Market Overview

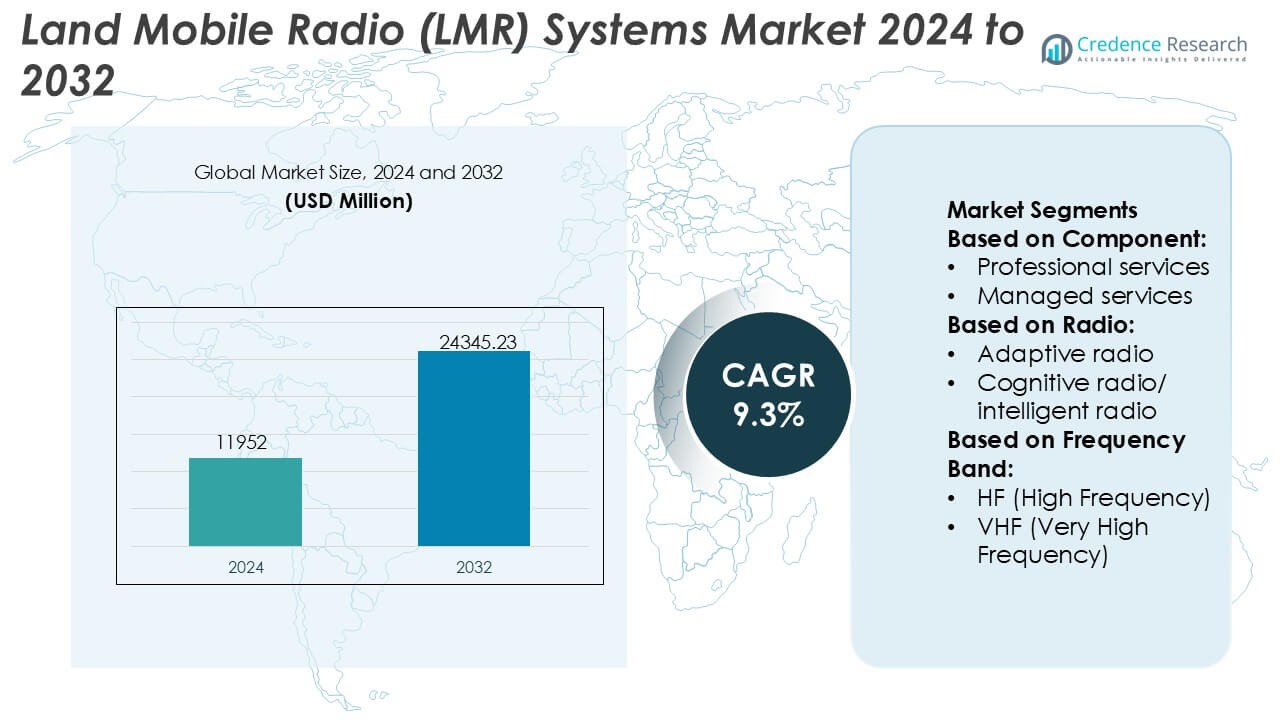

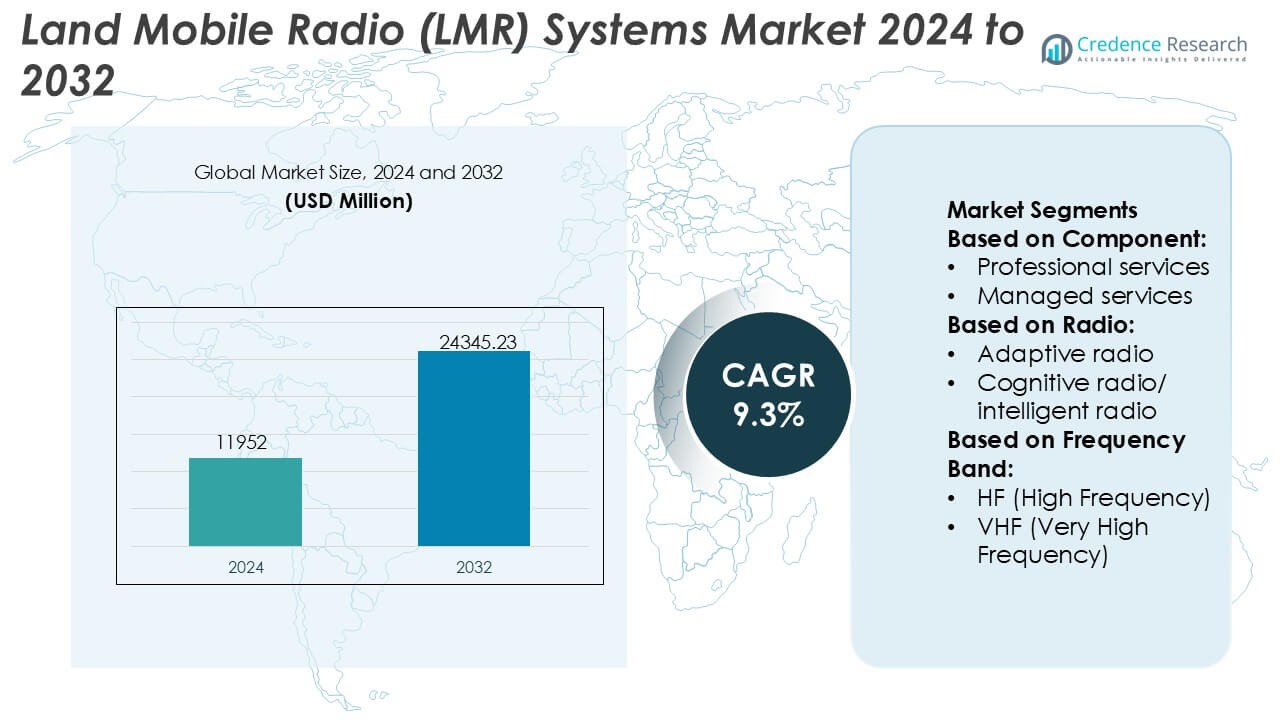

Land Mobile Radio (LMR) Systems Market size was valued USD 11952 million in 2024 and is anticipated to reach USD 24345.23 million by 2032, at a CAGR of 9.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Land Mobile Radio (LMR) Systems Market Size 2024 |

USD 11952 Million |

| Land Mobile Radio (LMR) Systems Market , CAGR |

9.3% |

| Land Mobile Radio (LMR) Systems Market Size 2032 |

USD 24345.23 Million |

The Land Mobile Radio (LMR) Systems Market is characterized by the presence of established global providers and specialized communication technology firms that compete on reliability, security, and interoperability. These players focus on delivering mission-critical voice solutions aligned with digital standards, advanced encryption, and resilient network performance for public safety, defense, transportation, and industrial users. Competitive strategies emphasize modernization of legacy systems, integration with broadband platforms, and expansion of managed and lifecycle services to strengthen long-term customer relationships. Regionally, North America leads the global market with an exact 41% share, supported by sustained government investments, extensive public safety deployments, and strict interoperability mandates. Strong regulatory frameworks and continuous infrastructure upgrades reinforce the region’s dominance in the LMR systems market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Land Mobile Radio (LMR) Systems Market was valued at USD 11,952 million in 2024 and is projected to reach USD 24,345.23 million by 2032, expanding at a CAGR of 9.3%, reflecting sustained demand for mission-critical communication solutions across public safety and defense sectors.

- Strong market growth is driven by rising reliance on secure, resilient voice communications for emergency response, defense operations, transportation safety, and critical infrastructure, where network reliability and interoperability remain non-negotiable requirements.

- Ongoing trends include accelerated migration from analog to digital LMR systems, integration with LTE and broadband networks, and increased adoption of managed and lifecycle services to optimize system performance and operational efficiency.

- The competitive landscape features established global vendors and specialized providers competing on encryption strength, standards compliance, system resilience, and long-term service capabilities, while high capital costs and long procurement cycles act as key market restraints.

- Regionally, North America leads with an exact 41% market share, supported by government funding and interoperability mandates, while the hardware segment holds the dominant share due to continuous upgrades of radios, base stations, and network infrastructure.

Market Segmentation Analysis:

By Component

The component segment of the Land Mobile Radio (LMR) systems market is led by hardware, which holds an estimated 52% market share, driven by sustained demand for base stations, repeaters, handheld radios, and vehicle-mounted units across public safety, transportation, and critical infrastructure sectors. Agencies prioritize robust and ruggedized devices that ensure mission-critical voice reliability in harsh environments. Within hardware, integrated circuits and digital signal processors support enhanced audio clarity, encryption, and interoperability. Software and services continue to expand, but capital-intensive network upgrades keep hardware as the dominant revenue contributor.

- For instance, Kenwood Corporation’s NX-5000 Series radios support NXDN, DMR, and P25 protocols within a single device and integrate a 49-bit digital vocoder and AES-256 encryption, while delivering audio output levels up to 1,000 mW for clear communication in high-noise environments.

By Radio

By radio type, Terrestrial Trunked Radio (TETRA) systems dominate with approximately 44% market share, supported by widespread adoption among public safety, defense, and emergency response organizations, particularly in Europe, the Middle East, and parts of Asia. TETRA systems offer secure group communications, low-latency call setup, and high spectrum efficiency, making them suitable for large-scale, mission-critical deployments. While adaptive and cognitive radios gain attention for dynamic spectrum use, their adoption remains limited to specialized applications, allowing TETRA to retain leadership due to maturity, standardization, and proven operational reliability.

- For instance, Thales Group’s TETRAPOL and TETRA solutions support end-to-end AES-256 encryption, enable call setup times below 300 milliseconds, and provide data transmission rates up to 28.8 kbps per carrier, while large national networks built on Thales infrastructure operate with tens of thousands of subscriber units connected to centralized switching and management platforms.

By Frequency Band

The frequency band segment is led by UHF (Ultra High Frequency), accounting for an estimated 46% market share, driven by its optimal balance of coverage, building penetration, and capacity for dense urban and indoor environments. UHF bands support clearer communication in cities, industrial sites, and transportation hubs, where signal obstruction is common. VHF remains relevant in rural and wide-area deployments, but UHF benefits from regulatory allocations, compact antenna designs, and compatibility with modern digital LMR standards, reinforcing its dominance in public safety and enterprise communication networks.

Key Growth Drivers

Rising Demand for Mission-Critical Communications

Public safety agencies, defense forces, transportation authorities, and utilities continue to rely on LMR systems for secure, resilient, and real-time voice communications. Unlike commercial cellular networks, LMR platforms deliver high reliability during natural disasters, power outages, and network congestion. Governments prioritize uninterrupted communication for emergency response, border security, and critical infrastructure protection. Large installed bases, long equipment life cycles, and mandatory interoperability standards further sustain replacement and upgrade demand. These factors collectively reinforce LMR systems as a foundational technology for mission-critical operations worldwide.

- For instance, RELM Wireless Corporation’s BK Radio KNG2 Series handheld and mobile radios are certified for P25 Phase 1 and Phase 2 operation, support AES-256 encryption, operate across VHF, UHF, and 700/800 MHz bands, and are qualified to MIL-STD-810 environmental testing, with specific models delivering transmitter power levels up to 6 watts for reliable coverage in demanding mission-critical environments.

Government Investments in Public Safety and Defense Infrastructure

Sustained government funding programs significantly support LMR system deployments across police, fire, emergency medical services, and military applications. National modernization initiatives emphasize digital radio migration, spectrum efficiency, and encrypted communications to address evolving security threats. Defense organizations invest in tactical and joint communication systems to improve battlefield coordination and situational awareness. Regulatory mandates requiring interoperable communication across agencies also accelerate procurement. Stable public-sector budgets and long-term contracts provide predictable demand, supporting continued expansion of LMR infrastructure at national, regional, and municipal levels.

- For instance, Hytera Communications Corporation Ltd’s H-Series professional radios support DMR Tier III trunking, deliver AES-256 encryption, provide channel capacities up to 1,000 channels per device, and enable integrated GPS with positioning accuracy down to 2.5 meters, while Hytera’s DMR trunked systems scale to support tens of thousands of registered subscriber radios under centralized network management platforms.

Transition from Analog to Digital LMR Technologies

Ongoing migration from analog to digital LMR systems drives equipment upgrades and network expansions. Digital platforms improve voice clarity, coverage efficiency, and spectrum utilization while enabling advanced features such as encryption, data transmission, and location services. Standards such as TETRA, P25, and DMR support scalable deployments across diverse user groups. Organizations modernize legacy networks to meet compliance requirements and enhance operational efficiency. This digital transition stimulates demand for new radios, base stations, software, and managed services across both developed and emerging markets.

Key Trends & Opportunities

Integration of LMR with Broadband and LTE Networks

Convergence between LMR systems and broadband technologies creates new growth opportunities. Hybrid solutions integrate LMR voice reliability with LTE and 5G data capabilities, enabling video streaming, situational analytics, and real-time information sharing. Public safety agencies increasingly deploy interoperability gateways and push-to-talk over cellular solutions to complement existing LMR networks. This integration extends system capabilities without compromising reliability, positioning vendors that offer seamless LMR-broadband interoperability for sustained competitive advantage.

- For instance, Icom Inc.’s IP-based radio systems support simultaneous LMR and LTE connectivity through RoIP gateways, enabling end-to-end digital voice transport with latency under 100 milliseconds, support up to 256 IP-linked radio nodes within a single network, and allow broadband backhaul of LMR communications over standard LTE links while maintaining native P25, DMR, and NXDN radio operation.

Expansion of Managed and Professional Services

Organizations increasingly outsource LMR network management, maintenance, and optimization to specialized service providers. Managed services reduce operational complexity, ensure regulatory compliance, and improve system uptime for end users. Professional services covering system design, integration, training, and lifecycle support gain traction, particularly among smaller agencies with limited technical resources. This shift from product-centric sales to service-oriented business models creates recurring revenue streams and strengthens long-term customer relationships for LMR solution providers.

- For instance, L3Harris Technologies, Inc. delivers managed services for large P25 networks that include 24/7 network operations center monitoring, support for systems with more than 1,000 radio sites, lifecycle sustainment of subscriber radios exceeding 100,000 units, and field-proven P25 Phase 2 systems capable of handling over 50,000 registered users within a single statewide communications network.

Growing Adoption in Transportation and Industrial Sectors

Beyond public safety, transportation, mining, oil and gas, and utilities expand LMR adoption to support workforce coordination and asset protection. Railways, airports, and ports depend on secure group communications for operational safety and efficiency. Industrial users favor LMR systems for their wide-area coverage and resistance to harsh environments. This diversification of end-use applications broadens the addressable market and supports steady demand growth across commercial and industrial verticals.

Key Challenges

Competition from Cellular and Push-to-Talk Alternatives

Commercial LTE and push-to-talk over cellular solutions present competitive pressure on traditional LMR deployments. Lower upfront costs, widespread device availability, and continuous network upgrades make cellular-based options attractive for non-mission-critical users. Some organizations consider partial substitution of LMR with broadband services for routine communications. Vendors must clearly differentiate LMR systems on reliability, security, and guaranteed availability to maintain relevance amid expanding commercial communication alternatives.

High Capital Costs and Long Procurement Cycles

LMR systems require significant upfront investment in infrastructure, spectrum licensing, and specialized equipment. Public-sector procurement processes often involve lengthy approval cycles, budget constraints, and complex tender requirements, delaying project execution. Smaller agencies may struggle to justify modernization costs despite operational benefits. These financial and administrative barriers can slow adoption rates, particularly in developing regions, and require vendors to offer flexible financing, phased deployments, and service-based models to overcome budget limitations.

Regional Analysis

North America

North America dominates the Land Mobile Radio (LMR) Systems Market with an estimated 41% market share, driven by extensive adoption across public safety, defense, utilities, and transportation sectors. Federal, state, and municipal agencies rely heavily on LMR for mission-critical communications, supported by sustained government funding and strict interoperability mandates. The region shows strong demand for P25-based digital systems, encryption upgrades, and lifecycle replacement of aging infrastructure. Advanced regulatory frameworks, high security requirements, and continued investment in emergency preparedness reinforce North America’s leadership position in the global LMR market.

Europe

Europe accounts for approximately 26% of the global LMR market share, supported by widespread deployment of TETRA systems across public safety, transportation, and municipal services. Countries such as the UK, Germany, France, and the Nordic region maintain large nationwide digital radio networks. Regional focus on cross-border interoperability, spectrum efficiency, and secure communications drives modernization initiatives. Replacement of legacy analog systems and integration with broadband services further support demand. Strong regulatory coordination and long-term public infrastructure programs position Europe as a stable and technologically mature LMR market.

Asia-Pacific

Asia-Pacific holds an estimated 21% market share and represents the fastest-growing regional market for LMR systems. Rapid urbanization, expanding transportation networks, and rising investments in public safety infrastructure drive adoption across China, India, Japan, South Korea, and Southeast Asia. Governments increasingly deploy digital LMR networks to support disaster management, law enforcement, and industrial operations. Large population centers, infrastructure expansion, and modernization of emergency response systems fuel demand. The region also benefits from cost-competitive manufacturing and increasing adoption of DMR and hybrid communication solutions.

Latin America

Latin America represents around 7% of the global LMR market share, supported by growing investments in public safety, mining, oil and gas, and transportation sectors. Countries such as Brazil, Mexico, and Chile deploy LMR systems to enhance law enforcement coordination and industrial workforce safety. While budget constraints limit large-scale nationwide deployments, gradual migration from analog to digital systems supports steady demand. Increasing focus on disaster response and critical infrastructure protection further drives adoption, particularly in metropolitan and resource-rich regions.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% market share, driven by security-focused investments and infrastructure development initiatives. Gulf countries deploy advanced LMR systems for public safety, defense, airports, and large-scale events, emphasizing encrypted and interoperable communications. In Africa, adoption remains selective but growing, particularly in mining, utilities, and emergency services. Government-led modernization programs and expanding critical infrastructure projects support gradual market expansion, despite challenges related to funding and uneven regional deployment levels.

Market Segmentations:

By Component:

- Professional services

- Managed services

By Radio:

- Adaptive radio

- Cognitive radio/ intelligent radio

By Frequency Band:

- HF (High Frequency)

- VHF (Very High Frequency)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Land Mobile Radio (LMR) Systems Market features a competitive landscape led by Kenwood Corporation, Thales Group, RELM Wireless Corporation, Hytera Communications Corporation Ltd, Icom Inc., L3Harris Technologies, Inc., Simoco Wireless Solutions Limited, Motorola Solutions, Inc., JVC Tait Ltd, and Leonardo SpA. The Land Mobile Radio (LMR) Systems Market exhibits a competitive landscape shaped by a mix of global technology providers and specialized communication solution vendors. Competition centers on delivering secure, reliable, and interoperable mission-critical communications for public safety, defense, transportation, utilities, and industrial users. Vendors differentiate through adherence to established digital standards, advanced encryption, network resiliency, and seamless integration with broadband and LTE platforms. Strategic focus areas include modernization of legacy analog networks, expansion of managed and lifecycle services, and development of hybrid communication architectures. Long procurement cycles and regulatory compliance requirements favor companies with strong system integration capabilities and proven deployment experience, while sustained investment in research and development supports ongoing improvements in coverage, spectrum efficiency, and operational reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kenwood Corporation

- Thales Group

- RELM Wireless Corporation

- Hytera Communications Corporation Ltd

- Icom Inc.

- L3Harris Technologies, Inc.

- Simoco Wireless Solutions Limited

- Motorola Solutions, Inc.

- JVC Tait Ltd

- Leonardo SpA

Recent Developments

- In November 2024, the Finnish Defense Forces announced the acquisition of Bittium Tough SDR Handheld and Vehicular radios and related accessories by proceeding with a purchase order to Bittium Wireless Ltd, which is a subsidiary of Bittium Corporation.

- In May 2024, Motorola Solutions launched the DIMETRA Connect solution with the MXP660 TETRA radio to offer seamless, automatic switching between traditional land mobile radio (TETRA) and broadband (4G/Wi-Fi) networks, ensuring first responders stay connected with uninterrupted voice and data, especially in coverage dead spots or challenging indoor/outdoor environments.

- In April 2024, Herrick Technology Laboratories (HTL) to accelerate the development of next-generation signals intelligence (SIGINT) and electronic warfare (EW)enabling them to accelerate developing and fielding advanced Software Defined Radio (SDR) solutions for Signals Intelligence (SIGINT) and Electronic Warfare (EW) for US defense/intelligence and allies, plus pursue strategic acquisitions to boost their cutting-edge, low SWaP (Size, Weight, and Power) products.

Report Coverage

The research report offers an in-depth analysis based on Component, Radio, Frequency Band and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- LMR systems will continue to serve as the backbone of mission-critical voice communications for public safety, defense, and critical infrastructure users.

- Gradual migration from analog to digital platforms will sustain long-term demand for equipment upgrades and network modernization.

- Hybrid architectures integrating LMR with LTE and 5G networks will expand functional capabilities while preserving communication reliability.

- Demand for encrypted and secure communications will increase due to rising security, cybersecurity, and data protection requirements.

- Managed services and lifecycle support offerings will gain importance as agencies seek to reduce operational complexity and maintenance burdens.

- Interoperability across agencies and jurisdictions will remain a key procurement criterion for new LMR deployments.

- Industrial, transportation, and utility sectors will expand LMR adoption to support workforce safety and operational coordination.

- Spectrum efficiency improvements and regulatory compliance will drive investments in advanced digital standards and technologies.

- Emerging markets will show steady adoption supported by public safety modernization and infrastructure development programs.

- Long equipment lifecycles and mission-critical reliability requirements will ensure sustained relevance of LMR systems alongside broadband alternatives.