Market Overview

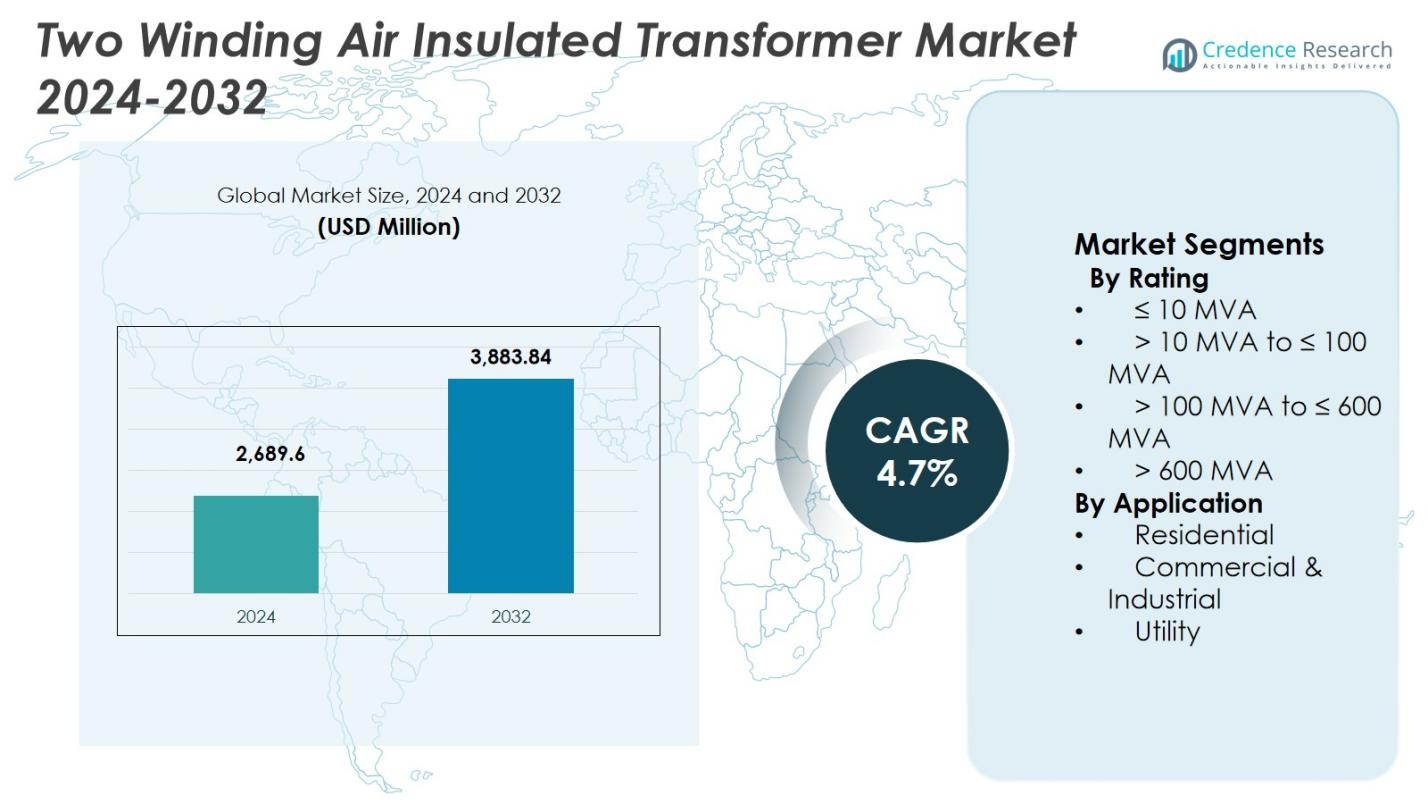

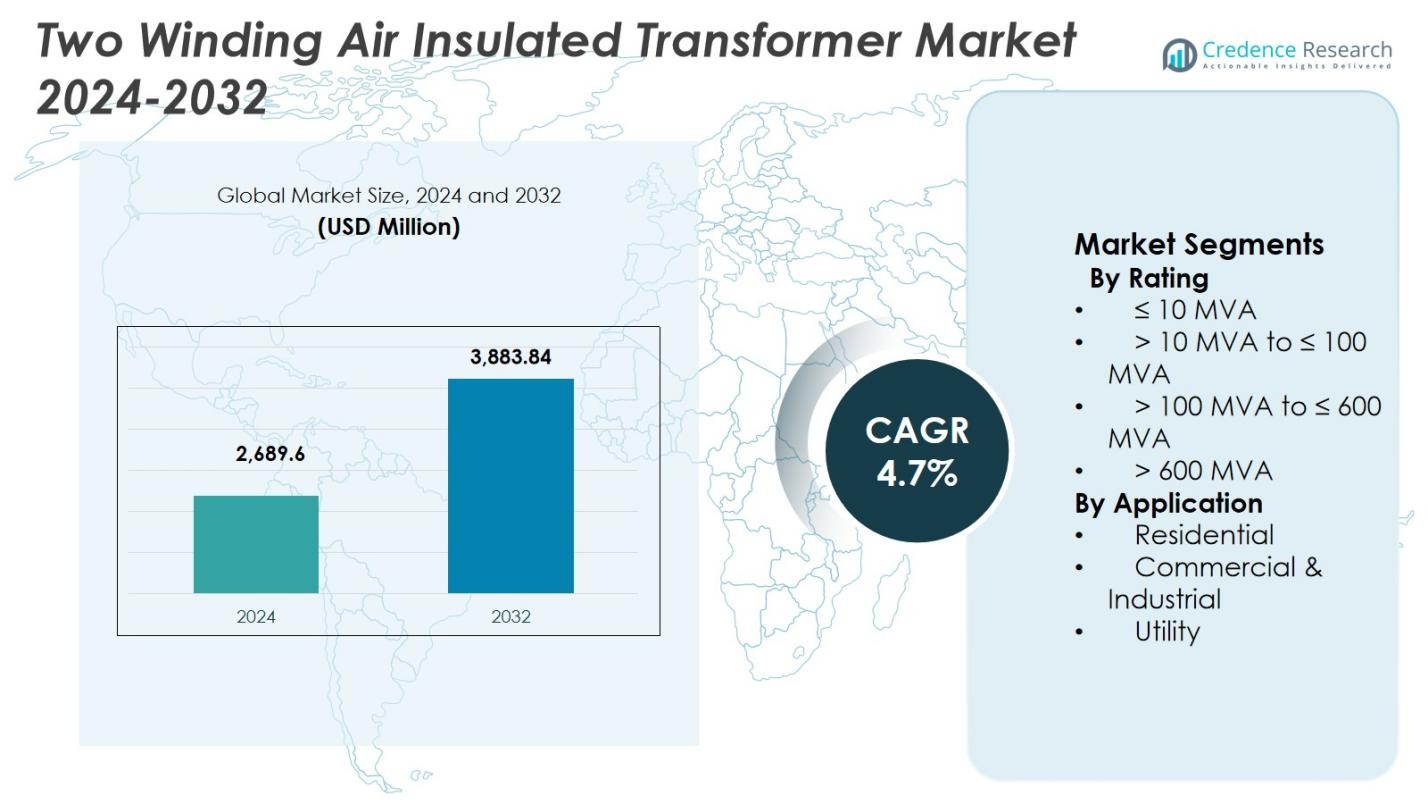

Two Winding Air Insulated Transformer Market size was valued at USD 2,689.6 million in 2024 and is anticipated to reach USD 3,883.84 million by 2032, growing at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Two Winding Air Insulated Transformer Market Size 2024 |

USD 2,689.6 Million |

| Two Winding Air Insulated Transformer Market, CAGR |

4.7% |

| Two Winding Air Insulated Transformer Market Size 2032 |

USD 3,883.84 Million |

Two Winding Air Insulated Transformer Market is supported by the presence of established global and regional manufacturers including Hitachi Energy, General Electric, Siemens Energy, Eaton, CG Power & Industrial Solutions, Hyosung Heavy Industries, Elsewedy Electric, ARTECHE, DAIHEN Corporation, and IMEFY Group. These companies focus on expanding manufacturing capacity, enhancing transformer efficiency, and supporting large-scale utility and industrial power projects. Asia Pacific leads the market with 34.7% share, driven by rapid grid expansion and electrification initiatives in China, India, and Southeast Asia. North America follows with 26.4% share, supported by grid modernization and infrastructure replacement, while Europe accounts for 24.1% share due to strong renewable energy integration and regulatory upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Two Winding Air Insulated Transformer Market was valued at USD 2,689.6 million in 2024 and is projected to reach USD 3,883.84 million by 2032, growing at a CAGR of 4.7% during the forecast period.

- Market growth is driven by expansion of transmission and distribution networks, rising electricity demand, and renewable energy integration, with the > 10 MVA to ≤ 100 MVA rating segment leading at 3% market share due to its optimal balance of capacity and cost efficiency.

- The market is witnessing increased adoption of modern air insulated transformers for grid modernization and replacement of aging infrastructure, supported by manufacturers focusing on efficiency improvements, capacity expansion, and localized production strategies.

- Market expansion faces restraints from large space requirements for air insulated installations and rising adoption of compact alternative insulation technologies in urban and space-constrained environments.

- Asia Pacific leads the market with 7% share, followed by North America at 26.4% and Europe at 24.1%, while the Utility application segment dominates with 52.8% share, supported by ongoing grid expansion and infrastructure upgrades.

Market Segmentation Analysis:

By Rating:

The Two Winding Air Insulated Transformer Market by rating is led by the > 10 MVA to ≤ 100 MVA segment, which accounted for 46.3% market share in 2024. This dominance is driven by strong demand from medium-scale power distribution, renewable energy integration, and industrial substations requiring reliable voltage regulation. These transformers offer an optimal balance between capacity, cost efficiency, and operational flexibility, making them widely adopted across expanding transmission and distribution networks. Growing investments in grid modernization, urban electrification, and renewable interconnections further support sustained demand for this rating range.

- For instance, Hitachi Energy reported delivering over 500 units in its 735–765 kV range globally, demonstrating sustained production and deployment of large and medium transformers tailored to critical grid infrastructure.

By Application:

By application, the Utility segment held the largest share of the Two Winding Air Insulated Transformer Market at 52.8% in 2024. Utilities extensively deploy these transformers for transmission substations, grid expansion projects, and replacement of aging infrastructure. Rising electricity demand, increasing renewable energy penetration, and government-led investments in power infrastructure strongly drive this segment. Air insulated transformers remain preferred in utility applications due to their high reliability, ease of maintenance, and suitability for high-capacity outdoor installations, supporting stable long-term grid performance and system resilience.

- For instance, GE Vernova (Grid Solutions) reported that Amprion (Germany) awarded a contract for twelve 400 kV power transformers, totaling more than 5,000 MVA, as part of grid reinforcement and asset renewal tied to the energy transition.

Key Growth Drivers

Expansion of Power Transmission and Distribution Infrastructure

The Two Winding Air Insulated Transformer Market benefits strongly from continuous expansion of transmission and distribution networks across developed and emerging economies. Rising electricity consumption, urbanization, and industrial growth are pushing utilities to invest in new substations and grid reinforcement projects. Governments and private utilities are upgrading aging power infrastructure to improve efficiency and reliability. Air insulated transformers are widely preferred in outdoor substations due to their robust design, cost-effectiveness, and ease of maintenance, which supports steady demand across utility-scale installations.

- For instance, GE Vernova’s Grid Solutions supplied two 500 kV air-insulated substations, Tigre Norte with 2×280 MVA capacity and Tigre Sul with 2×220 MVA capacity, for the Serra do Tigre Wind Complex in Brazil’s Rio Grande do Norte state.

Growing Integration of Renewable Energy Sources

Increasing deployment of renewable energy projects significantly drives the Two Winding Air Insulated Transformer Market. Wind and solar power plants require reliable step-up and step-down transformers to connect generation assets to the grid. Two winding air insulated transformers are well suited for renewable installations due to their operational reliability, thermal stability, and compatibility with varying load conditions. As countries accelerate renewable capacity additions to meet decarbonization targets, demand for grid-connected transformers continues to rise across both utility and industrial applications.

- For instance, Siemens Energy offers fluid-immersed two winding distribution transformers rated up to 9.8 MVA and 66 kV for wind farms. These can be installed beside turbines, inside towers, or in nacelles, handling variable wind loads effectively.

Industrialization and Electrification of Emerging Economies

Rapid industrialization and electrification in emerging economies support sustained growth of the Two Winding Air Insulated Transformer Market. Expansion of manufacturing facilities, data centers, transportation infrastructure, and commercial complexes increases the need for stable and efficient power distribution. Governments are also focusing on rural electrification and urban infrastructure development, creating demand for medium- and high-capacity transformers. Air insulated designs remain favored due to lower lifecycle costs and proven performance in diverse operating environments.

Key Trends & Opportunities

Grid Modernization and Replacement of Aging Transformers

A major trend in the Two Winding Air Insulated Transformer Market is the replacement of aging transformers with modern, higher-efficiency units. Utilities are prioritizing grid modernization to reduce technical losses, enhance reliability, and meet evolving regulatory standards. This creates strong opportunities for manufacturers offering advanced air insulated transformers with improved thermal performance, monitoring capabilities, and longer service life. Replacement demand remains especially strong in mature power markets with decades-old infrastructure.

- For instance, Hitachi Energy provides cooling system overhauls for aging transformers, converting from ONAN to ONAF configurations or single-tube to double-tube designs. These upgrades lower operating temperatures to slow insulation degradation and boost loading capacity without full replacement.

Rising Demand for High-Capacity Outdoor Substations

The market is witnessing increased demand for high-capacity outdoor substations to support expanding transmission networks and renewable integration. Two winding air insulated transformers are increasingly deployed in these substations due to their scalability and suitability for high-voltage applications. This trend creates opportunities for suppliers to develop customized, large-capacity transformer solutions that address space constraints, high load requirements, and long-term operational reliability in utility-scale projects.

- For instance, GE Vernova Inc. was selected by POWERGRID to supply over 70 extra-high-voltage 765 kV transformers and shunt reactors, with deliveries slated through 2027 to strengthen renewable transmission projects.

Key Challenges

Space Requirements and Installation Constraints

One of the key challenges in the Two Winding Air Insulated Transformer Market is the large physical footprint required for air insulated installations. In densely populated urban areas, space limitations can restrict deployment, especially compared to compact alternatives. Securing adequate land for outdoor substations increases project complexity and costs. These constraints may limit adoption in space-constrained environments, pushing some users toward alternative transformer technologies.

Competition from Alternative Insulation Technologies

The market faces growing competition from alternative transformer technologies that offer compact designs and enhanced safety features. Gas insulated and dry-type transformers are increasingly considered in applications where space efficiency and reduced environmental exposure are critical. While air insulated transformers remain cost-effective and reliable, technological advancements in competing solutions pose a challenge. Manufacturers must continuously improve efficiency, durability, and value propositions to maintain competitiveness across diverse end-use applications.

Regional Analysis

North America

The Two Winding Air Insulated Transformer Market in North America accounted for 26.4% market share in 2024, supported by steady investments in grid modernization and replacement of aging power infrastructure. Utilities across the United States and Canada are upgrading transmission and distribution networks to improve reliability and integrate renewable energy sources. Rising electricity demand from data centers, industrial facilities, and electric vehicle infrastructure further drives transformer installations. Air insulated transformers remain widely deployed in outdoor substations due to their proven performance, ease of maintenance, and suitability for medium- to high-capacity utility applications.

Europe

Europe held 24.1% market share in 2024 in the Two Winding Air Insulated Transformer Market, driven by strong focus on renewable energy integration and cross-border power interconnections. Countries across Western and Northern Europe continue to invest in grid reinforcement to support wind and solar capacity expansion. Replacement of legacy transformers to meet higher efficiency and safety standards also contributes to demand. Air insulated transformers are favored in utility substations and industrial facilities due to their reliability and adaptability to diverse climatic conditions, supporting consistent market growth across the region.

Asia Pacific

Asia Pacific dominated the Two Winding Air Insulated Transformer Market with 34.7% market share in 2024, reflecting rapid urbanization, industrial expansion, and large-scale electrification projects. China, India, and Southeast Asian countries are investing heavily in transmission and distribution infrastructure to support rising power consumption. Expansion of renewable energy capacity and rural electrification programs further accelerate demand. Air insulated transformers are extensively used in utility-scale substations due to cost efficiency and scalability, making the region the primary growth engine for the global market.

Latin America

Latin America accounted for 8.3% market share in 2024 in the Two Winding Air Insulated Transformer Market, supported by gradual expansion of power infrastructure and renewable energy projects. Countries such as Brazil, Mexico, and Chile are strengthening transmission networks to accommodate wind, solar, and hydropower generation. Investments in industrial development and urban power distribution also contribute to transformer demand. Air insulated transformers are preferred for outdoor substations in utility and industrial applications due to their durability and lower operational complexity in varied environmental conditions.

Middle East & Africa

The Middle East & Africa region captured 6.5% market share in 2024 in the Two Winding Air Insulated Transformer Market, driven by power infrastructure expansion and grid development initiatives. Rapid urban growth, industrialization, and large-scale infrastructure projects increase electricity demand across the region. Utilities are investing in new substations to support oil and gas facilities, desalination plants, and renewable energy installations. Air insulated transformers are widely adopted for outdoor applications due to their reliability in high-temperature environments and suitability for large-capacity power distribution systems.

Market Segmentations:

By Rating

- ≤ 10 MVA

- > 10 MVA to ≤ 100 MVA

- > 100 MVA to ≤ 600 MVA

- > 600 MVA

By Application

- Residential

- Commercial & Industrial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Two Winding Air Insulated Transformer Market includes key players such as Hitachi Energy, General Electric, Siemens Energy, Eaton, CG Power & Industrial Solutions, Hyosung Heavy Industries, Elsewedy Electric, ARTECHE, DAIHEN Corporation, and IMEFY Group. The market reflects a structured presence of global and regional manufacturers focused on expanding product portfolios and strengthening geographic reach. Companies emphasize capacity expansion, technological upgrades, and compliance with international efficiency standards to meet evolving utility and industrial requirements. Strategic investments in manufacturing facilities and localized production help players address regional demand and reduce supply chain risks. Collaboration with utilities and EPC contractors supports large-scale infrastructure projects and renewable energy integration. Continuous improvement in thermal performance, reliability, and lifecycle efficiency remains central to differentiation, enabling established players to maintain strong positions across transmission, distribution, and industrial power applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Hitachi Energy successfully tested a groundbreaking 765 kV natural ester-filled transformer, the world’s largest at this voltage and power level, enhancing safety and environmental performance for ultra-high-voltage grids.

- In September 2025, Siemens Energy announced a €220 million investment to expand its transformer manufacturing plant in Nuremberg, Germany, increasing production capacity by about 50% and creating ~350 new jobs to support rising grid equipment demand.

- In October 2025, GE Vernova announced it will acquire the remaining 50% stake in transformer manufacturer Prolec GE from partner Xignux for about $5.28 billion, consolidating full ownership to strengthen its grid equipment business (expected to close by mid-2026).

Report Coverage

The research report offers an in-depth analysis based on Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Two Winding Air Insulated Transformer Market will continue to benefit from sustained investments in transmission and distribution infrastructure worldwide.

- Growing electricity demand from urbanization and industrial expansion will support steady transformer deployment across utility networks.

- Grid modernization and replacement of aging transformers will remain a consistent source of demand in developed economies.

- Renewable energy integration will increase the need for reliable step-up and step-down transformers in power networks.

- Emerging economies will drive growth through electrification programs and expansion of industrial and commercial facilities.

- Utilities will prioritize transformers with higher efficiency, reliability, and longer operational life.

- Outdoor substations will continue to favor air insulated designs due to ease of maintenance and operational robustness.

- Technological improvements will enhance thermal performance and monitoring capabilities of transformers.

- Manufacturers will focus on localization of production to improve supply chain resilience and cost efficiency.

- Regulatory emphasis on grid reliability and energy efficiency will shape future product development and adoption.