Market Overview

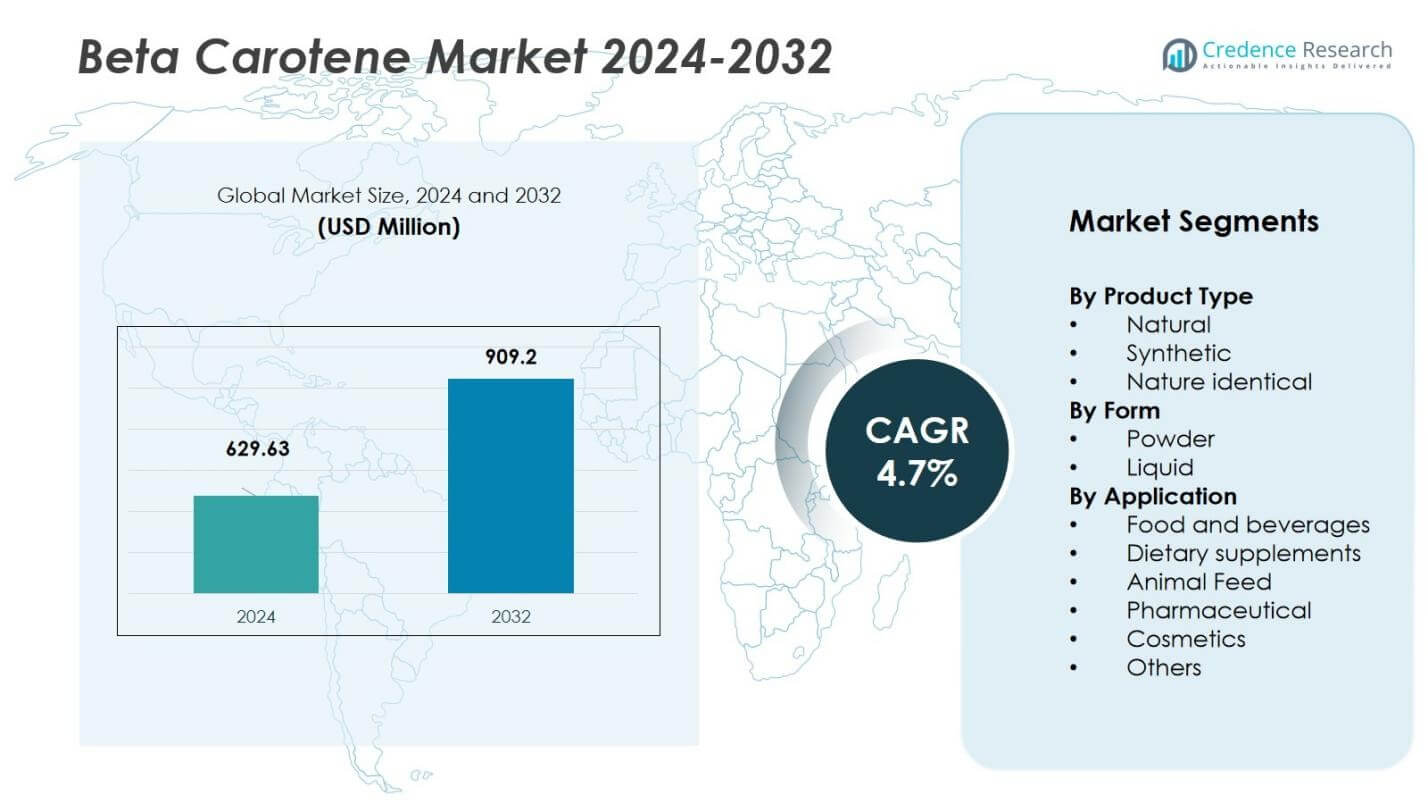

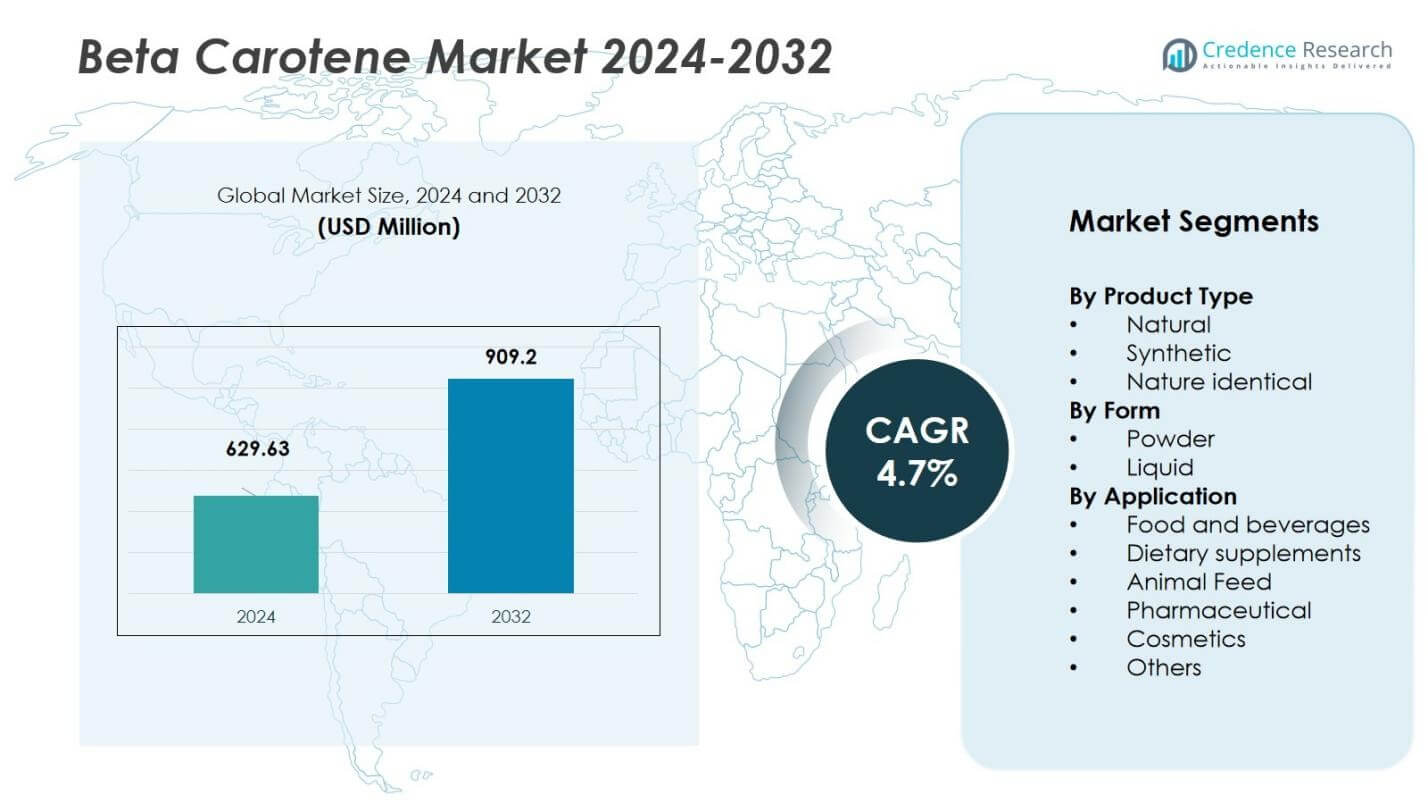

The Beta Carotene Market size was valued at USD 629.63 million in 2024 and is anticipated to reach USD 909.2 million by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Beta Carotene Market Size 2024 |

USD 629.63 Million |

| Beta Carotene Market, CAGR |

4.7% |

| Beta Carotene Market Size 2032 |

USD 909.2 Million |

The Beta Carotene Market is driven by leading players such as BASF SE, Koninklijke DSM N.V., Chr. Hansen Holding A/S, and Zhejiang Medicine Co., Ltd. These companies dominate the market through their extensive product portfolios, global reach, and continuous investments in research and development. BASF and DSM are particularly prominent, leveraging advanced extraction technologies and a strong presence across multiple regions. Europe holds the largest market share, commanding 45% of the global Beta Carotene Market, driven by robust demand in food & beverages and cosmetics. North America follows with a 36% share, supported by a growing preference for natural ingredients in dietary supplements. The Asia Pacific region, with its expanding middle-class population and increasing demand for functional products, is the fastest-growing, accounting for 15% of the market. These regions continue to shape the market’s growth, with innovation and sustainability driving future developments.

Market Insights

- The Beta Carotene Market was valued at USD 629.63 million in 2024 and is projected to reach USD 909.2 million by 2032, growing at a CAGR of 4.7% during the forecast period.

- Rising consumer demand for natural ingredients in food, beverages, and dietary supplements is a key driver for the market. Increasing health awareness and the shift towards plant-based products are also contributing to growth.

- A major trend is the growing use of Beta Carotene in functional foods and beverages, driven by consumer interest in products with added health benefits. Personalized nutrition is another emerging trend.

- The market is highly competitive, with key players such as BASF SE, DSM, Chr. Hansen, and Zhejiang Medicine leading the market through innovation and strategic partnerships.

- Europe leads the market with a share of 45%, followed by North America at 36%, and Asia Pacific at 15%, with the latter showing the fastest growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Beta Carotene Market is segmented into natural, synthetic, and nature-identical types. The natural segment holds the dominant market share, accounting for approximately 45% of the total market. This is due to increasing consumer preference for natural ingredients in food, beverages, and dietary supplements. Natural Beta Carotene, derived from plant-based materials, is particularly popular among health-conscious consumers. Its growth is driven by the rising demand for clean-label products and plant-based ingredients. The natural segment is expected to maintain its lead, supported by its health benefits and demand for natural supplements.

- For instance, DSM Nutritional Products launched its natural Beta Carotene line, using a patented fermentation process to extract the ingredient from non-GMO crops, ensuring purity and natural sourcing.

By Form

The market is divided into powder and liquid forms, with the powder segment holding the larger share of 60%. The powder form of Beta Carotene is favored for its ease of incorporation into a wide range of products, especially in dietary supplements and food & beverages. Its versatility and longer shelf life contribute to its dominance. The liquid segment, while growing, holds around 40% of the market, particularly for applications requiring easy dispersion, such as in beverages and cosmetics. The demand for powder form is expected to continue leading the market due to its cost-effectiveness and convenience.

- For instance, Chr. Hansen, a global leader in natural ingredients, developed a stable, water-dispersible powder form of Beta Carotene, which improves ease of formulation in dietary supplements and food products.

By Application

The Beta Carotene Market finds applications in food & beverages, dietary supplements, animal feed, pharmaceuticals, cosmetics, and others. The food and beverages segment holds the largest market share, accounting for approximately 40% of the total market. This growth is driven by increasing consumer awareness of the health benefits of Beta Carotene, particularly its role as a source of vitamin A and antioxidant properties. The dietary supplements sector follows closely, with a share of around 30%, fueled by the growing demand for natural ways to enhance health and well-being. Both sectors are projected to see sustained growth throughout the forecast period.

Key Growth Drivers

Rising Demand for Natural Ingredients

The growing preference for natural ingredients in food, beverages, and dietary supplements is a significant driver for the Beta Carotene Market. Consumers are increasingly seeking clean-label products that are free from artificial additives, preservatives, and colors. Natural Beta Carotene, derived from plant-based sources such as carrots and algae, aligns with the shift towards health-conscious and sustainable choices. This trend is particularly prominent in the food & beverage and dietary supplement industries, driving the demand for natural Beta Carotene and fueling market expansion.

- For instance, DSM‑Firmenich markets its Vibelly™ β‑Carotene (CaroCare®) range, produced via advanced fermentation, and designed for ready‐to‐drink beverages with guaranteed color intensity and stability.

Health Benefits and Awareness

The increasing awareness of the health benefits of Beta Carotene, particularly its role in boosting immunity and promoting eye health, is another key driver. As consumers become more educated about the importance of antioxidants and their impact on overall health, the demand for Beta Carotene as a functional ingredient rises. Its ability to enhance vision, protect against oxidative stress, and support skin health continues to propel its use in dietary supplements, pharmaceuticals, and cosmetics, contributing to the overall market growth.

- For instance, BASF’s Lucarotin® Nature‑identical Beta‑Carotene is offered in multiple formats including beadlets and cold‑water dispersible powders, meeting USP/Ph. Eur. monographs and supporting applications across human nutrition, food & beverages, and dietary supplements.

Technological Advancements in Extraction and Formulation

Advances in extraction technologies and formulation techniques are driving the growth of the Beta Carotene Market. Innovations in processing methods, such as improved extraction from algae and more efficient ways to stabilize Beta Carotene in various forms, have made the ingredient more accessible and cost-effective. These technological improvements also enable better product formulations, expanding its applications in different industries, such as cosmetics and animal feed, thereby creating new market opportunities and accelerating growth.

Key Trends & Opportunities

Expansion of Functional Foods and Beverages

One of the prominent trends in the Beta Carotene Market is the increasing incorporation of functional ingredients into food and beverage products. As consumers demand products that offer additional health benefits beyond basic nutrition, Beta Carotene’s antioxidant and immune-boosting properties have become highly sought after. This trend is opening up new opportunities for manufacturers to innovate and develop functional food and beverage products that cater to health-conscious consumers, thereby boosting market growth in the coming years.

- For instance, Allied Biotech Corporation has developed a range of carotenoid products for beverages like juice, milk, and yogurt, including transparent formulations for clear soft drinks and flavored water.

Growing Popularity of Personalized Nutrition

Personalized nutrition is an emerging trend that presents significant opportunities for the Beta Carotene Market. As consumers increasingly look for dietary supplements tailored to their specific health needs, Beta Carotene is gaining traction as a key ingredient in personalized formulations. This trend is being driven by advances in genomics and health data, allowing companies to create more targeted products that address individual health concerns, such as eye health, immune support, and skin protection. The rise of personalized nutrition is poised to open up new avenues for Beta Carotene applications.

- For instance, BASF offers nature-identical beta-carotene products suitable for dietary supplements that support immune health, meeting the needs of consumers prioritizing wellness.

Key Challenges

Regulatory and Quality Control Issues

One of the major challenges facing the Beta Carotene Market is the complex regulatory landscape surrounding natural ingredients. Different regions have varying standards for the use of Beta Carotene in food, beverages, and supplements, which can pose significant barriers for companies seeking to enter global markets. Additionally, quality control remains a challenge, particularly with the increasing demand for natural and organic ingredients. Ensuring consistent quality and meeting regulatory requirements can be resource-intensive for manufacturers, potentially hindering market expansion.

Price Volatility and Supply Chain Disruptions

Beta Carotene, especially in its natural form, is sourced from crops like carrots and algae, making it vulnerable to price volatility and supply chain disruptions. Environmental factors, such as crop failures or natural disasters, can significantly impact the availability and cost of raw materials. This price instability poses a challenge for manufacturers, as fluctuations in supply chain costs can directly affect product pricing and profitability. As demand for Beta Carotene continues to rise, ensuring a stable and reliable supply chain will be crucial for sustaining market growth.

Regional Analysis

Europe

The Europe region held a market share of 45% in the global Beta‑Carotene market in 2023. The region benefits from strong demand in food & beverages and cosmetics, driven by consumers seeking natural ingredients and anti‑aging products. Regulatory frameworks favour clean‑label and natural additives, which support growth in Europe’s dietary supplement and functional food segments. Germany, France, and the UK emerge as key markets, with well‑developed industries and higher disposable incomes. The increasing focus on health and wellness continues to drive the demand for Beta‑Carotene in Europe, supporting its dominance in the market.

North America

North America holds a significant share of 36% in the Beta‑Carotene market. The region is supported by rising consumer health awareness and growth in the dietary supplement and functional food sectors. Manufacturers in the U.S. capitalize on advanced distribution channels and regulatory clarity, enabling wider use of Beta‑Carotene in food fortification and cosmetics. Nutrition‑conscious trends and large animal feed industries also contribute to sustained demand in this region. The U.S. and Canada remain key markets, driven by higher disposable income and an increasing inclination toward preventive healthcare.

Asia Pacific

The Asia Pacific region is the fastest‑growing segment of the Beta‑Carotene market, with an expected market share of 15%. This growth is driven by expanding middle-class populations, rising health consciousness, and increasing consumption of processed foods. Growth is particularly strong in countries such as China and India, where the cosmetics, food & beverage, and animal feed sectors are rapidly expanding. The region offers significant opportunities for suppliers focusing on affordable and scalable natural Beta‑Carotene. The increasing demand for natural and functional products is set to boost market expansion in Asia Pacific.

Latin America

Latin America holds a smaller market share of 4%, but it shows solid growth potential as lifestyle shifts toward healthier foods increase across the region. Regional drivers include growing urbanisation, rising awareness about natural colourants, and expanding animal nutrition demand. Growth in Brazil and Mexico, along with increased use in dietary supplements and fortified foods, position Latin America as an emerging market for formulators and ingredient suppliers. As the demand for natural ingredients continues to rise, Latin America is expected to experience steady market growth in the coming years.

Middle East & Africa

The Middle East & Africa region contributes around 3% to the global Beta‑Carotene market, but it offers niche opportunities in cosmetics and animal‑feed applications. As regulatory frameworks evolve and preferences for natural additives rise, demand for Beta‑Carotene is gaining traction, especially in the Gulf Cooperation Council (GCC) countries. While current market shares are lower relative to other regions, the growing focus on health and wellness, along with a rise in demand for premium cosmetic products, positions the Middle East & Africa as a region with considerable potential for future growth.

Market Segmentations:

By Product Type

- Natural

- Synthetic

- Nature identical

By Form

By Application

- Food and beverages

- Dietary supplements

- Animal Feed

- Pharmaceutical

- Cosmetics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Beta Carotene Market is highly competitive, with key players such as BASF SE, Koninklijke DSM N.V., Chr. Hansen Holding A/S, and Zhejiang Medicine Co., Ltd. leading the market. These companies dominate the industry through strong brand recognition, extensive product portfolios, and innovative production methods. The market is characterized by a mix of established multinational corporations and regional players, each focusing on expanding their product offerings and geographical reach. Major players are leveraging strategic partnerships, mergers, and acquisitions to enhance their market position and expand their technological capabilities. For instance, collaborations in the agricultural sector enable key players to strengthen their supply chains, ensuring a steady and high-quality Beta Carotene supply. Furthermore, companies are increasingly investing in R&D to develop sustainable and cost-effective production methods, capitalizing on the growing demand for natural and clean-label products. As competition intensifies, firms are also focusing on product differentiation and improving production efficiency to maintain their leadership in the market.

Key Player Analysis

- Cyanotech Corporation

- Hansen Holding A/S

- Kemin Industries

- Divi’s Laboratories Ltd.

- Sensient Technologies Corporation

- Zhejiang Medicine Co., Ltd.

- BASF SE

- D. Williamson & Co., Inc.

- Allied Biotech Corporation

- Koninklijke DSM N.V.

Recent Developments

- In March 2023, BASF announced the expansion of its beta carotene production capacity in Asia. The expansion is in response to the growing demand for beta carotene in the region, particularly in China and India.

- In November 2023, Divi’s Laboratories Ltd. introduced new beta‑carotene solutions at the Food Ingredients Europe event.

- In February 2023, Koninklijke DSM N.V. launched a new, more stable form of beta‑carotene that offers improved heat and light resistance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for natural Beta Carotene is expected to continue growing as consumers increasingly seek clean-label and plant-based ingredients in food, beverages, and dietary supplements.

- Technological advancements in extraction methods will enhance the efficiency and sustainability of Beta Carotene production, leading to lower costs and improved product quality.

- The rising awareness of the health benefits of Beta Carotene, particularly its antioxidant and immune-boosting properties, will drive its use in dietary supplements and functional foods.

- Regulatory frameworks supporting natural and organic products will encourage the use of Beta Carotene in clean-label foods and beverages, especially in developed markets.

- The Asia Pacific region will witness the highest growth, driven by increased demand from countries like China and India, where middle-class populations are expanding rapidly.

- The cosmetics industry will continue to be a significant driver of Beta Carotene demand, as consumers seek natural ingredients for anti-aging and skin-care products.

- Personalized nutrition trends will open new opportunities for Beta Carotene, with an increasing focus on tailored health supplements targeting specific needs such as eye health and skin protection.

- The growing interest in plant-based diets will increase the use of Beta Carotene in plant-based food alternatives, providing additional market opportunities.

- Companies will continue to invest in research and development to improve the bioavailability and absorption of Beta Carotene in various formulations.

- The market will experience strong competition, with players focusing on product innovation, expanding their geographical reach, and forming strategic partnerships to enhance their market share.