Market Overview:

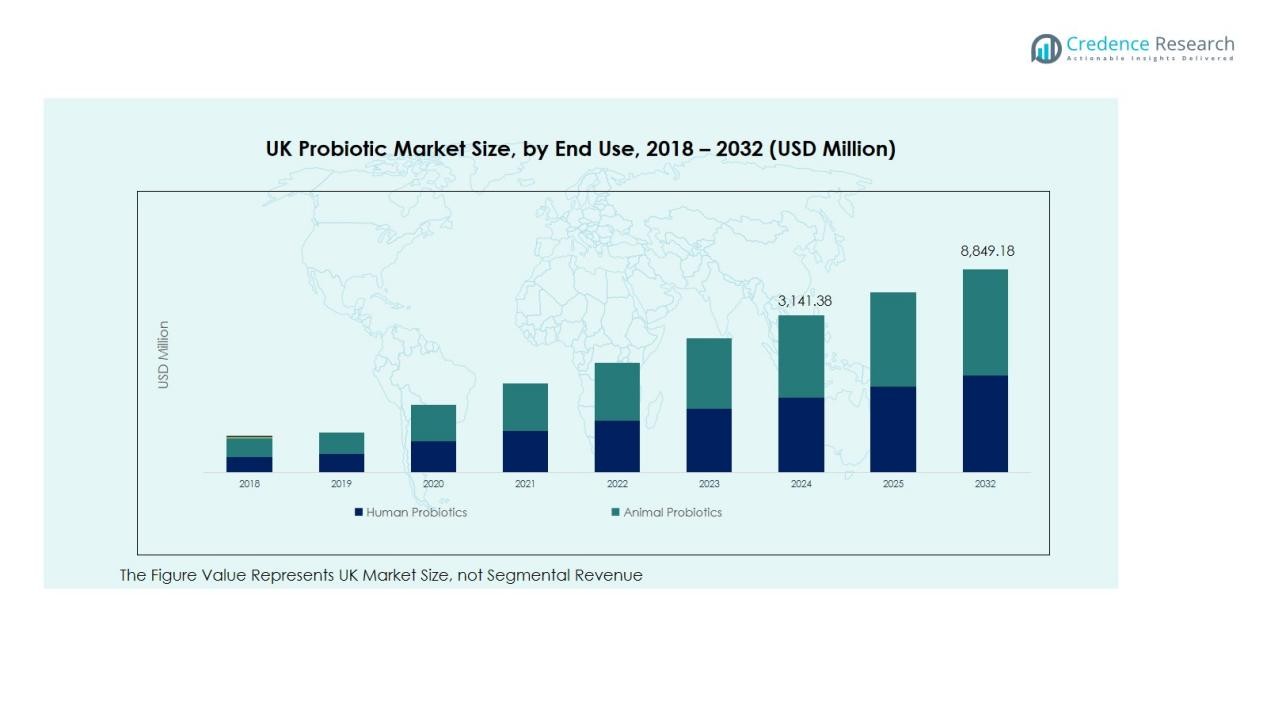

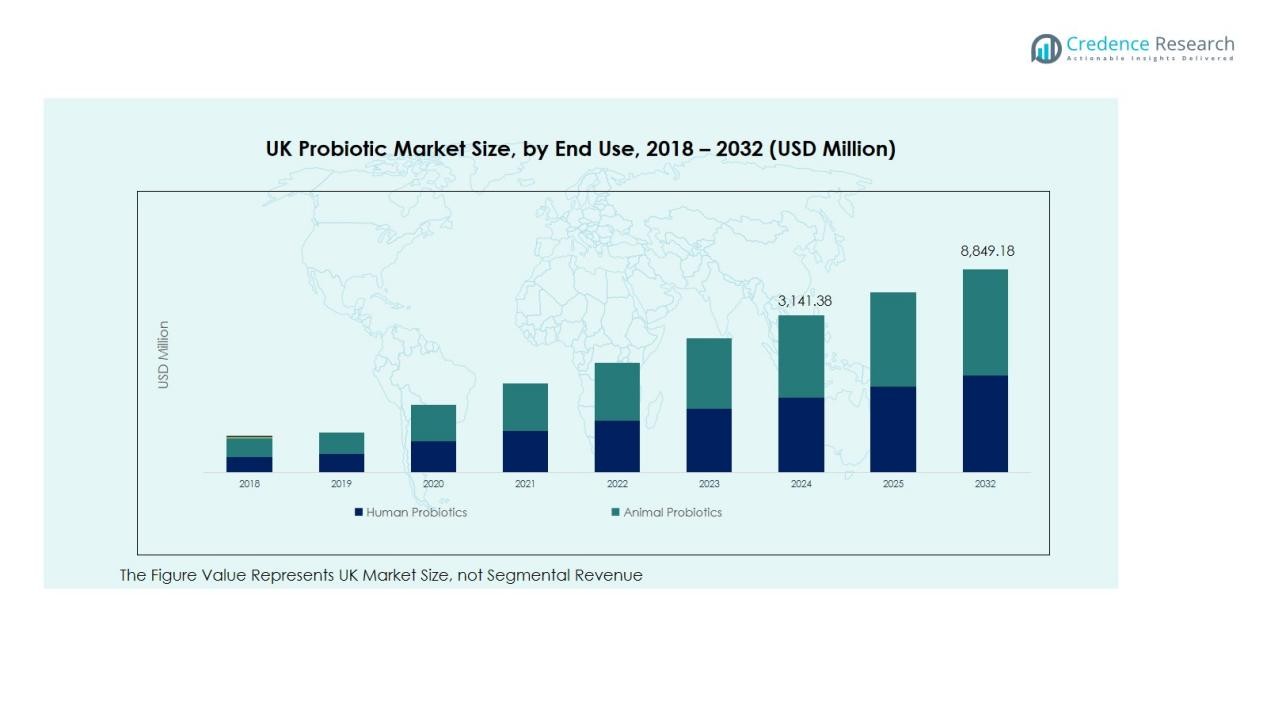

The UK Probiotic Market size was valued at USD 2,039.45 million in 2018 to USD 3,141.38 million in 2024 and is anticipated to reach USD 8,849.18 million by 2032, at a CAGR of 13.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Probiotic Market Size 2024 |

USD 3,141.38 Million |

| UK Probiotic Market, CAGR |

13.82% |

| UK Probiotic Market Size 2032 |

USD 8,849.18 Million |

Growing preference for natural and science-backed formulations drives the adoption of probiotic-infused dairy and non-dairy beverages, capsules, and dietary supplements. The introduction of advanced bacterial strains, improved shelf stability, and effective product marketing have strengthened consumer confidence. Supportive healthcare trends and the focus on preventive nutrition are further boosting product consumption across various demographic groups.

Regionally, England dominates the UK probiotic market due to a strong retail network, high consumer spending power, and growing interest in health-oriented food products. Scotland and Wales are witnessing steady growth, supported by the availability of fortified products in supermarkets and pharmacies. Northern Ireland is emerging as a promising region, driven by rising health awareness and expanding e-commerce access to personalized probiotic formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Probiotic Market was valued at USD 2,039.45 million in 2018 and reached USD 3,141.38 million in 2024, projected to hit USD 8,849.18 million by 2032, growing at a CAGR of 13.82%.

- Rising consumer focus on preventive healthcare and digestive wellness is driving market expansion.

- Strong demand for probiotic-enriched dairy and non-dairy foods supports product diversification and sales growth.

- Technological advancements improving strain stability and efficacy are strengthening consumer trust and brand loyalty.

- England leads the UK market due to higher spending power and a strong distribution network.

- Scotland and Wales show stable growth supported by fortified products and improved retail access.

- Northern Ireland is emerging as a promising market fueled by online retail growth and rising health awareness.

Market Drivers:

Rising Focus on Preventive Healthcare and Digestive Wellness

Consumers in the UK are shifting from curative healthcare to preventive approaches that promote long-term wellness. The growing awareness of gut health and its link to immunity and mental balance has boosted probiotic adoption. Functional foods and beverages fortified with live bacterial strains are increasingly favored for their health benefits. The UK Probiotic Market benefits from this preventive health trend, supported by greater access to nutritional education and healthcare awareness programs.

- For instance, Bio-Kult Everyday’s advanced 14-strain formulation delivers a guaranteed 2 billion CFU per capsule across its full two-year shelf life.

Expansion of Functional Food and Beverage Applications

The rapid integration of probiotics into dairy, non-dairy, and ready-to-drink segments drives market growth. Yogurts, smoothies, and fermented beverages enriched with beneficial strains appeal to both adults and younger consumers. Manufacturers are developing innovative flavor profiles and convenient formats that align with evolving dietary preferences. It benefits from rising supermarket penetration and increased availability of affordable, fortified products.

- For instance, in August 2025, Danone’s Activia launched its new Proactive yogurt line featuring billions of live probiotics and 3 g of prebiotic fiber per serving, reducing sugar content by 25% to enhance gut health benefits for a broader consumer base.

Growing Demand for Clinically Proven and Shelf-Stable Strains

Technological advancement in bacterial strain development has improved product stability and efficacy. Companies are investing in research to deliver scientifically validated probiotics that maintain potency under varying storage conditions. This innovation increases consumer trust and encourages consistent usage across food, beverage, and supplement categories. The market gains from such innovation-driven competitiveness and strong scientific backing.

Digitalization and E-commerce Penetration Driving Accessibility

Online platforms have become vital distribution channels for probiotic supplements and functional foods. Increased digital health awareness and influencer-led promotions are strengthening online sales. It supports consumer education through digital campaigns highlighting strain-specific benefits and usage. The growth of e-commerce provides greater accessibility, especially in smaller cities and rural regions, expanding the overall consumer base.

Market Trends:

Increasing Product Diversification and Personalized Nutrition Demand

Manufacturers are introducing diverse probiotic formulations tailored to specific health conditions, including digestive support, immunity, and skin wellness. The trend toward personalized nutrition is shaping product innovation across supplements and fortified foods. Consumers seek customized probiotic blends that address individual microbiome needs, supported by genetic and lifestyle assessments. The UK Probiotic Market benefits from this move toward functional personalization and higher consumer engagement in self-care. It supports the introduction of multi-strain products, vegan-friendly capsules, and lactose-free alternatives catering to evolving dietary preferences.

- For Instance, OptiBac Probiotics offers a ‘For Daily Immunity’ supplement that delivers 5 billion CFU of the extensively researched strain Lactobacillus paracasei CASEI 431® per capsule to enhance immune resilience.

Integration of Advanced Delivery Technologies and Sustainable Packaging

Technological advancement is transforming product development and consumer convenience. Encapsulation and microencapsulation technologies are improving strain survival through storage and digestion, increasing product reliability. It encourages the creation of next-generation probiotics that maintain potency without refrigeration. Sustainability also drives innovation, with companies adopting eco-friendly packaging to appeal to environmentally conscious consumers. The combination of technological precision and green practices enhances brand reputation and competitiveness, fostering long-term loyalty across retail and online channels.

- For example, Danone’s Actimel brand has been rolling out more recyclable packaging by removing plastic labels in Europe since 2023.

Market Challenges Analysis:

Regulatory Complexity and Strain Validation Issues

The probiotic industry faces stringent regulatory challenges in the UK, especially concerning product labeling and health claims. Companies must provide strong clinical evidence to validate strain-specific benefits, which increases research and compliance costs. The lack of standardized frameworks for probiotics often creates uncertainty during product approvals. The UK Probiotic Market faces hurdles in maintaining scientific credibility while meeting marketing requirements. It pushes manufacturers to balance innovation with adherence to evolving regulations and consumer transparency expectations.

Consumer Awareness and Market Saturation Concerns

The market faces growing competition from numerous brands offering similar probiotic solutions. Many consumers remain unaware of strain-specific functions, leading to confusion and inconsistent product use. It challenges companies to invest in education-focused marketing to build brand differentiation. High product prices and limited trust in unverified claims also restrict widespread adoption. Sustaining growth requires consistent awareness campaigns and collaborations with healthcare professionals to strengthen consumer confidence and loyalty.

Market Opportunities:

Expansion into Preventive and Functional Health Segments

Growing public interest in holistic and preventive health creates new opportunities for probiotic innovation. Manufacturers are expanding into areas such as mental wellness, weight management, and skin health using specialized probiotic strains. The UK Probiotic Market benefits from increasing collaborations between food technologists and healthcare researchers to develop multifunctional formulations. It supports stronger positioning in preventive nutrition, where consumers seek natural solutions over pharmaceuticals. Rising disposable income and access to health education further strengthen demand for premium, clinically supported products.

Growth Potential Across Online Retail and Emerging Demographics

E-commerce platforms present strong growth prospects by providing direct consumer access and personalized product recommendations. Online channels enable flexible purchasing options and awareness campaigns targeting younger and tech-savvy consumers. It supports subscription-based probiotic models and convenient digital consultations that enhance consumer engagement. Expanding penetration in smaller towns and regions through online retail helps companies reach untapped markets. Rising interest among fitness enthusiasts, women, and elderly populations also drives opportunities for niche probiotic formulations.

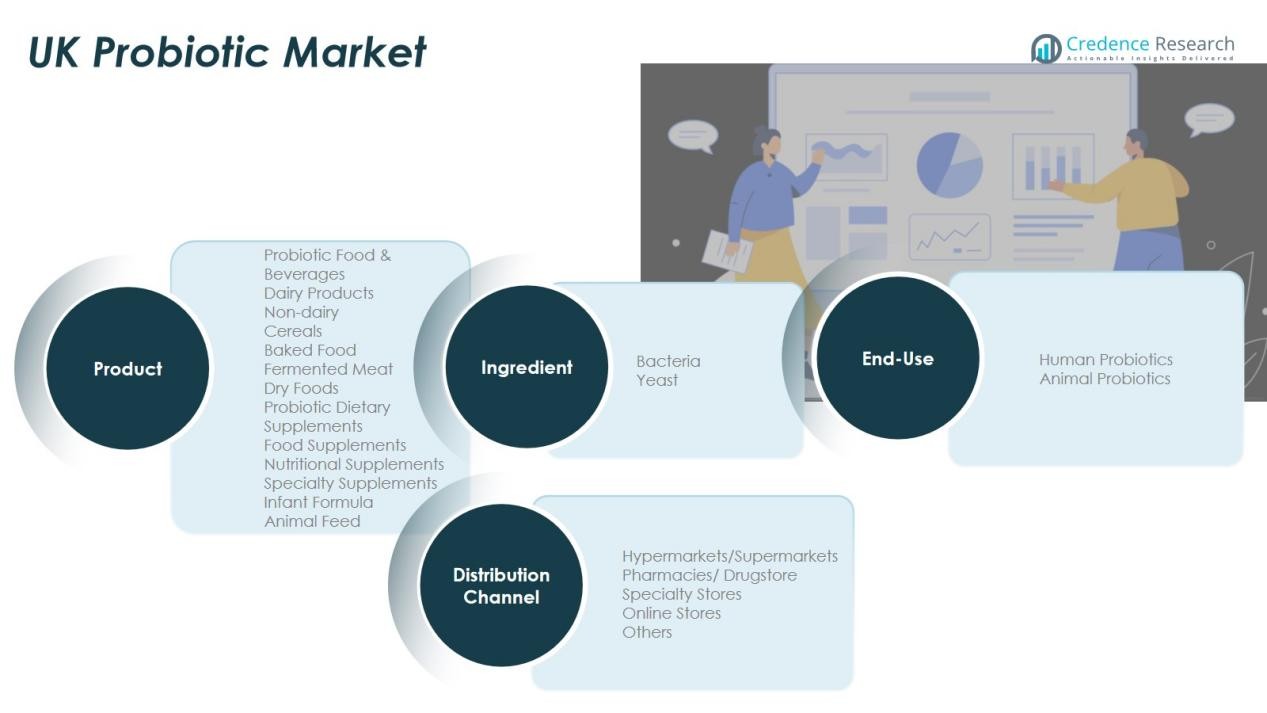

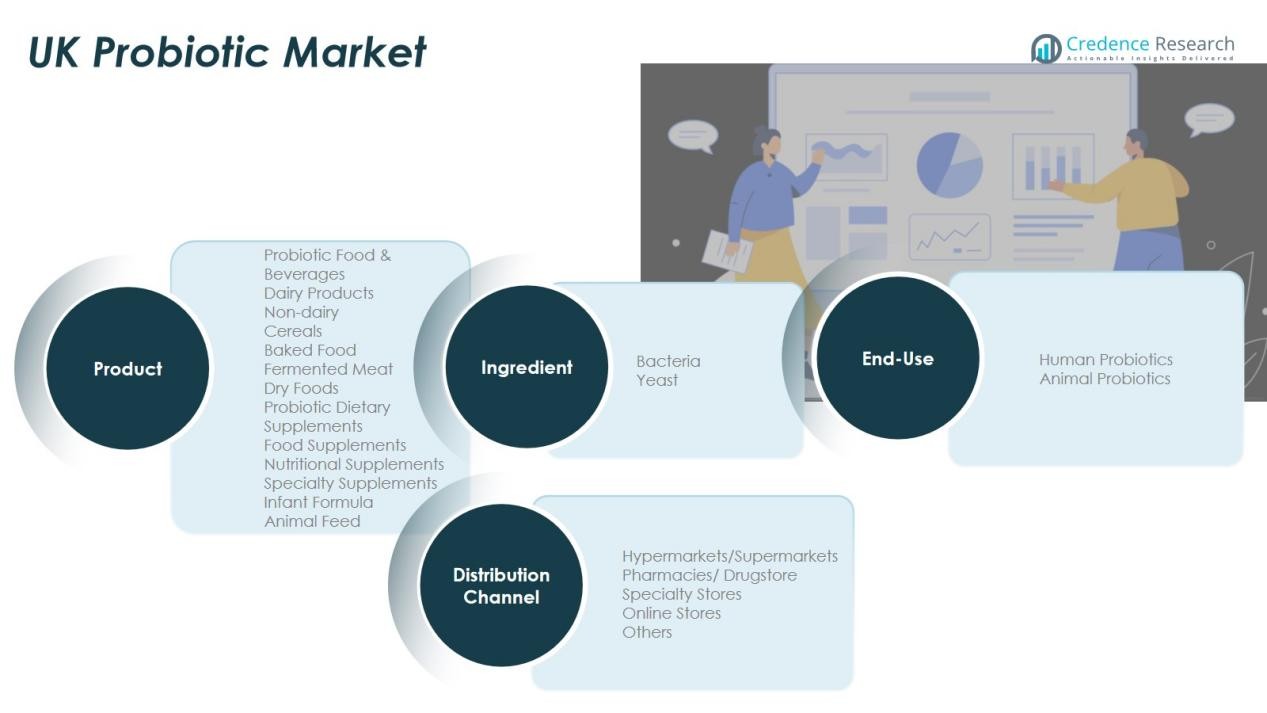

Market Segmentation Analysis:

By Type

The UK Probiotic Market is segmented into probiotic food and beverages, dietary supplements, and animal feed. Probiotic food and beverages dominate the market, driven by high consumption of yogurts, smoothies, and fermented drinks. The segment benefits from growing awareness of digestive wellness and preventive nutrition. Dietary supplements are expanding rapidly due to the availability of capsules, powders, and gummies offering targeted health benefits. It continues to attract attention from health-conscious consumers seeking convenient and science-backed products.

- For instance, OptiBac’s Bifido & Fibre sachets deliver 25 billion CFU of Bifidobacterium lactis BB-12 per dose, proven to survive stomach acidity and reach the gut alive

By Ingredient

Bacteria account for the majority of probiotic formulations due to their proven effectiveness in gut health management. Popular bacterial strains include Lactobacillus and Bifidobacterium, which enhance immunity and digestive balance. Yeast-based probiotics, such as Saccharomyces boulardii, are gaining traction for their role in preventing gastrointestinal disorders. It supports product diversification across functional foods and dietary supplements.

- For Instance, Clinical research shows that BioCodex’s Saccharomyces boulardii CNCM I-745 probiotic reduces the incidence of antibiotic-associated diarrhea (AAD). For example, a 2015 meta-analysis found that administration of S. boulardii reduced the risk of AAD from 18.7% to 8.5% across multiple studies.

By End-Use

Human probiotics hold a dominant market share supported by strong demand from adult and elderly populations. Rising awareness of gut health, mental well-being, and immune function fuels this growth. Animal probiotics are gaining momentum within livestock nutrition to improve feed efficiency and overall animal health. It reflects increasing interest in sustainable and antibiotic-free livestock production.

Segmentations:

By Type:

Probiotic Food & Beverages

- Dairy Products

- Non-Dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

By Ingredient:

By End-Use:

- Human Probiotics

- Animal Probiotics

By Distribution Channel:

- Hypermarkets/Supermarkets

- Pharmacies/Drugstores

- Specialty Stores

- Online Stores

- Others

By Trade & Commerce:

- Import Revenue by Region

- Export Revenue by Region

Regional Analysis:

England Leading Market Growth with Strong Consumer Adoption

England remains the dominant contributor to overall market revenue due to high health awareness and purchasing power. A well-developed retail network, including supermarkets, pharmacies, and online platforms, ensures wide product availability. Urban consumers in London, Manchester, and Birmingham actively purchase probiotic supplements and fortified food products. The UK Probiotic Market benefits from established healthcare infrastructure and a growing focus on preventive wellness. It continues to attract foreign and domestic investment aimed at developing advanced probiotic formulations and sustainable packaging solutions.

Scotland and Wales Witnessing Steady Demand Expansion

Scotland and Wales are registering consistent growth driven by increasing awareness of digestive health and immunity support. Local manufacturers and distributors are introducing affordable probiotic products to serve health-conscious consumers. Expanding penetration of plant-based and dairy-free probiotic beverages appeals to consumers with dietary restrictions. It benefits from active nutrition campaigns and collaborations with healthcare providers promoting probiotic use. Strong retail distribution through pharmacies and supermarkets supports stable regional market expansion.

Northern Ireland Emerging as a Promising Growth Territory

Northern Ireland is experiencing a gradual rise in probiotic consumption due to growing online retail access and rising disposable income. Consumers show increasing interest in dietary supplements offering specific digestive and immune benefits. Local pharmacies and e-commerce channels provide greater access to both domestic and international probiotic brands. It benefits from targeted marketing emphasizing clinically proven formulations and transparent labeling. The market outlook remains positive with rising participation of regional distributors and expanding digital sales channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Danone U.K.

- Nestlé U.K.

- Yakult U.K. Limited

- Bio-Kult (Protexin / ADM Protexin Ltd.)

- OptiBac Probiotics

- Symprove Ltd.

- The Activia Brand (Danone)

- Holland & Barrett (Private Label Probiotic Supplements)

- Lallemand Health Solutions

- Kerry Group plc

- Hansen Holding A/S

- BioGaia AB

- Probi AB

Competitive Analysis:

The UK Probiotic Market is characterized by strong competition among global and domestic players focusing on innovation and product diversification. Leading companies such as Danone U.K., Nestlé U.K., Yakult U.K. Limited, Bio-Kult (Protexin / ADM Protexin Ltd.), OptiBac Probiotics, Symprove Ltd., and The Activia Brand (Danone) dominate the market through broad product portfolios and strong retail presence. It emphasizes research-driven advancements in strain development, improved stability, and taste innovation to enhance consumer trust. Companies are strengthening brand visibility through partnerships with healthcare professionals and digital marketing initiatives. Continuous investment in sustainable packaging and personalized nutrition solutions further supports long-term competitiveness and market expansion.

Recent Developments:

- In July, 2025, Danone completed the acquisition of a majority stake in Kate Farms, a U.S.-based plant-based nutrition company, enhancing its specialized nutrition portfolio.

- In October 2025, BioGaia announced the publication of a scientific study on its new patented probiotic strain Lactobacillus reuteri BG-R46® in the journal Beneficial Microbes, highlighting its role in gut and immune health.

Report Coverage:

The research report offers an in-depth analysis based on By Type, By Ingredient, By End-Use, By Distribution Channel and By Trade & Commerce:. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK Probiotic Market is expected to witness steady expansion driven by rising preventive health awareness.

- Growing demand for functional foods and supplements will continue to strengthen product innovation and adoption.

- Manufacturers will focus on multi-strain formulations that target digestive, immune, and metabolic health benefits.

- Digital retail platforms will play a key role in broadening accessibility and consumer engagement nationwide.

- It will experience higher demand for vegan, lactose-free, and allergen-safe probiotic products catering to dietary diversity.

- Collaborations between research institutions and manufacturers will enhance clinical validation and strain efficiency.

- Sustainable packaging and clean-label initiatives will remain critical in influencing purchasing decisions.

- Increased awareness of the gut-brain connection will drive growth in mental wellness-oriented probiotic products.

- The market will attract new entrants introducing advanced delivery systems for improved strain survival and shelf life.

- Rising healthcare costs will push consumers toward natural, preventive solutions, supporting long-term probiotic consumption.