Market Overview

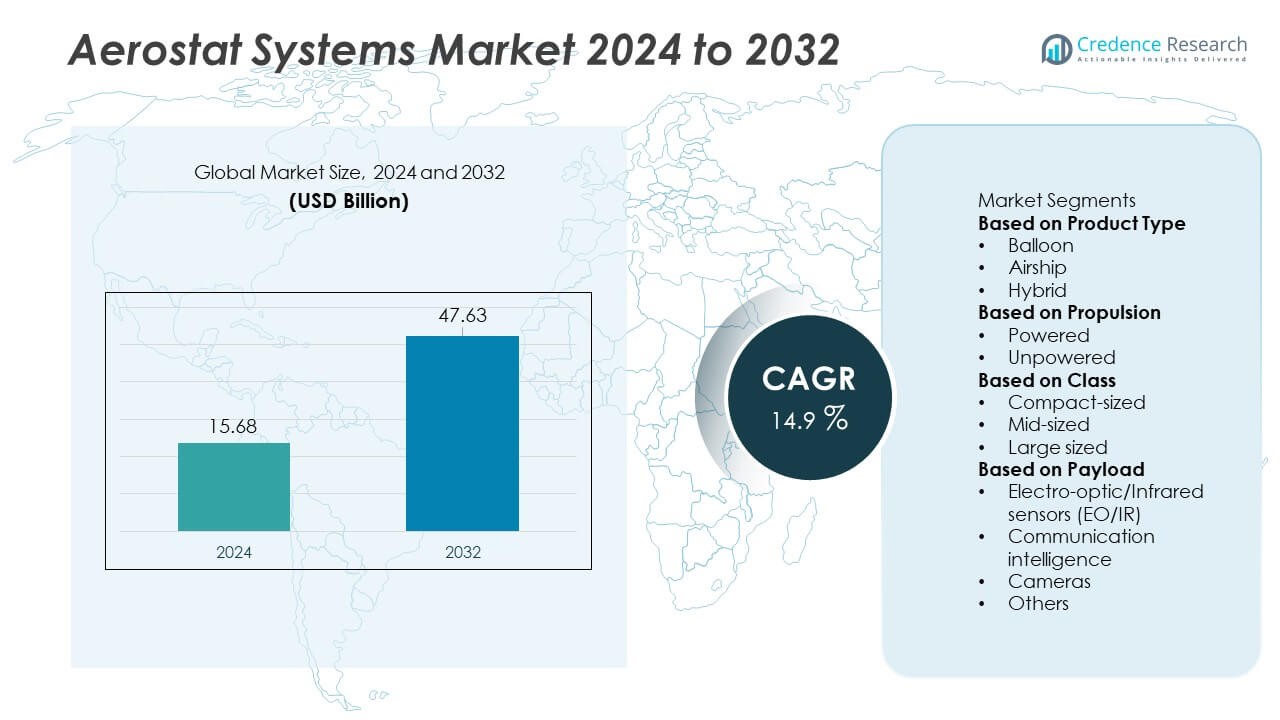

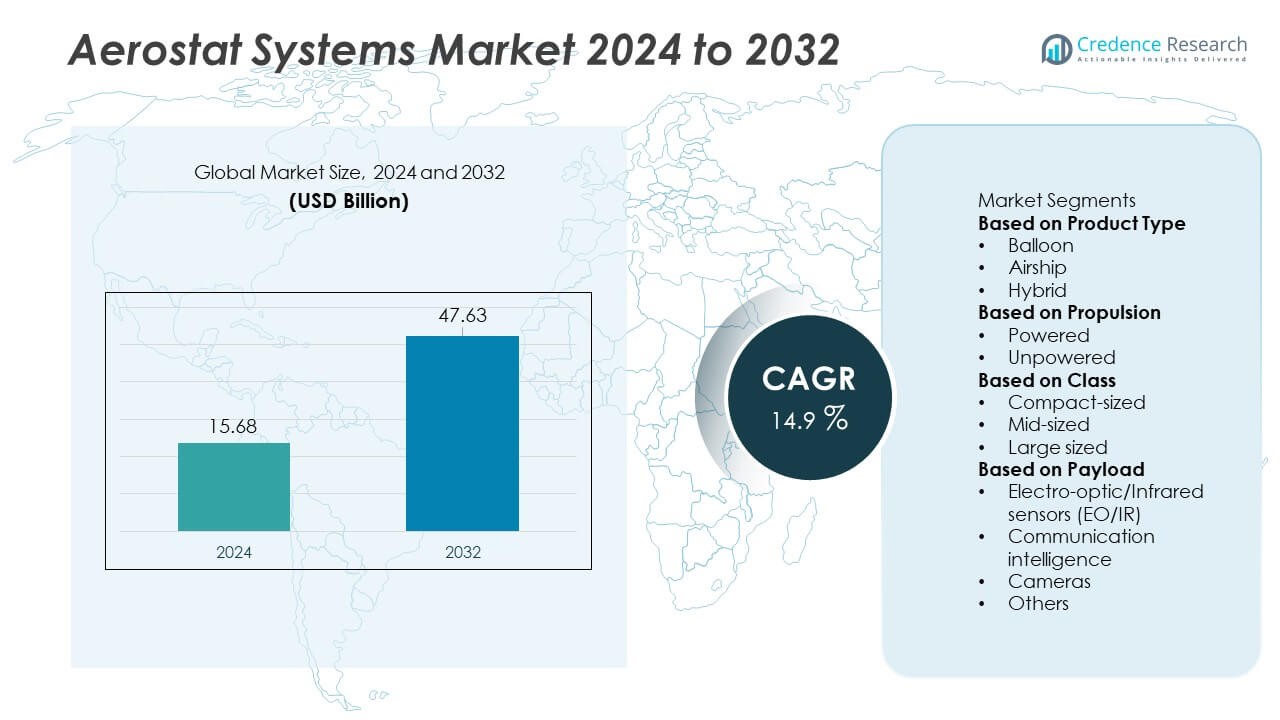

The Aerostat Systems Market was valued at USD 15.68 billion in 2024 and is projected to reach USD 47.63 billion by 2032, expanding at a CAGR of 14.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aerostat Systems Market Size 2024 |

USD 15.68 Billion |

| Aerostat Systems Market, CAGR |

14.9% |

| Aerostat Systems Market Size 2032 |

USD 47.63 Billion |

The Aerostat Systems market is led by major players such as Northrop Grumman Corporation, Lockheed Martin Corporation, L3Harris Technologies, Israel Aerospace Industries, AeroVironment, Allsopp Helikites, Altaeros, CNIM, Carolina Unmanned Vehicles, and ILC Dover. These companies strengthen market presence through advanced surveillance payloads, high-endurance platforms, and improved tether and propulsion technologies suited for military, homeland security, and environmental monitoring missions. Asia Pacific leads the global market with a 36% share, driven by rising defense modernization and border-security investments. North America follows with a 32% share due to strong procurement by defense agencies, while Europe holds a 22% share supported by intelligence, maritime security, and infrastructure monitoring applications.

Market Insights

Market Insights

- The Aerostat Systems market reached USD 15.68 billion in 2024 and is set to grow at a 14.9% CAGR during the forecast period.

- Market growth is driven by rising defense surveillance needs, with balloon systems holding 58% share due to low operating cost and long-duration monitoring capability.

- Key trends include increasing adoption of hybrid aerostats, offering higher payload capacity, improved stability, and extended mission endurance for both defense and commercial use.

- Competition strengthens as Northrop Grumman, Lockheed Martin, L3Harris, IAI, AeroVironment, and others advance aerostat platforms with better sensors, stronger tether systems, and enhanced real-time data transmission.

- Asia Pacific leads with 36% share, followed by North America at 32% and Europe at 22%, while powered aerostats dominate with 61% share due to superior altitude control and broader operational flexibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Balloon-based aerostat systems lead the product type segment with a 49% market share, driven by their cost-effectiveness, simple deployment, and strong suitability for long-duration intelligence, surveillance, and reconnaissance (ISR) missions. Defense agencies prefer balloons due to their ability to operate at high altitudes for extended periods while carrying radar, communication relays, or electro-optical sensors. Airships gain traction in border monitoring and communication roles but require higher operational infrastructure. Hybrid aerostats grow steadily as they combine buoyancy and aerodynamic lift, improving payload capacity and endurance. Rising demand for low-cost persistent surveillance continues to reinforce balloon dominance globally.

- For instance, the Lockheed Martin 74K aerostat supports payloads up to 500 kilograms while sustaining operating altitudes of approximately 1,500 meters (4,921 ft), enabling long-range radar surveillance during extended missions.

By Propulsion

Powered aerostat systems dominate this segment with a 57% market share, supported by their enhanced maneuverability, controlled navigation, and ability to maintain stable positions during adverse weather conditions. These systems are widely adopted for tactical surveillance, disaster management, and communication support where precise positioning is essential. Unpowered aerostats maintain relevance for static monitoring and elevated ISR functions but face limitations in mobility. Defense modernization programs and the increasing need for persistent, repositionable monitoring platforms drive demand for powered systems. Manufacturers focus on integrating electric propulsion units and lightweight structural materials to enhance endurance and operational efficiency.

- For instance, Israel Aerospace Industries (IAI), through its ELTA subsidiary, produces various advanced, long-endurance aerostat systems that provide persistent surveillance for extended periods, often exceeding a month, at a lower cost than manned aircraft.

By Class

Large-sized aerostat systems hold the leading position with a 46% market share, attributed to their high payload capacity, long endurance, and ability to carry advanced surveillance radars and communication systems. These systems are critical for border security, maritime domain awareness, and military early-warning networks. Mid-sized aerostats appeal to agencies requiring balanced endurance and affordability, while compact-sized versions serve tactical missions and rapid deployment needs. Growth in global defense spending and rising demand for wide-area monitoring continue to strengthen the prominence of large-sized aerostats across strategic security and intelligence operations.

Key Growth Drivers

Rising Demand for Persistent Surveillance and Border Security

Growing security threats and the need for continuous monitoring drive strong adoption of aerostat systems across defense and homeland security agencies. Aerostats provide long-endurance surveillance at lower operational costs compared to aircraft or drones. Their ability to stay aloft for days supports real-time tracking of border movement, illegal trafficking, and coastal threats. Governments worldwide invest in ISR modernization programs to enhance situational awareness. As regions strengthen perimeter security and counter-terrorism measures, the demand for high-altitude aerostat platforms continues to accelerate across military and civilian applications.

- For instance, TCOM’s 44M surveillance aerostat carries radar systems weighing up to 550 kilograms and operates at 1,500 meters for multi-day missions, enabling extended border surveillance with continuous wide-area coverage over large stretches of terrain.

Expansion of Communication and Network Relay Applications

Aerostat systems increasingly support communication relay functions in remote, disaster-prone, and conflict-affected regions. Their elevated position enables wider coverage for radio, cellular, and broadband networks. Defense forces use aerostats as temporary communication towers during field operations, while civil agencies deploy them during natural disasters to restore connectivity. Growing reliance on emergency response systems and rising network congestion in dense areas create new opportunities. As digital transformation expands globally, aerostat-based communication solutions gain traction for their cost efficiency and rapid deployment capability.

- For instance, the Altaeros SuperTower platform delivers LTE or 5G coverage with a radius of up to 40 kilometers (25 miles) from a maximum altitude of 305 meters (1,000 feet) above ground level. It uses an autonomous, tethered aerostat that can replace the coverage of approximately 10 to 15 traditional cell towers.

Technological Advancements in Payload, Sensors, and Materials

Modern aerostat systems benefit from advancements in radar technology, electro-optical sensors, and lightweight composite materials. Enhanced payload capacity enables multi-sensor platforms for surveillance, weather monitoring, and communication tasks. Improved tether systems and integrated power solutions extend operational endurance while reducing maintenance needs. Manufacturers adopt AI-enabled analytics and autonomous navigation to improve mission efficiency. These innovations support diverse use cases in defense, environmental monitoring, disaster assessment, and commercial connectivity. As sensor miniaturization and material durability improve, aerostat performance continues to advance.

Key Trends & Opportunities

Increasing Adoption of Hybrid Aerostats and Multi-Mission Platforms

Hybrid aerostats gain momentum due to their ability to combine buoyant lift with aerodynamic support, resulting in improved stability and greater payload flexibility. These systems support multi-mission operations, including surveillance, communication relay, and atmospheric research. Demand rises as agencies seek platforms with longer endurance and operational versatility. Commercial sectors explore hybrid aerostats for telecom coverage, environmental assessment, and event monitoring. Growing investment in multi-payload integration and long-range data transmission creates strong opportunities for manufacturers developing scalable and energy-efficient hybrid solutions.

- For instance, Aeroscraft’s “Dragon Dream” prototype (a scaled-down, half-size version of the proposed full-scale model) achieved a tethered controlled “first float” test in 2013. This demonstration successfully proved the company’s proprietary Control of Static Heaviness (COSH) buoyancy management system, which enables efficient lift modulation and stable operations by compressing and decompressing internal helium.

Growing Use of Aerostats in Civil and Environmental Monitoring

Civil agencies increasingly deploy aerostats for weather tracking, natural disaster assessment, wildlife monitoring, and infrastructure inspection. Their ability to remain stationary at high altitudes supports precise, long-duration data collection across large areas. Environmental researchers use aerostats for air-quality mapping, climate studies, and pollution tracking. Urban development projects explore aerostat-based aerial platforms for traffic monitoring and smart-city planning. As governments invest more in environmental resilience and climate research, demand for cost-effective, long-endurance monitoring systems grows steadily.

- For instance, Raven Aerostar’s Thunderhead balloon system reached over 20,000 meters and completed flight durations exceeding 30 hours, enabling high-altitude monitoring missions for atmospheric sampling and environmental data collection across wide regions.

Key Challenges

Operational Vulnerability to Weather Conditions and Airspace Regulations

Aerostat systems face challenges from strong winds, storms, and adverse weather that can disrupt stability and limit deployment windows. Compliance with airspace regulations complicates operation, especially near airports or dense urban areas. Obtaining clearance for high-altitude operations requires coordination with aviation authorities, increasing deployment time. Weather-induced operational risks raise maintenance needs and reduce overall system reliability. These constraints limit usage in regions with unpredictable climates, affecting mission scheduling and long-duration surveillance capabilities.

High Initial Investment and Maintenance Requirements

Although operational costs are lower than aircraft, aerostat systems require significant upfront investment for procurement, installation, and supporting infrastructure. Maintenance of tethers, envelopes, sensors, and power units adds to long-term expenses. Defense and commercial users face budget constraints when integrating advanced radar or multi-sensor payloads. Damage from environmental exposure or material fatigue increases replacement costs. These financial challenges make adoption difficult for smaller agencies and restrict large-scale deployment in developing regions.

Regional Analysis

North America

North America holds a market share of 37% driven by strong defense spending, advanced surveillance programs, and expanding homeland security initiatives. The U.S. leads regional adoption with continuous investments in border monitoring, aerial communication networks, and coastal surveillance. Demand rises as military agencies upgrade ISR capabilities and deploy long-endurance aerostats for persistent monitoring. The region benefits from a strong manufacturing base and active R&D in sensor integration, AI-driven analytics, and hybrid aerostat designs. Disaster management agencies also increasingly use aerostat systems for communication support, contributing to sustained market growth across defense and civil applications.

Europe

Europe accounts for a market share of 23%, supported by rising security modernization programs, cross-border surveillance requirements, and increased focus on regional defense cooperation. Countries such as the U.K., France, and Germany deploy aerostat systems to strengthen airspace monitoring and maritime surveillance. Civil agencies adopt aerostats for environmental research, traffic monitoring, and communication support in remote areas. The region also benefits from active development of lightweight materials and hybrid designs to improve durability and fuel efficiency. Growing investment in NATO-aligned security infrastructure further strengthens demand for advanced aerostat platforms across multiple missions.

Asia Pacific

Asia Pacific dominates the global market with a market share of 28%, driven by strong government spending on border surveillance, coastal protection, and military modernization programs. China, India, Japan, and South Korea lead adoption as regional security concerns intensify. Rising demand for communication relays in remote areas and large-scale disaster management capabilities boosts civil deployment. The region also expands the use of aerostats for atmospheric research and environmental monitoring. Growing investment in indigenous manufacturing, combined with rapid technological advances, supports long-term market expansion across both defense and commercial applications.

Latin America

Latin America holds a market share of 7%, influenced by increasing demand for surveillance solutions to address border control, drug trafficking, and coastal security challenges. Brazil and Mexico lead adoption with expanding military modernization efforts and civil security programs. Aerostats gain traction in communication support during natural disasters and in monitoring remote rainforest regions. The region also explores aerostat solutions for environmental studies and infrastructure inspection. Although budget constraints limit widespread deployment, rising security needs and planned modernization initiatives continue to create growth opportunities across defense and civil sectors.

Middle East & Africa

The Middle East & Africa region accounts for a market share of 5%, shaped by growing security threats, expanding military investments, and strong reliance on long-range surveillance systems. Countries such as Saudi Arabia, the UAE, Israel, and South Africa lead adoption due to border protection priorities and strategic defense modernization. Aerostats support persistent monitoring across desert terrains, maritime zones, and conflict-affected areas. Civil applications, including communication restoration and environmental monitoring, also gain momentum. Despite economic disparities, increasing demand for cost-effective, long-endurance surveillance platforms supports gradual market growth across the region.

Market Segmentations:

By Product Type

By Propulsion

By Class

- Compact-sized

- Mid-sized

- Large sized

By Payload

- Electro-optic/Infrared sensors (EO/IR)

- Communication intelligence

- Cameras

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Aerostat Systems market is shaped by leading players such as Northrop Grumman Corporation, ILC Dover, Lockheed Martin Corporation, Allsopp Helikites Ltd., CNIM, AeroVironment, Carolina Unmanned Vehicles, Israel Aerospace Industries, L3Harris Technologies, and Altaeros. These companies compete by advancing aerostat endurance, payload capacity, and all-weather reliability to meet rising demand for surveillance, communication, and border-monitoring missions. Manufacturers focus on high-strength envelope materials, improved tether systems, and integrated electro-optical and radar payloads to enhance operational efficiency. Strategic partnerships with defense agencies and homeland security programs strengthen global deployment opportunities. Companies also invest in hybrid-powered and autonomous aerostat systems to support long-duration intelligence missions. Expanding use in environmental monitoring, disaster management, and maritime surveillance further intensifies competition. As governments increase spending on persistent aerial surveillance, industry players differentiate through cost-efficient designs, rapid deployment capabilities, and advanced propulsion integration.

Key Player Analysis

Recent Developments

- In October 2025, Altaeros secured a second-year contract from the U.S. Department of Homeland Security / U.S. Customs and Border Protection (DHS/CBP) for aerostat operations and support at Santa Teresa, New Mexico, following the initial deployment of an ST-Flex aerostat in September 2024.

- In August 2024, Raytheon, a business unit of RTX, demonstrated the SeaVue Multi-role Radar’s advanced long-range target detection during the U.S. Navy’s Rim of the Pacific (RIMPAC) exercise. The SeaVue Multi-role Radar (SVMR) is a modern, software-defined radar offering all-weather surveillance and multi-mission capabilities for both crewed and uncrewed aircraft, including fixed-wing, rotary-wing, and aerostat platforms.

- In January 2024, L3Harris mentioned the delivery schedule for WESCAM MX-20D systems as part of Canada’s Remotely Piloted Aircraft Systems program, with deliveries starting in 2024.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Propulsion, Class, Payload and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for aerostat systems will rise as countries increase border surveillance and intelligence operations.

- Hybrid aerostats will gain traction due to stronger lift capacity and better endurance.

- Defense agencies will invest more in high-altitude platforms to support real-time monitoring.

- Commercial sectors will adopt aerostats for telecom coverage, event security, and environmental tracking.

- Advanced sensor integration will enhance mapping, detection, and communication capabilities.

- Powered aerostats will expand use in persistent monitoring applications across urban and remote zones.

- Governments will support aerostat deployment in disaster management and emergency response programs.

- Lightweight materials and aerodynamic designs will improve system durability and operating efficiency.

- Long-endurance aerostats will replace some drone-based operations in cost-sensitive missions.

- Asia Pacific will see strong installation growth due to rising security modernization and border protection needs.

Market Insights

Market Insights