Market Overview

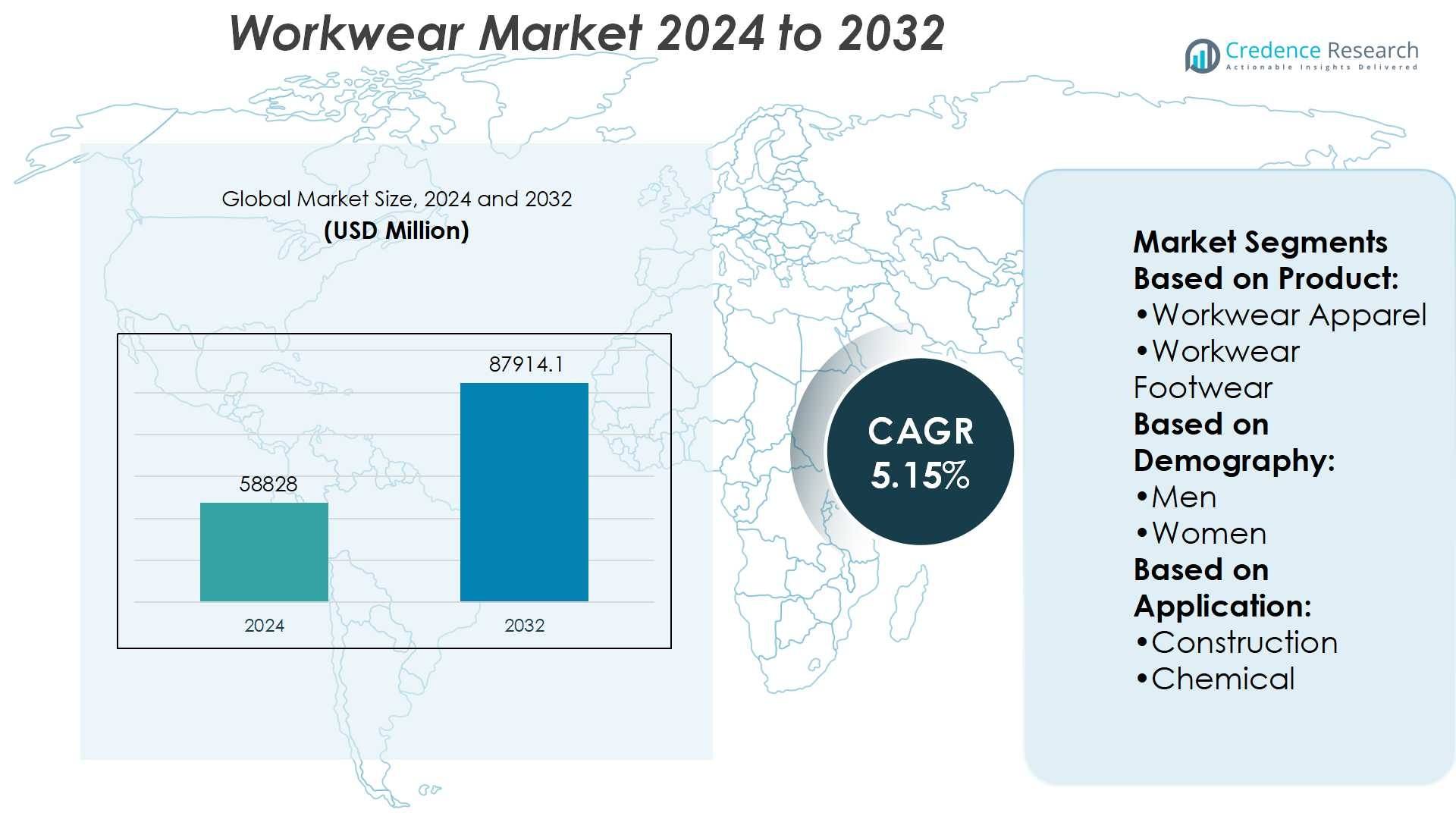

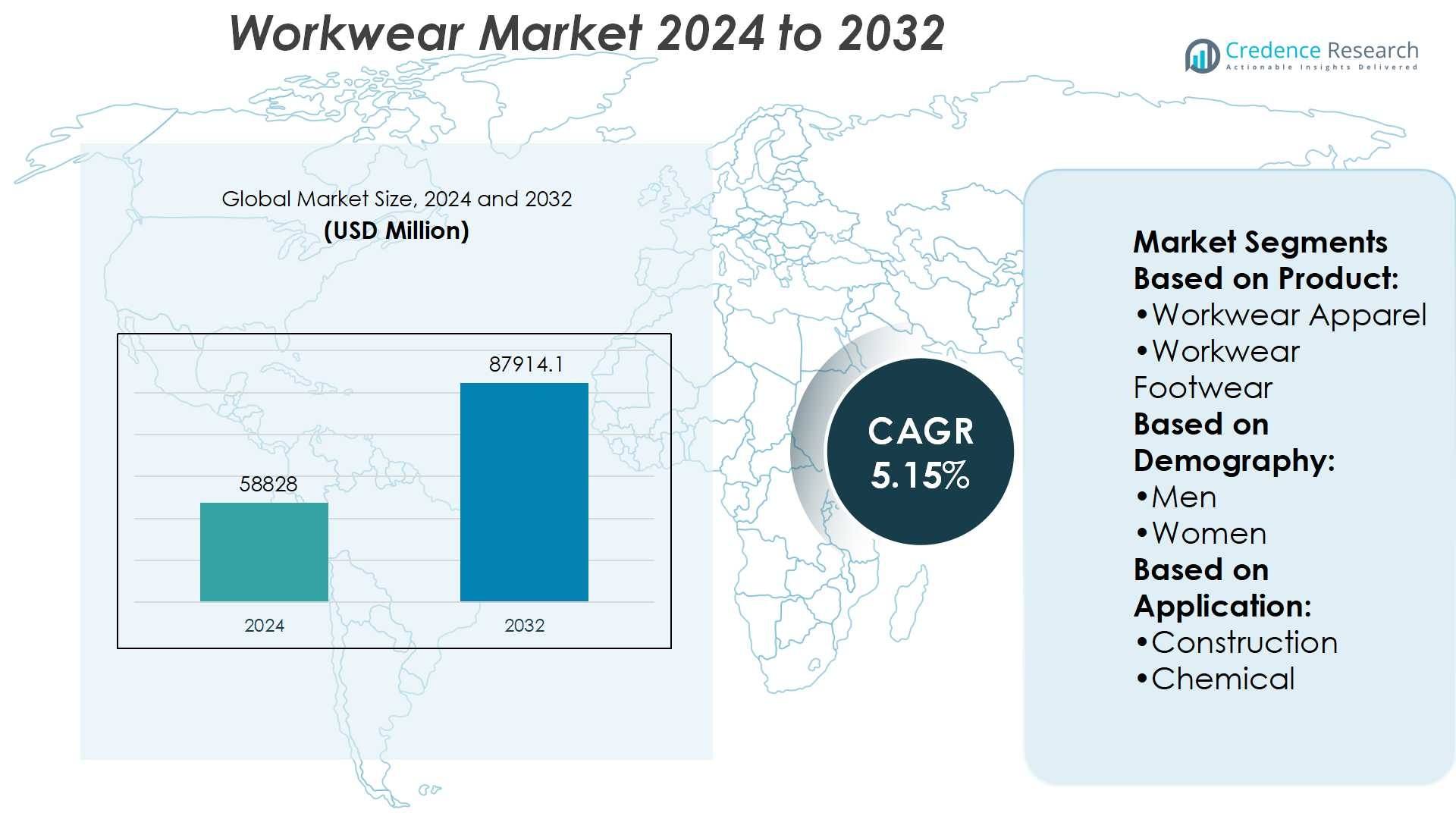

Workwear Market size was valued at USD 58828 million in 2024 and is anticipated to reach USD 87914.1 million by 2032, at a CAGR of 5.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Workwear Market Size 2024 |

USD 58828 Million |

| Workwear Market, CAGR |

5.15% |

| Workwear Market Size 2032 |

USD 87914.1 Million |

The Workwear Market is driven by rising workplace safety regulations, industrial expansion, and growing demand for durable protective clothing across construction, power, and chemical sectors. Companies invest in certified apparel and footwear to comply with strict safety standards while addressing workforce comfort. Sustainability drives adoption of eco-friendly fabrics, while customization supports branding and corporate identity. Trends highlight increasing use of smart textiles with monitoring features, fashion-oriented designs that enhance worker morale, and the expansion of e-commerce channels for faster procurement. Innovation in fabric technology and the shift toward inclusive workwear for women further shape market development.

The Workwear Market shows strong geographical presence, with Asia Pacific leading due to rapid industrialization, North America driven by strict safety regulations, and Europe emphasizing sustainability and compliance. Latin America and the Middle East & Africa record steady growth with expanding infrastructure projects. Key players shaping the market include Honeywell International, Inc., Carhartt, Inc., 3M, Ansell Ltd., Kimberly-Clark Corporation, Aramark (Vestis), Alexandra, A. Lafont SAS, Alsico Group, and Hard Yakka, each focusing on innovation, safety, and global expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Workwear Market was valued at USD 58,828 million in 2024 and is projected to reach USD 87,914.1 million by 2032, at a CAGR of 5.15%.

- Rising workplace safety regulations and industrial expansion drive demand for certified protective clothing.

- Growing adoption of eco-friendly fabrics and sustainable production methods shapes long-term market trends.

- Competition intensifies as global and regional players focus on innovation, customization, and rental service models.

- High costs of advanced materials and regulatory compliance create restraints for smaller enterprises.

- Asia Pacific leads the market, North America follows with strict safety standards, while Europe emphasizes sustainability; Latin America and the Middle East & Africa record steady growth.

- Key players such as Honeywell International, Carhartt, 3M, Ansell, Kimberly-Clark, Aramark, Alexandra, A. Lafont SAS, Alsico Group, and Hard Yakka strengthen market presence through product innovation and global expansion.

Market Drivers

Rising Focus on Workplace Safety and Employee Protection

The Workwear Market is strongly influenced by growing workplace safety regulations across industries. Governments and industry bodies enforce strict compliance standards to reduce accidents and improve worker protection. Companies adopt durable and functional workwear to safeguard employees in hazardous environments. Safety gear such as flame-resistant clothing, high-visibility jackets, and protective footwear gains priority. It supports industries like construction, mining, and oil and gas where risks are high. Employers view investment in quality workwear as a direct step toward compliance and workforce safety.

- For instance, Honeywell’s North Air-Fed Suit line includes models with built-in respiratory protection and ventilated full-body suits (size T05 and T06), each case package holding 8 units per case at a case weight of about 44.09 lbs, used in chemical and nuclear environments.

Growing Demand Across Expanding Industrial Sectors

The Workwear Market benefits from the expansion of manufacturing, construction, and logistics industries. Rapid industrialization in emerging economies drives the need for protective clothing at scale. Businesses seek uniforms that combine safety with comfort to meet productivity goals. It aligns with rising urban development projects and global infrastructure investments. Service-based industries, including healthcare and hospitality, also contribute by demanding functional and professional attire. This broad industrial adoption ensures consistent growth opportunities for manufacturers and suppliers.

- For instance, Alexandra’s men’s epaulette tunic (model H572) is manufactured in a 65% polyester / 35% cotton blend with a fabric weight of 210 grams per square meter, is designed for up to a 60-degree Celsius wash in industrial laundry, and features self-fabric epaulette bars to fit D101 epaulettes.

Increased Emphasis on Branding and Corporate Identity

The Workwear Market is also driven by corporate identity and branding requirements. Companies adopt customized uniforms to create a unified workforce image. Uniforms with logos, colors, and consistent designs enhance recognition and professionalism. It supports customer-facing sectors such as retail, hospitality, and aviation where image is critical. Employers use branded workwear as a marketing tool that improves visibility and strengthens brand recall. The trend elevates workwear from a safety measure to a business strategy.

Technological Advancements in Fabric and Design Innovation

The Workwear Market is further shaped by innovation in fabric technology and design. Advanced textiles improve durability, breathability, and protection against environmental hazards. Companies develop smart fabrics with moisture control, flame resistance, and antibacterial properties. It encourages adoption in industries requiring high-performance gear under extreme conditions. Lightweight materials and ergonomic designs increase comfort while reducing fatigue during long work shifts. These advancements make workwear more functional and appealing, strengthening its role in modern workplaces.

Market Trends

Rising Adoption of Sustainable and Eco-Friendly Materials

The Workwear Market is experiencing a strong shift toward eco-friendly fabrics. Manufacturers focus on organic cotton, recycled polyester, and biodegradable fibers to reduce environmental impact. It addresses growing demand for sustainable business practices across industries. Companies adopt green certifications to highlight their commitment to responsible sourcing. Workers increasingly prefer sustainable uniforms for comfort and environmental awareness. This trend aligns with global policies promoting reduced carbon footprints in textile production.

- For instance, Ansell’s “Ansell Earth” line includes over 80 new or updated gloves designed with reduced environmental footprint, using more than one bio-based or recycled material per glove.

Integration of Smart Textiles and Wearable Technology

The Workwear Market is shaped by innovations in smart clothing and digital features. Firms develop uniforms with sensors to track body temperature, heart rate, and fatigue. It enhances worker safety in high-risk sectors such as mining, energy, and construction. Smart fabrics with embedded communication systems support real-time monitoring and alerts. Employers adopt these solutions to improve workplace productivity and safety compliance. The integration of technology into workwear creates new value for both workers and organizations.

- For instance, Kimberly-Clark describes a multicomponent fiber textile that changes cross-sectional area by between 5% and 50% and adjusts surface bulk by between 5% and 50% over a temperature range from 32 °F to 120 °F.

Growing Demand for Fashion-Oriented and Comfortable Workwear

The Workwear Market is influenced by employee demand for stylish and comfortable designs. Companies invest in uniforms that balance safety with modern fashion appeal. It helps improve worker morale and employer branding in competitive industries. Lightweight fabrics, ergonomic fits, and versatile styles dominate procurement choices. Service sectors such as hospitality and retail prefer workwear that reinforces professional image while ensuring comfort. This trend expands the role of workwear beyond protection to include identity and lifestyle appeal.

Expansion of E-Commerce and Direct-to-Consumer Channels

The Workwear Market is impacted by the rapid growth of online distribution. Suppliers leverage digital platforms to reach global buyers and streamline procurement. It simplifies purchasing for small and medium enterprises lacking dedicated supply partners. E-commerce platforms offer customization options, fast delivery, and competitive pricing. Manufacturers build online catalogs showcasing sustainable fabrics and smart workwear solutions. This trend strengthens accessibility and accelerates market penetration across diverse industries.

Market Challenges Analysis

High Costs of Advanced Materials and Compliance Standards

The Workwear Market faces challenges linked to the high costs of advanced protective fabrics. Manufacturers using flame-resistant, antimicrobial, or smart textiles incur significant production expenses. It creates pricing pressure for companies seeking large-scale procurement. Small and medium enterprises struggle to balance compliance with strict safety standards and budget constraints. Regional variations in regulations further complicate supply strategies and increase certification costs. This cost burden limits accessibility for businesses operating in low-margin sectors.

Complex Supply Chains and Rising Competition

The Workwear Market is challenged by supply chain disruptions and intense market competition. Fluctuations in raw material availability affect production timelines and consistency. It impacts manufacturers relying on global suppliers for textiles and specialty components. Intense competition among local and international players drives price wars and margin pressure. Counterfeit and low-quality products also threaten brand reputation and customer trust. Managing these risks while maintaining product quality and timely delivery remains a critical challenge for industry participants.

Market Opportunities

Expansion into Emerging Economies and Industrial Growth

The Workwear Market holds strong opportunities in emerging economies with rapid industrial expansion. Infrastructure projects, construction activities, and manufacturing hubs in Asia Pacific, Latin America, and Africa increase demand for protective uniforms. It creates growth avenues for global suppliers aiming to serve high-volume markets. Governments in these regions implement stricter workplace safety regulations, driving procurement of certified workwear. Local players collaborate with international brands to meet rising expectations for durability and compliance. Expanding industrial bases provide long-term prospects for sustained revenue generation.

Innovation in Customization and Smart Workwear Solutions

The Workwear Market benefits from growing demand for personalized and technology-enabled solutions. Employers seek customized uniforms that reflect brand identity while ensuring worker protection. It strengthens opportunities for suppliers offering logo printing, design flexibility, and tailored fits. Smart workwear integrated with sensors, communication tools, and monitoring capabilities appeals to industries with safety-critical operations. Demand for sustainable and multifunctional fabrics further supports innovation in design. Companies investing in these advancements can capture premium segments and differentiate in competitive markets.

Market Segmentation Analysis:

By Product

The Workwear Market is segmented into workwear apparel and workwear footwear, both serving essential roles in workplace safety. Workwear apparel dominates demand due to its widespread use across industries including construction, chemical, and power. It covers protective suits, jackets, coveralls, and high-visibility clothing designed to meet regulatory safety standards. Employers prioritize apparel that combines durability, comfort, and compliance with industry-specific risks. Workwear footwear represents a growing segment supported by demand for slip-resistant, steel-toe, and heat-resistant shoes. Expanding awareness of foot safety in hazardous environments sustains steady adoption of protective footwear across industrial sectors.

- For instance, Alsico’s “Alsi-flex” fabric is made of 79 % recycled and renewable polyester and 21 % sustainably sourced cotton; this fabric delivers permanent weft stretch of at least 25 % and passes industrial washes at 75 °C.

By Demography

The Workwear Market by demography is divided into men and women, reflecting a shift toward inclusive and specialized product lines. Men account for a significant share due to their higher representation in heavy industries such as construction and power generation. It drives strong demand for rugged, functional, and performance-oriented workwear. Women form an increasingly important segment, supported by rising participation in industrial, scientific, and technical fields. Employers recognize the need for tailored fits and gender-specific designs to ensure comfort and safety. Growing awareness of inclusivity in workplace policies further encourages suppliers to expand offerings for female workers.

- For instance, 3M’s Protective Coverall 4520 is available in sizes ranging from Medium to 4X-Large, features an anatomical fit with extra room in arms and legs to enhance mobility, is made of SMS material, and includes elastic wrists, ankles, and waist for a secure fit.

By Application

The Workwear Market by application includes construction, chemical, biological, and power sectors, each with distinct requirements. Construction leads in adoption with high demand for helmets, high-visibility apparel, durable gloves, and safety footwear. It reflects the need for multi-protection solutions in high-risk environments. The chemical and biological segments demand specialized protective suits resistant to hazardous substances, ensuring compliance with occupational safety standards. The power sector requires flame-resistant apparel, insulated gloves, and arc-protective clothing to address extreme safety risks. Increasing investments in infrastructure, healthcare, and energy projects globally reinforce application-driven growth in the market.

Segments:

Based on Product:

- Workwear Apparel

- Workwear Footwear

Based on Demography:

Based on Application:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a 23.8% share of the Workwear Market in 2024, making it the second-largest regional segment. The United States dominates with 79.6% of regional revenue, supported by advanced industrial sectors and stringent occupational safety regulations. The region’s demand is concentrated in oil & gas, construction, mining, power generation, and healthcare. Companies prioritize premium-quality apparel with flame resistance, high visibility, and ergonomic design. Employers also adopt sustainable textiles and smart fabrics to comply with corporate and regulatory sustainability goals. Replacement cycles remain frequent because of strict safety compliance requirements, driving recurring revenue. North America’s focus on innovation, safety, and sustainability secures its strong position in the global market.

Europe

Europe accounts for 15% of the Workwear Market in 2024. Germany leads within the region, contributing 23.3% of total European revenue, driven by its strong automotive, construction, and engineering industries. The European Union enforces high standards for safety and sustainability, prompting companies to adopt eco-friendly and regulation-compliant materials. European consumers and businesses prefer durable, comfortable, and modern designs, especially in logistics, hospitality, and retail. Suppliers respond by investing in circular economy practices and using recycled fibers to reduce environmental impact. Innovation in design and focus on compliance help sustain steady demand across industrial and service sectors. Europe remains a highly regulated and influential market where sustainability and safety standards set the pace.

Asia Pacific

Asia Pacific dominates the Workwear Market with a 42.6% share in 2024, the largest among all regions. Industrial expansion in China, India, Vietnam, and Indonesia continues to drive significant demand. The region benefits from large labor forces, low-cost manufacturing, and strict safety regulations being introduced across multiple industries. Protective and certified apparel is widely used in construction, mining, and manufacturing. E-commerce platforms enhance accessibility, making workwear more available to small and medium enterprises. International suppliers expand operations by forming partnerships with local firms to meet compliance and cost demands. Asia Pacific’s combination of industrial growth, regulatory enforcement, and affordability ensures its continued dominance.

Latin America

Latin America represents between 5% and 10% share of the Workwear Market in 2024. Brazil and Mexico lead demand through infrastructure expansion, construction, and healthcare projects. Workwear adoption is increasing with greater formalization of labor markets and enforcement of safety standards. Local manufacturers supply affordable uniforms, though imported premium workwear remains essential for industries with stricter compliance. Rising investment in industrial and service sectors strengthens long-term opportunities. Demand also expands in professional services, where uniforms support branding and customer engagement. Latin America is growing steadily as safety awareness improves and governments promote workplace protection.

Middle East & Africa

The Middle East & Africa holds an estimated 6% share of the Workwear Market in 2024. Strong demand comes from oil & gas, power, mining, and large-scale infrastructure projects. The region’s hot climate influences demand for lightweight, heat-resistant, and UV-protective clothing. Local production remains limited, with reliance on imports from Asia and Europe to meet demand. Governments continue to strengthen worker safety policies, encouraging adoption of certified protective wear. Global suppliers target MEA by offering climate-appropriate and cost-efficient solutions. The region shows steady growth potential, supported by industrialization and increasing regulatory enforcement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Workwear Market companies include Honeywell International, Inc. (U.S.), A. Lafont SAS (France), Alexandra (U.K.), Ansell Ltd. (Australia), Kimberly-Clark Corporation (U.S.), Carhartt, Inc. (U.S.), Alsico Group (Belgium), 3M (U.S.), Hard Yakka (Australia), and Aramark (Vestis) (U.S.). The Workwear Market is defined by strong competition, with companies prioritizing safety, durability, and compliance to secure market share. Innovation in fabric technology, including flame resistance, antimicrobial protection, and moisture control, drives product differentiation. Sustainability has become a central focus, with manufacturers investing in eco-friendly textiles and circular production models. Digital platforms and e-commerce expand accessibility, allowing firms to serve both large enterprises and small businesses efficiently. Customization, branding, and service-based models such as rental programs further strengthen customer loyalty. Continuous investment in research, regulatory compliance, and global expansion ensures that leading firms remain competitive in this evolving market landscape.

Recent Developments

- In February 2025, Canadian Tire agreed to promote its out of doors and workwear logo, Helly Hansen, to Kontoor Brands. This strategic flow permits Kontoor, recognised for proudly owning Wrangler and Lee brands, to reinforce its portfolio within the out of doors clothing market and power boom.

- In October 2024, Atos announced the launch of its advanced Experience Operations Center (XOC) in collaboration with Nexthink. This innovative offering aims to improve digital workplace operations by enhancing end user experience through real-time, AI-driven efficiencies that boost workplace productivity.

- In July 2024, Ansell completed the acquisition of Kimberly‑Clark’s Personal Protective Equipment (PPE) business, bringing the Kimtech (scientific/cleanroom PPE) and KleenGuard (industrial safety PPE) brands into its portfolio. This strategic move broadens Ansell product offerings with new capabilities like the Right Cycle sustainable‑disposal program and APEX cleanroom services, reinforcing its global leadership in personal protection solutions.

- In February 2024, HCL Technologies Limited launched FlexSpace 5G, an advanced digital workplace experience-as-a-service aimed at enhancing efficiency and security for global businesses. Utilizing Verizon’s secure network and HCLTech’s premium hardware partnerships, this solution facilitates a smooth transition to a digital workplace for all employees, whether at their desks, remote, or on the go.

Report Coverage

The research report offers an in-depth analysis based on Product, Demography, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Workwear Market will see rising demand for eco-friendly fabrics and sustainable production methods.

- Smart textiles with monitoring features will gain wider adoption in safety-critical industries.

- E-commerce platforms will expand workwear accessibility for small and medium enterprises.

- Customization and branding will become stronger drivers of corporate uniform adoption.

- Demand for women-specific workwear designs will increase with rising workforce participation.

- Advanced protective gear will remain essential in construction, mining, and power sectors.

- Service industries will boost demand for professional uniforms supporting corporate identity.

- Global regulations on workplace safety will continue to push certified apparel usage.

- Investment in lightweight, ergonomic, and climate-adapted clothing will shape innovation.

- Strategic partnerships and regional expansions will define future growth opportunities.