Market Overview:

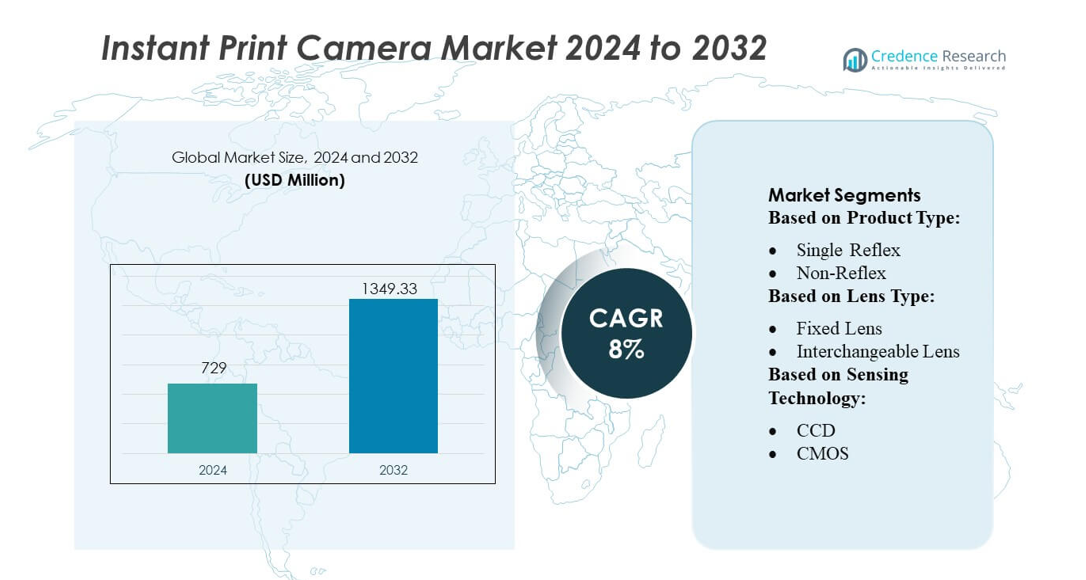

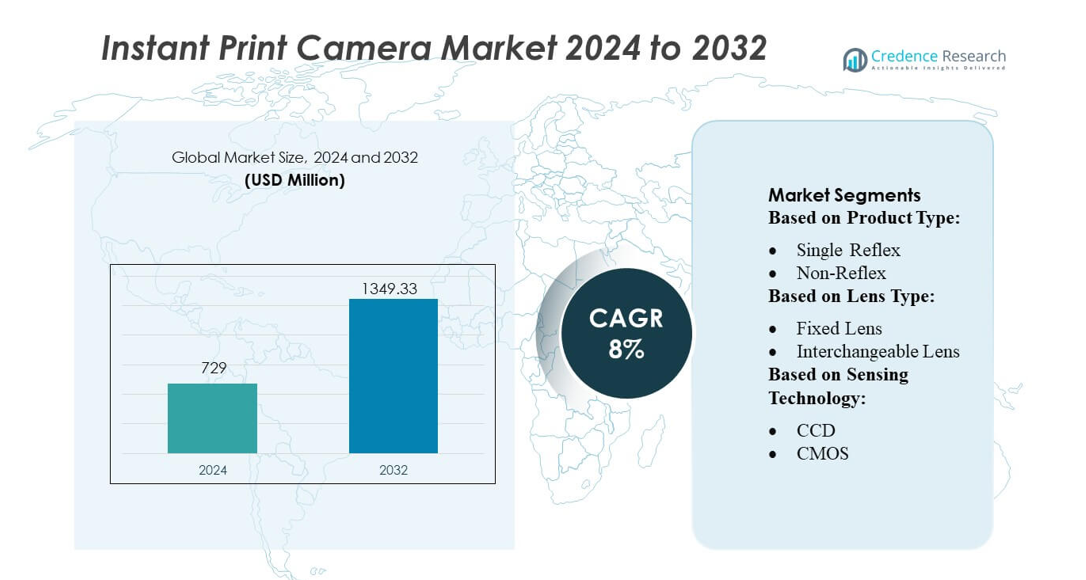

Instant Print Camera Market size was valued USD 729 million in 2024 and is anticipated to reach USD 1349.33 million by 2032, at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Instant Print Camera Market Size 2024 |

USD 729 million |

| Instant Print Camera Market, CAGR |

8% |

| Instant Print Camera Market Size 2032 |

USD 1349.33 million |

The Instant Print Camera Market is highly competitive, with leading players such as Olympus Corporation, Canon Inc., Leica Camera AG, FUJIFILM Holdings Corporation, OM Digital Solutions Corporation, Nikon Corporation, SIGMA CORPORATION, RICOH IMAGING COMPANY, LTD., Eastman Kodak Company, and Panasonic Corporation driving innovation and market growth. These companies focus on developing compact, user-friendly cameras with advanced printing technology, smart connectivity, and stylish designs to cater to lifestyle-oriented consumers. Product launches, regional expansion, and targeted marketing strengthen their market presence and consumer engagement. North America remains the leading region, capturing approximately 35% of the global market share, driven by high disposable income, strong social media engagement, and the popularity of instant photography among millennials and Gen Z consumers. Technological advancements and experiential marketing continue to reinforce the region’s dominance and attract broader adoption.

Market Insights

- The Instant Print Camera Market size was valued at USD 729 million in 2024 and is projected to reach USD 1349.33 million by 2032, growing at a CAGR of 8% during the forecast period.

- Growth is driven by rising consumer demand for instant photography, technological advancements in sensors and printing, and the popularity of compact, portable, and user-friendly cameras.

- Trends include integration of smart features, mobile connectivity, and lifestyle-oriented designs, as well as increased adoption through e-commerce and omnichannel retail platforms.

- The market is highly competitive, with key players focusing on product innovation, targeted marketing, and regional expansion to enhance consumer engagement and maintain market share.

- North America leads with approximately 35% market share, followed by Europe and Asia-Pacific, while fixed-lens and CMOS sensor cameras dominate their respective segments due to ease of use and affordability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In the Instant Print Camera Market, the non-reflex segment dominates, accounting for approximately 62% of the market share. Non-reflex cameras are favored for their compact design, ease of use, and immediate photo-printing capability, appealing to casual photographers and social media enthusiasts. Growth is driven by rising demand for portable imaging solutions and the trend of instant gratification in personal photography. Single reflex cameras, while offering higher image quality and advanced features, witness slower adoption due to their bulkier form factor and higher price points.

- For instance, Canon’s IVY CLIQ+ Instant Camera Printer employs an 8‑megapixel sensor and delivers peel‑and‑stick 2″×3″ ZINK™ photos in 50 seconds or less per print, combining digital capture and immediate print output in a compact device.

By Lens Type

Fixed lens cameras lead the lens type segment, capturing nearly 70% of the market share. Their popularity stems from simplicity, affordability, and reliable performance for casual and recreational users. Fixed lens instant cameras meet the demand for lightweight, ready-to-use devices without requiring technical knowledge of interchangeable lens systems. Interchangeable lens cameras, while attractive to professional users seeking creative flexibility, experience limited growth due to higher costs and complexity, positioning fixed lens models as the primary driver of market expansion.

- For instance, SOFORT 2 supports printing of Instax‑Mini format photo paper via a simple manual print lever, offers a macro mode capable of close‑focus down to 10 cm, and provides 10 lens and 10 film‑effect options — highlighting how a fixed‑lens design can deliver both simplicity and creative flexibility.

By Sensing Technology

CMOS-based instant print cameras dominate the sensing technology segment with a market share of approximately 65%. CMOS sensors offer lower power consumption, faster image processing, and better performance in compact, portable camera designs, aligning with consumer preferences for instant photography. CCD sensors, although providing higher image fidelity in certain lighting conditions, see slower adoption due to higher production costs and larger module size. The increasing integration of CMOS technology in user-friendly, budget-friendly instant cameras fuels overall market growth and strengthens its leadership in the segment.

Key Growth Drivers

Rising Consumer Preference for Instant Photography

The growing demand for instant photography among millennials and Gen Z is a primary growth driver. Consumers increasingly seek devices that provide immediate tangible prints for social sharing, scrapbooking, and personal keepsakes. The trend toward experiential and creative content consumption fuels purchases of instant print cameras. Ease of use, compact design, and social media compatibility enhance appeal. This shift in consumer behavior toward instant, shareable content significantly drives market expansion, encouraging manufacturers to innovate and launch more user-friendly, portable camera models.

- For instance, FUJIFILM’s recently launched hybrid model, instax WIDE Evo, offers a wide-format lens with wide-angle capability, a 3.5‑inch LCD for framing and preview, and supports combining multiple film and lens effects for creative output — directly catering to younger users wanting instant tangible prints plus modern creative control.

Technological Advancements in Camera Features

Innovations in camera sensors, printing mechanisms, and smart connectivity are accelerating market growth. Integration of CMOS sensors, high-speed printing, and mobile app compatibility improves image quality, efficiency, and user experience. Features like filters, stickers, and augmented reality overlays enhance creative expression and engagement. These technological enhancements attract both casual and professional users seeking multifunctional instant cameras. Continuous investment in R&D and the adoption of advanced electronics and compact design innovations position the market for sustained growth over the forecast period.

- For instance, OM SYSTEM OM-5 Mark II delivers in‑body 5‑axis image stabilization providing up to 6.5 stops of shutter speed compensation at center and, when paired with compatible lenses, up to 7.5 stops via 5‑axis sync IS — enabling sharp handheld shots even under challenging conditions.

Rising Popularity of DIY and Personalized Photography Products

The DIY culture and demand for personalized, tangible products drive adoption of instant print cameras. Consumers increasingly value creating custom photo albums, gifts, and decorative items, which instant cameras enable effortlessly. Social media trends and influencer-driven campaigns further fuel interest in personalized photography. This trend also supports cross-industry collaborations with stationery and lifestyle brands, expanding the market’s reach. As personalization becomes a key purchasing factor, instant print camera manufacturers capitalize on consumer desire for unique, interactive experiences, boosting overall sales and market penetration.

Key Trends & Opportunities

Integration of Smart Features and Mobile Connectivity

Smart instant print cameras with Bluetooth, Wi-Fi, and app-based controls are gaining traction. These features allow seamless printing from smartphones, editing photos digitally before printing, and sharing content on social media platforms. The opportunity lies in combining instant physical prints with digital convenience, appealing to tech-savvy users. Manufacturers can leverage this trend by introducing companion apps, cloud storage options, and AI-based enhancements, creating a hybrid experience that bridges traditional photography with modern digital demands, expanding market reach.

- For instance, SIGMA Corporation recently launched the Sigma BF in 2025, a full‑frame mirrorless camera distinguished by a radically simplified design and robust technical specs.

Growing Popularity of Compact and Portable Designs

Compact, lightweight, and stylish camera designs are increasingly favored, providing convenience for travel, events, and social gatherings. The trend toward portability aligns with consumer lifestyles, where mobility and aesthetics are key purchasing factors. There is significant opportunity for manufacturers to innovate in ergonomics, battery efficiency, and design customization. By offering visually appealing, easy-to-carry cameras, companies can capture younger demographics and casual users, driving both adoption and repeat purchases in the instant print camera market.

- For instance, RICOH IMAGING demonstrates its commitment to portability through models such as the Ricoh GR III and the recently released Ricoh GR IV. The GR III weighs approximately 257 g (with battery and SD card) and measures 109.4 mm × 61.9 mm × 33.2 mm, making it pocket-sized and ideal for travel or street photography.

Expanding E-commerce and Omnichannel Distribution

The growth of e-commerce platforms and omnichannel retail strategies provides opportunities for broader market penetration. Online platforms allow consumers to compare features, access product reviews, and make informed purchases conveniently. Manufacturers can leverage direct-to-consumer sales, targeted promotions, and exclusive online editions to reach tech-savvy buyers. Omnichannel strategies, combining online and offline presence, enhance visibility and brand loyalty. This distribution evolution supports increased sales volumes, especially in regions with limited physical retail presence, fueling overall market growth.

Key Challenges

High Cost of Advanced Instant Cameras

The premium pricing of advanced instant print cameras with smart features, interchangeable lenses, and high-resolution sensors restricts adoption among price-sensitive consumers. Cost barriers can slow market penetration in emerging regions where disposable income for luxury or niche photography products is limited. Manufacturers must balance innovation with affordability to maintain competitiveness. Without cost-effective options, mass-market adoption may remain constrained, limiting growth potential and slowing the transition from casual cameras to technologically advanced instant print solutions.

Limited Print Media Durability and Ongoing Consumable Costs

Instant print cameras rely on specialized photo paper, which adds recurring costs and may affect long-term consumer satisfaction. Additionally, print durability can vary, leading to fading or smudging over time. These factors can discourage frequent use and influence purchase decisions, especially among budget-conscious users. The dependence on proprietary consumables also restricts user flexibility and increases overall ownership costs, posing a notable challenge to market expansion and long-term adoption of instant print camera systems.

Regional Analysis

North America:

North America leads the Instant Print Camera Market, accounting for approximately 35% of the global share. High consumer disposable income, strong social media engagement, and growing popularity of lifestyle and DIY photography drive market growth. The U.S. and Canada witness high adoption of compact and technologically advanced cameras, including models with smart connectivity and mobile integration. Retail penetration through e-commerce and electronics stores enhances accessibility. Additionally, influencer marketing and experiential campaigns amplify demand among millennials and Gen Z consumers. North America remains a key innovation hub, encouraging product launches and R&D investments that sustain market dominance.

Europe:

Europe holds around 28% of the Instant Print Camera Market, driven by growing interest in personalized photography and creative expression. Countries like Germany, the U.K., and France show strong adoption of instant cameras for lifestyle, travel, and gifting purposes. High smartphone penetration combined with a preference for hybrid devices that integrate mobile apps and instant printing fuels growth. Additionally, fashion-conscious and experience-driven consumer segments propel demand for stylish, compact models. The region’s focus on sustainability also encourages innovations in eco-friendly printing materials, offering new opportunities for camera manufacturers to expand market presence and maintain steady growth.

Asia-Pacific:

Asia-Pacific accounts for nearly 25% of the market share, with China, Japan, and South Korea emerging as key contributors. Rising disposable income, increasing youth population, and high social media usage drive instant camera adoption. The region benefits from rapid urbanization and a growing interest in experiential and DIY photography. Affordable, compact, and trendy camera models gain traction among millennials and Gen Z. E-commerce platforms play a crucial role in distribution, making devices accessible to wider demographics. Continuous technological innovations and collaborations with lifestyle brands offer opportunities to capture further market share in this fast-growing region.

Latin America:

Latin America represents approximately 7% of the Instant Print Camera Market. Growth is fueled by increasing smartphone integration, rising interest in social and experiential photography, and expanding e-commerce access. Countries like Brazil and Mexico show adoption of portable and affordable instant cameras, especially among younger consumers. Limited consumer awareness and economic fluctuations pose adoption challenges, but marketing initiatives highlighting personalization, DIY projects, and social sharing create growth opportunities. Collaborations with local retailers and online platforms enhance accessibility and brand visibility, positioning Latin America for gradual market expansion in both urban and semi-urban regions.

Middle East & Africa:

The Middle East & Africa (MEA) region holds roughly 5% of the global instant print camera market. Growth is driven by rising urbanization, increased disposable income in GCC countries, and growing social media engagement. Lifestyle and gifting trends, especially during festivals and events, encourage adoption. However, limited retail infrastructure and higher import costs can constrain market penetration. E-commerce expansion and targeted promotional campaigns provide opportunities to improve accessibility. Manufacturers focusing on compact, portable, and stylish cameras tailored to regional preferences can leverage these trends to strengthen presence and gradually increase the market share across MEA.

Market Segmentations:

By Product Type:

By Lens Type:

- Fixed Lens

- Interchangeable Lens

By Sensing Technology:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Instant Print Camera Market include Olympus Corporation, Canon Inc., Leica Camera AG, FUJIFILM Holdings Corporation, OM Digital Solutions Corporation, Nikon Corporation, SIGMA CORPORATION, RICOH IMAGING COMPANY, LTD., Eastman Kodak Company, and Panasonic Corporation. The Instant Print Camera Market is highly competitive, driven by rapid technological advancements and evolving consumer preferences. Companies focus on differentiating products through features such as compact designs, high-resolution sensors, fast printing mechanisms, and smart connectivity with mobile devices. Innovation in user-friendly interfaces, customization options, and lifestyle-oriented designs strengthens brand positioning. Strategic initiatives, including product launches, regional expansions, and targeted marketing campaigns, enhance market presence and consumer engagement. Additionally, pricing strategies and omnichannel distribution play a critical role in capturing diverse consumer segments, balancing affordability with premium features to sustain growth in both mature and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Olympus Corporation

- Canon Inc.

- Leica Camera AG

- FUJIFILM Holdings Corporation

- OM Digital Solutions Corporation

- Nikon Corporation

- SIGMA CORPORATION

- RICOH IMAGING COMPANY, LTD.

- Eastman Kodak Company

- Panasonic Corporation

Recent Developments

- In April 2025, Genetec partnered with Axis Communications and Convergint to present integrated security solutions at The Security Event 2025. This collaboration shows a unified approach to advanced security technologies, combining expertise in video surveillance, access control, and system integration.

- In March 2025, Konica Minolta announced the sale of all shares and loans receivable by its subsidiary, MOBOTIX AG, to Certina Software Investments AG. MOBOTIX, known for its decentralized processing IP camera systems, will transition to new ownership as part of this deal. The divestiture aligns with Konica Minolta’s strategic restructuring efforts.

- In February 2025, Alarm.com acquired a majority stake in CHeKT, a Louisiana-based cloud platform specializing in remote video monitoring. This acquisition strengthens Alarm.com’s proactive video surveillance capabilities, offering improved security solutions for businesses and consumers.

- In February 2025, Hikvision introduced its latest Pro Series Network Cameras featuring ColorVu 3.0 technology, significantly improving low-light imaging performance. This advancement enhances visibility in dark environments, making the cameras ideal for round-the-clock surveillance

Report Coverage

The research report offers an in-depth analysis based on Product Type, Lens Type, Sensing Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising demand for instant and personalized photography.

- Technological advancements in sensors, printing mechanisms, and connectivity will drive product innovation.

- Compact and portable camera designs will continue to attract younger consumers and casual photographers.

- Integration with mobile apps and smart devices will enhance user experience and market adoption.

- Expansion of e-commerce and omnichannel retail will improve accessibility and sales reach globally.

- Increasing social media engagement will boost demand for instant cameras for content creation and sharing.

- Customizable and lifestyle-oriented products will drive consumer preference and repeat purchases.

- Growth opportunities will emerge in emerging markets with rising disposable income and urbanization.

- Continuous R&D investment will enable higher-quality prints and faster printing speeds.

- Collaborations with lifestyle and stationery brands will strengthen market presence and consumer engagement.