Market Overview:

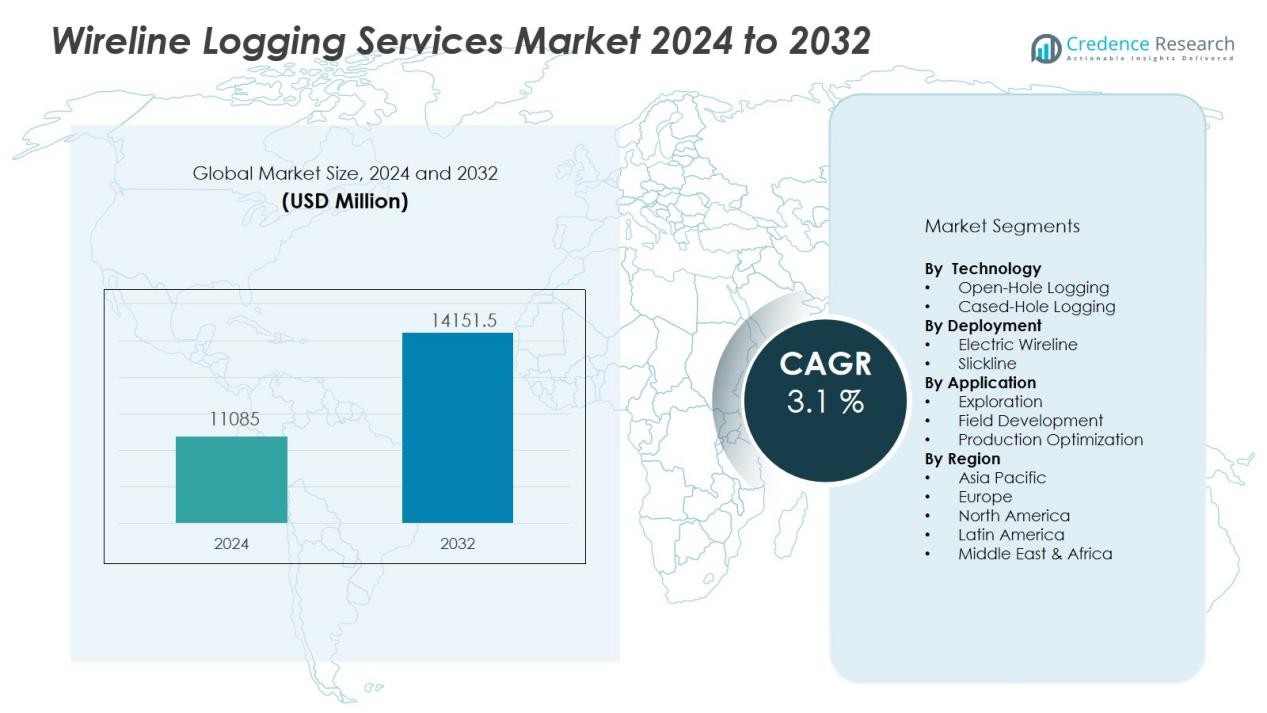

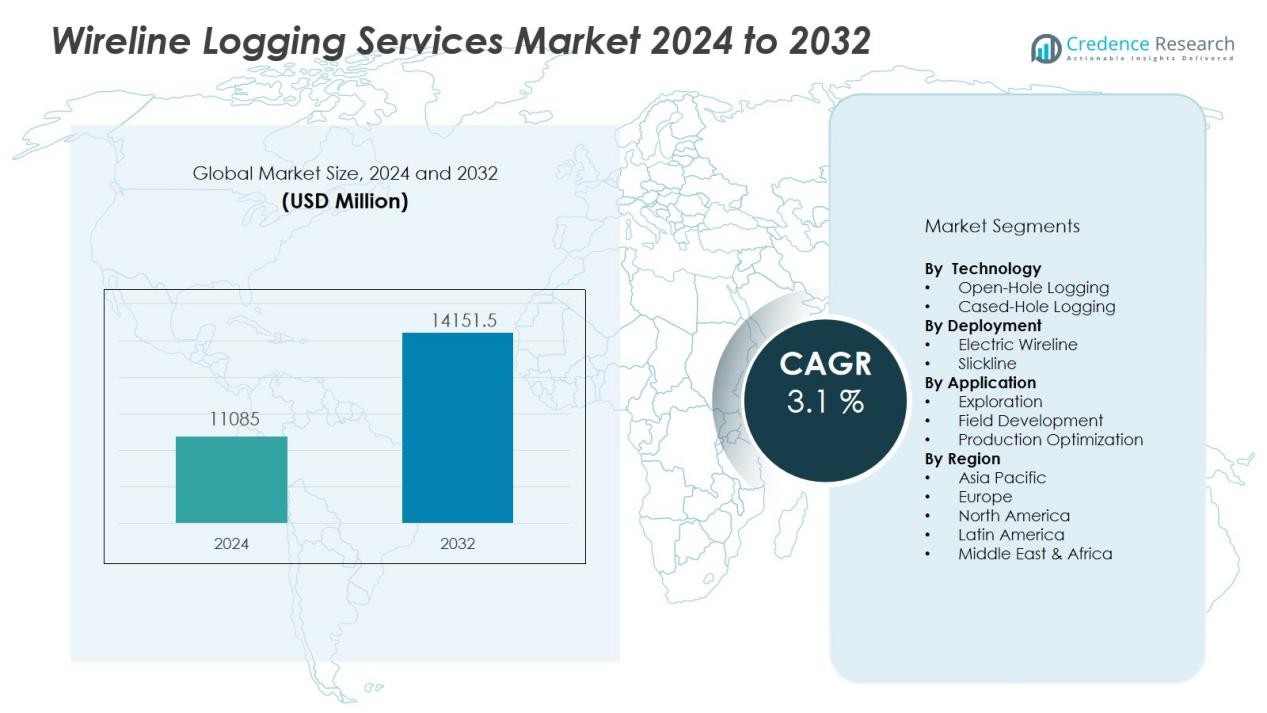

The Wireline logging services market size was valued at USD 11085 million in 2024 and is anticipated to reach USD 14151.5 million by 2032, at a CAGR of 3.1 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireline logging services market Size 2024 |

USD 11085 Million |

| Wireline logging services market, CAGR |

3.1 % |

| Wireline logging services market Size 2032 |

USD 14151.5 Million |

Key market drivers include rising global energy demand, increased investments in deepwater and unconventional hydrocarbon exploration, and the growing adoption of digital oilfield technologies. Operators prioritize precise formation evaluation to maximize recovery rates and optimize field development strategies, driving the uptake of wireline logging solutions. Technological advancements, such as advanced imaging tools and integration with cloud-based analytics, further enhance operational efficiency, data accuracy, and well integrity monitoring.

Regionally, North America dominates the wireline logging services market due to extensive shale development and robust exploration activity in the United States and Canada. The Middle East and Asia-Pacific regions are poised for significant growth, supported by expanding upstream investments and national initiatives to boost hydrocarbon output. Europe maintains a steady share, driven by ongoing offshore and mature field developments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The wireline logging services market reached USD 11,085 million in 2024 and is set to climb to USD 14,151.5 million by 2032, with a CAGR of 3.1%.

- Rising global energy demand and expanding deepwater and unconventional oil and gas exploration drive steady market growth.

- Operators focus on precise formation evaluation and recovery optimization, fueling the adoption of advanced wireline logging solutions.

- Technological advancements—including high-resolution imaging and cloud-based analytics—enhance data accuracy and operational efficiency.

- North America leads the market with a 38% share, followed by the Middle East at 27%, and Asia-Pacific at 19%, reflecting robust exploration and infrastructure investment.

- High operational costs, technical complexity, and regulatory pressures challenge market adoption, especially in deepwater and unconventional projects.

- Emerging markets in Asia-Pacific and Latin America present strong growth potential as national oil companies pursue new field development and unconventional resource expansion.

Market Drivers:

Rising Global Demand for Hydrocarbon Resources Fuels Service Adoption:

The wireline logging services market benefits from strong global demand for oil and natural gas, which compels exploration and production companies to intensify efforts to discover and develop new reserves. With energy consumption on the rise in both mature and emerging economies, operators increase drilling activities across conventional and unconventional fields. The wireline logging services market supports these efforts by providing vital downhole data that guides resource evaluation and production planning. It enables companies to optimize extraction strategies and maximize reservoir potential.

- For instance, Baker Hughes’ Proxima advanced logging services recorded full-resolution log data at speeds up to 60 ft/min on open-hole wells in 2024.

Advancements in Digital Oilfield Technologies Drive Precision and Efficiency:

Innovations in digital oilfield technologies play a critical role in accelerating the adoption of wireline logging services. Integration of real-time data acquisition, advanced sensors, and cloud-based analytics enables operators to obtain more accurate and timely formation data. The wireline logging services market leverages these advancements to deliver improved operational efficiency, minimize downtime, and enhance decision-making for field development. It supports data-driven exploration with robust formation evaluation and reservoir monitoring capabilities.

- For instance, Schlumberger has filed 256 patents related to digital oilfield technologies, demonstrating continuous innovation and leadership in real-time monitoring, data acquisition, and digital integration since the late 1970s.

Expansion of Unconventional and Deepwater Exploration Initiatives:

Expanding investment in unconventional and deepwater hydrocarbon exploration underpins growth in the wireline logging services market. Operators face increasing geological complexity and technical challenges in these environments, requiring high-precision formation evaluation. The market responds with advanced wireline logging tools that provide detailed reservoir insights, reduce drilling risks, and support well integrity. It plays a vital role in enabling safe and cost-effective operations in challenging exploration frontiers.

Focus on Reservoir Optimization and Enhanced Recovery Techniques:

A growing emphasis on maximizing recovery rates from both new and mature fields propels the demand for sophisticated wireline logging services. Operators use high-resolution logging tools to monitor reservoir conditions and optimize secondary and tertiary recovery methods. The wireline logging services market provides the technology and expertise needed to track reservoir performance and extend productive field life. It ensures operators can extract maximum value from their assets while maintaining operational safety and efficiency.

Market Trends:

Integration of Digital Technologies and Real-Time Data Analytics Transforms Operations:

The wireline logging services market is experiencing a shift toward digitalization and real-time analytics, reshaping how operators collect, process, and interpret subsurface data. Companies deploy advanced wireline tools equipped with high-resolution sensors and telemetry systems to transmit formation data instantly from wellsite to command centers. This trend supports data-driven decision-making, shortens the time between acquisition and analysis, and enables proactive adjustments to drilling or completion operations. The market responds with cloud-based platforms that streamline data integration and enhance collaboration between geoscientists and field teams. It creates new opportunities for remote operations, predictive maintenance, and seamless digital workflows across global assets.

- For instance, Schlumberger’s Performance Live digital ecosystem covered more than 12,000 wireline operation runs globally, including over 230 reservoir and well integrity evaluations offshore Norway in a single year, delivering real-time data and collaboration across teams.

Emphasis on Advanced Imaging and Multi-Parameter Logging Solutions:

Demand for advanced imaging and multi-parameter logging solutions is reshaping the wireline logging services market, reflecting operators’ need for more comprehensive reservoir characterization. The market now features high-definition borehole imaging, acoustic, and nuclear magnetic resonance tools that provide detailed insights into lithology, fluid properties, and formation boundaries. This shift supports accurate formation evaluation in both conventional and complex unconventional environments. Service providers develop modular and combinable tool strings that deliver tailored logging suites, improving operational efficiency and data quality. It meets the industry’s focus on reducing uncertainty, optimizing resource development, and ensuring well integrity throughout the asset lifecycle.

- For instance, Halliburton’s EarthStar resistivity LWD service can map reservoir and fluid boundaries more than 225 feet (68 meters) from the wellbore, doubling the range of previous technologies and enabling improved well placement with 3D images for real-time geosteering.

Market Challenges Analysis:

High Operational Costs and Complex Technical Requirements Limit Adoption:

The wireline logging services market faces significant challenges from high operational costs and complex technical requirements, particularly in deepwater and unconventional reservoirs. Service providers must invest in advanced equipment, skilled personnel, and specialized logistics to ensure reliable performance in harsh environments. These factors increase overall project costs and can limit the willingness of operators to deploy comprehensive logging programs in marginal fields. It must address evolving customer expectations for cost efficiency and robust data delivery, which require ongoing investment in both technology and workforce development.

Regulatory Pressures and Environmental Concerns Influence Market Dynamics:

Tighter regulations on well integrity, emissions, and environmental impact exert added pressure on the wireline logging services market. Regulatory agencies demand rigorous documentation, transparency, and compliance with safety standards, increasing the administrative and operational burden for service providers. Heightened environmental awareness drives the adoption of more sustainable practices and technologies, but it can also slow project timelines and add to costs. The market must balance the need for innovation with the imperative to meet regulatory and sustainability objectives across global operations.

Market Opportunities:

Growth Potential in Emerging Markets and Unconventional Resource Development:

The wireline logging services market holds strong growth potential in emerging markets, where expanding oil and gas activities create fresh demand for advanced formation evaluation solutions. National oil companies and independent operators in regions such as Asia-Pacific, Latin America, and Africa invest heavily in new exploration and field development. The market can capture new business by offering tailored services and technology suited for local geological conditions and operational requirements. It also benefits from increased focus on unconventional resources, such as shale and tight reservoirs, which require sophisticated logging and data interpretation capabilities.

Opportunities Driven by Digitalization and Remote Operations:

Digital transformation and remote operation technologies present significant opportunities for the wireline logging services market. Service providers leverage automation, cloud-based analytics, and real-time data platforms to enhance efficiency and deliver high-value insights across geographically dispersed assets. It can strengthen its value proposition by enabling remote monitoring, faster decision-making, and reduced operational risk. The adoption of digital twins and predictive maintenance solutions further expands the market’s potential to support cost-effective and future-ready oilfield operations.

Market Segmentation Analysis:

By Technology:

The wireline logging services market includes open-hole logging and cased-hole logging as primary technology segments. Open-hole logging dominates due to its crucial role in formation evaluation immediately after drilling, delivering comprehensive data on lithology, porosity, and fluid content. Cased-hole logging gains traction for well integrity assessment, production logging, and reservoir monitoring in mature fields. Service providers enhance both segments with digital sensors and high-resolution imaging to deliver more accurate downhole information.

- For instance, Halliburton’s X-tended Range Micro Imager (XRMI™) tool achieves a fivefold improvement in signal-to-noise ratio and a threefold expansion in dynamic range, providing superior borehole images even in highly resistive formations exceeding 2,000 ohm-m.

By Application:

Applications in the wireline logging services market span exploration, field development, and production optimization. Exploration activities leverage wireline logging to identify hydrocarbon zones and reduce drilling risks. Field development teams use advanced logging to design completion strategies and maximize reservoir productivity. Production optimization relies on continuous well monitoring and intervention using cased-hole logging, supporting efficient resource recovery and field longevity.

- For instance, Baker Hughes’s STAR Imager™ service captures 144 independent microresistivity measurements per logging run at a vertical resolution of 0.2 in—enabling clear identification of thin pay zones even in highly laminated formations. (144).

By Deployment:

The wireline logging services market segments by deployment into electric wireline and slickline services. Electric wireline holds the largest share, driven by its ability to provide real-time data transmission and support for complex measurement tools. Slickline services remain essential for basic downhole operations, such as mechanical intervention and valve adjustment, particularly in brownfield environments. The market supports both deployment types with technological upgrades, meeting a range of operational needs across the well lifecycle.

Segmentations:

By Technology:

- Open-Hole Logging

- Cased-Hole Logging

By Application:

- Exploration

- Field Development

- Production Optimization

By Deployment:

- Electric Wireline

- Slickline

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America accounts for 38% share of the global wireline logging services market, driven by robust shale oil and gas development across the United States and Canada. The region benefits from high drilling activity, advanced horizontal well designs, and extensive adoption of digital oilfield solutions. Service providers invest heavily in research and technology to deliver high-precision formation evaluation, supporting operators in maximizing recovery from unconventional reservoirs. The market in North America remains highly competitive, with a focus on operational efficiency and continuous improvement. It attracts ongoing investments as companies seek to maintain production levels and optimize mature fields. Regulatory clarity and strong infrastructure support the sustained growth of wireline services in this region.

Middle East :

The Middle East holds a 27% share of the wireline logging services market, reflecting its position as a global hub for oil production and upstream investments. Regional oil companies and international operators prioritize high-value, large-scale projects, driving consistent demand for wireline logging and reservoir monitoring. The market thrives on national strategies to increase output, develop unconventional resources, and enhance recovery rates in mature fields. Service providers deliver advanced technologies and tailored solutions to meet complex operational challenges across onshore and offshore environments. It benefits from strong governmental support and streamlined approval processes, which encourage the deployment of innovative logging tools. The region continues to attract major contracts and partnership agreements, bolstering its market presence.

Asia-Pacific and Latin America :

Asia-Pacific holds a 19% share of the global wireline logging services market, supported by active exploration, field redevelopment, and infrastructure upgrades in countries such as China, India, and Australia. National oil companies and private players invest in deepwater and onshore projects, driving steady adoption of advanced logging solutions. The region’s demand for energy and focus on unconventional resource development fuel further market growth. Latin America contributes a 10% share, with Brazil, Argentina, and Mexico leading new investments and offshore exploration campaigns. It benefits from increased interest in frontier basins and efforts to attract foreign capital for upstream development. Both regions present strategic growth opportunities for service providers seeking to expand their footprint and offer differentiated technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The wireline logging services market features intense competition among global leaders and specialized regional players. Key companies such as Expro Group, Halliburton, Pioneer Energy Services Corp., Baker Hughes Company, Casedhole Solutions, Inc., and Nabors Industries Ltd. shape the market landscape with extensive technology portfolios and global reach. These providers invest in innovation, digital integration, and advanced logging tools to address complex reservoir challenges and win long-term service contracts. The market values reliability, technical expertise, and rapid data delivery, driving firms to differentiate through real-time analytics and customized solutions. Leading players strengthen their competitive position through strategic alliances, acquisitions, and strong customer relationships. It rewards companies that can consistently deliver operational efficiency, reduce project risk, and support lifecycle reservoir management for both conventional and unconventional resources.

Recent Developments:

- In May 2024, Expro completed acquisition of Coretrax, a UK-based firm specializing in performance drilling tools and wellbore cleanup, expanding its well construction and intervention solutions footprint.

- In July 2025, Baker Hughes announced on July 29, 2025, a definitive agreement to acquire Chart Industries for $13.6 billion, aiming to accelerate its energy and industrial technology strategy. The acquisition is expected to complete by mid-2026, pending regulatory approval.

- In March 2025, Nabors Industries completed its acquisition of Parker Wellbore, including Quail Tools, expanding its drilling solutions and services.

Market Concentration & Characteristics:

The wireline logging services market remains moderately concentrated, with a few global players controlling a significant share and numerous regional companies serving niche requirements. It features strong competition among leading service providers that invest in advanced technologies, comprehensive service portfolios, and customer relationships to secure long-term contracts. Major companies leverage global networks and technical expertise to address diverse reservoir challenges across different geographies. The market is characterized by high entry barriers due to technological complexity, capital intensity, and the need for specialized workforce. It evolves with ongoing innovation in digital tools, real-time analytics, and customized solutions tailored to specific exploration environments.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Application, Deployment and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Digital transformation will drive the adoption of real-time data acquisition and advanced analytics in wireline logging operations.

- Service providers will develop more integrated and modular tool suites to meet evolving reservoir evaluation needs.

- Increased exploration in unconventional and deepwater reserves will expand demand for high-precision wireline logging services.

- Remote operations and automation will enhance efficiency, safety, and operational cost control for oil and gas companies.

- Growth in emerging markets, especially in Asia-Pacific and Africa, will open new business opportunities for service providers.

- Companies will prioritize environmentally responsible technologies to address stricter regulatory and sustainability requirements.

- Collaboration between oilfield service companies and technology firms will accelerate the introduction of next-generation logging solutions.

- Data-driven decision-making will play a larger role in optimizing production strategies and improving well performance.

- Investment in workforce training and digital skill development will become essential for service providers to maintain competitiveness.

- The market will see increased focus on lifecycle reservoir management, with services extending from exploration to enhanced recovery phases.