Market Overview:

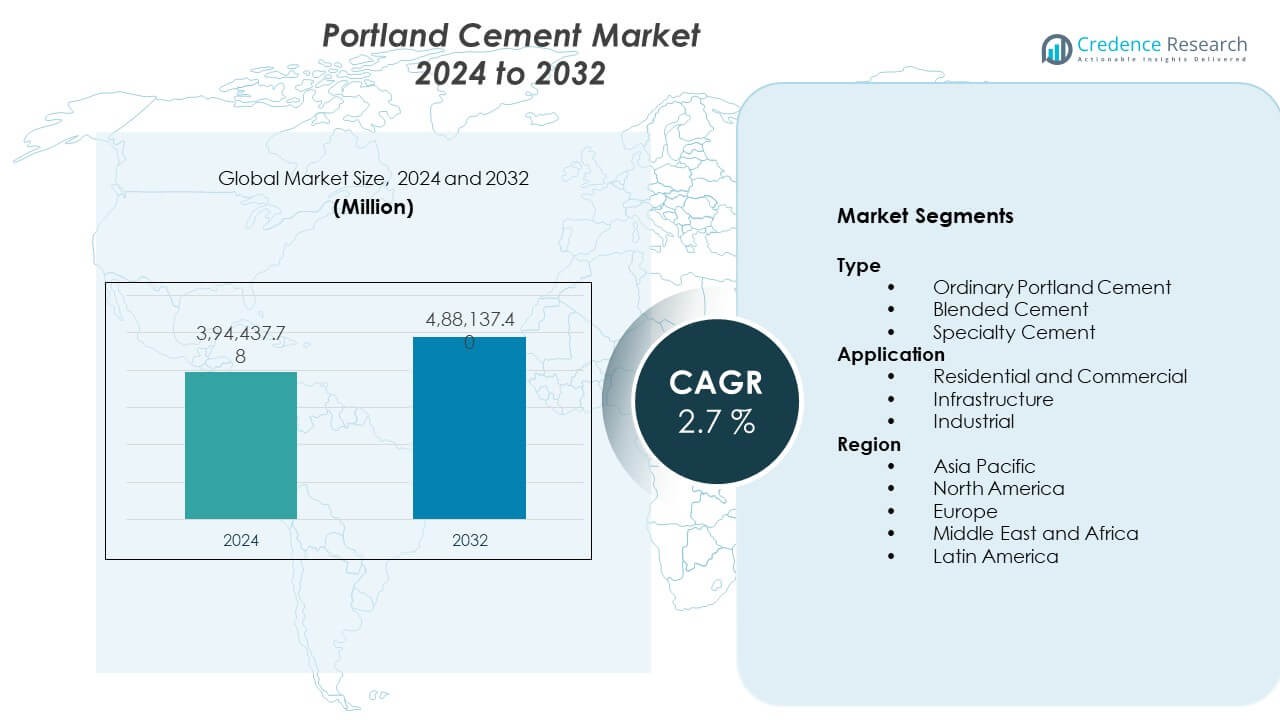

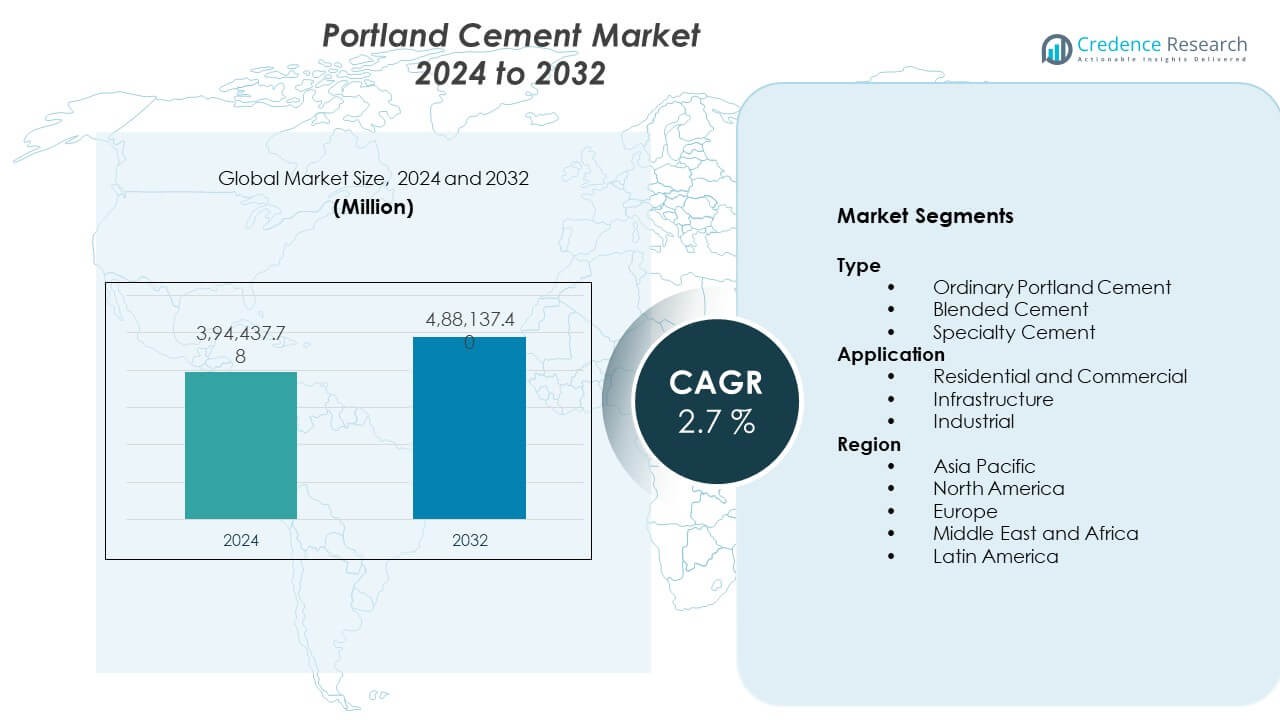

The Portland Cement Market is projected to grow from USD 394,437.78 million in 2024 to an estimated USD 488,137.4 million by 2032. The market is expected to record a compound annual growth rate of 2.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portland Cement Market Size 2024 |

USD 394,437.78 Million |

| Portland Cement Market, CAGR |

2.7% |

| Portland Cement Market Size 2032 |

USD 488,137.4 Million |

Demand growth links closely to infrastructure spending, housing needs, and urban expansion. Governments invest in roads, bridges, railways, and public buildings, which lifts cement use. Real estate activity supports steady volumes across urban and semi-urban areas. Industrial growth also increases demand for factories, warehouses, and logistics hubs. Producers improve kiln efficiency and clinker substitution to manage costs and emissions. Blended cement adoption helps meet environmental rules while maintaining performance. These factors sustain stable demand across economic cycles.

Asia Pacific leads the market due to large-scale construction activity and rapid urban growth. China and India drive volume through housing programs and infrastructure expansion. Southeast Asian countries emerge as strong contributors due to industrial parks and transport projects. North America shows steady demand from renovation and infrastructure upgrades. Europe focuses on low-carbon cement and plant modernization. The Middle East and Africa gain traction from energy projects and urban development, supporting regional market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market stood at USD 394,437.78 million in 2024 and is projected to reach USD 488,137.4 million by 2032, reflecting a CAGR of 2.7% driven by steady construction demand.

- Asia Pacific leads with about 55% share due to large infrastructure programs, Europe follows with nearly 18% supported by renovation and green building focus, and North America holds around 15% backed by infrastructure upgrades and housing demand.

- The Middle East and Africa ranks as the fastest-growing region with nearly 7% share, supported by urban development, energy projects, and large-scale public construction.

- By type, Ordinary Portland Cement accounts for nearly 60% share due to broad construction use, while Blended Cement holds about 30% driven by durability and sustainability needs.

- By application, Infrastructure represents around 45% of demand due to long-term public projects, while Residential and Commercial together contribute close to 40% through ongoing urban development.

Market Drivers:

Large-Scale Infrastructure And Public Investment Programs Across Regions

Government investment in transport and civic projects drives cement demand. Road, rail, and metro expansion requires steady material supply. Port upgrades and airport projects raise bulk cement use. Urban utilities need durable concrete structures. Housing programs increase base consumption levels. Industrial corridors create demand for foundations and plants. The Portland Cement Market benefits from long project timelines. Public funding supports predictable purchase cycles. Policy-backed spending reduces demand volatility.

- For instance, China State Railway Group reported completion of over 3,600 km of new high-speed rail lines in 2023, a scale that requires continuous high-volume cement supply for viaducts, tunnels, and stations.

Rapid Urbanization And Rising Housing Construction In Developing Economies

Urban population growth increases housing demand. Cities expand residential zones and mixed-use projects. Affordable housing schemes raise cement volumes. Private developers focus on high-density construction. Vertical growth supports higher cement intensity per site. Suburban expansion needs roads and drainage systems. Cement remains a core structural input. Demand stays stable across income segments. Urban planning sustains long-term consumption.

- For instance, India’s Pradhan Mantri Awas Yojana reported more than 50 million urban and rural houses sanctioned by 2024, each unit relying heavily on reinforced concrete for structural stability.

Industrial Expansion And Growth Of Manufacturing And Logistics Facilities

Industrial growth supports new factory construction. Warehouses and logistics parks need heavy concrete floors. Export-driven economies invest in industrial estates. Power plants and refineries use large cement volumes. Mining and metals sectors require durable structures. Data centers demand reinforced building shells. Industrial safety codes favor cement-based designs. Expansion supports steady off-take. Capacity utilization improves across regions.

Reconstruction, Renovation, And Disaster Recovery Construction Activity

Aging infrastructure requires repair and upgrades. Bridge retrofits consume high-strength cement. Urban renewal projects replace old buildings. Disaster recovery boosts short-term cement demand. Flood and earthquake zones need resilient structures. Insurance-backed rebuilding supports quick procurement. Public safety standards favor cement solutions. Reconstruction cycles repeat across regions. Demand remains counter-cyclical.

Market Trends:

Shift Toward Blended Cement And Lower-Clinker Product Formulations

Producers reduce clinker content to meet rules. Blended cement gains wider acceptance. Fly ash and slag improve durability. Builders accept performance-based standards. Production costs show better control. Energy use declines at plant level. The Portland Cement Market adapts product portfolios. Buyers value consistent quality. Sustainability goals shape mix designs.

- For instance, Holcim reports that its ECOPlanet cement range achieves up to 50% lower CO₂ emissions per ton compared to traditional Portland cement through higher supplementary cementitious material use.

Adoption Of Advanced Kiln Technology And Process Automation Systems

Plants adopt digital control systems. Automation improves output consistency. Predictive maintenance reduces downtime risks. Fuel efficiency gains support margin stability. Process data improves quality control. Workforce safety sees improvement. Technology upgrades shorten maintenance cycles. Output planning becomes more accurate. Capital investment focuses on efficiency.

- For instance, Heidelberg Materials deployed advanced process control systems across multiple plants, reporting thermal energy efficiency improvements exceeding 5% per kiln through real-time optimization.

Growing Preference For Ready-Mix Concrete Over Bagged Cement

Urban builders prefer ready-mix supply. Time savings improve project schedules. Quality control improves at batching plants. Large projects reduce on-site storage needs. Labor efficiency supports adoption. Transport networks enable wider coverage. Ready-mix demand reshapes distribution models. Cement firms integrate downstream services. Service reliability gains importance.

Increased Focus On Product Standardization And Performance Certification

Buyers demand certified material grades. Performance testing replaces brand-only selection. National standards gain stronger enforcement. Infrastructure agencies require compliance proof. Consistent strength ratings reduce risk. Certification supports export potential. Producers invest in lab facilities. Trust improves across supply chains. Standardization supports market transparency.

Market Challenges Analysis:

High Energy Costs And Dependence On Fossil Fuel Inputs

Cement production requires high thermal energy. Fuel price volatility affects cost structures. Coal and petcoke supply risks remain. Energy taxes raise operational expenses. Cost pass-through faces buyer resistance. Alternative fuels need investment support. The Portland Cement Market faces margin pressure. Smaller producers struggle with scale limits. Energy efficiency remains a priority.

Environmental Compliance Pressure And Carbon Emission Reduction Targets

Emission limits tighten across regions. Carbon reporting adds compliance costs. Emission control equipment raises capital needs. Approval delays affect plant expansion plans. Community opposition slows project timelines. Regulatory variation increases complexity. Compliance affects pricing flexibility. Technology upgrades demand skilled labor. Policy uncertainty affects long-term planning.

Market Opportunities:

Expansion Of Green Cement Solutions And Low-Carbon Product Portfolios

Low-carbon cement gains policy support. Public projects prefer sustainable materials. Carbon credits improve project economics. Innovation attracts institutional buyers. Product differentiation supports premium pricing. Research partnerships speed development cycles. The Portland Cement Market can enhance brand value. Early adoption builds competitive advantage. Sustainability drives future demand.

Growth Potential In Emerging Economies And Underserved Construction Markets

Emerging regions invest in basic infrastructure. Rural housing programs expand cement reach. Transport connectivity opens new demand pockets. Local plants reduce logistics costs. Urban migration sustains construction needs. Foreign investment supports industrial zones. Market penetration remains low in some regions. Capacity additions match demand growth. Long-term prospects stay positive.

Market Segmentation Analysis:

Type

The Portland Cement Market shows clear differences across product types. Ordinary Portland Cement leads due to broad construction use. Builders value consistent strength and easy availability. Blended Cement gains share due to durability benefits. This type supports longer structure life. Specialty Cement serves technical and niche needs. Users seek faster setting or chemical resistance. Product choice depends on cost and performance balance. Ordinary Portland Cement supports most building activity. Contractors prefer predictable performance. The material suits housing and offices. Supply networks remain strong across regions. Price sensitivity favors this type. Demand stays stable through cycles. Blended Cement aligns with durability goals. Infrastructure agencies prefer lower heat properties. The product supports mass concrete work. Producers promote clinker reduction benefits. Acceptance rises in public projects. Specialty Cement meets complex engineering needs. Industrial plants value resistance features. Fast-track projects use rapid-set grades. Volumes remain lower but margins stay firm.

- For instance, UltraTech Cement operates more than 50 integrated and grinding units, enabling large-scale Ordinary Portland Cement supply with compressive strength compliance above 53 MPa for structural applications.

Application

Application demand reflects project scale and funding sources. Residential and commercial construction forms the base load. Infrastructure projects drive bulk consumption. Industrial facilities require performance-focused grades. Each segment supports balanced demand patterns.

Housing growth sustains steady cement use. Commercial spaces support repeat demand. Urban expansion keeps volumes stable. Roads and bridges consume large quantities. Public budgets support long-term demand visibility. Factories and energy projects need high-strength cement. Technical standards guide selection decisions.

- For instance, Buzzi Unicem supports industrial and energy construction projects with high-performance cement designed to meet strict load-bearing and durability standards for power plants and manufacturing facilities.

Segmentation:

Type

- Ordinary Portland Cement

- Blended Cement

- Specialty Cement

Application

- Residential and Commercial

- Infrastructure

- Industrial

Region

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Regional Analysis:

Asia Pacific

Asia Pacific holds the largest share of the global market at around 55%. China and India drive demand through housing and infrastructure programs. Urban expansion sustains high cement consumption levels. Transport corridors and industrial zones support volume growth. Southeast Asia adds demand from manufacturing and port projects. Local production capacity supports supply stability. The Portland Cement Market benefits from long-term construction plans across the region.

North America and Europe

North America accounts for nearly 15% of global demand. Infrastructure repair and housing renovation support steady consumption. Public funding improves demand visibility across states. Europe represents about 18% of the market share. Green building policies shape product selection in this region. Producers focus on low-carbon cement grades. Stable regulations support predictable demand patterns.

Middle East & Africa and Latin America

The Middle East and Africa hold close to 7% of the market share. Urban development and energy projects support cement demand. Mega projects drive short-term volume spikes. Latin America contributes nearly 5% of global demand. Housing needs and transport upgrades sustain consumption. Local production helps manage logistics costs. These regions offer long-term expansion potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Portland Cement Market shows strong competition among global and regional producers. Large players benefit from scale, integrated operations, and wide distribution networks. Cost leadership remains critical due to price sensitivity across construction sectors. Companies focus on capacity optimization and energy efficiency to protect margins. Product portfolios include ordinary, blended, and specialty grades to meet diverse demand. Strategic plant locations reduce logistics costs. Mergers strengthen regional presence and resource access. Competitive strength depends on operational efficiency, brand trust, and regulatory compliance. It favors firms with strong balance sheets and sustainable production strategies.

Recent Developments:

- In November 2025, Heidelberg Materials North America entered into a binding purchase agreement to acquire Walan Specialty Construction Products in Delaware, adding a modern slag grinding plant with an annual capacity of 150,000 tonnes to its low-carbon portfolio. Prior to this, in November 2024, the company announced the acquisition of Giant Cement Holding Inc. and its subsidiaries for approximately $600 million to strengthen its footprint in the Eastern United States, a transaction expected to close in 2025.

- In October 2025, Taiheiyo Cement announced the acquisition of ready-mixed concrete business assets in Northern and Southern California to expand its U.S. West Coast supply chain, with finalization expected by December 2025. Previously, in July 2024, the company inaugurated a new $220 million production line at its subsidiary in the Philippines, significantly boosting its local production capacity with advanced kiln technology.

- In September 2025, CRH completed the acquisition of Eco Material Technologies for $2.1 billion, a strategic move to become a leader in Supplementary Cementitious Materials (SCMs) in North America. This acquisition integrates North America’s largest producer of sustainable cement alternatives into CRH’s portfolio, aligning with its decarbonization and infrastructure modernization goals.

- In June 2025, Anhui Conch Cement finalized the acquisition of key assets from Yaobai Special Cement Limited, including Yili Yaobai Cement and other subsidiaries, for approximately CNY 400 million to strengthen its market position in western China. Additionally, in April 2025, the company partnered with Huawei and the China Building Materials Federation to launch the industry’s first large-scale AI model designed to optimize cement manufacturing efficiency and digital transformation.

Report Coverage:

The research report offers an in-depth analysis based on type and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Infrastructure investment will sustain long-term cement demand

- Urban housing growth will support steady consumption

- Blended cement adoption will increase across public projects

- Energy efficiency will remain a top producer priority

- Alternative fuels will gain wider acceptance

- Automation will improve plant productivity

- Regional capacity expansion will continue in Asia

- Sustainability targets will shape product innovation

- Supply chain optimization will gain importance

- Competitive intensity will remain high