| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cell Signaling Market Size 2024 |

USD 5,333.2 Million |

| Cell Signaling Market, CAGR |

6.63% |

| Cell Signaling Market Size 2032 |

USD 8,894.4 Million |

Market Overview:

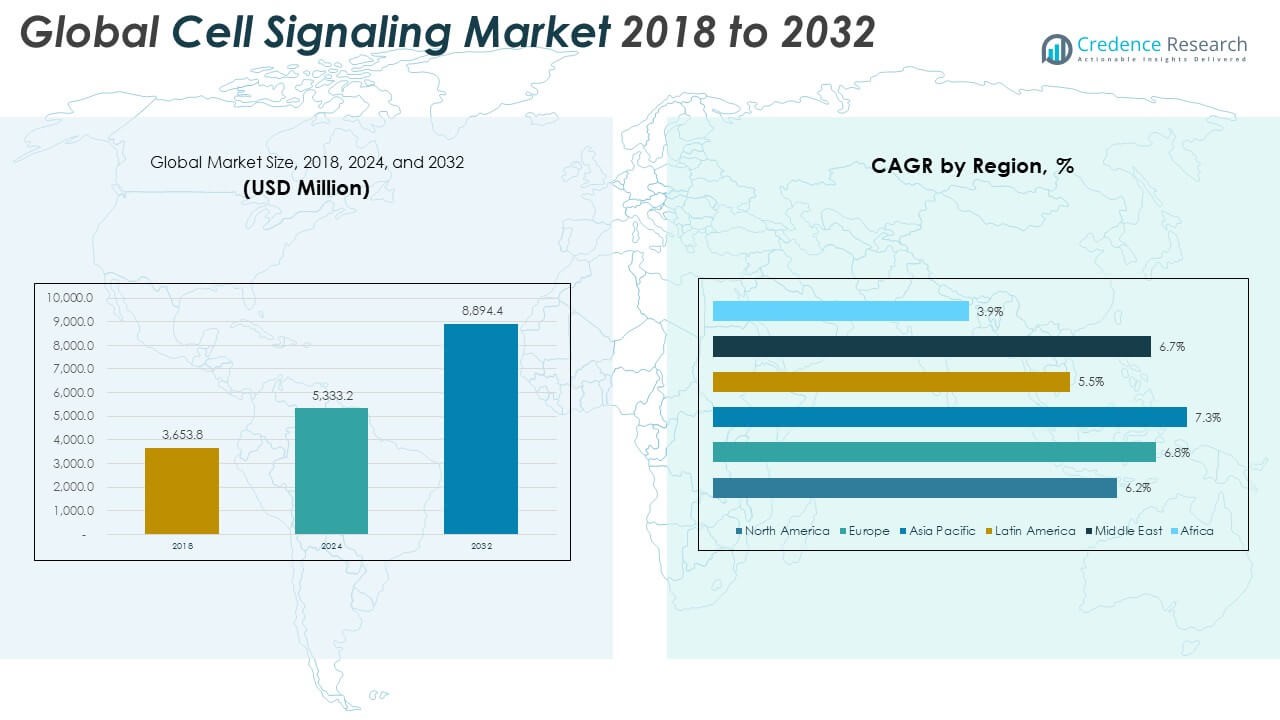

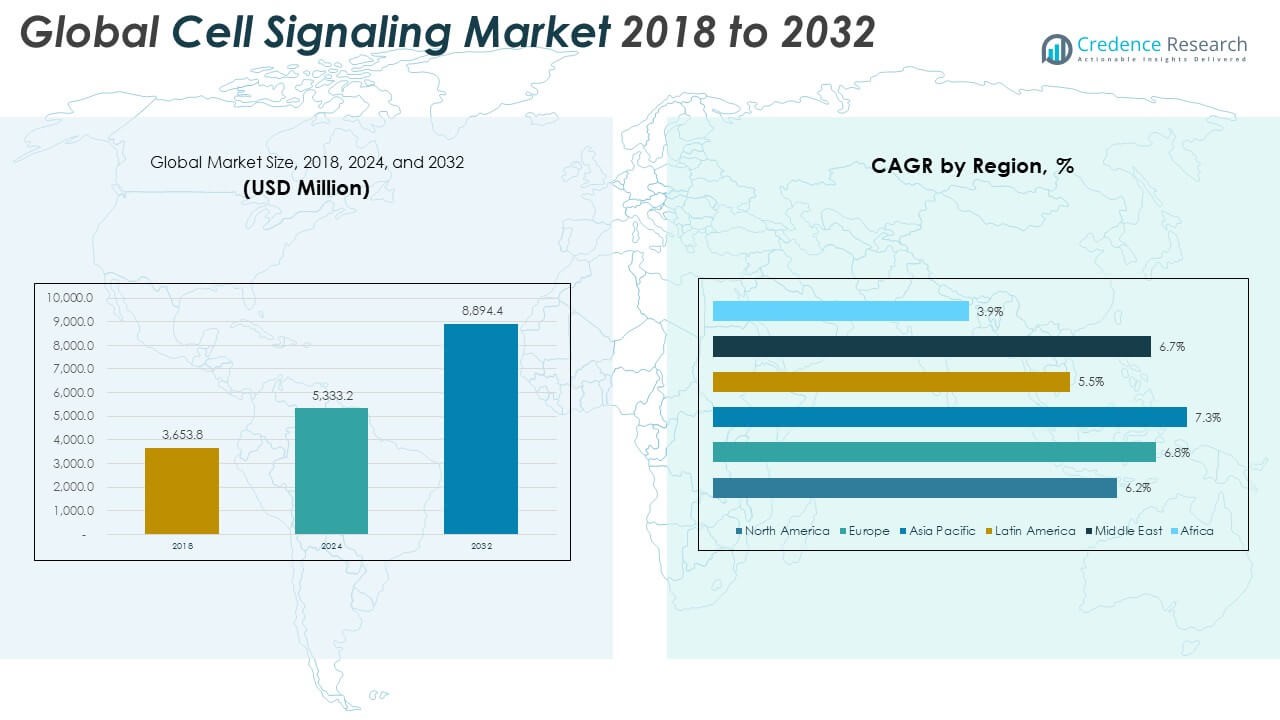

The Global Cell Signaling Market size was valued at USD 3,653.8 million in 2018 to USD 5,333.2 million in 2024 and is anticipated to reach USD 8,894.4 million by 2032, at a CAGR of 6.63% during the forecast period.

The growth of the global cell signaling market is primarily driven by a combination of technological advancements, rising chronic disease prevalence, and increased R&D investments. As researchers delve deeper into the complexities of cellular pathways, there is a growing need for sensitive, accurate, and high-throughput analytical tools. This need is further amplified by the shift toward precision medicine and biomarker-based therapies, which require detailed signaling data for effective patient stratification and treatment planning. The expanding application of cell signaling technologies in oncology, neurology, immunology, and stem cell research is also boosting market demand. Additionally, the development of novel pathway-specific reagents, such as antibodies and assays targeting AKT, MAPK/ERK, and HER family signaling, is enhancing research capabilities and therapeutic development. Collaborations among academia, research institutions, and biopharmaceutical companies continue to drive innovation and commercial success across the cell signaling landscape.

Regionally, North America dominates the global cell signaling market, accounting for the largest revenue share due to its well-established pharmaceutical industry, robust healthcare infrastructure, and high levels of investment in biomedical research. The United States, in particular, leads in terms of both product development and adoption of advanced research technologies. Europe follows closely, supported by strong research funding, academic collaborations, and high utilization of cell-based assays in countries like Germany, the United Kingdom, and France. Meanwhile, the Asia-Pacific region is experiencing the fastest growth, driven by rising healthcare expenditures, an expanding biotechnology sector, and increasing government support for life sciences research in countries such as China, India, Japan, and South Korea. Latin America, the Middle East, and Africa are emerging as potential markets with growing interest in molecular diagnostics and research-based applications, although their market penetration remains relatively limited due to infrastructural and regulatory challenges. Overall, the global cell signaling market is poised for robust expansion, supported by scientific innovation, strategic collaborations, and increasing healthcare demands across all regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Cell Signaling Market was valued at USD 3,653.8 million in 2018, increased to USD 5,333.2 million in 2024, and is projected to reach USD 8,894.4 million by 2032, growing at a CAGR of 6.63% during the forecast period.

- The increasing prevalence of chronic diseases such as cancer, autoimmune disorders, diabetes, and cardiovascular conditions is driving demand for cell signaling tools used in disease modeling and targeted drug development.

- Significant technological advancements in high-throughput screening, flow cytometry, immunohistochemistry, and next-generation sequencing have improved the speed, precision, and scalability of cellular pathway analysis.

- Growing R&D investments by governments, academic institutions, and private sector firms are accelerating innovation in antibodies, assay kits, and pathway-specific reagents to support applications in oncology, neurology, immunology, and stem cell research.

- The global shift toward precision medicine and biomarker-driven therapies is increasing the demand for accurate signaling data to support companion diagnostics, patient stratification, and personalized treatment planning.

- The market faces challenges due to the high cost of advanced reagents and equipment, limited access in low-resource settings, and the complexity of data interpretation caused by inconsistent protocols and lack of assay standardization.

- North America holds the largest revenue share in the global market, led by the United States, while the Asia-Pacific region is the fastest growing, driven by rising healthcare expenditures and increased government support in countries such as China, India, Japan, and South Korea.

Market Drivers:

Rising Prevalence of Chronic Diseases and Demand for Targeted Therapeutics Are Fueling Scientific Exploration:

The increasing global incidence of chronic conditions, including cancer, autoimmune diseases, diabetes, and cardiovascular disorders, continues to drive the demand for advanced biomedical research tools. These diseases are complex, often involving dysregulation in signaling pathways that control cell proliferation, apoptosis, and immune response. Researchers and pharmaceutical developers rely heavily on cell signaling data to uncover disease mechanisms and design targeted therapies. The Global Cell Signaling Market benefits directly from this demand, with key products such as antibodies, assays, and reagents gaining rapid traction. Drug development programs now emphasize pathway-specific interventions, requiring accurate profiling of molecular interactions. The need to decode signaling disruptions for early diagnosis and precise treatment is transforming how research institutions and healthcare providers approach chronic disease management.

- For instance, Amgen’s bemarituzumab, a first-in-class anti-FGFR2b antibody, demonstrated sub-nanomolar cross-species affinity for FGFR2b receptors and over 20-fold enhanced binding affinity to human Fc gamma receptor IIIa compared to its fucosylated version.

Technological Advancements in Research Platforms Are Accelerating Adoption Across Biomedical Applications:

Technological progress in high-throughput screening, flow cytometry, immunohistochemistry, and next-generation sequencing has significantly expanded the scope and precision of cellular analysis. These platforms enable faster, more detailed exploration of intracellular communication and protein interactions. Innovations in reagent design, signal amplification techniques, and multiplexed assay formats are strengthening the utility of cell signaling tools in both academic and commercial laboratories. It is evolving into an integral part of molecular diagnostics, stem cell research, and therapeutic target validation. Companies are integrating automation and AI-driven analysis into these platforms, improving productivity and reproducibility in lab settings. The demand for faster and more reliable insights has propelled the market’s growth across clinical, pharmaceutical, and life science sectors.

- For instance, Johnson & Johnson has integrated machine learning and data-at-scale approaches in its drug discovery pipeline, enabling project teams to move directly from compound synthesis to animal experiments without intermediate in vitro assays. This strategy has reduced project cycle times by approximately two to three weeks per cycle, with cumulative time savings across 20 or more cycles, accelerating decisions and increasing throughput in therapeutic candidate selection.

Increased Research and Development Investments Are Supporting Product Innovation and Pipeline Expansion:

Governments, academic institutions, and private sector investors are significantly raising funding for life sciences and biomedical research. These investments support large-scale research initiatives focused on personalized medicine, cancer immunotherapy, and neurodegenerative disease treatment—all of which rely on deep understanding of cell signaling pathways. It continues to expand as product development in reagents, antibodies, and assay kits meets the growing needs of research professionals. Biopharmaceutical companies are entering collaborations with research organizations to co-develop pathway-targeted solutions, accelerating innovation. The surge in patent filings and clinical trial activity involving signal transduction targets reflects a strong forward momentum in this domain. With funding streams aligned to high-value therapeutic areas, product commercialization timelines are also improving.

Shift Toward Precision Medicine and Biomarker Discovery Is Redefining Market Expectations:

The global healthcare industry is shifting from generalized treatment approaches to precision medicine strategies, where therapies are tailored to individual patient profiles. This transition requires robust signaling pathway data to identify molecular biomarkers and predict treatment responses. It plays a critical role in enabling this shift, supplying researchers with essential tools to dissect cellular behaviors and disease heterogeneity. Companion diagnostics and targeted therapeutics depend on accurate cell signaling analysis, creating a high-value ecosystem around these tools. Regulatory agencies and healthcare providers increasingly emphasize data-driven treatment planning, further boosting the need for reliable signaling assays. The market aligns closely with these precision-focused trends, supporting its sustained relevance and expansion.

Market Trends:

Growing Integration of Artificial Intelligence and Machine Learning in Signal Pathway Analysis:

The integration of artificial intelligence (AI) and machine learning (ML) technologies is transforming how researchers interpret complex signaling data. These tools assist in identifying patterns across large datasets, allowing faster and more accurate insights into cellular communication networks. AI algorithms can now process high-throughput screening results, predict pathway interactions, and streamline experimental workflows. The Global Cell Signaling Market is benefiting from this technological convergence, particularly in drug discovery and disease modeling. Companies are embedding AI into laboratory platforms to enhance assay efficiency and reduce variability in research outcomes. It is strengthening the role of computational biology in cellular research, making signal transduction studies more scalable and precise.

- For instance, Johnson & Johnson’s deployment of AI/ML technologies has enabled direct correlation between predicted and observed pharmacokinetics (PK) in preclinical models, supporting more predictive and efficient design and optimization of therapeutic molecules.

Expansion of Single-Cell Analysis Is Unlocking Cellular Heterogeneity at Unprecedented Levels:

Single-cell analysis technologies are gaining traction for their ability to isolate and analyze individual cells rather than bulk populations. This capability enables researchers to uncover previously hidden differences in cellular behavior, especially in cancer, stem cell, and immunology research. The Global Cell Signaling Market is adapting to this trend with tailored reagents and protocols designed for single-cell workflows. New innovations in microfluidics, droplet-based assays, and single-cell RNA sequencing are expanding the market’s application base. It is supporting a more refined understanding of signaling dynamics at the individual cell level, which is critical for disease stratification and therapeutic targeting. The demand for single-cell compatible products continues to increase among both academic and commercial users.

- For instance, a recently published microfluidic platform achieved single-cell isolation efficiency ranging from 67.8% to 85.2% depending on cell type, with more than 76% final single-cell isolation efficiency for certain cancer cell lines, enabling high-throughput and long-term single-cell culture and heterogeneity analysis.

Rising Commercialization of Organoids and 3D Cell Culture Models for Pathway Research:

Organoids and 3D cell culture systems are becoming standard tools for modeling human tissues in vitro. These models offer more physiologically relevant environments compared to traditional 2D cultures, allowing more accurate study of cell signaling in complex tissue architectures. The Global Cell Signaling Market is responding with assays and detection kits optimized for these advanced models. Pharmaceutical and biotechnology firms are using 3D systems to test drug responses and simulate disease conditions, improving translational research outcomes. It is reshaping preclinical testing protocols and reducing reliance on animal models. Market players are expanding product portfolios to support this evolving research paradigm.

Increased Demand for Multiplexed Assays to Enhance Data Yield and Reduce Sample Volume:

Multiplexed assay technologies are emerging as essential tools for laboratories aiming to maximize data from limited biological samples. These assays allow simultaneous detection of multiple signaling molecules, improving throughput and conserving valuable reagents. The Global Cell Signaling Market is experiencing strong demand for multiplexing platforms in immunoassays, flow cytometry, and bead-based detection. Researchers favor these systems for their cost-efficiency, reproducibility, and ability to capture dynamic pathway interactions. It is driving the development of high-content kits tailored for complex disease studies and biomarker discovery. Multiplexed assays are becoming a cornerstone of modern cell signaling workflows across research and clinical labs.

Market Challenges Analysis:

High Cost of Advanced Reagents and Equipment Limits Accessibility Across Research Settings:

The cost of high-quality antibodies, signaling pathway assays, flow cytometry tools, and multiplexed platforms remains a significant barrier for many laboratories, especially in academic and low-resource settings. The Global Cell Signaling Market often caters to specialized users with access to institutional or commercial funding, leaving smaller institutions with limited capabilities. It faces challenges in achieving wider market penetration due to the price sensitivity associated with these advanced research tools. Procurement delays, reliance on imports, and lack of domestic manufacturing in emerging economies further constrain adoption. The complexity of certain instruments also demands skilled personnel and expensive training, which restricts scalability in developing regions. These factors collectively hinder the democratization of signaling research technologies.

Data Interpretation Complexity and Standardization Issues Hinder Research Reproducibility:

Signal transduction studies often generate vast, multi-dimensional datasets that require advanced bioinformatics expertise for accurate interpretation. Inconsistencies in experimental protocols, variations in reagent quality, and differences in data processing methods reduce reproducibility across laboratories. The Global Cell Signaling Market must address these issues to maintain reliability and user confidence. It struggles with limited standardization in assay validation and data reporting formats, which can compromise research outcomes. The lack of uniform guidelines across institutions and regulatory bodies slows down clinical translation of cell signaling insights. Ensuring consistent results across different platforms and users remains a critical challenge for market participants aiming to expand into translational and diagnostic applications.

Market Opportunities:

Expanding Applications in Personalized Medicine and Companion Diagnostics Offer New Revenue Streams:

The rise of personalized medicine is creating strong demand for cell signaling tools that help identify patient-specific biomarkers and guide targeted therapies. Companion diagnostics rely on precise analysis of signaling pathways to predict therapeutic responses and monitor disease progression. The Global Cell Signaling Market holds significant potential to supply reagents, assays, and platforms tailored to these applications. It stands to benefit from the growing pipeline of targeted drugs in oncology, immunology, and neurology that require pathway-specific validation. Collaborations between diagnostic firms and pharmaceutical companies are opening new product development avenues. Market players that align product offerings with clinical utility will gain early-mover advantage.

Growing Investment in Biotechnology and Research Infrastructure Across Emerging Markets Supports Market Entry:

Emerging economies are expanding national research capabilities and investing in life sciences infrastructure, creating new commercial opportunities. Governments in Asia-Pacific, Latin America, and the Middle East are funding biotech incubators, academic research, and translational science programs. The Global Cell Signaling Market can expand its footprint by partnering with local distributors and institutions. It can also localize manufacturing and customize products for region-specific disease research needs. Rising academic-industry collaboration and regulatory modernization are facilitating faster product approvals. These markets offer long-term growth potential through untapped demand and supportive policy environments.

Market Segmentation Analysis:

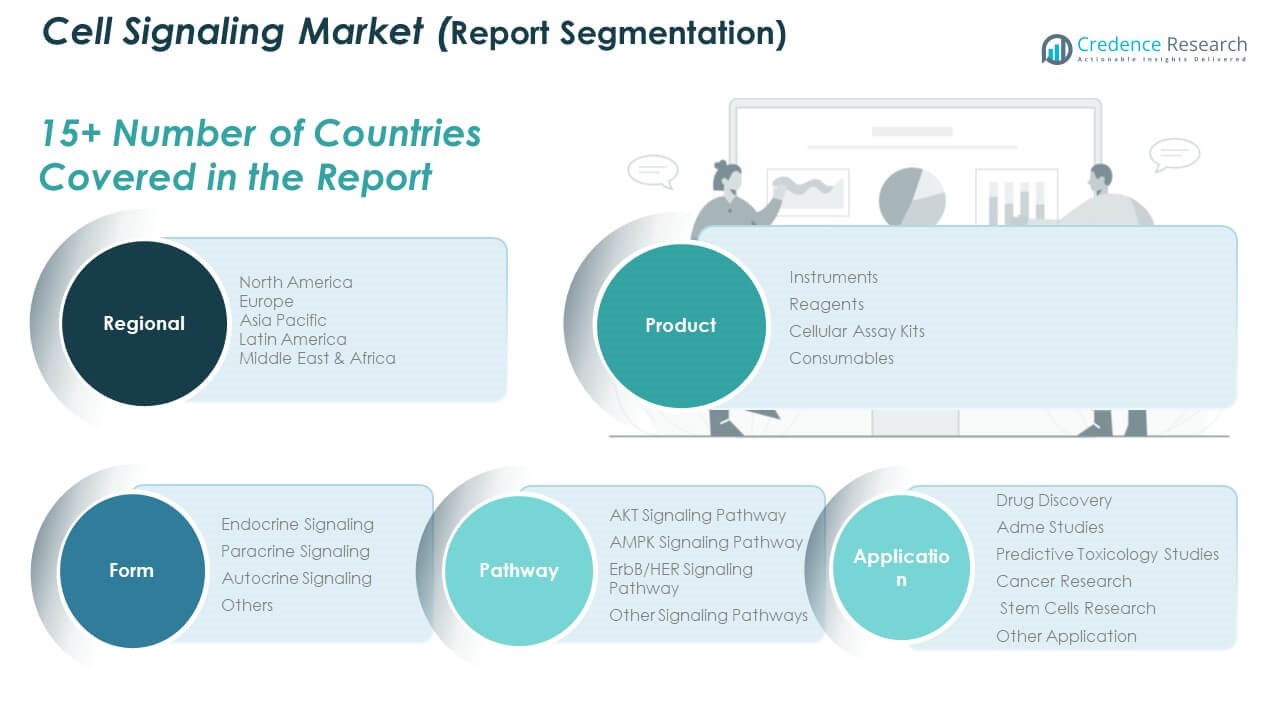

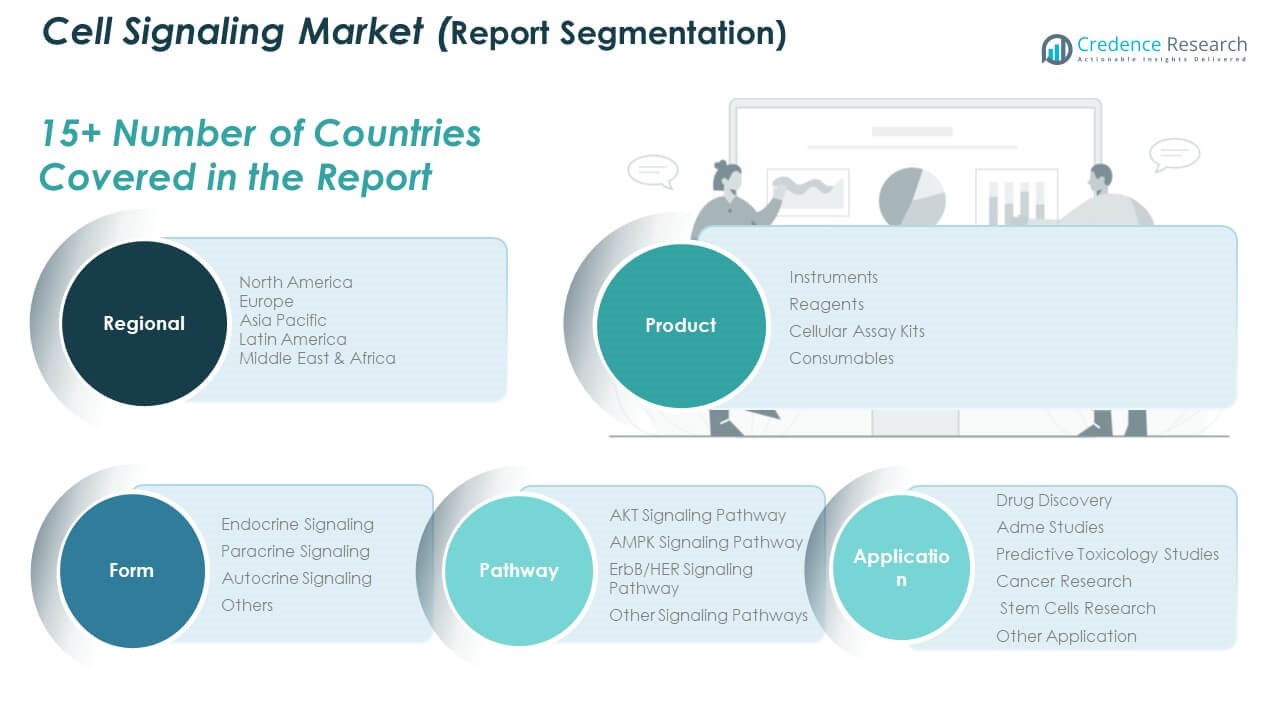

By Product Segment

The product segment includes instruments, reagents, cellular assay kits, and consumables. Among these, reagents dominate the market due to their essential role in immunoassays, Western blotting, and flow cytometry applications. Instruments such as analyzers and signal detection systems support precision and scalability. Cellular assay kits are widely used for their ready-to-use formats, while consumables ensure consistent experimental workflows in laboratories.

- For instance, Instruments such as analyzers and signal detection systems support precision and scalability, as demonstrated by BD Biosciences’ launch of the BD FACSDiscover™ A8 Cell Analyzer, which combines spectral flow cytometry and real-time imaging in a single platform and enables advanced immunophenotyping.

By Form Segment

The form segment comprises endocrine, paracrine, autocrine, and other signaling types. Endocrine signaling holds a major share due to its involvement in hormone regulation and systemic disorders. Paracrine signaling is significant in immune and inflammatory responses. Autocrine signaling plays a key role in cancer cell communication. The others category includes signaling mechanisms under specialized research.

- For instance, Autocrine signaling plays a key role in cancer cell communication, and BPS Bioscience, Inc. provides over 250 stable cell lines, including those with autocrine pathway reporters, to facilitate cancer research.

By Pathway Segment

Key pathways include the AKT, AMPK, and ErbB/HER signaling pathways, along with others. The AKT pathway leads due to its association with cell growth and survival, particularly in oncology. AMPK signaling is vital in metabolic and energy regulation. ErbB/HER pathways are essential in breast and lung cancer therapies. Other pathways are gaining attention in complex disease modelling.

By Application Segment

Applications span drug discovery, ADME studies, predictive toxicology, cancer research, stem cell research, and others. Drug discovery dominates with extensive use in target identification. Cancer research drives substantial demand. ADME and toxicology studies are expanding in preclinical testing. Stem cell research is emerging rapidly, especially in regenerative medicine.

Segmentation:

By Product Segment

- Instruments

- Reagents

- Cellular Assay Kits

- Consumables

By Form Segment

- Endocrine Signaling

- Paracrine Signaling

- Autocrine Signaling

- Others

By Pathway Segment

- AKT Signaling Pathway

- AMPK Signaling Pathway

- ErbB/HER Signaling Pathway

- Other Signaling Pathways

By Application Segment

- Drug Discovery

- ADME Studies

- Predictive Toxicology Studies

- Cancer Research

- Stem Cell Research

- Other Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Cell Signaling Market size was valued at USD 1,019.04 million in 2018 to USD 1,454.06 million in 2024 and is anticipated to reach USD 2,350.79 million by 2032, at a CAGR of 6.2% during the forecast period. North America holds the largest share of the Global Cell Signaling Market, contributing approximately 27.3% in 2024. The region benefits from a mature healthcare system, high research funding, and strong pharmaceutical and biotechnology sectors. The United States dominates the regional landscape, supported by academic excellence and early adoption of innovative research tools. Government initiatives and public–private partnerships continue to drive advancements in precision medicine and molecular diagnostics. Canada and Mexico are expanding their contributions through research institutions and clinical trial collaborations. The region remains a key driver of innovation and commercialization in the market.

Europe

The Europe Cell Signaling Market size was valued at USD 832.34 million in 2018 to USD 1,227.02 million in 2024 and is anticipated to reach USD 2,073.29 million by 2032, at a CAGR of 6.8% during the forecast period. Europe accounts for around 23% of the global revenue share in 2024. Strong academic frameworks, public funding, and EU-driven research initiatives fuel market growth. Leading countries such as Germany, the UK, and France are adopting advanced signaling technologies in oncology, toxicology, and stem cell applications. Regulatory alignment and focus on clinical validation support commercialization. Western Europe leads in adoption, while Eastern Europe shows gradual improvement with EU-supported programs. The market continues to thrive on scientific collaboration and translational research.

Asia Pacific

The Asia Pacific Cell Signaling Market size was valued at USD 1,161.18 million in 2018 to USD 1,760.95 million in 2024 and is anticipated to reach USD 3,083.69 million by 2032, at a CAGR of 7.3% during the forecast period. Asia Pacific is the fastest-growing region, with a projected share of about 33% of global market revenue in 2024. Countries like China, Japan, South Korea, and India are investing heavily in biotechnology, life sciences, and healthcare infrastructure. The region’s large population base and increasing prevalence of chronic diseases boost research demand. Local manufacturing and growth of CROs are improving affordability and access. Japan leads in drug discovery, while India emerges in contract research and clinical studies. Government-backed genomics and innovation programs are creating long-term growth platforms.

Latin America

The Latin America Cell Signaling Market size was valued at USD 211.19 million in 2018 to USD 290.43 million in 2024 and is anticipated to reach USD 444.72 million by 2032, at a CAGR of 5.5% during the forecast period. Latin America holds about 5.4% of the global market revenue in 2024. Brazil and Mexico lead in regional adoption, supported by improvements in academic research and partnerships with global companies. Infrastructure gaps and unequal access to technology remain key limitations. It is gradually incorporating cell signaling tools in cancer biology and toxicology research. Public health programs and donor-funded initiatives are increasing interest in diagnostics. Local institutions are beginning to adopt assay kits and reagent systems in translational research.

Middle East

The Middle East Cell Signaling Market size was valued at USD 263.80 million in 2018 to USD 387.34 million in 2024 and is anticipated to reach USD 651.07 million by 2032, at a CAGR of 6.7% during the forecast period. The Middle East contributes around 7.3% to the Global Cell Signaling Market in 2024. Countries like Saudi Arabia, UAE, and Israel are investing in research centers and medical innovation zones. Israel drives high-value research in oncology and immunology, while GCC nations focus on infrastructure development. Academic and clinical research is gaining momentum, supported by increased funding. The region is adopting high-end laboratory tools for cancer and metabolic disease research. Imports of assay kits and reagents remain high, indicating demand for localized solutions.

Africa

The Africa Cell Signaling Market size was valued at USD 166.25 million in 2018 to USD 213.40 million in 2024 and is anticipated to reach USD 290.85 million by 2032, at a CAGR of 3.9% during the forecast period. Africa represents the smallest share of the Global Cell Signaling Market, with approximately 4% in 2024. Growth is concentrated in South Africa, Egypt, and Kenya, driven by public health research and academic projects. Infrastructure challenges and funding constraints hinder broader adoption. The market is slowly incorporating signaling technologies in research focused on infectious diseases, oncology, and population health. Collaborations with global organizations support training and resource access. Affordable, scalable solutions are essential to increase participation in global life sciences research.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Abcam plc.

- BD Biosciences

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- BioVision, Inc.

- BPS Bioscience, Inc.

- Cell Signaling Technology, Inc.

- Cisbio Bioassays

- Full Moon BioSystems, Inc.

- Miltenyi Biotec

- Promega Corporation

- Qiagen N.V.

- Other Key Players

Competitive Analysis:

The Global Cell Signaling Market is highly competitive, with several key players focusing on innovation, product differentiation, and strategic collaborations. Companies such as Abcam plc, BD Biosciences, Danaher Corporation, and Cell Signaling Technology, Inc. lead the market through strong portfolios of antibodies, assay kits, and signaling pathway tools. It is witnessing increased mergers, acquisitions, and partnerships aimed at expanding geographic reach and strengthening research capabilities. Players are investing in automation, AI-integrated platforms, and single-cell analysis technologies to stay ahead. Emerging firms are entering with niche offerings and cost-effective solutions, intensifying competition. The market favors companies with strong distribution networks, technical support, and customized solutions for oncology, stem cell research, and precision medicine. Global players continue to expand their footprints in Asia-Pacific and Latin America, targeting rising demand and research activity. Competitive success depends on innovation, pricing flexibility, and the ability to meet evolving research and clinical needs.

Recent Developments:

- In July 2025, BD Biosciencesunveiled the BD FACSDiscover™ A8 Cell Analyzer at CYTO2025. This new product is the world’s first spectral cell analyzer to combine high-parameter spectral flow cytometry with real-time imaging capabilities in a single instrument. The BD FACSDiscover™ A8 enables advanced immunophenotyping using BD SpectralFX™ Technology and BD CellView™ Image Technology, providing researchers with unique applications and unparalleled experimental power in cellular analysis.

- In November 2024, Danaher Corporationlaunched two new CLIA and CAP-certified laboratories designed to accelerate the development and commercialization of precision medicine diagnostics. These centers integrate advanced technologies and assays from Danaher subsidiaries such as Leica Biosystems, Cepheid, and Beckman Coulter Diagnostics, streamlining the process from biomarker validation to clinical trial assays and global deployment. This strategic move aims to simplify and speed up pharma translational research and precision treatment development.

- In November 2024, BPS Bioscience, Inc.highlighted its portfolio of over 250 stable cell lines, including top-performing luciferase reporter cell lines and knockout cell lines for cell signaling research. The company’s luciferase reporter cell lines, such as the CRE/CREB Luciferase Reporter CHO Cell Line and NFAT Luciferase Reporter CHO Cell Line, enable precise quantification of gene expression and pathway activity. BPS Bioscience also offers a Cell Line Rental Program, allowing researchers to access these lines at reduced cost for testing and validation.

- In May 2024, Bio-Rad Laboratories, Inc.introduced three new StarBright™ Red Dyes—StarBright Red 715, 775, and 815—and expanded its StarBright Violet Dye series with 29 additional highly validated antibodies. The StarBright Dye portfolio now totals 32 dyes across multiple laser lines, offering exceptional brightness, minimal background, and compatibility with most flow cytometers, including the Bio-Rad ZE5 Cell Analyzer. These innovations provide researchers with greater flexibility and precision in multicolor flow cytometry for immunology and translational research.

Market Concentration & Characteristics:

The Global Cell Signaling Market exhibits moderate to high market concentration, with a few established players accounting for a significant share of total revenue. It is characterized by strong brand loyalty, high technical barriers to entry, and continuous innovation. Leading companies maintain competitive advantage through proprietary technologies, extensive product portfolios, and strong relationships with academic and clinical research institutions. The market emphasizes precision, reproducibility, and regulatory compliance, which favor established brands. Demand centers around research-intensive applications such as oncology, immunology, and stem cell science. It also features a growing emphasis on customization, single-cell analysis, and AI-driven platforms. While global in scope, the market shows regional differences in adoption rates, pricing sensitivity, and infrastructure readiness.

Report Coverage:

The research report offers an in-depth analysis based on product, form, pathway, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for precision medicine will accelerate the use of pathway-specific assays and companion diagnostics.

- Expansion of single-cell and spatial transcriptomics will drive next-generation cell signaling research tools.

- Increasing investments in biotechnology across Asia-Pacific and Latin America will open new commercial opportunities.

- Adoption of AI and machine learning will enhance data interpretation and predictive pathway modelling.

- Strategic collaborations between pharma, biotech, and academic institutions will foster innovation and product development.

- Development of multiplexed and miniaturized assay formats will support high-throughput and cost-effective applications.

- Regulatory emphasis on reproducibility and standardization will influence product design and validation.

- Growing focus on oncology and immunotherapy research will sustain demand for advanced signaling technologies.

- Entry of new players offering niche and region-specific solutions will intensify market competition.

- Advances in automation and cloud-based data platforms will improve scalability and global research integration.