable patients. It encourages proactive disease management and supports adoption of targeted therapies. Diagnostic companies can partner with healthcare providers to offer bundled solutions that include testing, counseling, and monitoring. Governments and insurers are exploring reimbursement models to support preventive genomic care. Population-wide screening programs present commercial opportunities across both developed and emerging economies. The market stands to benefit from broader awareness and infrastructure development in genetic medicine.

Rising Investments in Novel Therapies and Digital Health Solutions Drive Market Innovation

Pharmaceutical and biotechnology firms are directing capital toward next-generation therapies that address the root mechanisms of hypertrophic cardiomyopathy. The market is poised to benefit from pipeline drugs in advanced clinical stages, including those targeting sarcomeric protein modulation. It attracts venture funding and strategic collaborations focused on accelerating product development. Digital health platforms offer complementary opportunities in remote monitoring, treatment adherence, and symptom tracking. These tools enhance patient engagement and streamline data collection for clinicians. The Hypertrophic Cardiomyopathy Treatment market can leverage digital integration to expand access and improve long-term outcomes.

Market Segmentation Analysis:

By Treatment Type:

The Hypertrophic Cardiomyopathy Treatment market categorizes into medications, surgical procedures, implantable devices, and lifestyle modifications. Medications dominate due to their non-invasive nature and role in managing symptoms such as chest pain and arrhythmia. Beta-blockers and calcium channel blockers are widely prescribed, while myosin inhibitors are gaining adoption for their disease-modifying effects. Surgical procedures, including septal myectomy, hold importance for patients unresponsive to drug therapy. Implantable cardioverter defibrillators (ICDs) support high-risk patients by preventing sudden cardiac death and show increased usage in advanced care settings. Lifestyle modifications support medical therapy but hold a smaller revenue share due to limited standalone effectiveness. The market reflects growing integration of combination approaches to optimize long-term outcomes.

- For instance, Medtronic reported implanting over 190,000 ICDs globally as of its FY2024, with more than 2,000 specifically placed in high-risk HCM patients.

By Administration:

Oral administration leads the market due to the prevalence of drug-based management and patient preference for ease of use. It supports adherence in chronic therapy and enables wide distribution through retail and hospital pharmacies. Injectable therapies serve niche roles, often in acute care or during surgical preparation. It includes intravenous drugs used to stabilize cardiac output or manage comorbid conditions. Transdermal delivery, while less common, offers non-invasive alternatives and is under exploration for future drug formulations. The Hypertrophic Cardiomyopathy Treatment market sees continued focus on optimizing drug delivery to improve efficacy and minimize side effects.

- For instance, Bristol Myers Squibb reported that over 11,000 patients had been prescribed Camzyos (mavacamten) in oral formulation by its FDA approval, demonstrating strong uptake in both hospital and outpatient settings.

By End-User:

Hospitals account for the largest share due to their ability to provide comprehensive diagnostic, surgical, and emergency services. It supports complex interventions such as septal reduction and device implantation, requiring multidisciplinary cardiac teams. Cardiology clinics offer specialized follow-up care and manage a significant volume of outpatient consultations. These settings drive growth in pharmacological and non-surgical therapies. Homecare settings gain relevance with the rise of remote monitoring tools and oral therapy regimens. They enable chronic disease management for stable patients, reducing hospital burden. The Hypertrophic Cardiomyopathy Treatment market expands across care settings through tailored service delivery models.

Segments:

Based on Treatment Type:

- Medications

- Surgical Procedures

- Implantable Devices

- Lifestyle Modifications

Based on Administration:

- Oral

- Injectable

- Transdermal

Based on End-User:

- Hospitals

- Cardiology Clinics

- Homecare Settings

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the dominant position in the Hypertrophic Cardiomyopathy Treatment market, accounting for 40.2% of the global share in 2024. It benefits from advanced healthcare infrastructure, strong reimbursement frameworks, and early adoption of innovative therapeutics. The United States leads due to widespread use of myosin inhibitors, ICD implantation, and cardiac genetic screening. It supports a large base of specialized cardiology centers, enabling timely diagnosis and effective disease management. High prevalence of lifestyle-related cardiac disorders also contributes to patient volume. Canada complements regional growth with improved access to cardiac imaging and increased funding for rare disease research. The market in North America continues to expand through strong clinical research activity and integration of digital health platforms.

Europe

Europe ranks second, capturing 28.6% of the Hypertrophic Cardiomyopathy Treatment market. It shows robust demand across Germany, the United Kingdom, France, and the Nordics due to strong public health programs and consistent clinical guidelines. The region demonstrates significant uptake of oral pharmacological therapies supported by universal healthcare systems. It also sees steady growth in septal reduction procedures and ICD placements across advanced hospital networks. Regulatory bodies such as the EMA support accelerated approval for orphan drugs and novel therapies, contributing to faster market entry. Efforts to expand genetic counseling services and establish family screening protocols drive early-stage patient identification. Europe maintains a favorable outlook through its commitment to clinical standardization and technological adoption.

Asia-Pacific

Asia-Pacific holds 18.3% of the global Hypertrophic Cardiomyopathy Treatment market and shows the fastest growth trajectory. Rising healthcare investment in China, India, Japan, and South Korea boosts access to specialized cardiovascular care. It benefits from large patient populations and increasing awareness of inherited cardiac diseases. Japan demonstrates early adoption of myosin inhibitors and advanced diagnostics, supported by national health coverage. China and India are expanding capabilities in cardiac imaging, catheter-based procedures, and device implantation. Growing availability of trained cardiologists and participation in multinational clinical trials strengthen regional capabilities. The market in Asia-Pacific continues to rise with improved infrastructure and emphasis on early diagnosis.

Latin America

Latin America accounts for 7.1% of the Hypertrophic Cardiomyopathy Treatment market, led by Brazil, Mexico, and Argentina. Urban centers with specialized cardiology hospitals support growth through access to surgical procedures and device-based therapies. It faces challenges related to limited availability of genetic testing and uneven distribution of cardiac care resources. Public-private partnerships are helping bridge gaps in diagnostic services and improve access to medications. Government health initiatives increasingly promote chronic disease management. The region holds potential through gradual infrastructure development and targeted education campaigns.

Middle East & Africa

The Middle East & Africa region represents 5.8% of the global market and remains in the early stages of development. The market is concentrated in countries such as Saudi Arabia, the UAE, and South Africa where advanced private healthcare systems exist. It faces systemic challenges related to limited cardiology workforce and access to high-cost therapies. Diagnostic delays remain common in rural areas due to a lack of imaging and screening services. Efforts to introduce cardiac centers of excellence and expand insurance coverage support future growth. The Hypertrophic Cardiomyopathy Treatment market in this region shows emerging potential through strategic health investments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Key players in the Hypertrophic Cardiomyopathy Treatment market include Bristol Myers Squibb, Pfizer, Novartis, Takeda Pharmaceuticals, AstraZeneca, Eli Lilly, Merck, Sanofi, Gilead Sciences, and Johnson & Johnson.These companies maintain a competitive edge by leveraging robust R&D pipelines, strategic acquisitions, and global distribution networks. They invest in clinical trials targeting myosin inhibition, gene modulation, and precision cardiology to differentiate their portfolios. Strong collaboration with academic institutions and biotech firms accelerates innovation and regulatory approvals. Many players focus on expanding indications for existing cardiovascular drugs to strengthen their presence in this specialized segment. Product lifecycle management, patent extensions, and real-world evidence collection support market sustainability. Competitive strategies emphasize improving patient adherence through convenient formulations, digital therapy support tools, and value-based care models. These firms also engage in partnerships with diagnostic companies to integrate genetic screening and early detection into treatment pathways. Regional expansion into emerging markets and adaptation to local healthcare policies ensure broader market reach. Pricing strategies and access programs address affordability challenges, especially in developing economies. The competitive landscape remains dynamic as firms compete on clinical efficacy, safety profiles, and long-term patient outcomes in a high-need therapeutic area.

Recent Developments

- In January 2025, trametinib (from Novartis) demonstrated significant reductions in mortality, cardiac surgery, and transplantation in children with severe hypertrophic cardiomyopathy linked to RAS/MAPK mutations.

- In 2025, The FDA extended the PDUFA date for Cytokinetics’ aficamten , requesting additional REMS details without new clinical data.

- In October 2024, Johnson & Johnson completed its acquisition of V-Wave, enhancing its MedTech position in cardiovascular disease management.

Market Concentration & Characteristics

The Hypertrophic Cardiomyopathy Treatment market displays moderate concentration, with a few major pharmaceutical companies leading innovation and commercialization. It features a mix of established players and emerging biotech firms focused on niche therapeutics. The market is characterized by high entry barriers due to complex clinical development, regulatory scrutiny, and the need for specialized expertise in cardiogenetics. Product differentiation centers on mechanism of action, safety profile, and long-term efficacy, especially for disease-modifying therapies like myosin inhibitors. It exhibits strong R&D orientation, with companies investing in precision medicine, biomarker discovery, and combination therapies to address both obstructive and non-obstructive forms. Clinical success significantly impacts market share, making late-stage pipelines and regulatory approvals critical to competitive positioning. The market also reflects evolving patient expectations for personalized care, non-invasive treatment options, and digital engagement tools. It shows regional disparities in access and adoption, influenced by reimbursement structures, healthcare infrastructure, and clinician awareness. Strategic collaborations between pharma, diagnostics, and digital health companies shape the future of treatment models and accelerate innovation across care settings.

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Administration, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness growing adoption of myosin inhibitors as first-line therapy for obstructive hypertrophic cardiomyopathy.

- Genetic testing and family screening will become standard practice in early diagnosis and risk stratification.

- AI-enabled imaging tools will enhance diagnostic accuracy and support early intervention decisions.

- Pharmaceutical companies will expand pipelines with targeted therapies addressing both obstructive and non-obstructive forms.

- Regulatory bodies will continue to support fast-track approvals for orphan and rare cardiac disease treatments.

- Digital health platforms will play a larger role in remote monitoring and treatment adherence.

- Emerging markets will experience faster adoption of advanced care models due to healthcare infrastructure investments.

- Combination therapy strategies will gain traction to improve long-term patient outcomes.

- Public and private insurers will broaden reimbursement for high-cost drugs and device-based interventions.

- Industry collaborations will intensify between pharma, diagnostics, and tech firms to create integrated care solutions.