Market Overview

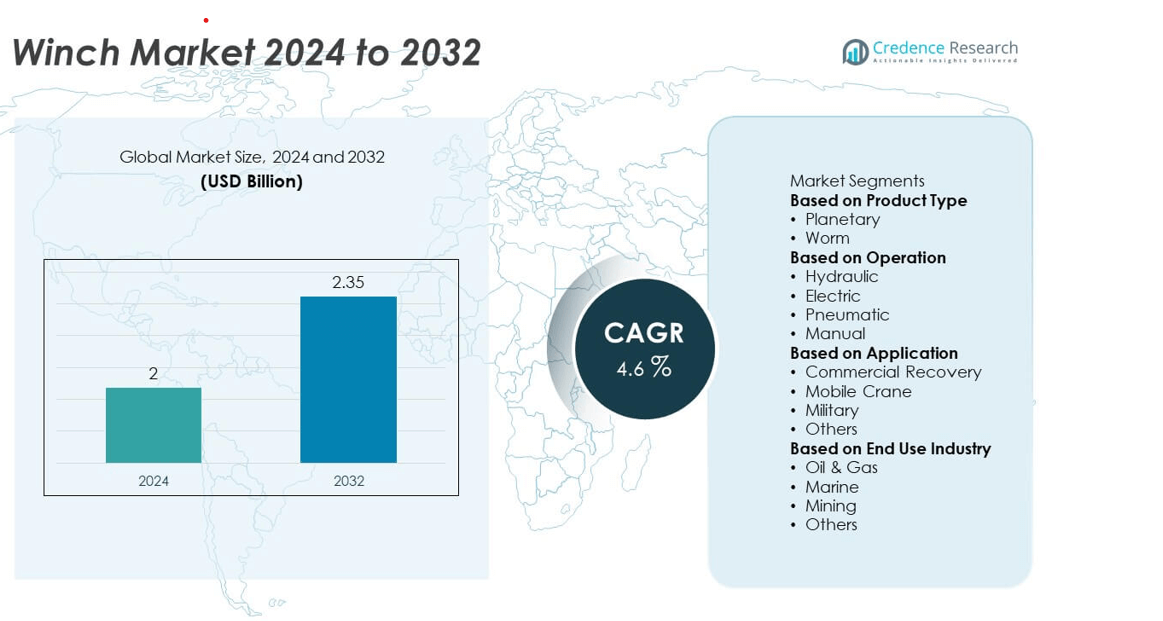

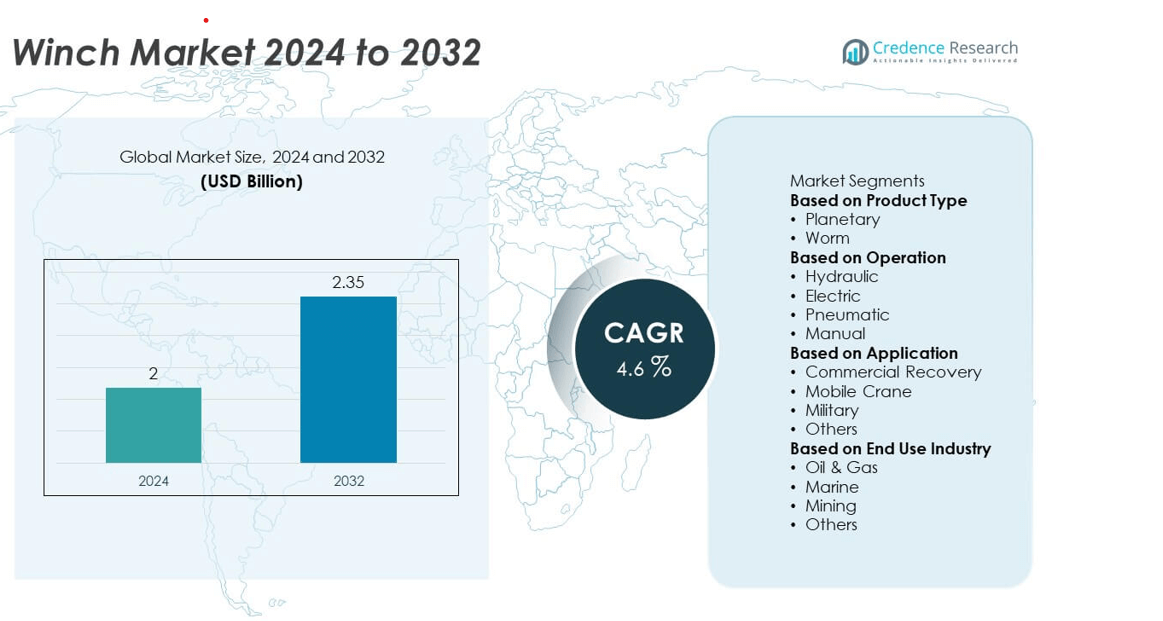

The winch market was valued at USD 2 billion in 2024 and is projected to reach USD 2.35 billion by 2032, registering a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Winch Market Size 2024 |

USD 2 Billion |

| Winch Market, CAGR |

4.6% |

| Winch Market Size 2032 |

USD 2.35 Billion |

The winch market is driven by key players such as TWG, A Dover Company, Ingersoll Rand Inc., Ramsey Winch, Warn Industries, Inc., Mile Marker Industries, LLC, Superwinch, PACCAR Winch Division, Rotzler GmbH + Co. KG, Thern, Inc., and Winches Inc. These companies focus on delivering advanced planetary, hydraulic, and electric winches with improved efficiency, durability, and remote-control features to meet diverse industrial and commercial demands. Asia-Pacific leads the market with 31% share, supported by large infrastructure projects and shipbuilding activities, followed by North America with 33% share driven by construction and automotive recovery demand, while Europe accounts for 28% share with strong adoption in port operations and offshore projects.

Market Insights

- The winch market was valued at USD 2 billion in 2024 and is projected to reach USD 2.35 billion by 2032, growing at a CAGR of 4.6% during the forecast period.

- Rising demand from construction, infrastructure, and marine industries drives growth, with planetary winches leading the product type segment with over 60% share due to their high efficiency and compact design.

- Key trends include the adoption of electric winches with wireless controls, growing use of IoT-enabled load monitoring, and increasing demand for corrosion-resistant solutions for offshore and marine applications.

- The market is competitive, with key players such as TWG, Ingersoll Rand, Ramsey Winch, and Warn Industries focusing on product innovation, expanding distribution networks, and offering energy-efficient and automated winch systems.

- North America holds 33% share, Asia-Pacific 31%, and Europe 28%, while Latin America and Middle East & Africa collectively contribute 8% share, driven by mining, construction, and port development projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Planetary winches dominated the winch market in 2024, holding over 60% share due to their high efficiency, compact design, and superior load-handling capacity. These winches are widely used in construction, marine, and off-road applications, where heavy-duty lifting and pulling are required. Their ability to deliver smooth operation and higher torque at lower power input makes them the preferred choice for demanding industrial applications. Worm winches, while slower, are favored for their self-locking capability, offering safety in load-holding applications such as small cranes and material handling systems.

- For instance, TWG, part of Dover, announced the launch of the dp EL22 Electric Winch in October 2023. It features a 22,000 lb rated line pull and a “high-efficiency, 4-stage planetary geartrain”.

By Operation

Hydraulic winches led the market with over 40% share in 2024, driven by their ability to handle heavy loads and operate continuously in harsh conditions. They are widely adopted in offshore, marine, and industrial applications where high torque and durability are critical. Electric winches follow closely, supported by their ease of installation, lower maintenance requirements, and growing adoption in automotive recovery and light-duty lifting. Pneumatic winches serve niche industries like oil and gas, while manual winches remain relevant in small-scale operations due to their cost-effectiveness.

- For instance, Warn Industries manufactures high-capacity winches, including a 16,500 lb electric model (like the 16.5ti), the company also produces industrial hydraulic winches with capacities of up to 18,000 lbs.

By Application

Commercial recovery accounted for over 35% share of the winch market in 2024, fueled by the rising number of vehicle breakdowns and off-road recovery operations worldwide. Growth in the automotive aftermarket and demand for 4×4 recovery solutions further support this segment. Mobile cranes represent the next major application, using winches for lifting and positioning loads in construction and logistics projects. Military applications are steadily increasing, as winches are integral to armored vehicle recovery and field operations. Other uses include forestry, marine towing, and industrial material handling, contributing to steady market expansion.

Market Overview

Rising Demand from Construction and Infrastructure Projects

The surge in global infrastructure development is a major driver, contributing to over 35% of winch installations in 2024. Winches are essential for lifting, pulling, and positioning heavy materials at construction sites, including bridges, high-rise buildings, and industrial facilities. Government investments in road, rail, and port projects further fuel demand. Planetary and hydraulic winches are preferred due to their ability to handle heavy-duty operations with high efficiency and durability, making them crucial for contractors seeking reliable lifting solutions in demanding environments.

- For instance, Ramsey Winch offers hydraulic planetary winches with 15,000 lb line pull ratings, such as models in the RPH series, which are built to meet demanding performance needs for industrial applications like construction.

Growth in Marine and Offshore Applications

Marine and offshore industries accounted for over 30% share of winch demand, driven by their use in anchoring, towing, and mooring operations. Hydraulic and electric winches are vital for offshore drilling rigs, ships, and port facilities that require high-torque and continuous operation. Increasing global trade, rising offshore oil exploration, and demand for efficient cargo handling systems are boosting winch installations. The adoption of corrosion-resistant and remotely operated winches is also rising, meeting safety and reliability standards in harsh marine environments.

- For instance, in June 2024, Rotzler GmbH launched the APEX Control System Platform, a new, highly customizable control system for winches and other equipment on special-purpose and recovery vehicles. For marine applications, Rotzler has manufactured corrosion-resistant hydraulic winches, such as models in the TITAN series, for many years

Expansion of Automotive Recovery and Utility Vehicles

The growing demand for automotive recovery solutions contributes to over 25% of market growth. Electric winches are increasingly used in tow trucks, off-road vehicles, and utility trucks for vehicle recovery and load pulling. Rising popularity of adventure tourism, 4×4 vehicles, and off-road events supports the adoption of compact, high-performance winches. The expansion of fleet management services and rising vehicle breakdown incidents also drive steady demand. Manufacturers are introducing lightweight, wireless-controlled winches to improve safety and convenience for users.

Key Trends & Opportunities

Adoption of Electrification and Remote-Controlled Winches

The market is witnessing a shift toward electric winches with wireless and smart control features, improving operator safety and ease of use. These systems allow remote operation, reducing manual intervention and enhancing precision during lifting or pulling tasks. Growth in battery-powered winches is supported by demand for eco-friendly solutions in urban construction and logistics. Manufacturers are focusing on integrating IoT and load-monitoring sensors, offering predictive maintenance capabilities and performance analytics for better efficiency and reduced downtime.

- For instance, Kongsberg Maritime introduced a frequency converter-driven electric towing winch in May 2025 designed for tug operations, improving operational efficiency and reducing environmental footprint compared to hydraulic alternatives.

Rising Opportunities in Defense and Specialty Applications

The defense sector presents strong growth opportunities as winches are crucial for vehicle recovery, aircraft handling, and tactical field operations. Military modernization programs across North America, Europe, and Asia-Pacific are driving procurement of heavy-duty hydraulic winches with advanced safety features. Specialty applications, including forestry, mining, and disaster recovery, are also contributing to demand. Manufacturers developing modular and portable winches suitable for extreme conditions and remote locations are likely to gain a competitive edge in this growing segment.

- For instance, Thern is a well-established manufacturer of industrial winches, cranes, and hoists. They offer custom engineering services to tailor products for specific projects across numerous industries, including wastewater management, aerospace, and construction.

Key Challenges

High Installation and Maintenance Costs

The high cost of heavy-duty winches, particularly hydraulic systems, poses a challenge for small contractors and fleet operators. Additional expenses for installation, hydraulic fluid maintenance, and skilled labor raise the total cost of ownership. This cost barrier slows adoption in price-sensitive markets despite the growing need for lifting and pulling solutions. Suppliers are working on cost-effective designs and modular systems to address these challenges and attract a wider customer base.

Operational Risks and Safety Concerns

Winch operations carry risks of cable snapping, overloading, and operator injury if not used correctly. Safety regulations are becoming stricter, requiring manufacturers to integrate fail-safe mechanisms, overload protection, and improved braking systems. Training gaps and lack of skilled operators in developing regions further increase the risk of accidents. Addressing these concerns through automation, advanced control systems, and proper operator training is critical to ensuring safe and reliable market growth.

Regional Analysis

North America

North America held 33% share in 2024, driven by strong demand from construction, oil and gas, and automotive recovery sectors. The United States leads the region with significant investments in infrastructure modernization and pipeline projects, supporting hydraulic winch adoption. Growth in adventure tourism and off-road vehicle usage further boosts electric winch demand. Canada contributes with increased mining and forestry operations, requiring robust lifting and pulling solutions. High adoption of advanced, automated winches and strict workplace safety regulations encourage investment in premium equipment with remote-control features and enhanced load-monitoring capabilities.

Europe

Europe accounted for 28% share in 2024, supported by extensive use of winches in construction, port operations, and renewable energy projects. Germany, the U.K., and France drive growth through large-scale infrastructure and offshore wind farm installations. The region emphasizes energy-efficient and low-noise equipment to comply with environmental standards, creating opportunities for electric and hybrid winches. Demand for specialized winches in shipbuilding and defense applications is rising steadily. European manufacturers focus on integrating automation and safety systems, strengthening their position in a market characterized by strict operational and quality regulations.

Asia-Pacific

Asia-Pacific led the global winch market with 31% share in 2024, fueled by rapid industrialization and urbanization in China, India, and Southeast Asia. Large infrastructure projects, including highways, metros, and ports, drive significant demand for planetary and hydraulic winches. Rising shipbuilding activities and offshore oil exploration add to growth. The region also benefits from the increasing adoption of electric winches for cost-efficient vehicle recovery and material handling. Manufacturers are focusing on local production and affordable models to meet the price-sensitive market, while government investment in smart city development continues to support strong demand.

Latin America

Latin America captured 5% share in 2024, with demand concentrated in Brazil, Mexico, and Chile. The market benefits from expanding mining operations and construction projects, which require durable and high-capacity winches. The oil and gas industry, particularly offshore exploration in Brazil, contributes to hydraulic winch installations. However, slower economic growth and budget constraints limit faster adoption of advanced automated systems. Opportunities exist for manufacturers to introduce cost-effective, low-maintenance winches to meet regional needs, focusing on reliability and ease of operation for use in remote locations with limited technical support.

Middle East & Africa

The Middle East & Africa region accounted for 3% share in 2024, supported by demand from oil and gas, construction, and defense sectors. Gulf nations invest heavily in infrastructure and offshore projects, creating consistent demand for hydraulic winches. Africa contributes through mining and utility projects requiring portable and rugged lifting solutions. The region is gradually adopting advanced safety features and automation to improve efficiency under challenging operational environments. Suppliers offering corrosion-resistant, high-performance winches tailored to extreme climates are positioned to gain traction in this cost-sensitive but steadily growing market.

Market Segmentations:

By Product Type

By Operation

- Hydraulic

- Electric

- Pneumatic

- Manual

By Application

- Commercial Recovery

- Mobile Crane

- Military

- Others

By End Use Industry

- Oil & Gas

- Marine

- Mining

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the winch market includes leading players such as TWG, A Dover Company, Ingersoll Rand Inc., Ramsey Winch, Warn Industries, Inc., Mile Marker Industries, LLC, Superwinch, PACCAR Winch Division, Rotzler GmbH + Co. KG, Thern, Inc., and Winches Inc. These companies focus on developing high-performance planetary and hydraulic winches to cater to construction, marine, and automotive recovery sectors. Strategies include continuous investment in product innovation, integration of remote-control systems, and development of energy-efficient solutions to meet sustainability goals. Many players are expanding their global footprint through partnerships and distributor networks, ensuring availability across key growth regions like Asia-Pacific and North America. Emphasis is placed on manufacturing durable, corrosion-resistant equipment for offshore and heavy-duty applications. Competitive pricing, aftersales support, and customized winch solutions remain key differentiators as companies aim to strengthen market presence and capture growing demand across multiple end-use industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, At SEMA 2024, Mile Marker showcased its Rhino Pull 1000 Portable Electric Winch, engineered for rugged off-road use with a line pull capacity of 1,000 lbs and featuring enhanced thermal protection allowing continuous operation for up to 30 minutes without overheating.

- In November 2024, PACCAR Winch Division Black Phoenix Group acquired PACCAR Winch from PACCAR Inc., effective October 31, 2024.

- In 2024, Thern launched its Series 3000 electric winch with a 10,000 lbs rated line pull, featuring enhanced durability motors with a thermal cutoff rated for 40 minutes of continuous operation

- In October 2023, TWG announced launch of the dp EL22 Electric Winch, rated for 22,000 lb line-pull

Report Coverage

The research report offers an in-depth analysis based on Product Type, Operation, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for winches will rise steadily with growing construction, infrastructure, and industrial projects worldwide.

- Planetary winches will continue to dominate due to their high efficiency and load-handling capacity.

- Hydraulic winches will see strong demand in offshore, marine, and heavy-duty applications.

- Electric winches will gain traction with increased adoption in vehicle recovery and light lifting operations.

- Asia-Pacific will remain a key growth region supported by urbanization and port development projects.

- Remote-controlled and IoT-enabled winches will become standard for improved safety and monitoring.

- Manufacturers will focus on developing corrosion-resistant and energy-efficient designs for harsh environments.

- Defense and specialty applications will create new opportunities for heavy-duty and portable winches.

- Growth in 4×4 off-road activities will boost demand for compact and high-performance winches.

- Strategic collaborations and distribution expansion will help players strengthen global market presence.