Market Overview

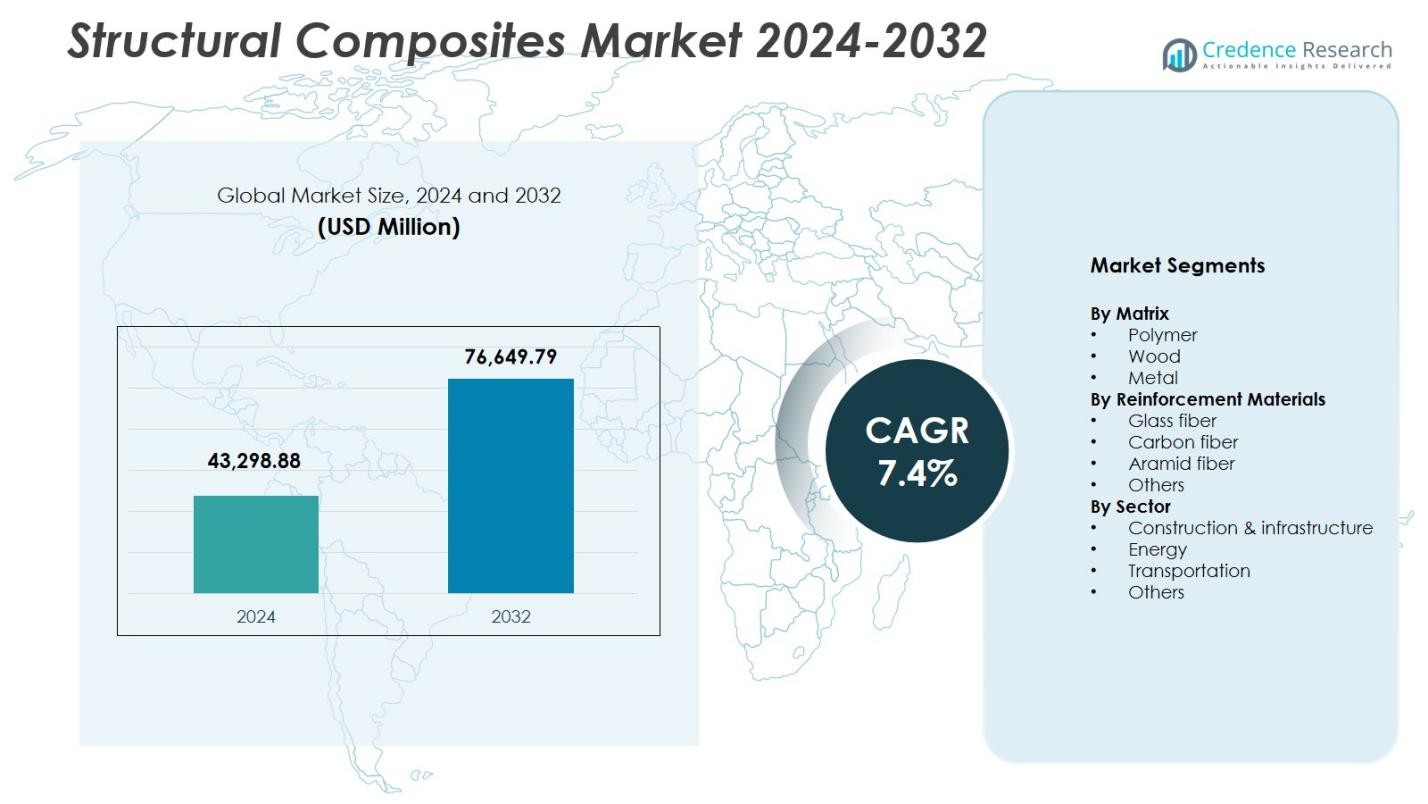

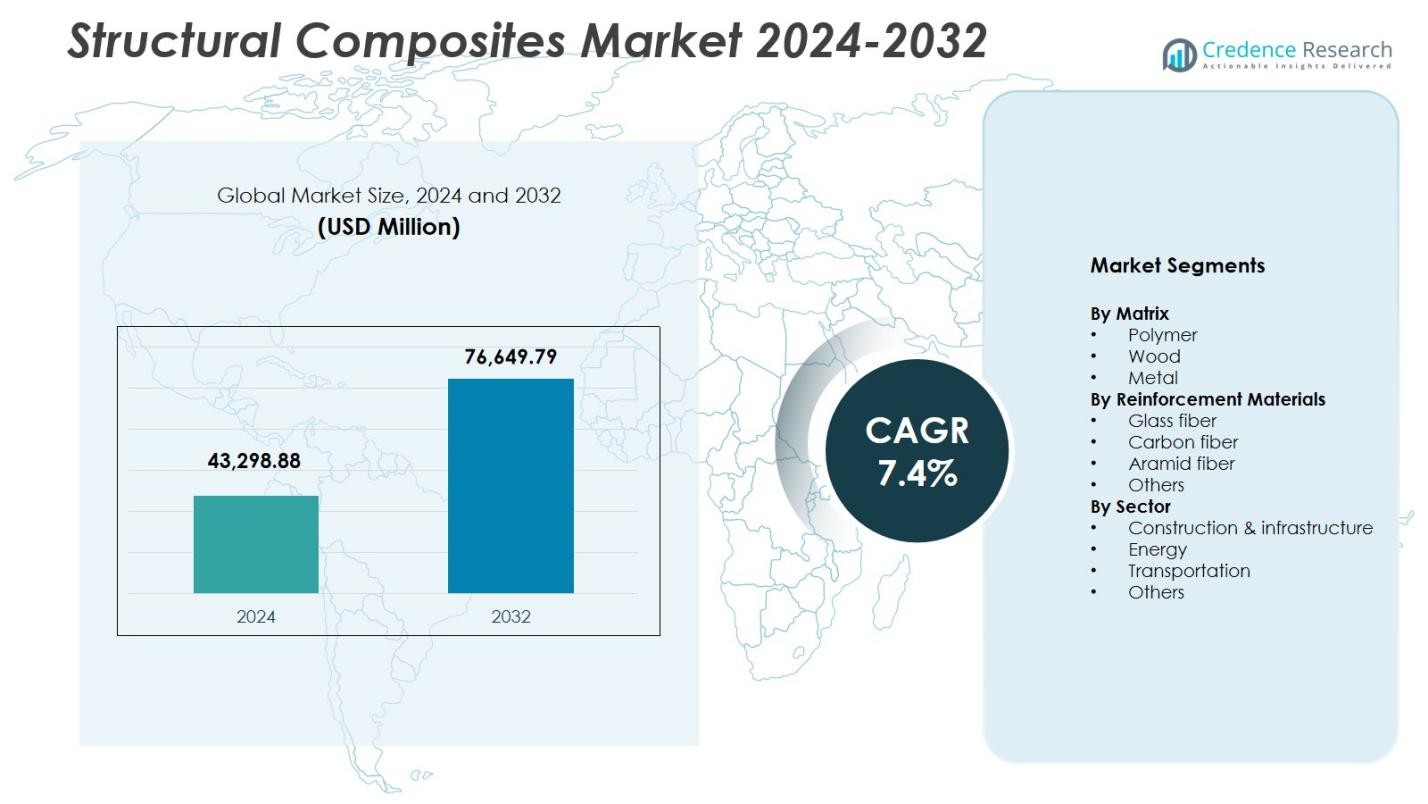

Structural Composites Market size was valued at USD 43,298.88 million in 2024 and is anticipated to reach USD 76,649.79 million by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Structural Composites Market Size 2024 |

USD 43,298.88 Million |

| Structural Composites Market, CAGR |

7.4% |

| Structural Composites Market Size 2032 |

USD 76,649.79 Million |

Structural Composites Market is shaped by key players such as Hexcel Corporation, Toray Group, Owens Corning, Solvay, Teijin Limited, Mitsubishi Chemical Holdings Corporation, Huntsman Corporation, Hexion Inc., SGL Group, and Argosy International Inc., all driving advancements in high-performance materials for structural applications. These companies focus on enhanced strength, durability, and lightweighting to meet rising demand across construction, transportation, aerospace, and energy sectors. North America leads the market with a 32.4% share in 2024, supported by strong manufacturing capabilities and infrastructure investment, while Europe and Asia-Pacific closely follow with robust adoption across renewable energy and industrial development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Structural Composites Market size reached USD 43,298.88 million in 2024 and is projected to grow at a CAGR of 7.4% through 2032.

- Rising demand for lightweight, corrosion-resistant materials in construction, transportation, and renewable energy continues to drive strong adoption of polymer matrix composites, which held a 8% share in 2024.

- Key trends include rapid expansion of wind energy installations, increased automotive lightweighting, and advancements in recyclable composite technologies supporting sustainability goals.

- Leading players such as Hexcel Corporation, Toray Group, Owens Corning, Solvay, and Teijin Limited focus on high-strength materials, automation, and product innovations to strengthen market presence.

- North America led with 4% share, followed by Europe at 29.7% and Asia-Pacific at 28.1%, supported by large infrastructure programs, renewable energy growth, and expanding transportation applications.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Matrix

The Structural Composites Market by matrix is dominated by the polymer segment, holding 62.8% share in 2024, driven by its high strength-to-weight ratio, corrosion resistance, and versatility across construction, energy, and transportation applications. Polymer composites continue to gain traction due to reduced lifecycle costs, ease of fabrication, and suitability for large-scale structural components such as bridge decks, wind turbine blades, and automotive body panels. The wood and metal matrix segments follow, supported by niche applications, but polymer remains the preferred choice as industries focus on lightweighting, durability, and improved structural performance.

- For instance, Mitsubishi Chemical Group provided autoclavable carbon fiber prepreg for an OEM’s car body panels, such as roofs and hoods up to two meters wide, streamlining painting at 180°C for 45 minutes.

By Reinforcement Materials

The Structural Composites Market by reinforcement materials is led by the glass fiber segment, accounting for 54.6% share in 2024, supported by its cost-effectiveness, excellent mechanical properties, and widespread adoption in infrastructure and transportation structures. Glass fiber composites enable high tensile strength, impact resistance, and design flexibility, making them suitable for bridges, rebar, marine components, and building panels. Carbon fiber follows with strong demand in aerospace and high-performance automotive applications, while aramid fiber and others cater to specialized requirements. The dominance of glass fiber is further reinforced by increasing investments in durable, lightweight composite solutions.

- For instance, Dextra’s Durabar GFRP rebar, made from fiberglass reinforced polymer, is 4x lighter and 2x stronger than steel, produced in ISO-9001 certified factories for straight bars, coils, and bends in concrete reinforcement.

By Sector

The Structural Composites Market by sector is dominated by the construction & infrastructure segment, which captured 41.3% share in 2024 due to rapid adoption of composite materials for bridge rehabilitation, structural strengthening, modular construction, and corrosion-resistant building components. The sector benefits from composites’ long service life, reduced maintenance costs, and superior load-bearing capabilities. Energy applications, especially wind turbine blades, continue to expand, while transportation demand is driven by lightweight vehicle manufacturing. Other sectors contribute through marine, industrial, and defense applications. The strong dominance of construction & infrastructure reflects global infrastructure modernization and sustainability-driven material substitution.

Key Growth Drivers

Rising Demand for Lightweight and High-Strength Materials

The Structural Composites Market grows significantly as industries prioritize lightweight and high-strength materials to improve efficiency and durability. Composites offer superior mechanical performance, corrosion resistance, and design flexibility, enabling their widespread use in transportation, construction, and industrial equipment. Automakers and aerospace manufacturers increasingly replace metal parts with composites to enhance fuel efficiency and reduce emissions. Additionally, infrastructure developers adopt composite beams, panels, and rebar to lower maintenance costs and extend service life, collectively driving strong demand across global engineering and manufacturing sectors.

- For instance, Strongwell’s COMPOSOLITE panels, made via pultrusion with fiber reinforced polymer, serve as 3.15-inch thick modular structural components that interlock for load-bearing applications in buildings.

Expansion of Renewable Energy and Wind Power Installations

The rapid rise in global wind energy deployment serves as a strong catalyst for composite consumption, especially in manufacturing large, high-performance turbine blades. Structural composites provide exceptional fatigue resistance, stiffness, and lightweight characteristics essential for longer and more efficient blade designs. Governments worldwide invest in renewable energy capacity addition, creating sustained demand for composite materials. Offshore wind projects, requiring superior corrosion resistance and structural reliability, further elevate market growth. These factors collectively position composites as a critical material for the next generation of renewable energy infrastructure.

- For instance, Vestas equips its V162-6.2 MW EnVentus turbine with carbon- and glass-fiber reinforced plastic blades measuring 79.35 meters in length. These composites enable a rotor diameter of 162 meters, supporting enhanced energy capture in diverse wind conditions.

Increasing Infrastructure Modernization and Repair Activities

Infrastructure rehabilitation initiatives worldwide support market expansion, as composites deliver long-lasting, corrosion-resistant solutions for bridges, tunnels, and public utilities. Structural composites reduce installation and maintenance costs compared to steel and concrete alternatives, making them preferred for strengthening and retrofitting projects. Growing investments in smart and sustainable infrastructure amplify the need for advanced materials with extended operational life. Governments and private developers leverage composite-based decks, rebar, wraps, and structural beams to enhance performance and resilience, significantly accelerating market growth across both developed and emerging economies.

Key Trends & Opportunities

Technological Advancements in High-Performance Composite Manufacturing

Continuous innovation in resin chemistry, fiber technologies, and automated production processes presents major opportunities for the Structural Composites Market. Advanced techniques such as resin transfer molding, filament winding, and automated fiber placement improve production speed, consistency, and cost efficiency. The emergence of recyclable composites and thermoplastic matrices drives sustainability-focused innovation. These technologies enable the development of lighter, stronger, and more durable components, unlocking opportunities across aerospace, automotive, defense, and large-scale construction. Manufacturers investing in digital fabrication and material optimization benefit from reduced waste and enhanced product performance.

- For instance, Advanced Composites Inc. uses filament winding machines with carbon and fiberglass materials to produce high-performance tubing and structures for defense and commercial uses, supporting prototyping through full production runs.

Growing Adoption of Sustainable and Eco-Efficient Composite Solutions

The increasing global emphasis on ESG goals and circular economy practices drives adoption of bio-based resins, natural fibers, and recyclable composite systems. Industries seek environmentally friendly structural solutions that meet stringent emission standards without compromising performance. Sustainable composites create new opportunities in green buildings, renewable energy equipment, next-generation mobility, and carbon-neutral infrastructure. Regulatory support for low-carbon materials accelerates the shift toward eco-efficient composites, encouraging manufacturers to expand sustainable product lines and innovate across supply chains to meet rising demand for greener structural materials.

- For instance, Hexcel’s Nature Range also pairs flax fibers with bio-derived resins to replace petrochemical epoxies, preserving processing properties for composites in wind turbine blades. This supports emission reductions in renewable energy without altering resin characteristics.

Key Challenges

High Production Costs and Complex Manufacturing Processes

Despite strong performance benefits, the Structural Composites Market faces challenges due to high material costs, labor-intensive processes, and extensive capital requirements. Advanced fibers, specialized tooling, and precision fabrication contribute to elevated production expenses compared to traditional steel and aluminum. Manufacturers must also manage long cycle times and strict quality control standards, which limit scalability. These cost barriers hinder adoption in price-sensitive applications, particularly in developing regions. Overcoming this challenge requires advancements in automation, lower-cost raw materials, and optimized design techniques to enhance cost competitiveness.

Limited Recycling Technologies and End-of-Life Management Issues

Recycling structural composites remains a major challenge due to complex material compositions, cross-linked resin systems, and limited availability of economically viable recycling technologies. Most composite waste ends up in landfills, raising environmental concerns and prompting regulatory scrutiny. Industries require scalable solutions for recovering fibers and repurposing composite waste without degrading performance. The lack of mature recycling infrastructure restricts widespread adoption, particularly in high-volume sectors such as automotive and construction. Addressing this challenge demands breakthroughs in chemical recycling, thermoplastic composite development, and circular material systems.

Regional Analysis

North America

North America holds a leading position in the Structural Composites Market with a 32.4% share in 2024, supported by strong adoption across aerospace, infrastructure rehabilitation, and wind energy installations. The region benefits from advanced manufacturing capabilities, high investment in lightweight materials, and robust presence of major composite producers. Infrastructure modernization programs accelerate demand for corrosion-resistant rebar, bridge decks, and structural strengthening solutions. The expanding electric vehicle sector further boosts composite usage in lightweight body structures. Favorable regulatory frameworks promoting energy efficiency and sustainability continue to reinforce market expansion across the United States and Canada.

Europe

Europe captured a 29.7% share in the Structural Composites Market in 2024, driven by extensive renewable energy deployment, stringent environmental regulations, and industry-wide commitment to lightweight engineering. The region leads in offshore wind turbine installations, creating substantial demand for advanced composite blades and structural components. Automotive OEMs accelerate composite integration to meet emission-reduction targets, while construction companies prioritize durable and recyclable composite solutions. Strong R&D investment, particularly in Germany, the U.K., and France, supports innovations in high-performance and sustainable materials. The region’s regulatory push for circularity strengthens long-term composite adoption.

Asia-Pacific

Asia-Pacific dominates growth momentum in the Structural Composites Market, holding a 28.1% share in 2024, driven by rapid industrialization, expanding infrastructure projects, and increasing renewable energy capacity. China and India significantly contribute to market expansion through large-scale construction, transportation modernization, and rising investment in wind energy installations. The region benefits from competitive raw material availability and cost-effective manufacturing, enabling broader adoption across sectors. Automotive lightweighting, high-speed rail development, and marine applications further strengthen demand. Asia-Pacific’s expanding industrial base and government support for sustainable infrastructure ensure continued composite penetration across diverse applications.

Latin America

Latin America accounted for a 5.4% share in the Structural Composites Market in 2024, supported by growing applications in construction, oil and gas, and transportation equipment. Countries such as Brazil and Mexico increasingly adopt composite materials for corrosion-resistant structures, pipelines, and marine components due to challenging environmental conditions. Infrastructure upgrades and rising renewable energy investments, particularly in wind power, contribute to demand growth. Local manufacturing expansion and partnerships with global composite producers enhance market accessibility. Economic diversification efforts across major economies further encourage adoption of durable, high-performance structural composites.

Middle East & Africa

The Middle East & Africa region held a 4.4% share in the Structural Composites Market in 2024, driven by infrastructure development, energy sector expansion, and rising use of composites in harsh environmental conditions. The region increasingly employs composite materials for pipelines, building facades, and industrial structures due to their superior resistance to corrosion, heat, and chemical exposure. Renewable energy initiatives, including large solar and wind projects, support additional demand. Growing construction activity in GCC countries and industrialization across Africa further accelerate market penetration. Collaboration with global composite manufacturers strengthens local capability and adoption.

Market Segmentations:

By Matrix

By Reinforcement Materials

- Glass fiber

- Carbon fiber

- Aramid fiber

- Others

By Sector

- Construction & infrastructure

- Energy

- Transportation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Structural Composites Market features leading companies such as Hexcel Corporation, Hexion Inc., Teijin Limited, Solvay, Mitsubishi Chemical Holdings Corporation, Toray Group, Huntsman Corporation, Owens Corning, SGL Group, and Argosy International Inc., all driving technological innovation and global market expansion. These players focus on developing high-performance composites with enhanced mechanical strength, durability, and sustainability to meet rising demand across aerospace, construction, transportation, and energy sectors. Strategic initiatives such as mergers, product advancements, and capacity expansions strengthen their market positioning. Many companies invest heavily in automation, recyclable composite technologies, and lightweight materials to serve emerging applications. Partnerships with OEMs and infrastructure developers further enable tailored composite solutions for complex engineering requirements, ensuring continuous growth and competitive differentiation across regions.

Key Player Analysis

- Owens Corning

- Solvay

- Argosy International Inc

- Hexion Inc

- SGL Group

- Teijin Limited

- Mitsubishi Chemical Holdings Corporation

- Huntsman Corporation

- Toray Group

- Hexcel Corporation

Recent Developments

- In September 2025, AM Group acquired UBC Composites, a European specialist in high-end carbon fiber components for aesthetic and structural applications, integrating its production facilities in Germany and Slovakia to enhance capabilities in premium automotive, defense, aerospace, and renewable energy sectors.

- In December 2025, Syensqo and Vertical Aerospace announced a long-term partnership to integrate Syensqo’s high-performance composites and adhesives across the VX4 electric aircraft structure.

- In November 2025, FibreCoat and Lofith Composites formed a strategic partnership to develop next-generation thermoplastic composite materials for space applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Matrix, Reinforcement Materials, Sector and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as industries increasingly adopt lightweight and high-strength composite structures.

- Advancements in automated composite manufacturing will enhance production efficiency and reduce costs.

- Renewable energy expansion, especially wind power, will elevate demand for advanced composite blades and components.

- Infrastructure modernization projects will accelerate adoption of corrosion-resistant composite materials.

- Automotive and aerospace sectors will continue shifting toward composite-based lightweighting solutions.

- Development of recyclable and bio-based composites will support sustainability objectives.

- Increased investment in high-performance carbon fiber technologies will strengthen premium applications.

- Emerging economies will expand composite usage across construction, transport, and industrial segments.

- Digital design, simulation tools, and smart composite monitoring systems will improve performance optimization.

- Global players will focus on strategic partnerships and capacity expansion to meet evolving structural composite needs.

Market Segmentation Analysis:

Market Segmentation Analysis: