Market Overview

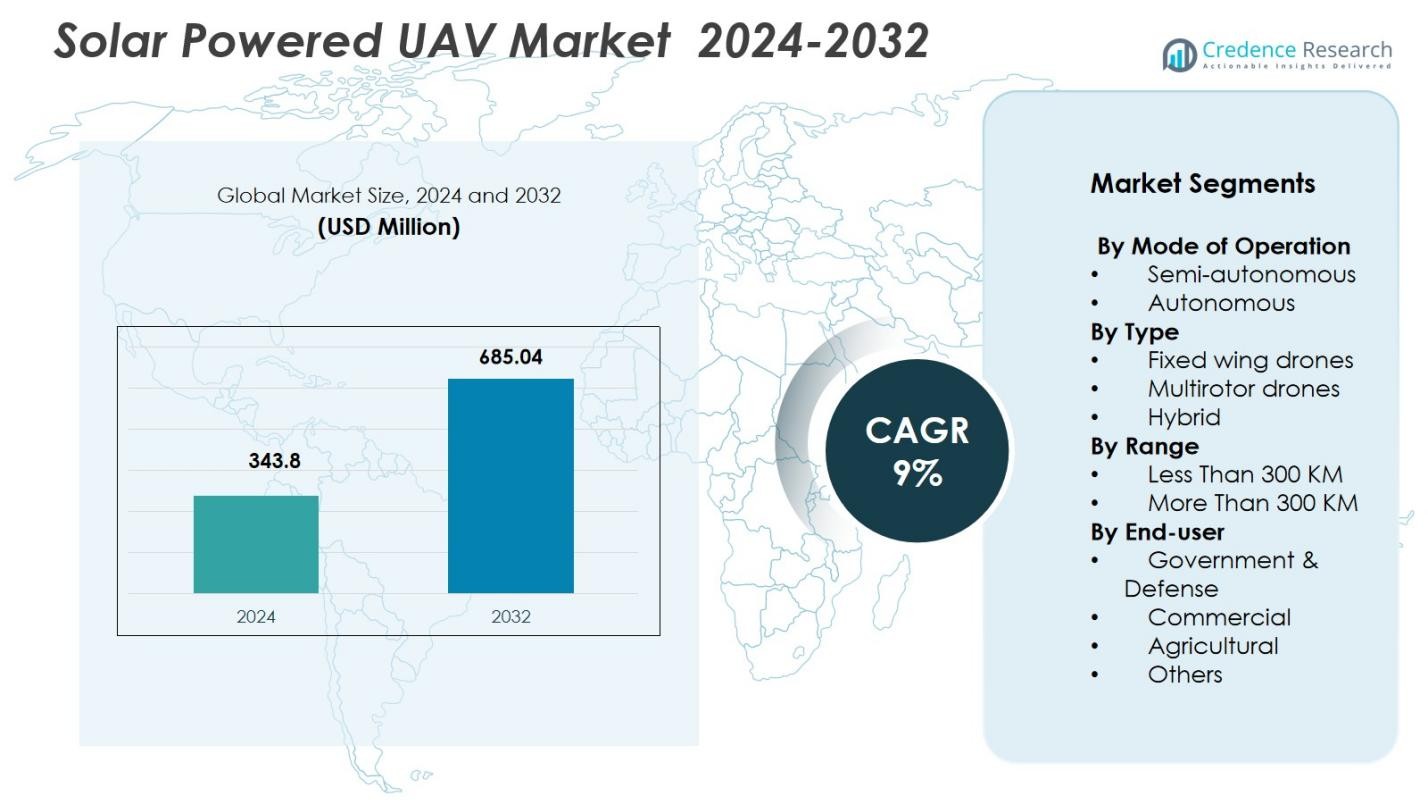

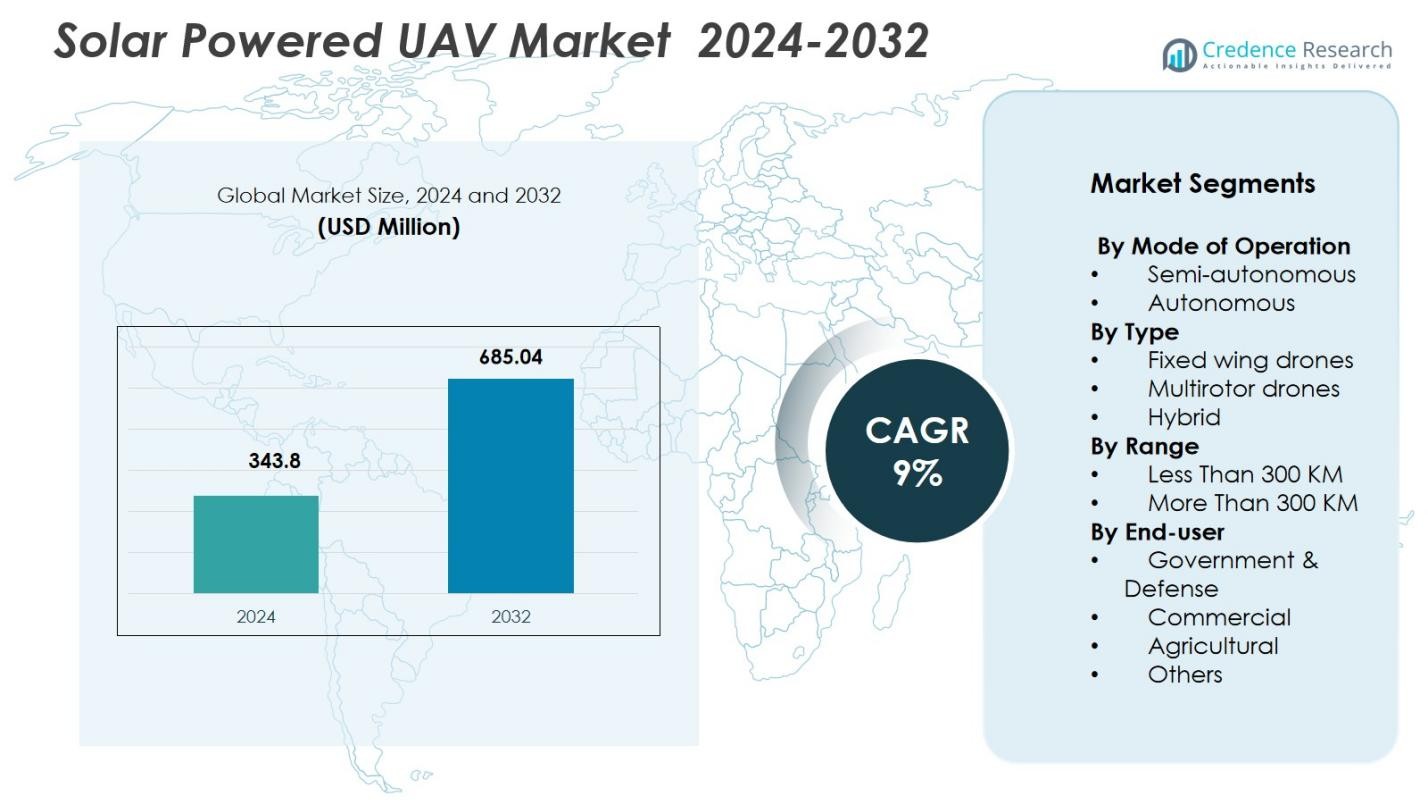

Solar Powered UAV Market size was valued USD 343.8 Million in 2024 and is anticipated to reach USD 685.04 Million by 2032, at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar Powered UAV Market Size 2024 |

USD 343.8 Million |

| Solar Powered UAV Market, CAGR |

9% |

| Solar Powered UAV Market Size 2032 |

USD 685.04 Million |

Solar Powered UAV Market features strong participation from leading players such as AeroVironment Inc., Airbus SE, Aurora Flight Sciences, Atlantik Solar, Avy, BAE Systems, DJI, Elektra, Eos Technologie, and the Chinese Academy of Aerospace Aerodynamics, all of which actively invest in long-endurance platforms, advanced solar integration, and autonomous capabilities. These companies expand their portfolios through innovations in lightweight materials, high-efficiency photovoltaic systems, and stratospheric flight technologies. Regionally, North America leads the market with a 34.6% share in 2024, supported by robust defense spending, extensive R&D activities, and strong adoption of high-altitude solar-powered UAVs for surveillance, communication, and environmental monitoring applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Solar Powered UAV market was valued at USD 343.8 million in 2024 and is projected to reach USD 685.04 million by 2032, growing at a CAGR of 9%.

- Market growth is driven by rising demand for long-endurance surveillance, increasing adoption in environmental monitoring, and expanding use across commercial sectors such as agriculture, infrastructure inspection, and telecommunications.

- Key trends include advancements in high-efficiency solar cells, lightweight composite materials, and AI-enabled autonomous navigation, enabling multi-day flight capability and enhancing mission versatility across industries.

- Major players such as AeroVironment Inc., Airbus SE, Aurora Flight Sciences, and BAE Systems strengthen the market through R&D investment, high-altitude UAV development, and strategic collaborations with defense and research institutions.

- North America leads with a 34.6% share, followed by Europe at 28.3% and Asia-Pacific at 24.7%, while fixed-wing UAVs dominate with a 58.7% segment share due to superior endurance and energy-harvesting efficiency.

Market Segmentation Analysis

Market Segmentation Analysis

By Mode of Operation

The Solar Powered UAV market by mode of operation is led by autonomous systems, capturing 62.4% market share in 2024. Their dominance stems from increasing demand for long-endurance missions, real-time decision-making capabilities, and reduced human intervention in defense, environmental monitoring, and surveillance operations. Autonomous UAVs integrate advanced sensors, AI-based navigation, and automated flight control systems that enhance mission efficiency and operational safety. Semi-autonomous UAVs continue to grow steadily as industries adopt hybrid human-machine control for precision applications, yet full autonomy remains the preferred choice due to superior reliability and extended operational capability.

- For instance, Airbus Zephyr S, a solar-powered high-altitude pseudo-satellite (HAPS), completed a maiden autonomous flight exceeding 25 days in Arizona, USA, in 2018, operating at 21 km altitude above weather disruptions.

By Type

Fixed-wing drones dominate the Solar Powered UAV market, accounting for 58.7% market share in 2024, driven by their exceptional endurance, aerodynamic efficiency, and suitability for high-altitude, long-distance missions. These drones are widely adopted for border surveillance, atmospheric research, and large-area mapping. Multirotor drones are gaining traction for short-range commercial applications requiring high maneuverability, while hybrid UAVs, combining VTOL capabilities with fixed-wing endurance, show rising adoption among emergency response and logistics operators. However, fixed-wing platforms retain leadership due to their superior flight efficiency and ability to maximize solar energy harvesting.

- For instance, ETH Zurich’s AtlantikSolar fixed-wing UAV achieved an 81.5-hour continuous solar-powered flight over 2,338 km, validating multi-day endurance for low-altitude mapping and atmospheric measurement applications.

By Range

Solar Powered UAVs with a range of more than 300 km hold the dominant position, securing 64.1% market share in 2024, primarily due to their extensive use in strategic defense missions, long-duration surveillance, disaster assessment, and scientific data collection. Their larger wingspan allows improved solar panel integration, enabling multi-day endurance without refueling. UAVs with less than 300 km range serve sectors like agriculture, infrastructure inspection, and commercial monitoring where shorter missions suffice, yet long-range platforms remain preferred for mission-critical operations demanding uninterrupted flight and broad-area coverage.

Key Growth Drivers

Rising Demand for Long-Endurance Surveillance and Monitoring

The Solar Powered UAV market is significantly driven by the growing need for long-endurance surveillance across defense, environmental monitoring, and disaster management sectors. Governments and security agencies increasingly deploy solar-powered UAVs for border patrolling, maritime surveillance, and persistent intelligence gathering due to their ability to remain airborne for days without refueling. Their extended operational capability supports real-time data acquisition over vast areas, making them highly efficient for climate research, wildlife tracking, and forest fire detection. As sustainability becomes a strategic priority, solar-powered UAVs offer a cost-effective, energy-efficient alternative to fuel-based UAVs, reducing operational expenses and minimizing carbon emissions. The continual rise in geopolitical tensions and environmental monitoring mandates further amplifies adoption, cementing long-endurance capability as a fundamental growth catalyst for the market.

- For instance, Airbus’ Zephyr completed endurance trials surpassing 25–30 days of continuous flight, enabling persistent border monitoring and military ISR operations for agencies such as the U.S. Army.

Technological Advancements in Solar Efficiency and Lightweight Materials

Rapid advancements in photovoltaic efficiency, battery storage, and lightweight composite materials are accelerating the development of next-generation Solar Powered UAVs. Improved solar cell technologies, such as thin-film and multi-junction cells, enable higher energy conversion rates even under low-light conditions, extending flight duration across varied geographies. Simultaneously, innovations in lithium-sulfur and solid-state batteries enhance energy density, supporting long-range missions with reduced charging cycles. Lightweight carbon fiber and advanced polymers reduce structural weight while improving durability and aerodynamic performance. These technological improvements allow manufacturers to design UAVs with larger wingspans, superior energy harvesting capabilities, and enhanced payload capacity. As research institutions and aerospace companies increase investment in next-generation solar UAV platforms, these advancements serve as a major driver enabling broader commercial, industrial, and defense applications.

- For instance, BAE Systems’ PHASA-35 solar UAV combines ultra-lightweight solar cells with long-life battery packs across a 35 m composite wingspan, targeting stratospheric endurance of up to 12 months for missions such as environmental monitoring and border surveillance.

Growing Adoption Across Commercial and Civil Applications

Commercial and civic sectors are rapidly embracing Solar Powered UAVs due to their operational efficiency, low energy costs, and suitability for high-frequency monitoring tasks. Industries such as agriculture, infrastructure, telecommunications, and renewable energy utilize solar UAVs for activities like crop health assessment, power line inspection, land mapping, and asset monitoring. Their ability to operate without frequent battery swaps or fueling makes them ideal for remote or hazardous locations. Government agencies increasingly rely on these UAVs for disaster response, flood assessment, and environmental compliance tracking. The expanding role of UAVs in delivering broadband connectivity and supporting remote communication networks especially in developing regions further enhances market demand. As businesses prioritize predictive analytics, automation, and sustainability, solar-powered UAV platforms are becoming essential tools that enable continuous, cost-effective aerial intelligence, driving widespread adoption across diverse sectors.

Key Trends & Opportunities

Integration of AI, Autonomy, and Advanced Data Analytics

A major trend shaping the Solar Powered UAV market is the rapid integration of AI-driven autonomy, onboard analytics, and edge computing. These technologies enable real-time decision-making, automated route optimization, and intelligent mission management without constant ground control supervision. AI-enabled object recognition, anomaly detection, and predictive maintenance capabilities unlock new opportunities in security surveillance, precision agriculture, and industrial asset monitoring. The combination of solar energy and autonomous capability ensures continuous, self-sustaining UAV operations, enhancing their appeal for large-scale, long-duration projects. As industries demand more accurate, real-time insights, the fusion of AI and solar-powered UAVs is transforming them into strategic tools for data-driven enterprises.

- For instance, Skydweller Aero’s MAPS drone, with a 236-foot wingspan covered in over 17,000 solar cells generating up to 100kW, integrates Thales’ AI-powered AirMaster S radar for autonomous target classification and maritime surveillance during multi-week flights.

Increasing Use in Telecommunications and Connectivity Expansion

Solar Powered UAVs are emerging as a promising solution for extending telecommunications networks, particularly in remote and underserved regions. High-altitude long-endurance (HALE) solar UAVs can function as airborne communication relays, providing temporary or supplementary connectivity during emergencies, natural disasters, or large public events. Telecom operators explore partnerships to deploy these UAVs as cost-efficient alternatives to satellites for rural broadband coverage and IoT network expansion. Their ability to operate at stratospheric altitudes for extended periods enables stable line-of-sight communication, supporting 5G backhaul and real-time sensor ecosystems. This trend presents significant commercial opportunities as countries focus on bridging digital divides and enhancing digital infrastructure resilience.

- For instance, Airbus’ Zephyr has been evaluated in collaboration with defense and telecom partners such as the UK Ministry of Defence to demonstrate stratospheric communication relay capabilities, supporting resilient connectivity during missions.

Key Challenges

Limitations in Energy Storage and Weather Dependency

Despite rapid technological improvements, energy storage limitations and weather dependency remain substantial barriers for Solar Powered UAV operations. Cloud cover, seasonal variations, and insufficient sunlight can significantly reduce energy harvesting, limiting mission endurance and affecting operational reliability. Battery performance degrades under extreme temperatures, further constraining UAV functionality in harsh environments. Night-time operations depend entirely on stored energy, which restricts mission duration during winter or high-latitude deployments. These challenges force manufacturers to explore hybrid propulsion systems or ultra-efficient materials, yet overcoming natural environmental constraints remains a complex technical hurdle affecting market scalability.

High Development Costs and Regulatory Restrictions

The development of Solar Powered UAVs incurs high costs due to advanced photovoltaic systems, lightweight structural materials, long-endurance design requirements, and sophisticated navigation technologies. Such investment-intensive development often limits adoption among small and mid-sized enterprises. Additionally, regulatory restrictions related to beyond-visual-line-of-sight (BVLOS) operations, high-altitude flights, and cross-border UAV missions pose significant challenges for commercial deployment. Airspace permissions, safety certifications, and data privacy regulations vary across regions, slowing market penetration. Heightened concerns over national security, unauthorized surveillance, and data misuse further intensify scrutiny. These financial and regulatory constraints collectively impede widespread adoption and commercialization of solar-powered UAV platforms.

Regional Analysis

North America

North America leads the Solar Powered UAV market with a 34.6% share in 2024, driven by strong defense modernization programs, rising investment in long-endurance UAV platforms, and the presence of advanced aerospace manufacturers. The U.S. Department of Defense and NASA actively adopt solar UAVs for border surveillance, atmospheric research, and communication relay missions, strengthening regional demand. Expanding applications in disaster response, wildfire monitoring, and infrastructure inspection further support market growth. Favorable regulatory frameworks for UAV testing and innovation, combined with continuous technological advancements, position North America as a dominant hub for long-endurance solar UAV development.

Europe

Europe holds a 28.3% market share in 2024, supported by large-scale R&D initiatives, environmental monitoring programs, and strong participation from aerospace leaders focusing on next-generation solar UAV platforms. The region increasingly deploys solar UAVs for climate studies, maritime monitoring, and cross-border security operations, driven by stringent sustainability and emission-reduction policies. Countries such as Germany, France, and the U.K. invest in long-endurance UAV technologies for civil and defense applications. The strong presence of high-altitude platform system (HAPS) projects and supportive EU aviation regulations further enhance Europe’s position as a key contributor to global solar UAV advancement.

Asia-Pacific

Asia-Pacific accounts for 24.7% of the Solar Powered UAV market in 2024, driven by expanding defense budgets, rapid technological adoption, and growing use of UAVs in agriculture, infrastructure, and disaster management. China, Japan, South Korea, and India are leading adopters, focusing on long-endurance UAVs for border monitoring, communication support, and environmental surveillance. The region’s vulnerability to natural disasters increases demand for continuous aerial monitoring solutions, while government-led drone modernization programs accelerate adoption. Rising investments in solar technology manufacturing and UAV ecosystem development further strengthen Asia-Pacific as a rapidly growing regional market.

Latin America

Latin America captures a 6.4% share of the market in 2024, supported by increasing reliance on UAVs for environmental monitoring, agricultural management, and forest protection. Countries such as Brazil, Chile, and Mexico deploy solar-powered UAVs for monitoring deforestation, optimizing large-scale farming operations, and conducting disaster assessment. Limited infrastructure in remote zones drives interest in long-endurance UAVs capable of extended missions without refueling. Although budget constraints and regulatory challenges slow rapid adoption, growing government interest in climate surveillance and border monitoring creates steady opportunities for solar UAV deployment across the region.

Middle East & Africa

The Middle East & Africa region holds a 6% market share in 2024, with demand primarily driven by defense surveillance needs, border security operations, and infrastructure monitoring in remote areas. Countries in the Gulf region invest in solar-powered UAVs for oil pipeline inspection, desert surveillance, and strategic communications. In Africa, solar UAVs are increasingly adopted for wildlife monitoring, anti-poaching programs, and agricultural assessment across vast landscapes. Harsh climatic conditions favor solar UAVs capable of long-endurance flights, while rising interest in renewable technologies and national security modernization programs supports gradual but steady market expansion.

Market Segmentations

By Mode of Operation

- Semi-autonomous

- Autonomous

By Type

- Fixed wing drones

- Multirotor drones

- Hybrid

By Range

- Less Than 300 KM

- More Than 300 KM

By End-user

- Government & Defense

- Commercial

- Agricultural

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Solar Powered UAV market features a dynamic competitive landscape defined by continuous innovation, strategic collaborations, and a strong focus on long-endurance platform development. Leading companies such as AeroVironment Inc., Airbus SE, Aurora Flight Sciences, Atlantik Solar, Avy, BAE Systems, DJI, Elektra, Eos Technologie, and the Chinese Academy of Aerospace Aerodynamics drive advancements in photovoltaic integration, lightweight structures, and high-altitude flight capabilities. These players invest heavily in R&D to enhance solar efficiency, battery storage, and autonomous navigation systems, enabling multi-day mission endurance. Partnerships with defense agencies, environmental research organizations, and telecom operators further accelerate product deployment across surveillance, climate monitoring, and communication relay applications. New entrants focus on niche solutions such as hybrid VTOL-solar UAVs and specialized payload systems, intensifying competition. As government demand for sustainable aerial intelligence grows, companies prioritize scalability, reliability, and technological differentiation to maintain market leadership.

Key Player Analysis

- Aurora Flight Sciences

- DJI

- Elektra

- Airbus SE

- Atlantik Solar

- Avy

- AeroVironment Inc.

- Chinese Academy of Aerospace Aerodynamics

- BAE Systems

- Eos Technologie

Recent Developments

- In July 2025, Skydweller Aero partnered with Thales to launch the solar-powered drone Skydweller designed for ultra-long endurance maritime surveillance and capable of flying continuously for up to 90 days.

- In July 2025, XSun and H3 Dynamics announced a collaboration to build the world’s first UAV that combines solar, hydrogen fuel-cell, and battery power aiming for extended endurance and lower emissions.

- In February 2025, Kea Aerospace achieved its first stratospheric flight with its solar-powered UAV (the “Kea Atmos”) reaching 56,284 ft altitude and flying 420 km in 8 hours 20 minutes, a milestone toward long-duration solar flight.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Mode of Operation, Type, Range, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness increased adoption of long-endurance UAVs for defense, environmental monitoring, and strategic communication missions.

- Advancements in high-efficiency solar cells will enhance energy harvesting and extend operational flight duration.

- Integration of AI and autonomous navigation systems will improve mission accuracy and reduce dependency on human control.

- High-altitude platform systems (HAPS) will gain traction as alternatives to satellites for connectivity and surveillance.

- Hybrid solar-electric propulsion designs will emerge to overcome weather limitations and ensure consistent performance.

- Commercial sectors such as agriculture, mining, and infrastructure inspection will expand their use of solar-powered UAVs.

- Governments will increase investments in renewable aviation technologies to meet sustainability and emission-reduction goals.

- Lightweight materials and aerodynamic innovations will enable larger wingspans and improved payload capacity.

- Telecom operators will explore solar UAVs for rural broadband deployment and emergency communication support.

- Regulatory frameworks will gradually evolve to support BVLOS operations and high-altitude UAV integration into national airspace.

Market Segmentation Analysis

Market Segmentation Analysis