Market Overview

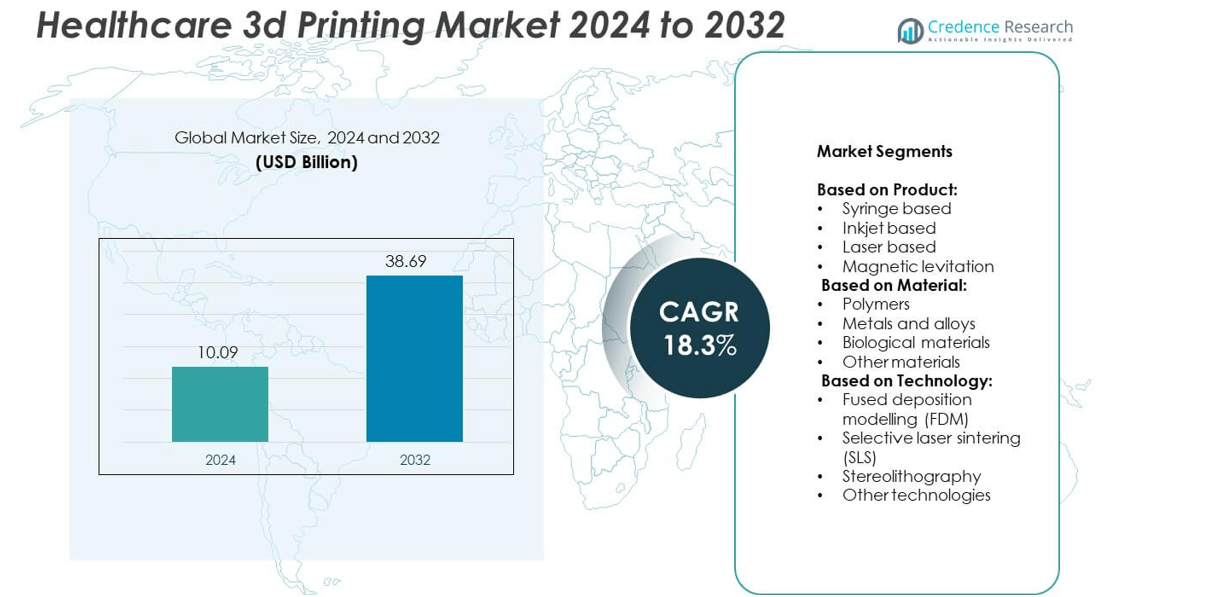

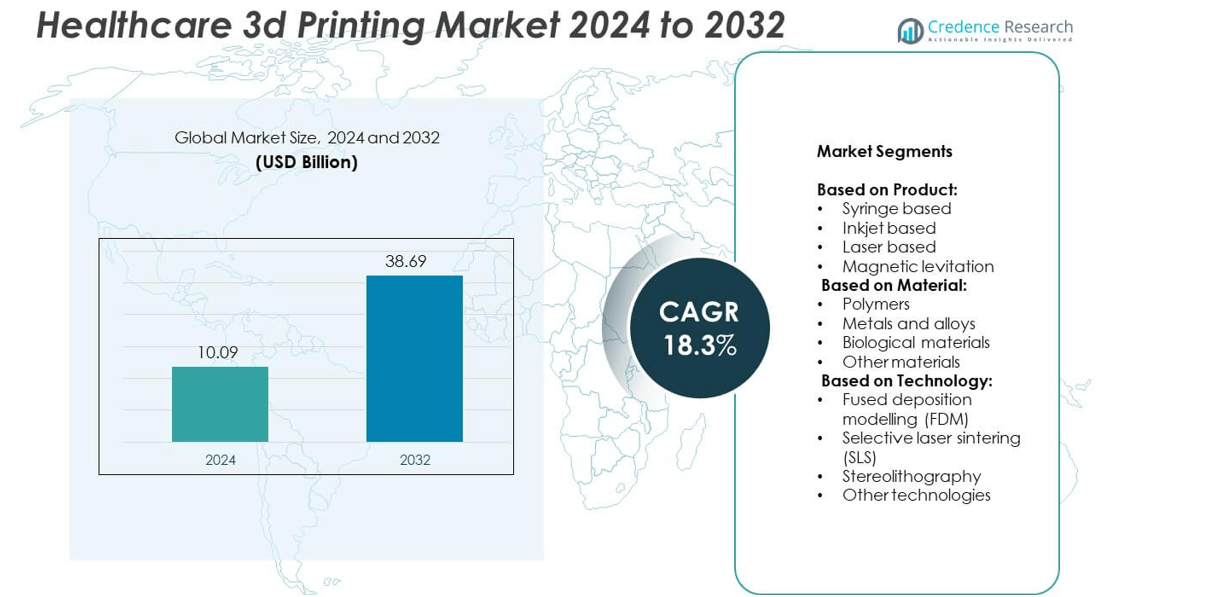

The healthcare 3D printing market size was valued at USD 10.09 billion in 2024 and is expected to reach USD 38.69 billion by 2032, growing at a CAGR of 18.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare 3D Printing Market Size 2024 |

USD 10.09 billion |

| Healthcare 3D Printing Market, CAGR |

18.3% |

| Healthcare 3D Printing Market Size 2032 |

USD 38.69 billion |

The Healthcare 3D Printing market grows due to rising demand for personalized medical devices and surgical models. Advancements in biocompatible materials and printing technologies improve precision and clinical outcomes. Hospitals adopt point-of-care 3D printing labs to reduce lead times and improve patient care. AI-driven design tools streamline model creation and boost efficiency. Growing use of bioprinting for tissue engineering and drug testing expands applications. Supportive regulatory frameworks and increasing healthcare investments accelerate technology adoption across developed and emerging regions.

North America leads the Healthcare 3D Printing market, supported by advanced healthcare infrastructure and strong R&D initiatives. Europe follows with robust regulatory frameworks and high adoption in dental and orthopedic applications. Asia Pacific shows rapid growth driven by rising healthcare investments and local manufacturing efforts. Key players driving innovation and expansion include Stratasys, Materialise, 3D Systems, and Dassault Systèmes. Collaborations with hospitals and research centers strengthen their market presence and enable development of patient-specific solutions globally.

Market Insights

- The Healthcare 3D Printing market was valued at USD 10.09 billion in 2024 and is projected to reach USD 38.69 billion by 2032, growing at a CAGR of 18.3%.

- Rising demand for personalized medical devices, surgical models, and patient-specific implants drives strong market expansion.

- Key trends include rapid growth in bioprinting, integration of AI-driven design tools, and expansion of point-of-care manufacturing facilities.

- Leading companies such as Stratasys, Materialise, 3D Systems, and Dassault Systèmes invest in R&D and collaborate with hospitals to deliver advanced solutions.

- Challenges include high setup costs, complex regulatory approvals, and shortage of skilled professionals in medical 3D printing.

- North America leads adoption due to advanced healthcare infrastructure, while Europe and Asia Pacific show strong momentum through research programs and rising healthcare investments.

- Growing interest from developing regions, increasing partnerships between technology providers and medical institutions, and advancements in biocompatible materials are expected to create significant opportunities for market participants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Personalized Medical Solutions

The Healthcare 3D Printing market is driven by the rising need for patient-specific medical devices and implants. Surgeons and healthcare providers prefer customized solutions to improve treatment outcomes and reduce surgical complications. It allows precise anatomical modeling for pre-surgical planning, improving accuracy in complex procedures. Orthopedic and dental sectors are early adopters due to their requirement for tailored implants. Rising demand for prosthetics and orthotics with improved comfort and fit further supports growth. Hospitals integrate 3D printing labs to provide on-site production of patient-specific models.

- For instance, Ricoh 3D for Healthcare received FDA 510(k) clearance for its patient-specific anatomic models across orthopedic, cardiovascular, craniomaxillofacial, neurological, gastrointestinal, genitourinary, and breast surgery applications.

Advancements in Biocompatible Materials and Printing Technologies

Rapid innovation in biocompatible polymers, resins, and metals strengthens the adoption of 3D printing in healthcare. It enables the creation of durable, safe, and functional components used in surgical tools, implants, and prosthetics. Improved printing resolution and speed allow production of highly detailed models and functional parts. Leading companies focus on developing FDA-cleared materials suitable for medical use. Integration of multi-material printing expands application possibilities across different medical disciplines. Continuous R&D efforts enhance the reliability and scalability of printed components.

- For instance, 3D Systems has manufactured more than 2 million implants and instruments for over 100 CE-marked and FDA-cleared medical devices in North America and Europe.

Cost-Effective and Efficient Manufacturing Approach

The Healthcare 3D Printing market benefits from its ability to lower production costs and material waste. It eliminates the need for expensive tooling and reduces lead time for custom devices. Production of small batches becomes more economical compared to traditional manufacturing. Hospitals achieve faster turnaround for surgical guides and models, leading to better resource utilization. It also reduces inventory requirements by supporting on-demand manufacturing. Healthcare systems adopt 3D printing to optimize workflow and save operational costs.

Growing Adoption in Training and Education

Medical institutions use 3D printed models for training surgeons and medical students. It provides a hands-on experience for understanding complex anatomy without relying on cadavers. Realistic models help improve skills and reduce error rates in live procedures. The Healthcare 3D Printing market sees rising demand from simulation-based learning programs worldwide. It supports the development of procedure-specific practice tools for specialized surgeries. Growing awareness among educators drives continued investment in 3D printing facilities for medical training.

Market Trends

Integration of 3D Bioprinting for Tissue and Organ Development

The Healthcare 3D Printing market is witnessing rapid adoption of bioprinting for tissue engineering and regenerative medicine. Research institutions and biotech firms work on printing functional tissues for transplantation and drug testing. It enables development of patient-specific grafts that reduce rejection risks and improve recovery. Pharmaceutical companies adopt bioprinted tissues for safer and faster drug validation. Growing funding for organ-on-chip and bio-ink technology accelerates commercialization efforts. Successful advancements bring the industry closer to printing fully functional organs.

- For instance, SprintRay enables the design and in-office 3D printing of surgical guides in as little as 30 minutes, using its Surgical Guide 2 resin that is sterilisable via autoclave without losing dimensional accuracy

Shift Toward Point-of-Care Manufacturing Facilities

Hospitals and clinics invest in on-site 3D printing labs to meet urgent patient needs. It shortens production timelines for surgical models and implants, improving clinical efficiency. Point-of-care manufacturing supports same-day delivery of anatomical guides, which enhances surgical precision. Regulatory bodies encourage in-house production under strict quality standards. Healthcare providers use these facilities to reduce dependence on external suppliers. This trend strengthens localized, patient-focused healthcare delivery models.

- For instance, Open Bionics has delivered over 1,000 upper-limb prostheses to patients globally.

Rising Use of AI and Automation in Design Processes

AI-powered software is being integrated into 3D model generation, reducing design time and errors. It automates segmentation of patient scans into accurate printable models. Machine learning improves predictive modeling for implant success and surgical outcomes. The Healthcare 3D Printing market benefits from these intelligent systems, which make workflows faster and scalable. Software providers collaborate with device makers to deliver seamless solutions. Automation also supports consistent quality control across multiple printing units.

Expansion of Multi-Material and Hybrid Printing Capabilities

Manufacturers are developing printers capable of using multiple materials in one build process. It allows combining rigid and flexible materials for complex medical devices. Hybrid printing integrates additive and subtractive techniques, improving precision and surface finish. Dental and orthopedic sectors adopt these technologies for advanced product customization. Growing availability of medical-grade composites broadens design options. Continuous upgrades in hardware and software drive innovation in functional medical part production.

Market Challenges Analysis

Regulatory and Standardization Barriers Slowing Adoption

The Healthcare 3D Printing market faces challenges due to complex regulatory requirements across regions. Medical devices created through additive manufacturing must meet strict safety and performance standards. It takes significant time to secure approvals from agencies like FDA and EMA, delaying product launches. Lack of uniform global standards creates compliance difficulties for manufacturers operating in multiple markets. Certification processes for materials, printers, and final products remain expensive and time-consuming. This slows down the scaling of 3D printing solutions for critical healthcare applications.

High Initial Investment and Skilled Workforce Shortage

Setting up advanced 3D printing infrastructure involves high capital expenditure, limiting access for smaller hospitals and clinics. It also requires skilled engineers and technicians trained in medical printing, design, and quality control. The shortage of qualified professionals affects production consistency and innovation speed. Material costs, especially for biocompatible and specialized resins, remain a financial hurdle. Maintenance and calibration of printers add to operational expenses. These factors collectively restrict rapid expansion and adoption of healthcare 3D printing technology.

Market Opportunities

Expansion into Personalized Medicine and Advanced Therapeutics

The Healthcare 3D Printing market has strong opportunities in personalized medicine applications. It enables the production of patient-specific drug delivery systems and tailored implants. Pharmaceutical companies explore 3D printed pills with controlled release profiles for better treatment outcomes. Surgeons benefit from custom surgical tools that reduce operation time and improve precision. Growing focus on targeted therapies creates demand for precise, customizable devices. This expansion supports the shift toward more effective, individualized care pathways worldwide.

Emerging Markets and Rising Healthcare Investments

Developing countries present untapped potential for healthcare 3D printing adoption. It supports cost-effective production of medical devices for resource-constrained regions. Governments invest in digital healthcare infrastructure and innovation hubs, promoting adoption of advanced technologies. Local manufacturing reduces import dependency and improves access to critical devices. Collaborations between technology providers and hospitals accelerate regional market penetration. These factors create long-term growth opportunities for companies entering emerging economies.

Market Segmentation Analysis:

By Product:

Syringe-based, inkjet-based, laser-based, and magnetic levitation systems. Syringe-based printing holds a strong position due to its precision in depositing bio-inks for tissue engineering applications. Inkjet-based systems are popular for high-speed, cost-effective printing of scaffolds and drug formulations. Laser-based printing offers high resolution and is favored for complex implant design and dental applications. Magnetic levitation remains a niche segment but shows promise for research on cell growth and tissue development. Each product type supports unique applications, driving diverse adoption across clinical and research settings.

- For instance, Materialise produces 280,000 personalized 3D-printed instruments and implants per year, including 160,000 of those for the U.S. market.

By Material:

The market includes polymers, metals and alloys, biological materials, and other specialized materials. Polymers dominate usage due to their flexibility, biocompatibility, and wide availability for medical use. Metals and alloys such as titanium and stainless steel are critical for orthopedic and dental implants where strength is essential. Biological materials gain traction for tissue engineering, regenerative medicine, and bioprinting of organ models. Other materials, including ceramics and composites, support niche applications like dental crowns and bone grafts. The choice of material directly impacts product performance and regulatory approval timelines.

- For instance, Evonik’s VESTAKEEP® PEEK material line has been used in over 80 medical devices that have received FDA 510(k) clearance, a milestone reached in 2017. Since then, the material has continued to be used in numerous other cleared devices, expanding its presence in applications like spinal implants, suture anchors, cranial implants, and 3D-printed implants, such as the cranial implants cleared for 3D Systems in April 2024

By Technology:

The Healthcare 3D Printing market is categorized into fused deposition modelling (FDM), selective laser sintering (SLS), stereolithography, and other technologies. FDM is widely used for prototyping and educational models due to its affordability and ease of use. SLS provides strong, durable components suited for functional implants and surgical tools. Stereolithography offers high-resolution printing, ideal for intricate surgical guides and dental models. Other technologies, including digital light processing and electron beam melting, expand capabilities for advanced medical applications. It ensures healthcare providers can select the most suitable approach based on accuracy, material compatibility, and cost efficiency.

Segments:

Based on Product:

- Syringe based

- Inkjet based

- Laser based

- Magnetic levitation

Based on Material:

- Polymers

- Metals and alloys

- Biological materials

- Other materials

Based on Technology:

- Fused deposition modelling (FDM)

- Selective laser sintering (SLS)

- Stereolithography

- Other technologies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Healthcare 3D Printing market, accounting for 38% of the global revenue. Strong presence of advanced healthcare infrastructure and early technology adoption supports this leadership. Hospitals and research centers invest in 3D printing labs to produce patient-specific implants and surgical guides. It benefits from favorable regulatory support, with the U.S. FDA issuing clear guidelines for 3D printed medical devices. High prevalence of chronic diseases drives demand for custom prosthetics and implants. Leading companies like 3D Systems and Stratasys have established R&D and production facilities in the U.S., boosting regional innovation. Collaborations between medical universities and technology providers accelerate the development of bioprinting solutions for tissue and organ research.

Europe

Europe contributes 29% of the Healthcare 3D Printing market, driven by strong government funding and robust research networks. The region has a well-established regulatory environment under the European Medical Device Regulation (MDR), encouraging safe adoption of additive manufacturing. Countries like Germany, the U.K., and France are major hubs for medical device production and innovation. It benefits from a strong dental and orthopedic sector that actively deploys 3D printed components for patient care. University hospitals partner with technology developers to create complex anatomical models for surgical planning. Supportive policies for digital healthcare transformation further boost adoption across Western and Northern Europe. Continuous growth of medical technology clusters ensures consistent investment and training for professionals.

Asia Pacific

Asia Pacific holds 22% of the Healthcare 3D Printing market, with rapid growth fueled by rising healthcare expenditure. China, Japan, and India invest heavily in research infrastructure and digital manufacturing technologies. It sees increasing demand for affordable, custom medical devices to cater to large patient populations. Government initiatives like “Made in China 2025” and Japan’s funding programs promote local production of advanced medical solutions. Rapid expansion of private hospitals and diagnostic centers drives adoption of surgical models and guides. Domestic manufacturers offer cost-effective 3D printing solutions, supporting penetration in tier-2 and tier-3 cities. Growing partnerships with global players help transfer technical expertise and ensure quality compliance.

Latin America

Latin America represents 7% of the Healthcare 3D Printing market, with Brazil and Mexico leading regional adoption. It gains momentum through investment in advanced medical training and improved hospital infrastructure. 3D printed anatomical models are increasingly used in surgical education and pre-operative planning. It faces challenges from budget constraints, but local innovators provide affordable solutions for public hospitals. Growing demand for dental prosthetics and orthopedic implants fuels expansion in urban centers. Collaborations with universities and global companies help bring new technologies to the region. Gradual regulatory progress creates a more favorable environment for local production and imports.

Middle East and Africa

Middle East and Africa account for 4% of the Healthcare 3D Printing market, but display promising growth potential. The Gulf countries invest in smart hospitals and digital healthcare infrastructure, supporting adoption of 3D printing technologies. It plays a role in producing customized surgical tools and low-volume medical components locally. South Africa and UAE lead research efforts, creating centers for innovation and training. Access to cost-effective printers helps smaller clinics explore on-demand manufacturing. Increasing medical tourism in the Middle East boosts demand for advanced implants and prosthetics. Gradual improvement in regulations and funding will likely accelerate market penetration in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Metamorph 3D Print Services

- Stratasys

- Oceanz

- 3D Biotek

- Xometry

- Envision TEC

- Cyfuse Biomedical

- Materialise

- Dassault Systèmes

- Nano3D Biosciences

- REGENHU

- Renishaw

- Aspect Biosystems

- Aprecia Pharmaceuticals

- 3D Systems

Competitive Analysis

The Healthcare 3D Printing market is characterized by strong competition among key players such as Metamorph 3D Print Services, Stratasys, Oceanz, 3D Biotek, Xometry, Envision TEC, Cyfuse Biomedical, Materialise, Dassault Systèmes, Nano3D Biosciences, REGENHU, Renishaw, Aspect Biosystems, Aprecia Pharmaceuticals, and 3D Systems. These companies focus on innovation, partnerships, and expanding production capabilities to meet growing demand for patient-specific solutions. The competitive landscape is shaped by continuous R&D investments aimed at improving printing speed, accuracy, and biocompatible material availability. Companies work closely with hospitals and research institutes to develop advanced surgical models, implants, and bioprinting applications. Strategic acquisitions and collaborations strengthen market presence and expand product portfolios. The market also sees rising focus on regulatory compliance to gain faster approvals for 3D printed medical devices. Service providers invest in scalable, on-demand manufacturing platforms to meet customized healthcare needs efficiently. Emerging players target niche applications such as tissue engineering and drug delivery systems, intensifying competition. The combination of hardware innovation, software development, and bioprinting research positions the industry for sustained growth. Competitive dynamics are expected to accelerate with the entry of new regional manufacturers and expansion of global players into emerging markets.

Recent Developments

- In 2024, 3D Systems achieved a significant milestone by receiving FDA 510(k) clearance for its VSP® PEEK Cranial Implants. This is the world’s first FDA-cleared, additively manufactured PEEK implant for cranioplasty.

- In 2024, Stratasys launched the new J5 Digital Anatomy 3D printer at the RAPID + TCT event.

- In 2024, Renishaw launched a new metal AM system featuring TEMPUS technology, which significantly reduces build times by allowing lasers to fire while the recoater is in motion.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Healthcare 3D Printing market will see wider adoption in hospitals for point-of-care manufacturing.

- Bioprinting of tissues and organs will progress toward clinical trials and wider research use.

- Regulatory frameworks will become clearer, speeding up approvals for printed medical devices.

- AI-driven design tools will make production faster and more precise for surgeons and clinicians.

- Demand for customized implants and prosthetics will grow in orthopedics and dental applications.

- Emerging economies will invest more in local 3D printing facilities to improve healthcare access.

- Multi-material and hybrid printing technologies will expand applications in complex device production.

- Training models and simulation tools will gain popularity in medical education and skill development.

- Material innovation will focus on biocompatible and recyclable options to meet sustainability goals.

- Collaborations between technology providers and healthcare institutions will accelerate innovation and adoption.