Market Overview

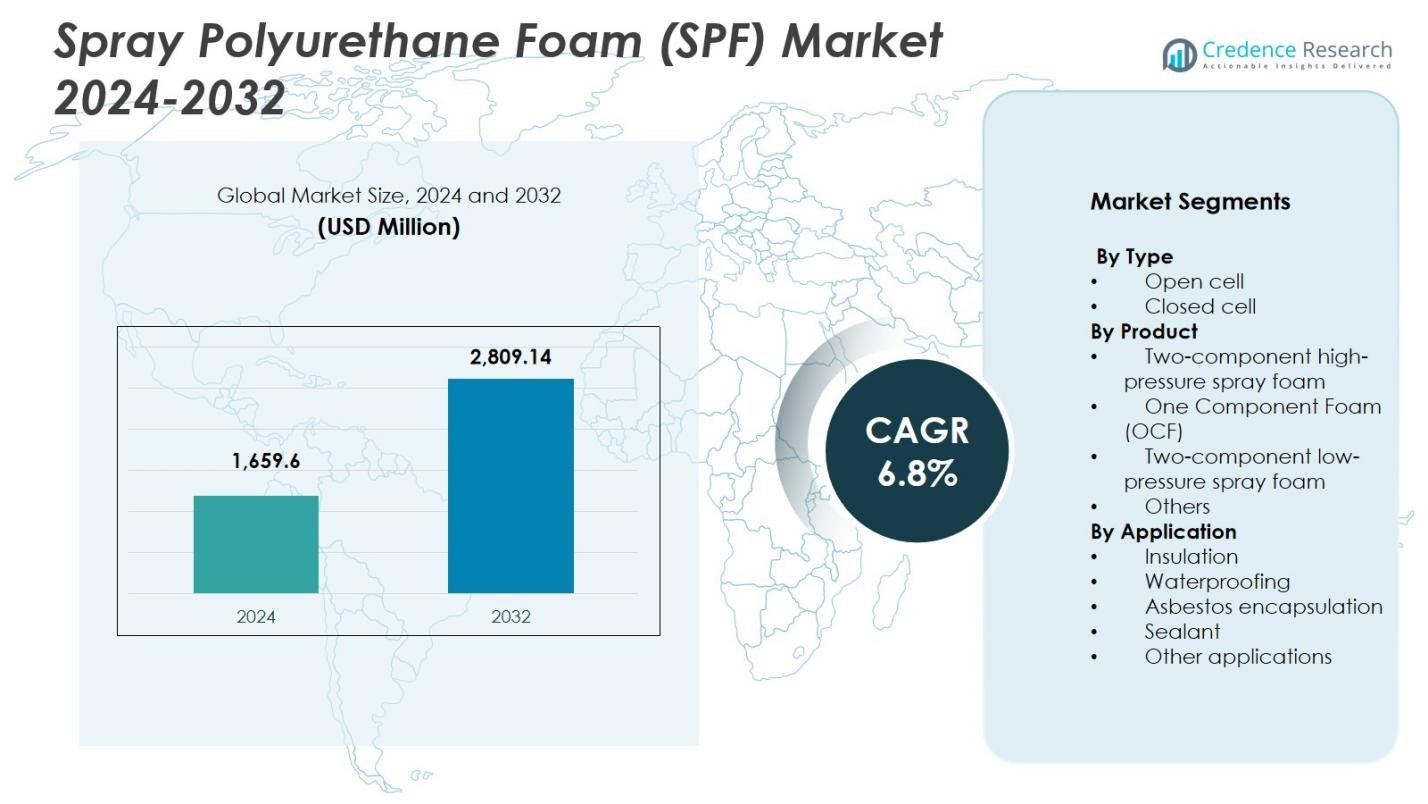

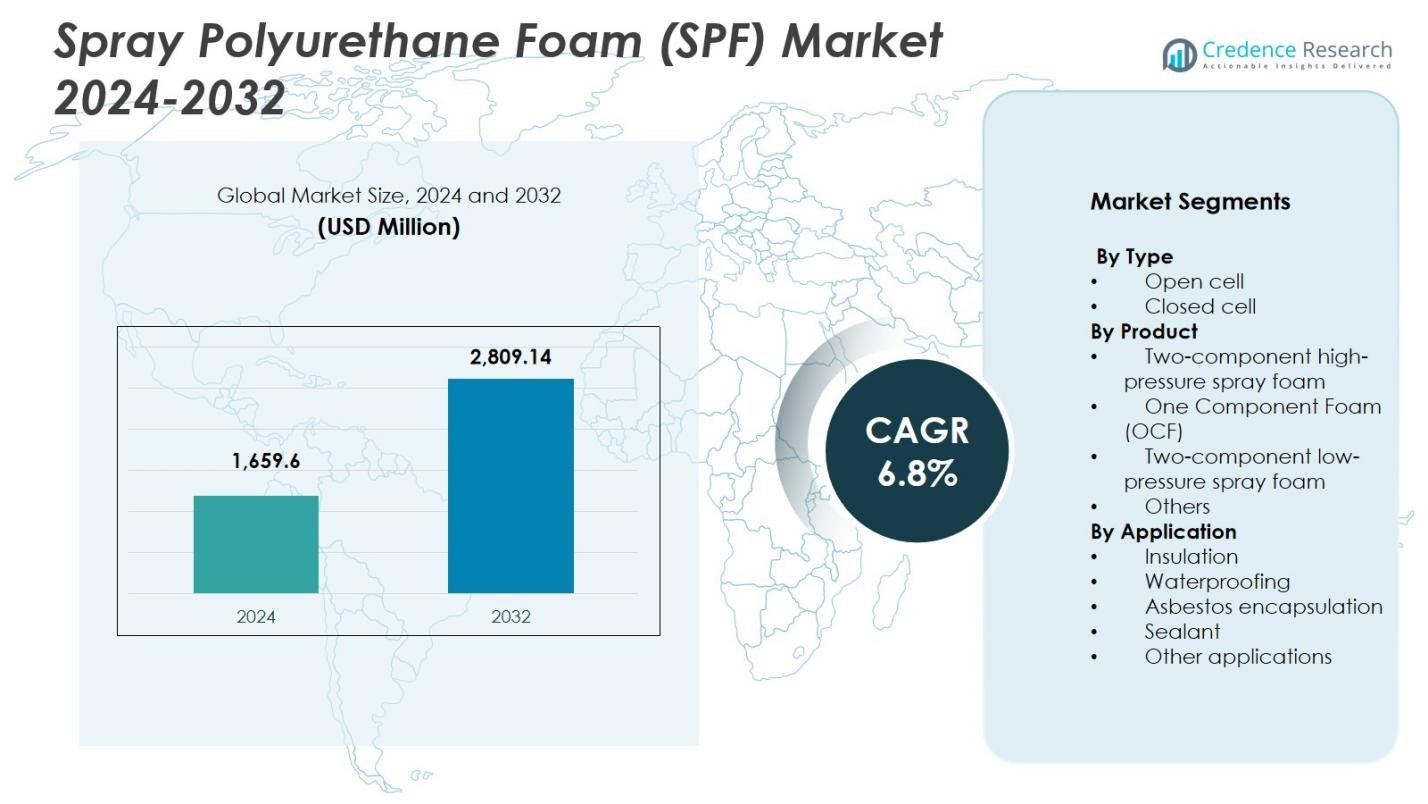

Spray Polyurethane Foam (SPF) Market size was valued at USD 1,659.6 million in 2024 and is anticipated to reach USD 2,809.14 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spray Polyurethane Foam (SPF) Market Size 2024 |

USD 1,659.6 Million |

| Spray Polyurethane Foam (SPF) Market, CAGR |

6.8% |

| Spray Polyurethane Foam (SPF) Market Size 2032 |

USD 2,809.14 Million |

Spray Polyurethane Foam (SPF) Market is driven by leading players such as Johns Manville, Accella Corporation, Isothane Ltd., Huntsman, CertainTeed, LyondellBasell Industries, BASF SE, Icynene-Lapolla, Dow, and Invista, who focus on advanced formulations, high-performance insulation systems, and energy-efficient solutions. These companies strengthen their presence through product innovation, strategic collaborations, and expansion into high-growth construction markets. Regionally, North America leads the Spray Polyurethane Foam (SPF) Market with 37.6% share in 2024, supported by strict energy codes, rising retrofit activities, and strong adoption of closed-cell SPF in commercial and residential applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Spray Polyurethane Foam (SPF) Market reached USD 1,659.6 million in 2024 and will grow at a CAGR of 6.8% through 2032, driven by rising use in insulation and waterproofing applications.

- Strong demand for high-performance insulation, stricter building energy codes, and increased retrofitting activities are key drivers supporting SPF adoption across residential, commercial, and industrial sectors.

- Market trends reflect growing use of low-GWP formulations, bio-based polyols, and advanced spraying technologies that enhance installation efficiency and environmental compliance.

- Major players such as Johns Manville, BASF SE, Huntsman, Dow, Icynene-Lapolla, and LyondellBasell Industries expand their portfolios through innovation and stronger contractor partnerships while focusing on high-pressure SPF solutions.

- North America leads with 37.6% share, followed by Europe at 28.3% and Asia-Pacific at 24.1%, while the insulation segment dominates globally with 54.2% share due to its superior thermal performance and regulatory-driven demand.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

The Spray Polyurethane Foam (SPF) Market by type is dominated by closed-cell foam, accounting for 61.4% share in 2024 due to its superior thermal resistance, high structural strength, and moisture barrier capabilities. Closed-cell SPF is widely used in commercial and industrial buildings where durability and energy-efficiency targets are stringent. Open-cell foam, with its lower density and sound-absorption performance, supports demand in residential interiors, but its share remains lower. Growth in the dominant closed-cell segment is driven by rising insulation mandates, improved building envelope standards, and increasing adoption in cold-storage, roofing, and transportation applications.

- For instance, Johns Manville’s Corbond IV closed-cell SPF, a HFO-blown medium-density system, insulates commercial and industrial structures with zero ODP and low GWP for superior thermal and moisture performance.

By Product

In the product segmentation, two-component high-pressure spray foam leads the market with 48.7% share in 2024, supported by its widespread use in large-scale insulation and roofing projects that require fast reaction time, high yield, and superior adhesion. The segment benefits from expanding construction activities, stringent energy-saving regulations, and the increasing retrofit of aging buildings. One-component foam and two-component low-pressure systems continue to grow in small-scale residential sealing and repair work, but their market shares remain lower. The dominant high-pressure SPF segment advances primarily due to contractor preference, productivity benefits, and enhanced formulation technologies.

- For instance, in Masdar City in the UAE, a “Modern Combo Roofing System” incorporating spray polyurethane foam formulated with Honeywell’s Solstice Liquid Blowing Agent was selected to meet stringent thermal-performance and environmental requirements for new roofs, demonstrating contractor preference for high-pressure SPF systems on complex, large-area projects.

By Application

The application landscape is led by the insulation segment, contributing 54.2% share in 2024 owing to SPF’s high R-value per inch, ability to reduce air leakage, and proven performance in both new construction and retrofitting. Regulatory pressure to comply with energy-efficiency codes and the rising adoption of green-building certifications continue to drive this segment’s expansion. Waterproofing and sealant applications are gaining traction in foundation protection and building envelope performance, while asbestos encapsulation remains specialized. The insulation segment’s dominance is reinforced by accelerating urban infrastructure growth and increased demand for sustainable, energy-saving materials.

Key Growth Drivers

Rising Demand for High-Performance Insulation

The Spray Polyurethane Foam (SPF) Market grows significantly due to the increasing global emphasis on energy-efficient construction. SPF offers one of the highest R-values per inch, enabling superior thermal performance and reduced HVAC loads. As governments strengthen building efficiency codes and implement carbon-reduction targets, adoption accelerates across residential, commercial, and industrial sectors. The push for green buildings, combined with escalating retrofitting activities in aging infrastructure, further reinforces the demand for SPF insulation solutions. This regulatory and performance-driven momentum continues to be a major catalyst for market expansion.

- For instance, BASF’s ENERTITE open-cell SPF enhanced energy efficiency, comfort, and moisture control in 572 multi-family units across two Tucson, Arizona developments.

Expansion of Construction and Infrastructure Projects

A surge in new construction and renovation projects worldwide drives substantial use of SPF in roofing, wall insulation, air sealing, and moisture control. Rapid urbanization in Asia-Pacific, along with infrastructure modernization in North America and Europe, increases the requirement for advanced insulation materials. SPF’s ability to provide structural reinforcement, reduce energy leakage, and deliver long-term durability positions it as a preferred material for builders. Additionally, growth in cold-storage facilities, logistics warehouses, and temperature-sensitive industrial units strengthens demand for high-pressure SPF products.

- For instance, Spray Tight Foam Insulators applied Lapolla FOAM-LOK 2800-4G closed-cell SPF as a roofing system on the 350,000-square-foot International Precast Solutions manufacturing facility in River Rouge, Michigan.

Growing Adoption of Sustainable and Eco-Efficient Materials

Sustainability pressures are transforming the SPF landscape as manufacturers incorporate low-GWP blowing agents, bio-based polyols, and greener formulations. These innovations align with global environmental regulations targeting carbon footprints and chemical emissions in insulation materials. Demand rises from customers seeking durable, environment-friendly materials that support LEED and other green-building certifications. Enhanced lifecycle benefits, reduced energy consumption, and improved thermal performance drive the preference for sustainable SPF products. This transition strengthens market growth as industries adopt climate-aligned insulation solutions.

Key Trends & Opportunities

Advancements in Foam Formulation and Application Technologies

A major trend shaping the SPF market is the development of next-generation formulations with improved fire resistance, lower emissions, and enhanced curing performance. Growing investment in smart spraying equipment, automated proportioning systems, and real-time application monitoring boosts installation accuracy and reduces material waste. Opportunities emerge for companies providing innovative, contractor-friendly systems that enhance productivity and safety onsite. These advancements enable SPF to meet stricter environmental standards while improving building quality and driving high-performance insulation adoption.

- For instance, Evonik and Chemours jointly developed SPF systems that combine DABCO PM 301 catalysts with Opteon 1100 and Opteon 1150 HFO blowing agents, delivering ultra-low GWP values such as 16 for Opteon 1150, which is around 100 times lower than traditional HFC blowing agents.

Rising Opportunities in Retrofits and Energy-Efficient Upgrades

Aging building stock across developed regions creates substantial opportunities for SPF as governments incentivize retrofitting and energy-efficiency improvements. SPF’s ability to seal air gaps, strengthen structural integrity, and reduce long-term energy costs makes it a preferred material for upgrades in residential, commercial, and industrial facilities. Growing emphasis on net-zero buildings and decarbonization further accelerates adoption. Companies offering retrofit-optimized formulations and low-pressure systems stand to gain as renovation activities outpace new construction in several mature markets.

- For instance, Huntsman applied SPF to structures at Camp Victory in Baghdad, reducing air conditioning needs from eight units at 92°F to two units at 70°F. This retrofit delivered 50% fuel savings and full ROI within 75 days, demonstrating SPF’s role in sealing envelopes for military facilities.

Key Challenges

Environmental and Regulatory Compliance Pressures

Manufacturers face increasing challenges due to stringent regulations governing chemical emissions, blowing agents, worker exposure limits, and waste disposal. Compliance with evolving standards such as low-GWP requirements demands continuous reformulation and higher R&D expenditure. Small and mid-size producers struggle with the cost burden of meeting these mandates, potentially impacting pricing and market competitiveness. Additionally, regulatory scrutiny on isocyanates and VOC emissions creates operational constraints and requires enhanced safety protocols across production and application processes.

High Installation Costs and Skilled Labor Shortage

SPF installation remains cost-intensive due to specialized equipment, high-pressure systems, and the need for certified applicators. Skilled labor shortages in several regions, particularly in developing markets, create bottlenecks that limit large-scale adoption. Incorrect installation can lead to insulation failures, moisture issues, and call-backs, increasing overall project risk. These challenges raise barriers for small contractors and end users, slowing penetration in cost-sensitive segments. Addressing cost optimization and workforce training remains essential for ensuring consistent market growth.

Regional Analysis

North America

North America leads the Spray Polyurethane Foam (SPF) Market with 37.6% share in 2024, driven by strict building energy codes, rapid adoption of high-performance insulation, and strong demand from residential retrofitting programs. The region benefits from well-established construction practices, widespread use of closed-cell SPF for roofing and commercial insulation, and rising investments in green-building certifications. Growth remains supported by infrastructure modernization, expansion of cold-storage facilities, and increasing environmental compliance related to low-GWP blowing agents. The U.S. continues to dominate the regional market due to continuous innovation and contractor-driven SPF applications.

Europe

Europe holds 28.3% share in 2024, propelled by stringent sustainability mandates, widespread adoption of low-emission building materials, and accelerated efforts to decarbonize residential and commercial structures. The region’s renovation wave, supported by the EU’s energy-efficiency directives, boosts SPF demand for insulation, air sealing, and moisture control applications. Countries such as Germany, France, and the U.K. are leading consumers due to strong regulatory enforcement and increasing retrofitting of aging buildings. Growth also benefits from innovations in eco-friendly SPF formulations aligned with circular-economy goals and low-carbon construction practices.

Asia-Pacific

Asia-Pacific emerges as the fastest-growing region with 24.1% market share in 2024, supported by rapid urbanization, infrastructure expansion, and rising awareness of energy-efficient building solutions. Increasing construction of commercial complexes, residential high-rises, and industrial facilities fuels widespread SPF adoption, especially in insulation and waterproofing. China, India, Japan, and South Korea drive demand through large-scale development projects and supportive government initiatives promoting green buildings. The region’s manufacturing strength and availability of cost-effective raw materials also enhance market growth. Rising investments in cold-chain logistics and industrial refrigeration further strengthen SPF penetration.

Latin America

Latin America accounts for 6.2% share in 2024, driven by expanding urban development, increasing reconstruction activities, and growing interest in modern insulation systems across Brazil, Mexico, and Colombia. The region’s warm climate accelerates demand for SPF-based thermal management to reduce cooling loads in residential and commercial buildings. Adoption gains momentum as contractors shift toward high-performance materials capable of addressing moisture, air infiltration, and structural reinforcement. Government initiatives promoting energy-efficient housing and the expansion of industrial warehousing create additional opportunities for SPF manufacturers. However, market growth is moderated by economic fluctuations and varying regulatory frameworks.

Middle East & Africa

The Middle East & Africa represents 3.8% market share in 2024, supported by rising construction of commercial buildings, hospitality infrastructure, and temperature-controlled storage facilities. SPF demand grows as the region prioritizes thermal insulation to manage extreme climatic conditions and reduce energy consumption in HVAC-intensive structures. Countries such as the UAE, Saudi Arabia, and South Africa show increasing adoption for roofing, waterproofing, and industrial applications. Government sustainability programs and green-building certifications also encourage the use of advanced insulation materials. Despite growth potential, market expansion faces challenges from limited contractor expertise and fluctuating raw-material availability.

Market Segmentations:

By Type

By Product

- Two-component high-pressure spray foam

- One Component Foam (OCF)

- Two-component low-pressure spray foam

- Others

By Application

- Insulation

- Waterproofing

- Asbestos encapsulation

- Sealant

- Other applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Spray Polyurethane Foam (SPF) Market is shaped by leading players such as Johns Manville, Accella Corporation, Isothane Ltd., Huntsman, CertainTeed, LyondellBasell Industries, BASF SE, Icynene-Lapolla, Dow, and Invista, who collectively drive innovation, product diversification, and global market expansion. These companies focus on advanced formulations with enhanced thermal performance, reduced environmental impact, and compliance with evolving low-GWP regulations. Strategic investments in R&D, capacity expansions, and development of high-pressure systems strengthen their competitive standing. Partnerships with contractors, distributors, and construction firms improve market presence, while M&A activities support technology acquisition and geographic reach. Market players increasingly prioritize sustainable solutions, integrating bio-based polyols and next-generation blowing agents to meet green-building standards. Continuous innovations in application equipment and digital installation tools further differentiate offerings, reinforcing leadership in a growing insulation and energy-efficiency–driven market.

Key Player Analysis

- Johns Manville

- Accella Corporation

- Isothane Ltd.

- Huntsman

- CertainTeed

- LyondellBasell Industries

- BASF SE

- Icynene-Lapolla

- Dow

- Invista

Recent Developments

- In September 2024, BASF SE announced a collaboration with Future Foam to launch Lupranate T 80-based flexible polyurethane foam products, expanding its polyurethane offerings with a new commercially available TDI-based solution for comfort and insulation applications.

- In January 2024, Dow Inc. introduced a new series of high-performance spray polyurethane foam insulation products designed to deliver improved thermal efficiency and lower environmental impact for building and construction customers.

- On November 14, 2023, DAP, a leader in home improvement and construction products, changed spray foam application by introducing the first 1-component broadcast spray foam: Wall & Cavity Foam with Wide Spray Applicator.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Spray Polyurethane Foam (SPF) Market will experience sustained growth as global construction activity continues to expand across residential, commercial, and industrial sectors.

- Energy-efficiency regulations will drive greater adoption of SPF due to its high thermal performance and long-term insulation benefits.

- Demand for low-GWP formulations will strengthen as countries enforce stricter environmental and emissions standards.

- Retrofitting and renovation projects will become a major growth avenue, particularly in mature markets with aging building infrastructure.

- Advancements in spray equipment and digital application technologies will enhance installation accuracy and contractor productivity.

- Manufacturers will increasingly introduce bio-based and eco-efficient SPF solutions to align with global sustainability goals.

- Expansion of cold-chain logistics and temperature-controlled facilities will support rising use of SPF in industrial applications.

- Growing urbanization in developing regions will boost consumption of SPF for insulation and waterproofing solutions.

- Strategic partnerships and M&A activity will intensify as companies seek technological capabilities and geographic expansion.

- Workforce training and certification programs will gain importance to address skill shortages and ensure quality installations.

Market Segmentation Analysis:

Market Segmentation Analysis: