| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

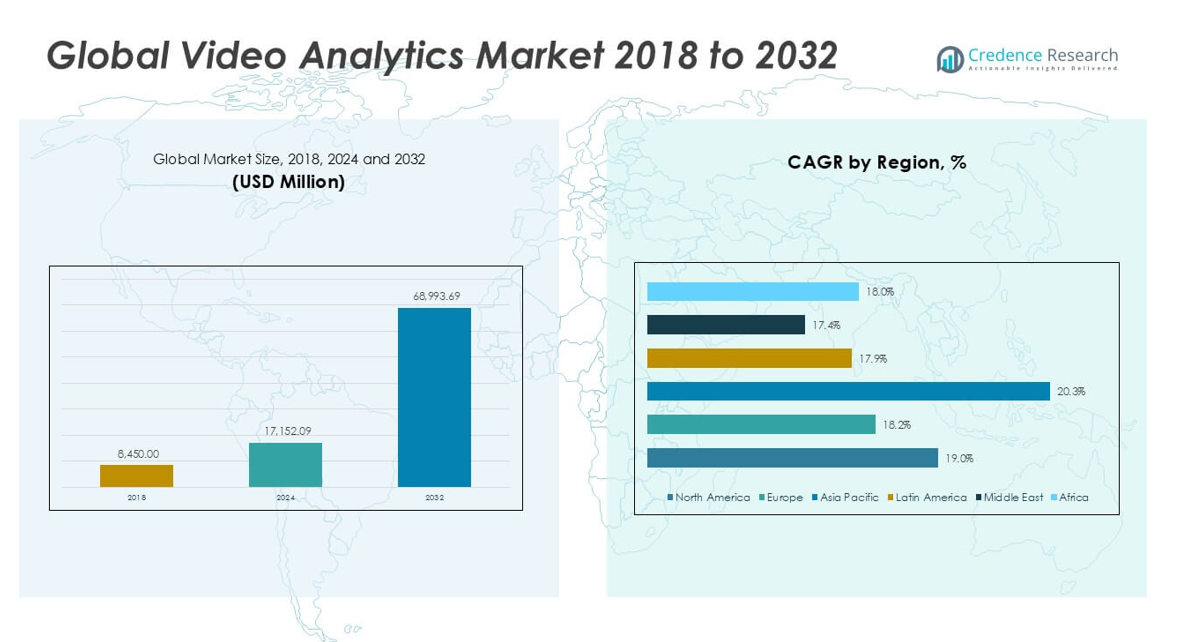

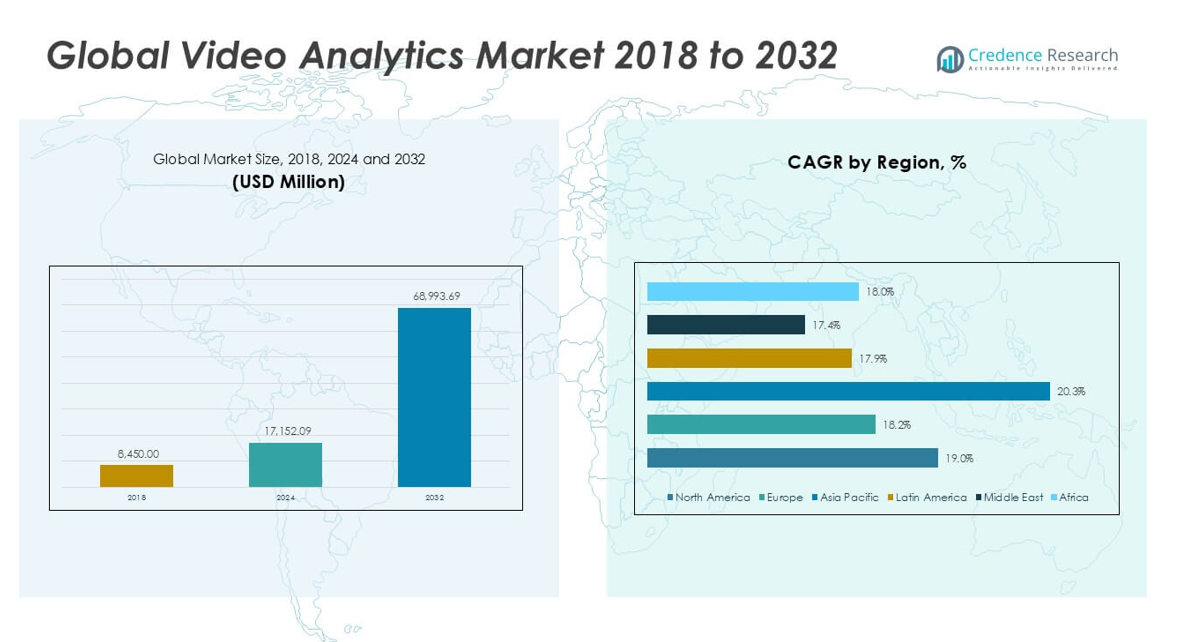

| Video Analytics Market Size 2024 |

USD 17,152.09 million |

| Video Analytics Market, CAGR |

19.04% |

| Video Analytics Market Size 2032 |

USD 68,993.69 million |

Market Overview

The Global Video Analytics Market is projected to grow from USD 17,152.09 million in 2024 to an estimated USD 68,993.69 million based on 2032, with a compound annual growth rate (CAGR) 19.04% from 2025 to 2032.

Rising demand for real-time monitoring and proactive threat detection is driving the adoption of video analytics solutions worldwide. The integration of AI-powered analytics into existing surveillance systems enables automated alerts, reducing human dependency and improving incident response times. Key trends include the growing use of edge-based analytics, cloud-based video processing, and facial recognition in urban safety and retail intelligence. Privacy concerns and high implementation costs remain challenges; however, continued innovation in software efficiency and regulatory compliance tools is helping mitigate these issues.

North America holds a dominant position in the video analytics market due to early adoption and strong investment in smart city initiatives and homeland security. Europe follows with steady demand across public transportation and government sectors. Asia Pacific is expected to witness the highest growth, fueled by rapid urbanization, infrastructure development, and rising security concerns. Key players in the global market include IBM Corporation, Axis Communications, Cisco Systems, Avigilon (Motorola Solutions), Genetec, Agent Video Intelligence, and Honeywell International.

Market Insights

- The Global Data Center Rack Market is projected to grow from USD 4,696.14 million in 2024 to USD 9,440.06 million by 2032, registering a CAGR of 9.14% from 2025 to 2032.

- Rising demand for scalable and energy-efficient rack systems is driving market growth across cloud computing, hyperscale, and edge data centers.

- Increasing adoption of virtualization, AI workloads, and big data analytics is boosting the need for structured and high-performance rack environments.

- Market growth is challenged by high initial setup costs and space constraints, especially in smaller or legacy data centers.

- North America holds the largest market share, supported by strong hyperscale and cloud service provider presence.

- Asia-Pacific is the fastest-growing region, fueled by rapid digital infrastructure expansion in China, India, and Singapore.

- Europe contributes steadily to the market, driven by data localization regulations and increasing demand for green and energy-efficient data centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Real-Time Surveillance and Security Intelligence

The Global Video Analytics Market is witnessing strong growth due to the increasing need for real-time surveillance across public and private sectors. Governments and enterprises seek faster incident response, predictive threat detection, and continuous monitoring to enhance safety and reduce manual surveillance efforts. It enables automated alerts and intelligent video filtering, reducing dependency on human operators. Airports, transportation systems, and urban infrastructure projects are integrating video analytics to support smart security frameworks. The need for 24/7 visibility and situational awareness fuels widespread adoption in high-risk and sensitive environments. The market continues to benefit from rising security investments and national surveillance initiatives.

- For instance, by late 2024, more than 8.4 million CCTV cameras were estimated to be connected to AI-enabled analytics platforms globally, and 18,000 airport terminals had deployed video analytics systems with facial recognition capabilities

Integration of Artificial Intelligence and Deep Learning Technologies

The integration of AI and deep learning algorithms into video analytics platforms significantly enhances their capabilities. It improves motion detection, object recognition, facial analysis, and behavior prediction with higher accuracy. These advanced features enable proactive decision-making in security operations and business optimization. The Global Video Analytics Market benefits from the trend of embedding AI at the edge, allowing devices to process data locally without latency. This evolution supports faster response and lowers bandwidth costs. AI-based analytics also opens new applications in traffic management, retail heatmapping, and industrial safety monitoring.

- For instance, in 2024, over 47% of enterprises adopted video analytics platforms embedded with deep learning capabilities, and more than 42,000 public safety projects worldwide implemented AI-based facial recognition analytics

Growth in Smart City Projects and Public Safety Investments

Smart city development plays a central role in driving demand for advanced video analytics. Urban planners and municipalities implement intelligent surveillance solutions to monitor traffic, manage crowds, and enforce regulations. It supports real-time insights that help authorities manage urban safety more effectively. The Global Video Analytics Market is aligned with government-backed programs focusing on digital transformation, law enforcement modernization, and crime prevention. These projects require scalable, automated systems that provide accurate video data interpretation. Public safety concerns across densely populated regions contribute significantly to market expansion.

Operational Efficiency and Business Intelligence in Commercial Applications

Enterprises across retail, banking, and logistics are adopting video analytics to optimize operations and improve customer experience. It delivers actionable insights by analyzing customer behavior, queue lengths, and employee activity. The Global Video Analytics Market supports functions beyond security by enabling data-driven decisions in store layouts, workforce allocation, and service delivery. Businesses use it to enhance performance, reduce shrinkage, and improve sales strategies. The ability to integrate analytics with other enterprise systems strengthens its value proposition. Growing interest in operational intelligence across sectors continues to expand its commercial relevance.

Market Trends

Growing Adoption of Cloud-Based Video Analytics Solutions for Scalability

Cloud-based video analytics is becoming a preferred solution due to its flexibility and scalability. It allows organizations to store and process large volumes of video data without significant infrastructure investments. The Global Video Analytics Market is expanding as companies move toward cloud deployment to support remote access and centralized control. It enables faster software updates, seamless integration, and real-time analytics across multiple locations. Cloud-based platforms also support easier data sharing and collaboration between security teams. The growing demand for cost-effective, scalable solutions is driving organizations to prioritize cloud-based video analytics over traditional on-premises systems.

- For instance, a leading financial services chain deployed a cloud-based video management system across more than 200 bank branches in multiple cities, enabling centralized monitoring and real-time analytics for all locations using a single cloud platform

Increased Integration of Video Analytics with Internet of Things (IoT) Devices

The integration of video analytics with IoT ecosystems is transforming operational processes across industries. IoT-enabled sensors and devices generate valuable data that video analytics systems can process in real-time for improved situational awareness. The Global Video Analytics Market benefits from this trend by offering solutions that combine video feeds with IoT sensor data to create comprehensive security and operational frameworks. It strengthens applications in traffic management, energy monitoring, and automated safety protocols. Video analytics platforms now support cross-device communication to deliver more accurate insights. IoT integration is becoming essential for businesses seeking to maximize the utility of their video surveillance infrastructure.

- For instance, IoT Analytics reported that the number of IoT use cases adopted by enterprises grew by more than 53,000 between 2021 and 2024, with video analytics and sensor integration ranking among the top applications for operational efficiency and real-time monitoring

Rising Use of Edge-Based Video Analytics for Faster Processing

Edge-based video analytics is gaining prominence due to its ability to process data closer to the source. It reduces latency and minimizes bandwidth consumption by analyzing video locally on cameras or edge devices. The Global Video Analytics Market is seeing rapid adoption of edge solutions in sectors that require immediate alerts, such as transportation and critical infrastructure. It supports real-time decision-making where network constraints limit cloud access. Edge computing also enhances data privacy by keeping sensitive information within local networks. The trend toward distributed processing is shaping the future of video analytics deployments worldwide.

Growing Implementation of AI-Powered Facial and Behavior Recognition

AI-powered facial and behavior recognition is becoming a key application within video analytics. It provides advanced capabilities for identifying individuals, analyzing crowd patterns, and detecting suspicious activities with high accuracy. The Global Video Analytics Market is evolving to meet the increasing demand for intelligent features that support security, marketing, and operational needs. It enables real-time identity verification in airports, retail stores, and event venues. Facial and behavior recognition technologies are also improving in reliability and speed, making them suitable for large-scale deployments. This trend is reshaping video analytics by expanding its use beyond traditional surveillance functions.

Market Challenges

High Initial Investment and Complex Integration Hinder Adoption

The Global Video Analytics Market faces challenges due to the high initial investment required for deployment. Advanced analytics solutions often demand significant spending on hardware, software, and network infrastructure. It can be difficult for small and medium-sized businesses to justify these costs, especially when budget constraints are present. Complex integration with legacy systems further delays implementation across organizations. Video analytics platforms must align with existing security frameworks, which can require customization and technical support. The high cost and integration complexity slow market penetration in cost-sensitive regions.

For instance, deploying a comprehensive video analytics system for a mid-sized facility typically requires an upfront investment of $60,000 to $150,000 for hardware, software, and integration, with additional annual maintenance costs ranging from $8,000 to $20,000 depending on system complexity and scale.

Privacy Concerns and Regulatory Compliance Restrict Market Growth

The Global Video Analytics Market encounters resistance from growing privacy concerns and strict regulatory environments. It processes large volumes of personal and sensitive data, raising public fears about surveillance misuse. Compliance with data protection laws such as GDPR imposes additional operational burdens on service providers and end-users. Organizations must implement data encryption, access controls, and consent mechanisms to meet these legal requirements. Navigating evolving privacy regulations across different countries creates barriers to cross-border deployments. Privacy challenges continue to limit the unrestricted expansion of video analytics solutions globally.

Market Opportunities

Expansion in Retail and Transportation Sectors Creates New Growth Avenues

The Global Video Analytics Market holds significant opportunities in retail and transportation sectors. Retailers are using it to analyze customer behavior, optimize store layouts, and improve security. It supports inventory management, loss prevention, and queue monitoring, which help businesses enhance operational efficiency. Transportation hubs such as airports, railways, and highways are investing in video analytics to manage traffic flow, detect incidents, and ensure passenger safety. The rising focus on smart transportation and automated traffic management creates demand for real-time analytics solutions. These expanding applications offer strong growth potential for vendors and service providers.

Emerging Markets and Smart City Projects Offer Untapped Potential

The Global Video Analytics Market can expand rapidly in emerging economies where smart city initiatives are gaining momentum. Governments in Asia Pacific, the Middle East, and Latin America are increasing investments in urban security, intelligent traffic systems, and public safety infrastructure. It aligns well with these projects by providing scalable, automated surveillance solutions that improve city management. Vendors can capitalize on the growing need for affordable, cloud-based video analytics in these regions. Smart city development offers long-term opportunities to integrate advanced analytics into transportation, utilities, and law enforcement networks. The rising urbanization in these markets supports sustained growth for video analytics solutions.

Market Segmentation Analysis

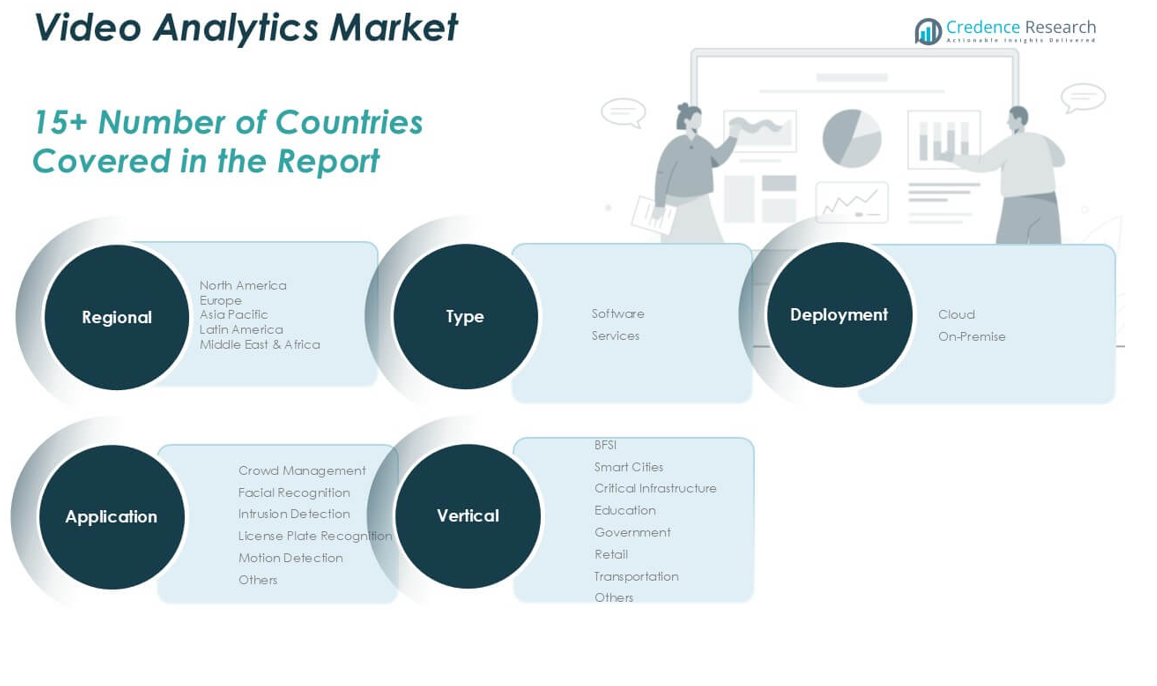

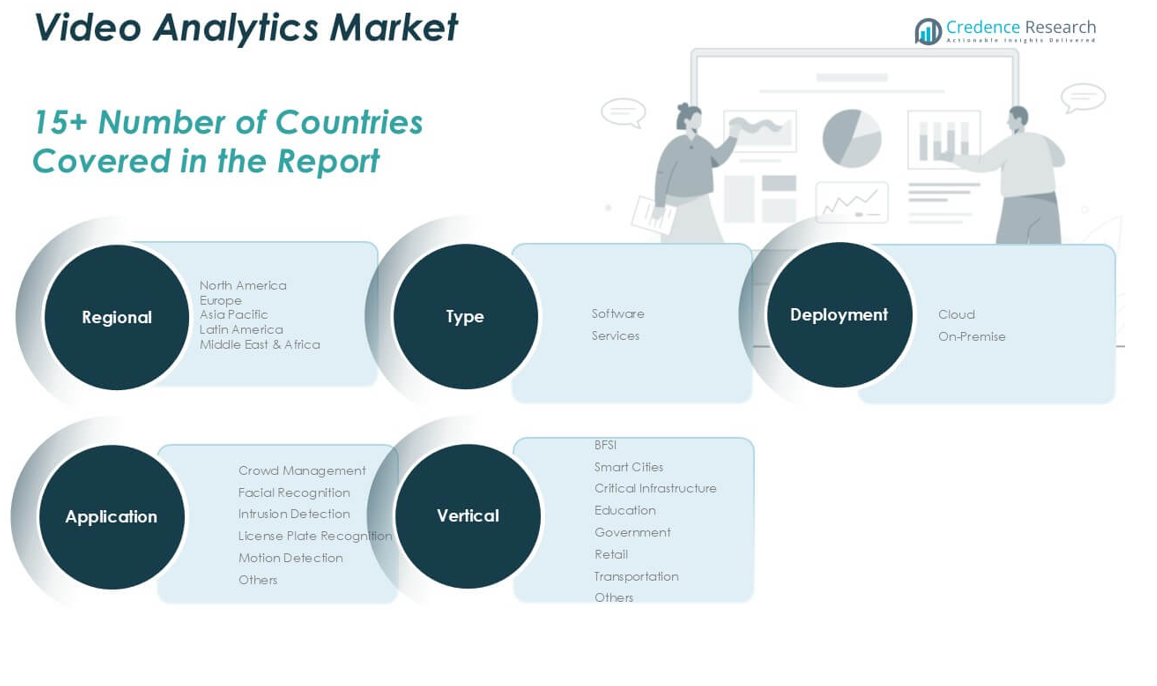

By Type

The Global Video Analytics Market is divided into software and services segments. Software holds a significant market share due to the demand for advanced video management, facial recognition, and real-time monitoring solutions. It offers features that support automated analysis, event detection, and reporting, which are critical for security and operational efficiency. Services, including installation, maintenance, and consulting, also contribute to market growth by helping organizations deploy and manage video analytics systems effectively. It supports system integration and ensures continuous performance optimization.

- For instance, Genetec reported that in 2024, it licensed over 2,400,000 video analytics software modules worldwide, while its services division completed more than 25,000 installation and maintenance projects.

By Application

The Global Video Analytics Market covers applications such as crowd management, facial recognition, intrusion detection, license plate recognition, motion detection, and others. Crowd management and facial recognition are leading segments driven by public safety, event security, and retail intelligence needs. Intrusion detection and motion detection are widely used in critical infrastructure, transportation, and urban security. License plate recognition is gaining demand in traffic management and automated parking systems. It supports law enforcement and smart city surveillance across multiple industries.

- For instance, a 2024 Axis Communications survey found that over 800,000 video analytics systems were deployed for crowd management and facial recognition globally, while more than 350,000 systems were used for license plate recognition and traffic monitoring.

By Deployment

The Global Video Analytics Market includes cloud and on-premise deployment options. Cloud-based solutions are gaining popularity for their scalability, remote access, and centralized control capabilities. On-premise systems continue to hold importance where strict data privacy and control are required, especially in government and defense sectors. It supports real-time processing and fast response in both deployment models, depending on specific organizational needs.

By Vertical

The Global Video Analytics Market serves verticals such as BFSI, smart cities, critical infrastructure, education, government, retail, transportation, and others. Smart cities and transportation sectors drive significant demand due to large-scale security and traffic management requirements. BFSI, retail, and government sectors use it to enhance surveillance, customer insights, and operational control. The technology supports safety, efficiency, and intelligent decision-making across diverse industry applications.

Segments

Based on Type

Based on Application

- Crowd Management

- Facial Recognition

- Intrusion Detection

- License Plate Recognition

- Motion Detection

- Others

Based on Deployment

Based on Vertical

- BFSI

- Smart Cities

- Critical Infrastructure

- Education

- Government

- Retail

- Transportation

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Video Analytics Market

The North America Video Analytics Market holds a significant regional market share, with revenue growing from USD 6,236.40 million in 2024 to an estimated USD 24,968.68 million by 2032. It registers a strong CAGR of 19.0%, driven by widespread adoption in government, transportation, and retail sectors. The region benefits from advanced infrastructure, early technology adoption, and substantial investments in smart city projects and homeland security. The United States leads market demand, supported by stringent regulatory frameworks and extensive deployment of AI-powered video analytics solutions. Canada and Mexico contribute to steady growth, focusing on public safety and critical infrastructure. The region’s mature technology ecosystem fosters continuous innovation and expansion.

Europe Video Analytics Market

Europe commands a substantial regional market share, with market value projected to increase from USD 4,510.53 million in 2024 to USD 17,176.16 million by 2032. It achieves a CAGR of 18.2%, supported by robust public safety initiatives and smart city deployments across countries like Germany, the UK, and France. It emphasizes privacy-compliant solutions that align with GDPR regulations, fostering trust and adoption. The region’s growth also stems from increasing demand in transportation hubs and critical infrastructure sectors. Rising investments in AI-based surveillance and analytics technologies enhance operational efficiency across public and private domains.

Asia Pacific Video Analytics Market

The Asia Pacific Video Analytics Market shows the highest CAGR at 20.3%, expanding from USD 4,494.63 million in 2024 to USD 19,756.40 million by 2032. It captures a growing regional market share fueled by rapid urbanization, infrastructure development, and increasing security concerns. China, India, Japan, and South Korea drive demand through large-scale smart city projects and rising adoption in retail and transportation. The growing middle class and government support for digital transformation accelerate market expansion. It supports scalable cloud-based and AI-integrated video analytics to meet diverse regional needs.

Latin America Video Analytics Market

Latin America holds a smaller but growing regional market share, expected to rise from USD 843.71 million in 2024 to USD 3,139.21 million by 2032. It experiences a CAGR of 17.9%, driven by increased investments in urban security and public safety infrastructure in Brazil, Mexico, and Argentina. Governments focus on upgrading surveillance networks to manage crime rates and traffic. Emerging demand in commercial sectors such as retail and banking supports adoption. The region faces challenges related to infrastructure but continues progressing with government initiatives.

Middle East Video Analytics Market

The Middle East Video Analytics Market, with a CAGR of 17.4%, is projected to grow from USD 562.48 million in 2024 to USD 2,021.89 million by 2032. It holds a growing regional market share, driven by heightened focus on security and critical infrastructure protection in countries like the UAE, Saudi Arabia, and Qatar. Investments in smart city initiatives and border security applications fuel market demand. The region leverages cloud-based and edge analytics to improve response times and operational efficiency. It continues adopting AI-driven surveillance technologies to address geopolitical challenges.

Africa Video Analytics Market

Africa’s Video Analytics Market is expanding at a CAGR of 18.0%, increasing from USD 504.34 million in 2024 to USD 1,931.34 million by 2032. It holds a rising regional market share amid growing urbanization and security concerns in South Africa, Nigeria, and Kenya. Governments and enterprises adopt video analytics for public safety, traffic management, and commercial applications. The market benefits from international investments and infrastructure development. It continues evolving with greater emphasis on scalable and cost-effective solutions to meet diverse regional requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Avigilon Corporation (Motorola Solutions, Inc.)

- Canon Inc.

- Cisco Systems, Inc.

- Claro Enterprise Solutions

- Honeywell International Inc.

- Huawei Technologies Co Ltd.

- IBM Corporation

- Irisity AB

- Qualcomm Technologies, Inc.

- Robert Bosch Gmb

Competitive Analysis

The Video Analytics Market remains highly competitive, with key players focusing on technological innovation and strategic partnerships to enhance their market presence. Companies invest heavily in AI, machine learning, and edge computing to improve analytics accuracy and speed. It faces intense competition from both established technology firms and emerging startups offering specialized solutions. Vendors prioritize expanding their product portfolios and entering new geographical markets to capture diverse industry verticals. Differentiation through customization, integration capabilities, and customer support strengthens market positioning. Continuous R\&D and acquisition strategies help maintain a competitive edge in a rapidly evolving environment. The dynamic landscape demands agility and innovation to meet growing security and operational efficiency requirements worldwide.

Recent Developments

- In May 2025, Avigilon Corporation released Unity Video 8.6.0.8, featuring seamless integration with HALO 4 sensors, unified event linking, and enhanced system control

- In March 2025, Cisco Systems introduced Agile Services Networking at Mobile World Congress, delivering real-time visibility and AI-powered assurance for service provider video analytics networks

Market Concentration and Characteristics

The Global Video Analytics Market is moderately concentrated, with a mix of established multinational companies and emerging players competing for market share. It features strong competition driven by continuous technological advancements and increasing customer demand for intelligent surveillance solutions. Leading companies focus on product innovation, AI integration, and cloud-based analytics to strengthen their positions. It offers a wide range of solutions tailored to various industries, including retail, transportation, government, and critical infrastructure. Market participants actively pursue strategic partnerships, mergers, and acquisitions to expand their global footprint and service capabilities. The market favors companies that can deliver scalable, accurate, and real-time analytics supported by reliable customer service.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Deployment, Vertical and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Global Video Analytics Market will continue to grow rapidly, driven by increasing demand for real-time security and surveillance solutions across public and private sectors. It will expand its reach into new industries and applications, strengthening its global impact.

- Cloud-based video analytics solutions will gain strong preference, offering organizations scalable, flexible, and cost-efficient options that enable faster deployment and centralized management. It will attract businesses seeking seamless access to video intelligence.

- Edge-based video analytics will become a key focus area, supporting faster data processing, reduced latency, and improved bandwidth management, especially in transportation, smart cities, and critical infrastructure. It will shape real-time decision-making capabilities.

- Artificial intelligence and deep learning will significantly enhance video analytics capabilities, improving object detection, facial recognition, and behavior analysis accuracy across diverse environments. It will lead to more sophisticated and predictive analytics platforms.

- Privacy-focused solutions will become essential, with companies required to meet evolving global data protection laws and public expectations for secure and ethical video surveillance practices. It will drive investments in compliance technologies.

- The integration of video analytics with Internet of Things (IoT) devices will create advanced, interconnected ecosystems that support smart traffic, automated safety systems, and intelligent building management. It will unlock new operational efficiencies.

- Growing adoption of video analytics in retail, healthcare, and education sectors will support improved customer engagement, operational control, and safety management beyond traditional security applications. It will expand the technology’s commercial relevance.

- Emerging markets, particularly in Asia Pacific, Latin America, and Africa, will offer significant growth opportunities through smart city projects, infrastructure upgrades, and expanding urban security networks. It will fuel regional market penetration.

- Continuous innovation in video compression, storage, and bandwidth optimization will make video analytics more accessible to small and medium-sized businesses. It will enable wider adoption across cost-sensitive industries and regions.

- Strategic collaborations, product portfolio diversification, and mergers among key players will intensify, driving faster innovation cycles and competitive pricing structures. It will create a dynamic market landscape focused on scalability and performance.