Market Overview

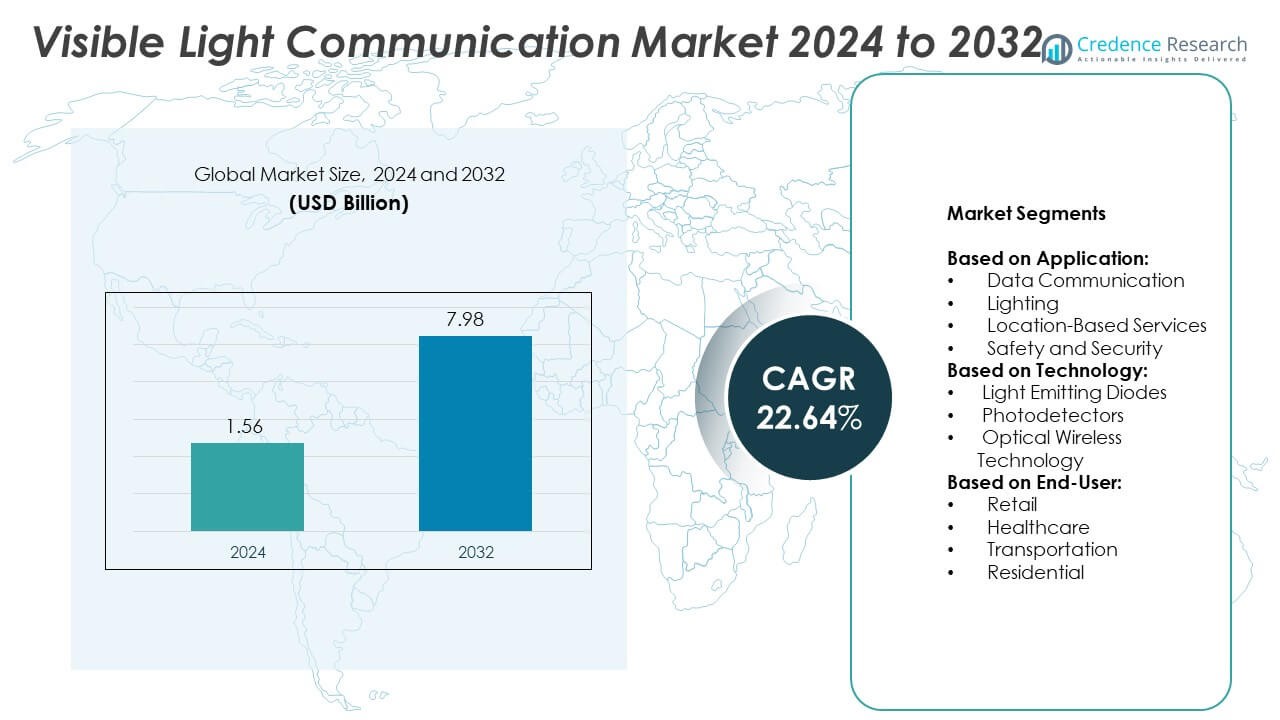

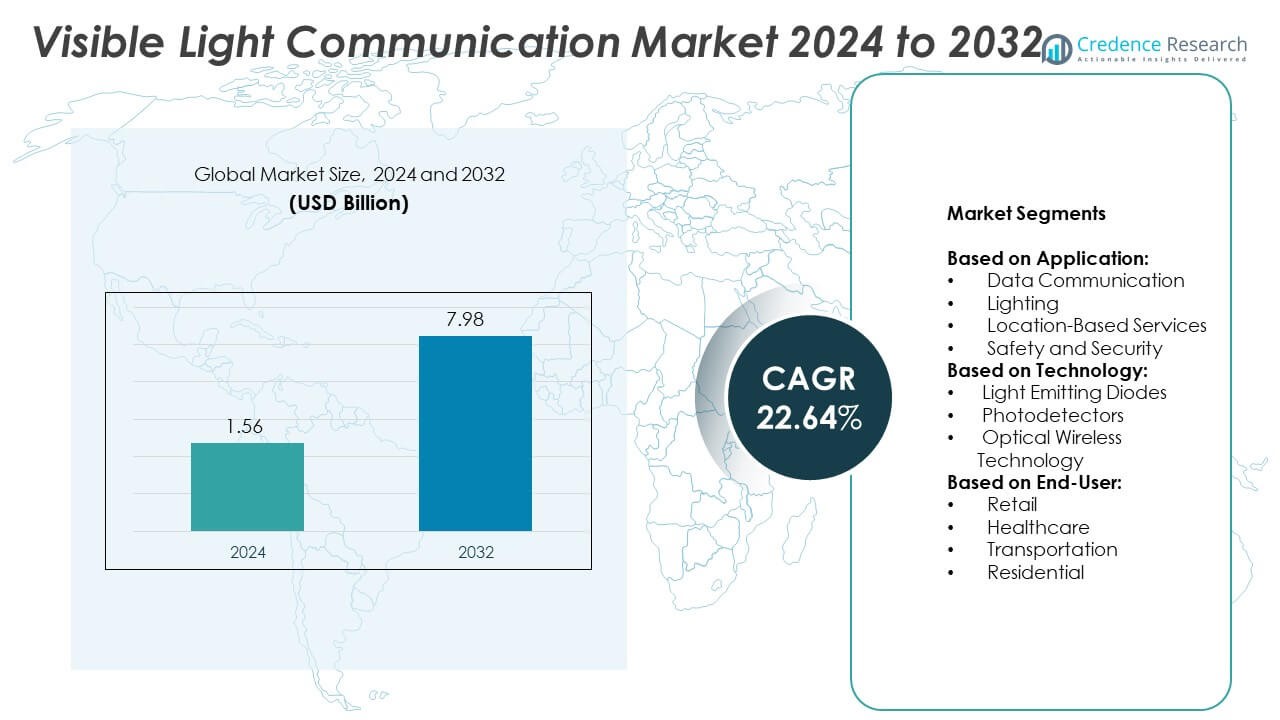

Visible Light Communication Market size was valued at USD 1.56 billion in 2024 and is anticipated to reach USD 7.98 billion by 2032, at a CAGR of 22.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Visible Light Communication Market Size 2024 |

USD 1.56 Billion |

| Visible Light Communication Market, CAGR |

22.64% |

| Visible Light Communication Market Size 2032 |

USD 7.98 Billion |

The Visible Light Communication market grows due to rising demand for high-speed, secure, and interference-free wireless connectivity. It benefits from increasing smart city projects, smart building integration, and energy-efficient LED adoption. The market also gains momentum from applications in healthcare, retail, and transportation that require precise indoor positioning and data transmission. Technological advancements in LEDs, photodetectors, and optical wireless systems enhance system reliability and performance. Expansion of hybrid VLC-RF networks supports wider adoption across commercial, industrial, and residential sectors.

North America leads the Visible Light Communication market, driven by smart city initiatives and advanced infrastructure, followed by Europe and Asia-Pacific with growing adoption in commercial, healthcare, and industrial sectors. It gains traction in retail and transportation for indoor navigation, asset tracking, and vehicle communication. Key players including PureLiFi, Broadcom, Osram, and Philips focus on technological innovation, hybrid VLC-RF solutions, and strategic collaborations to strengthen regional presence and expand deployment across urban and industrial applications worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Visible Light Communication market was valued at USD 1.56 billion in 2024 and is projected to reach USD 7.98 billion by 2032, growing at a CAGR of 22.64%.

- Rising demand for high-speed, secure, and interference-free communication drives market growth globally.

- Increasing adoption of smart city projects, smart building integration, and energy-efficient LED lighting supports market trends.

- Key players including PureLiFi, Broadcom, Osram, Philips, and Samsung Electronics focus on innovation and strategic partnerships to strengthen market presence.

- Limited transmission range, line-of-sight dependency, and high implementation costs remain significant challenges for widespread adoption.

- North America leads the market due to advanced infrastructure and early adoption, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- Expansion in healthcare, retail, transportation, and industrial automation offers long-term opportunities, supported by technological advancements in LEDs, photodetectors, and hybrid VLC-RF systems.

Market Drivers

Rapid Adoption of High-Speed Wireless Communication in Urban Infrastructure

The demand for faster and more reliable data transmission drives growth in the Visible Light Communication market. It offers high-speed connectivity without relying on congested radio frequency bands. Smart cities and urban infrastructure increasingly integrate VLC for traffic management, street lighting, and public safety networks. The technology supports seamless communication in dense environments, ensuring minimal interference and enhanced security. Telecom operators adopt VLC to complement existing wireless networks and reduce spectrum pressure. It enables precise indoor and outdoor positioning, benefiting logistics, transportation, and public services. Widespread adoption of LED lighting further supports market expansion.

- For instance, Terra Ferma introduced its Helios and Fortis Li‑Fi product lines in January 2025 for U.S. and NATO government and military applications, delivering full‑duplex visible light communication capabilities with speeds surpassing 1.0 Gbps

Rising Demand for Secure and Interference-Free Communication Solutions

Organizations seek communication systems that reduce risks of interception and signal disruption. Visible Light Communication delivers secure transmission through confined light beams, limiting unauthorized access. It finds applications in hospitals, defense facilities, and financial institutions requiring high privacy levels. It also supports sensitive environments where radio frequency communication may interfere with equipment. Companies increasingly invest in VLC systems to safeguard critical data transfer. The market benefits from growing awareness of cybersecurity risks and regulatory compliance requirements. It provides reliable alternatives for environments unsuitable for traditional wireless technologies.

- For instance, LVX System of Companies developed an LED-based VLC system capable of 3 Mbit/s data transmission via photon pulse-width modulation—a secure optical communication method that supplements Wi‑Fi in business environments

Integration of Internet of Things and Smart Building Technologies

IoT adoption in commercial and residential buildings stimulates demand for VLC solutions. It enables high-speed data links between sensors, devices, and control systems through existing LED infrastructure. Smart lighting systems leverage VLC to enhance energy efficiency and automate building operations. It supports real-time monitoring and management, improving operational productivity. Industry players develop VLC-enabled devices to meet smart home and office requirements. It allows seamless connectivity with minimal hardware modifications, lowering deployment costs. The integration with IoT accelerates adoption across industrial, healthcare, and educational sectors.

Technological Advancements in LED and Photodetector Systems

Innovations in LED efficiency and photodetector sensitivity drive market growth. It increases transmission range, data rates, and overall system reliability. Companies invest in miniaturized and cost-effective VLC components to expand commercial applications. It enables advanced communication in automotive, aviation, and industrial automation sectors. Research focuses on hybrid systems combining VLC with traditional wireless networks for enhanced performance. Technological progress reduces power consumption and maintenance requirements. It encourages adoption in regions with limited radio frequency spectrum availability.

Market Trends

Expansion of Indoor Positioning and Navigation Solutions

The Visible Light Communication market shows strong growth in indoor positioning and navigation applications. It enables precise location tracking in airports, shopping malls, and industrial warehouses. Companies adopt VLC to improve asset management, optimize workflow, and enhance customer experiences. It reduces dependence on GPS in enclosed spaces where signals are weak or unavailable. Retailers and logistics operators implement VLC-based systems to streamline operations and increase efficiency. It also supports location-based marketing and targeted services. Widespread LED infrastructure accelerates adoption across commercial and institutional facilities.

- For instance, Signify (formerly Philips Lighting) deployed a VLC-based positioning system in a German Edeka supermarket that achieved 30 cm accuracy, enhancing shoppers’ in-store navigation and service delivery.

Integration with Automotive and Transportation Systems for Enhanced Safety

VLC trends focus on integrating communication systems with vehicles and transportation infrastructure. It allows vehicles to exchange data with traffic signals, streetlights, and other cars, improving safety and traffic management. Automakers develop VLC-enabled headlights and taillights to enable vehicle-to-vehicle and vehicle-to-infrastructure communication. It reduces collision risks and enhances autonomous driving capabilities. Transport authorities invest in VLC-based systems to monitor traffic flow and provide real-time updates. It offers secure and interference-free communication in dense traffic environments. Consumer demand for advanced safety features drives further innovation.

- For instance, researchers in Indonesia demonstrated a car-to-car VLC system that transmitted ECU data during daytime up to 2 meters, and at night up to 11 meters, significantly extending communication range compared to IR systems.

Development of Hybrid Communication Networks Combining VLC and RF Technologies

Hybrid networks combining Visible Light Communication and traditional radio frequency systems gain popularity. It allows uninterrupted data transmission and mitigates limitations of standalone systems. Telecom operators implement hybrid solutions to balance network loads and improve overall efficiency. It supports high-speed internet, secure data transfer, and low-latency applications. Industry players develop devices capable of switching between VLC and RF to maintain performance in varying conditions. It encourages adoption in offices, factories, and smart cities. Research focuses on optimizing integration and minimizing deployment costs.

Adoption of Energy-Efficient and Sustainable Communication Solutions

Sustainability trends influence VLC adoption in commercial and residential sectors. It leverages energy-efficient LED lighting for dual purposes of illumination and data transmission. Companies adopt VLC to reduce energy consumption while enhancing connectivity. It supports green building certifications and eco-friendly infrastructure projects. Industrial and healthcare facilities implement VLC to lower operational costs without compromising performance. It enables long-term energy savings and aligns with regulatory initiatives. Consumer awareness of environmentally responsible technologies further accelerates adoption.

Market Challenges Analysis

Limited Range and Line-of-Sight Dependency Restricting System Deployment

The Visible Light Communication market faces challenges due to its dependence on direct line-of-sight transmission. It cannot penetrate walls or obstacles, which limits coverage in complex indoor and urban environments. Users must maintain a clear path between transmitters and receivers to ensure stable data transfer. It also struggles in outdoor settings under strong sunlight or fluctuating lighting conditions. Companies invest in specialized LEDs and photodetectors to improve performance, but deployment costs remain high. It restricts widespread adoption in large-scale infrastructure projects and multi-story buildings. Market growth depends on developing solutions that overcome these physical limitations.

High Implementation Costs and Integration Complexity Hindering Adoption

The adoption of Visible Light Communication systems requires significant investment in compatible LED lighting, photodetectors, and control units. It involves retrofitting existing infrastructure, which increases upfront expenses for businesses and public institutions. Companies face technical challenges in integrating VLC with existing wireless networks and IoT systems. It requires skilled personnel for installation, maintenance, and network management. Market players also encounter standardization gaps that slow large-scale deployment. It limits rapid adoption in small and medium-sized enterprises and cost-sensitive regions. Overcoming financial and technical barriers remains critical for market expansion.

Market Opportunities

Expansion in Smart Cities and Intelligent Infrastructure Projects Driving Adoption

The Visible Light Communication market presents significant opportunities in smart city initiatives worldwide. It enables high-speed, secure, and reliable communication for street lighting, traffic management, and public safety systems. Municipal authorities invest in VLC to enhance urban mobility, reduce energy consumption, and improve citizen services. It allows precise positioning and data transmission in dense urban areas where traditional wireless networks face congestion. Developers integrate VLC with IoT platforms to enable real-time monitoring and automation. It also supports environmental sustainability goals through energy-efficient LED infrastructure. Growing government focus on digital and intelligent cities accelerates adoption.

Opportunities in Healthcare, Industrial Automation, and Retail Sectors

VLC offers unique advantages for sectors requiring secure and interference-free communication. The market benefits from demand in hospitals, where it supports sensitive equipment without disrupting operations. It enables real-time monitoring, asset tracking, and patient management through LED-based communication systems. Industrial facilities adopt VLC to streamline automation, improve safety, and ensure precise machine-to-machine connectivity. Retailers leverage VLC for indoor navigation, targeted promotions, and customer analytics. It provides a cost-effective solution by utilizing existing LED lighting infrastructure. Expanding applications in these sectors create sustained growth potential for market players.

Market Segmentation Analysis:

By Application:

The Visible Light Communication market serves diverse applications that drive its adoption across industries. Data communication remains the largest segment, supporting high-speed indoor and outdoor networking without reliance on congested radio frequencies. It ensures secure and reliable transfer of information in commercial, industrial, and residential setups. Lighting applications benefit from dual-purpose LED infrastructure, providing illumination while enabling communication. Location-based services gain traction in retail stores, airports, and warehouses, offering precise navigation and asset tracking. Safety and security solutions leverage VLC to monitor sensitive environments and prevent unauthorized access. It supports real-time monitoring in hospitals, government facilities, and critical infrastructure.

- For instance, The LiFiMAX system, developed by Oledcomm, does offer connection speeds of up to 100 Mbps, according to its official product specifications. Some models, such as the LiFiMAX Compact, can reach up to 150 Mbps

By Technology:

LED-based technology dominates the market due to energy efficiency and widespread adoption in smart lighting systems. It provides high-speed data transmission while maintaining consistent illumination levels. Photodetectors form the receiving component in VLC systems, ensuring precise signal capture and minimal interference. Advances in photodetector sensitivity enhance transmission range and system reliability. Optical wireless technology integrates LEDs and photodetectors to enable robust, secure communication in both indoor and outdoor environments. It supports hybrid deployments alongside RF networks to improve coverage and performance. Continuous technological innovation reduces system costs and increases adoption potential.

- For instance, researchers at CMOS photonics platform developers created an integrated silicon nitride‑on‑silicon photodetector achieving external quantum efficiency above 60%, opto‑electronic bandwidth up to 9 GHz, and an avalanche gain‑bandwidth product of 173 GHz, all within a visible‑light integrated photonics architecture.

By End-User:

Retail applications utilize VLC for indoor navigation, personalized promotions, and real-time analytics, enhancing customer engagement. It allows retailers to optimize store layouts and track assets efficiently. Healthcare facilities adopt VLC for secure communication in operating rooms, patient monitoring, and equipment management. Transportation benefits from VLC-enabled vehicle-to-vehicle and vehicle-to-infrastructure communication, improving traffic safety and autonomous driving capabilities. Residential adoption focuses on smart homes, where VLC supports high-speed data transfer and IoT connectivity. It offers energy-efficient and secure alternatives to traditional Wi-Fi and RF systems. Growing awareness of VLC advantages across end-users drives continued market expansion.

Segments:

Based on Application:

- Data Communication

- Lighting

- Location-Based Services

- Safety and Security

Based on Technology:

- Light Emitting Diodes

- Photodetectors

- Optical Wireless Technology

Based on End-User:

- Retail

- Healthcare

- Transportation

- Residential

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Visible Light Communication market at 32%, driven by early adoption of advanced communication technologies and high investment in smart city projects. The region benefits from widespread LED infrastructure and a strong presence of technology providers developing VLC solutions. It sees applications across transportation, healthcare, and commercial sectors where secure and high-speed data transfer is critical. Companies focus on integrating VLC with IoT and 5G networks to enhance connectivity and efficiency. It also supports government initiatives for energy-efficient and sustainable urban development. North American end-users increasingly deploy VLC for indoor positioning, navigation, and data communication in airports, malls, and office complexes. Research institutions and universities contribute to technological advancements, accelerating commercialization.

Europe

Europe captures a 28% market share, supported by stringent regulations on energy efficiency and growing adoption of smart building solutions. It invests heavily in sustainable infrastructure, promoting dual-use LED systems that combine lighting with communication capabilities. The region emphasizes VLC for secure data transmission in hospitals, industrial facilities, and public institutions. It encourages adoption through incentives for energy-efficient technologies and green building certifications. Industry players collaborate with telecom operators to deploy hybrid networks combining VLC and RF technologies. Growing awareness of indoor positioning and location-based services further drives market growth. It maintains strong R&D focus, enhancing photodetector sensitivity and system reliability.

Asia-Pacific

Asia-Pacific accounts for 25% of the Visible Light Communication market, fueled by rapid urbanization, infrastructure development, and rising smart city initiatives in countries such as China, Japan, and South Korea. It experiences high demand from transportation and industrial automation sectors, where VLC improves safety, efficiency, and secure communication. Governments actively promote smart lighting and IoT integration, accelerating deployment in commercial and residential buildings. The market benefits from lower deployment costs due to widespread LED adoption and supportive policies. It also gains momentum in retail applications for indoor navigation, asset tracking, and personalized services. Industry collaborations focus on developing hybrid VLC-RF systems to enhance network performance in dense urban environments.

Latin America

Latin America holds a 10% market share, supported by increasing adoption of smart city projects and modern infrastructure in Brazil, Mexico, and Argentina. It leverages VLC for traffic management, public safety, and commercial communication solutions. Companies invest in pilot projects to demonstrate the benefits of energy-efficient lighting integrated with high-speed data transfer. It provides secure and interference-free communication for financial institutions, hospitals, and educational facilities. Market growth remains steady, supported by expanding LED infrastructure and government initiatives to modernize urban networks. It presents opportunities for foreign and local vendors to establish partnerships for wider VLC deployment.

Middle East & Africa

The Middle East & Africa region captures 5% of the market, with adoption concentrated in the UAE, Saudi Arabia, and South Africa. It benefits from investments in smart city developments and large-scale commercial projects incorporating intelligent lighting systems. It addresses the need for secure communication in high-value infrastructure such as airports, government buildings, and industrial hubs. Companies explore VLC for data communication and location-based services in commercial complexes and transport networks. It faces challenges in standardization and high initial deployment costs, but demand increases with ongoing urbanization and technological modernization. Collaborative projects between governments and technology providers accelerate adoption in key metropolitan areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Philips

- Osram

- Infineon Technologies

- VLC Technologies

- Hod Luminaires

- Renesas Electronics

- Broadcom

- PureLiFi

- Samsung Electronics

- LightWave Logic

- Luminus Devices

- Siemens

- LEDiant

- General Electric

- Nakagawa Laboratories

Competitive Analysis

Key players in the Visible Light Communication market include PureLiFi, Luminus Devices, Broadcom, General Electric, Samsung Electronics, Osram, Renesas Electronics, Nakagawa Laboratories, LEDiant, Philips, Siemens, Hod Luminaires, Infineon Technologies, LightWave Logic, and VLC Technologies. These companies focus on technological innovation to strengthen their market positions and expand global reach. They invest in research and development to enhance LED efficiency, photodetector sensitivity, and optical wireless technology performance. It allows faster data transmission, higher security, and reliable communication in commercial, industrial, and residential applications. Strategic partnerships and collaborations with telecom operators and smart city developers support large-scale deployments. They also introduce hybrid solutions combining VLC and RF systems to address network limitations. It helps improve system reliability and adoption in urban and high-density environments. Companies prioritize energy-efficient and cost-effective solutions to meet growing sustainability requirements. Continuous product development in automotive, healthcare, and retail sectors strengthens competitive advantage. They leverage intellectual property and patents to maintain differentiation in high-speed communication technologies. It ensures the delivery of innovative, secure, and scalable solutions to end-users globally, driving long-term market growth and resilience.

Recent Developments

- In 2025, At OFC 2025, Broadcom unveiled new optical interconnect solutions to accelerate AI infrastructure, and optical networking in the spotlight

- In March 2025, Luminus Devices launched Generation 2 warm dimming COB LEDs with dynamic color temperature transition, enhancing both aesthetics and efficiency for lighting designers.

- In February 2024, pureLiFi unveiled next-gen LiFi connectivity solutions that “break through barriers” with enhanced LiFi performance at MWC 2024

Report Coverage

The research report offers an in-depth analysis based on Application, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Visible Light Communication market will grow with rising demand for high-speed wireless connectivity.

- It will expand in smart city projects for traffic management and public safety applications.

- Adoption in healthcare facilities will increase due to secure and interference-free communication needs.

- Integration with IoT and smart building systems will drive market development.

- It will gain traction in retail for indoor navigation, asset tracking, and personalized services.

- Automotive and transportation sectors will adopt VLC for vehicle-to-vehicle and vehicle-to-infrastructure communication.

- Technological innovations in LEDs and photodetectors will enhance system performance and reliability.

- Hybrid networks combining VLC and RF technologies will support seamless data transmission.

- Energy-efficient lighting solutions will encourage adoption in residential and commercial buildings.

- Expanding research and development will create opportunities for next-generation VLC applications.