Market Overview:

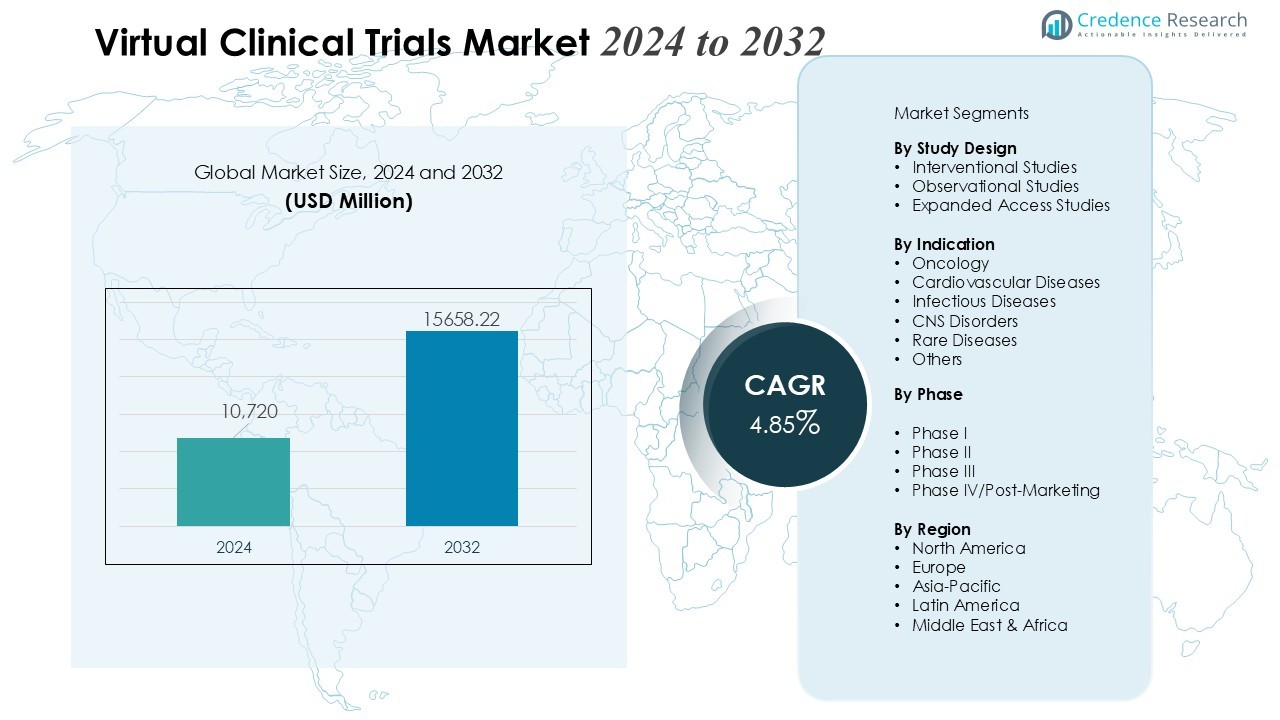

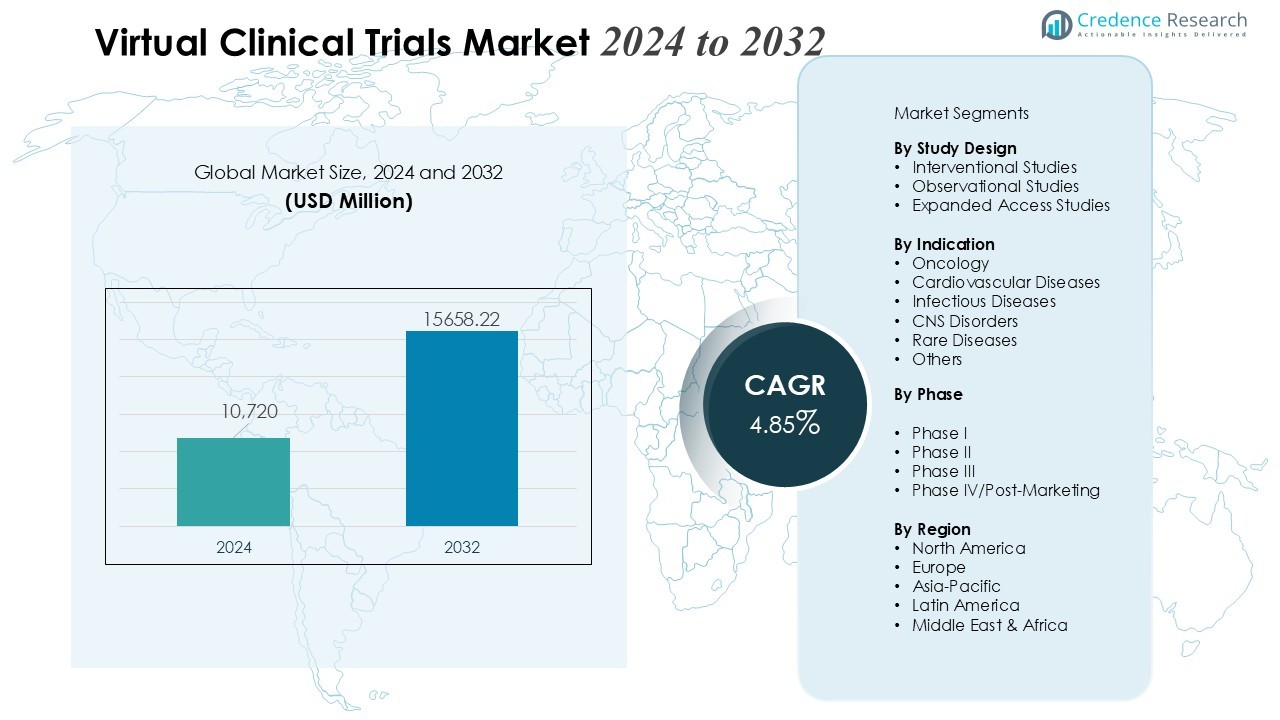

The Virtual Clinical Trials Market size was valued at USD 10,720 million in 2024 and is anticipated to reach USD 15658.22 million by 2032, at a CAGR of 4.85 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Virtual Clinical Trials Market Size 2024 |

USD 10,720 Million |

| Virtual Clinical Trials Market, CAGR |

4.85% |

| Virtual Clinical Trials Market Size 2032 |

USD 15658.22 Million |

Multiple drivers shape market momentum, led by the need to reduce trial costs, improve patient diversity, and enhance retention rates. Sponsors prioritize virtual and hybrid approaches to streamline data collection, expand geographic reach, and minimize patient burden. Advancements in wearable biosensors, real-time data analytics, and cloud-based electronic clinical outcome assessments (eCOA) improve data accuracy and operational efficiency. Rising emphasis on patient-centric research models and increasing support from regulatory authorities further elevate adoption.

Regionally, North America holds a leading share due to strong digital health infrastructure, high R&D investments, and early integration of decentralized trial platforms. Europe maintains significant participation driven by supportive regulatory harmonization and expanding remote trial capabilities. Asia-Pacific records the fastest growth, supported by large patient pools, expanding internet penetration, and rising pharmaceutical outsourcing activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Virtual Clinical Trials Market is set to grow from USD 10,720 million in 2024 to USD 15,658.22 million by 2032, supported by a CAGR of 4.85%, reflecting steady global adoption of decentralized study models.

- Growing demand for patient-centric research accelerates uptake, with remote participation improving recruitment, retention, and diversity across complex therapeutic areas.

- Cost-efficiency pressures drive strong adoption, as decentralized designs reduce site overheads, streamline workflows, and shorten trial timelines for sponsors.

- Advancements in digital health technologies—including wearables, telehealth, mobile apps, and real-time monitoring—enhance data accuracy and operational visibility.

- Regulatory authorities increasingly support decentralized and hybrid models, offering clearer guidance on digital endpoints, eConsent, and remote data collection.

- Key challenges persist due to regulatory disparities, data integrity concerns, limited standardization, and inconsistent digital infrastructure across global regions.

- North America leads in adoption, Europe expands with strong regulatory harmonization, and Asia-Pacific records the fastest growth due to large patient pools and rising digital connectivity.

Market Drivers:

Market Drivers:

Growing Demand for Patient-Centric Research Models

Virtual Clinical Trials Market gains strong momentum from the industry’s shift toward patient-centricity. Sponsors aim to reduce the burden of travel, lengthy site visits, and limited scheduling flexibility. It supports broader participation by enabling remote engagement and real-time communication. Patient convenience improves recruitment outcomes and strengthens retention rates across complex therapeutic areas.

- For instance, Sage Bionetworks’ mPower study utilized an iPhone app for Parkinson’s disease progression tracking, conducting the entire observational trial remotely with informed consent and measurements. The initiative engaged 9,500 participants successfully.

Rising Need for Cost Efficiency and Faster Trial Timelines

Pharmaceutical and biotechnology companies increase adoption of decentralized approaches to lower operational costs. Virtual Clinical Trials Market benefits from reduced site overheads, streamlined workflows, and optimized resource allocation. It accelerates data collection cycles and improves trial visibility for sponsors and investigators. Faster enrollment and fewer delays strengthen overall development productivity.

- For instance, a sponsor in a Phase II trial using parallel site activation, as detailed by Gen Li, reduced sites from 29 to 20, saving over $250,000 in activation and maintenance costs.

Advancements in Digital Health Technologies and Real-Time Monitoring

Integration of telehealth platforms, biosensors, mobile applications, and remote monitoring devices transforms trial execution. Virtual Clinical Trials Market leverages these solutions to improve data accuracy and patient compliance. It enables continuous tracking of physiological markers and delivers richer evidence sets for clinical evaluation. Enhanced interoperability and cloud-based systems create stronger digital ecosystems for large-scale studies.

Regulatory Support and Expanding Global Acceptance of Decentralized Models

Regulatory authorities across major markets encourage hybrid and fully virtual protocols to improve trial accessibility and resilience. Virtual Clinical Trials Market benefits from clear guidance frameworks, strengthened data governance, and improved validation standards for digital tools. It promotes wider industry confidence and accelerates global deployment of decentralized approaches. Harmonized standards and cross-border collaboration increase sponsor adoption across multiple therapeutic domains.

Market Trends:

Expansion of Hybrid Trial Models and Increased Use of Remote Patient Technologies

Hybrid models represent a major trend in the Virtual Clinical Trials Market, supported by broader integration of remote and site-based processes. Sponsors implement flexible trial frameworks to balance digital convenience with essential in-person assessments. It strengthens recruitment among diverse patient groups and expands study access across geographically dispersed populations. Wearable devices, mobile health applications, and remote diagnostic tools improve data flow and reduce follow-up gaps. Real-time visibility into patient progress enables faster decision-making for research teams. Growth in cloud-connected endpoints also supports protocol adherence and lowers operational friction.

- For instance, Pfizer’s primary global Phase II/III COVID-19 vaccine trial (BNT162b2) enrolled over 44,000 participants across approximately 150 sites and monitored safety using a combination of methods, including participant-reported electronic diaries for expected reactions and ongoing, observer-blinded clinical surveillance by site staff and an independent data and safety monitoring board for all adverse and serious adverse events.

Adoption of AI-Driven Analytics, Automation, and Advanced Data Validation Techniques

Artificial intelligence, machine learning, and automated data management systems shape the next phase of the Virtual Clinical Trials Market. Sponsors deploy predictive analytics to optimize patient matching, identify risk patterns, and refine protocol complexity. It accelerates data quality checks and improves the reliability of outcome assessments. Automation reduces manual intervention and strengthens compliance with regulatory expectations. Digital platforms introduce stronger validation layers for eCOA, ePRO, and sensor-based datasets. Wider integration of decentralized platforms supports global trial scalability and elevates confidence in remote evidence generation.

- For instance, Clinion’s AI-driven platform integrates multiple data sources, cutting trial timelines through intelligent automation while upholding data integrity across 100+ global studies.

Market Challenges Analysis:

Regulatory Complexities, Data Integrity Concerns, and Limited Standardization

The Virtual Clinical Trials Market faces persistent challenges due to varying regulatory interpretations across regions. Sponsors manage diverse expectations for digital endpoints, remote consent, and device validation. It increases the need for precise documentation and stronger audit trails. Data integrity concerns arise when multiple digital tools operate across fragmented systems. Limited standardization for virtual workflows slows protocol alignment and raises compliance risks. Integration delays and inconsistent guidelines restrict wider adoption of fully decentralized models.

Technological Barriers, Patient Digital Divide, and Operational Constraints

Differences in digital literacy, device access, and connectivity create major obstacles for patient participation. Virtual Clinical Trials Market stakeholders identify gaps in training, onboarding, and technical support for diverse populations. It requires consistent troubleshooting and higher resource allocation to maintain patient engagement. Sponsors face operational constraints when digital platforms lack interoperability or secure data exchange pathways. Cybersecurity risks demand continuous upgrades and strict governance frameworks. Limited site readiness and uneven technology infrastructure slow momentum for large-scale virtual deployments.

Market Opportunities:

Expansion of Digital Therapeutics, Remote Monitoring Capabilities, and Precision Medicine Trials

The Virtual Clinical Trials Market creates strong opportunities through the rise of digital therapeutics and precision treatment models. Sponsors pursue remote monitoring strategies to capture richer, continuous data from diverse patient groups. It supports protocol designs that require high-frequency assessments and personalized interventions. Growth in wearable technology and AI-driven analytics strengthens evidence generation for chronic and rare diseases. Broader acceptance of decentralized models opens access to global populations that traditional trials often exclude. Stronger digital ecosystems allow seamless integration of eCOA, sensor data, and telehealth services.

Scaling of Hybrid Trial Frameworks, Global Recruitment Reach, and Real-Time Data Platforms

Hybrid models deliver new opportunities by combining site-based oversight with digitally enabled engagement. Virtual Clinical Trials Market participants gain flexibility to expand beyond geographic limitations and recruit underrepresented populations. It enhances study efficiency by supporting continuous communication and remote follow-up. Real-time data platforms allow faster interpretation of clinical endpoints and accelerate decision-making. Stronger interoperability supports multi-country trials and reduces operational delays. Digital maturity across healthcare systems paves the way for broader deployment of decentralized approaches.

Market Segmentation Analysis:

By Study Design

The Virtual Clinical Trials Market records strong adoption across observational, interventional, and expanded-access models. Sponsors prioritize observational studies due to minimal site requirements and wider patient reach. Interventional studies gain momentum with improved remote monitoring tools and structured data workflows. It supports protocol adherence while reducing participant burden. Expanded-access programs benefit from faster enrollment and broader geographic inclusion.

- For instance, Science 37’s RPM suite integrates with wearables for real-time vitals monitoring in decentralized trials, enabling AI-powered alerts that identify early risk signals across global Phase II–IV studies.

By Indication

Chronic diseases, oncology, and rare disorders dominate the indication landscape due to high demand for continuous data capture and patient-centric models. The Virtual Clinical Trials Market experiences strong traction in oncology, where complex endpoints require real-time monitoring. It enhances patient compliance and broadens eligibility among remote or mobility-limited groups. Chronic disease trials benefit from wearable biosensors and digital adherence tools. Rare disease studies gain access to global populations that traditional sites rarely reach.

- For instance, Dexcom G6 continuous glucose monitor achieved a mean absolute relative difference (MARD) of 9.0% in glucose readings for diabetes management trials.

By Phase

Early-phase and late-phase trials both leverage decentralized approaches for efficiency and improved evidence generation. The Virtual Clinical Trials Market sees strong participation in Phase II and Phase III studies, supported by large sample sizes and long-term follow-up needs. It enables faster data verification and stable retention rates. Phase I studies adopt hybrid designs to balance safety oversight with digital tools. Post-marketing studies utilize virtual platforms to monitor real-world outcomes across diverse populations.

Segmentations:

By Study Design

- Interventional Studies

- Observational Studies

- Expanded Access Studies

By Indication

- Oncology

- Cardiovascular Diseases

- Infectious Diseases

- CNS Disorders

- Rare Diseases

- Others

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV/Post-Marketing

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Strong Market Leadership in North America with High Digital Health Integration

North America maintains a leading position in the Virtual Clinical Trials Market, supported by strong digital health infrastructure and high R&D spending by major pharmaceutical companies. Sponsors in the United States accelerate adoption of decentralized and hybrid models to enhance enrollment and reduce trial delays. It benefits from mature telehealth networks, wide EHR integration, and strong interoperability standards. Regulatory clarity from the FDA strengthens industry confidence and expands virtual protocol acceptance. Advanced use of AI-driven analytics, real-time monitoring tools, and connected medical devices supports large-scale deployment. Canada contributes steady growth through collaborative research networks and improved digital readiness across healthcare institutions.

Expanding Regulatory Support and Rapid Decentralization Across Europe

Europe records significant participation driven by harmonized regulatory frameworks and strong national healthcare systems. The region advances decentralized models to improve patient access and streamline cross-border trial execution. Virtual Clinical Trials Market stakeholders gain advantages from the region’s emphasis on data governance and secure digital platforms. It benefits from strong uptake in Germany, the United Kingdom, and the Nordics due to high digital maturity. Growth in remote monitoring tools and eConsent platforms supports efficient study workflows. Rising investments in precision medicine and rare disease research expand opportunities for virtual and hybrid trial designs.

Fastest Growth in Asia-Pacific Supported by Large Patient Pools and Expanding Connectivity

Asia-Pacific delivers the highest growth rate supported by large, diverse patient populations and rising demand for accessible clinical research. Countries such as China, Japan, India, and South Korea strengthen digital health infrastructure to accelerate decentralized trial adoption. Virtual Clinical Trials Market participants leverage the region’s strong recruitment potential and rapid urbanization. It benefits from improving broadband access, higher smartphone penetration, and expanding telemedicine networks. Government initiatives and public–private collaborations support digital evidence generation and enhance regulatory alignment. Growing outsourcing activities and rising biopharmaceutical investments position Asia-Pacific as a strategic hub for virtual trial expansion.

Key Player Analysis:

- ICON, plc

- Parexel International Corporation

- IQVIA

- Covance

- PRA Health Sciences

- LEO Innovation Lab

- Medidata

- Oracle

- CRF Health

- Clinical Ink

- Medable, Inc.

- Signant Health

- Halo Health Systems

- Croprime

Competitive Analysis:

Competitive landscape in the Virtual Clinical Trials Market features major CROs, technology providers, and digital health innovators that expand decentralized capabilities through advanced platforms and strong global networks. Key players include ICON plc, Parexel International Corporation, IQVIA, Covance, PRA Health Sciences, LEO Innovation Lab, and Medidata. These companies invest in AI-enabled analytics, remote monitoring tools, and unified eClinical platforms to strengthen trial efficiency and data accuracy. It supports faster enrollment, broader geographic reach, and improved patient retention across complex therapeutic areas. Strategic partnerships with biotech firms, device manufacturers, and technology vendors help expand service portfolios and enhance virtual protocol delivery. Competitive focus centers on interoperability, regulatory alignment, and differentiated patient engagement tools that improve scalability and strengthen market leadership.

Recent Developments:

- In August 2025, IQVIA announced a long-term clinical and commercial partnership with Veeva Systems.

- In October 2025, Parexel expanded its Global Site Alliance Program, achieving 40% faster site activation and four times more patient enrollments per site.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Study Design, Indication, Phase and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Rise in hybrid and fully decentralized models will strengthen long-term adoption across therapeutic areas.

- Expansion of remote monitoring devices and AI tools will elevate data quality and accelerate decision cycles.

- Global recruitment reach will improve as sponsors engage diverse patient populations through digital platforms.

- Interoperability among eClinical systems will advance and support seamless evidence integration.

- Regulatory frameworks will evolve toward clearer validation standards for digital endpoints and remote procedures.

- Growth in precision medicine trials will increase demand for high-frequency, real-time data collection.

- Investment in cybersecurity and trust-enhancing technologies will improve stakeholder confidence in virtual models.

- Stronger collaboration between CROs, technology vendors, and biopharma companies will drive innovation.

- Patient engagement platforms will improve retention and reduce protocol deviation rates in complex studies.

- Expansion in emerging markets will accelerate virtual trial scalability and increase global deployment.

Market Drivers:

Market Drivers: