Market Overview:

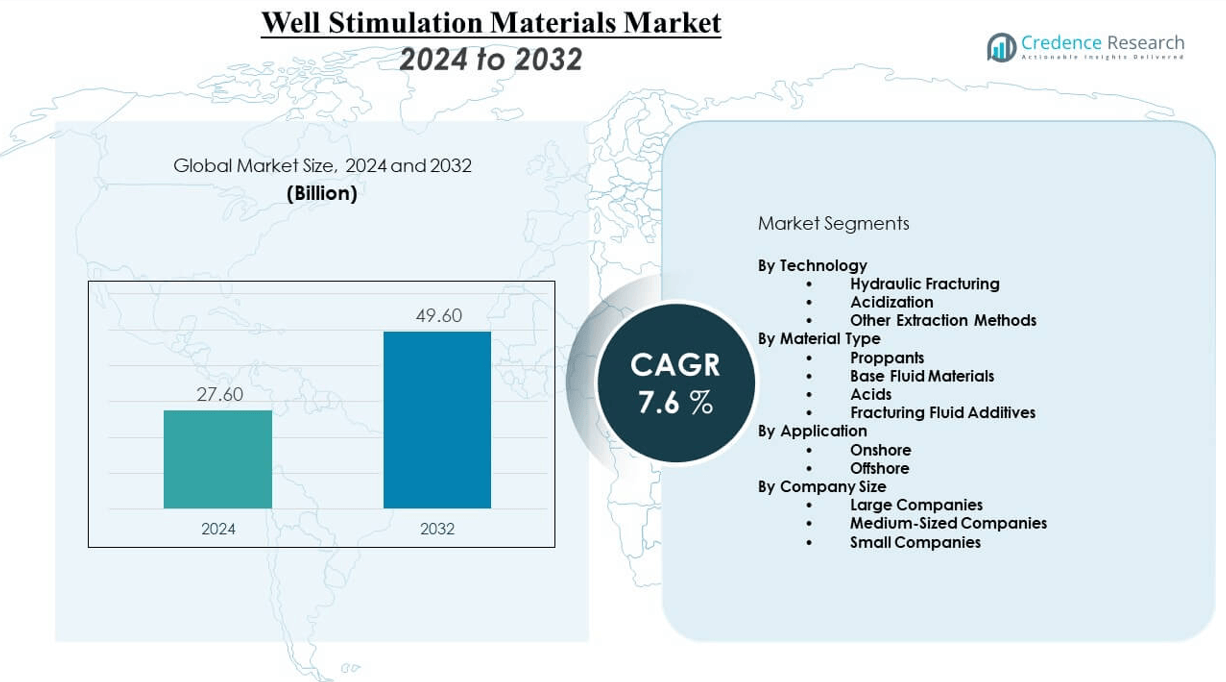

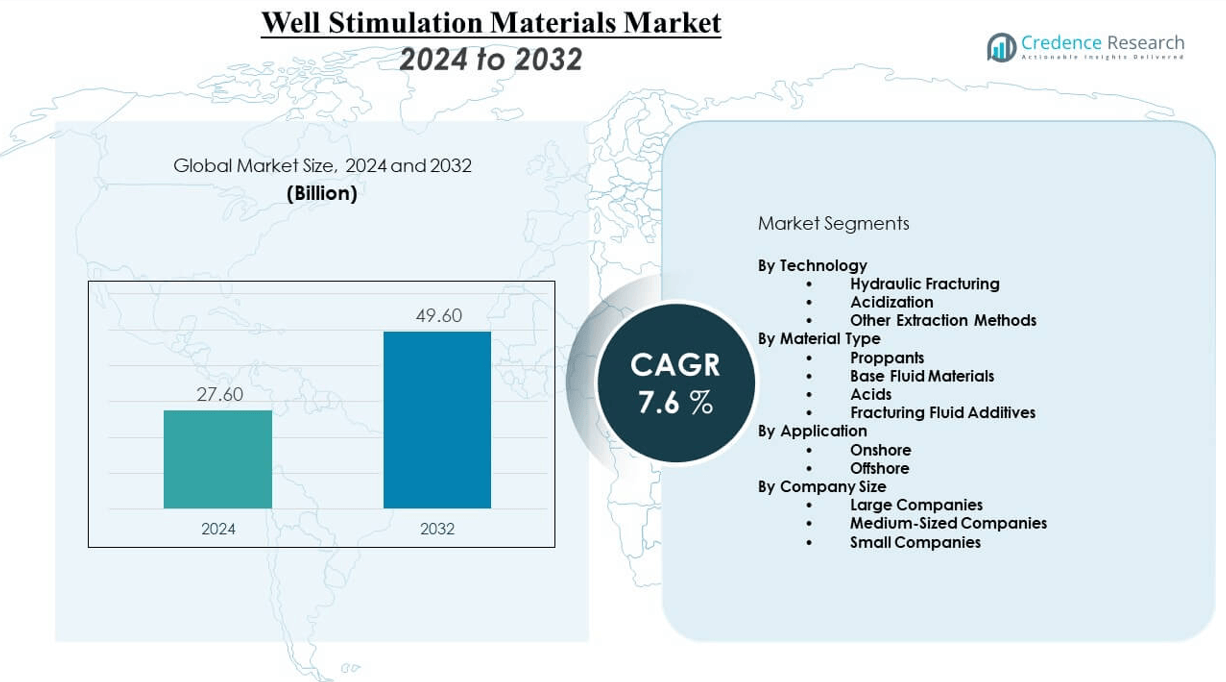

The Well Stimulation Materials Market is projected to grow from USD 27.6 billion in 2024 to an estimated USD 49.6 billion by 2032, with a compound annual growth rate (CAGR) of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Well Stimulation Materials Market Size 2024 |

USD 27.6 billion |

| Well Stimulation Materials Market, CAGR |

7.6% |

| Well Stimulation Materials Market Size 2032 |

USD 49.6 billion |

Growth in the Well Stimulation Materials Market is strongly influenced by rising global energy demand, ongoing exploration of unconventional reserves, and the need for cost-efficient extraction processes. Operators are focusing on advanced stimulation techniques such as hydraulic fracturing and acidizing, which require specialized proppants, chemicals, and fluids to optimize production rates. Environmental concerns are encouraging the use of eco-friendly and low-toxicity materials, while continuous R&D investments are leading to innovations in nanotechnology-based and lightweight materials that improve efficiency and reduce operational costs.

Regionally, North America dominates the Well Stimulation Materials Market due to extensive shale gas and tight oil development, supported by advanced hydraulic fracturing infrastructure. The Middle East follows, driven by large-scale conventional reserves and government-backed initiatives to sustain oil output. Europe shows steady adoption in mature basins, while Asia Pacific emerges as a high-growth region, led by China and India’s rising energy needs and increasing exploration of unconventional resources. Latin America also shows potential, with Brazil and Argentina investing in shale and offshore projects to strengthen their energy production base.

Market Insights:

- The Well Stimulation Materials Market is projected to grow from USD 27.6 billion in 2024 to USD 49.6 billion by 2032, registering a CAGR of 7.6% during the forecast period.

- Rising global energy demand and continuous exploration of unconventional reserves drive strong adoption of well stimulation materials.

- Advanced hydraulic fracturing and acidizing techniques boost the demand for proppants, gelling agents, and specialized chemicals.

- High operational costs and raw material price fluctuations act as key restraints for companies and operators.

- Stringent environmental regulations and public opposition to hydraulic fracturing limit expansion in certain regions.

- North America dominates due to shale gas and tight oil development, while the Middle East leverages large conventional reserves.

- Asia Pacific and Latin America emerge as high-growth regions driven by increasing exploration in China, India, Brazil, and Argentina.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Energy Demand and Expanding Exploration Activities:

The global increase in energy consumption drives continuous exploration and production activities, creating strong demand for well stimulation materials. The need to enhance hydrocarbon recovery from both conventional and unconventional reserves has made stimulation technologies indispensable for the oil and gas industry. The well stimulation materials market benefits from large-scale drilling projects, particularly in regions with high shale and tight oil potential. Governments and private operators invest heavily in exploration to secure energy security and long-term supply stability. It remains a priority to ensure cost-effective production, which relies on the consistent use of proppants, acids, and specialized fluids. Expanding offshore exploration also broadens material application, requiring durable and high-performance inputs. Energy independence goals of several nations further accelerate adoption, strengthening demand across regional markets. It has become essential for operators to adopt advanced stimulation solutions that improve well productivity and extend lifecycle output.

- For instance, Schlumberger’s DELFI cognitive environment integrates seismic and well data to dynamically adjust acidizing programs, improving operational precision in over 300 offshore projects.

Growing Adoption of Hydraulic Fracturing and Acidizing:

The increasing reliance on hydraulic fracturing and acidizing techniques represents a major driver for the well stimulation materials market. Operators seek to maximize extraction efficiency from unconventional formations, where conventional drilling often falls short. The growing complexity of reservoirs demands materials capable of withstanding extreme pressure and temperature environments. Proppants, gelling agents, and corrosion inhibitors play a pivotal role in maintaining well stability and productivity during these processes. It reflects a shift toward technology-intensive solutions that improve hydrocarbon recovery while reducing overall operational risks. Hydraulic fracturing activity in North America and emerging exploration in Asia Pacific underscore the growing demand. The industry emphasizes the need for consistency and precision, which directly ties into the selection of specialized stimulation materials. It continues to anchor market expansion by aligning material use with evolving drilling and production strategies.

- For instance, Halliburton reported delivering over 1.2 million pounds of high-strength ceramic proppants for hydraulic fracturing operations in the Permian Basin during the first half of 2025.

Technological Advancements and Material Innovation:

Continuous investment in research and development fuels significant innovation within the well stimulation materials market. Companies focus on producing lightweight, eco-friendly, and nanotechnology-based materials that enhance efficiency and reduce environmental impact. The introduction of advanced chemical formulations improves fluid viscosity control, ensures better fracture propagation, and minimizes formation damage. It creates opportunities to reduce downtime and extend well productivity with greater reliability. Operators demand materials with higher performance characteristics that can adapt to diverse geological conditions. Innovations also reduce the need for excessive water use, addressing one of the key concerns associated with hydraulic fracturing. The market gains momentum as manufacturers offer sustainable solutions without compromising extraction efficiency. It highlights a transition toward next-generation materials that redefine cost-effectiveness and environmental responsibility in well stimulation.

Environmental Regulations and Sustainable Practices:

Stringent environmental regulations strongly influence material adoption, prompting companies to focus on low-toxicity and biodegradable alternatives. Governments and regulatory bodies worldwide implement standards that aim to reduce ecological risks associated with well stimulation operations. The well stimulation materials market responds by investing in green chemistry and environmentally safe additives. Operators actively pursue sustainable practices to comply with regulations while maintaining competitive production levels. It also aligns with investor and public pressure to adopt cleaner technologies. The growing push for corporate responsibility drives companies to balance efficiency with ecological stewardship. Sustainable material development becomes not just a compliance measure but a competitive differentiator. It secures long-term viability for players who successfully integrate environmental priorities into their material offerings.

Market Trends:

Rising Digital Integration in Stimulation Operations:

The well stimulation materials market observes a growing integration of digital technologies in stimulation operations. Operators employ predictive analytics and real-time monitoring tools to optimize material usage during fracturing and acidizing. It enhances efficiency by reducing waste, improving accuracy, and aligning supply with field requirements. Advanced software models allow better understanding of fracture behavior, driving informed material selection. The shift toward data-driven decision-making accelerates operational precision across multiple regions. Remote monitoring platforms enable operators to adjust stimulation programs dynamically, reducing risks of downtime or overuse of chemicals. The trend reflects broader industry adoption of digital oilfield solutions, linking materials more closely with advanced analytics. It reshapes the value chain by combining physical resources with digital intelligence.

- For instance, Baker Hughes’ digital stimulation platform processed real-time data from over 500 wells globally in 2024, optimizing chemical usage and reducing material waste by measurable volumes.

Shift Toward Customized Material Formulations:

The demand for tailored solutions is rising, pushing companies to develop customized formulations that match reservoir-specific challenges. The well stimulation materials market adapts to varied geological complexities, requiring precise combinations of proppants, surfactants, and fluid additives. Operators seek flexible materials capable of optimizing production in unconventional, offshore, and mature wells alike. It reflects the growing need for site-specific engineering solutions rather than one-size-fits-all approaches. Customization improves operational efficiency and minimizes risks associated with formation damage. Collaborative R&D between oilfield service providers and material manufacturers expands innovation pipelines. The adoption of advanced formulations boosts recovery rates, enhances sustainability, and provides competitive advantages. It positions customization as a defining trend that will shape long-term industry strategies.

Increasing Demand for Lightweight and High-Strength Proppants:

Operators increasingly favor lightweight, high-strength proppants for their ability to withstand extreme downhole pressures while maintaining fracture conductivity. The well stimulation materials market benefits from the transition toward ceramics and coated sand alternatives that outperform traditional sand. Lightweight proppants improve logistics by reducing transport costs while enhancing well productivity. It also supports deeper reservoir penetration, particularly in high-pressure unconventional formations. The demand aligns with operators’ focus on efficiency and long-term production stability. Manufacturers invest in scalable production technologies to meet rising demand across North America, the Middle East, and Asia Pacific. Proppant innovation demonstrates the strong link between material performance and operational economics. It establishes advanced proppants as a core focus for material development strategies.

Integration of Sustainability in Supply Chains:

Sustainability has emerged as a significant trend shaping supply chains and procurement processes. The well stimulation materials market responds with eco-friendly products and transparent sourcing practices. Companies prioritize lifecycle assessment, recycling, and reduced emissions in production. It signals a broader industry commitment to aligning with global decarbonization targets. Operators seek suppliers capable of delivering performance alongside sustainability credentials. Green certifications and adherence to ESG standards play a key role in supplier selection. This transformation extends beyond materials to encompass logistics, packaging, and distribution networks. It underscores the role of sustainable supply chains as a strategic priority influencing buyer preferences.

Market Challenges Analysis:

High Operational Costs and Supply Chain Volatility:

The well stimulation materials market faces significant challenges due to high operational costs and fluctuating raw material prices. Proppants, specialty chemicals, and advanced fluids require complex manufacturing processes that drive cost pressures for both suppliers and operators. It becomes difficult to balance the need for innovation with price competitiveness, especially during periods of volatile crude oil prices. Supply chain disruptions caused by geopolitical tensions, trade restrictions, and logistics constraints further intensify cost challenges. Operators are compelled to reassess sourcing strategies and diversify suppliers to mitigate risks. Companies struggle to maintain margins while adapting to unpredictable market conditions. The reliance on imports in certain regions exacerbates vulnerability to global supply imbalances. It highlights the necessity for strong cost management and resilience strategies in the market.

Environmental Concerns and Regulatory Barriers:

Stringent environmental regulations and growing public scrutiny present persistent challenges for industry participants. The well stimulation materials market must adapt to strict restrictions on water usage, chemical discharge, and emissions during operations. It requires companies to invest heavily in green chemistry solutions, which may increase development costs. Public opposition to hydraulic fracturing in specific regions creates reputational and operational risks for operators. Regulatory delays also hinder project approvals, slowing material adoption in critical markets. The pressure to comply with ESG standards limits flexibility for companies operating across multiple jurisdictions. It pushes stakeholders to align business models with sustainability while managing profitability. Navigating this complex regulatory environment demands continuous adaptation, innovation, and transparency.

Market Opportunities:

Expansion of Unconventional Resource Development:

The growing focus on unconventional resources offers significant opportunities for the well stimulation materials market. Shale gas, tight oil, and coalbed methane projects require extensive stimulation efforts, creating long-term demand for advanced materials. It supports the development of specialized proppants, chemical additives, and fluid systems that enhance recovery efficiency. Expanding exploration in Asia Pacific and Latin America strengthens opportunities for global suppliers. Governments and private companies invest heavily in unconventional resource projects to meet rising domestic energy demand. The trend creates room for collaboration between material innovators and oilfield service providers. It also encourages cross-border partnerships to address unique geological conditions.

Adoption of Eco-Friendly and Nanotechnology-Based Materials:

The transition toward sustainable energy practices provides room for innovative material adoption. The well stimulation materials market benefits from the growing use of eco-friendly, biodegradable, and nanotechnology-based solutions. It meets regulatory expectations while maintaining extraction efficiency. Nanomaterials improve fracture conductivity, reduce formation damage, and optimize well performance. Companies investing in green innovations position themselves as preferred suppliers in markets with strong environmental oversight. The opportunity extends beyond compliance into building long-term competitive advantages. It reshapes the industry by aligning growth with global sustainability targets and technological progress.

Market Segmentation Analysis:

By Technology

The Well Stimulation Materials Market is led by hydraulic fracturing, which dominates due to its critical role in unconventional oil and gas recovery, particularly shale and tight reservoirs. Acidization, including matrix acid stimulation, acid fracturing, and hydrochloric acid washes, plays a vital role in carbonate formations where permeability enhancement is required. Other extraction methods such as nitrogen and CO₂ injection remain specialized techniques, supporting recovery in complex or mature reservoirs where conventional methods are insufficient.

- For instance, Acidization techniques (matrix acid stimulation, acid fracturing, hydrochloric acid washes) are critical for enhancing permeability in carbonate formations. Major chemical suppliers like BASF SE and Occidental Petroleum actively produce hydrochloric acid solutions for oilfield acidizing operations globally, serving thousands of wells annually.

By Material Type

Proppants form the largest segment, with ceramic proppants, coated sand, and raw sand providing fracture stability and long-term conductivity under high pressure. Base fluid materials such as polymer gelling agents, surfactants, friction reducers, crosslinking agents, and gel breakers ensure efficient fracture propagation and flow control. Acids, including hydrochloric, hydrofluoric, and natural variants, remain indispensable for cleaning wellbores and enhancing reservoir permeability. Fracturing fluid additives like biocides, corrosion inhibitors, and scale inhibitors safeguard well integrity and extend operational life.

- For instance, Base fluid materials including polymer gelling agents, surfactants, friction reducers, and gel breakers are critical for efficient fracture propagation. Polymer-based drag reducing agents are estimated to hold about 61% of total demand across crude oil pipeline applications in 2025, driven by suppliers who innovate to enhance shear stability and operational efficiency.

By Application

The market divides into onshore and offshore operations, with onshore projects holding a larger share due to extensive shale gas development and lower operational costs. Offshore applications continue to grow steadily, driven by deepwater exploration and the need for advanced stimulation techniques to optimize production in challenging environments.

By Company Size

Large companies dominate the landscape with strong R&D capabilities and global supply chains that support large-scale operations. Medium-sized companies capture regional opportunities by offering tailored solutions, while small companies compete through cost efficiency and localized expertise, collectively strengthening the competitive environment of the well stimulation materials market.

Segmentation:

By Technology

- Hydraulic Fracturing

- Acidization (Matrix acid stimulation, Acid fracturing, Hydrochloric acid wash, etc.)

- Other Extraction Methods (Nitrogen injection, CO₂ injection)

By Material Type

- Proppants (Ceramic proppants, Coated sand, Raw sand)

- Base Fluid Materials (Polymer gelling agents, Surfactants, Friction reducers, Crosslinking agents, Gel breakers)

- Acids (Hydrochloric acid, Hydrofluoric acid, Natural acids)

- Fracturing Fluid Additives (Biocides, Corrosion inhibitors, Scale inhibitors)

By Application

By Company Size

- Large Companies

- Medium-Sized Companies

- Small Companies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe

North America leads the Well Stimulation Materials Market with a share of nearly 38%, driven by extensive shale gas and tight oil development across the United States and Canada. Strong infrastructure for hydraulic fracturing, coupled with continuous technological innovation, ensures high adoption of advanced proppants, acids, and fluid additives. It benefits from well-established service providers and large companies that dominate supply and R&D efforts. The regulatory environment encourages efficiency and sustainability, shaping demand for eco-friendly materials. Europe holds around 22% share, supported by mature hydrocarbon fields in the North Sea and renewed interest in unconventional reserves. Strict environmental regulations in the region drive demand for low-toxicity chemicals and sustainable fluid formulations. It demonstrates steady growth potential, despite limited large-scale unconventional resource development compared to North America.

Asia Pacific

Asia Pacific accounts for about 25% share of the global Well Stimulation Materials Market, with China and India emerging as key demand centers. Rising energy consumption and government-backed exploration programs fuel investment in both onshore and offshore projects. It benefits from increasing shale gas exploration in China, which requires extensive stimulation materials for reservoir development. India and Southeast Asia also expand exploration activity, creating opportunities for regional suppliers and global players to establish strong distribution networks. The growing need for energy security encourages adoption of advanced stimulation technologies to optimize hydrocarbon recovery. Market growth is supported by collaborative ventures between local companies and international service providers. It remains one of the most promising regions for long-term expansion.

Middle East, Latin America, and Africa

The Middle East contributes around 10% share of the Well Stimulation Materials Market, with large-scale conventional reserves driving steady demand for acids and stimulation fluids. National oil companies invest heavily in maintaining production capacity, ensuring consistent material use across major fields. Latin America represents close to 4%, supported by shale development in Argentina and offshore projects in Brazil. It remains an emerging hub for unconventional resources, creating growth opportunities for proppants and advanced fluid systems. Africa holds about 1% share, with activity concentrated in Nigeria and Angola, where offshore developments rely on high-performance materials. It demonstrates gradual adoption, but future potential depends on regulatory stability and investment in exploration. Collectively, these regions reinforce global diversification and highlight untapped opportunities in unconventional and offshore development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Akzo Nobel NV

- Linde Group

- Chevron Phillips Chemical Company LLC

- FMC Corporation

- CARBO Ceramics Incorporated

- US Silica Holdings Incorporated

- Ashland

- BASF SE

- Dow

- DuPont

- Ecolab

- Solvay

- Badger Mining Corporation

- Weatherford

- Sierra Frac Sand LLC

- Air Liquide Group

- Ferus Incorporated

- Air Products and Chemicals Incorporated

Competitive Analysis:

The Well Stimulation Materials Market is highly competitive, with large multinational corporations and regional suppliers shaping the industry landscape. Major players such as BASF SE, Dow, DuPont, Chevron Phillips Chemical, Solvay, and Ecolab dominate through strong product portfolios, global distribution networks, and R&D investments. It is characterized by constant innovation in proppants, acids, and eco-friendly additives, as companies aim to balance performance with regulatory compliance. Regional firms like US Silica and Sierra Frac Sand enhance competitiveness by offering cost-efficient, location-specific solutions. Air Liquide and Linde Group contribute by supplying gases essential for stimulation methods, while Weatherford integrates materials with service offerings. Intense competition drives continuous product development and strategic partnerships to secure market presence.

Recent Developments:

- In Akzo Nobel NV, the company signed a Memorandum of Cooperation with Sinopec in December 2024 to support global expansion of the Chinese energy giant. This partnership focuses on supplying AkzoNobel’s high-performance protective coatings for projects involving refining facilities, natural gas processing, and chemical production sites, reflecting their shared vision toward a sustainable future.

- In Linde Group, as of July 2025, the company announced two new long-term agreements to supply bulk industrial gases for U.S. rocket launches. Linde will expand its Mims, Florida facility and construct a new air separation unit in Brownsville, Texas, both targeted to come online by 2026-2027, reinforcing its position in the fast-growing U.S. space market.

- In Chevron Phillips Chemical Company LLC, the company made a significant $15 billion bid in 2019 to acquire Nova Chemicals. This acquisition would position Chevron Phillips as one of the largest polyethylene producers in North America and extend its market and technological reach in polyethylene and polystyrene sectors.

Market Concentration & Characteristics:

The Well Stimulation Materials Market is moderately concentrated, with global chemical companies and specialized suppliers holding significant shares. It is driven by a mix of established leaders with strong capital investments and smaller players providing cost-efficient niche solutions. Large companies dominate high-value materials such as advanced proppants, fluid additives, and specialty chemicals. It features high barriers to entry due to regulatory compliance, capital intensity, and technological requirements. Regional fragmentation exists, but global players leverage scale and innovation to maintain leadership.

Report Coverage:

The research report offers an in-depth analysis based on technology, material type, application, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for unconventional oil and gas will increase adoption of advanced stimulation materials.

- Rising focus on eco-friendly and biodegradable chemicals will reshape material innovation.

- Proppants with higher strength and conductivity will see greater demand in high-pressure wells.

- Digital technologies and real-time monitoring will optimize material usage and reduce costs.

- North America will maintain leadership, while Asia Pacific emerges as a fast-growing region.

- Offshore projects will expand the need for advanced fluid systems and corrosion inhibitors.

- Strategic partnerships between oilfield service companies and chemical suppliers will intensify.

- Regulatory frameworks will accelerate adoption of sustainable solutions.

- Investment in R&D will drive nanotechnology-based and next-generation additives.

- Supply chain resilience will remain a priority to mitigate raw material price fluctuations.