Market Overview

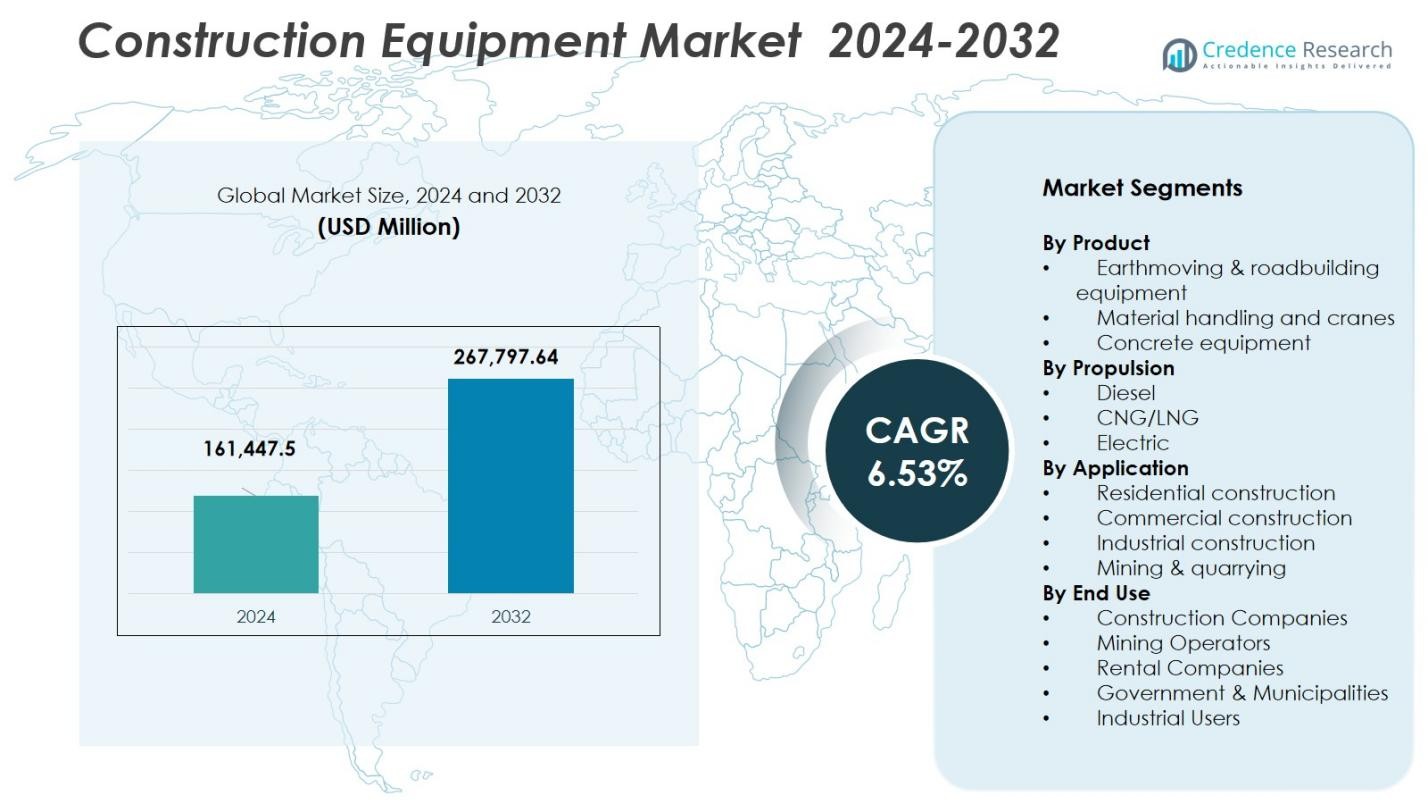

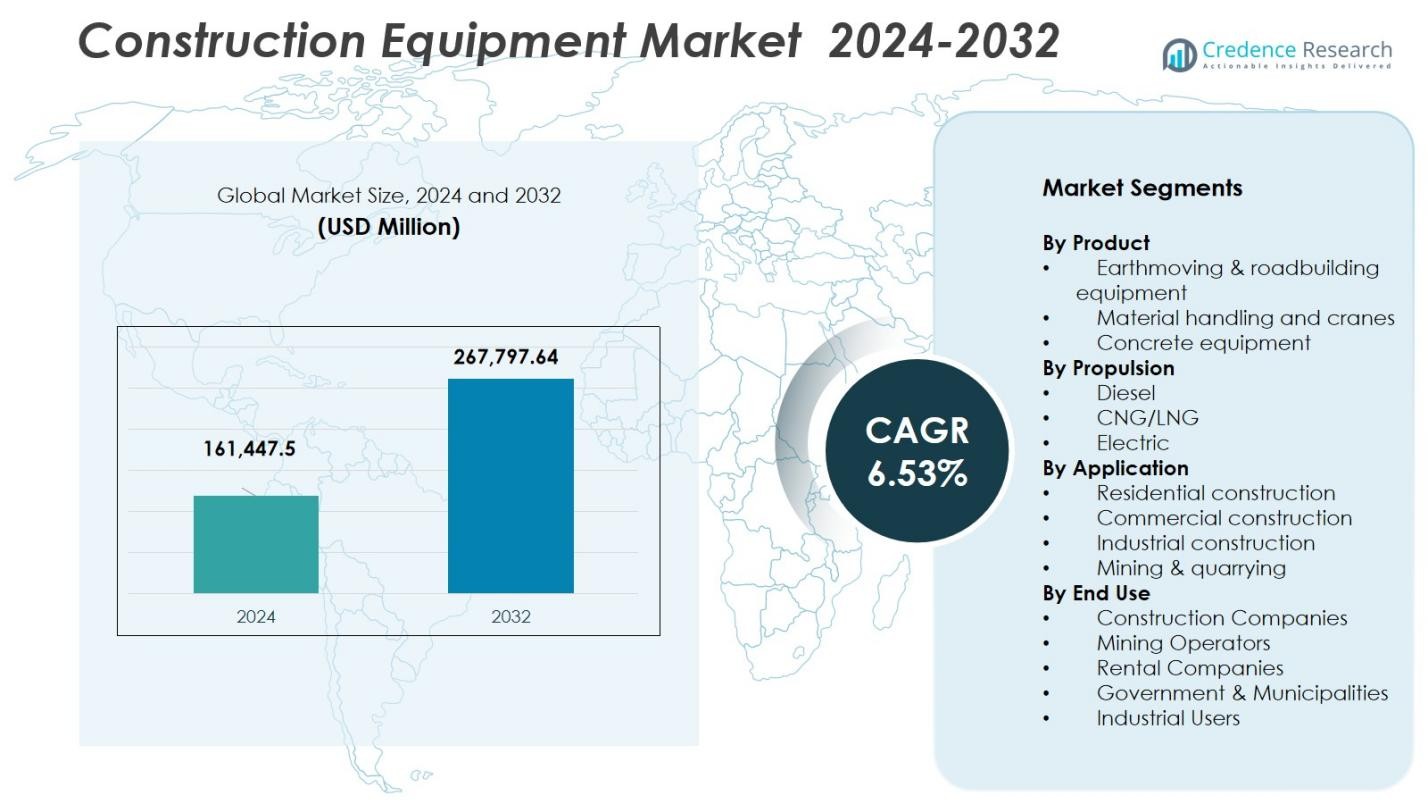

The Construction Equipment Market size was valued at USD 161,447.5 million in 2024 and is anticipated to reach USD 267,797.64 million by 2032, at a CAGR of 6.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Equipment Market Size 2024 |

USD 161,447.5 Million |

| Construction Equipment Market, CAGR |

6.53% |

| Construction Equipment Market Size 2032 |

USD 267,797.64 Million |

The Construction Equipment Market is driven by prominent global manufacturers such as Caterpillar, Komatsu, Volvo Construction Equipment, Hitachi Construction Machinery, Deere & Company, CNH Industrial, Sany, Liebherr, Doosan, and Terex, each focusing on advanced machinery, electrification, automation, and enhanced durability to meet evolving user needs. These players strengthen their market presence through innovation, expanded product portfolios, rental support services, and robust dealer networks. Regionally, Asia Pacific holds the leading position with a 43% market share, supported by extensive infrastructure development, rapid industrial growth, and rising urban construction activities across China, India, Japan, and Southeast Asia. Strong government investments and expanding commercial and residential projects further reinforce the region’s dominance in equipment demand and adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Construction Equipment Market was valued at USD 161,447.5 million in 2024 and is projected to reach USD 267,797.64 million by 2032, growing at a CAGR of 6.53% during the forecast period.

- Rising infrastructure development, rapid urban expansion, and strong demand from commercial construction holding a 38% segment share continue to drive market growth across major economies.

- Key trends include increasing adoption of electric and hybrid machinery, telematics integration, and rising preference for rental and leasing models among construction contractors.

- Leading players such as Caterpillar, Komatsu, Volvo CE, Hitachi Construction Machinery, and Deere & Company focus on innovation, advanced engines, and expanded distribution networks to maintain strong positions.

- Asia Pacific leads the market with a 43% share, followed by North America at 27% and Europe at 22%, supported by diverse construction activities, industrial development, and sustained investments in infrastructure modernization.

Market Segmentation Analysis:

By Product

Earthmoving & road-building equipment dominated the product landscape in 2024 with 52% market share, driven by extensive demand for excavators, loaders, and graders across large infrastructure and urban development projects. Its leadership reflects ongoing government investments in transportation networks and the rising need for high-capacity machines that improve productivity on construction sites. Material handling and cranes held a considerable portion of the market due to expansion in industrial facilities and logistics hubs, while concrete equipment continued to gain traction as high-rise and commercial building activities increased globally.

- For instance, Volvo Construction Equipment launched a new lineup of excavators including the EC210 and EC500 with enhanced performance and operator features in May 2024, addressing the needs of large-scale infrastructure projects.

By Propulsion

Diesel-powered construction equipment remained the leading propulsion category in 2024, accounting for 78% of the market, supported by its high torque output, reliability in heavy-duty operations, and well-established fueling infrastructure. Demand is further sustained by widespread use in mining, roadbuilding, and remote job sites where alternative fuels are less accessible. Electric equipment, though smaller in share, is expanding rapidly as OEMs scale battery-powered models to meet emission regulations. Meanwhile, CNG/LNG equipment captured a modest portion of the market as contractors explore lower-emission, cost-efficient fuel options.

- For instance, Caterpillar enhanced its Stage V-compliant diesel engines in March 2025, reducing emissions while maintaining power, underscoring diesel’s ongoing importance even amid tightening regulations.

By Application

The commercial construction segment held the largest share of the market in 2024 at 38%, driven by expanding urban commercial development, warehousing, retail centers, and office infrastructure. Increasing public–private partnerships and investments in transportation and utility facilities further supported equipment demand. Residential construction followed, supported by housing expansion in emerging economies, while industrial construction benefited from manufacturing capacity upgrades. Mining and quarrying sustained steady growth due to rising extraction activities, which require high-performance earthmoving and material-handling equipment to ensure operational efficiency.

Key Growth Drivers

Rising Infrastructure Development and Urban Expansion

Global infrastructure investments continue to accelerate, driving sustained demand for construction equipment across roads, railways, energy facilities, and urban development projects. Governments in emerging economies are prioritizing large-scale transport corridors and smart city initiatives, while developed markets focus on upgrading aging infrastructure. This extensive project pipeline increases the need for efficient earthmoving, material-handling, and road-building equipment. Rapid urbanization further amplifies equipment adoption as cities expand housing, commercial complexes, and public utilities, creating consistent opportunities for manufacturers and rental service providers.

- For instance, in the Gulf region, mega projects like NEOM City in Saudi Arabia are boosting demand for high-capacity cranes, earthmoving machinery, and road-building equipment, supporting both construction and industrial sectors.

Technological Advancements and Equipment Modernization

Advances in automation, digital monitoring, and telematics are transforming equipment performance and ownership models. Contractors increasingly adopt connected machines that enhance fuel efficiency, uptime, and jobsite productivity through predictive maintenance and real-time fleet management. Hybrid and electric models also attract interest as regulations tighten around emissions. These innovations encourage fleet modernization, raising demand for next-generation excavators, loaders, compact equipment, and cranes. OEMs that integrate AI-driven diagnostics and autonomous features gain a competitive edge as users prioritize long-term cost savings and operational reliability.

- For instance, Technoton’s telematics system enables real-time tracking of fuel consumption, engine load modes, and equipment diagnostics, helping construction companies reduce fuel theft and optimize operations.

Expansion of the Mining and Industrial Sectors

Growing global demand for metals, minerals, cement, and other industrial materials is stimulating equipment purchases within mining and heavy industrial applications. Large-scale extraction projects require high-capacity excavators, dump trucks, and drilling equipment capable of operating in challenging terrains, supporting steady market growth. Industrial construction—such as manufacturing plants, logistics hubs, and energy facilities—further drives demand for cranes, concrete equipment, and lifting solutions. As commodity prices stabilize and investment in resource-intensive sectors increases, construction equipment manufacturers benefit from a robust, long-term demand outlook.

Key Trends & Opportunities

Electrification and Low-Emission Equipment Adoption

The shift toward sustainable construction practices is accelerating the adoption of electric and hybrid machinery. Contractors seek quieter, emission-free equipment for urban projects, while governments introduce policies supporting green construction technologies. Advancements in battery capacity, charging infrastructure, and powertrain efficiency are enabling electric excavators, loaders, and compact machines to transition from niche to mainstream use. This trend presents a major opportunity for OEMs to differentiate through innovative designs, modular battery systems, and reduced operating costs, positioning environmentally friendly equipment as a core future growth avenue.

- For instance, Hitachi Construction Machinery is advancing hybrid drive technology with models like the ZH200, integrating electric drives to enhance energy efficiency and meet stringent emissions regulations

Growing Preference for Rental and Leasing Models

Rising project cost pressures and the need for flexible fleet management are propelling the adoption of rental and leasing services. Contractors increasingly rely on rental companies to access specialized machines, reduce upfront capital expenditure, and optimize equipment availability during peak demand phases. The trend opens significant opportunities for rental providers to expand their fleets with advanced, telematics-enabled machinery that attracts cost-conscious construction firms. As large infrastructure and industrial projects require diversified fleets, rental platforms become integral to equipment distribution and utilization efficiency across global markets.

- For instance, BigRentz reports a notable shift among contractors favoring rental over outright equipment purchases to reduce capital expenditure and increase operational flexibility.

Key Challenges

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuating steel, aluminum, and component costs continue to pressure equipment manufacturers’ margins, especially when global supply chains experience delays or shortages. Uncertainties related to geopolitical tensions, shipping constraints, and manufacturing bottlenecks disrupt production timelines and increase operating expenses. OEMs face challenges in balancing pricing strategies while maintaining competitiveness, particularly in price-sensitive markets. These disruptions also affect availability of critical components such as engines, hydraulics, and semiconductors, which can lead to extended delivery cycles and hinder large-scale fleet upgrades.

Strict Emission Standards and Compliance Costs

Increasingly stringent environmental regulations require OEMs to invest heavily in cleaner engines, electrification, and advanced after-treatment systems. Meeting Tier 4, Stage V, and other emission norms drives up development, testing, and production costs, presenting challenges for smaller manufacturers. Contractors operating in regulated markets must also upgrade or retrofit older equipment, increasing ownership costs. While essential for sustainability, compliance can slow equipment adoption, particularly in developing regions where cost barriers are high and supporting infrastructure for electric or alternative-fuel equipment remains limited.

Regional Analysis

North America

North America held a 27% market share in the construction equipment market in 2024, supported by major investments in infrastructure modernization, including transportation networks, energy projects, and urban redevelopment. The U.S. Infrastructure Investment and Jobs Act continues to stimulate demand for earthmoving, material-handling, and road-building machinery. Strong adoption of advanced telematics and electric equipment further strengthens market performance as contractors prioritize productivity, safety, and compliance with emission standards. Canada contributes steadily through ongoing residential and commercial development, reinforcing the region’s consistent need for high-performance construction machinery.

Europe

Europe accounted for a 22% market share in 2024, driven by stringent emission standards, rapid adoption of electric and hybrid construction equipment, and sustained investment in urban infrastructure. Countries such as Germany, France, and the U.K. continue upgrading transport corridors, renewable energy facilities, and public infrastructure, supporting demand for technologically advanced machinery. The region benefits from strong OEM presence and innovation in automation, telematics, and compact equipment suitable for dense urban environments. Ongoing sustainability initiatives and green construction policies further accelerate the shift toward low-emission, energy-efficient equipment fleets.

Asia Pacific

Asia Pacific dominated the global market with a 43% market share in 2024, propelled by massive infrastructure projects, rapid urbanization, and expanding industrial activity across China, India, Japan, and Southeast Asia. Large-scale investments in roads, railways, ports, housing, and smart city development drive substantial demand for earthmoving and road-building equipment. Government-led construction initiatives and availability of cost-effective machinery further strengthen regional adoption. The region also experiences rising equipment rentals and growing interest in electrified models as environmental regulations evolve, reinforcing Asia Pacific’s position as the most influential and fastest-growing market.

Latin America

Latin America captured a 5% market share in 2024, supported by a steady recovery in construction and mining activities across Brazil, Mexico, Chile, and Colombia. Expansion of transportation infrastructure, urban housing, and industrial facilities contributes to a gradual rise in demand for excavators, loaders, and cranes. The region’s strong reliance on mining especially in copper, iron ore, and lithium drives additional opportunities for heavy-duty equipment. However, economic fluctuations and investment uncertainties temper growth, although increasing public infrastructure spending and modernization efforts across major economies continue to support long-term equipment adoption.

Middle East & Africa

The Middle East & Africa region held a 3% market share in 2024, driven by large-scale infrastructure, energy, and commercial development projects in the Gulf Cooperation Council (GCC) nations and expanding mining operations across Africa. Mega-projects related to urban development, tourism, and industrial diversification particularly in Saudi Arabia and the UAE boost demand for high-capacity construction machinery. African countries contribute through rising investments in transportation networks and mining exploration. Although budget constraints and political instability affect some markets, increasing foreign investment and economic diversification efforts continue to support steady equipment deployment.

Market Segmentations:

By Product

- Earthmoving & roadbuilding equipment

- Material handling and cranes

- Concrete equipment

By Propulsion

By Application

- Residential construction

- Commercial construction

- Industrial construction

- Mining & quarrying

By End Use

- Construction Companies

- Mining Operators

- Rental Companies

- Government & Municipalities

- Industrial Users

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the construction equipment market is characterized by the presence of major global players such as Caterpillar, Komatsu, Volvo Construction Equipment, Hitachi Construction Machinery, Deere & Company, CNH Industrial, Sany, Liebherr, Doosan, and Terex. These companies compete on technological innovation, product reliability, and extensive distribution networks. Market leaders focus on expanding their portfolios with advanced, fuel-efficient, and increasingly electric models to meet evolving regulatory and operational demands. Strategic partnerships, mergers, and investments in automation, telematics, and autonomous solutions further strengthen their competitive positions. Additionally, rental fleet expansion, after-sales services, and regional manufacturing capabilities play crucial roles in retaining market share and enhancing customer loyalty across diverse construction and industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, New Holland Construction introduced the W100D Compact Wheel Loader, featuring an all-new operator-centric cab and enhanced cab functionalities. Designed for landscapers, agricultural operators, snow removal professionals, and similar users, the W100D delivers strong performance and productivity within a compact size category that has historically offered limited options.

- In January 2025, Volvo CE launched its New Generation Excavators in Southeast Asia to improve customer efficiency, productivity, and safety. The lineup includes five models EC210, EC220, EC230, EC300, and EC360—which became available across the region starting January 2025.

- In December 2024, Xuzhou Construction Machinery Group (China) unveiled a series of diesel, electric, and hybrid excavators during BAUMA China 2024.

- In February 2024, Deere & Company (US) launched its 9RX tractor lineup, offering models with up to 830 HP. The range includes three high-horsepower four-track variants: the 9RX 710, 9RX 770, and 9RX 830.

Report Coverage

The research report offers an in-depth analysis based on Product, Propulsion, Application, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as governments increase investments in infrastructure and urban development projects.

- Adoption of electric and hybrid construction equipment will accelerate as emission regulations tighten globally.

- Automation, telematics, and AI-enabled machinery will become standard features to enhance productivity and reduce operating costs.

- Rental and leasing models will grow as contractors prioritize flexibility and cost efficiency in fleet management.

- Demand for compact and versatile equipment will rise due to space constraints in urban construction environments.

- Mining and industrial expansion will continue to generate strong demand for high-capacity heavy-duty machinery.

- OEMs will focus on developing energy-efficient engines and battery technologies to improve performance and sustainability.

- Digital platforms for remote monitoring, predictive maintenance, and fleet optimization will see wider adoption.

- Regional manufacturing and local sourcing will increase as companies aim to reduce supply chain risks.

- Partnerships, mergers, and strategic collaborations will intensify as players pursue technological leadership and market expansion.