Market Overview:

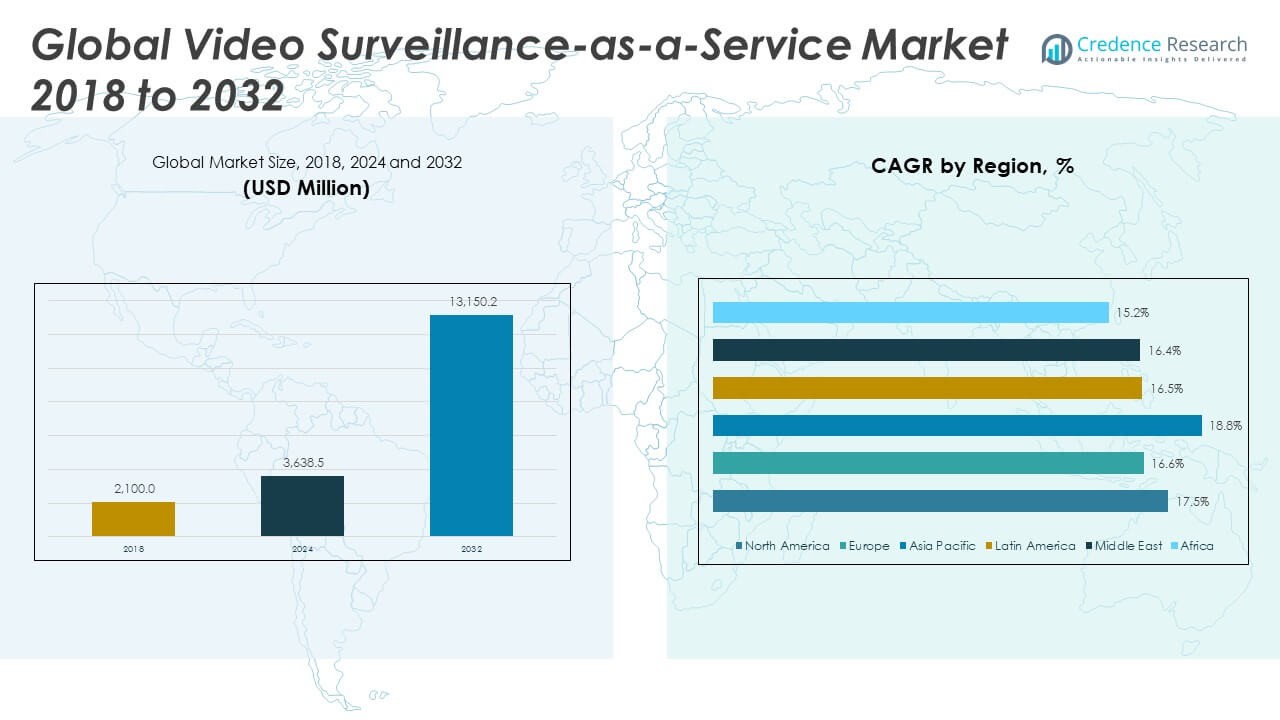

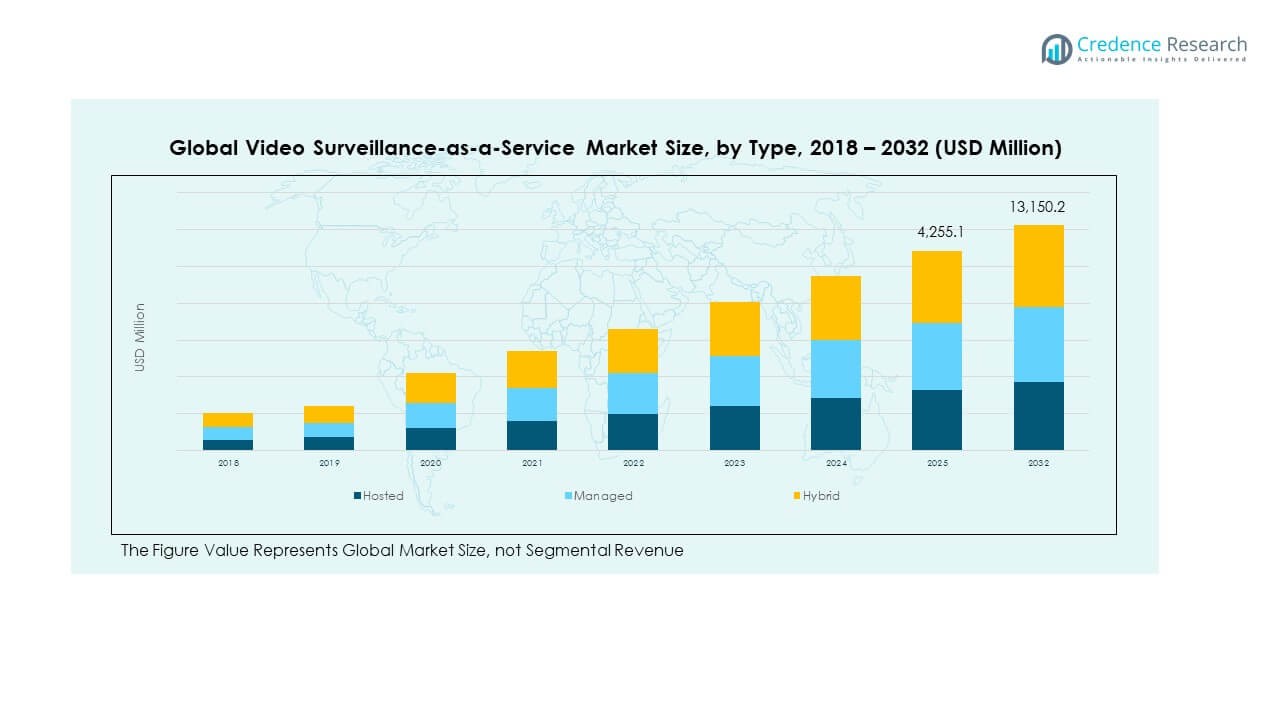

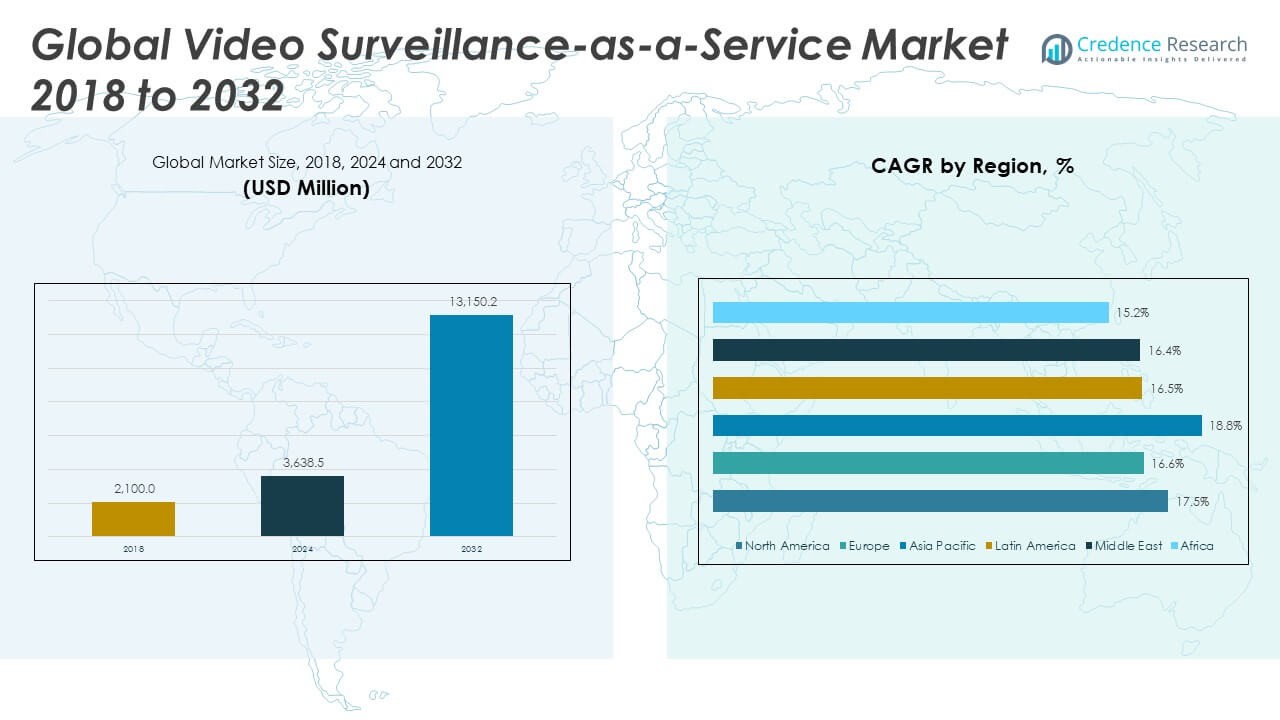

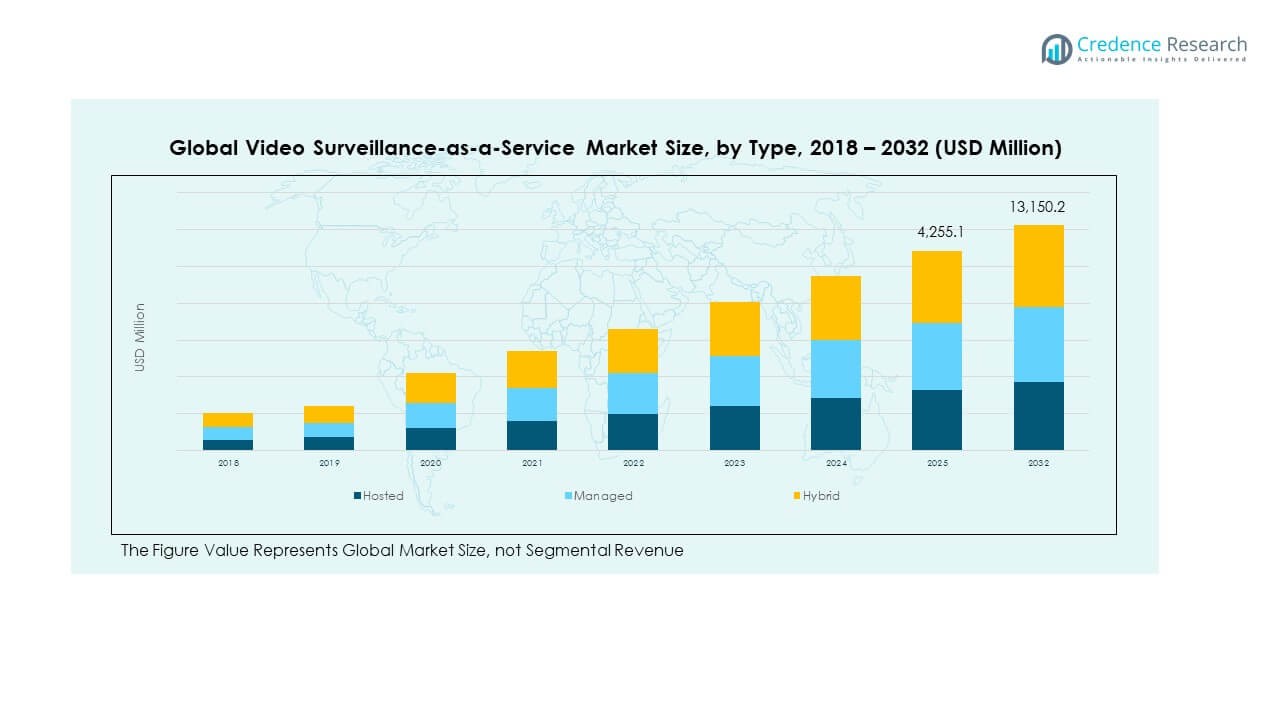

The Video Surveillance-as-a-Service (VSaaS) Market size was valued at USD 2,100.00 million in 2018 to USD 3,638.54 million in 2024 and is anticipated to reach USD 13,150.21 million by 2032, at a CAGR of 17.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Video Surveillance-as-a-Service (VSaaS) Market Size 2024 |

USD 3,638.54Million |

| Video Surveillance-as-a-Service (VSaaS) Market, CAGR |

17.49% |

| Video Surveillance-as-a-Service (VSaaS) Market Size 2032 |

USD 13,150.21 Million |

The market is primarily driven by the increasing demand for cloud-based surveillance solutions, real-time monitoring, and advanced analytics capabilities. Organizations are actively shifting from traditional surveillance systems to VSaaS to reduce infrastructure costs, simplify system management, and enable remote access. The proliferation of smart cities, IoT integration, and the growing need for heightened security in commercial, industrial, and residential sectors further accelerate adoption. Technological advancements such as AI-powered video analytics, facial recognition, and integration with mobile platforms are also fueling the market’s rapid expansion across diverse end-use industries.

Regionally, North America leads the Video Surveillance-as-a-Service Market due to its robust IT infrastructure, high adoption of cloud technologies, and strong presence of key market players. Europe follows closely with growing smart city initiatives and stringent security regulations. The Asia-Pacific region is emerging as a high-growth market, driven by rapid urbanization, expanding infrastructure, and government-led public safety initiatives in countries like China and India. Latin America and the Middle East & Africa are gradually embracing VSaaS due to increasing awareness and investments in surveillance for urban and industrial security.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Video Surveillance-as-a-Service (VSaaS) Market was valued at USD 3,638.54 million in 2024 and is projected to reach USD 13,150.21 million by 2032, growing at a CAGR of 17.49%.

- Rising demand for real-time remote monitoring and centralized surveillance management fuels market expansion across commercial and industrial sectors.

- Increasing adoption of AI-powered analytics enhances threat detection and operational efficiency, driving strong uptake in smart city projects.

- High dependence on stable internet connectivity and concerns around data privacy act as key restraints in certain developing regions.

- North America dominates the market due to advanced infrastructure, strong vendor presence, and high cloud adoption rates.

- Asia Pacific shows the highest growth potential supported by rapid urbanization, government safety initiatives, and expanding digital infrastructure.

- Regulatory mandates in sectors like transportation and healthcare encourage large-scale VSaaS deployments across Europe and emerging markets.

Market Drivers:

Surging demand for remote surveillance and real-time monitoring across security-critical sectors

The increasing need for enhanced safety measures in commercial, residential, and industrial settings is driving demand for remote surveillance. Enterprises seek scalable solutions that eliminate physical infrastructure costs while providing centralized access to video feeds. VSaaS meets this need by enabling real-time monitoring from any location using cloud-based platforms. Businesses value the ability to scale without incurring high hardware or storage costs. This flexibility supports security personnel in monitoring multiple sites from a central control room. The Video Surveillance-as-a-Service (VSaaS) Market benefits from the integration of networked cameras and cloud storage systems. It enables seamless video access and quick data retrieval, supporting critical decision-making in time-sensitive environments.

Growing preference for cloud infrastructure over traditional security systems

Organizations are increasingly adopting cloud-based surveillance to replace legacy systems that are expensive to maintain. Traditional video setups require large physical servers, maintenance teams, and on-site data storage, which can limit flexibility and increase downtime risks. In contrast, VSaaS provides a subscription-based model with minimal upfront investment. Enterprises also benefit from automatic updates and scalability without hardware limitations. This shift supports greater operational efficiency and simplifies surveillance workflows. The Video Surveillance-as-a-Service (VSaaS) Market is gaining momentum among SMEs due to its lower total cost of ownership. It ensures higher availability, secure storage, and ease of integration with existing IT infrastructure.

- For instance, Axis Communications has deployed over one million cloud-connected cameras worldwide through its Axis Cloud Connect platform. Their solutions provide seamless device onboarding, secure remote video access, and automated updates, enabling organizations to centralize monitoring and add new sites or cameras without complex network reconfiguration or expensive hardware investments

Government support and regulatory compliance requirements elevate adoption

Governments worldwide are strengthening public safety frameworks and enforcing security compliance in public and private domains. Regulatory mandates in sectors such as banking, transportation, and healthcare now require round-the-clock surveillance and secure data retention. Authorities expect higher accountability and traceability through video footage and real-time alerts. VSaaS platforms help organizations comply by offering time-stamped recordings, centralized access logs, and encrypted storage. It also supports quick retrieval during investigations, audits, or law enforcement needs. The Video Surveillance-as-a-Service (VSaaS) Market experiences steady growth from regulatory-driven deployments in sensitive zones like airports and educational institutions. It aligns well with privacy and data protection frameworks across various jurisdictions.

- For instance, Genetec’s Security Center 5.12 is certified for FIPS 201 and listed under the Federal Identity Credential and Access Management (FICAM) conformance program, meeting stringent U.S. federal government security standards.

Proliferation of smart cities and IoT-enabled surveillance applications

Urban modernization initiatives rely heavily on intelligent surveillance systems integrated with IoT devices. Smart cities deploy VSaaS solutions to monitor traffic congestion, ensure public safety, and manage critical infrastructure. Municipalities use AI-powered video analytics to detect incidents, analyze crowd patterns, and generate actionable insights. VSaaS platforms offer the agility and cloud computing power needed to process high volumes of real-time video data. The Video Surveillance-as-a-Service (VSaaS) Market gains significant traction from these public sector investments. It supports 24/7 surveillance, reduces manual intervention, and enhances situational awareness. As urban infrastructure continues to evolve, VSaaS stands as a backbone for secure, connected environments.

Market Trends:

Integration of AI-powered analytics for intelligent video insights

AI-powered video analytics is transforming traditional video surveillance into predictive security tools. Organizations are integrating object detection, motion sensing, facial recognition, and license plate recognition into VSaaS platforms. These features enable real-time identification of threats and unusual activities without human intervention. It improves response time and minimizes the chance of oversight in high-traffic areas. Retailers use AI to track customer behavior and optimize store layouts. The Video Surveillance-as-a-Service (VSaaS) Market is witnessing rapid demand for platforms that offer actionable insights from video data. It promotes a shift from passive monitoring to proactive surveillance strategies.

Rise in mobile access and multi-device compatibility for remote operations

End users increasingly expect surveillance platforms to offer access via smartphones, tablets, and web portals. Remote workers, security teams, and managers benefit from mobile applications that allow live feed access, alerts, and playback features. This trend supports flexible security operations, particularly in distributed business environments. It reduces the dependency on physical command centers and improves real-time responsiveness. The Video Surveillance-as-a-Service (VSaaS) Market adapts by offering multi-platform compatibility and user-friendly interfaces. It enhances user engagement and enables quicker decision-making during incidents.

Shift toward hybrid cloud deployments for storage optimization

Organizations are adopting hybrid models that combine local storage for high-priority video with cloud storage for long-term archiving. This approach optimizes bandwidth usage and reduces latency in accessing critical footage. It also provides a balance between data privacy and scalability. Large enterprises use hybrid VSaaS models to segment data based on security protocols. It supports compliance needs while managing costs effectively. The Video Surveillance-as-a-Service (VSaaS) Market sees rising adoption of these models in manufacturing, education, and energy sectors. It ensures continuous access without overwhelming infrastructure.

- For instance, Genetec’s hybrid cloud solution enables organizations to combine on-premises VMS (Video Management Systems) for immediate access at critical locations with cloud-based VSaaS for distributed sites or long-term archival.

Expansion of subscription-based pricing and service bundling

Vendors are offering flexible pricing models, enabling organizations to pay only for the features and storage they use. Monthly or annual subscription models attract SMEs that lack upfront capital for traditional systems. Service bundling includes analytics tools, cybersecurity features, and multi-site management under one plan. This trend simplifies vendor relationships and improves budget planning. It drives customer retention by offering continuous value and scalability. The Video Surveillance-as-a-Service (VSaaS) Market benefits from this customer-centric shift in pricing strategy. It aligns with the broader trend of “security-as-a-service” across enterprise IT portfolios.

- For instance, OpenEye’s VSaaS service offers a flexible subscription model where clients pay only for the features and storage levels needed.

Market Challenges Analysis:

Cybersecurity risks and concerns around video data integrity and privacy

One of the most critical challenges is the vulnerability of cloud-based surveillance systems to cyberattacks. Hackers target VSaaS platforms to gain unauthorized access to video feeds and sensitive user information. Inadequate encryption and poorly configured networks leave gaps in security. Customers are increasingly concerned about data breaches and misuse of surveillance footage. Regulatory scrutiny around user privacy and data protection intensifies pressure on vendors. It forces them to invest heavily in compliance frameworks and advanced security protocols. The Video Surveillance-as-a-Service (VSaaS) Market faces resistance from sectors where data sensitivity is high, such as healthcare and banking. Building user trust remains a significant barrier to broader adoption.

Limited internet infrastructure and bandwidth issues in developing regions

The deployment of VSaaS solutions depends heavily on reliable internet connectivity and bandwidth capacity. Many emerging economies still face inconsistent network performance, leading to video lag, buffering, or data loss. These limitations affect the quality and reliability of real-time monitoring. Businesses operating in remote or semi-urban locations struggle to adopt VSaaS at scale. Service providers must balance resolution settings and compression standards to manage bandwidth constraints. It restricts the use of advanced features like high-definition video or AI analytics. The Video Surveillance-as-a-Service (VSaaS) Market finds slower growth in regions lacking the necessary IT infrastructure to support cloud video transmission effectively.

Market Opportunities:

Growing scope for VSaaS adoption in education, logistics, and retail segments

Multiple industries are under pressure to strengthen security without increasing physical infrastructure. Educational institutions, warehouses, and retail outlets are turning to VSaaS for cost-effective surveillance solutions. These sectors benefit from centralized monitoring across multiple sites, improving operational control. The Video Surveillance-as-a-Service (VSaaS) Market finds significant growth potential by targeting mid-size businesses in these segments. It allows remote access, intelligent alerting, and video storage without heavy investment in local hardware.

Expansion across emerging economies with increasing digital readiness

Developing countries are witnessing a surge in smart city projects and digitization initiatives. Governments and businesses seek surveillance solutions that are fast to deploy and easy to manage. VSaaS platforms address these needs with minimal hardware and scalable services. Cloud adoption is also accelerating in regions like Southeast Asia, Latin America, and the Middle East. It creates opportunities for vendors to enter new markets and establish local partnerships. The Video Surveillance-as-a-Service (VSaaS) Market can capitalize by offering region-specific solutions tailored to local infrastructure and compliance needs.

Market Segmentation Analysis:

The Video Surveillance-as-a-Service (VSaaS) Market is segmented

By type into hosted, managed, and hybrid solutions. Hosted VSaaS holds a significant share due to its ease of deployment and minimal on-site infrastructure requirements. Managed services attract enterprises looking for end-to-end monitoring, maintenance, and support. Hybrid models are gaining traction, especially among large organizations balancing local control with cloud scalability. Each model caters to specific operational and security needs, offering flexibility based on business size and technical capability.

- For instance, hosted VSaaS solutions like those offered by AxxonSoft allow all video feeds to be transmitted directly from cameras to the cloud, minimizing on-site hardware and enabling rapid scalability.

By vertical, the commercial segment leads the market due to widespread adoption across retail, hospitality, and corporate environments. It uses VSaaS for loss prevention, employee monitoring, and customer behavior analysis. The industrial sector follows, driven by the need for perimeter security, equipment monitoring, and safety compliance. Government deployments continue to rise, driven by smart city initiatives and public safety mandates. Residential adoption increases with demand for remote home monitoring and mobile access. The “others” category includes education, transportation, and healthcare, where tailored VSaaS solutions address sector-specific surveillance needs. The market continues to evolve with diverse use cases across industries.

- In the industrial sector, companies such as Amazon and Walmart implement VSaaS for perimeter security, equipment monitoring, and compliance, enabling real-time alerts and remote access to facilities.

Segmentation:

By Type

By Vertical

- Commercial

- Industrial

- Residential

- Government

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America

The North America Video Surveillance-as-a-Service (VSaaS) Market size was valued at USD 730.38 million in 2018 to USD 1,249.45 million in 2024 and is anticipated to reach USD 4,509.23 million by 2032, at a CAGR of 17.5% during the forecast period. North America held a market share of 34.3% in 2024. It leads the global landscape due to high adoption of cloud-based security systems, well-established IT infrastructure, and strong presence of VSaaS providers. Public safety initiatives, widespread use of smart surveillance across government facilities, and corporate campuses fuel demand. Enterprises in the U.S. and Canada are deploying AI-integrated video systems to improve threat detection and reduce human error. The market benefits from strict regulatory frameworks that mandate compliance and secure data handling. It also gains momentum from rising security concerns across commercial and educational institutions. Growth continues as businesses adopt multi-site surveillance managed through unified cloud platforms.

Europe

The Europe Video Surveillance-as-a-Service (VSaaS) Market size was valued at USD 494.76 million in 2018 to USD 820.03 million in 2024 and is anticipated to reach USD 2,779.33 million by 2032, at a CAGR of 16.6% during the forecast period. Europe accounted for 22.5% of the market share in 2024. It sees increasing demand driven by enhanced security regulations, GDPR compliance, and growing use of surveillance in transportation, retail, and public infrastructure. Countries such as Germany, France, and the UK invest heavily in public surveillance networks and video analytics. The market benefits from strong demand for video storage redundancy and encrypted data transmission. Governments promote video security to counter terrorism threats and support emergency response systems. Enterprises adopt VSaaS for scalable storage and centralized management. Interest continues to grow for AI-powered features such as crowd analysis and behavioral recognition.

Asia Pacific

The Asia Pacific Video Surveillance-as-a-Service (VSaaS) Market size was valued at USD 569.10 million in 2018 to USD 1,025.51 million in 2024 and is anticipated to reach USD 4,054.22 million by 2032, at a CAGR of 18.8% during the forecast period. Asia Pacific contributed 28.2% to the global market share in 2024. It is emerging as a high-growth region, supported by rapid urbanization, increasing infrastructure investments, and strong government backing for surveillance projects. China leads in large-scale video surveillance deployments through smart city projects and public safety mandates. India and Southeast Asia are expanding adoption across transportation, retail, and industrial zones. The market benefits from low-cost cloud services, high internet penetration, and rising demand for remote access solutions. Small and medium enterprises adopt VSaaS to reduce hardware costs and improve flexibility. Regional vendors offer localized solutions suited to compliance and infrastructure needs.

Latin America

The Latin America Video Surveillance-as-a-Service (VSaaS) Market size was valued at USD 144.27 million in 2018 to USD 247.75 million in 2024 and is anticipated to reach USD 835.96 million by 2032, at a CAGR of 16.5% during the forecast period. It represented 6.8% of the global market share in 2024. The region is witnessing gradual adoption of VSaaS across commercial and public sectors, driven by rising urban crime rates and the need for low-cost security solutions. Countries such as Brazil, Mexico, and Colombia are adopting cloud-based surveillance for public transit systems, retail outlets, and government buildings. Limited infrastructure in remote areas makes cloud deployment more attractive than traditional systems. The market faces bandwidth and connectivity challenges, but regional investments in telecom networks are improving adoption rates. Demand rises for flexible subscription models and remote monitoring features. Enterprises use VSaaS to manage multiple locations through centralized dashboards.

Middle East

The Middle East Video Surveillance-as-a-Service (VSaaS) Market size was valued at USD 107.10 million in 2018 to USD 176.81 million in 2024 and is anticipated to reach USD 593.15 million by 2032, at a CAGR of 16.4% during the forecast period. It accounted for 4.9% of the global market share in 2024. Demand is driven by infrastructure security needs across oil & gas, transportation, and commercial sectors. Countries like the UAE and Saudi Arabia are adopting VSaaS for surveillance in airports, seaports, and government facilities. Mega projects such as smart cities and economic zones generate consistent demand for scalable, cloud-based video solutions. Enterprises focus on real-time threat detection and compliance with strict security policies. Vendors customize platforms for regional language support and data localization. High-value assets and geopolitical concerns reinforce surveillance requirements.

Africa

The Africa Video Surveillance-as-a-Service (VSaaS) Market size was valued at USD 54.39 million in 2018 to USD 119.00 million in 2024 and is anticipated to reach USD 378.32 million by 2032, at a CAGR of 15.2% during the forecast period. Africa held 3.3% of the global market share in 2024. The market remains nascent but shows steady growth in urban hubs across South Africa, Nigeria, and Kenya. Public safety concerns, growing retail activity, and private sector security investments drive adoption. Limited infrastructure and low internet penetration present deployment challenges. Organizations adopt hybrid VSaaS models to balance local storage with cloud access. Governments explore surveillance in education, traffic, and border control settings. It gains traction from improved broadband networks and mobile-based surveillance platforms. Vendors target affordable packages for SMEs and local businesses seeking efficient monitoring solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Video Surveillance-as-a-Service (VSaaS) Market features strong competition among global and regional players focused on innovation, scalability, and integrated analytics. Leading companies such as Axis Communications, Honeywell, Bosch Security Systems, Cisco Systems, and Genetec dominate through extensive product portfolios and strong channel partnerships. It includes a mix of hardware providers, software developers, and cloud service vendors competing to offer end-to-end surveillance solutions. Players invest in AI-powered analytics, mobile access features, and cybersecurity enhancements to strengthen product differentiation. Strategic collaborations with telecom providers and data center operators help expand global reach. It reflects a dynamic environment where continuous product upgrades and regional compliance drive competitive positioning. New entrants target niche applications and cost-sensitive segments to establish presence.

Recent Developments:

- In February 2025, ADT launched major new products such as ADT+ and Trusted Neighbor and also expanded its ADT Safe Places initiative, highlighting its innovation in both the consumer and community security space.

- In April 2025, companies OrionVM, Blaize, and VSaaS.ai announced a partnership at ISC West to create an AI-powered VSaaS solution. Built for edge environments, this collaboration utilizes Blaize’s AI accelerators and OrionVM’s cloud infrastructure to offer real-time threat detection, multi-stream video analytics, and the ability to upgrade existing camera networks without hardware replacement.

Market Concentration & Characteristics:

The Video Surveillance-as-a-Service (VSaaS) Market shows moderate to high concentration, with a few major players holding significant shares across developed regions. It exhibits rapid innovation cycles, driven by cloud technology, AI integration, and growing demand for real-time analytics. The market favors flexible subscription models and scalability, attracting small and mid-sized enterprises. Price competition remains high in emerging regions, where cost-efficiency drives purchasing decisions. Vendors differentiate through service reliability, data security, and user-friendly platforms. It continues evolving with rising demand for remote monitoring, hybrid storage models, and regulatory compliance. The market reflects a shift from hardware-centric to service-oriented security ecosystems.

Report Coverage:

The research report offers an in-depth analysis based on type and vertical.It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will witness strong growth driven by increasing adoption of cloud-native surveillance systems across commercial and public sectors.

- AI-powered video analytics will become a standard feature, enhancing threat detection and reducing manual monitoring efforts.

- Demand for mobile-accessible surveillance platforms will rise, supporting remote operations and real-time response.

- Hybrid cloud deployment models will gain traction, offering optimized storage and faster video retrieval.

- Regulatory compliance and data protection requirements will influence product design and vendor strategies.

- Smart city initiatives will continue to drive adoption in transportation, traffic management, and urban safety.

- Vendors will expand service bundling, combining storage, analytics, and cybersecurity into unified offerings.

- Emerging economies will become key growth areas due to infrastructure development and digital transformation.

- Integration with IoT and edge devices will improve data collection and enable advanced situational awareness.

- Partnerships with telecom and cloud providers will enhance scalability and global deployment capabilities.